Peerless Info About Elements Of Comprehensive Income

The components of comprehensive income usually consist of the following items:

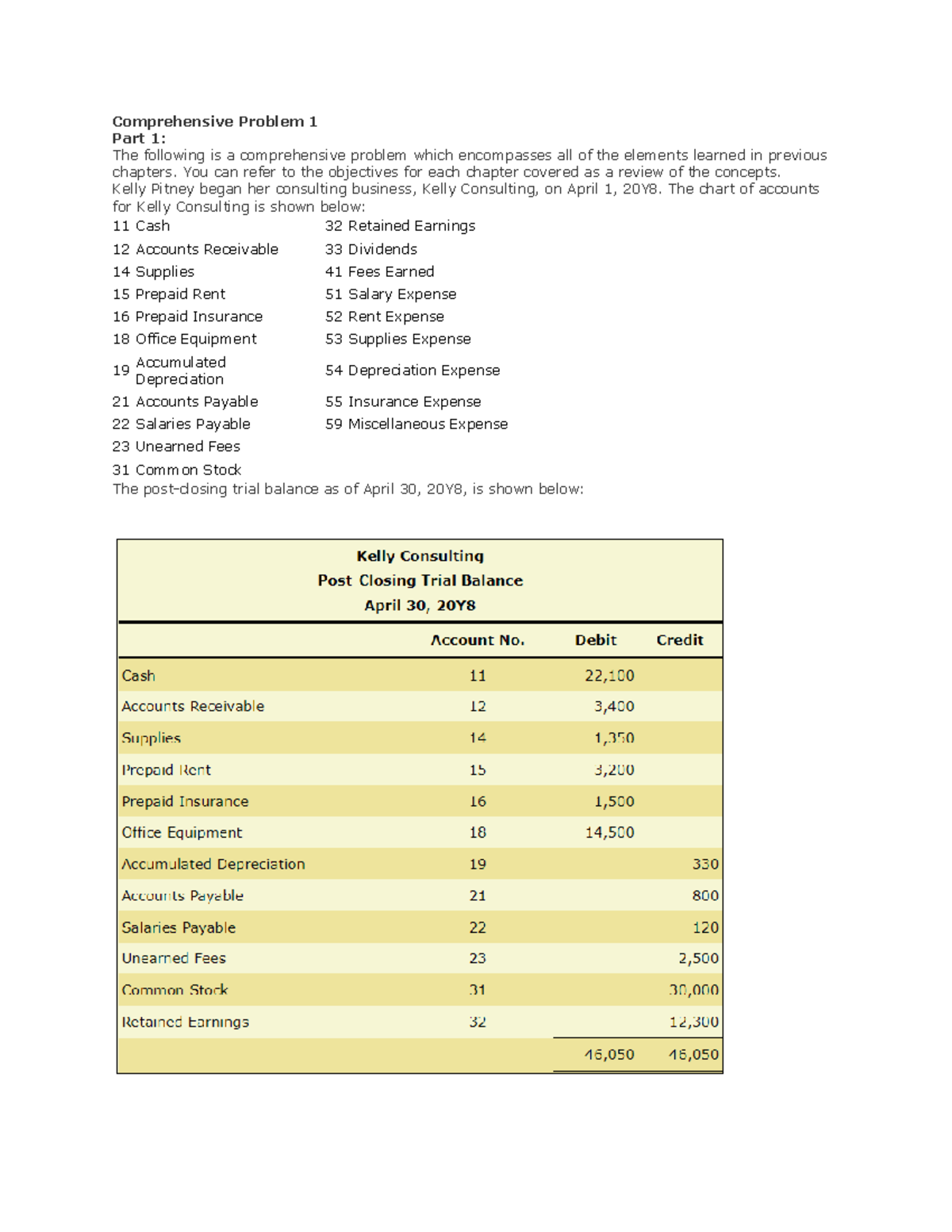

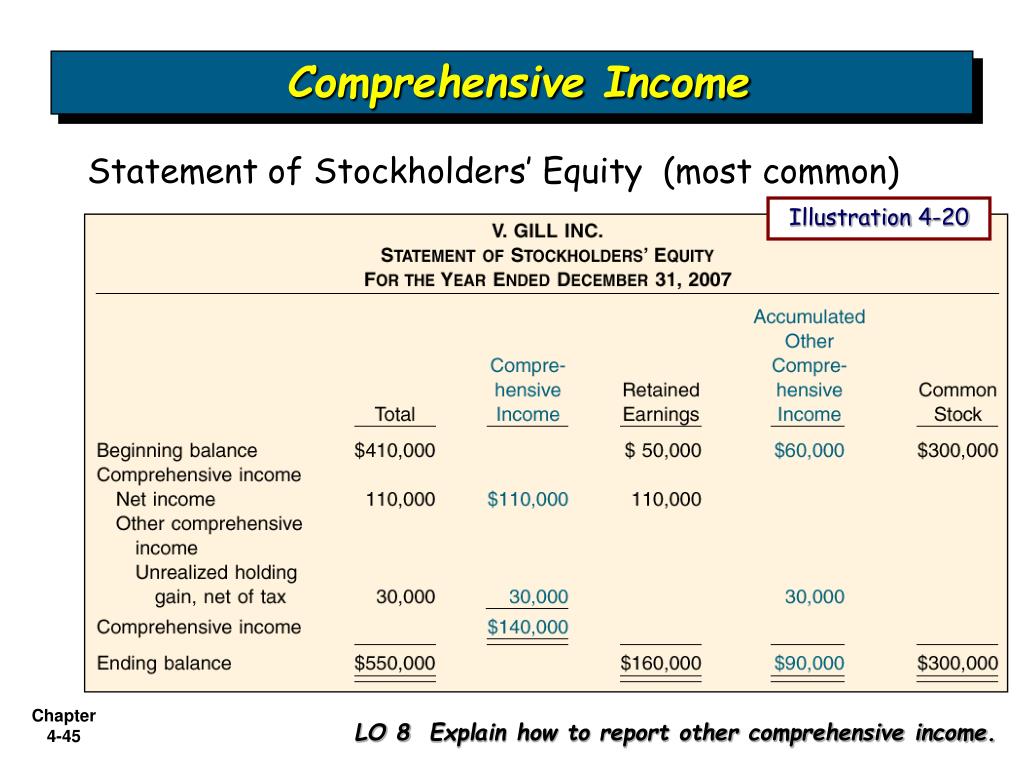

