Heartwarming Tips About Balance Sheet Of A Sole Proprietorship

A single entry system is most suited to a cash basis accounting system,.

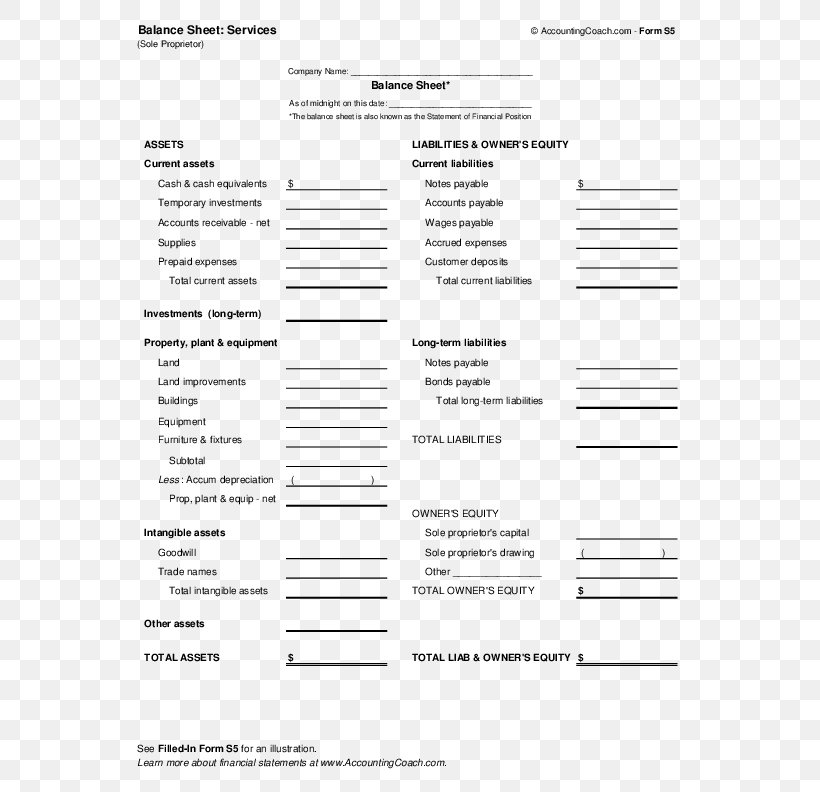

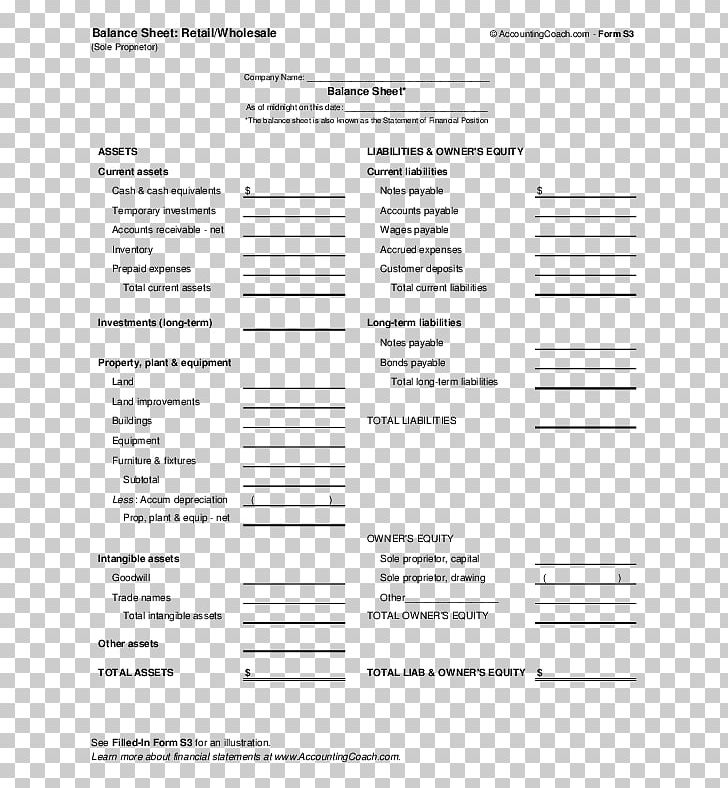

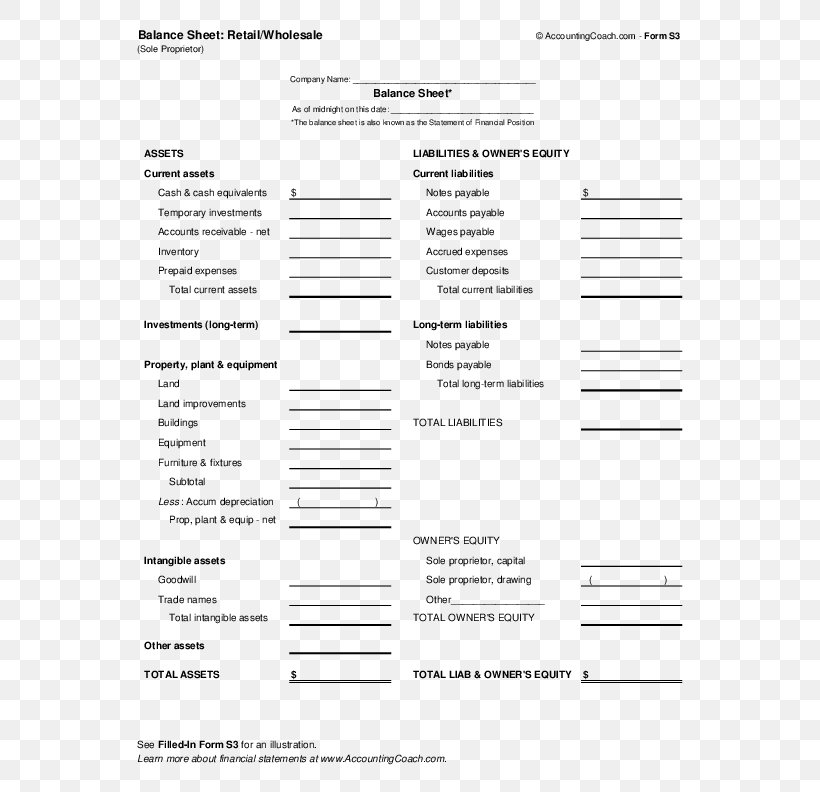

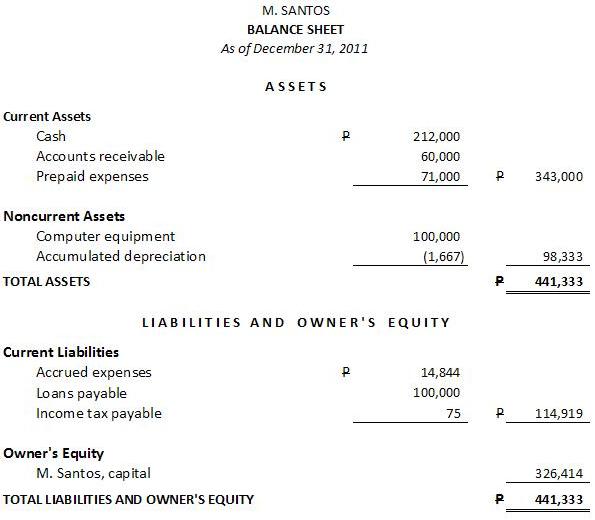

