Awesome Info About Purpose Of Preparing Financial Statements

Balance sheets, income statements, cash flow statements, and annual reports.

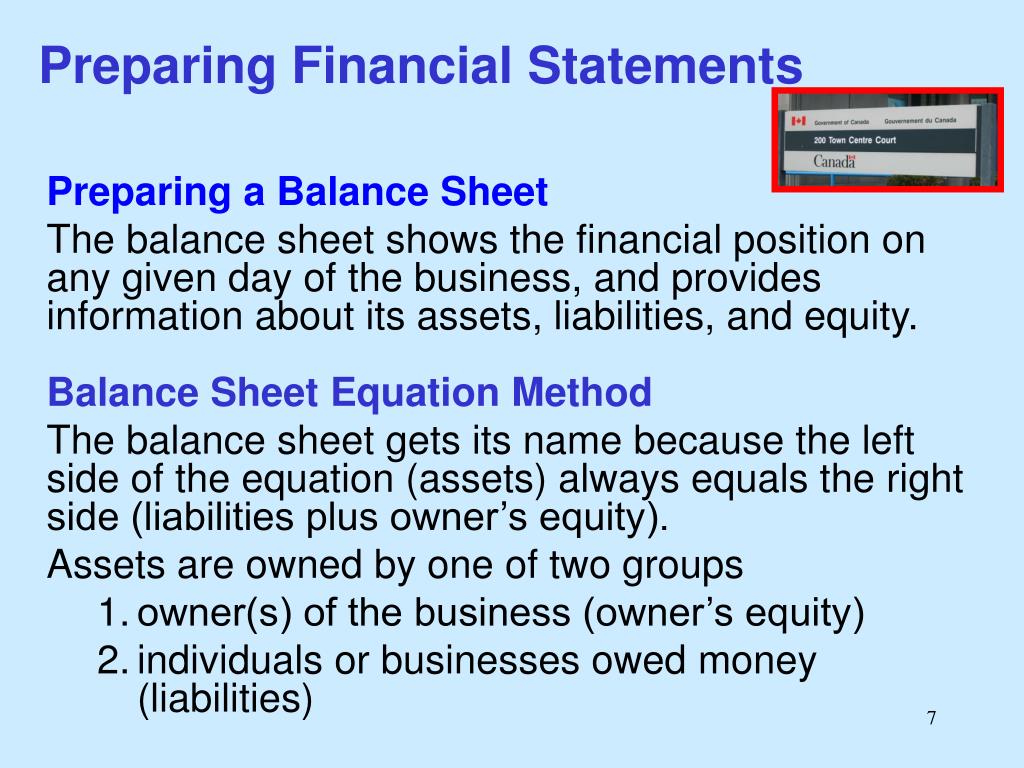

Purpose of preparing financial statements. Understanding financial statements. International accounting standard 1 presentation of financial statements. The purpose of financial statements are to provide both business insiders and outsiders a concise, clear picture of the current financial status in the business.

