Fun Tips About Coca Cola Income Statement 2018

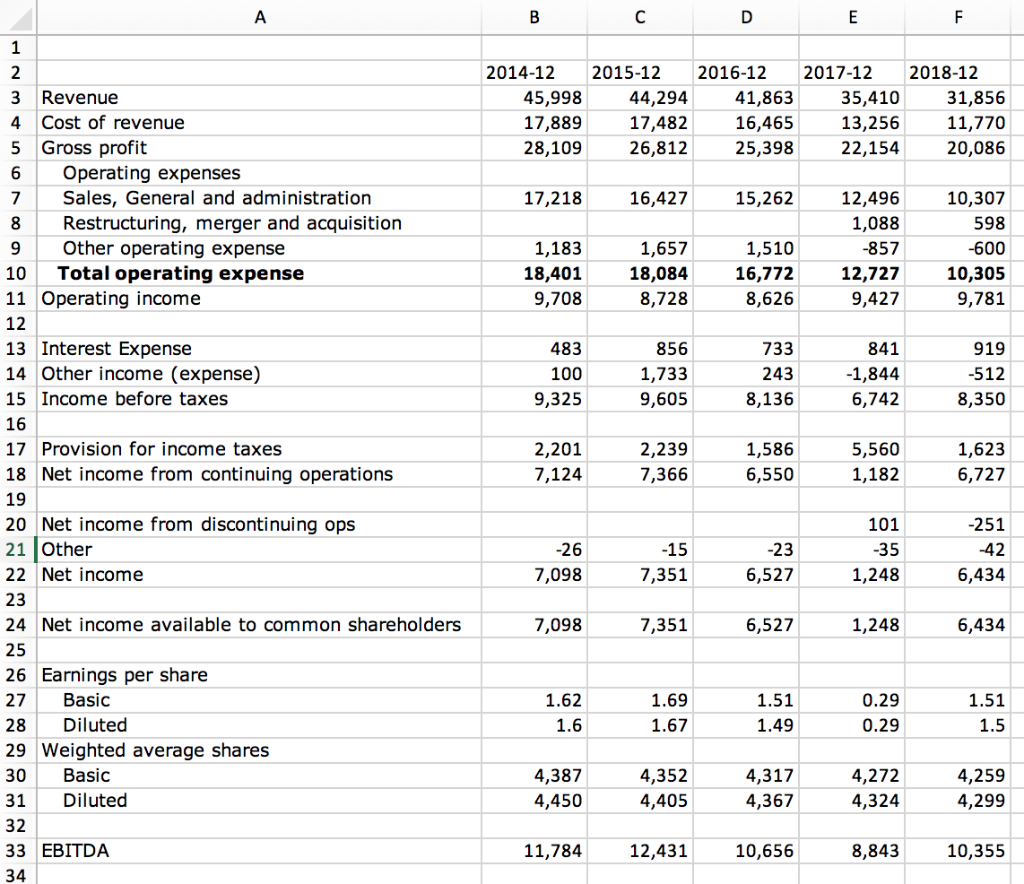

The effective income tax rate for fiscal year.

