Painstaking Lessons Of Tips About Balance And Income Statement

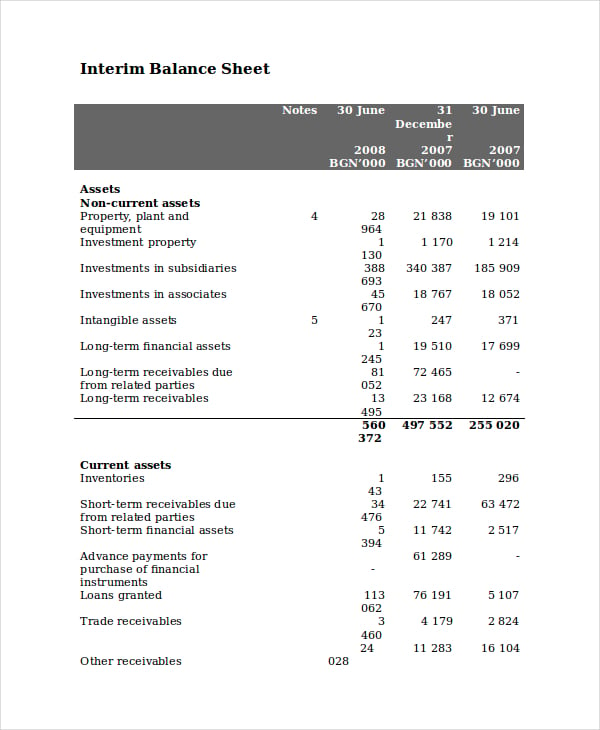

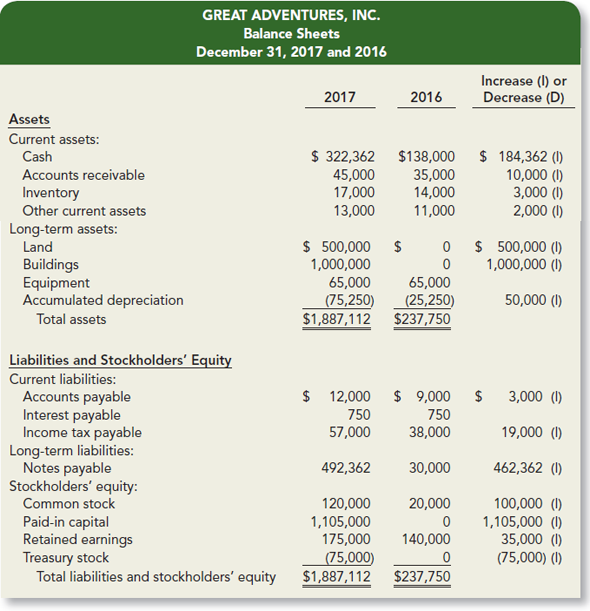

The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

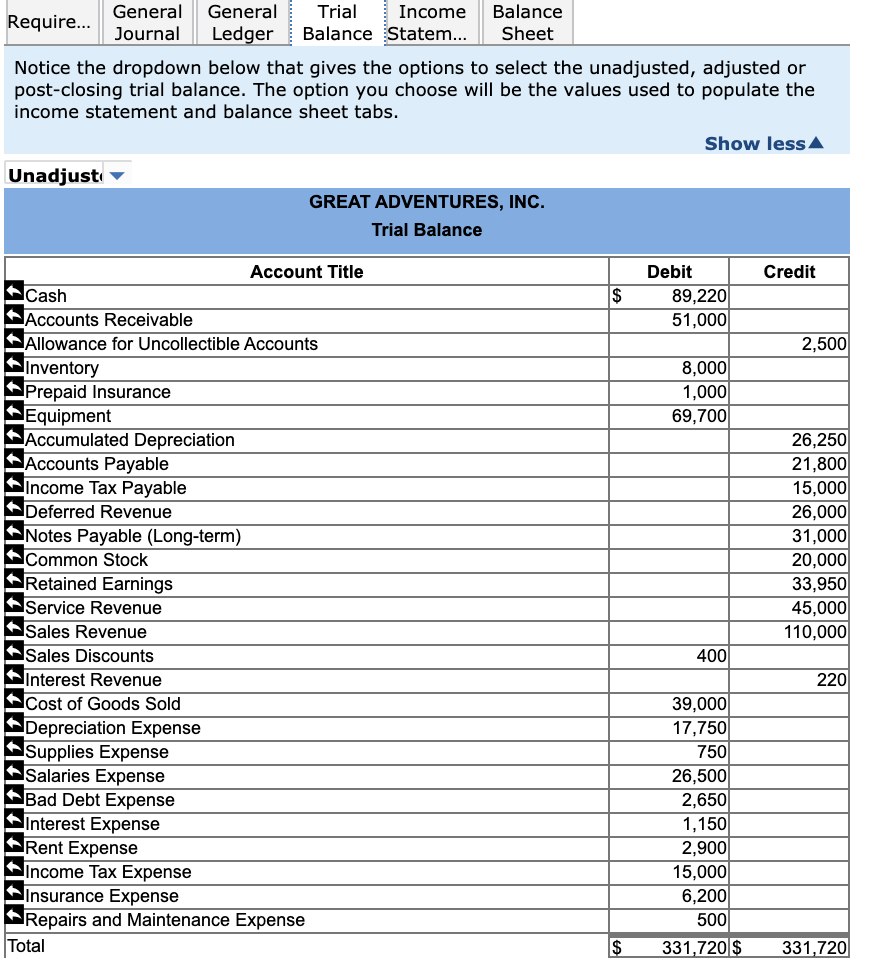

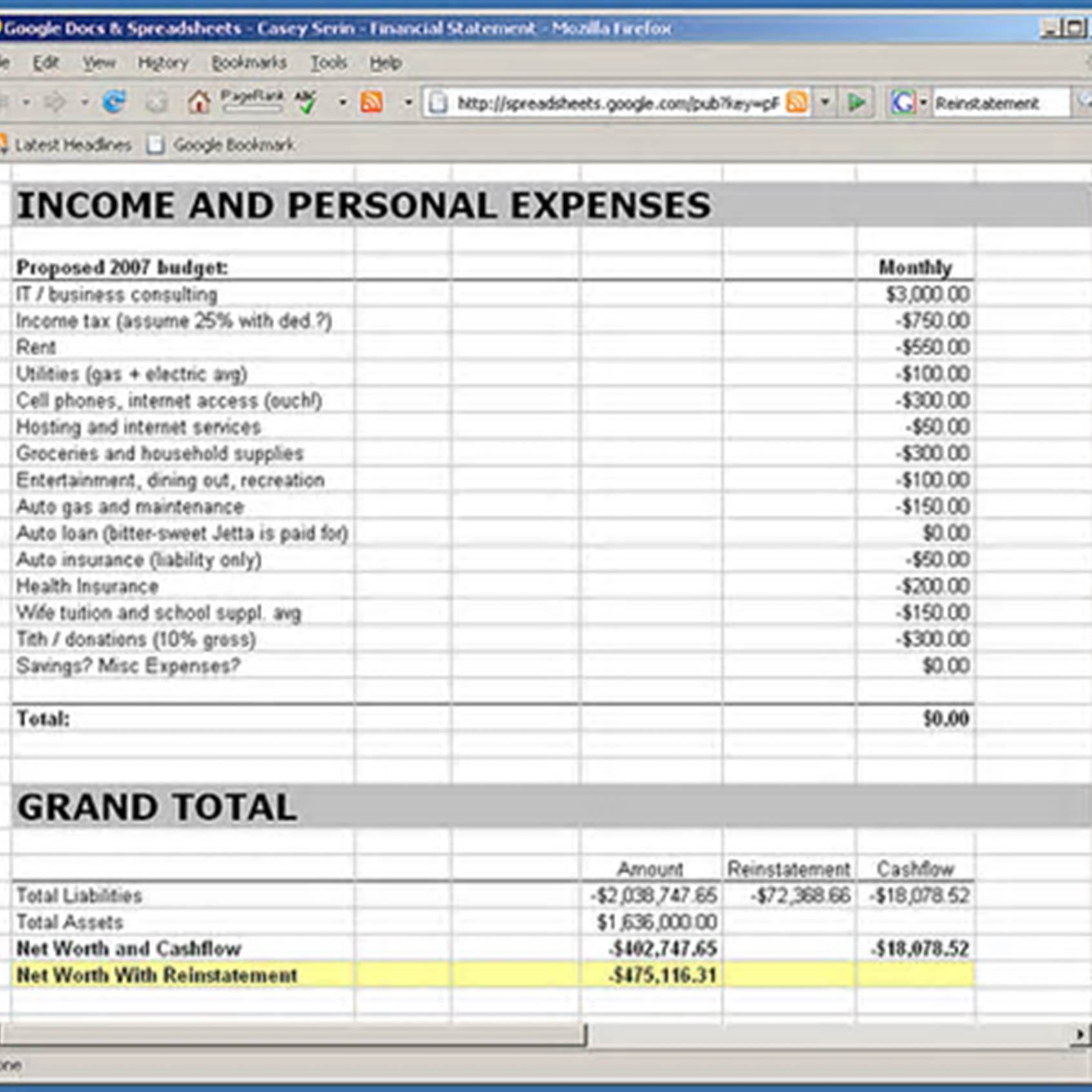

Balance and income statement. The income statement, balance sheet, and statement of cash flows are required financial statements. A balance sheet and an income statement are financial tools used to manage a business’s financial performance. A balance sheet highlights its assets, liabilities, equity, and other financial investments at a given time.