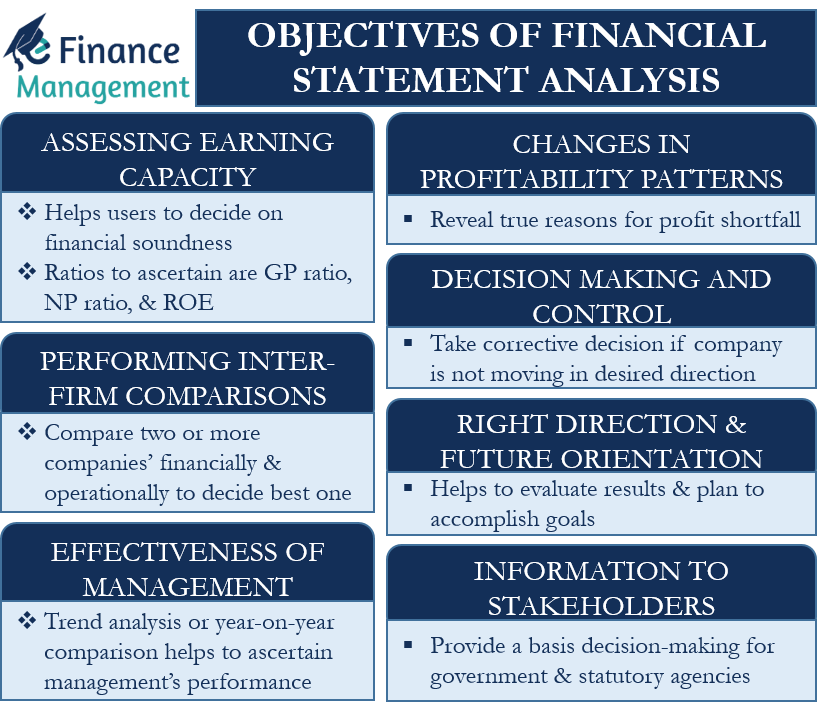

The general purpose of the financial statements is to provide information about the results of operations, financial position, and cash flows of an organization. Objective of ias 1. Here are the three main purposes:

Financial statements can also give potential investors or stakeholders an idea of your company’s financial performance and financial position to help them decide your business’s valuation. The objective of ias 1 (2007) is to prescribe the basis for presentation of general purpose financial statements, to ensure comparability both with the entity's financial statements of previous periods and with the financial statements of other entities. Understanding how to read a company's financial statements is a key skill for any investor wanting to make smart investment choices.

