Heartwarming Tips About The Format Of Trial Balance

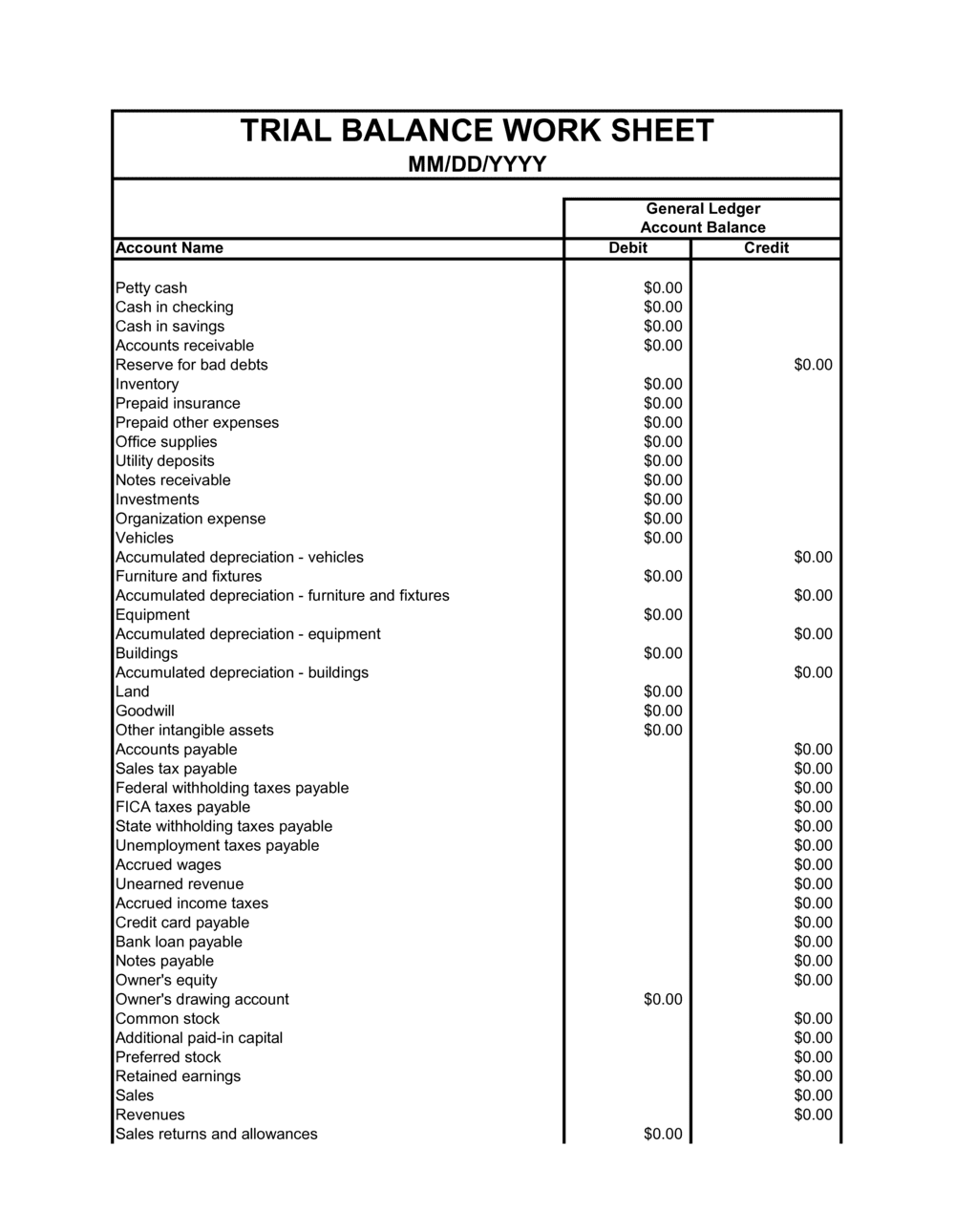

Trial balance is basically a statement having a debit side and a credit side where all the debit balances of journal entries and ledger postings are recorded on the debit side of the trial balance, and all the credit balances of journal entries and ledger postings are recorded on the credit side of the trial balance.

