Have A Tips About Balance Sheet And Cash Flow Statement Of A Company

The income statement, balance sheet, and cash flow statement.

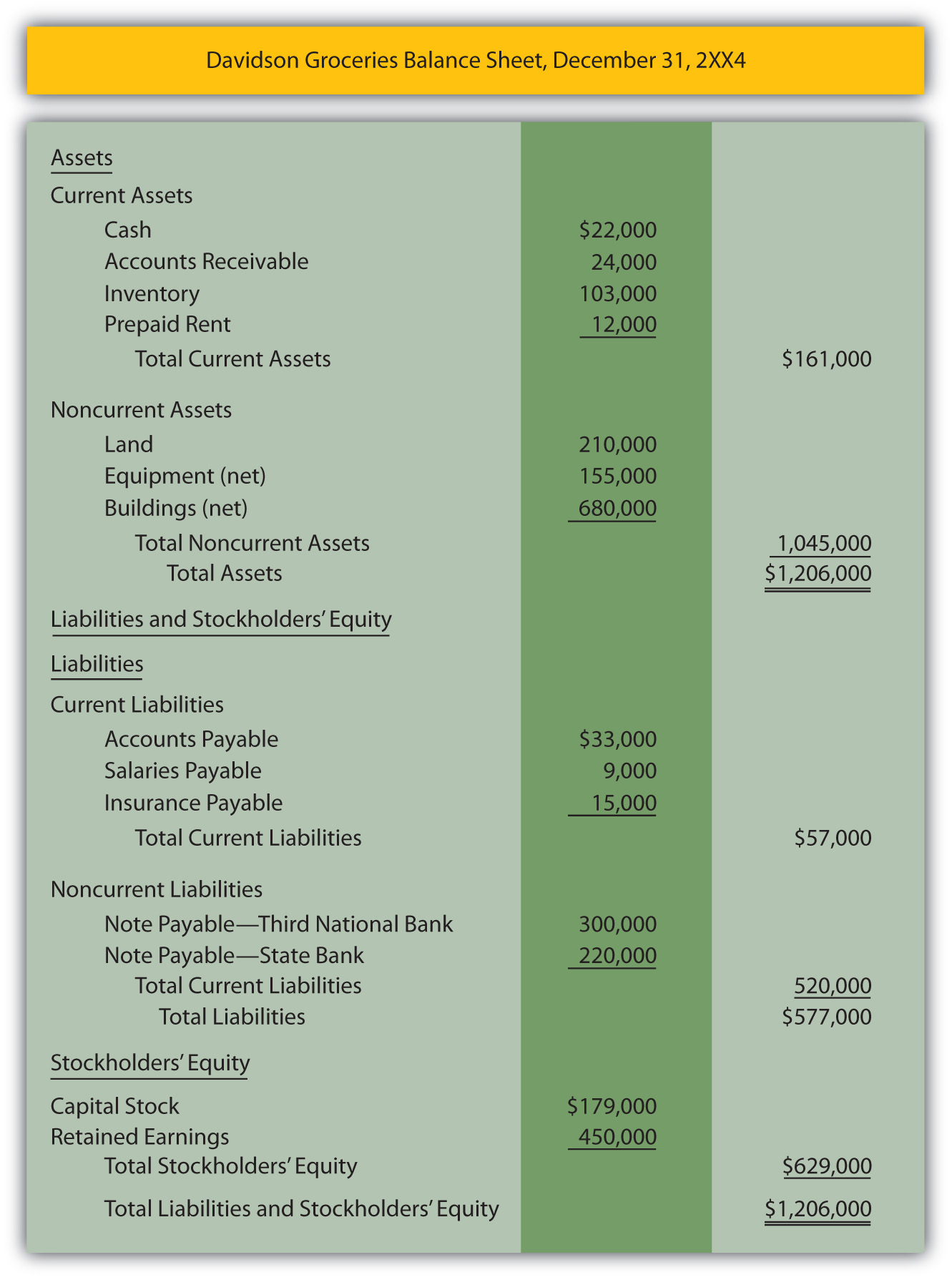

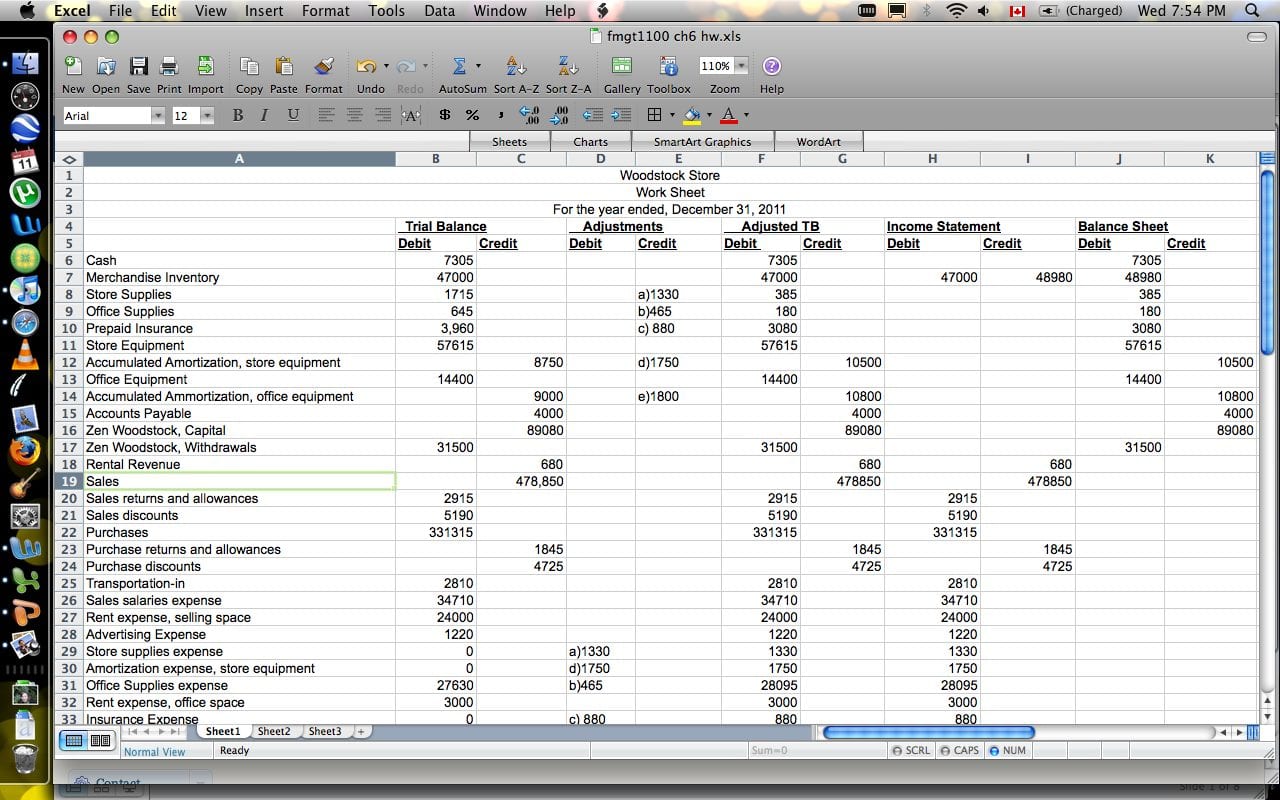

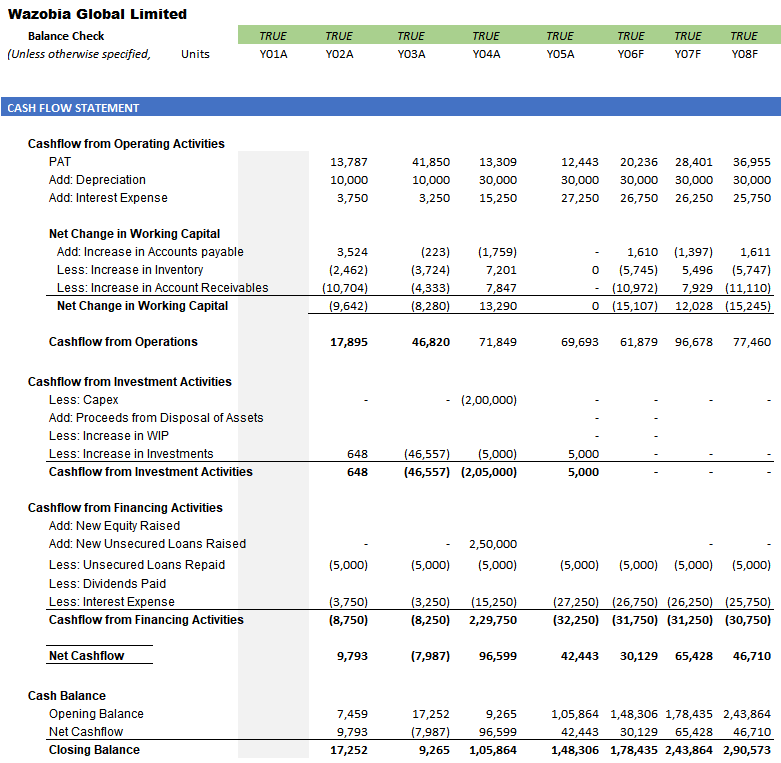

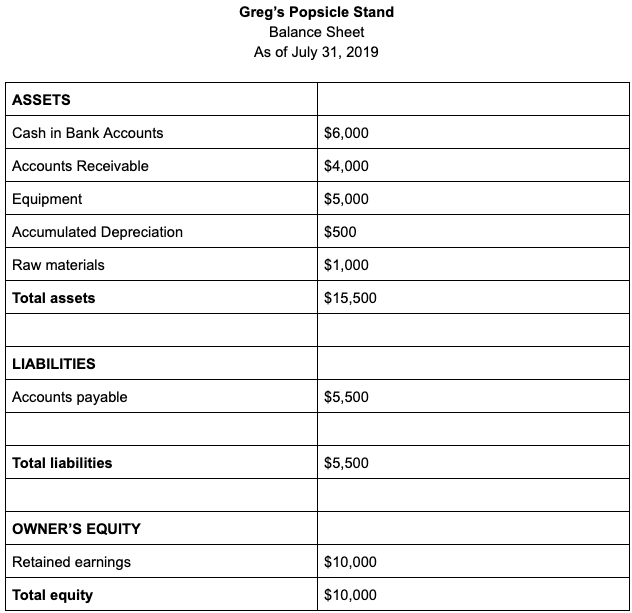

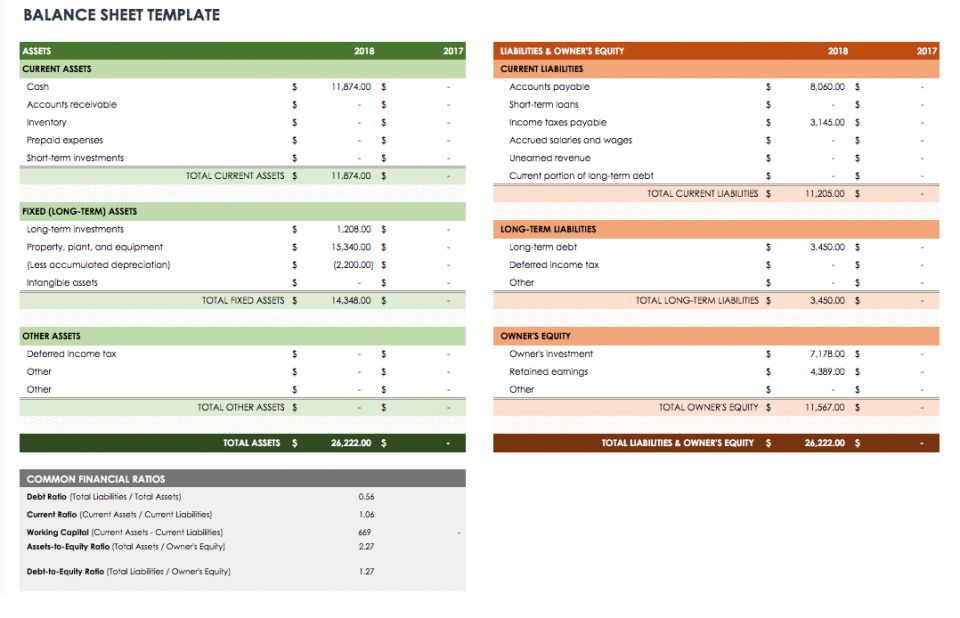

Balance sheet and cash flow statement of a company. The cash flow statement provides a view of a company’s overall liquidity by showing cash transaction activities. The balance sheet also referred to as the statement of financial. A balance sheet is a financial statement that reports a company's assets, liabilities, and shareholder equity.

Remember the interconnectivity between p&l and balance sheet while basic, it’s worth reminding ourselves that total assets must always be equal to total liabilities (and equity). The three statements are vital to gaining a complete understanding of a company’s performance. First, the income statement provides an insight into income and expenses.

