Cool Info About Llc Balance Sheet Equity Section

This represents the cash or other assets that you have invested in the company.

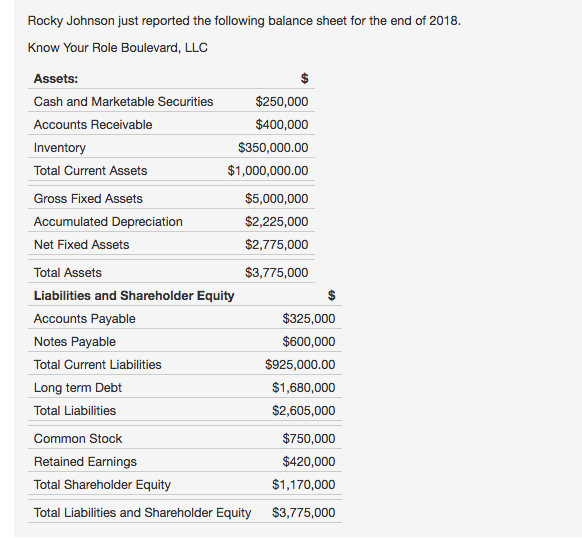

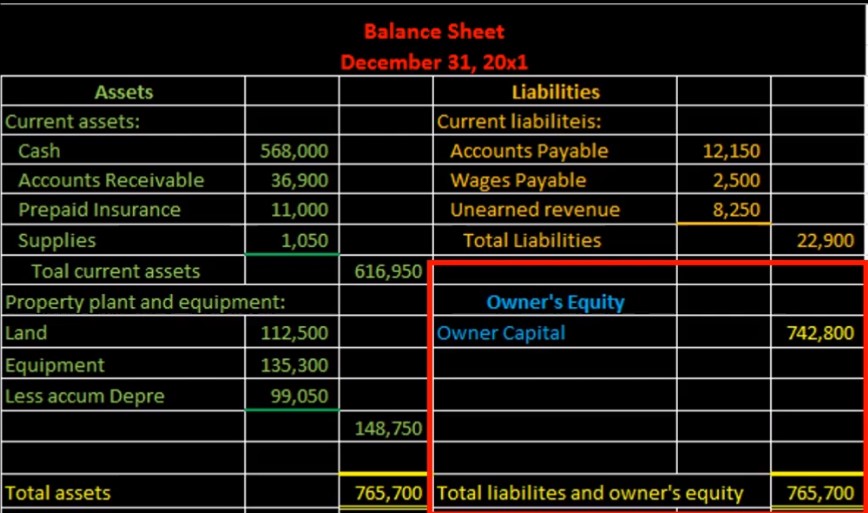

Llc balance sheet equity section. For partners, it consists of their capital accounts. The equity section as a reminder, the balance sheet has three major sections: We will delve into the details of each section, discussing the key line items and their significance in financial analysis.