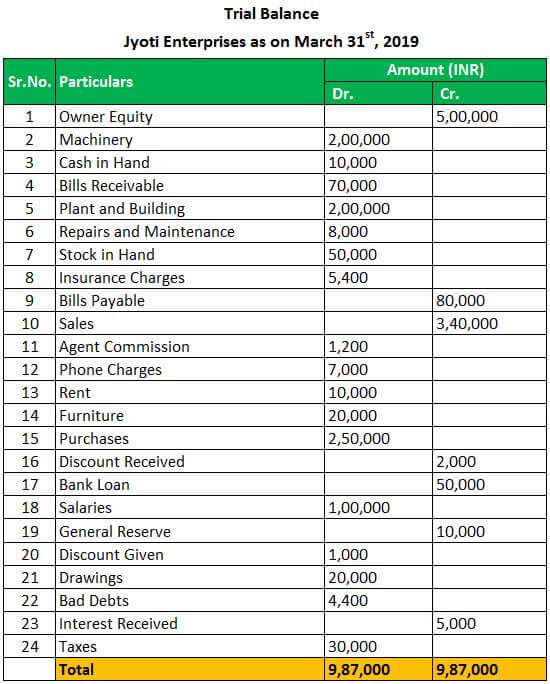

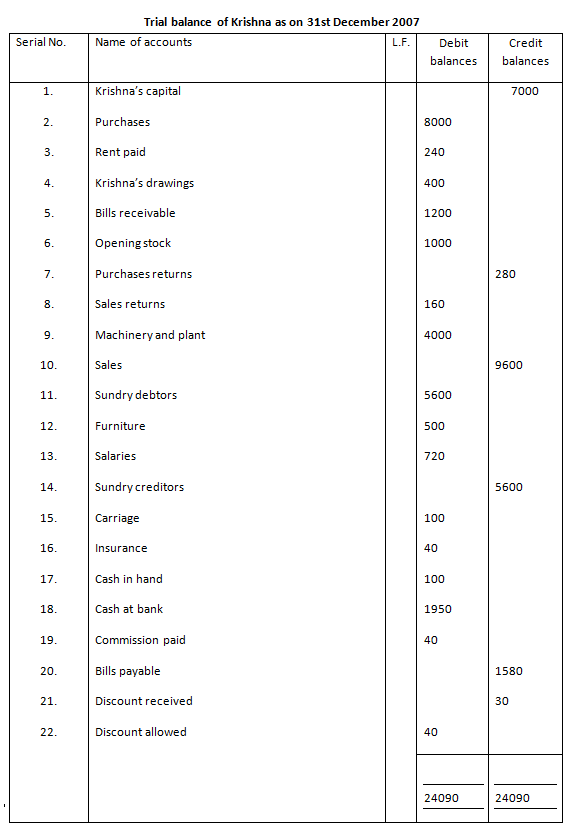

The format of trial balance. What is a trial balance? It is prepared towards the end of a financial year to draw financial statements like profit and loss accounts and balance sheets. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

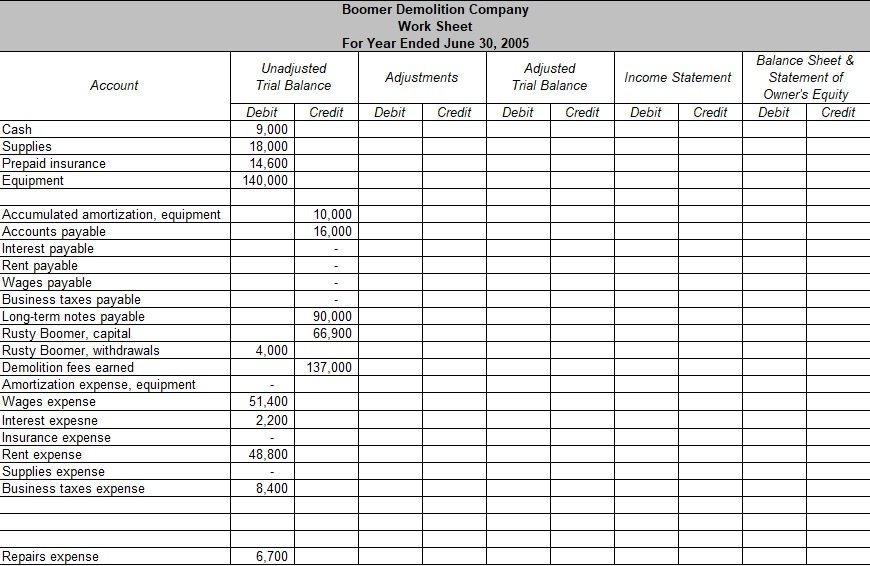

There are three main types of trial balance: The trial balance is prepared after all the transactions for the period have been journalized and posted to the general ledger. Trial balance trial balance format.

