Inspirating Tips About Cash Flow Outflow

To better manage cash flow in your business, you should:

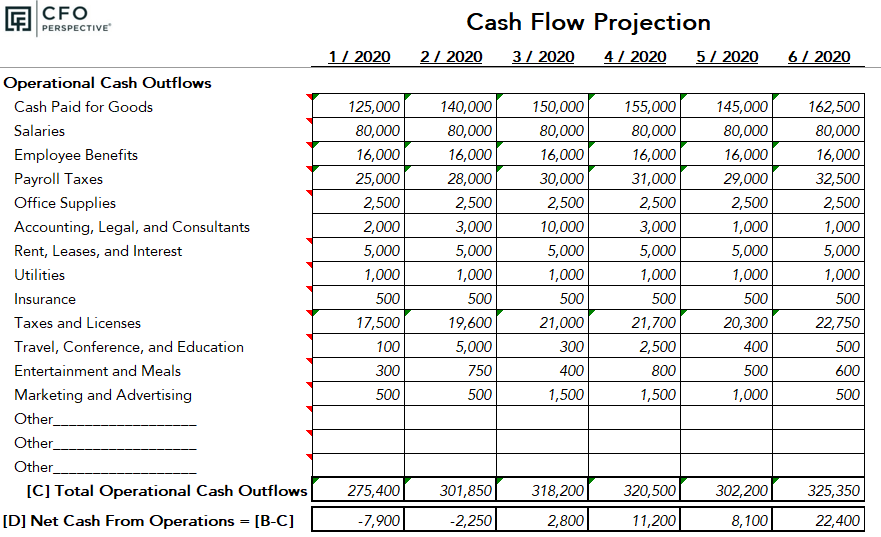

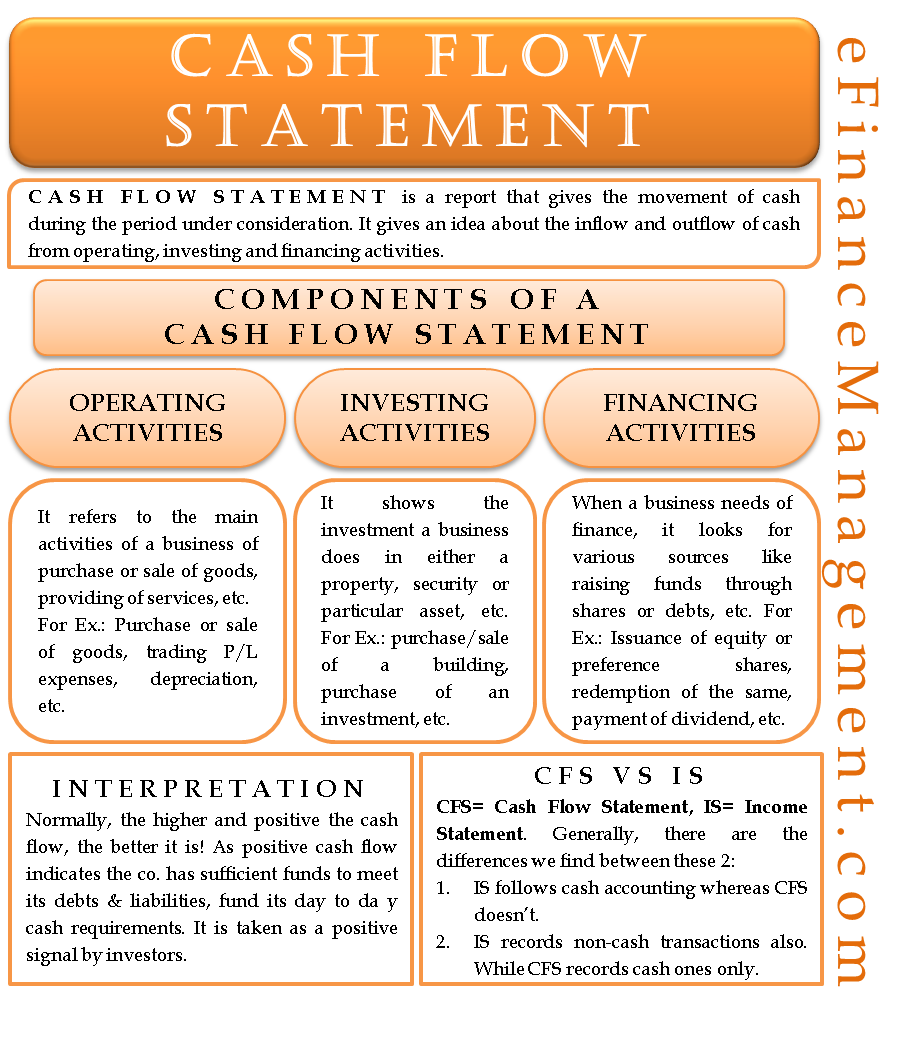

Cash flow outflow. This represents all outgoing cash flows that flow out of the company. A company creates value for shareholders through. Cash flow from investing activities (cfi) is one of the sections on the cash flow statement that reports how much cash has been generated or spent from various.

