Unbelievable Info About Absorption Income Statement Format

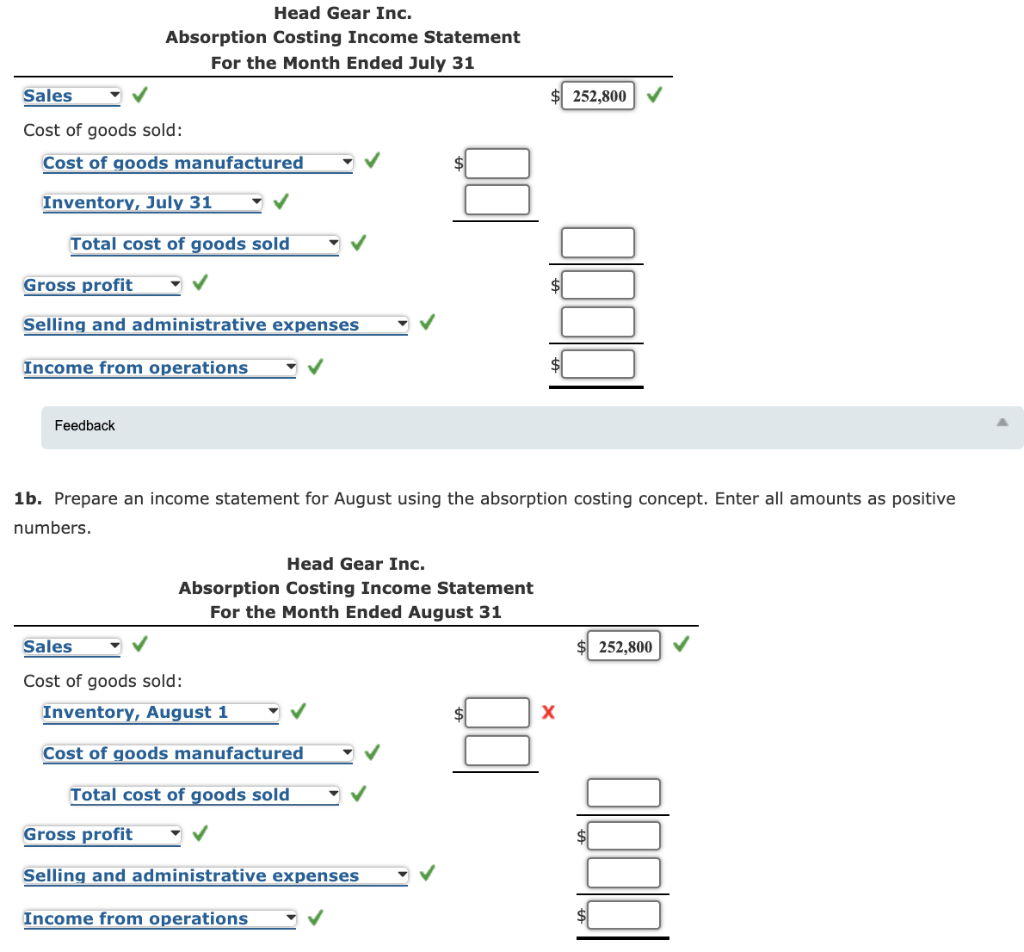