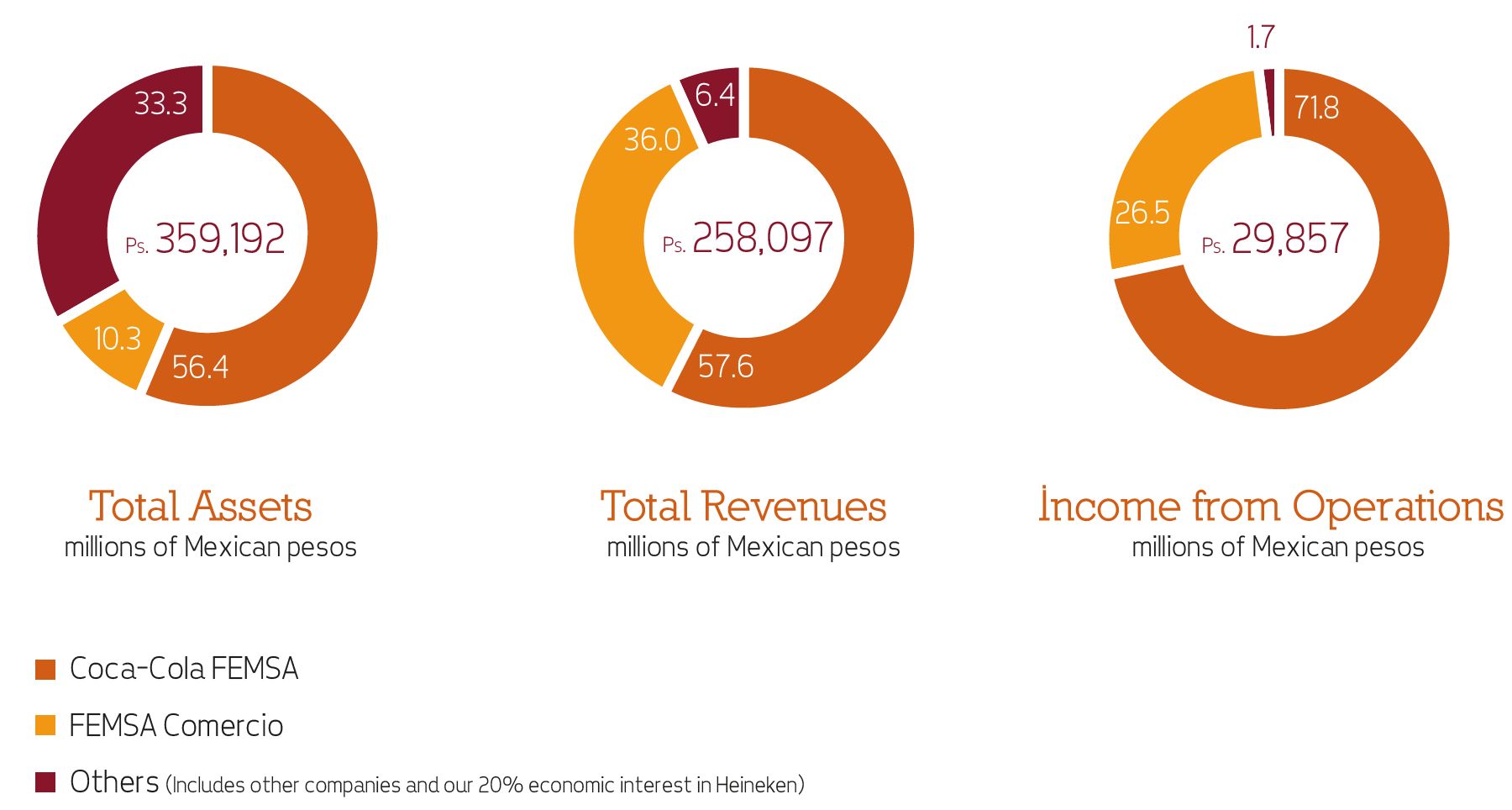

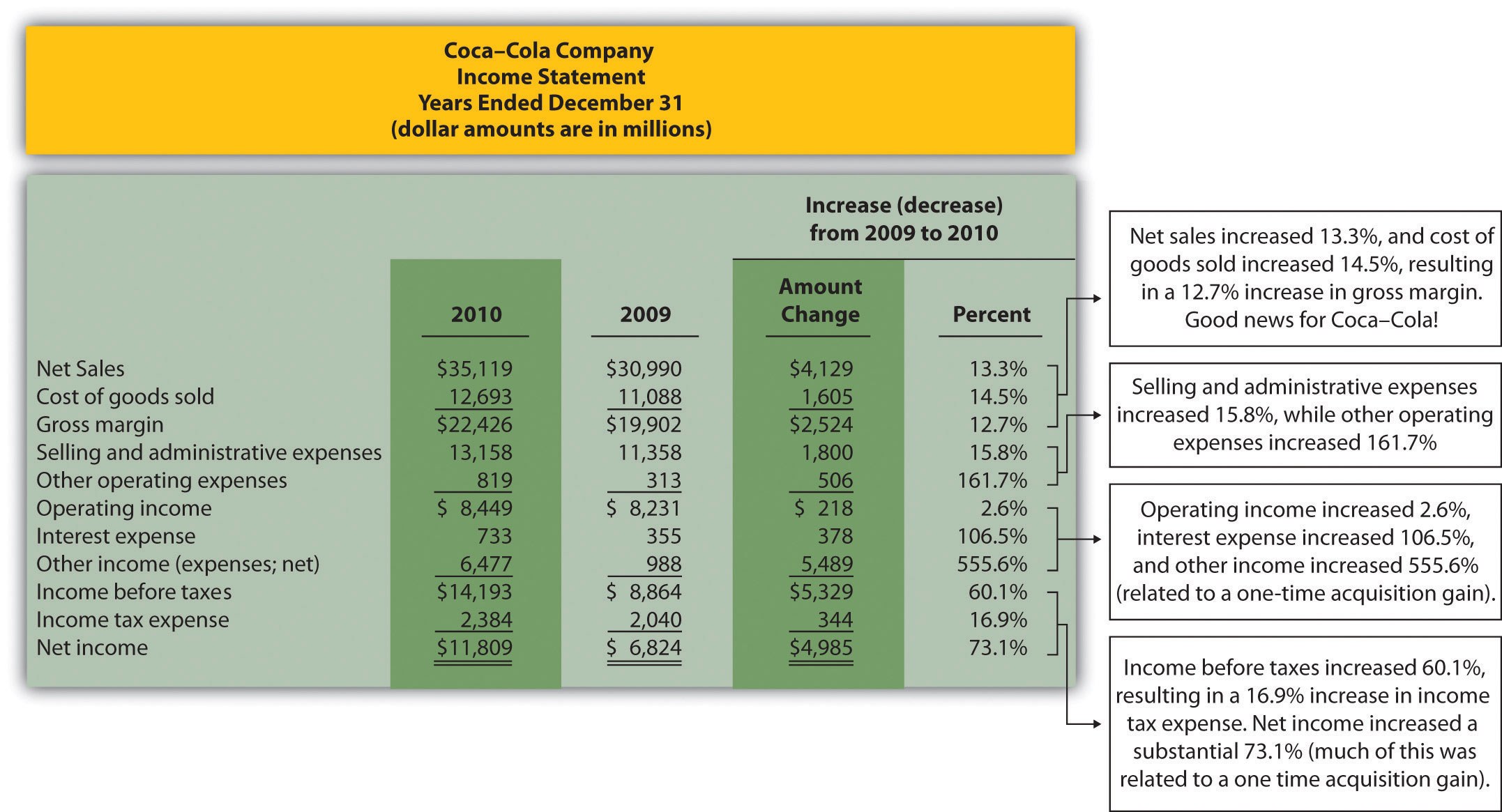

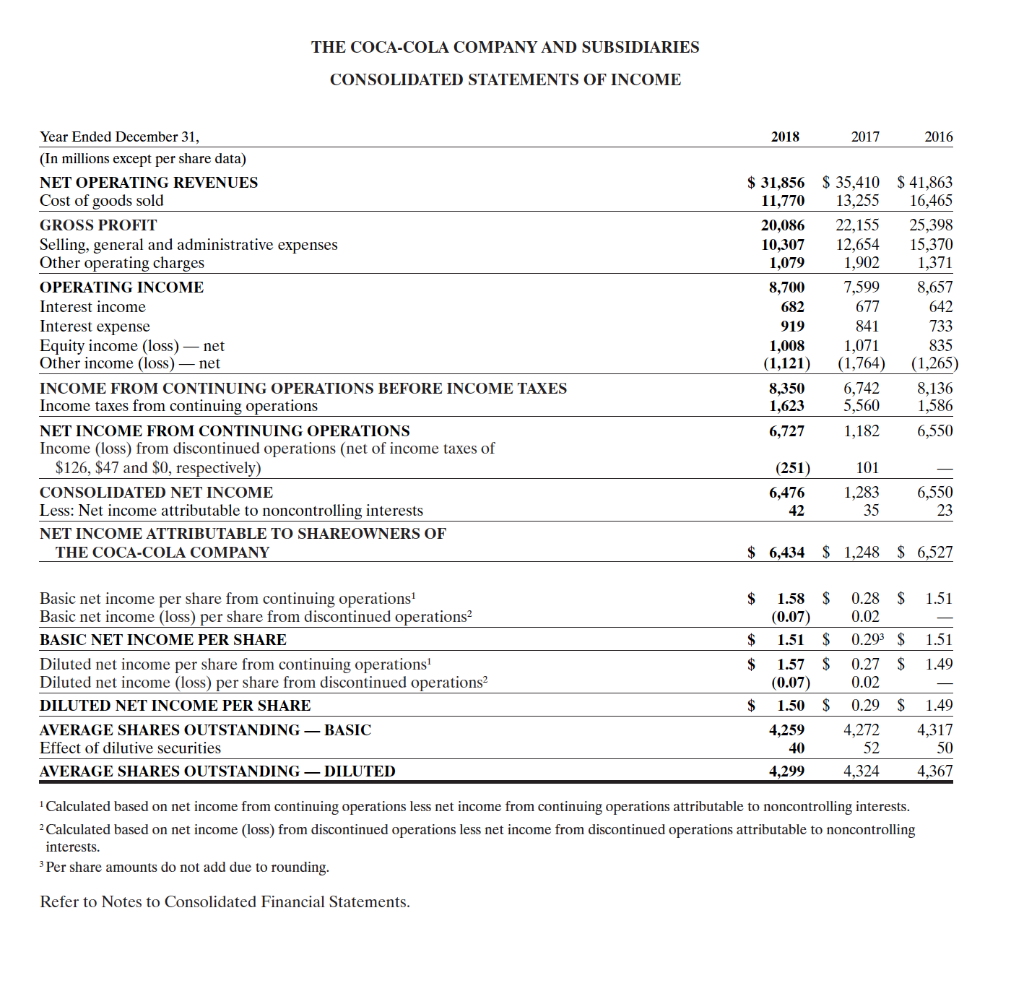