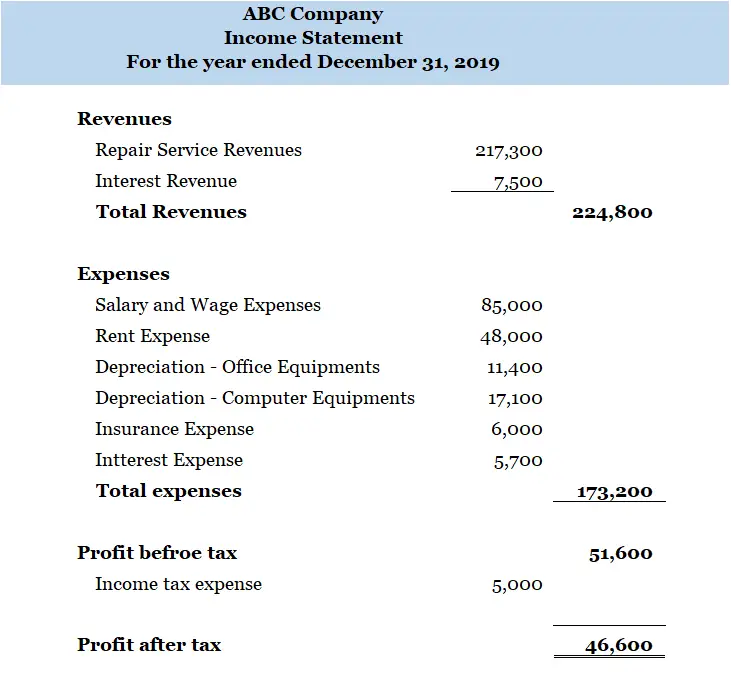

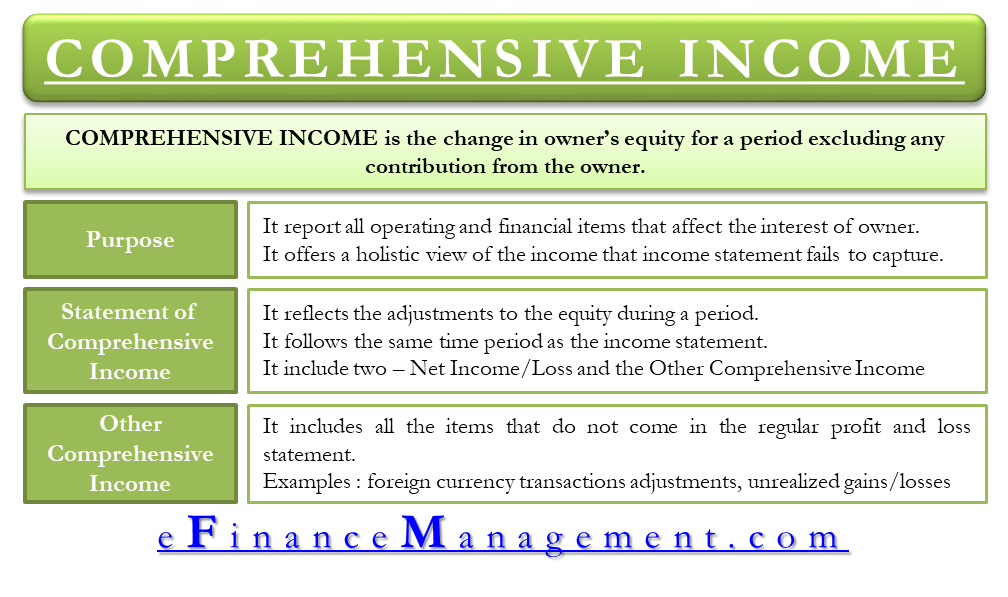

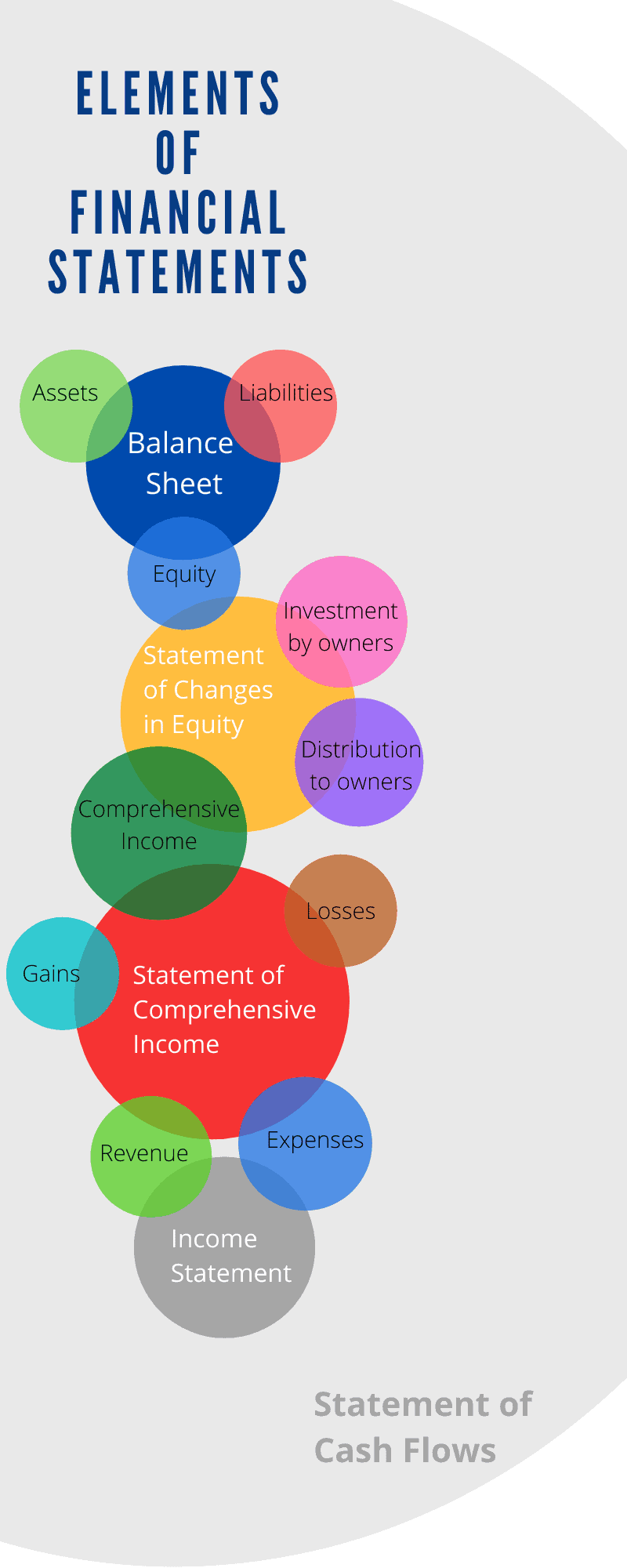

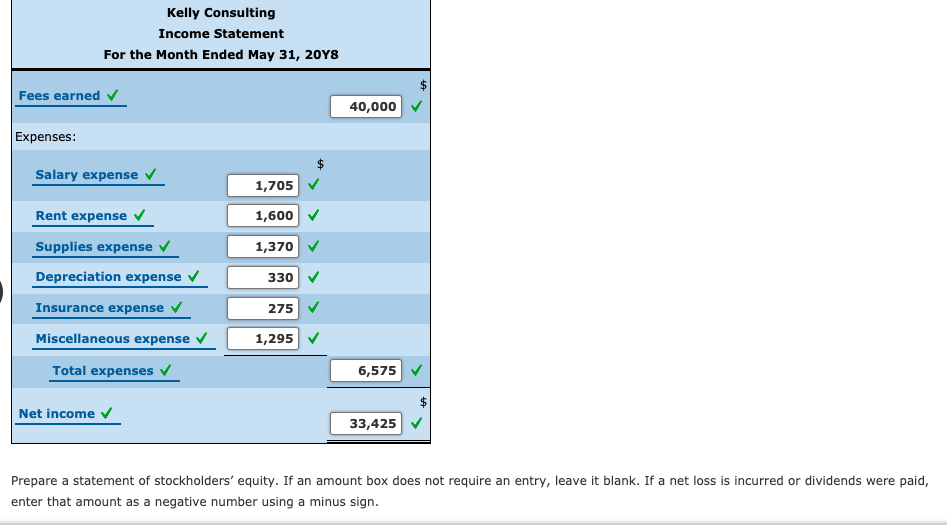

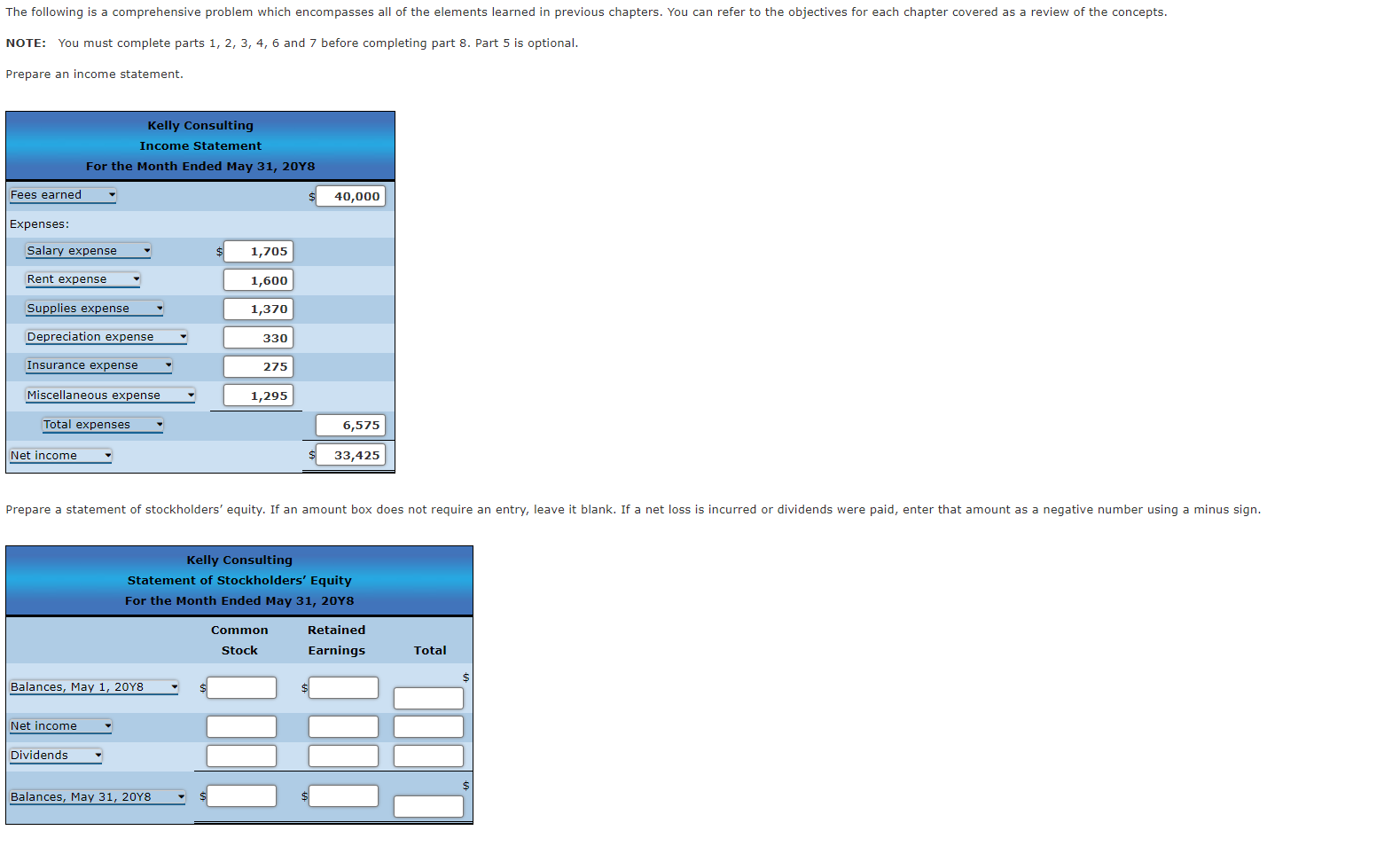

