Peerless Tips About Cash Flow And Fund Difference

Cash flow refers to the overall cash generated by the.

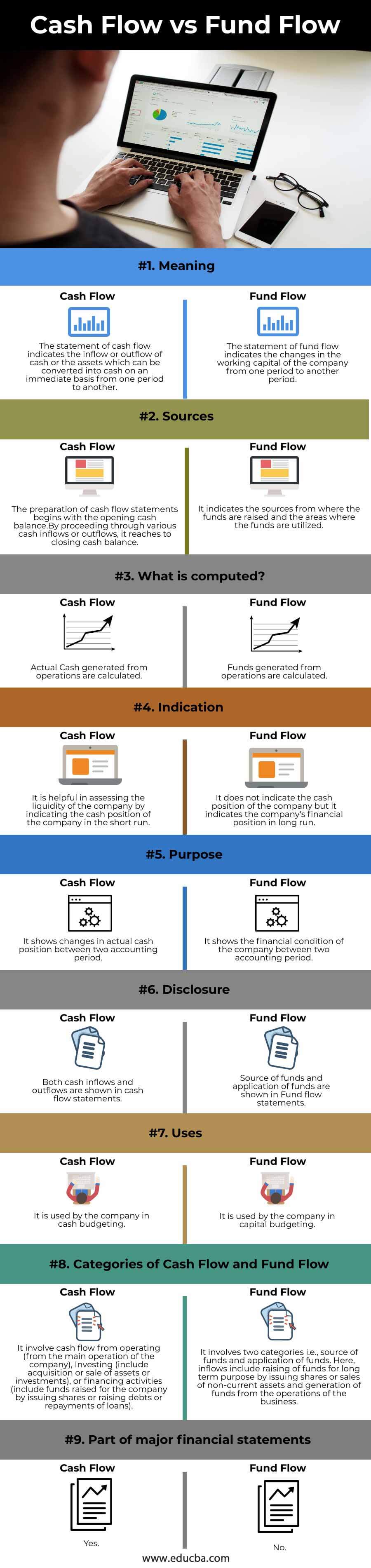

Cash flow and fund flow difference. The basis of the accounting discipline is the idea of cash flow and fund flow. It helps understand the net cash flow. Cash flow is based on the concept of outflow and.

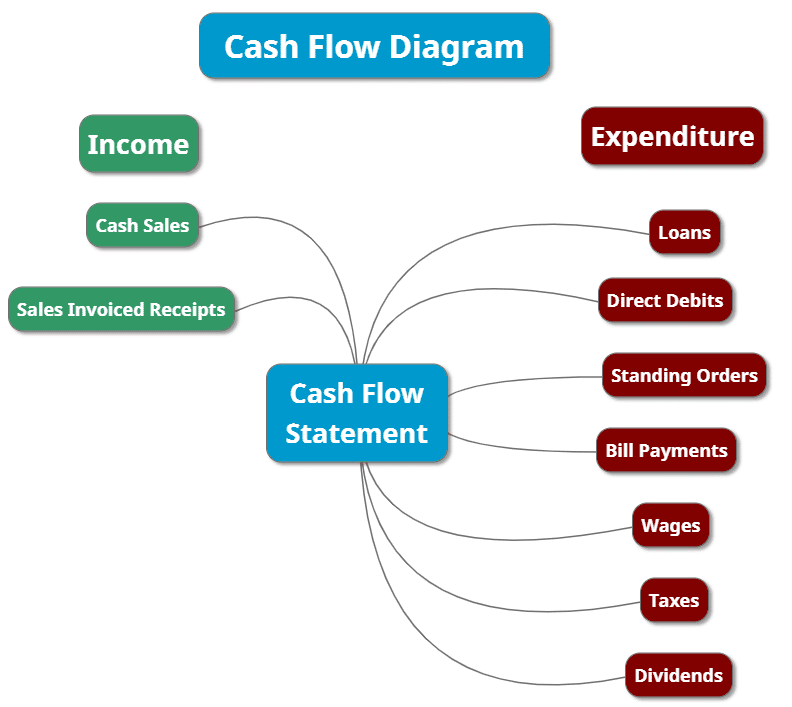

These are advantageous to evaluate a company's liquidity condition. Cash flow refers to the current format for reporting the inflows and outflows of cash, while funds flow refers to an outmoded format for reporting a subset of the same information. Inflows can include the money retail investors put into mutual funds.

