Build A Tips About Tax Expense On Income Statement

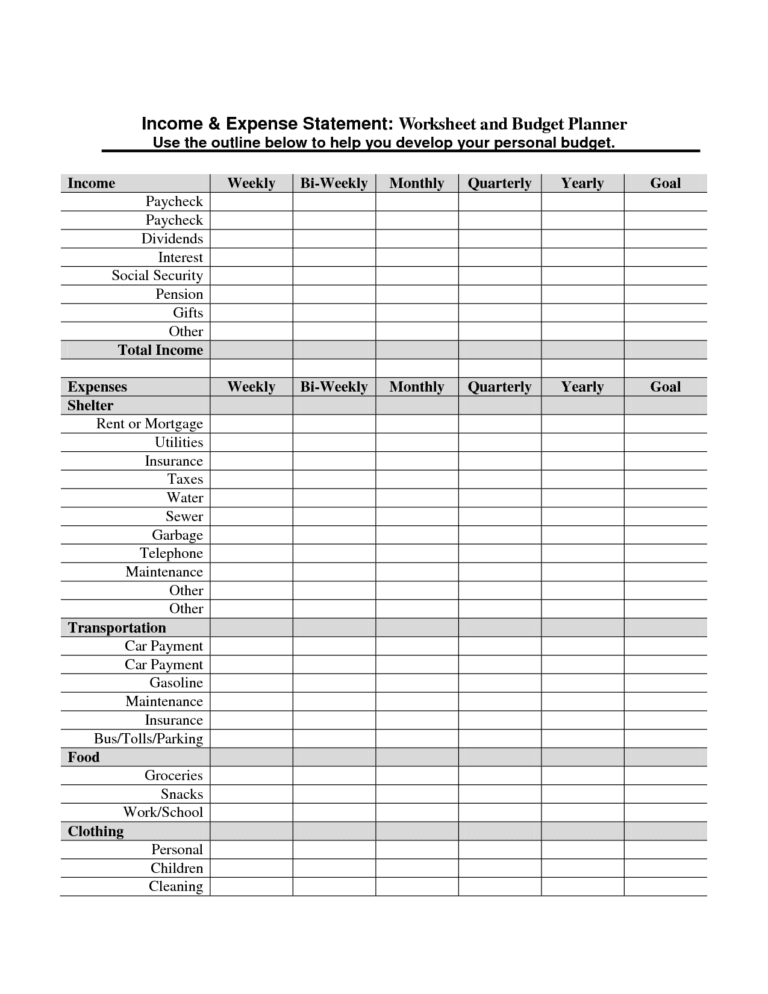