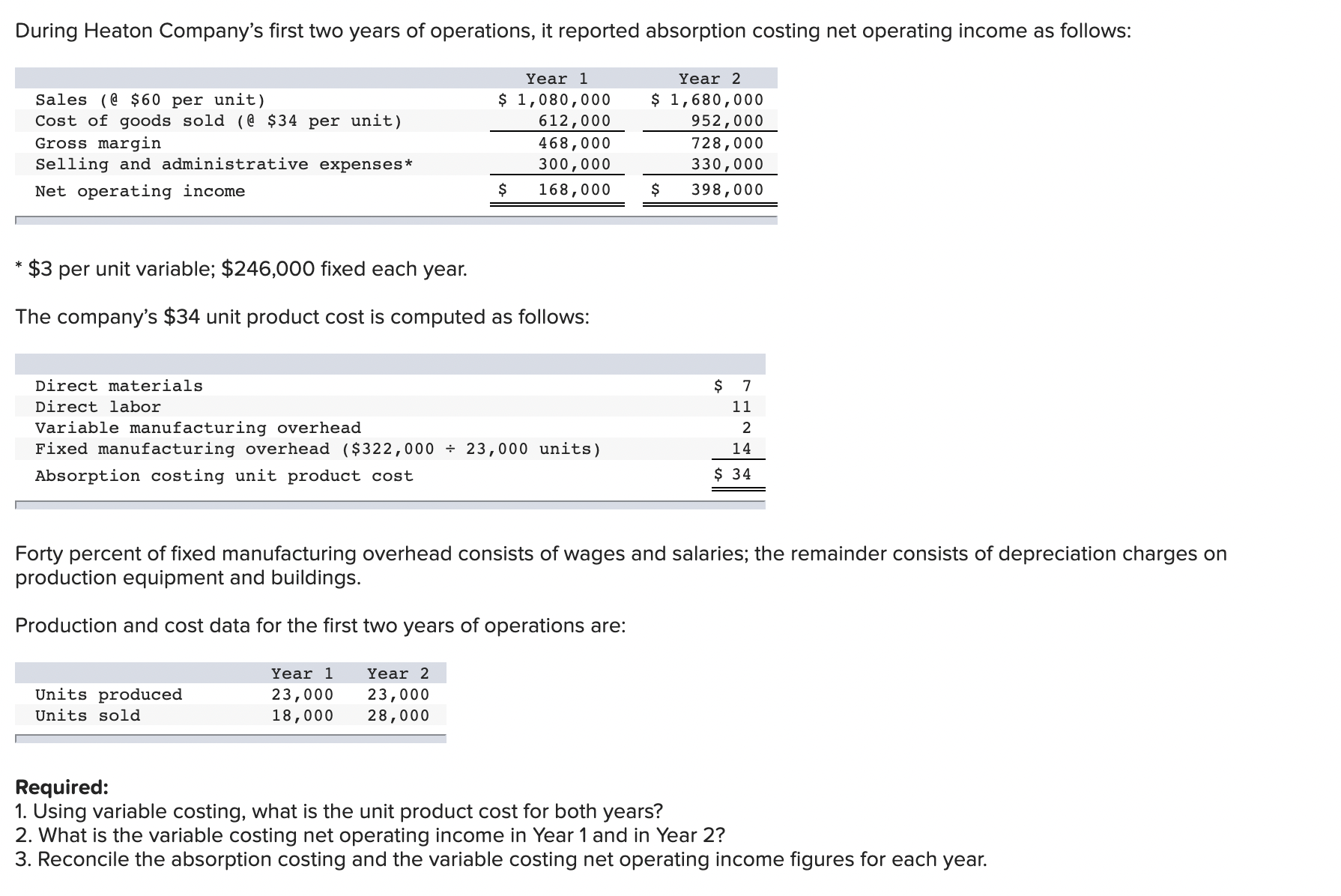

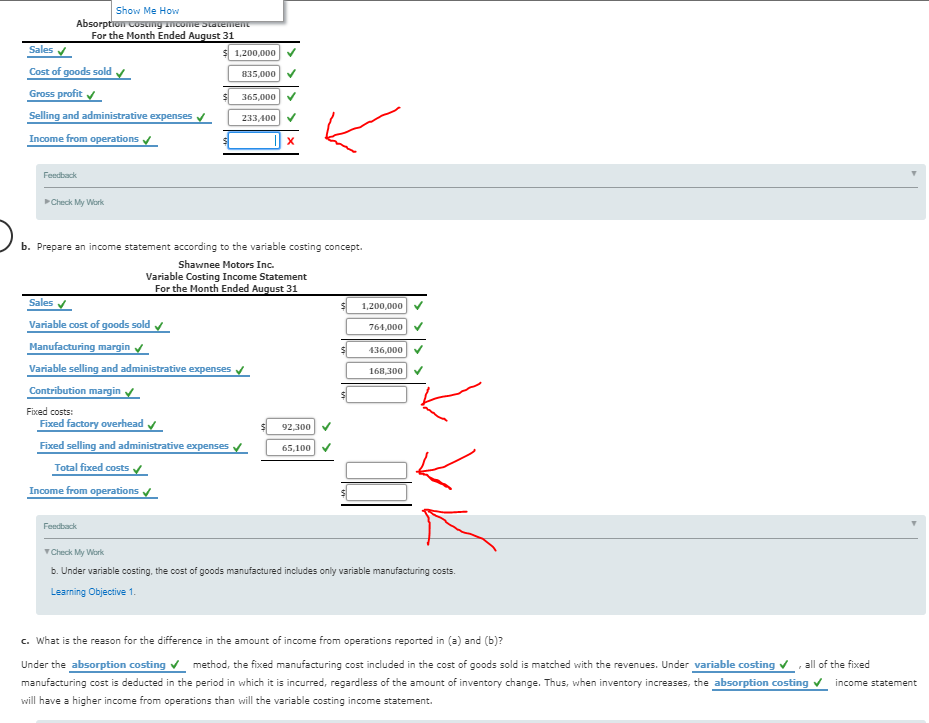

Income statement (absorption) for month ended may:

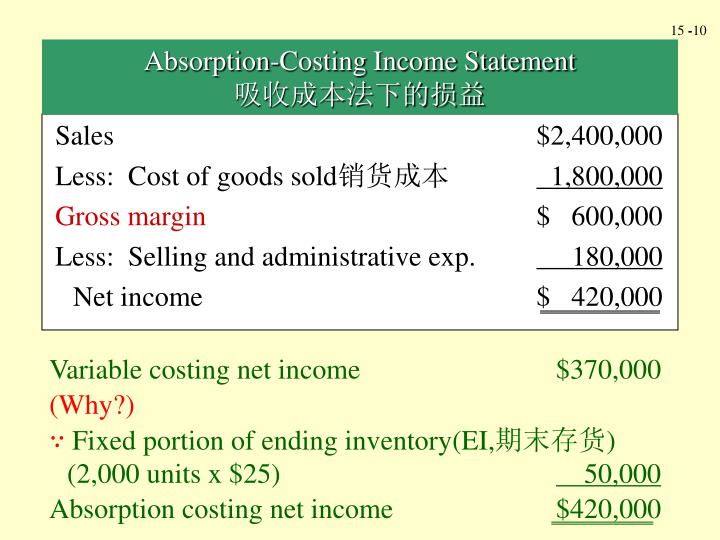

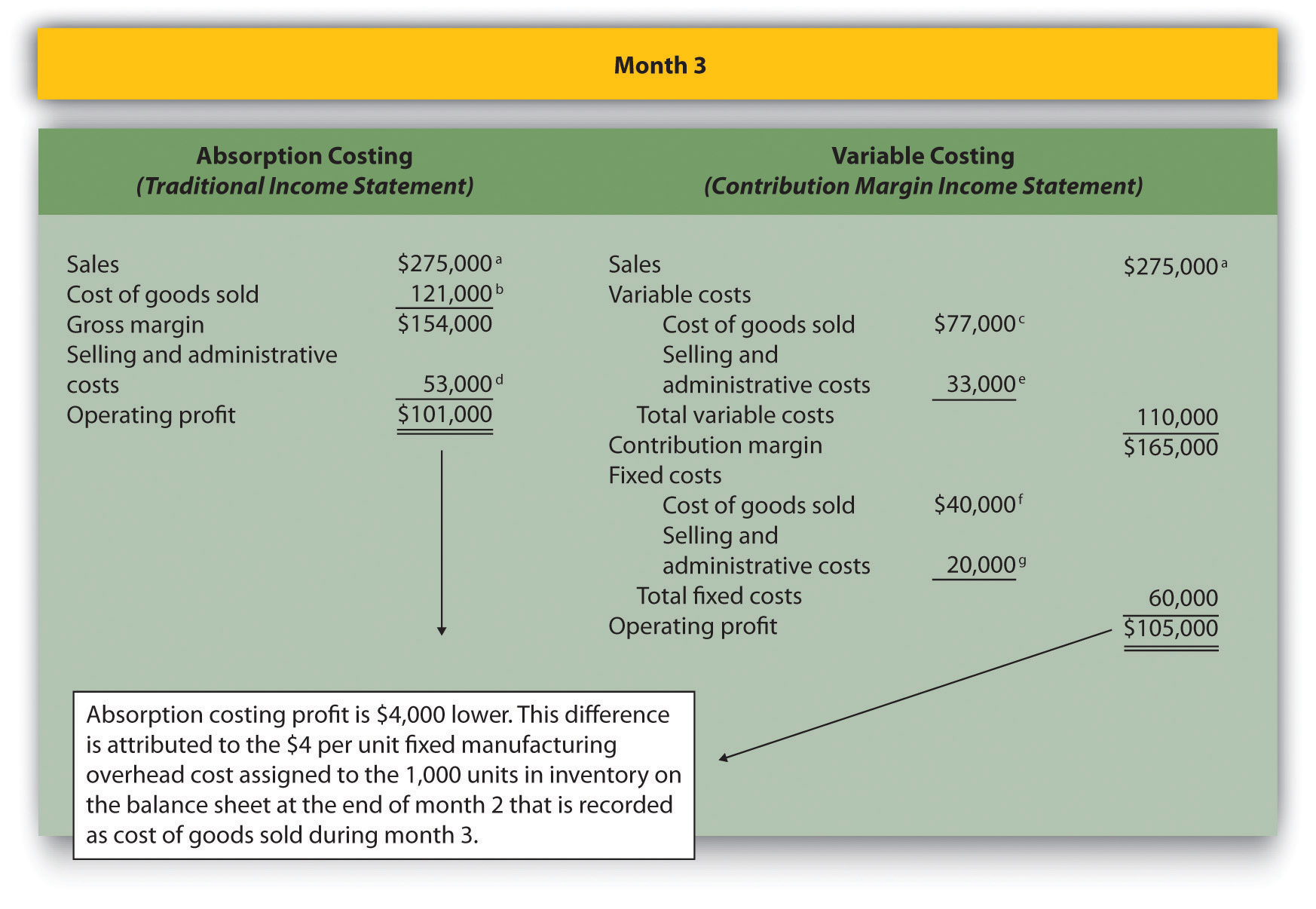

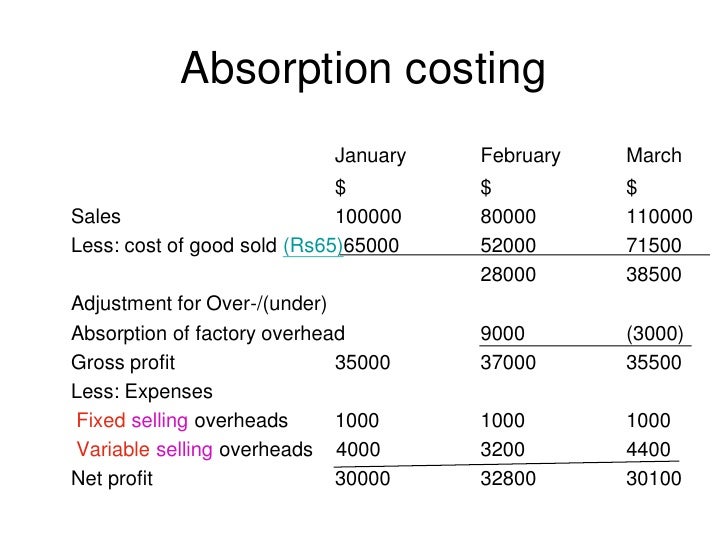

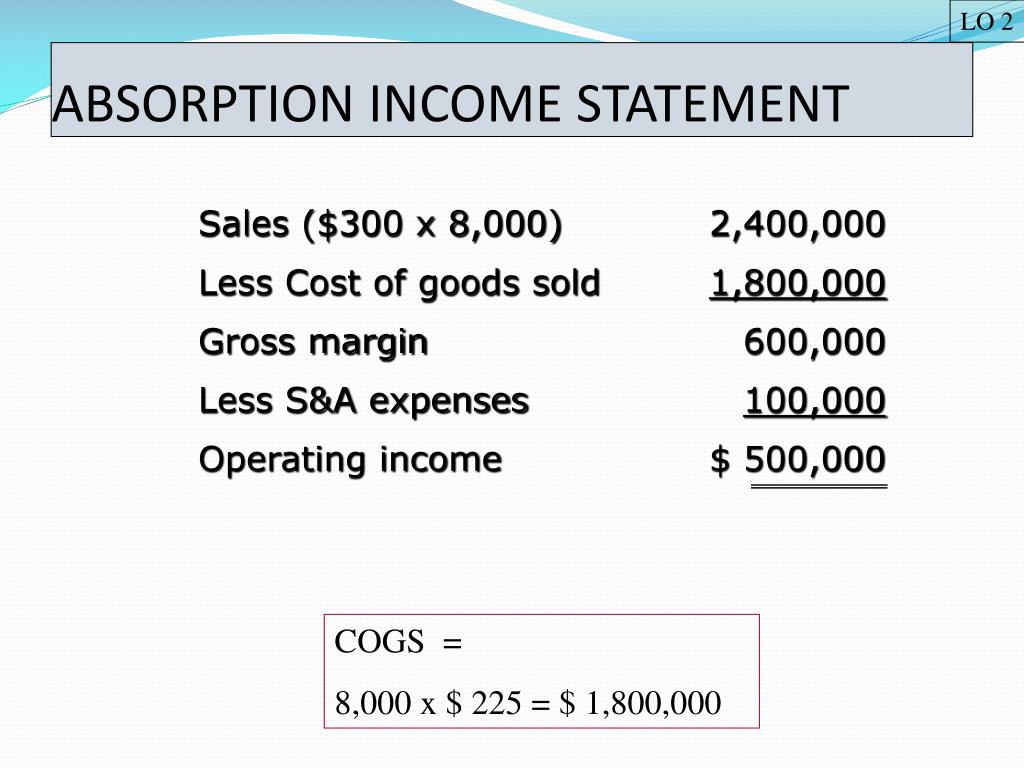

Absorption income statement format. Increases in inventory cause income to be higher under absorption costing than under variable costing, and vice versa. Absorption costing is a costing system that is used in valuing inventory. Selling expenses (15,000 fixed + variable 0.20 x 9,000 units sold)