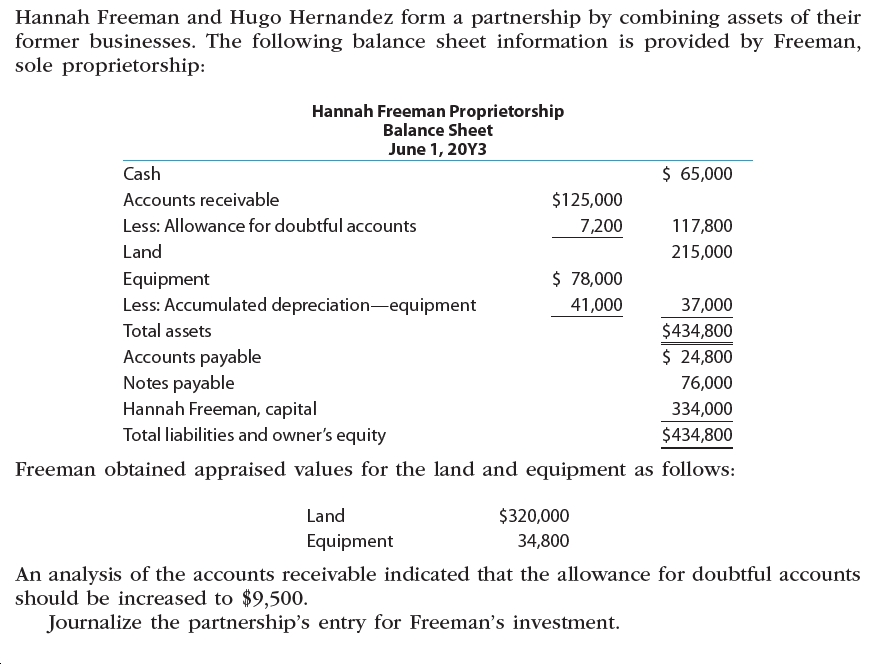

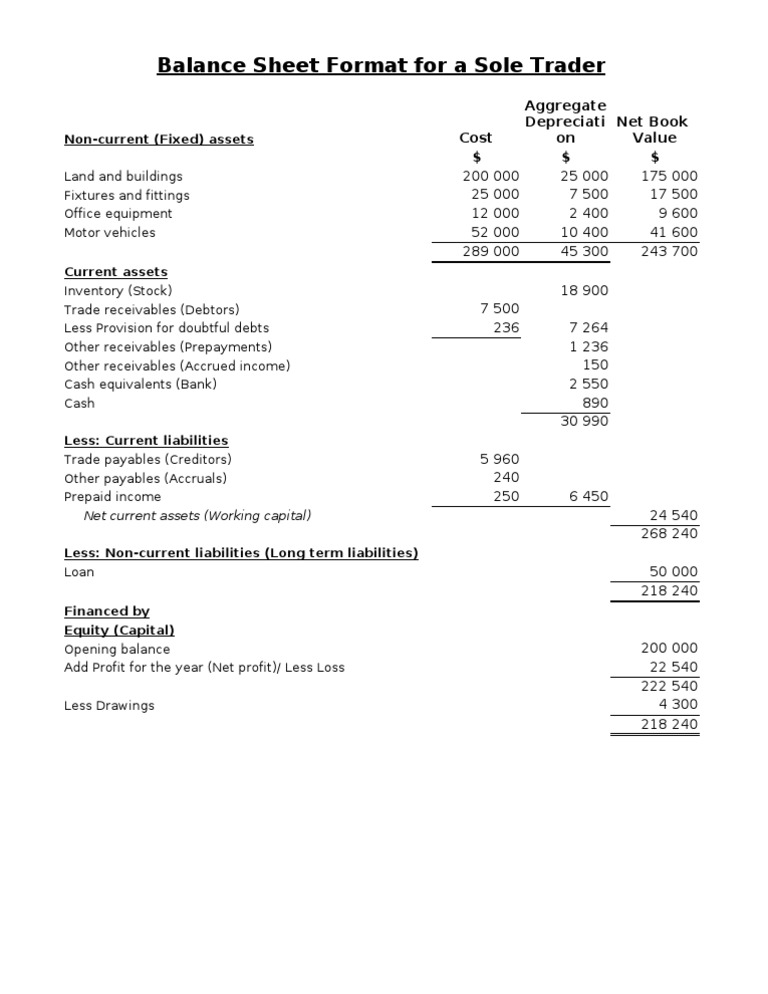

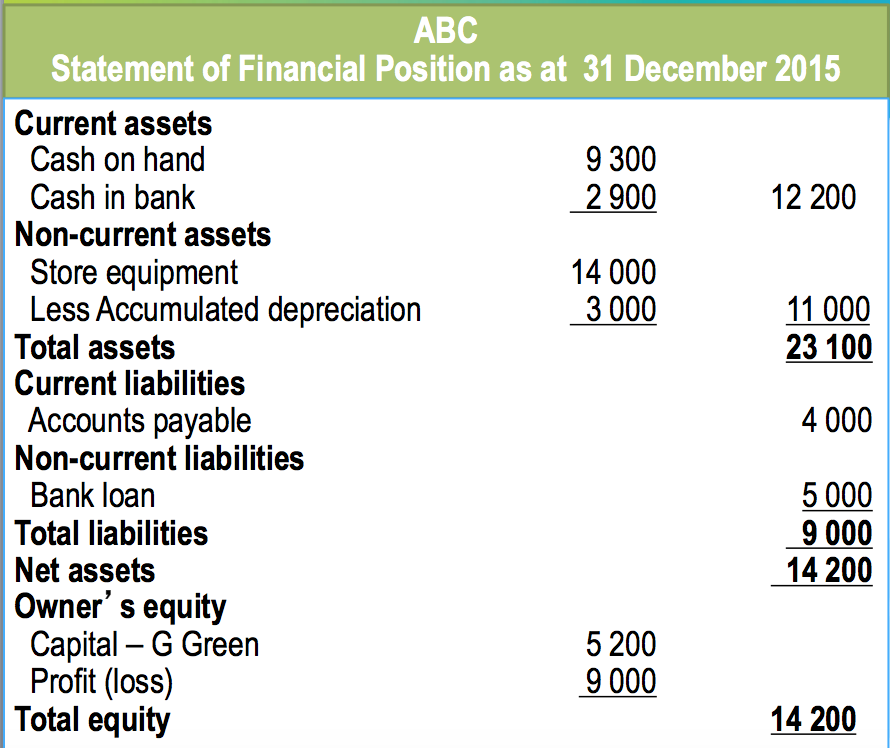

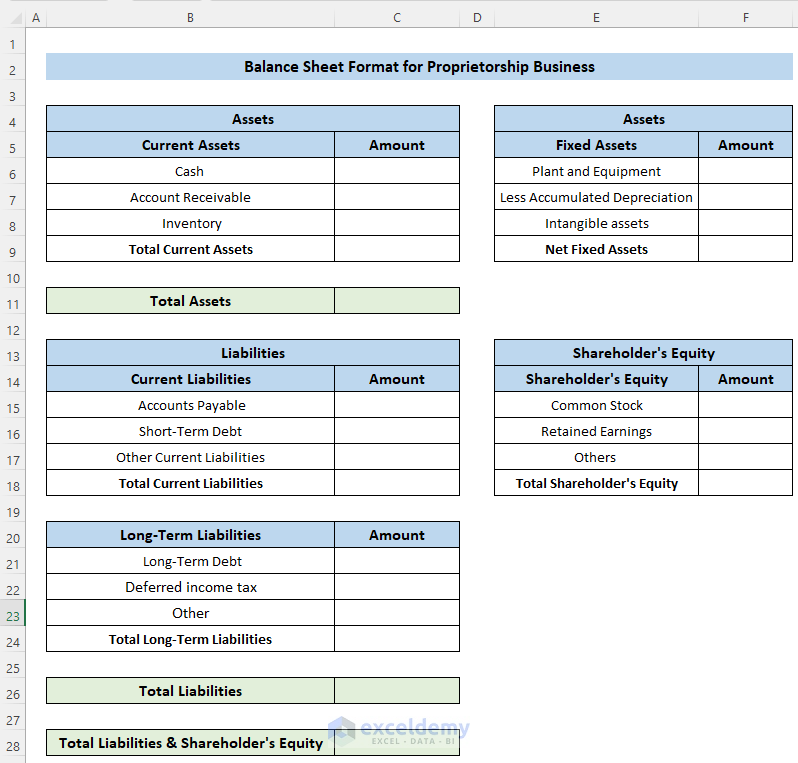

Balance sheet of a sole proprietorship. Pdf form & excel templates. In this manner, a balance sheet contains an organization's assets, liabilities and shareholder’s equity, which is alluded to as proprietors' equity on account of a sole proprietorship. In accounting, the balance sheet of the sole proprietorship reflects the accounting equation:

But i think sole proprietorships are the one type of entity where a spreadsheet or even a handwritten summary can work. Learn as you fill in your company's amounts on our professionally designed financial report. There are typically two accounts listed:

Learn about this important financial statement as you complete the form. A balance sheet is broken into two main sections: Since it cannot be used to produce a balance sheet, only an income statement.