To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity. In this article, you will learn all the differences that exist between the balance sheet and income statement, including what makes them so important. Investors and creditors analyze the balance sheet to determine how well management is putting a company's.

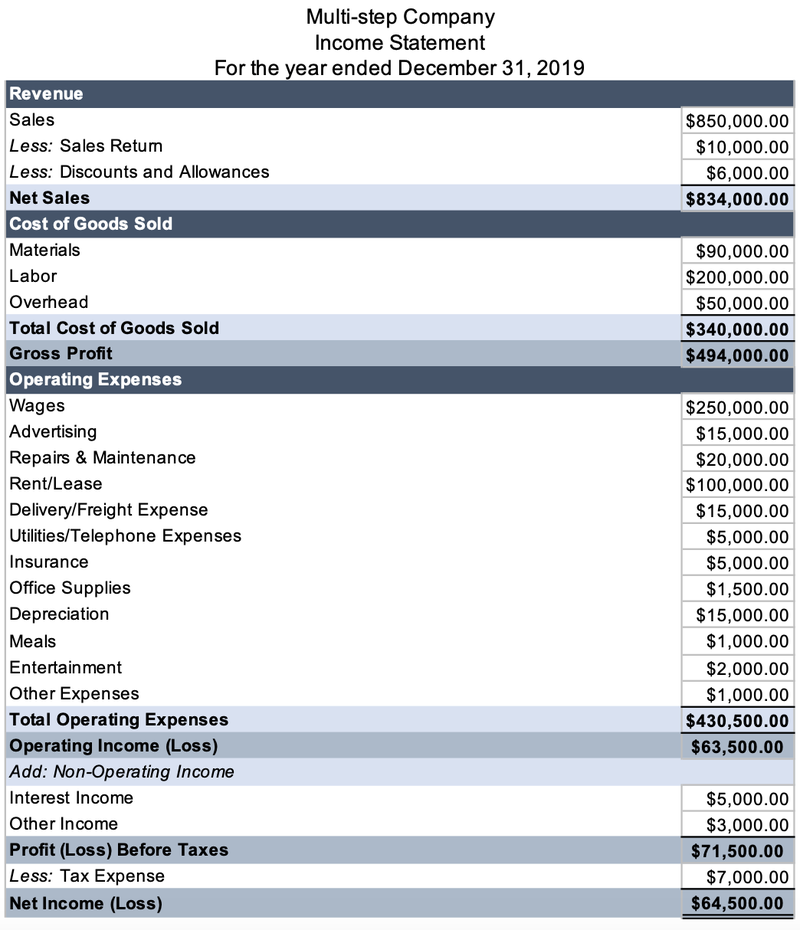

The statement displays the company’s revenue, costs, gross profit, selling and administrative expenses, other expenses and income, taxes paid, and net profit in a coherent and logical manner. Whereas an income statement provides a broader perspective of business performance, balance sheets include a detailed view of the amount of value and risk of the business. The income statement illustrates the profitability of a company under accrual accounting rules.

The balance sheet while the definition of an income statement may remind you of a balance sheet, the two documents are designed for different uses. Statements and releases today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. A balance sheet and an income statement are two different methods of gauging a business’s financial health.

