Ideal Tips About Preparation Of Trial Balance Is Gst Sheet Format

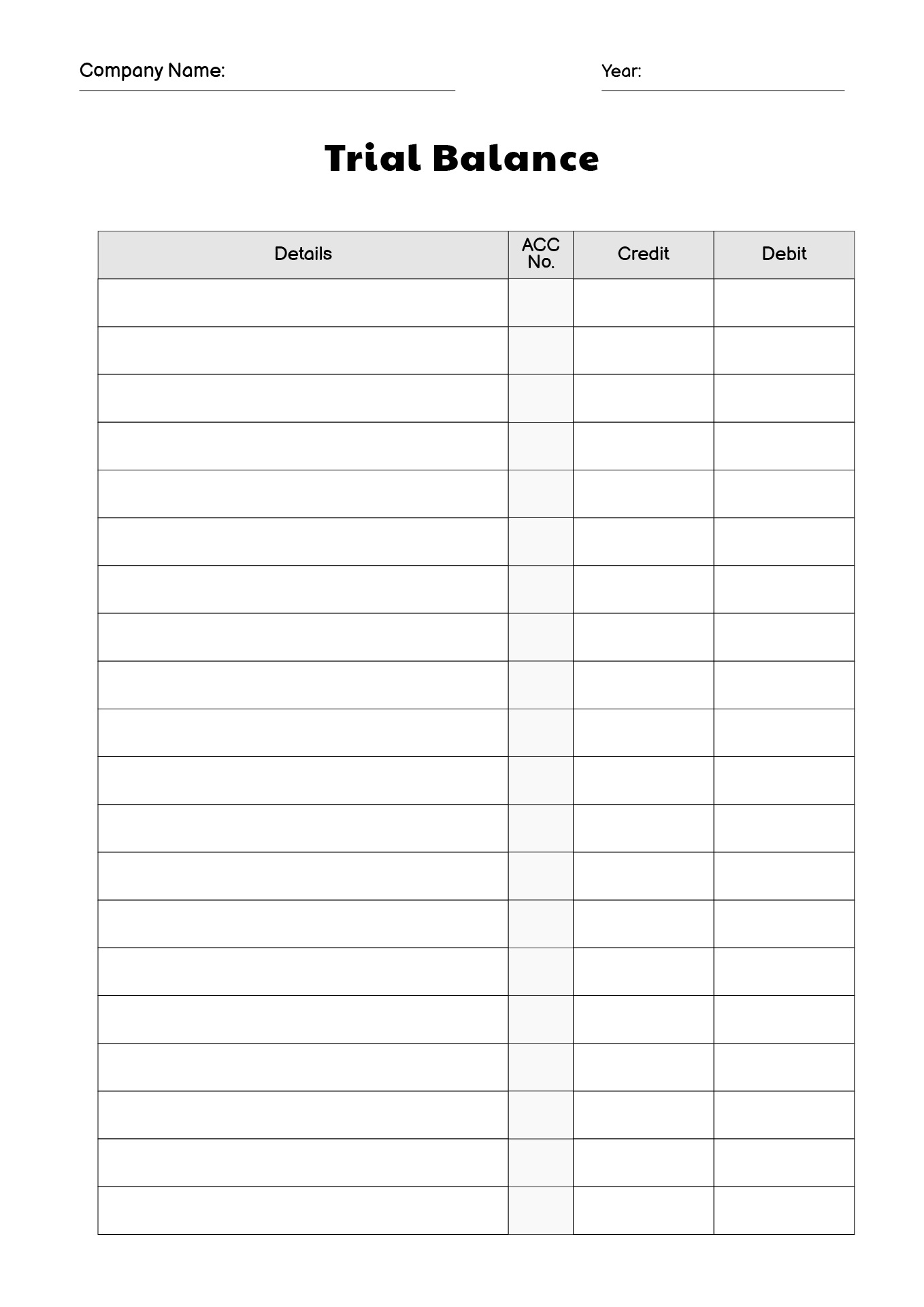

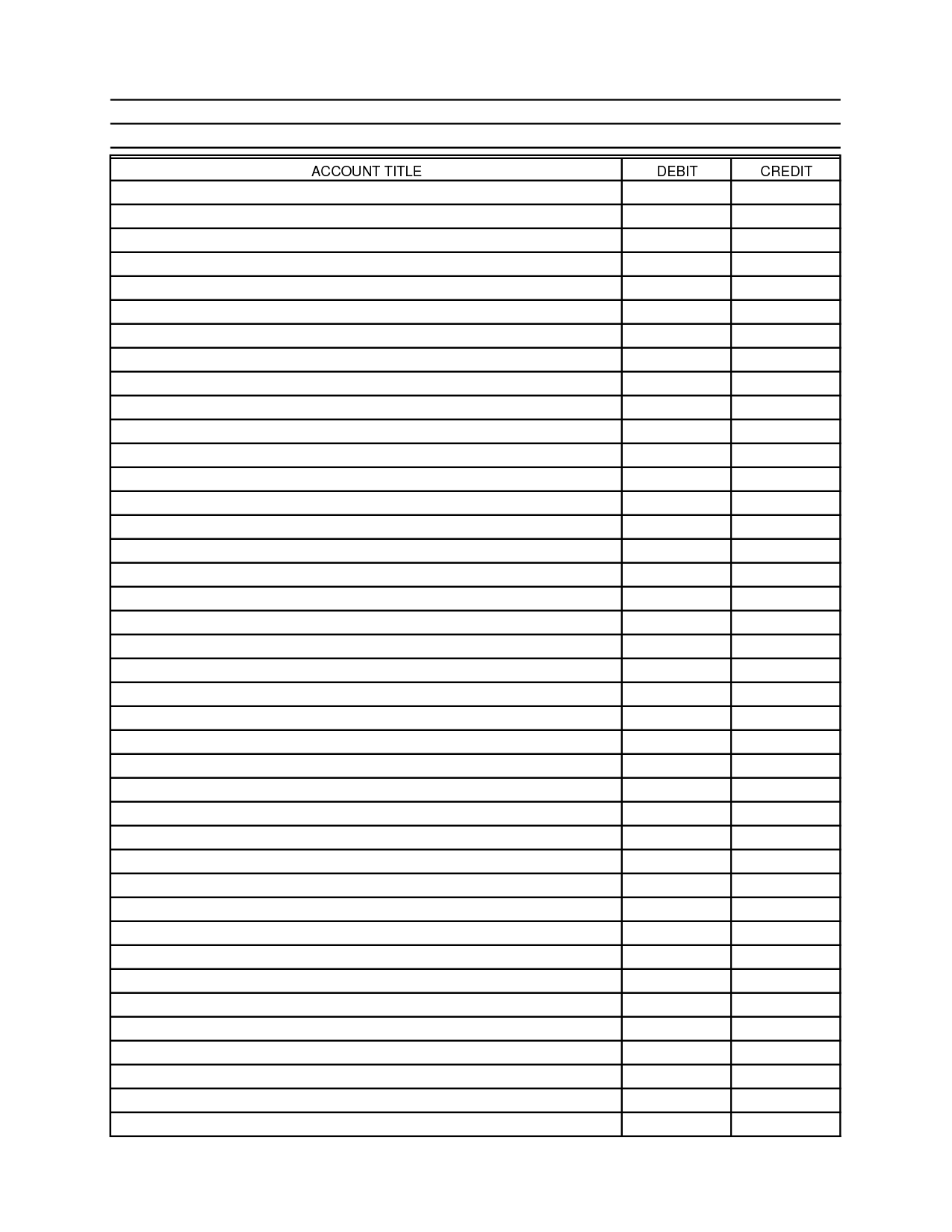

Account name, account number, and the associated debit and credit amounts columns should all have column headings.