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. This article will provide a quick overview of the. Although the balance sheet and cash flow statement are two critical financial statements companies must use, there are several key differences between the two financial documents:

The basic formula for the balance sheet is as follows: The cash flow statement (cfs), along with the income statement and balance sheet, represent the three core financial statements. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

The balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. Finally, the cash flow statement illustrates how cash is generated and invested. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of the reporting standards established.

Make adjustments for non cash transactions. View the latest news, buy/sell ratings, sec filings and insider transactions for your stocks. Compare your portfolio performance to leading indices and get personalized stock ideas based on your portfolio.

This value can be found on the income statement of the same accounting period. The balance sheet focuses on managing capital. Then cash inflows and outflows are calculated using changes in the balance sheet.

Understanding financial statements. The cash flow statement is required for a complete set of financial statements. Changes in current assets and current liabilities on the balance sheet are related to revenues and expenses on the income statement but need to be adjusted on the cash flow statement to reflect the actual amount of cash received or spent by the business.

Find the cash and cash equivalent at the beginning and end of the reporting period. The financial statements are used by. Calculate the total of the changes in the operating, investing, and financing activities.

In this guide, we will walk you through each of the above steps. Complete the cash flow statement and cash on the balance sheet. Explanation, components, and examples by jason fernando updated jan 31, 2024 profit and loss statement meaning, importance, types, and examples by jason fernando updated dec.

:max_bytes(150000):strip_icc()/AppleCFSInvesto2-6a84aed790a5476abbc3ef04b1718106.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)