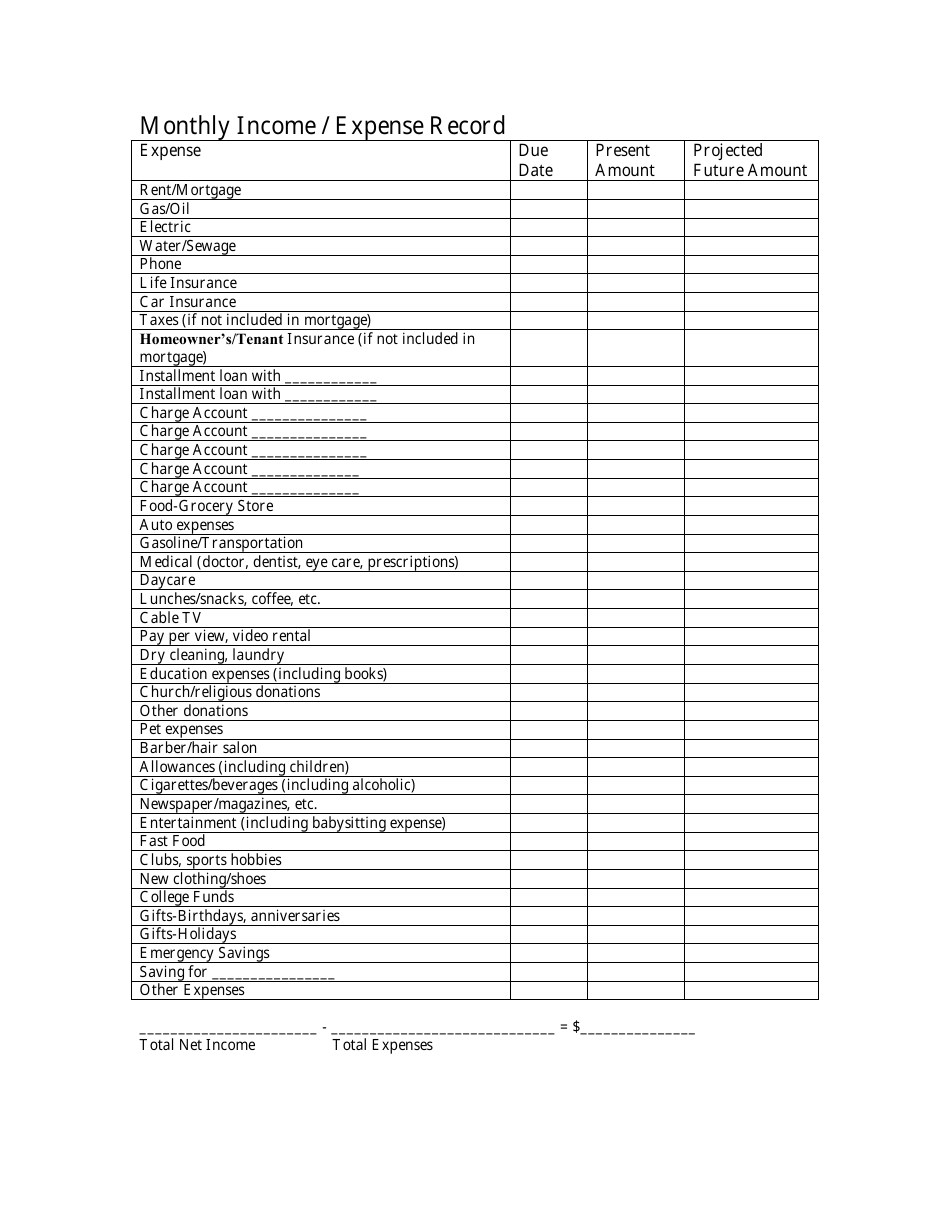

Input the appropriate numbers in this formula:

