Painstaking Lessons Of Tips About Cecl Expected Credit Loss

Why did fasb make the change?

Cecl expected credit loss. The financial accounting standards board (fasb) issued a new expected credit loss accounting standard in june 2016. In 2016, the financial accounting standards board issued accounting. 6 rows on the radar:

In response, the financial accounting standards board (fasb) introduced the current expected credit loss (cecl) model. Current expected credit loss (cecl) adoption guidance. The asu adds to u.s.

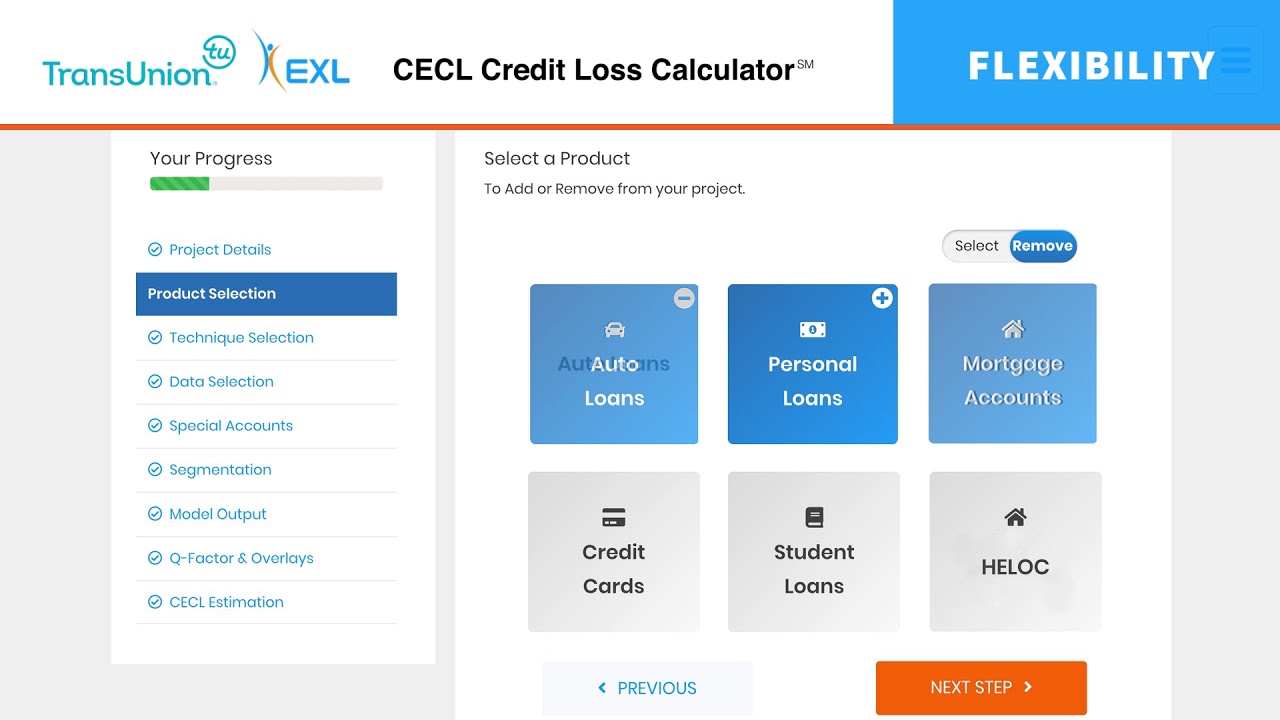

The current expected credit loss (cecl) model in effect for private companies for the years beginning after december 15, 2022, requires consideration of a. Current expected credit losses (cecl) is a credit loss accounting standard (model) that was issued by the financial accounting standards board (fasb) on june 16, 2016. Insights on implementing the cecl model.