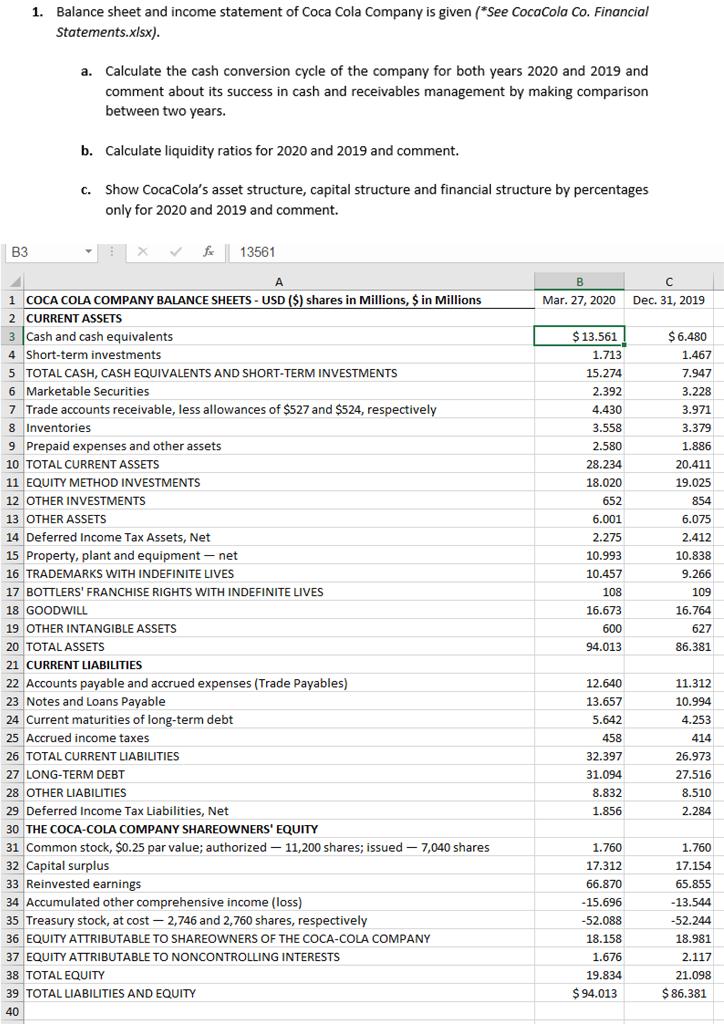

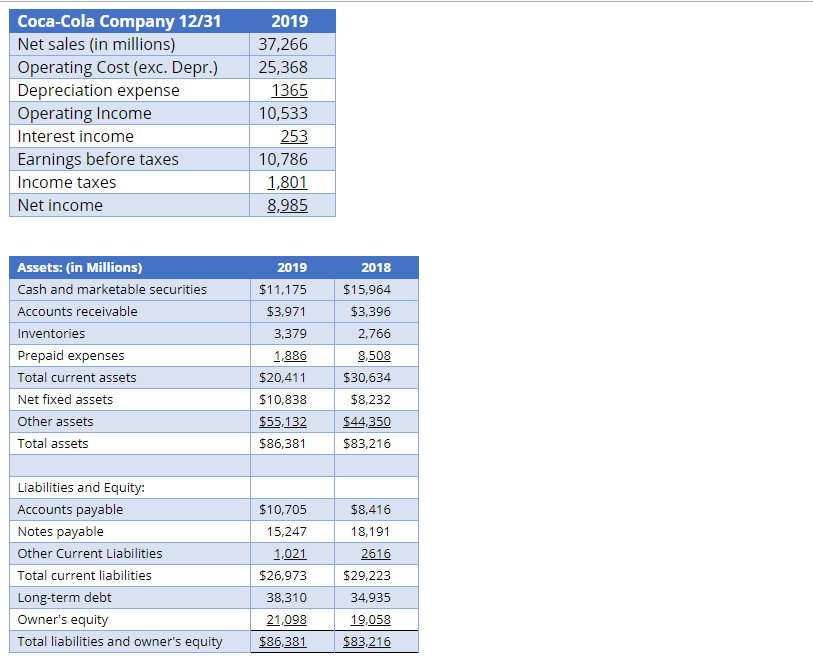

Coca cola income statement 2018. And subsidiaries (collectively the “group”), which comprise the. Equity income (loss) — net: View the latest ko financial statements, income statements and.