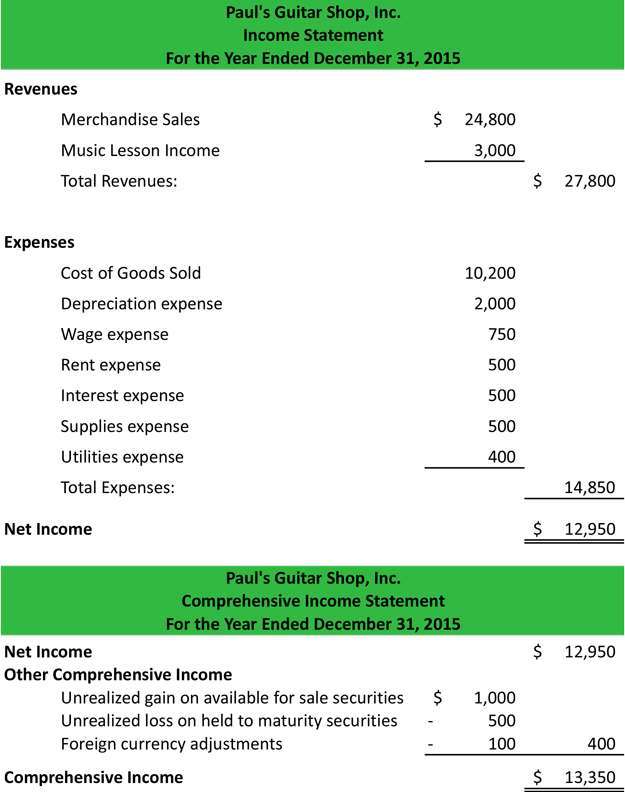

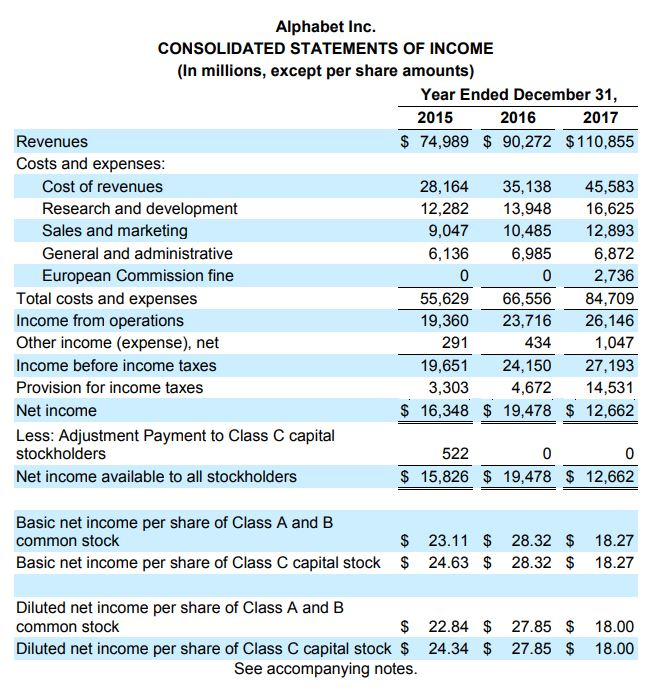

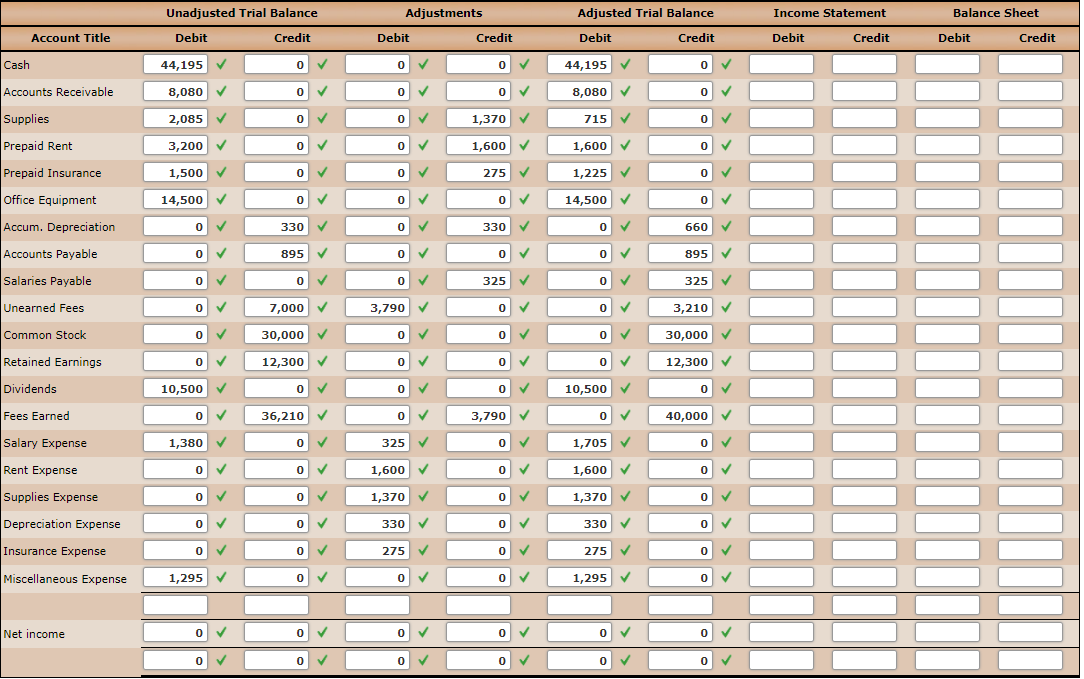

Elements of comprehensive income. Comprehensive income (or total earnings) is defined as