Both the statements of cash flow and fund flow have a unique scope and function in a firm. Cash flow vs. Cash flow refers to the concept of inflow and outflow of cash and cash equivalents during a particular period.

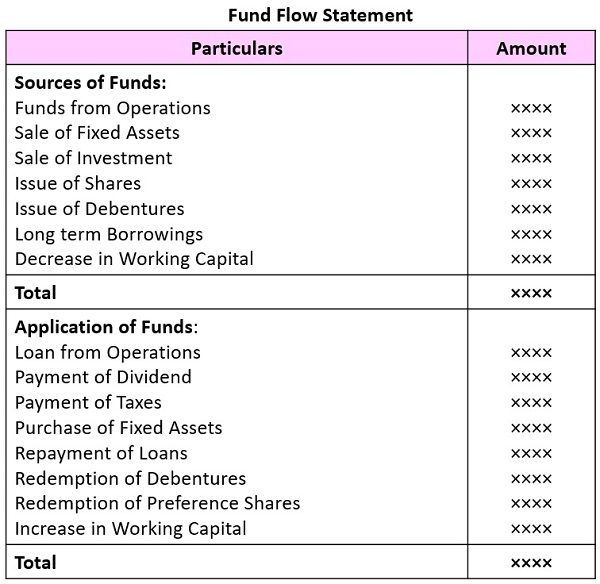

Cash flow vs. They are vital indicators of a company’s financial health. Table of contents difference between cash flow and fund flow statements meaning purpose components structure cash flow fund flow summary the fund flow statement details the inflows and outflows of funds during a particular accounting period.

In conclusion, the main difference between the cash flow statement and the fund flow. Cash flow is derived from the statement of cash flows. Cash flow statements record the movement of cash only.

The difference between cash flow and fund flow is evident in accounting. Fund flow and cash flow are two concepts fundamental to financial accounting. There are generally four different kinds of financial statements in accounting:.

The first two terms mentioned are somehow mistaken and confused because of their names, especially for people that are new in the field of business. Fund flow records the movement of cash in and out of a company. Cash flow is recorded on a company's cash flow statement.

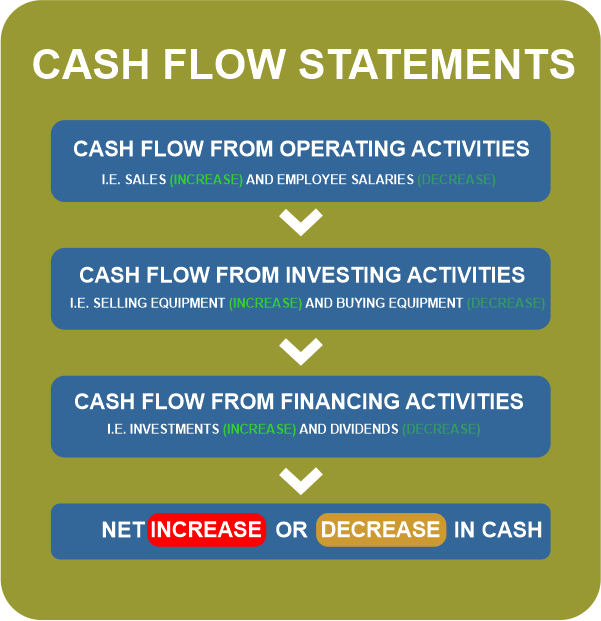

Funds flow statements record the changes in working capital. Fund flow on the other hand, is when there is a change in the financial position of a business between the previous year and the current one. The cash flow statement focuses on cash inflows and outflows from operating, investing, and financing activities.

In accounting, there is a wide variety of statements present. Fund flow focuses on the movement of cash only and reflects the net flow after measuring inflows and outflows. It starts with opening and closing balance of cash and deals only with cash and it shows causes for changes in cash.

It helps understand the financial position of the company. Financing activities cash involved in raising capital via debt or equity financing, along with payments met in the form of dividends, are identified as sourcing from financing activities. Cash flow statement, fund flow statement, income statement — to name a few.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/GettyImages-1163745146-8e67b32f7c8042d5b10b799dd850cec7.jpg)