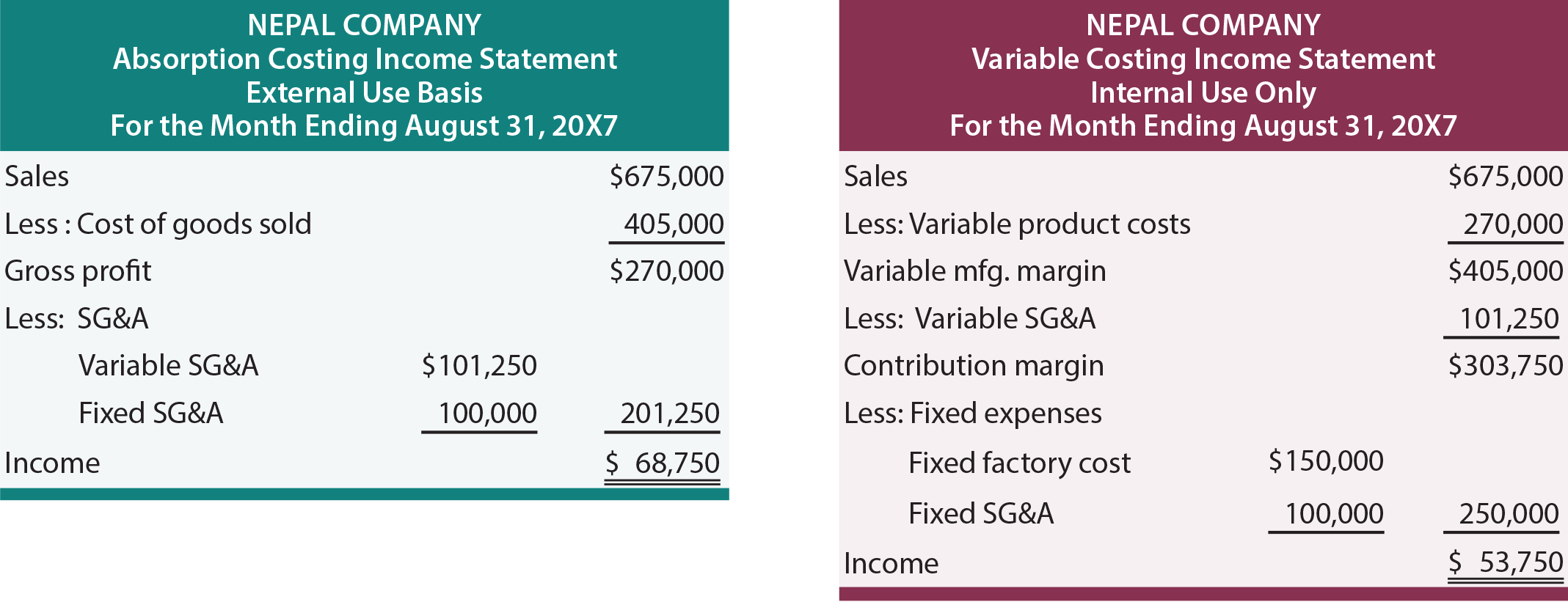

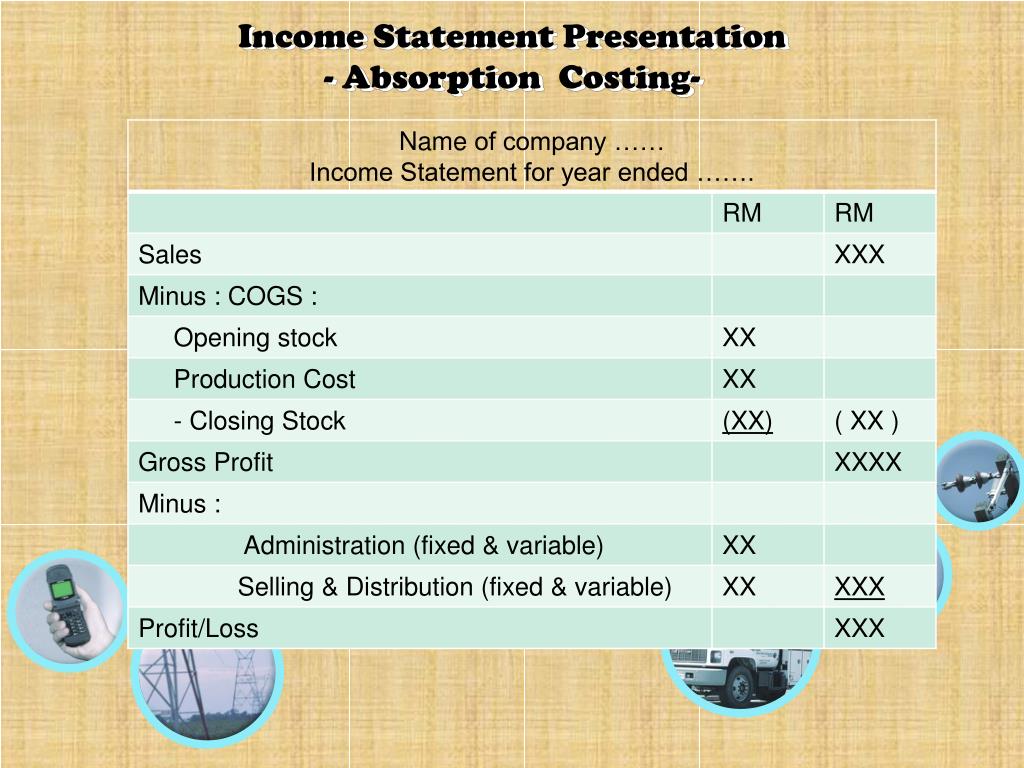

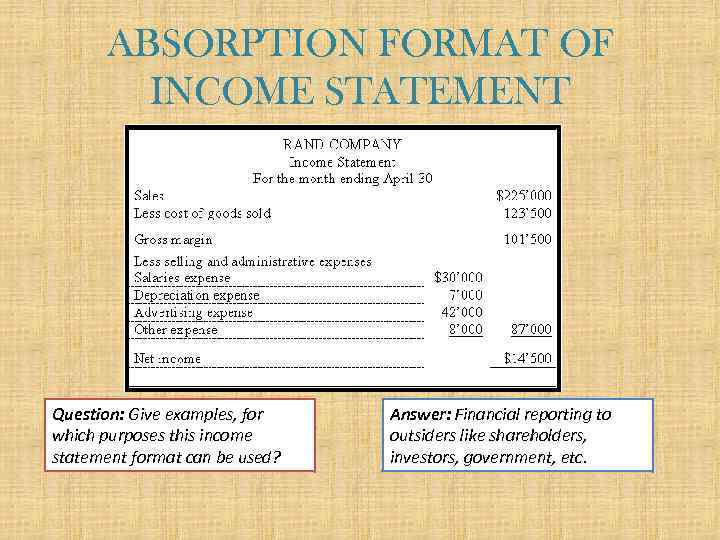

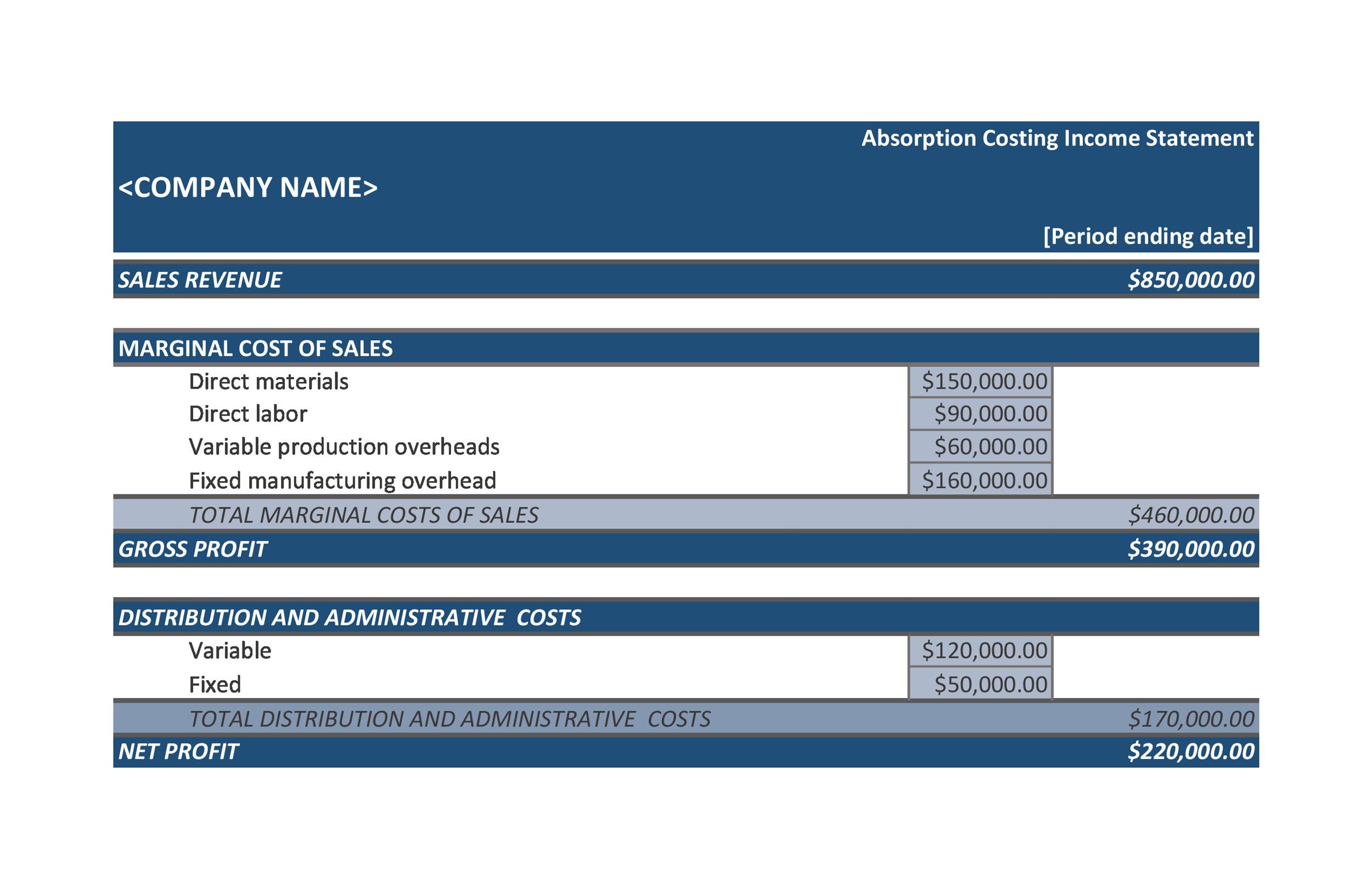

Absorption costing is the costing method used