By andy marker | march 9, 2022 (updated april 28, 2023) we’ve compiled a collection of the most helpful free small business balance sheet templates for small business owners, accountants, and other stakeholders. A balance sheet reports a business’s assets, liabilities and equity at a specific point in time. Although the template is an example of a balance sheet for a sole proprietorship, you can quickly modify it for a corporation or partnership.

A balance sheet is really important when it comes to a proprietorship business or any type of business. Liabilities are obligations to creditors, lenders, etc. Assets refer to properties owned and controlled by the company.

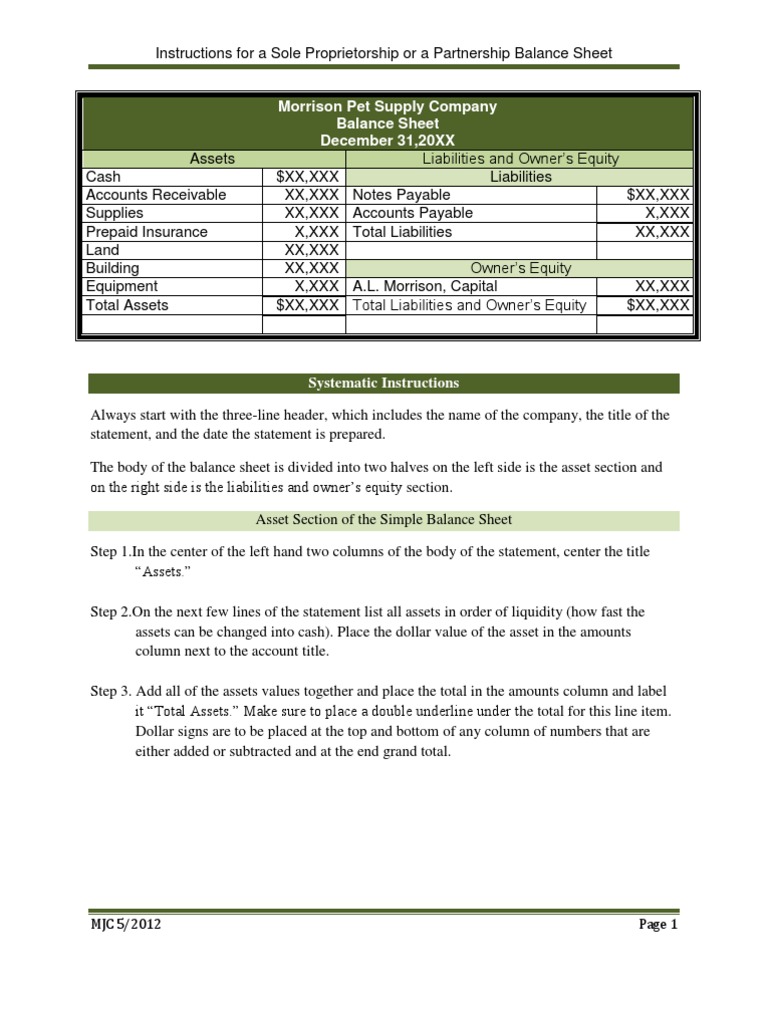

The balance sheet of a sole proprietorship indicates the name of the business, the name of the statement and the date of the statement. Assets on one side and liabilities and equity on the other side. In order to prepare a final account, you will need to gather the following information:

The balance sheet formats require the two sides must balance out, meaning they should be equal to one another. Sole traders are also required to prepare a balance sheet. The owner’s capital account and owner’s draw account.

Freelance writers, photographers, graphic designers, and other independent contractors often operate as sole proprietors. There’s money the proprietor makes in the course of conducting business, and there are business. For a sole proprietor, equity is called owner’s equity.

A sole proprietorship tends to generate smaller amounts of revenue and incur lower levels of expenses than more complex types of organizations. There are typically two accounts listed: The drawing account is a temporary account in which the owner's current year draws or withdrawals are recorded.

Assets, liabilities and ownership equity are listed as of a The sole proprietorship balance sheet depends on the bookkeeping condition that expresses that assets equal liabilities in addition to shareholder’s equity. It is an unincorporated business owned and operated by one individual with no distinction between the business and the owner.