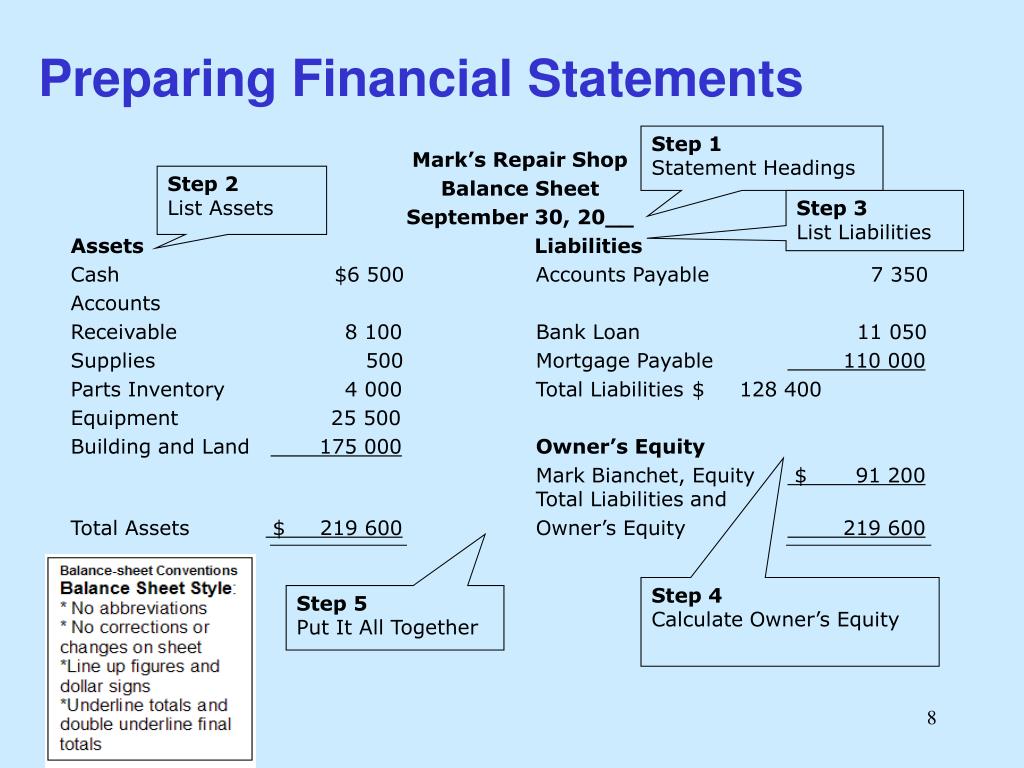

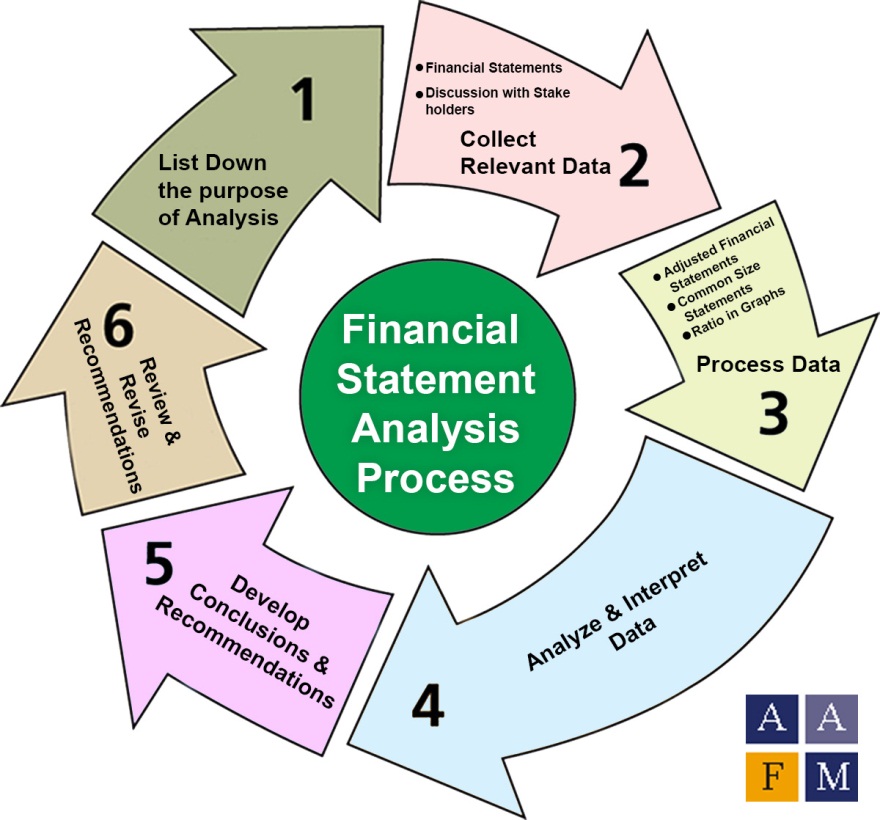

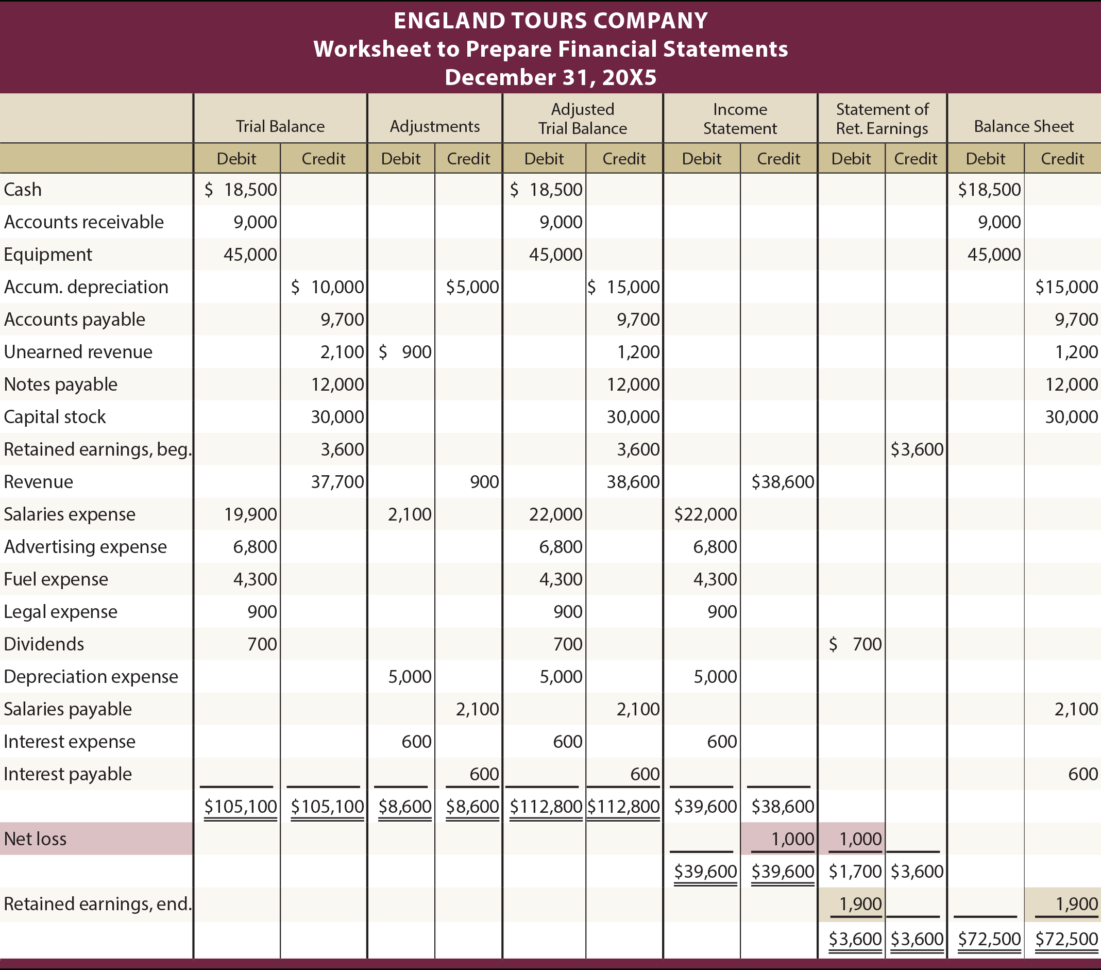

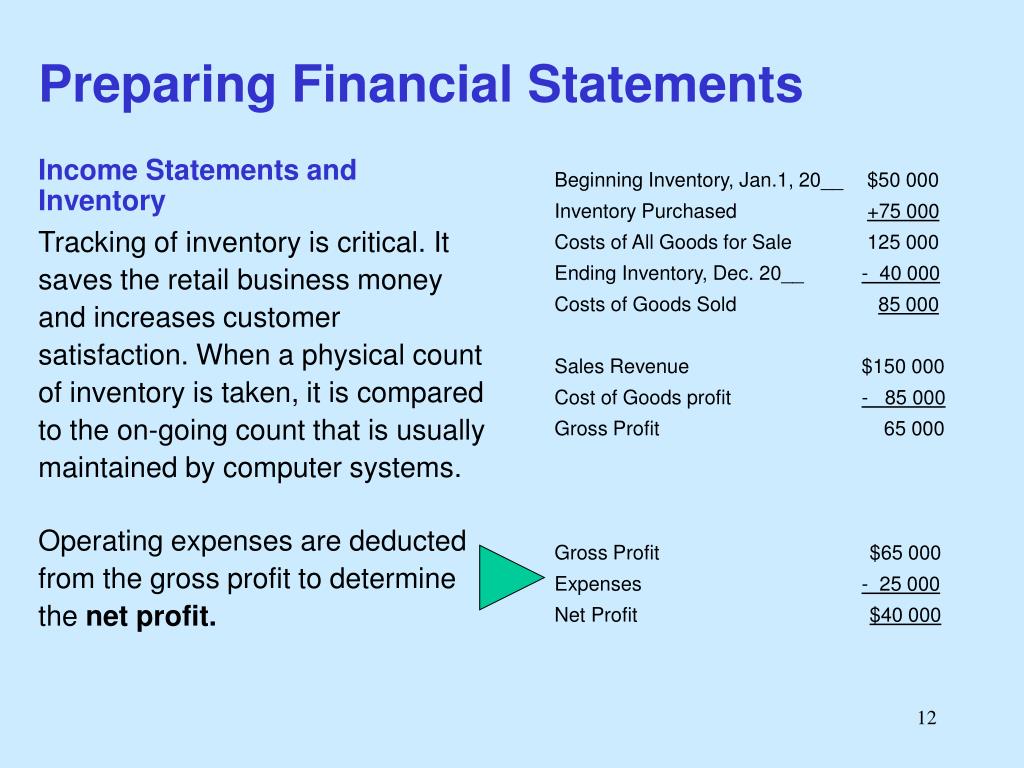

To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: What are the three financial statements? Financial statement preparation is a crucial aspect of a company's financial management, involving the recording and reporting of its financial transactions and activities.

This provides a summary of previous financial data which can help businesses to make informed. The three major financial statement reports. There are four sections to a company's financial.