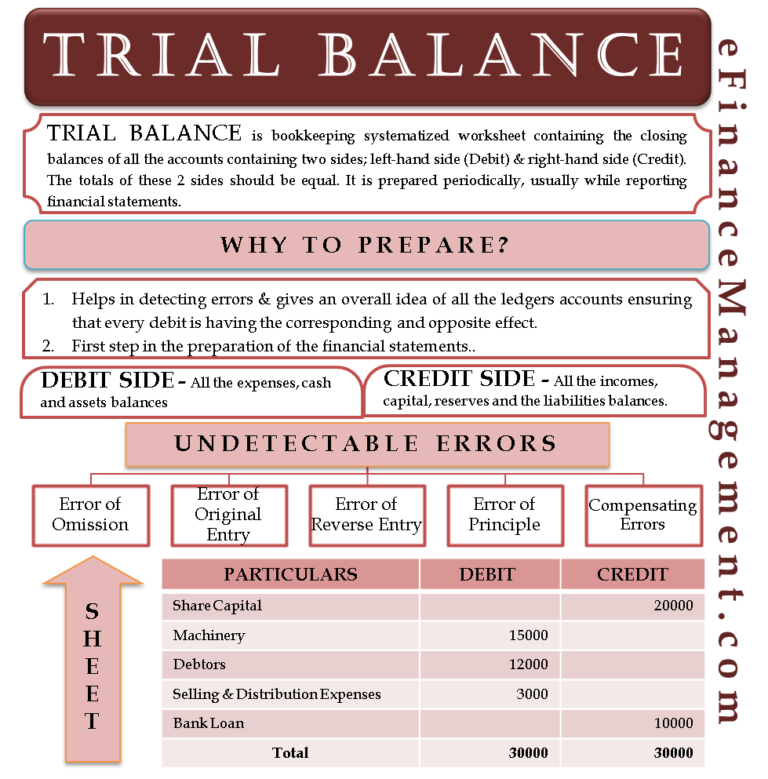

Preparation of trial balance is gst balance sheet format. A balanced trial balance ascertains the arithmetical accuracy of financial records. Here is the process to prepare trial balances in your business: Trial balance and balance sheet.

