Ideal Info About Accounts Receivable Turnover Ratio Interpretation Sample Business Balance Sheet

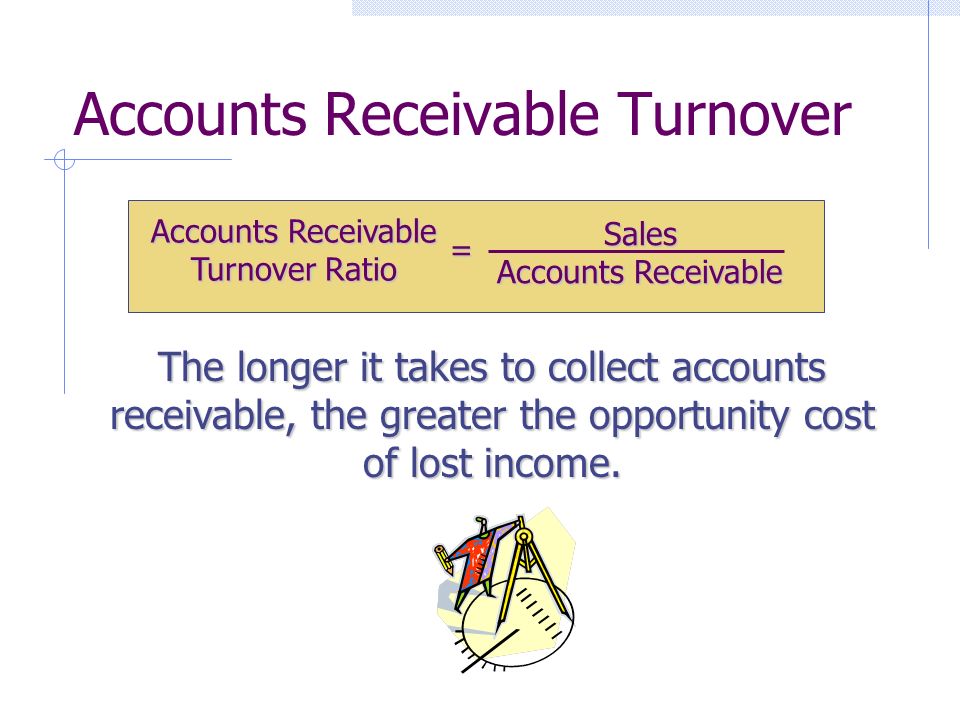

It demonstrates how quickly and effectively a company can convert ar.

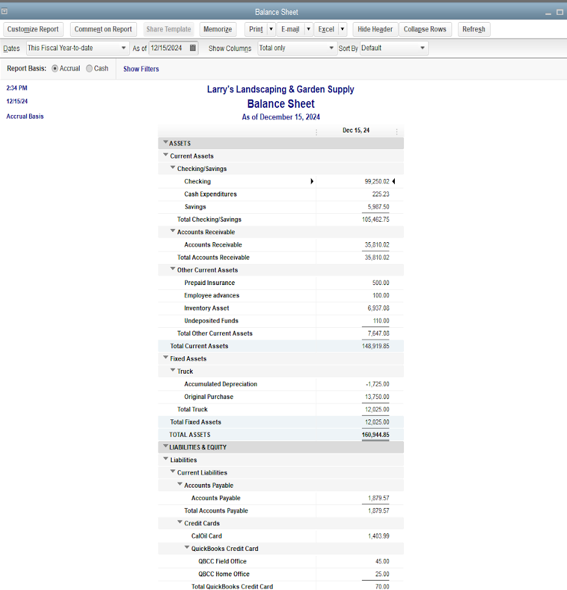

Accounts receivable turnover ratio interpretation sample business balance sheet. The accounts receivable turnover ratio (ar t/o ratio) is an accounting measure of effectiveness. What is the accounts receivable turnover ratio? Accounts receivable ratio = $400,000 / $35,000 = 11.43.

