Ideal Info About Cash Flow Reconciliation Indirect Method

It helps ensure that financial statements accurately reflect the cash changes that took place during the reporting period.

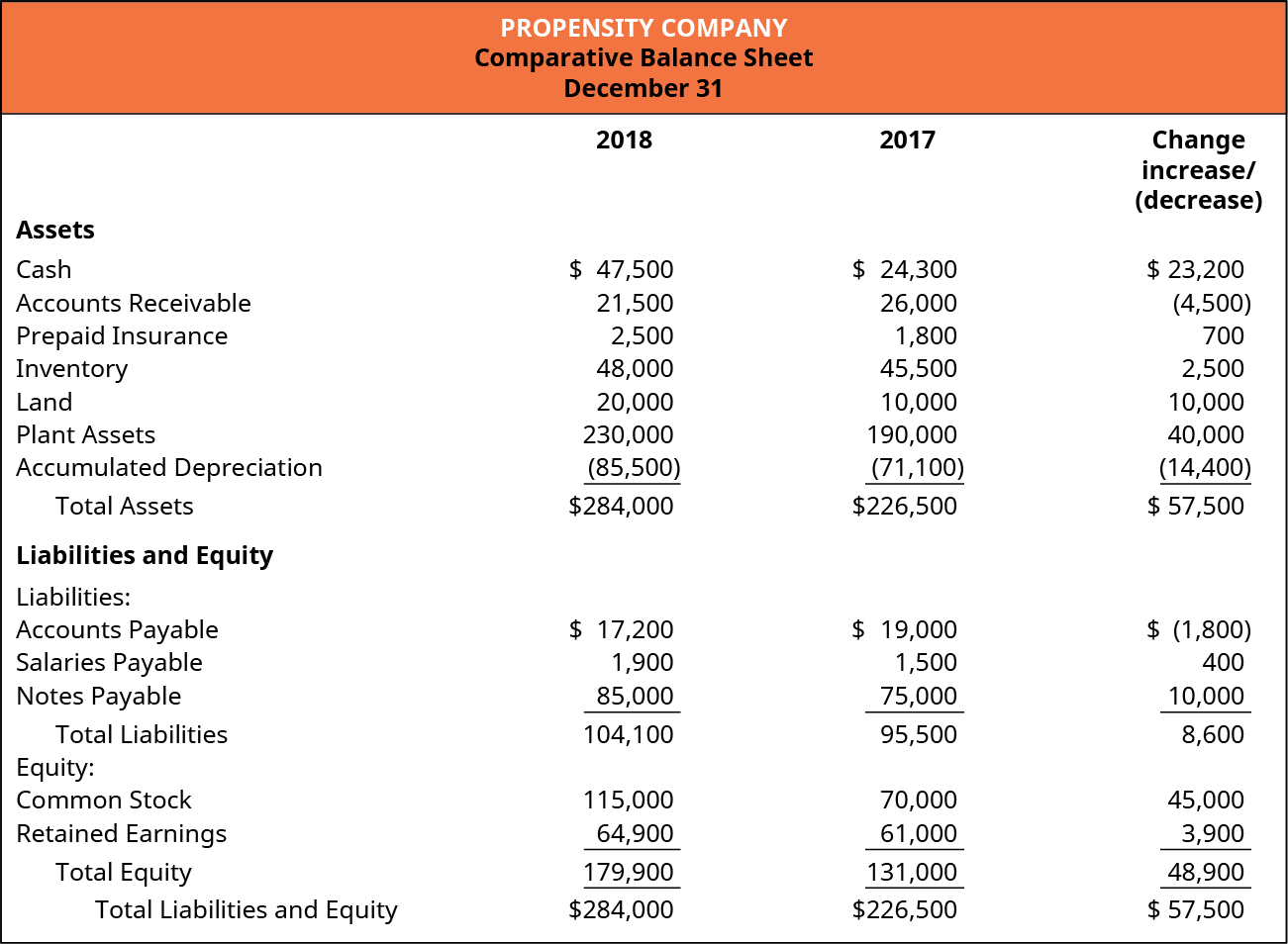

Cash flow reconciliation indirect method. You can gather this information from the company’s balance sheet and income statement. Steps in converting cash flows from indirect method to direct method. The cash flow indirect method uses the information from the cash statement to calculate the cash flow within a certain period.