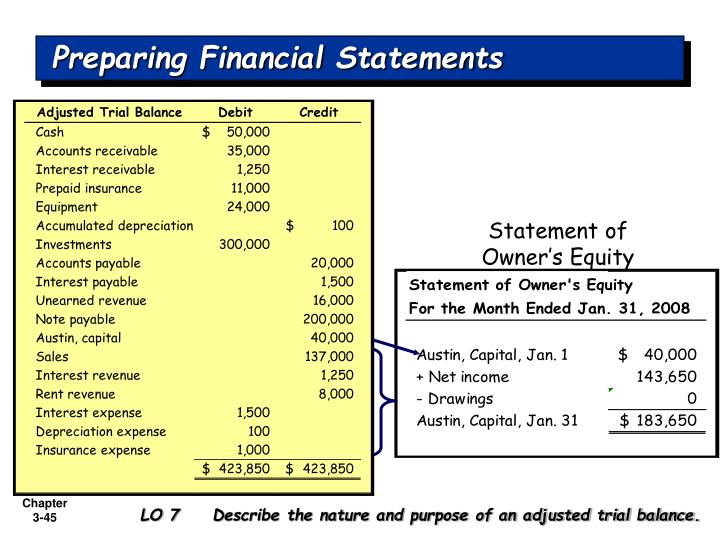

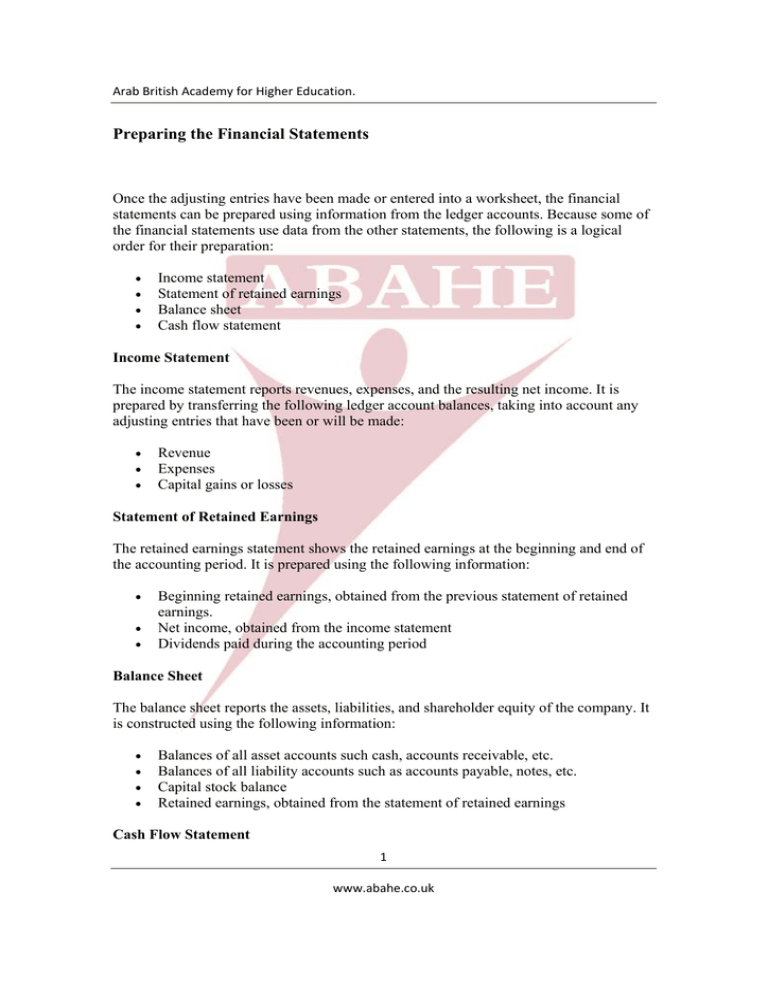

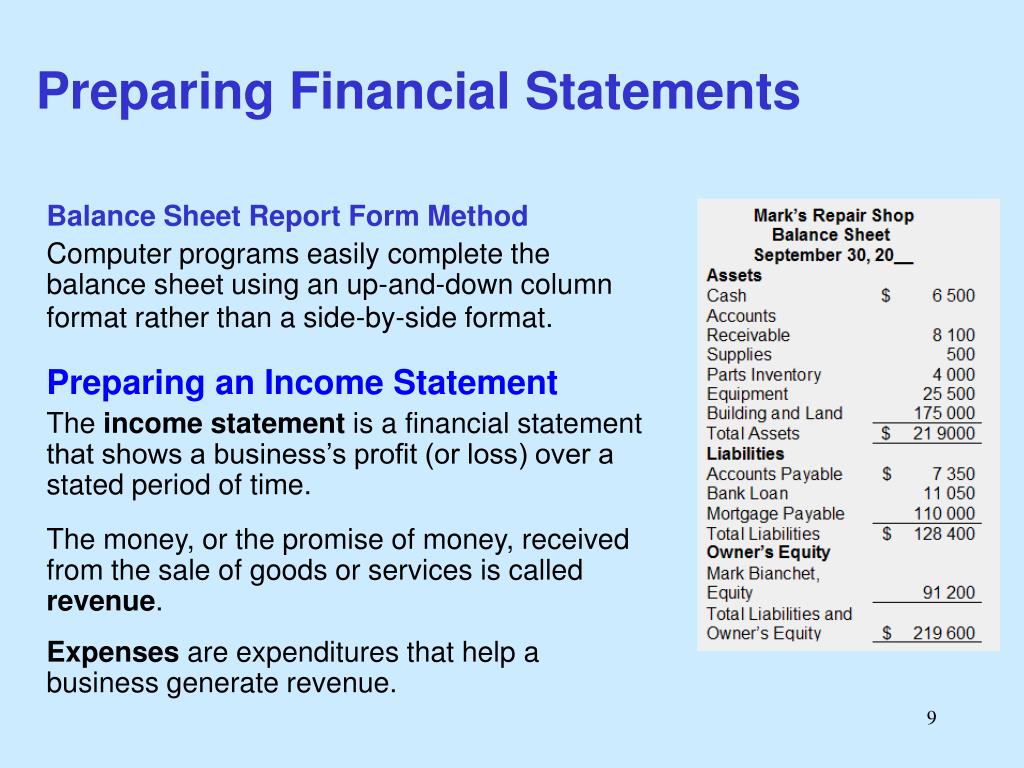

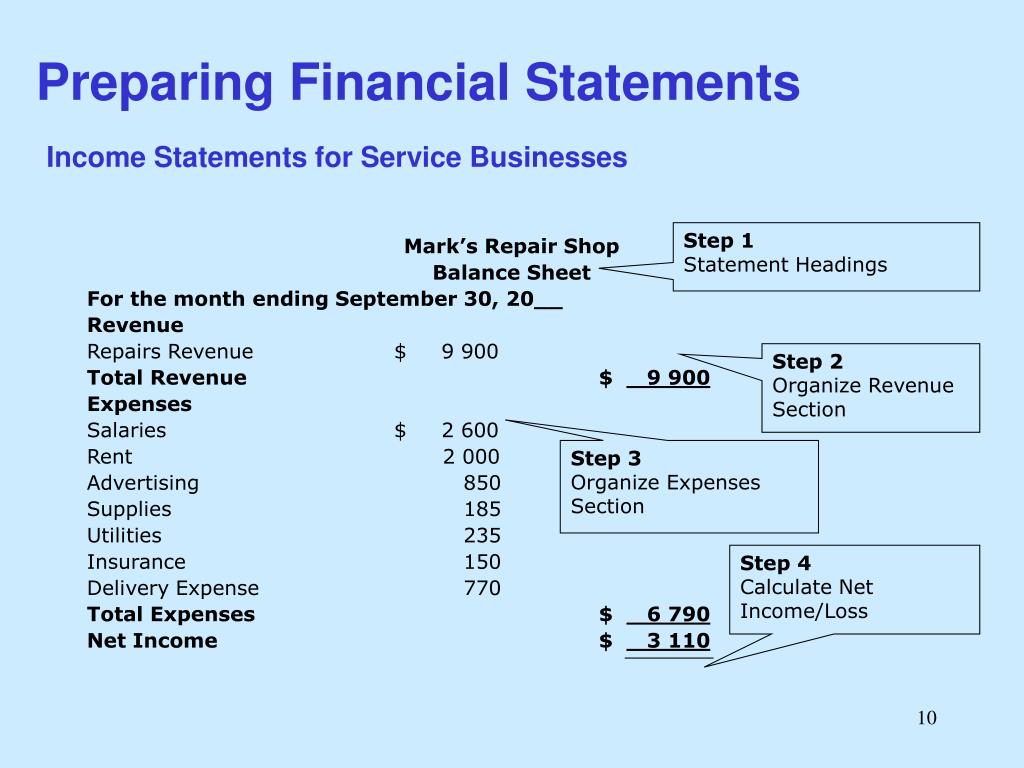

Including the balance sheet, income statement, statement of retained earnings, and statement of cash flows; Income statement the income statement, also known as a profit and loss statement, is important because it shows the overall profitability of your company for the time period in question. A company's accounting professional typically prepares financial statements, which give a clear picture of the company's financial position at a specific time.

Chapter 3—financial statements and the reporting entity financial statements 3.1 objective and scope of financial statements 3.2 reporting period 3.4 perspective adopted in financial statements 3.8 going concern assumption 3.9 the reporting entity 3.10 consolidated and unconsolidated financial statements 3.15 And (4) statements of shareholders’ equity. Income statements show how much money a company made and spent over a period of.

There’s another important purpose of financial statements: The purpose of financial statements is to allow businesses to understand their financial standing. The irs also looks at financial statements when performing an audit of your business.

The financial statements include the income statement, balance sheet, cash flow statement and statement of equity. Explain the purpose of the financial statements; Is the most important step in the accounting cycle because it represents the purpose of.

There are four main financial statements. Each of the financial statements provides important financial information for both internal and external stakeholders of a company. They are also a vital part of creating plans for growth or even surviving a downturn in the economy.