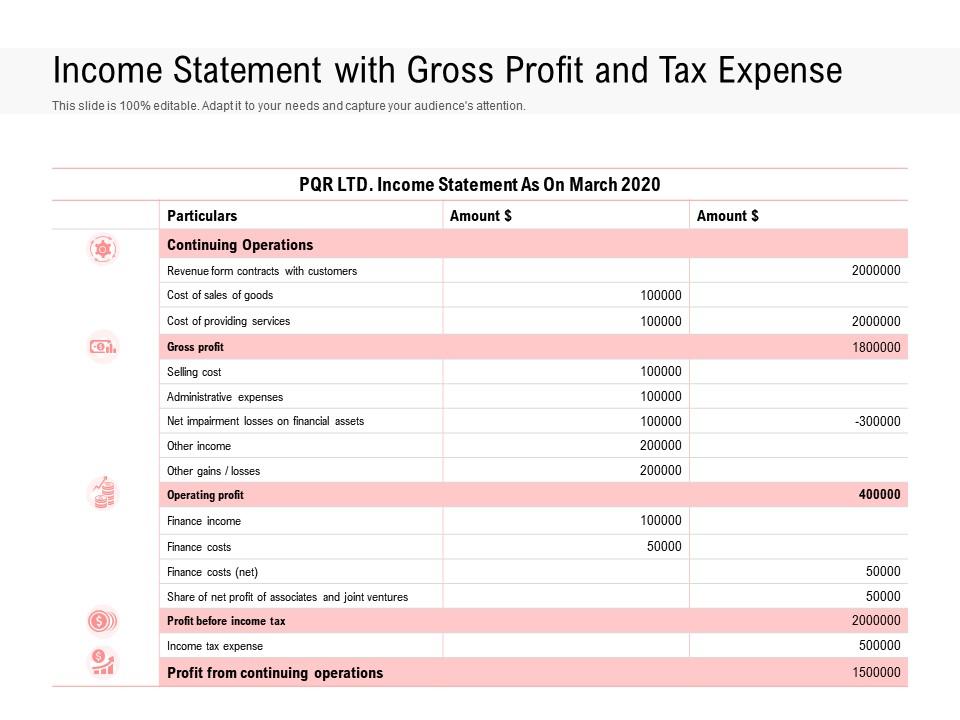

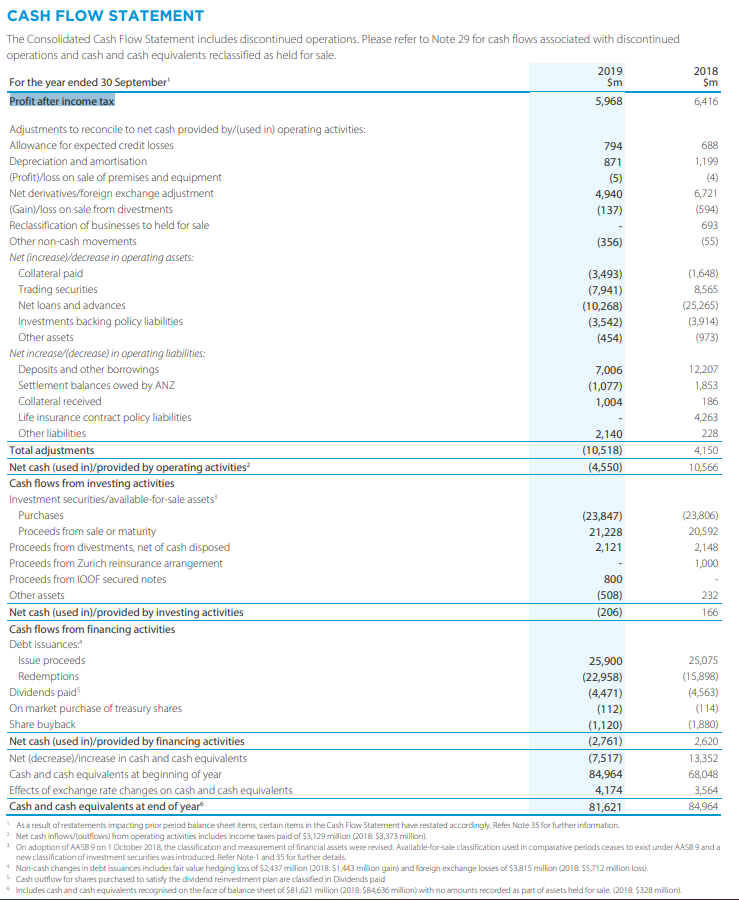

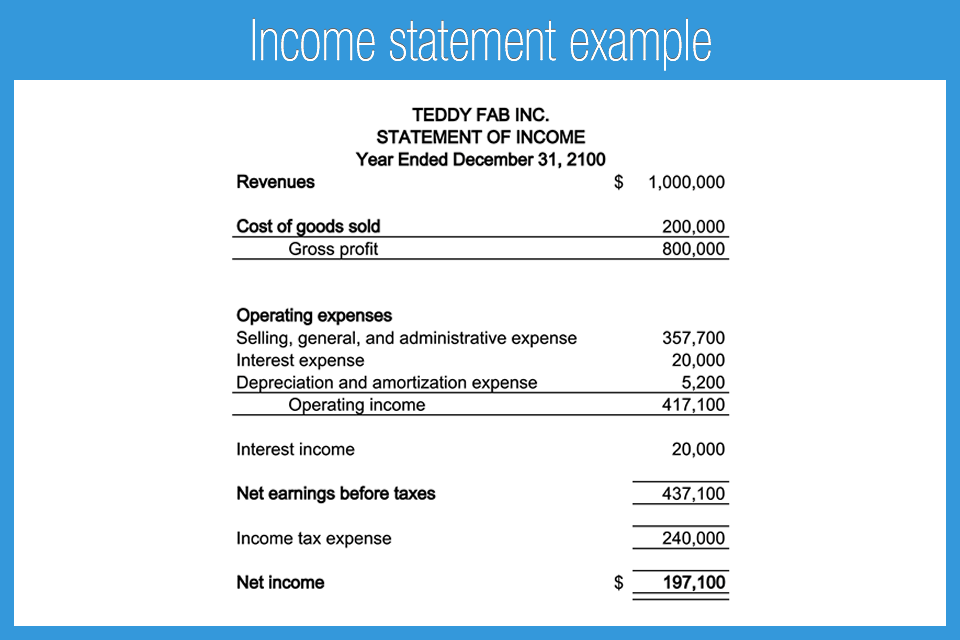

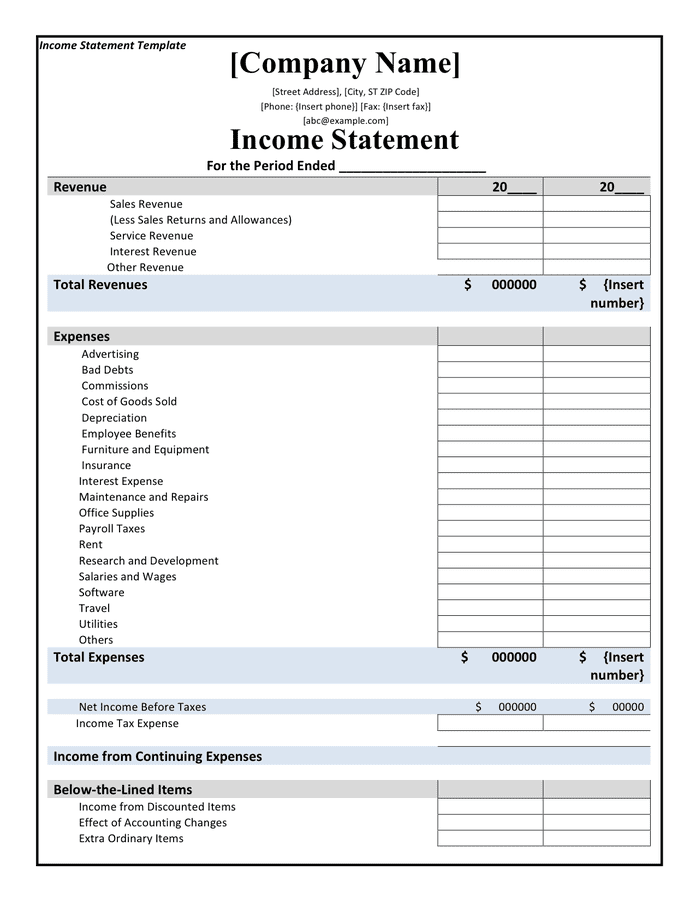