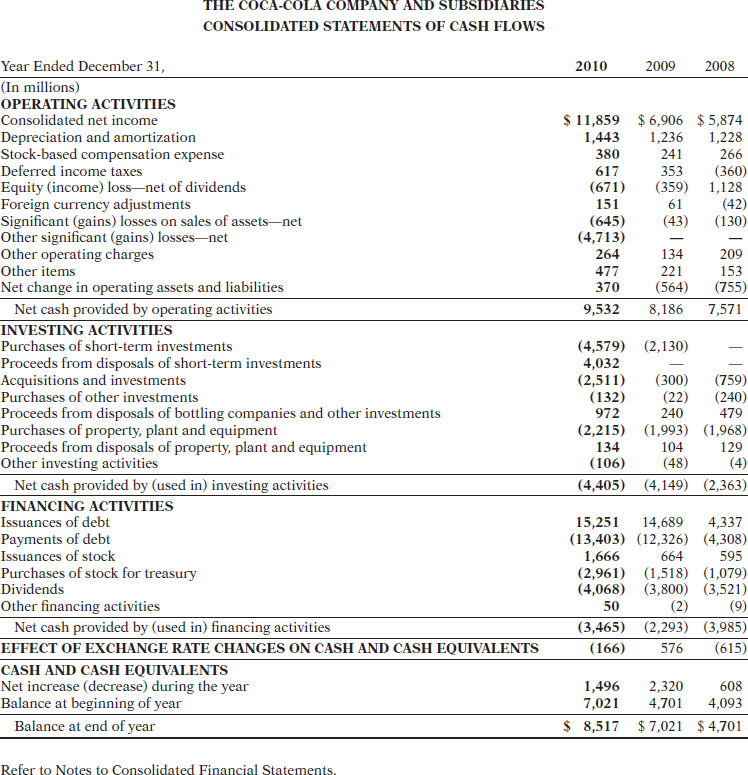

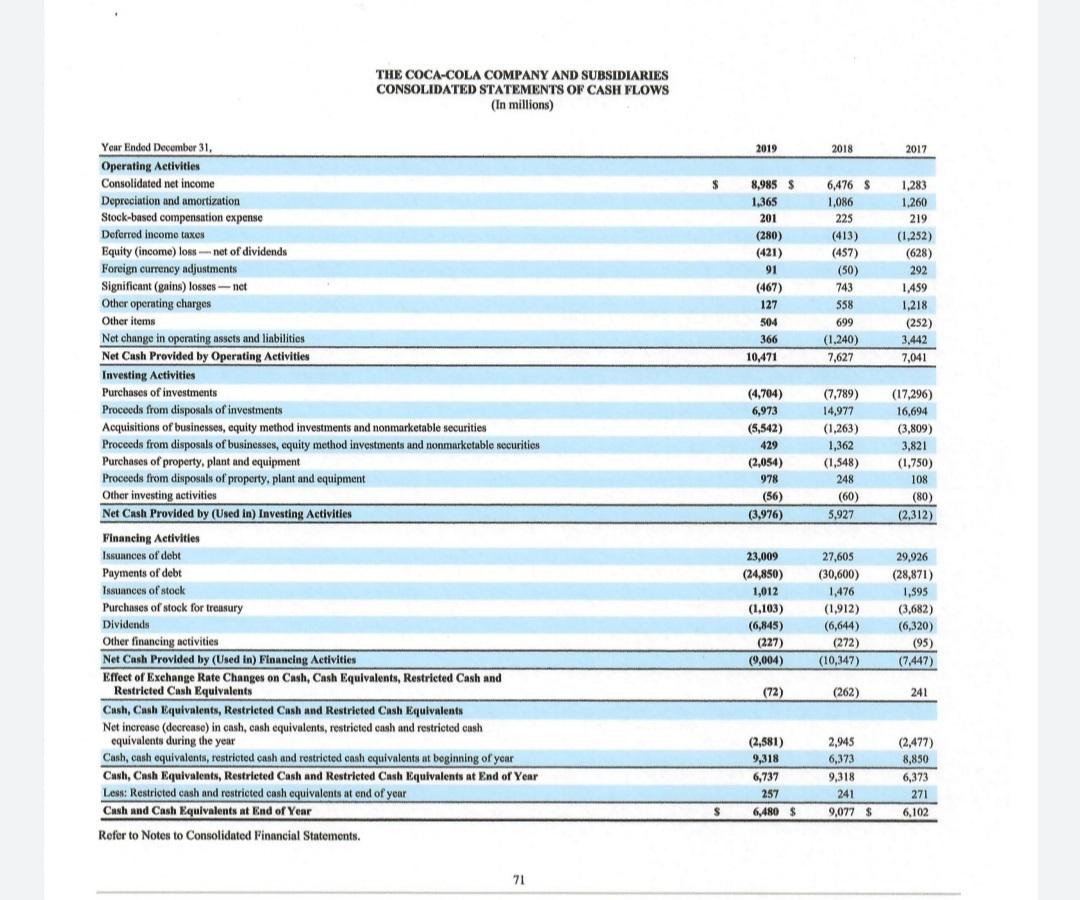

Cash flow from operations was $11.6 billion for the full year, up 5%; Annual stock financials by marketwatch. Revenue & profit assets & liabilities margins price ratios other ratios other metrics income statement balance sheet cash flow statement key financial ratios view.

2017 annual report cover ccbcc 20.9 mb Accrued income taxes: Find out the revenue, expenses and profit or loss over the last fiscal year.