Losses at gamesa are expected at around €2 billion before special items. Cash received represents inflows, while money spent represents outflows. The reasons for these cash payments fall into one of the following.

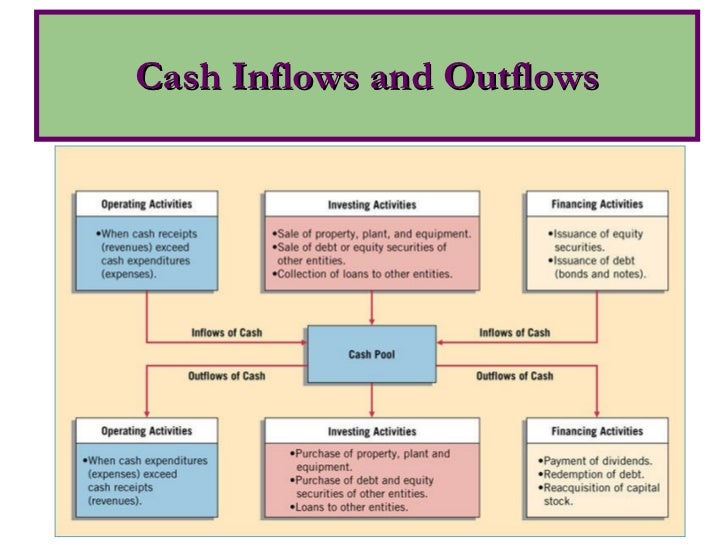

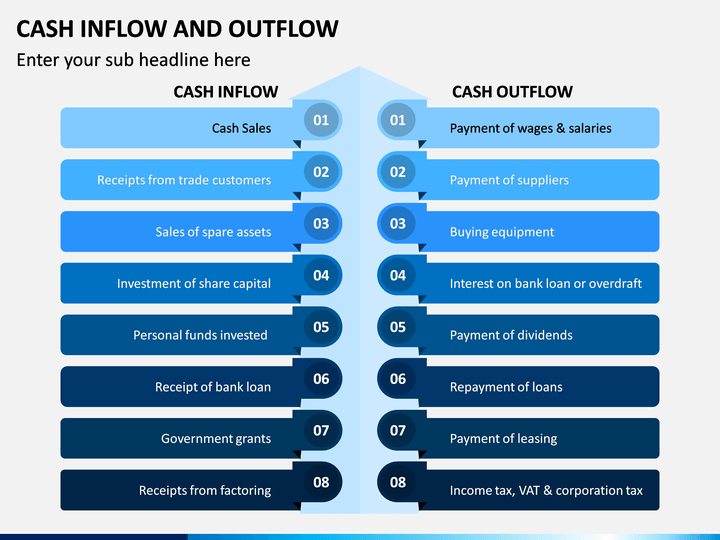

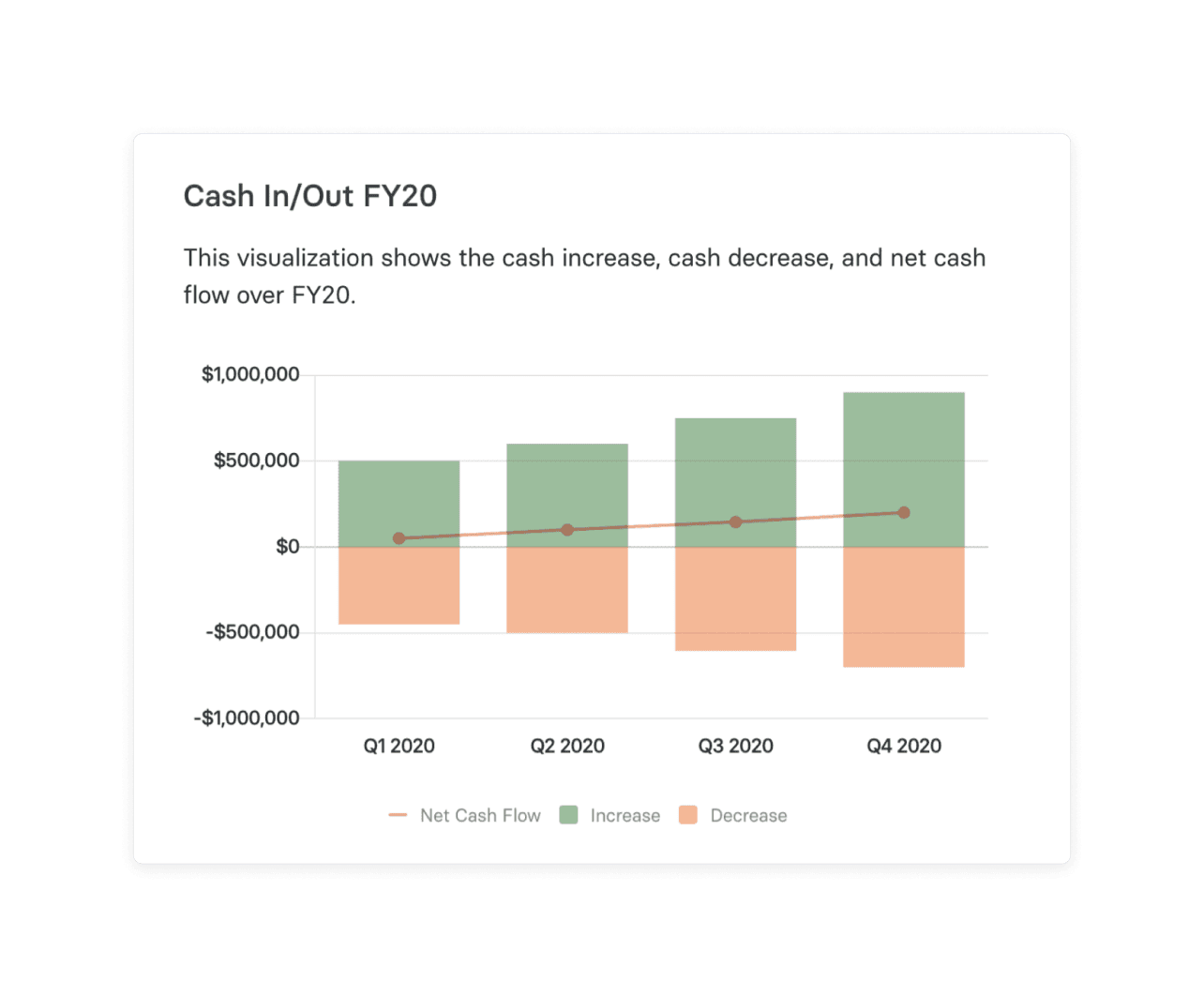

Cash inflows and outflows come from operating, financing, and. Cash outflow is the amount of cash that a business disburses. Cash flow is the net amount that flows in and out of a business in a month, quarter, or year.

In a sentence, an outflow is a movement of cash out of a bank account that may or may not occur at the same time as the associated cost. While the receipt of money is. Maintain a positive cash flow by keeping your cash inflow greater than your outflow keep.

Cash inflow and outflow. Indeed, wall street analysts have carpenter generating $148 million in free cash flow in its financial 2024, leading to $179 million in its financial 2025. Financing cash flow is the net cash generated.

Cash flow can be defined as the flow of money in and out of businesses during a period and needs to be monitored closely. In simple terms, the term cash outflow describes any money leaving a business. Financing activities cash flow is cash inflow and cash outflow relating to a company’s creditors and business owner or owners.

Obvious examples of cash outflow as experienced by a wide range of businesses include. Cash flow is best described as the sum of the income flowing into and out of business. This period is usually a month, quarter, or year.

Pretax free cash flow is expected at a negative of about €1 billion. These expenses are categorized in the cash flow. In most cases, the term “outflow” refers.

Cash flow is the net cash and cash equivalents transferred in and out of a company. A cash outflow refers to the movement of money from a business due to various expenses. Pages net cash flow net cash flow is the difference between all cash inflows and all cash outflows of a business:

It’s the opposite of cash outflow, which is the money. Cash flow is not the same as working capital or gross/net profit, and the distinction. The counterpart to cash inflow is cash outflow.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Financing_Activities_Sep_2020-01-bb839165006243148d0fd854ee5f477f.jpg)