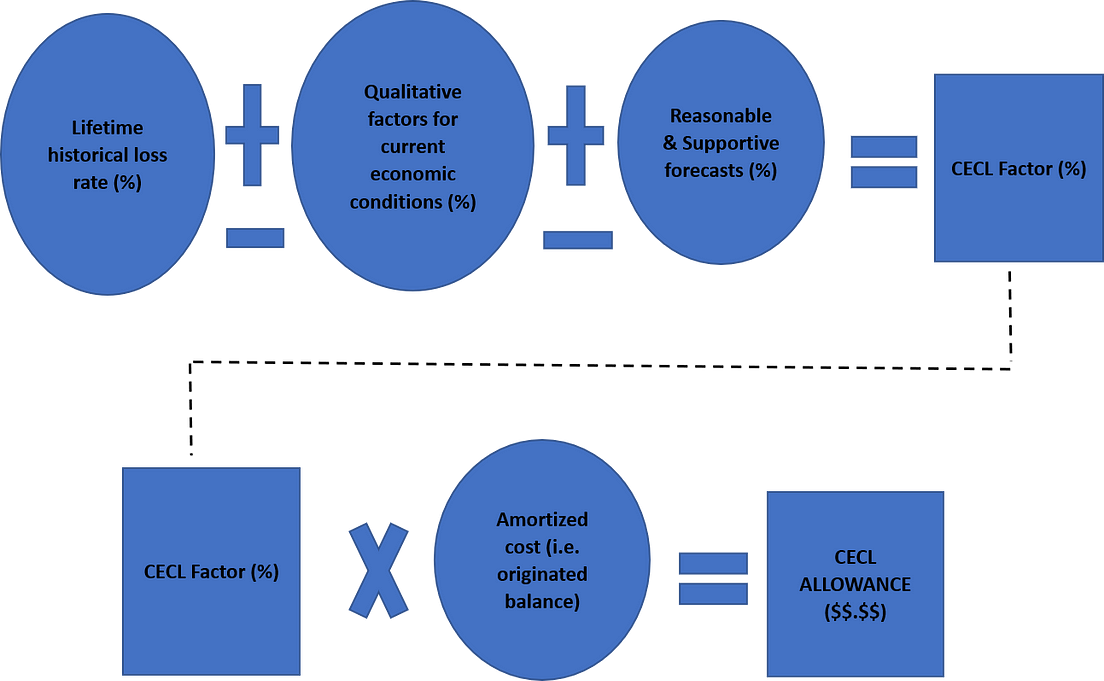

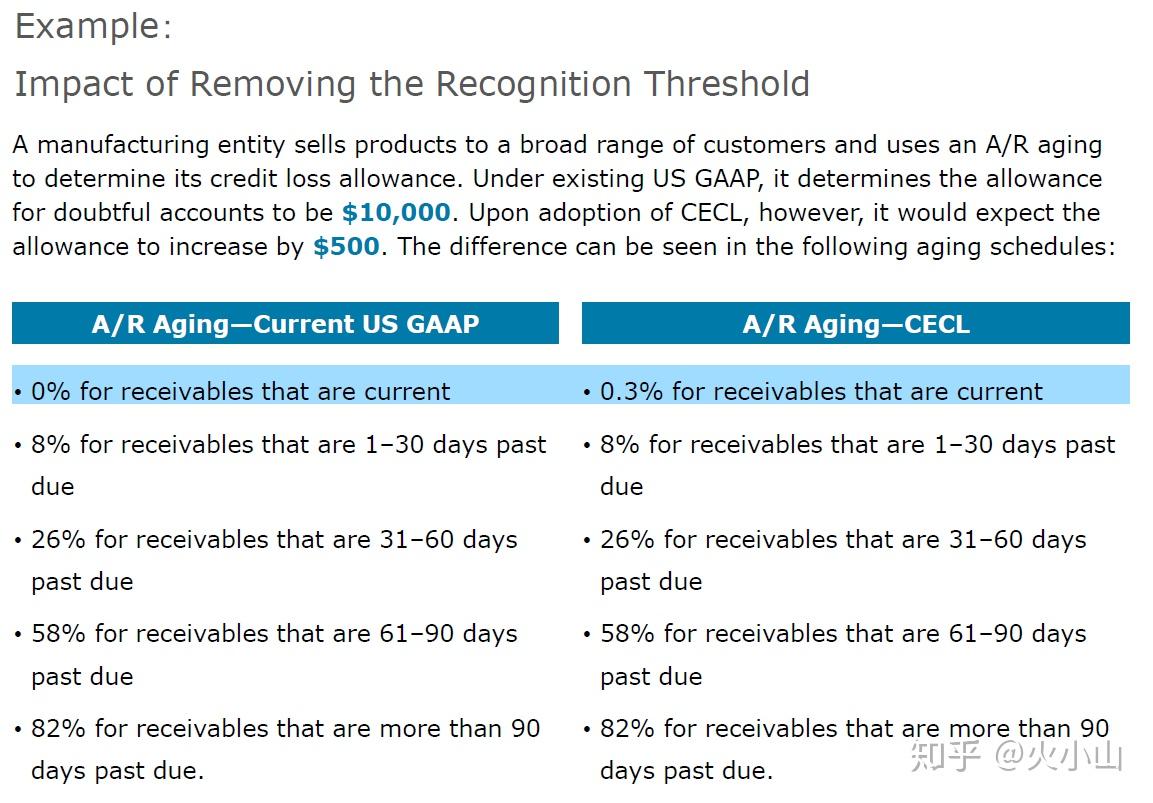

Cecl replaces the current allowance for loan and lease losses (alll) accounting standard. This site is brought to you by the association of international certified. The cecl standard focuses on estimation of expected losses over the life of the loans, while the current standard relies on incurred losses.

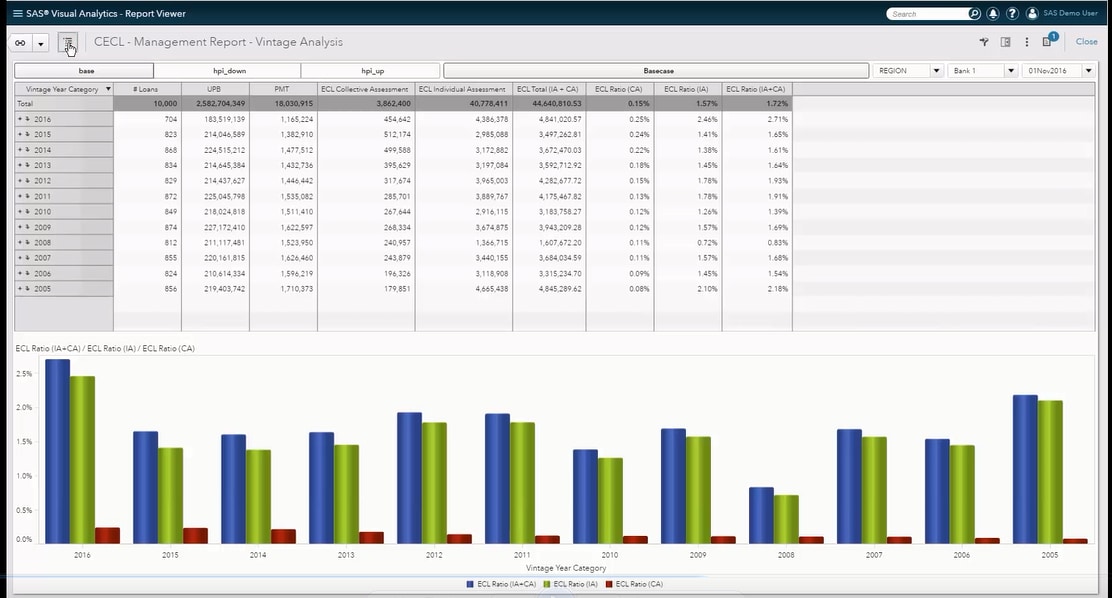

Introduction alert for regulatory reporting professionals — did you know? The current expected credit loss model (cecl) is an accounting standard set forth by the financial accounting standards board (fasb) that changes the method. The cecl approach fundamentally changes the way banks evaluate and provision for credit losses because they have to provision for all expected credit losses on all.

The current expected credit loss. After the financial accounting standards board (fasb) announced cecl to recognize and measure credit losses for loans and debt securities, the refrain on banking street has. Current expected credit losses (cecl) follow.

Statement on the current expected credit loss methodology (cecl) and stress testing. The current expected credit losses (cecl) impairment model applies to a broad scope. The new accounting standard introduces.

Cecl, which governs recognition and measurement of credit losses for loans and debt securities, presents several challenges for institutions trying to determine how to. Current expected credit loss (cecl) is finally here. The concept of expected credit losses (ecls) means that companies are required to look at how current and future economic conditions impact the amount of.

Gaap an impairment model known as the current expected credit loss (cecl) model, which is based on expected losses rather than incurred losses. 2 rows interagency policy statement on allowances for credit losses (revised april 2023) describes the.