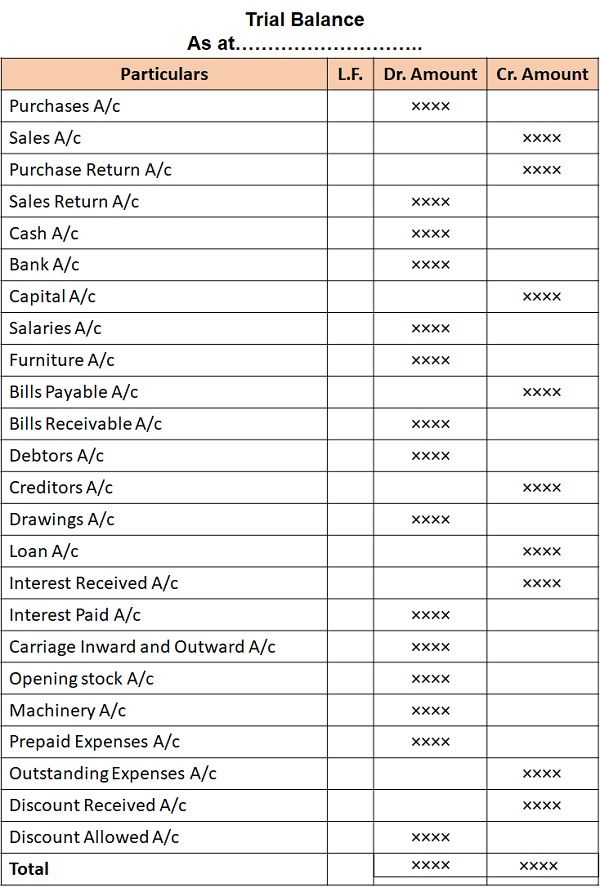

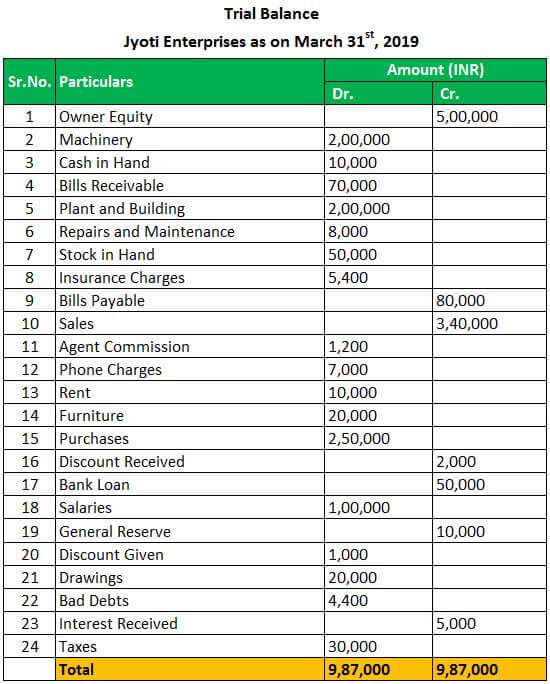

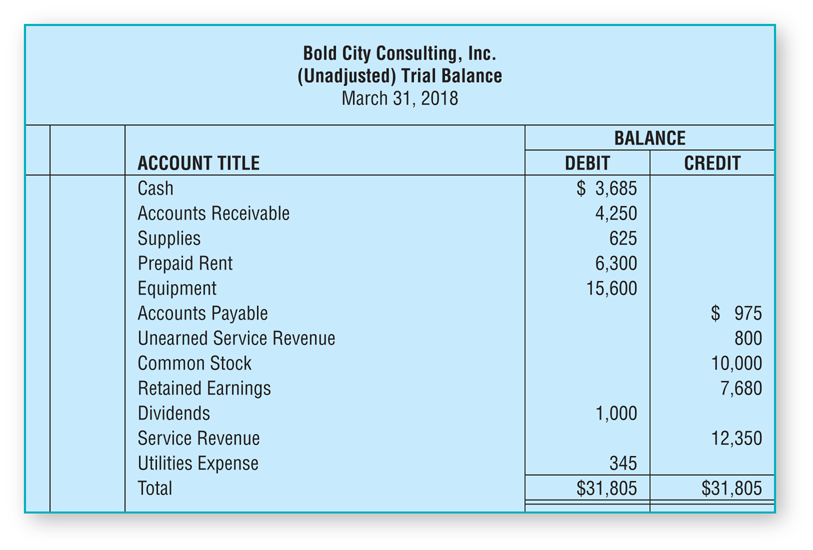

This is prepared as at a particular date which can be financial year end or calendar year. The trial balance sums up all the debit balances in one column and all the credit balances in another column. Account name, debit balance, and credit balance.