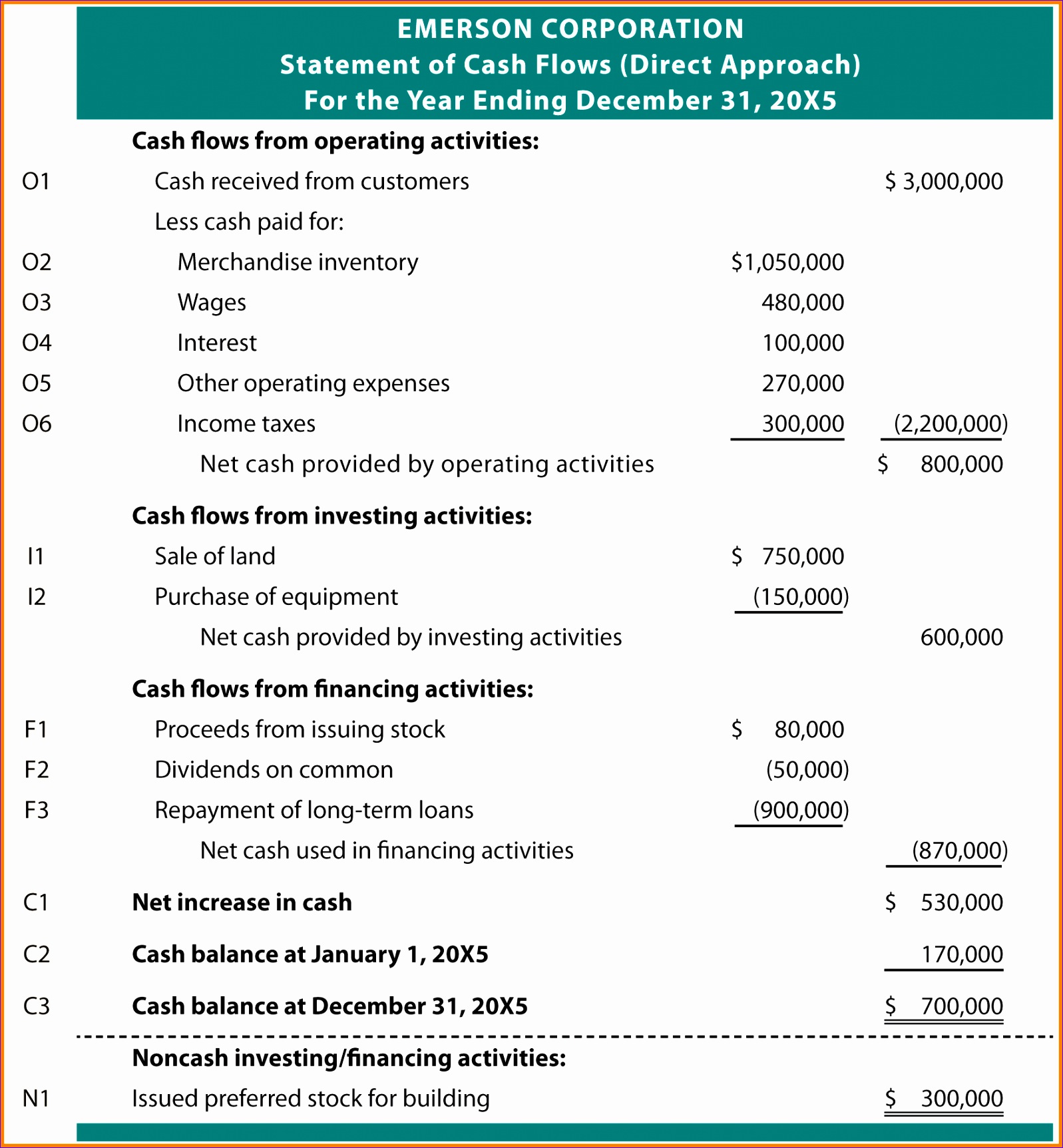

In the following sections i will go through the steps, one by one, in a list format. I’ve also included them in the pdf version of this article that you can download. Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories.