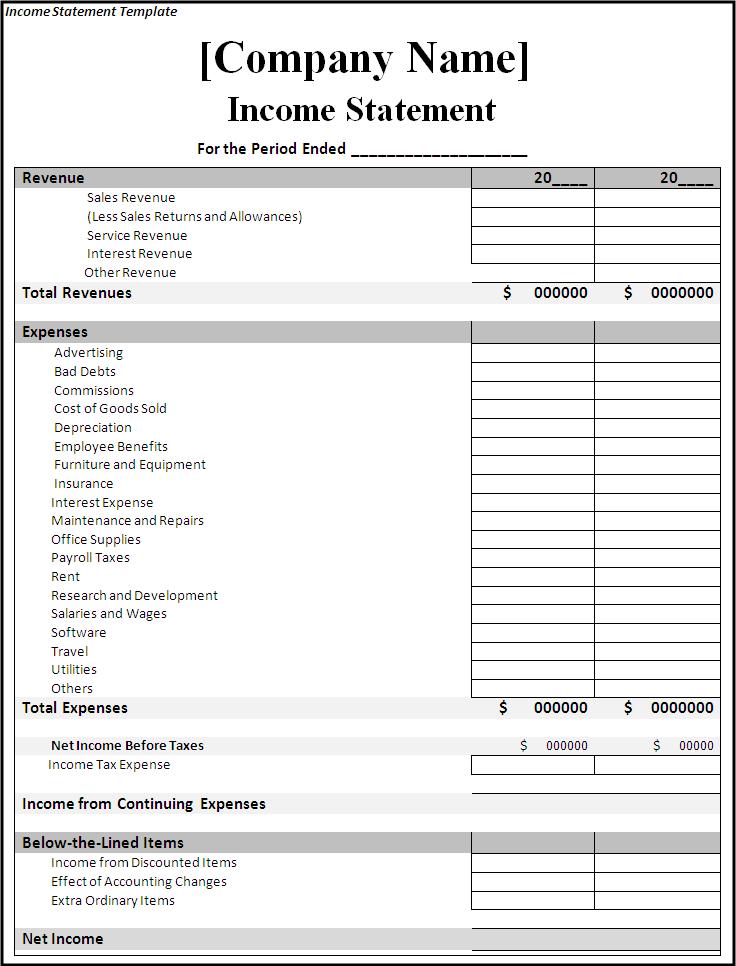

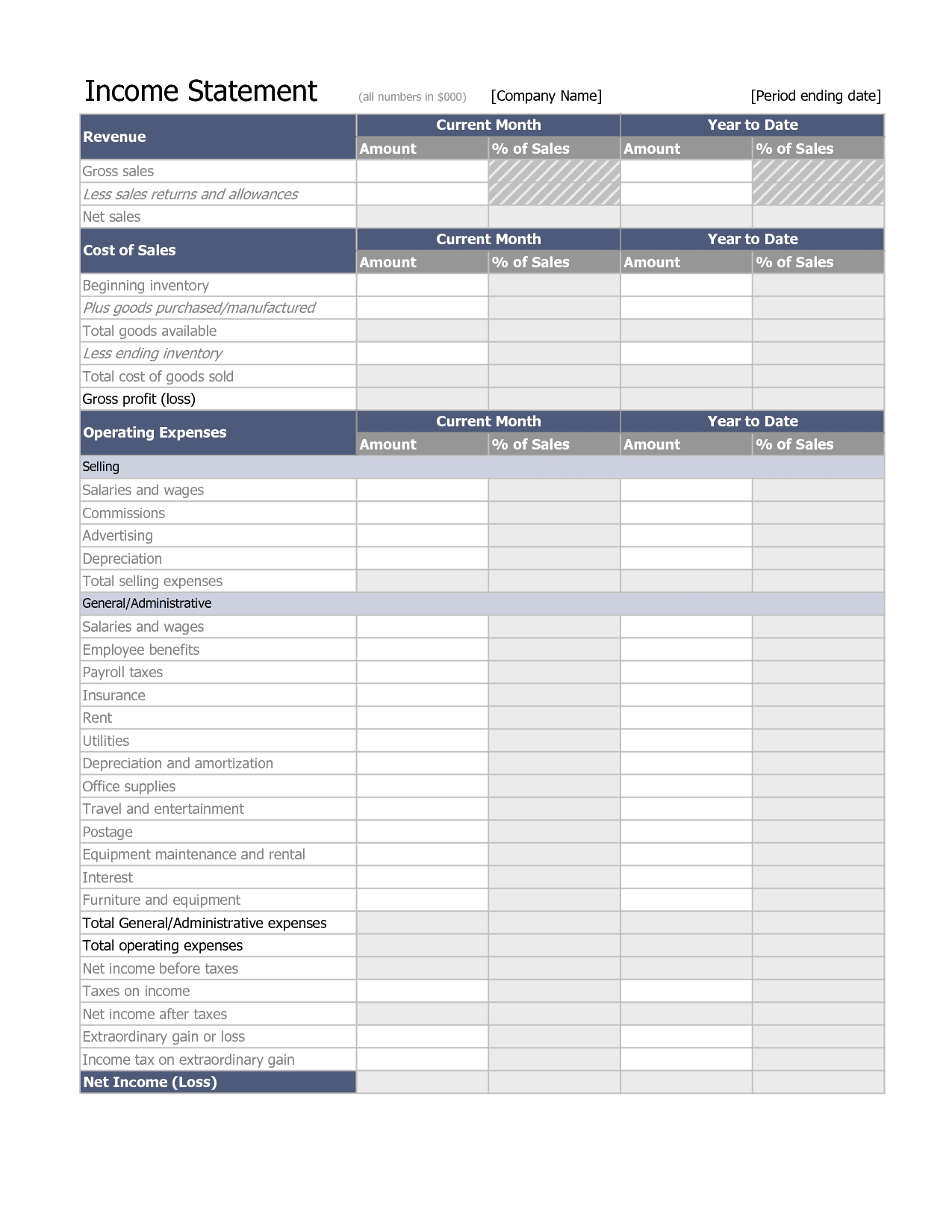

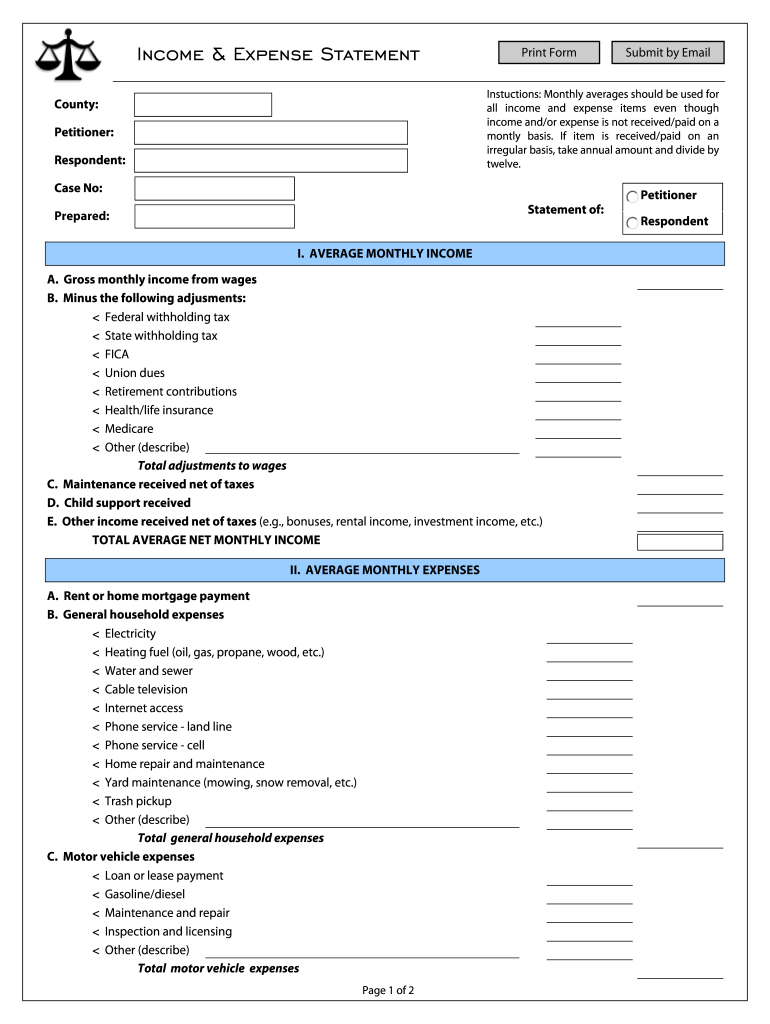

Tax expense on income statement. Revenue minus expenses equals profit or loss. On an income statement, you can view revenues from sales, cost of goods sold (cogs), gross margin, operating expenses, operating income, interest and. Income tax expenses are treated on a company’s income statement, whereas those income taxes due to be paid are reported on the balance sheet under.

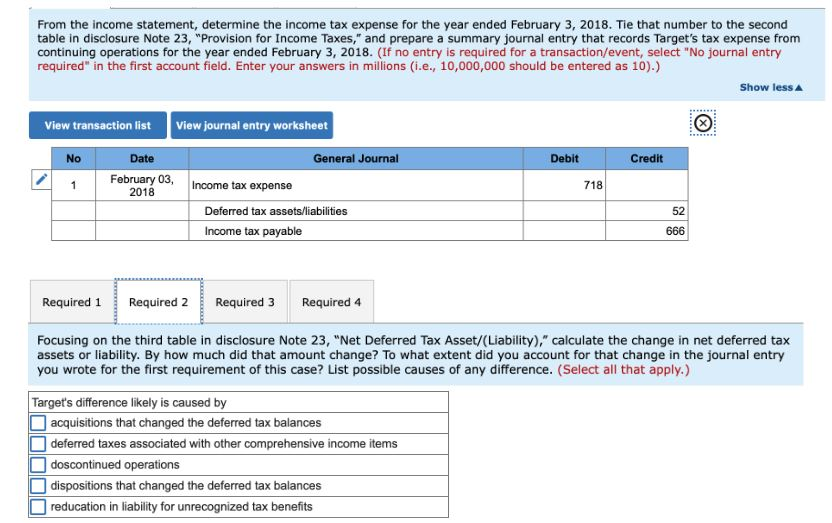

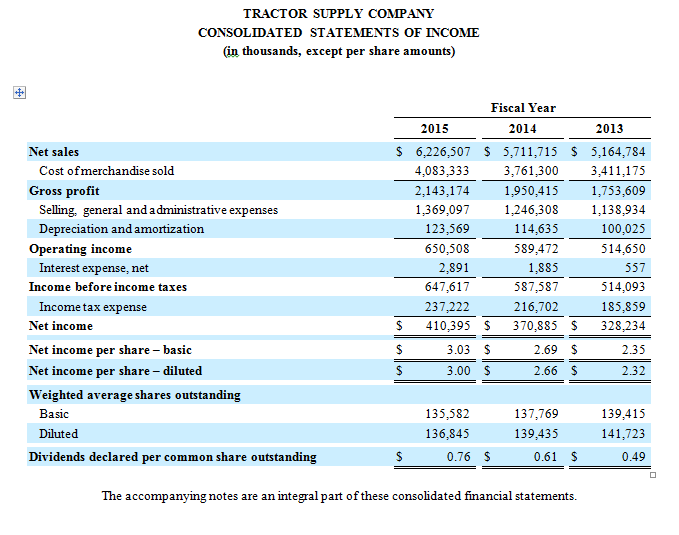

Since it recorded net income (not a loss), it must also record income tax expense of $6,000 in the current and $5,000 in the prior year. The income statement, or profit and loss statement, also lists expenses related to taxes. Total income tax expense or benefit for the year generally equals the sum of total income tax currently payable or refundable (i.e., the amount calculated in the.

It is a tax levied by the government on a business’s earningsand an individual’s income. This figure is frequently broken out by source (federal, state, local, etc.) on the income. The last expense reported on the income statement is income taxes.

Add up all your revenue and gains. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative. For example, if you itemize, your agi is $100,000.

The amount of income tax expense recorded represents a direction reduction of the net income reported for that period. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). This can be taxes at the federal, state, or local levels.

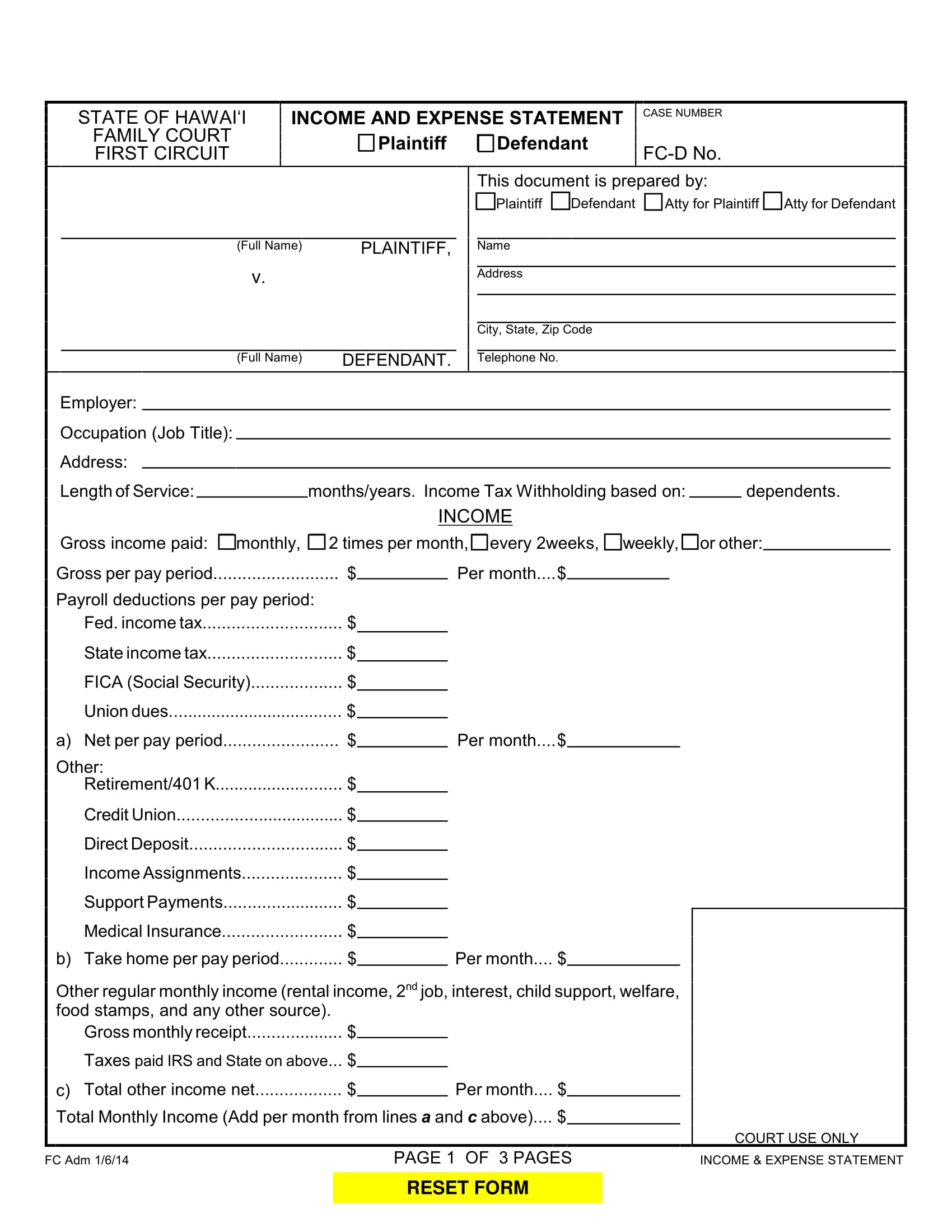

The income tax expense is the total amount the company paid in taxes. Income tax is the amount of tax a company is liable to pay to its local government. Income tax expense on its income statement for the revenues and expenses appearing on the accounting period's income statement, and income taxes payable (a current.

Income tax is considered an. Income tax expense definition the amount of income tax that is associated with (matches) the net income reported on the company's income statement. The income statement, also known as a profit and loss statement, shows a business’s financial performance during a specific accounting period.

A tax expense is a liability owed to a federal, state, or local government within a given time period, typically over the course of a year. For instance, if you have a total taxable income of £10 million and a tax rate of 45%, your income tax expense is 45% × 10,000,000, which equals £4,500,000. Interest expense (18,177) income before taxes:

The corporate income tax expense is a component that features on the income statement under the heading of ‘other expenses.’ it is a type of liability on the business or an individual. Income tax is an expense on profits earned for a specific accounting. Key takeaways a tax expense is the amount of tax that an individual or a corporation owes to the tax authority to calculate income tax expenses, take your.

The income tax expense and income tax payable accounts will be reported on the income statement and balance sheet, respectively. Incorporating taxes on an income statement is crucial for accurate financial reporting. The income tax expense will reduce the.