all changes in equity over a period, excluding those resulting from investments by owners and distributions to owners in a company's financial reporting. Sales, general, and administrative expenses; The statement of comprehensive income is made up of two parts:

It introduces the subject and reproduces the official text along with explanatory notes and examples designed to enhance understanding of the requirements. This document has been prepared by the staff and is not Net income, and other comprehensive income, which incorporates the items excluded from the income statement.

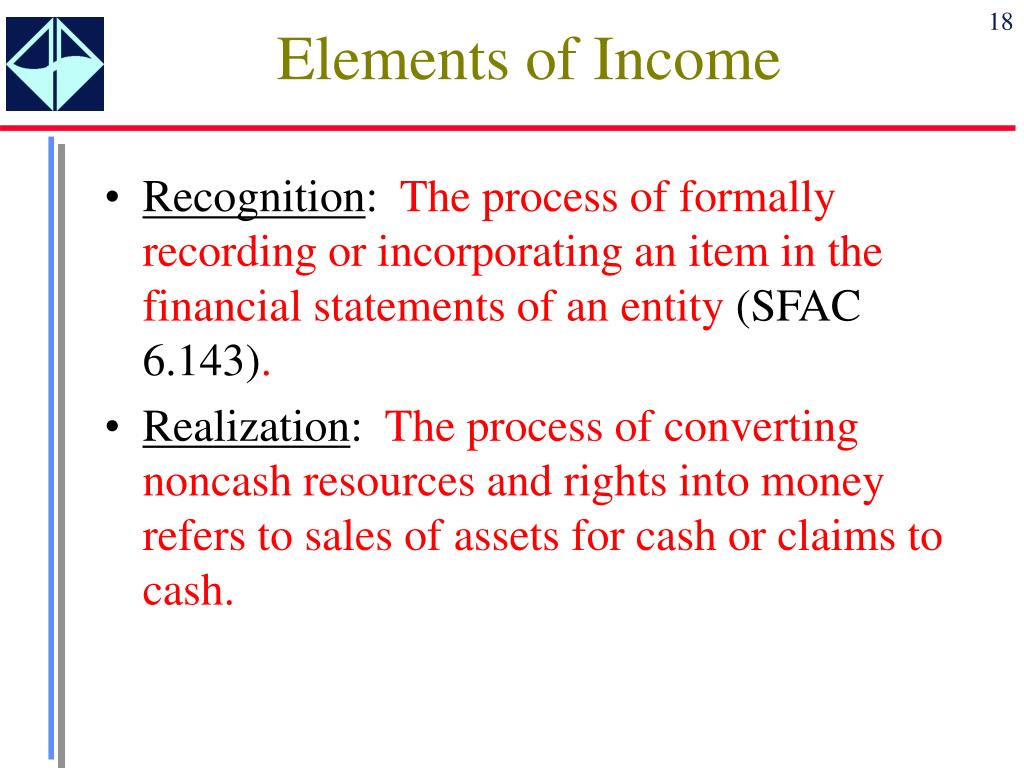

(2) exchange transactions and other transfers between enterprise and other entities that are not its owners. The key elements of statement of comprehensive income based on the given definition are: The evidence map presented in fig.