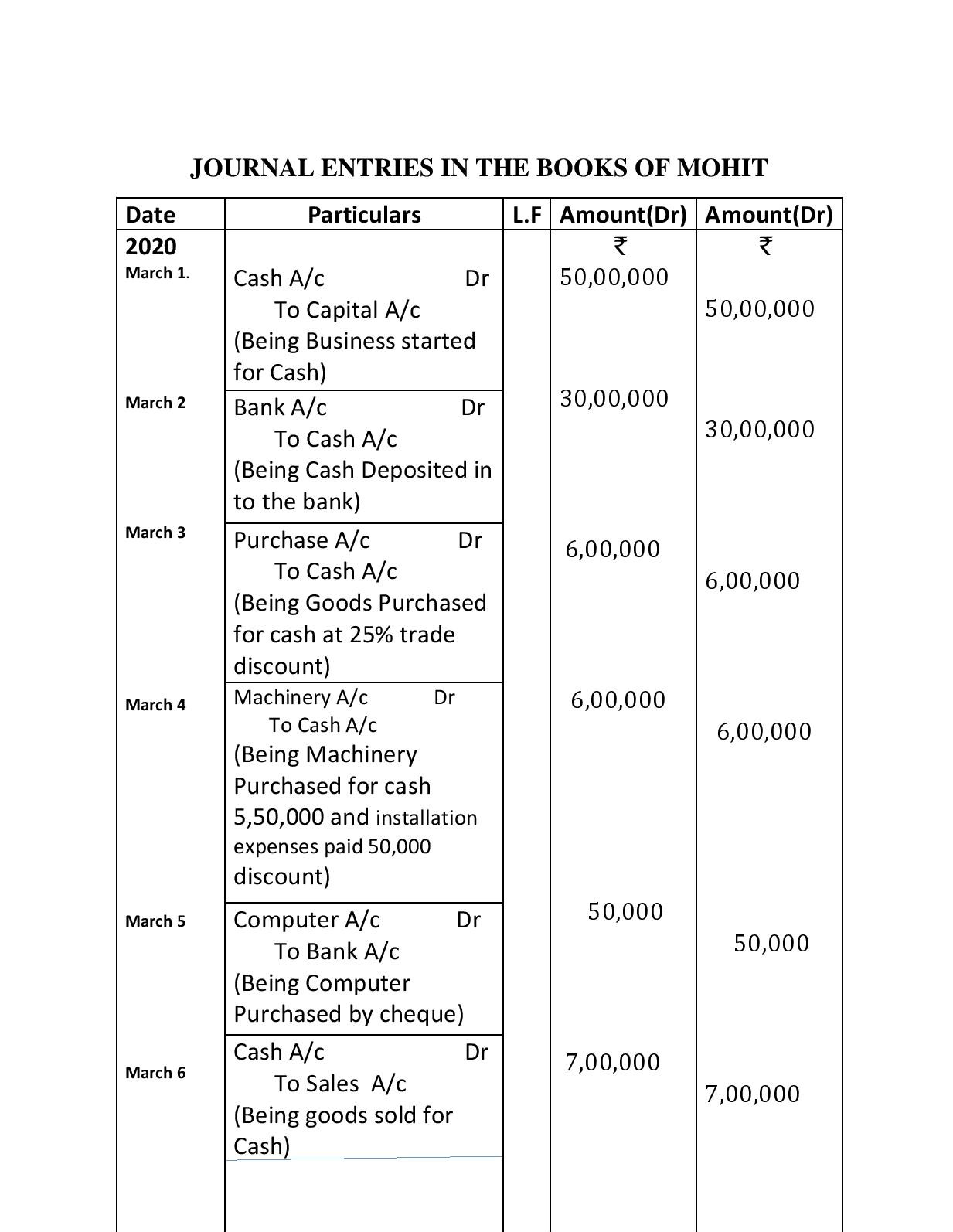

How to prepare a trial balance? The format consists of three columns: Trial balance is basically a statement having a debit side and a credit side where all the debit balances of journal entries and ledger postings are recorded on the debit side of the trial balance, and all the credit balances of journal entries and ledger postings are.