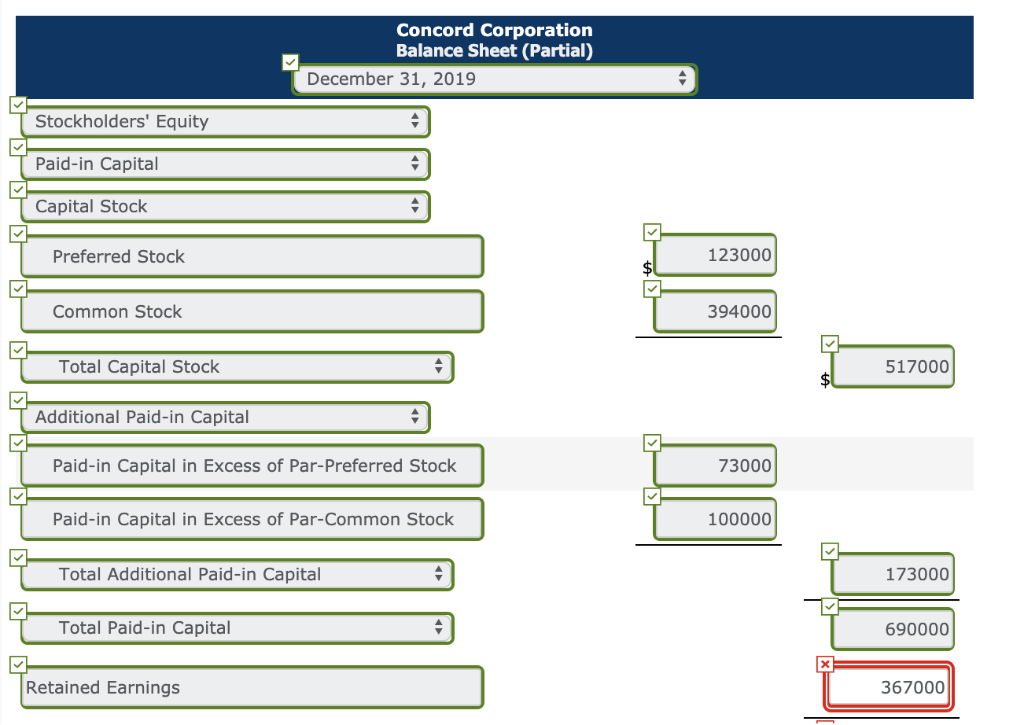

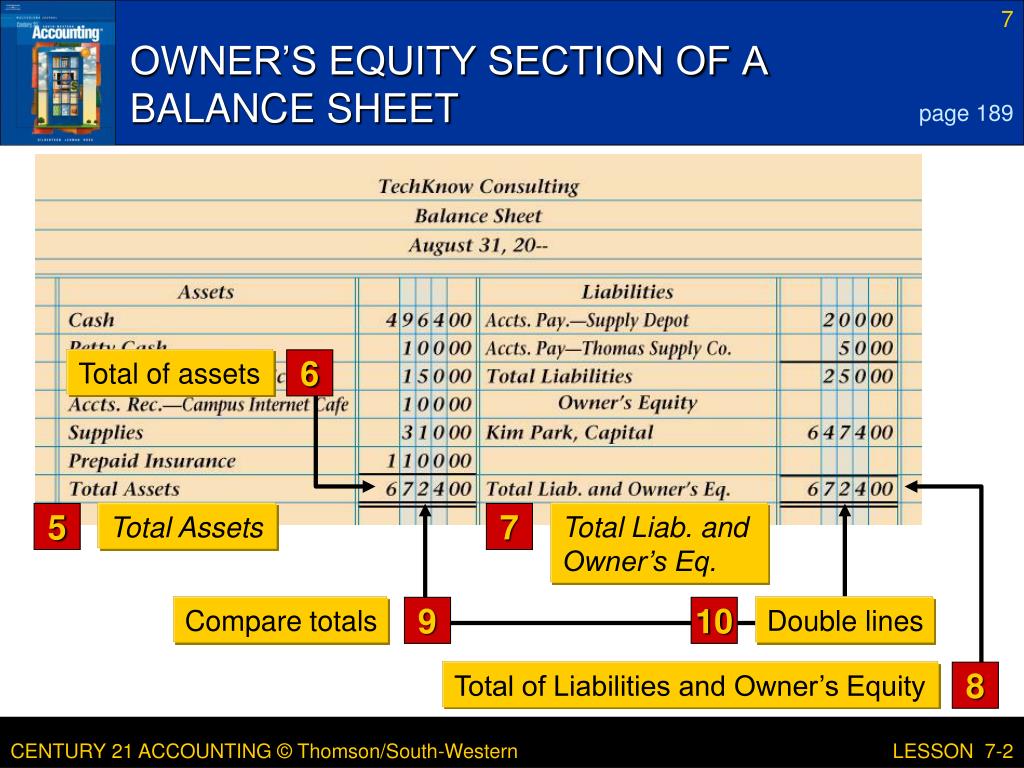

The first or primary area is the stock available and sold. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. The left side of the balance sheet outlines all of a company’s assets.

The equity section is composed of two significant areas or elements to determine value. This is a list of what the company owes. The balance sheet is based on the fundamental equation:

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Equity section of the balance sheet definition. The part of a balance sheet with the heading stockholders' equity or owner's equity.