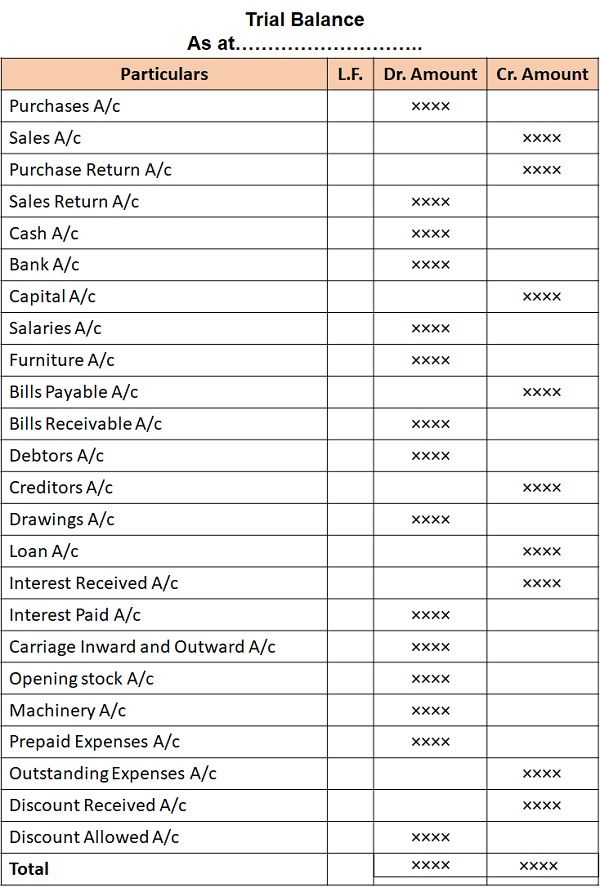

Trial balance is the report of accounting in which ending balances of a different general ledger of the company are and is presented into the debit/credit column as per their balances, where debit amounts are listed on the debit column, and credit amounts are listed on the credit column. Trial balances are a vital auditing technique used to ensure whether the total debit equals the total credit in the general ledger accounts, which plays a crucial role in creating the balance sheet and other financial statements. Trial balance refers to a part of a financial statement that records the final balances of the.

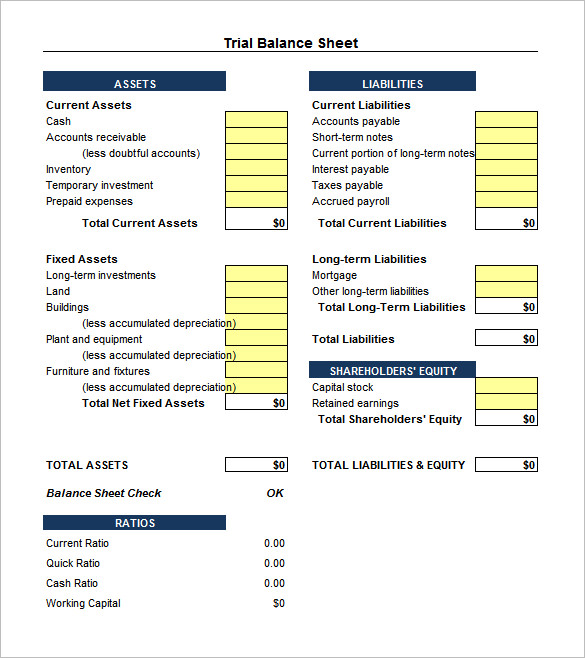

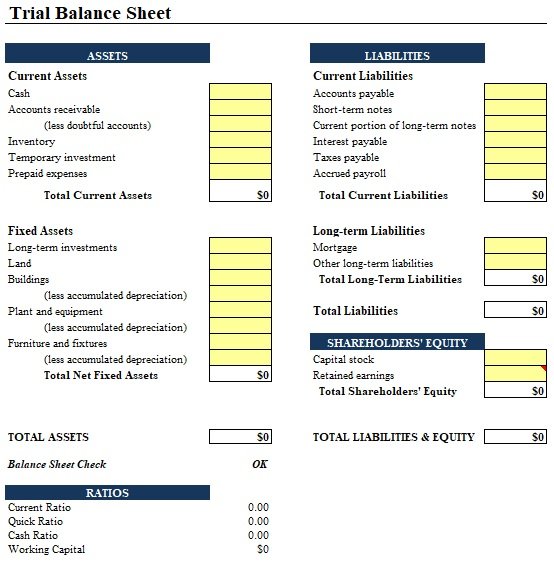

Although a trial balance may equal the debits and credits, it does not mean the figures are correct. The accounts reflected on a trial balance are related to all major accounting items, including assets, liabilities, equity, revenues, expenses, gains,. What is a trial balance?