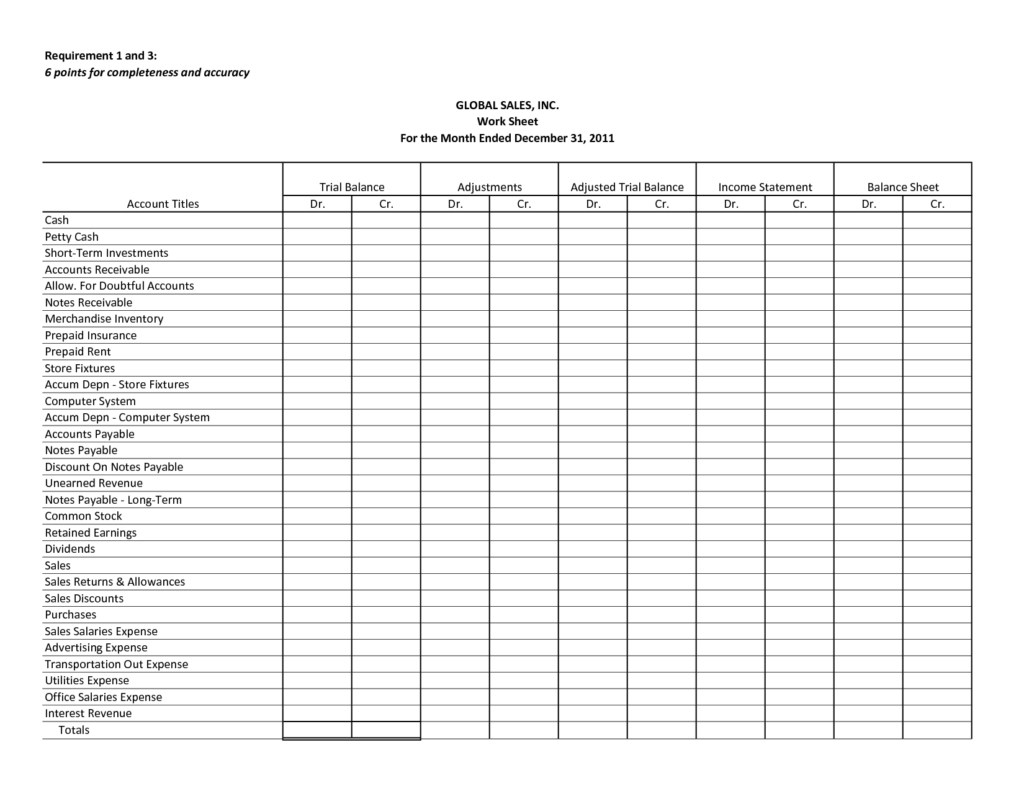

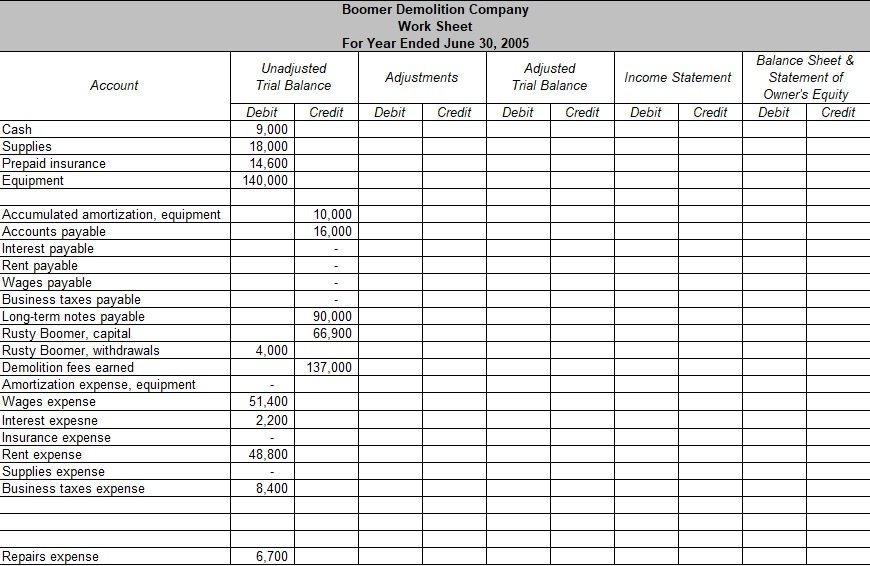

Preparing an unadjusted trial balance is the fourth step in the accounting cycle. One just needs to remember these rules to record all the transactions in the books of accounts. Post the ledger accounts into trial balance and place the balance in the debit or credit column.

Construct a worksheet with eight columns. It’s typically prepared as a preliminary step before creating financial statements. How to prepare a trial balance.

The trial balance is an accounting report or worksheet, mostly for internal use, listing each of the accounts from the general ledger together with their closing balances (debit or credit). A trial balance is a list of all accounts in the general ledger that have nonzero balances. Transfer the account name, account number, and account amount for each ledger account to the corresponding debit or credit column on the trial balance worksheet.

The format of a trial balance is shown below. The ending balance of each ledger account is then reflected in the trial balance sheet. What is the trial balance format?

The totals of each column should agree in value. What is an accounting cycle 2. It is prepared at the end of a particular period to indicate the correct nature of the balances of various accounts.

A typical trial balance will have the name of ledger and the balances. Following are the steps to prepare trial balance: The trial balance includes the closing balances of assets, liabilities, equity, incomes and expenses.

You can use the vyapar software to prepare your trial balance sheet for free. A trial balance sheet is a report that lists the ending balances of each account in the chart of accounts in balance sheet order. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

![GST vs SST What's the difference? [UPDATED] CompareHero Balance](https://i.pinimg.com/originals/83/77/ba/8377bacc69620c8c80183cd6fe916e1d.jpg)