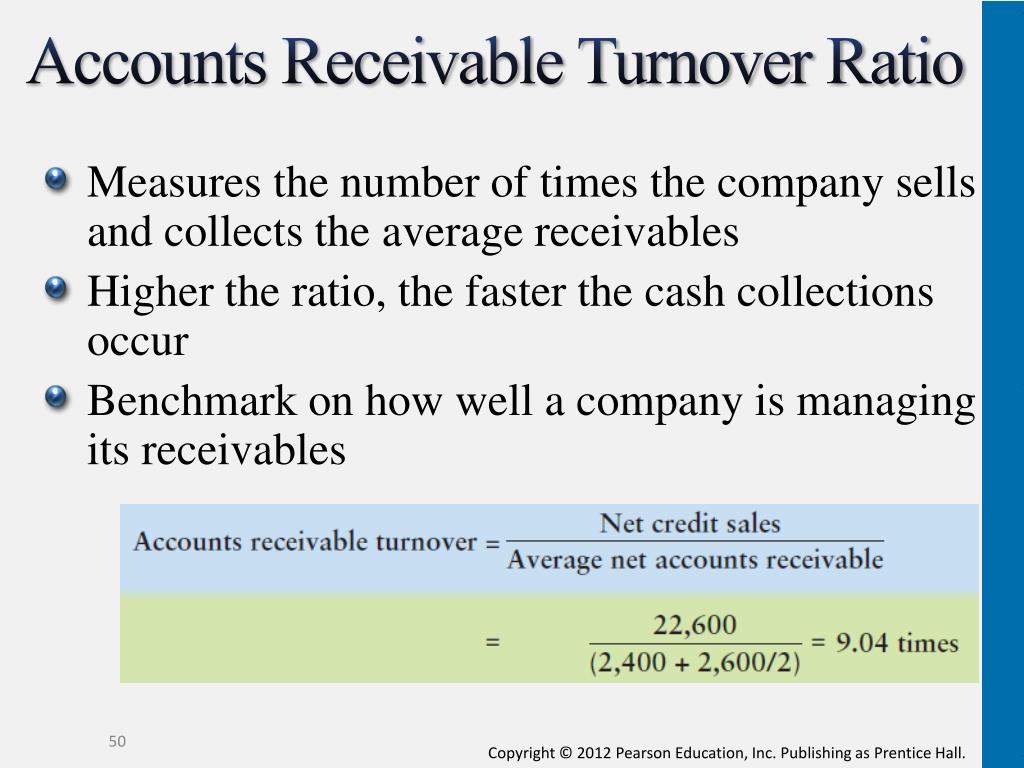

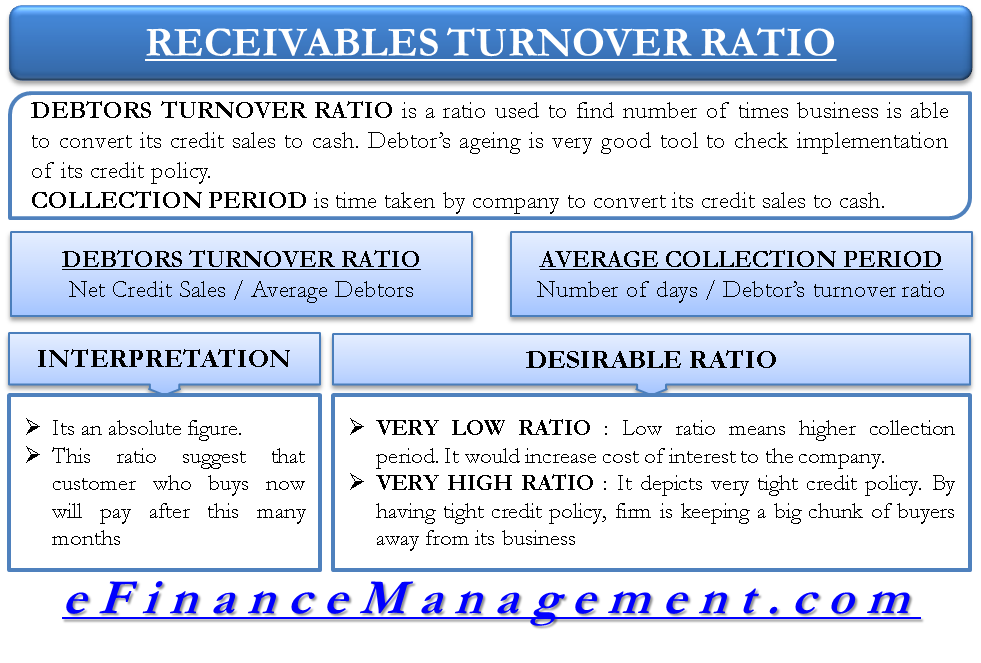

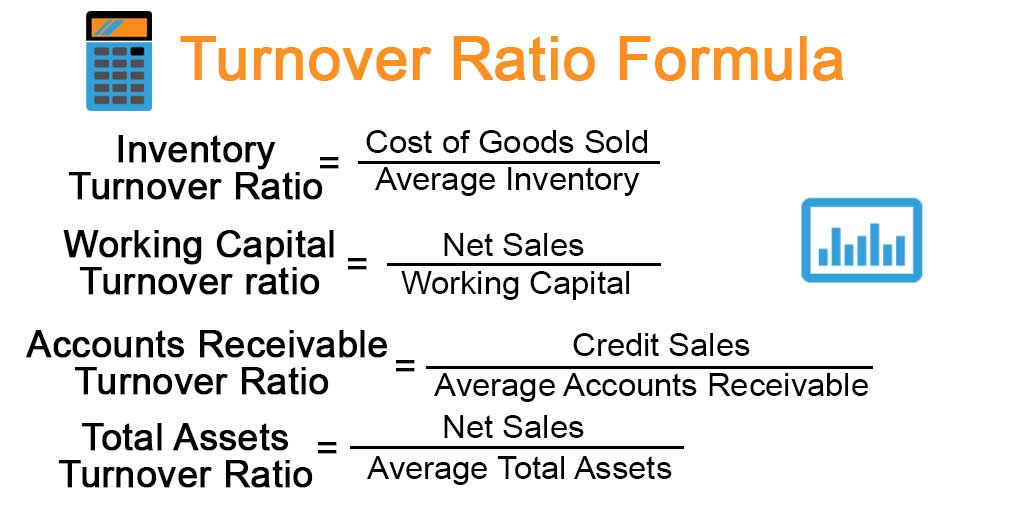

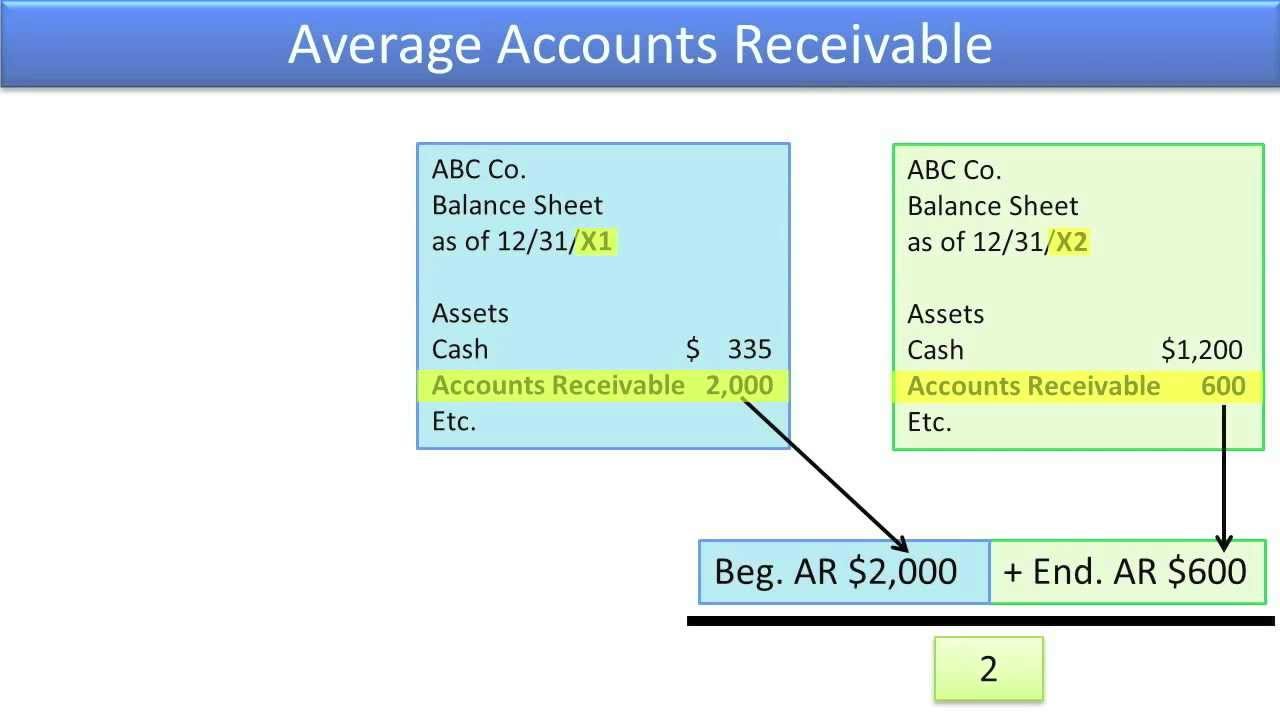

The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. In financial modeling, the accounts receivable turnover ratio (or turnover days) is an important assumption for driving the balance sheet forecast. By examining financial statements including the balance sheet and income statement, ratio analysis is a quantitative approach to acquiring insight into a company’s liquidity, operational efficiency, and profitability.

Accounts receivable turnover ratio = (net credit sales) / (average accounts receivable) so, for alpha lumber: Total credit sales = $110,000 sales returns = $8,000 sales allowances = $2,000 accounts receivable = $20,000 Divide the net credit sales by average account receivable, you will get the receivables turnover ratio.

Determine your net credit sales. This ratio measures how fast. The ratio measures how often a company collects its average accounts receivable balance in cash during an accounting period.