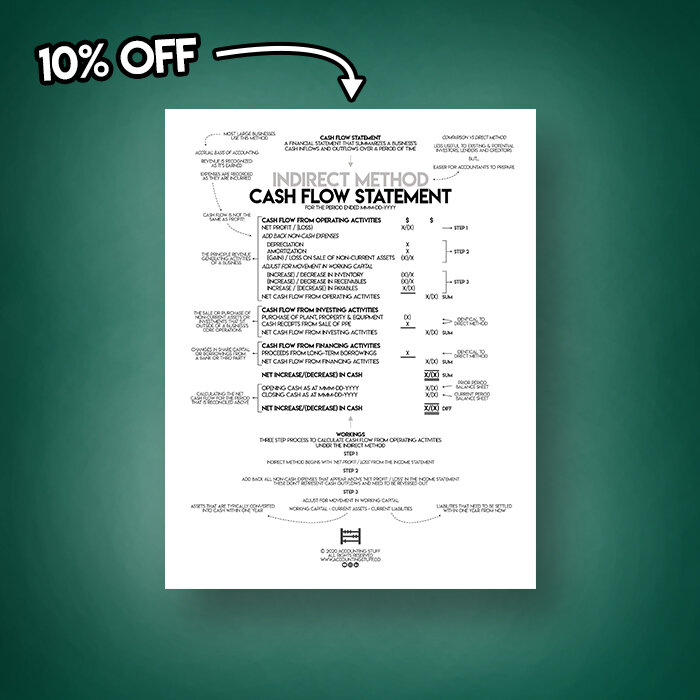

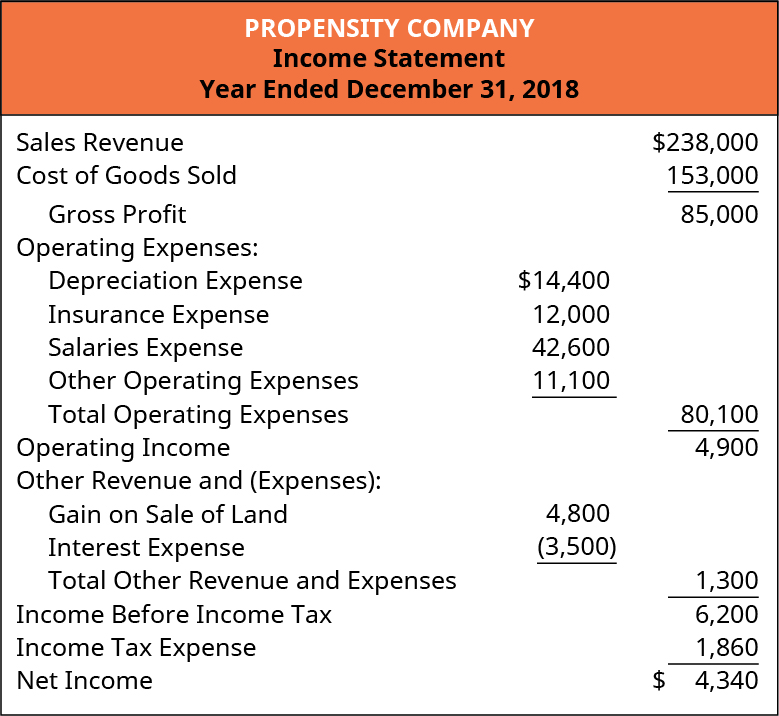

For the indirect method, start your reconciliation with your company's net income, or profit, for the desired time period. Net income is disaggregated into total revenues and total expenses; It is used both by companies for quick calculations and by investors who want to get an idea of the financial situation of a company.

Add back noncash expenses, such as depreciation, amortization, and depletion. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Begin with net income from the income statement.

The indirect method actually follows the same set of procedures as the direct method except that it begins with net income rather than the business’s entire income statement. September 07, 2023 what is the cash flow statement indirect method? The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities.

It starts with a business’s net income and then lists cash flows, both received and paid, for various activities (i.e., the three cash flow categories: Reporting entities have latitude in how they present an indirect method reconciliation, as there is no prescribed format. Determine net cash flows from operating activities.

Reconciliation of free cash flow (in thousands) three months ended december 31, for the year ended december 31, 2023. Add back noncash expenses, such as depreciation, amortization, and depletion. Using the indirect method, operating net cash flow is calculated as follows:

Determine net cash flows from operating activities. Cashflow statement indirect method, explained the financial controller 198k subscribers subscribe 2.5k 72k views 1 year ago bergen county in this video. The cash flow statement indirect method is one way to present a company’s total cash flow.

Cut one small expense and. Using the indirect method, operating net cash flow is calculated as follows: For instance, assume that sales are stated at $100,000 on an accrual basis.

You'll find this figure at the bottom of the company's income. The indirect cash flow method calculates cash flow by adjusting net income with differences from noncash transactions. A reconciliation of cash balances is an important tool used when applying the indirect method of analyzing cash flow performance.