It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually. To do this, you’ll need to add liabilities and shareholders’ equity together. The three financial statements are:

Balance sheets are useful to gain insight into a company’s value and whether it is liquid enough to pay off its debts. Net income and retained earnings. Income statements emphasize net profit within an accounting period.

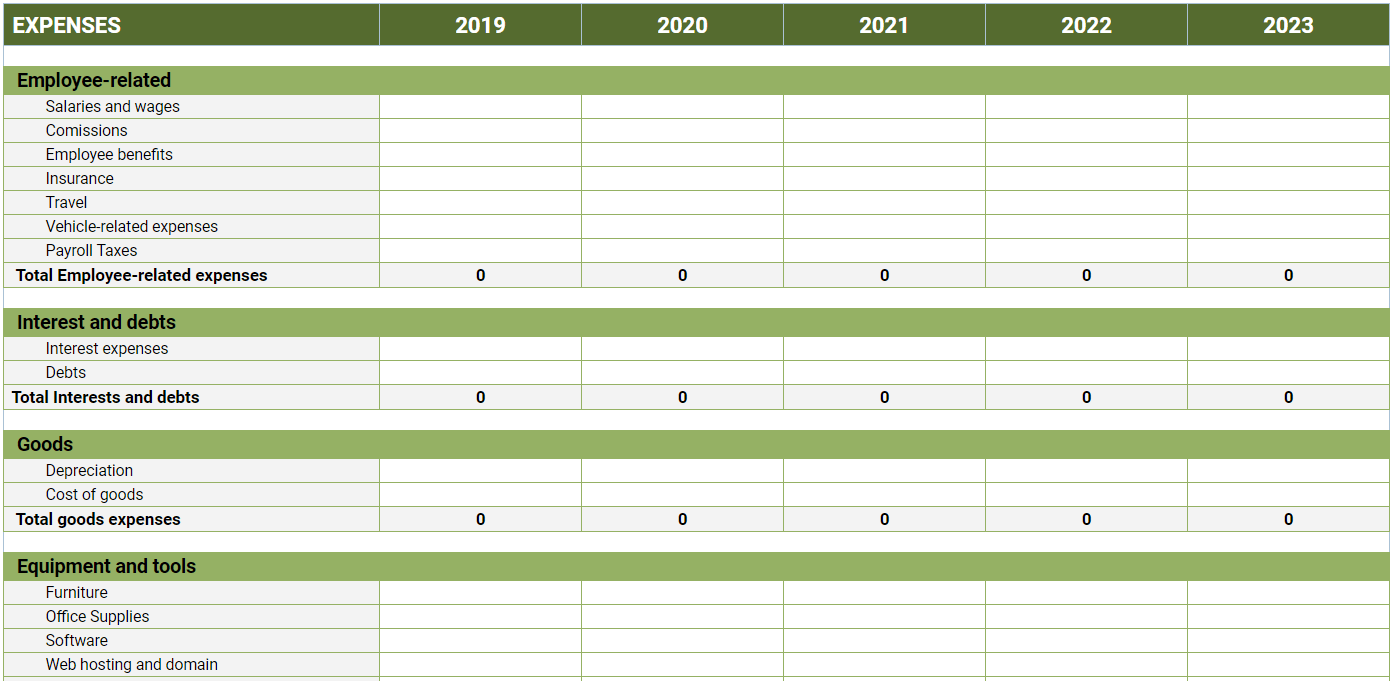

(1) the income statement, (2) the balance sheet, and (3) the cash flow statement. Income statements, balance sheets, and cash flow statements are all financial reports that detail how money enters and departs a company. For example, financial statements issued for the month of december will contain a balance sheet as of december 31 and an income statement for the month of.

The balance sheet is one of the three fundamental financial statements and is key to both financial modeling and accounting. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value. An income statement is a financial report detailing a company’s income and expenses over a reporting period.

The balance sheet is one of the three core financial statements that are used. Each of the financial statements provides important financial information for both internal and external stakeholders of a company. Differentiate between expenses and payables.

The balance sheet presents a snapshot of a company’s assets, liabilities, and equity at a specific point in time, highlighting its financial position. Cash flow statements go into the greatest detail about specific revenue sources and expenses. Knowing when to use each is helpful in.