This is done to determine that debits equal credits in the recording process the trial balance is the first step toward recording and interesting your financial results. A trial balance includes the figures from the profit and loss (income statement) and the balance sheet financial statements. How is the trial balance prepared?

A trial balance is prepared by transferring data from ledger accounts. This means that it states the total for each asset, liability, equity, revenue, expense, gain, and loss account. As per the accounting cycle, preparing a trial balance is the next step after.

Accounts are listed in the accounting equation order with assets. At the bottom of each of the debit and credit columns are the totals. Trial balance is a financial statement summarising the debit and credit balance of the ledger accounts to verify arithmetical accuracy of financial books.

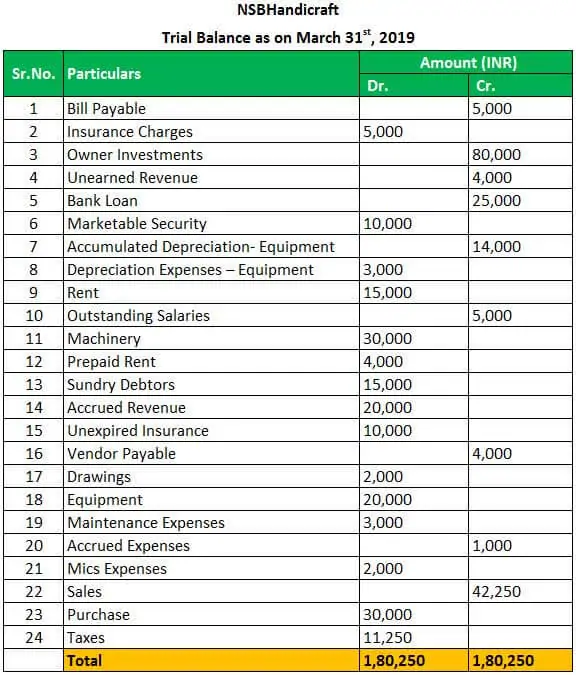

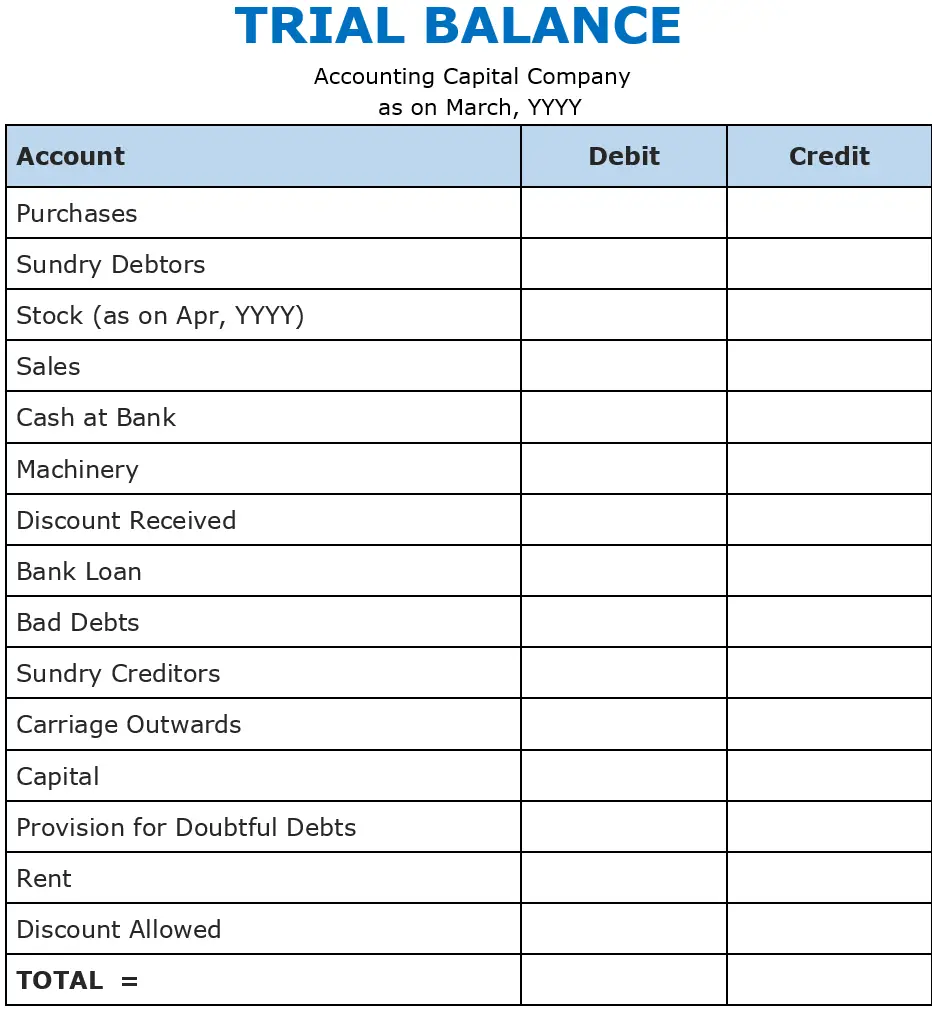

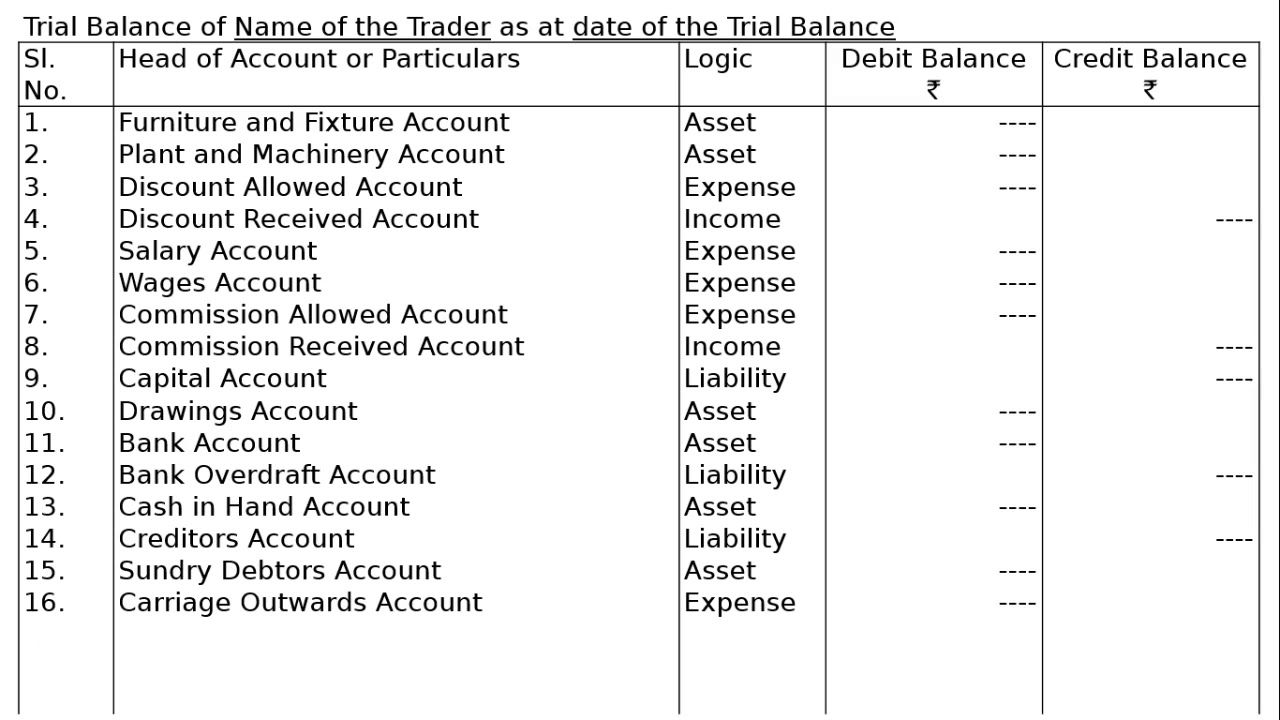

The header must contain the name of the company, the label of a trial balance (unadjusted), and the date. April 13, 2023 to prepare a trial balance, you need to list the ledger accounts along with their respective debit or credit amounts. The total of both should be equal.

As we know, the trial balance is the report of accounting in which ending balances of a different general ledger are presented into the debit/credit column as per their balances where debit amounts are listed on the debit column, and. The trial balance has a simple format: The trial balance format is easy to read because of its clean layout.

However, remember both sides of a trial balance must be equal. Trial balance has a tabular format that shows details of all ledger balances in one place. Illustration key points to remember conclusion format of trial balance trial balance of m/s abc for the year ended 31/03/2019 methods of preparing trial balance it can be arranged in the following three ways: