Real Info About Define Cash Flow Statement In Accounting

The statement of cash flows is one of the main financial statements produced by a business, alongside the the income statement and balance sheet.

Define cash flow statement in accounting. Thus, the statement of cash flows is actually enhanced to reveal the totality of investing and financing activities, whether or not cash is actually involved. By looking at the cash flow statement, one can see whether the company has sufficient cash flowing in to pay its debts, fund its operations, and return money to shareholders via. In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in a given time period.

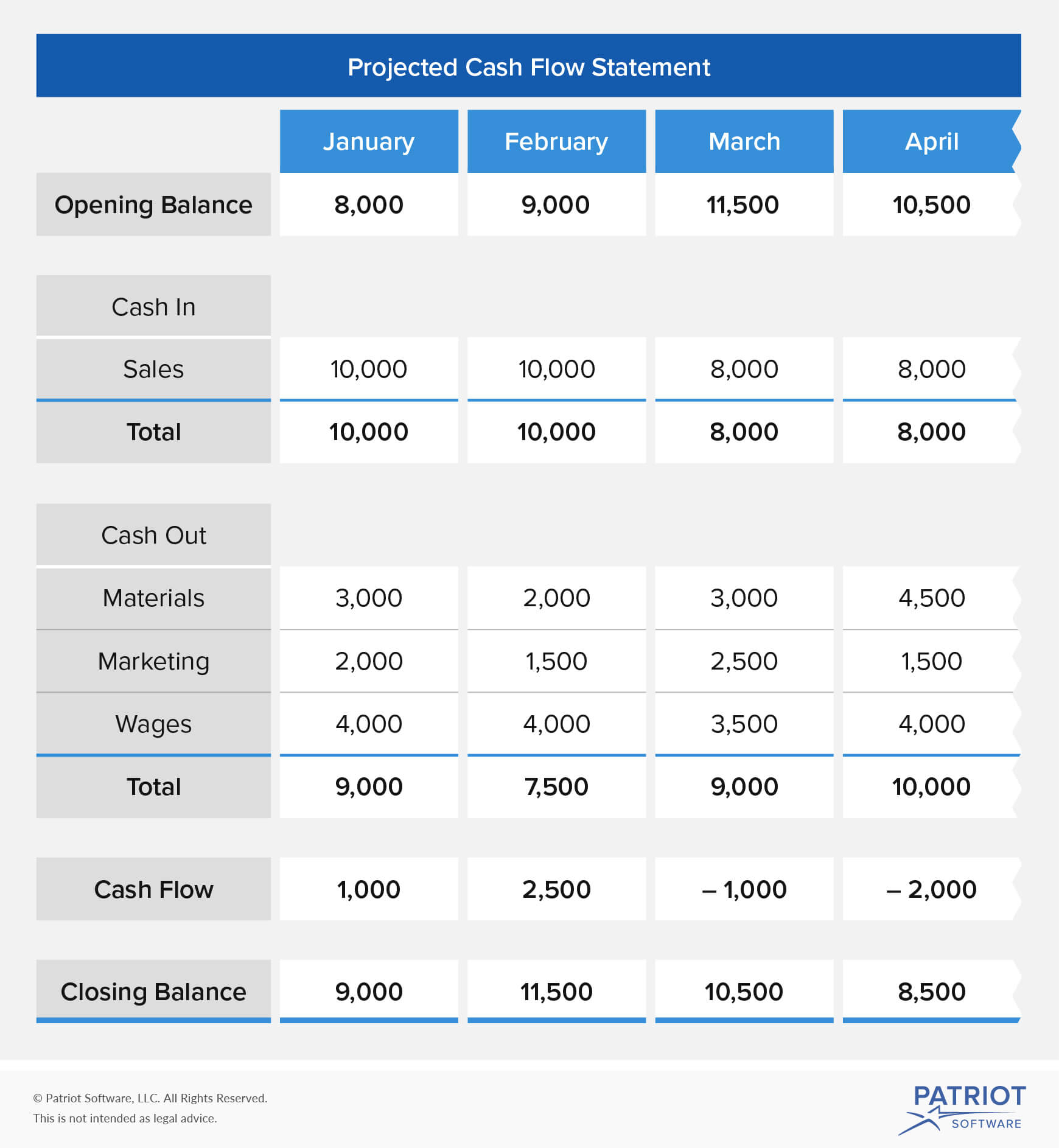

A cash flow statement tells you how much cash is entering and leaving your business in a given period. Companies that work with cash basis accounting. Reviewing it can give you information about your cash flow as opposed to net income.

What is a cash flow statement? The cash flow statement acts as a corporate checkbook to reconcile a company's balance sheet and income statement. Looking over a cash flow statement is one of the best ways to find areas to cut back so you can maximize your business's profits.

Gaap, the statement of cash flows includes a separate section reporting these noncash items. The cash flow statement is required for a complete set of financial statements. A cash flow statement is the best way to see how much money you're making and losing over any given time period—anywhere from two weeks to a month, a year, or five years.

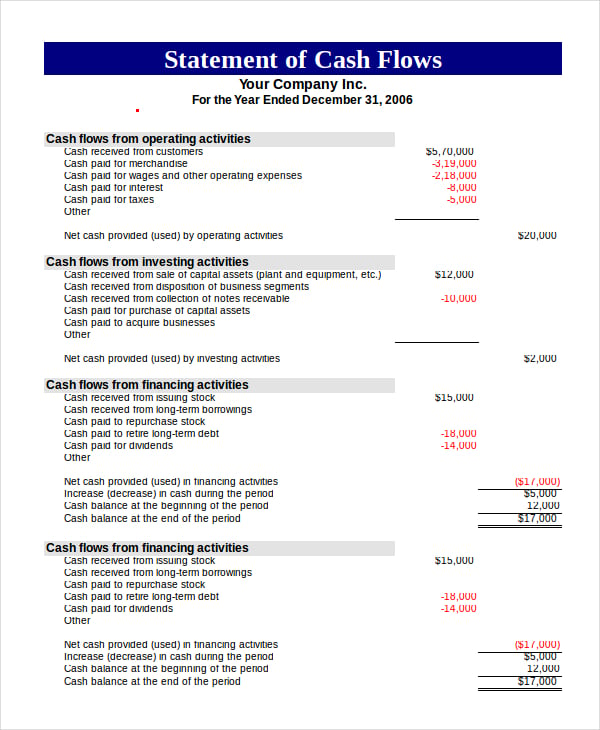

The main components of the cash flow statement are: What is a statement of cash flows? It is a summary of a firm’s cash receipts and cash payments during a period of time.

What is a cash flow statement? The cash flow statement has three main parts: Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time.

The accounting for cash equivalents is the same as that for cash. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements.

This article provides key cash flow definitions, outlines the main components of a cash flow statement, gives a practical example and established methods for preparing such a report, highlights its significance and limitations, and compares it to other financial statements. A cash flow statement is a financial statement that presents total data. A cash flow statement (cfs) is a financial statement that captures how much cash is generated and utilized by a company or business in a specific time period.

Its particular focus is on the types of activities that create and use cash, which are. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or scf. Define “cash” and “cash equivalents.”.

In financial accounting, a cash flow statement, also known as statement of cash flows, [1] is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing and financing activities. There are many types of cf, with various important uses for running a business and performing financial analysis. A cash flow statement is an important tool used to manage finances by tracking the cash flow for an organization.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)