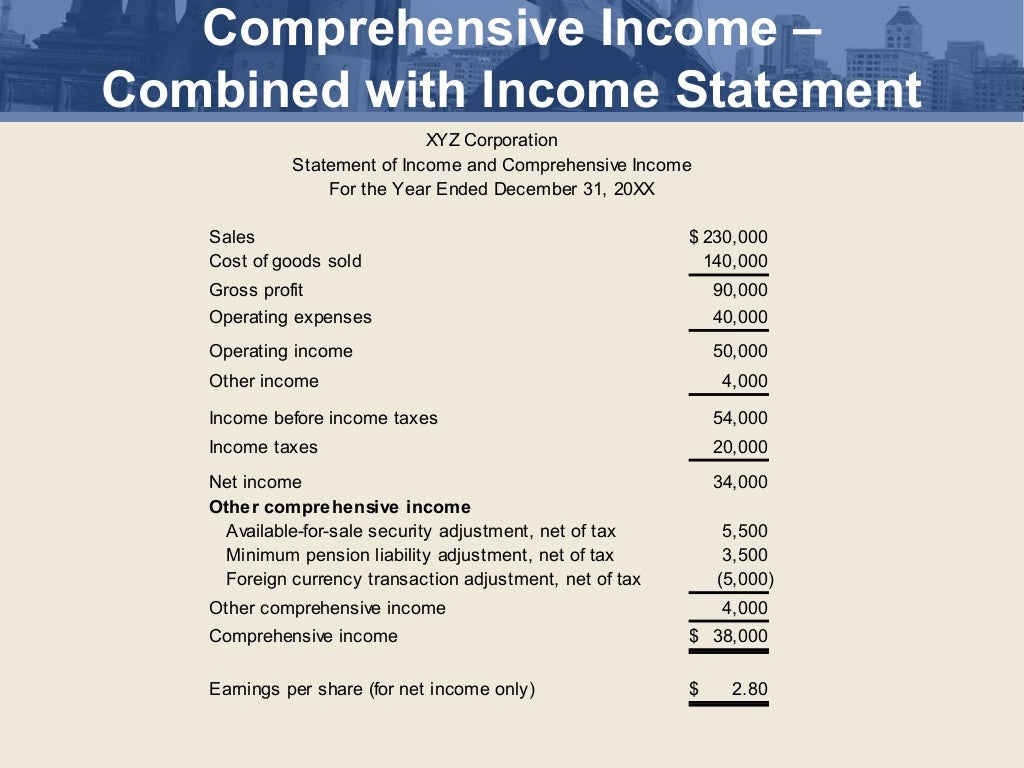

Regarding the number of concepts covered, 35 studies (44.3%) of the intervention covered only one concept,. The statement of comprehensive income begins with the profit or loss from the income statement, or alternatively, as a section of a single statement of comprehensive income. In june 2011 the board amended ias 1 to improve how items of other income comprehensive income should be presented.

This statement's bottom line represents comprehensive income rather than net income. As well as net income, comprehensive income includes. Comprehensive income and a change in terminology in the titles of financial statements.

Components of comprehensive income. Comprehensive income has two major components, which are other comprehensive income (oci) and net income. Reporting entities should present each of the components of other comprehensive income separately, based on their nature, in the statement of.

Comprehensive income may be presented in a single statement or in two consecutive statements. These are the main accounts for the statement of comprehensive income. Statement of comprehensive income refers to the statement which contains the details of the revenue, income, expenses, or loss of the company that is not realized when a company prepares the financial statements of the accounting period, and the same is presented after net income on the company’s income statement.

Actually each of the elements of comprehensive income should be reported net of tax. Comprehensive income includes net income and oci. Net income and other comprehensive income (oci).

Other comprehensive income elements come after net income. Net income and other comprehensive income. A closer look on comprehensive income and its various categories

Components of oci (a statement of other comprehensive income). This article looks at what differentiates profit or loss from other comprehensive income and where items should be presented. By offering predictive value, you can plan, strategize your business, and prepare for the future.

:max_bytes(150000):strip_icc()/comprehensiveincome_final-2ff1de7967204cd2a69a4ab5b8778fff.png)