If your company's numbers are high, it can mean better cash flow, a good balance sheet and income statement, balanced asset turnover, and improved creditworthiness. Accounts receivable turnover is an efficiency ratio or activity ratio that measures how many times a business can turn its accounts receivable into cash during a period. As you can see in the example below, the accounts receivable balance is driven by the assumption that revenue takes approximately 10 days to be received (on average).

Higher accounts receivables turnover (art): In financial accounting , the accounts receivable turnover ratio can be used to create balance sheet forecasts which are necessary for the business. This indicates that the company is able to swiftly collect outstanding payments.

The formula to calculate it is as follows: To determine the average number of days it took to get invoices paid, you must divide the number of days per year, 365, by the accounts receivable turnover ratio of 11.4. The first part of the accounts receivable turnover ratio formula calls for your net credit sales, or in other words, all of your sales for the year that were made on credit (as opposed to cash).

This figure should include your total credit sales, minus any returns or allowances. Here is a basic interpretation of the accounts receivables turnover formula: Investors should interpret accounts receivable information on a company's balance sheet as money that the company has a reasonable assurance.

This is a higher a/r turnover ratio than abc company in sample 1, which means that xyz is collecting from customers faster than abc. Updated march 28, 2022. The ar balance is based on the average number of days in which revenue will be received.

The accounts receivable turnover ratio indicates how effectively a business collects credit from its debtors. An average accounts receivable turnover ratio of 12 means that your company collects its receivables 12 times per year or every 30 days. Receivables turnover ratio = 5.88.

:max_bytes(150000):strip_icc()/receivableturnoverratio-8f6c3aac6494463a8e6cdd011e236fbe.jpg)