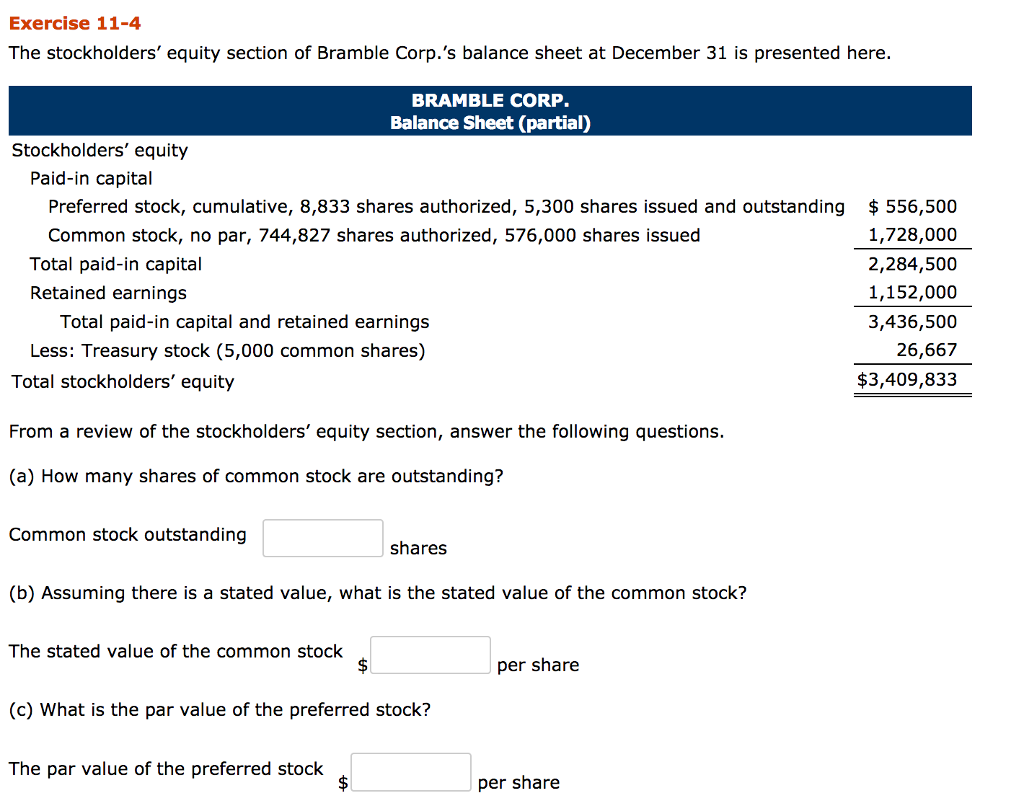

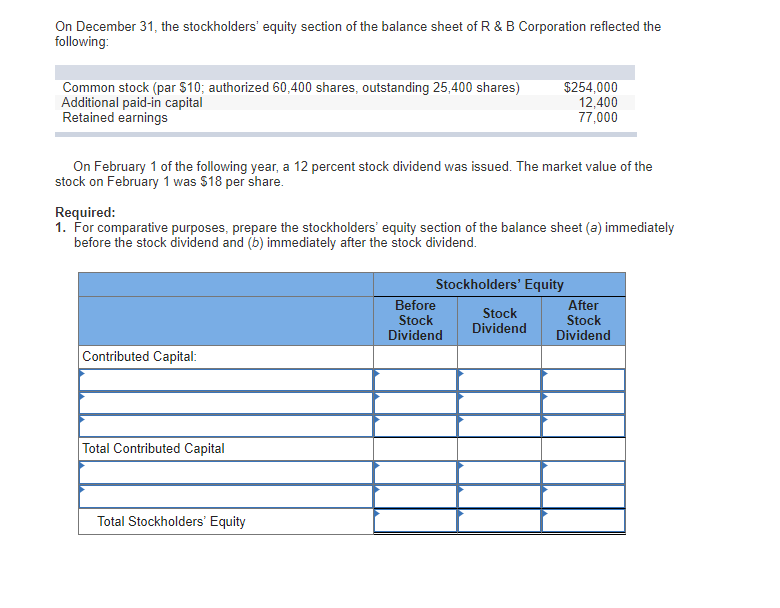

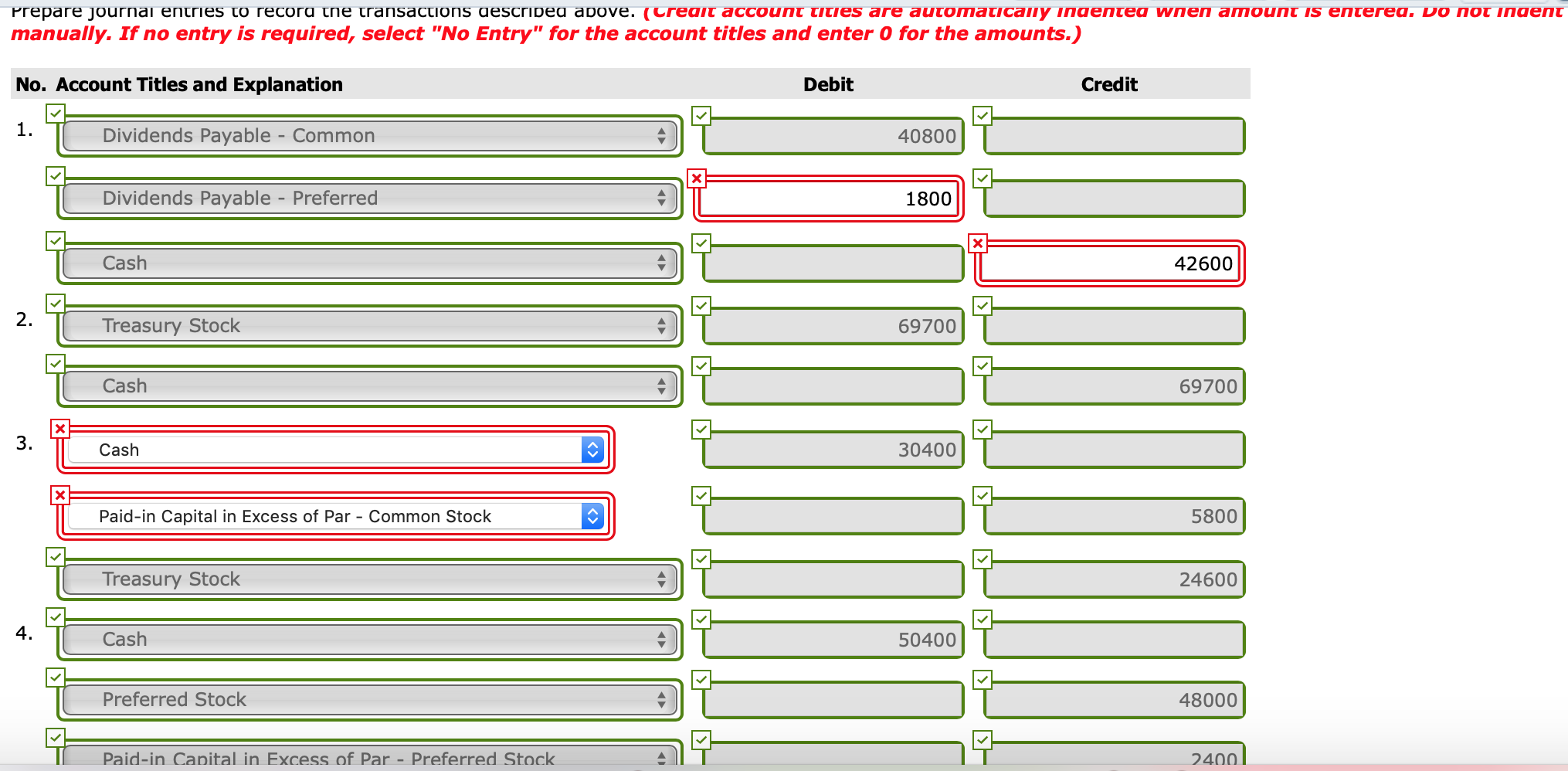

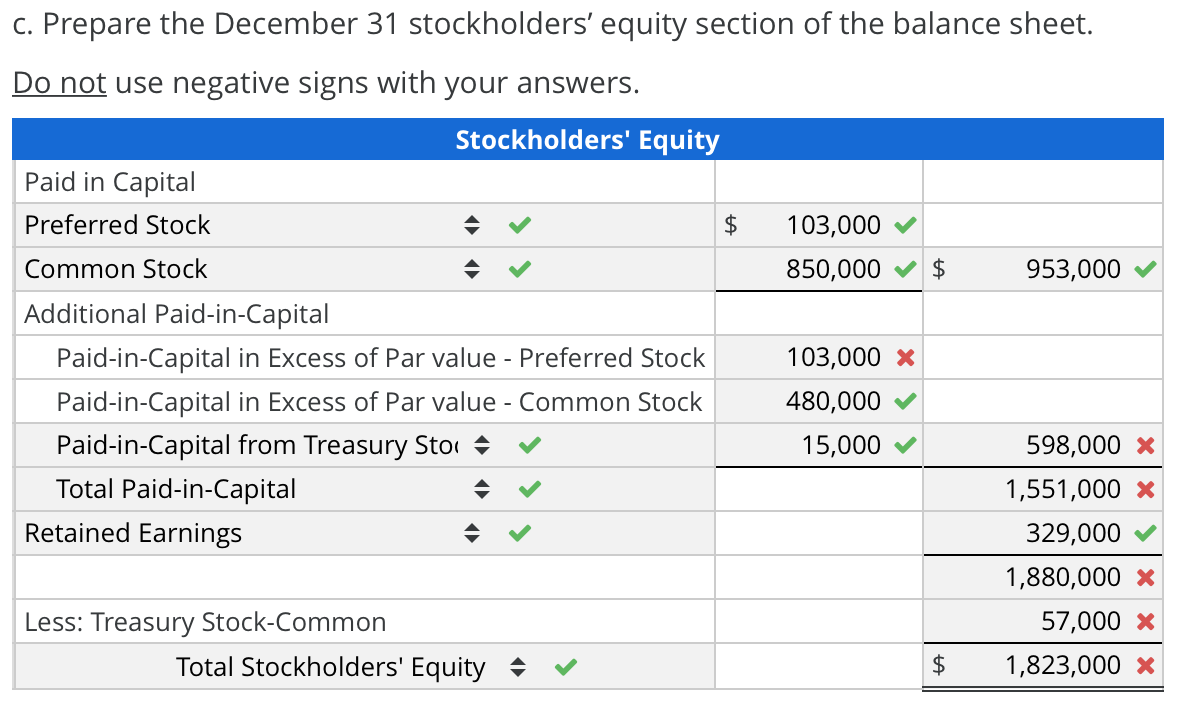

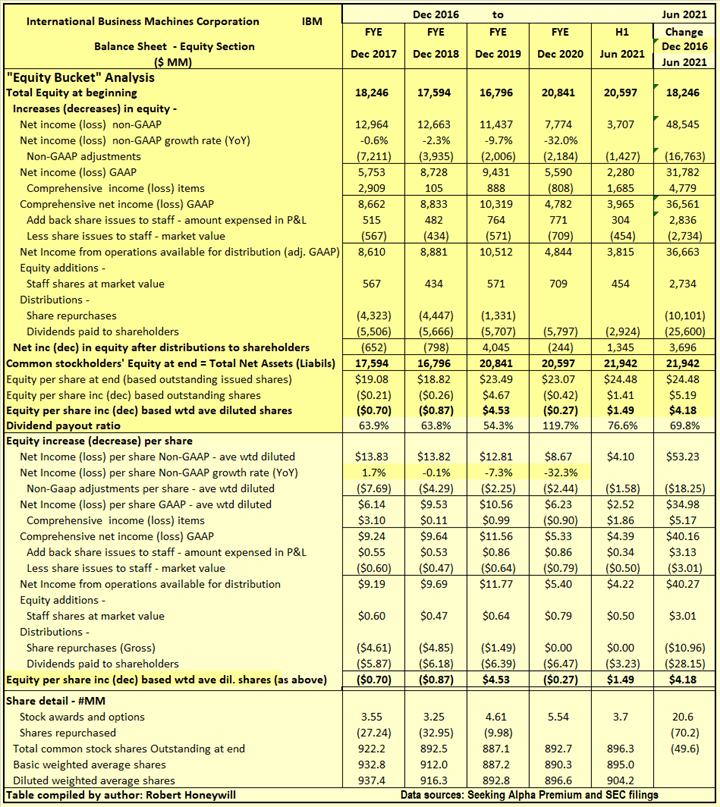

Lesson fourteen covers the stockholders' equity section of the balance sheet including the paid in capital and retained earnings segments. Please refer to your bank statements in order to list the amount of money your corporation has as of each date on record. Shareholders' equity sections for corporations include shares of stock outstanding, dividends paid out and retained earnings.

As a reminder, the balance sheet has three major sections: Reports the cost we paid for treasury stock. But what if the underlying entity is an llc?

Owner's equity is the amount a stakeholder has left if all the assets of the business were sold today. When it comes to equity, the accounts displayed depend on the type of entity of your business. The section could look like this:

Let’s dive deeper into that part of the balance sheet. By jason watson, cpa posted wednesday, november 1, 2023 massaging of the equity section of your balance sheet is required when being taxed as an s corporation. Each member's capital account records the initial contribution and any additional contributions made during the year.

Includes common stock, preferred stock, and any paid in capital accounts including paid in capital for treasury stock. Learn how to calculate owner's equity (plus examples). The total amount of this section is the amount of reported assets minus the amount of reported liabilities.

First, the capital accounts are reported on the company's balance sheets as shareholder equity and loans from shareholders. With liabilities, this is obvious—you owe loans to a bank, or repayment of bonds to holders of debt. The second area relates to the activities of the company over a period of time, this is known as retained earnings.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)