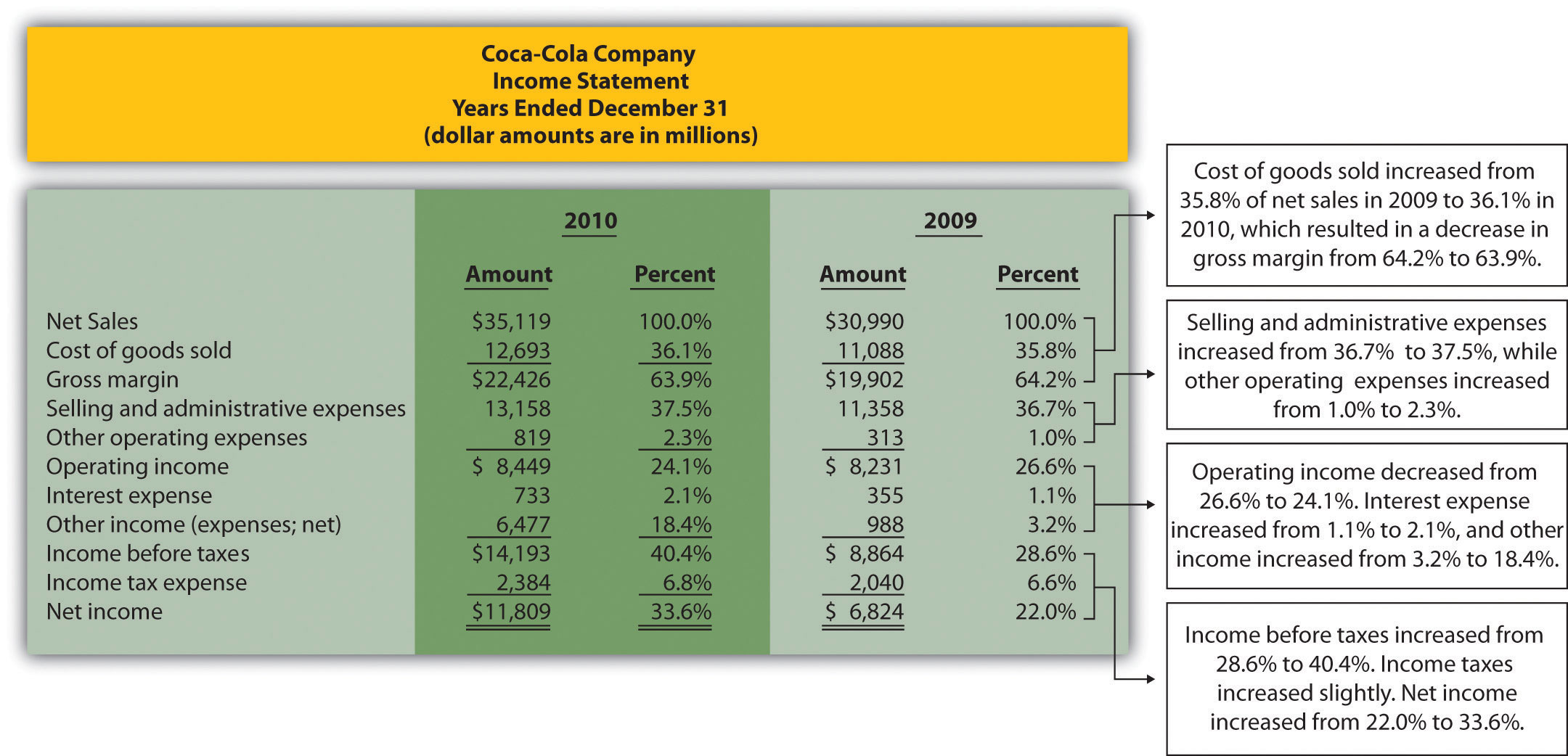

Djia s&p 500 global dow nasdaq compare to open 881.94 prior close 879.14. Net revenues declined 6% to $7.1 billion for the quarter and declined 10% to $31.9 billion for the year. 1 d 5 d 1 m 3 m ytd 1 y 3 y $ % advanced charting compare compare to benchmark:

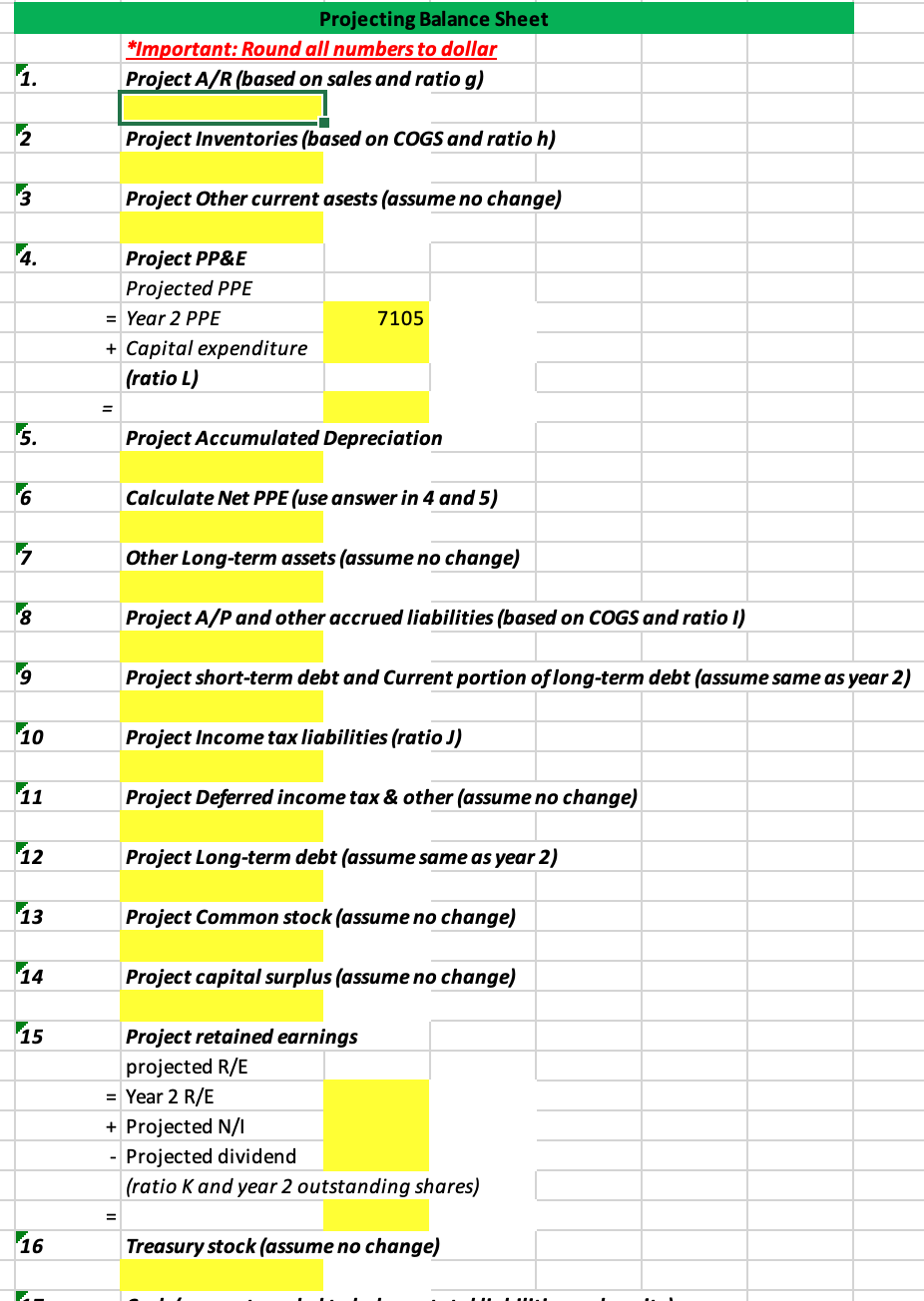

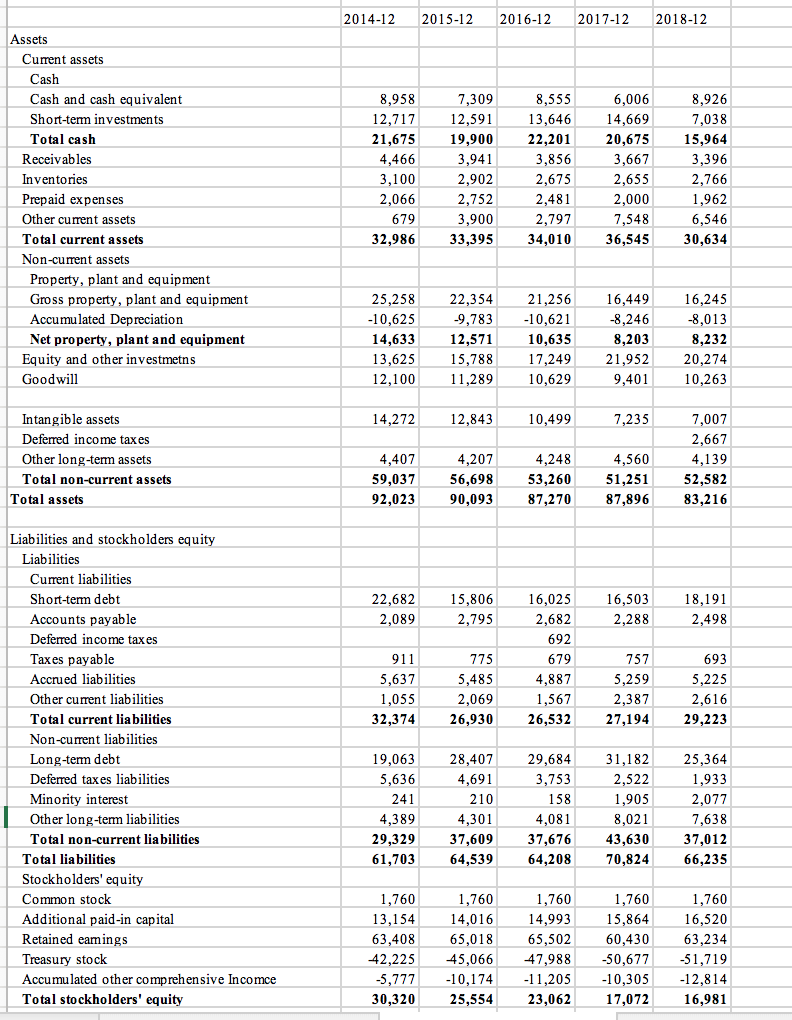

Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View ko financial statements in full, including balance sheets and ratios. The portion of profit or loss for the period, net of income taxes, which is attributable to the parent.

Gross margin in the fourth quarter of 2023 improved by 120 basis points (a) to 39.3%.income from operations for fiscal year 2023 was $834 million, up $193 million,. Income statement cash flow latest quarterly results view previous results fy 2023 fiscal year ended dec 31, 2023 earnings release pdf audio. Shares of the company closed down less than 1% on tuesday.

Income tax expense for the fourth quarter of 2023 was $36.7 million, compared to $37.0 million in the fourth quarter of 2022. Other income (loss) — net: Up to 10 years of financial statements.

2017 ccbcc annual report cover. March 26, 2018 ( fy 2017). Ten years of annual and quarterly income statements for cocacola.

View ko.us financial statements in full, including balance sheets and ratios. Annual balance sheet for ko company financials. February 13, 2024 at 7:04 a.m.