for financial accounting and tax purposes because it reflects a more comprehensive net income on income statement and a more complete cost of inventories on balance sheet by shifting costs between different periods in accordance with the matching concept. The difference in profits rs. The absorption costing income statement is also known as the traditional income statement.

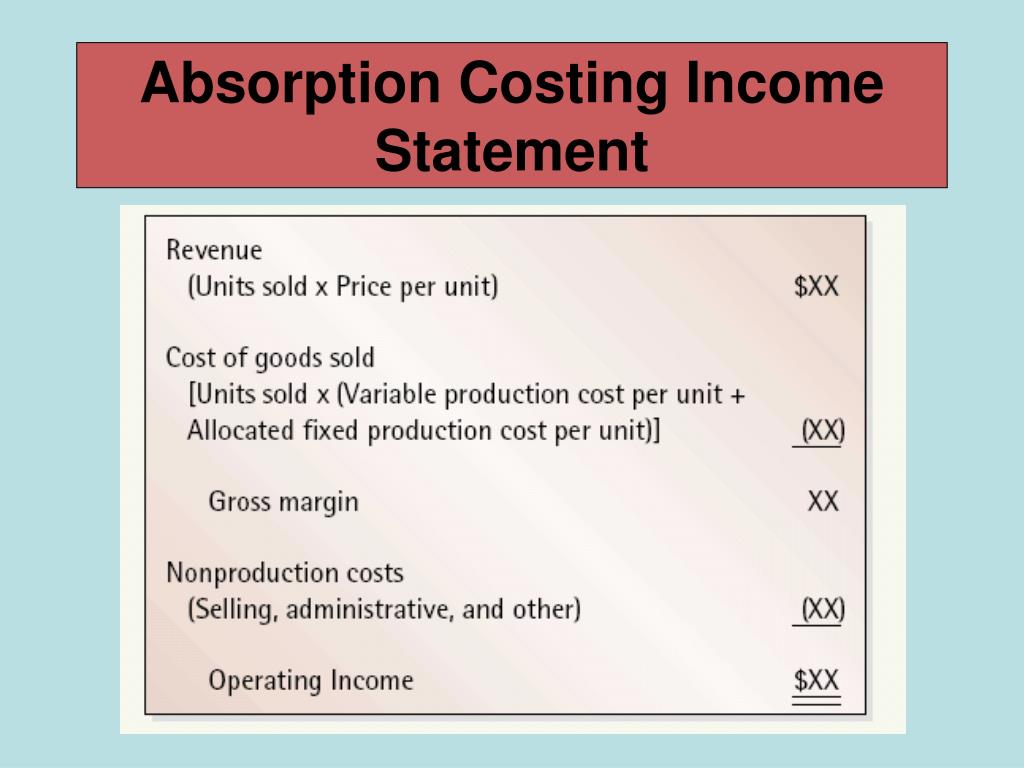

The resulting figure represents commodities for sale. This is consistent with a general rule of thumb: The absorption rate is simply the variable costs of manufacturing plus the direct fixed costs of manufacturing.

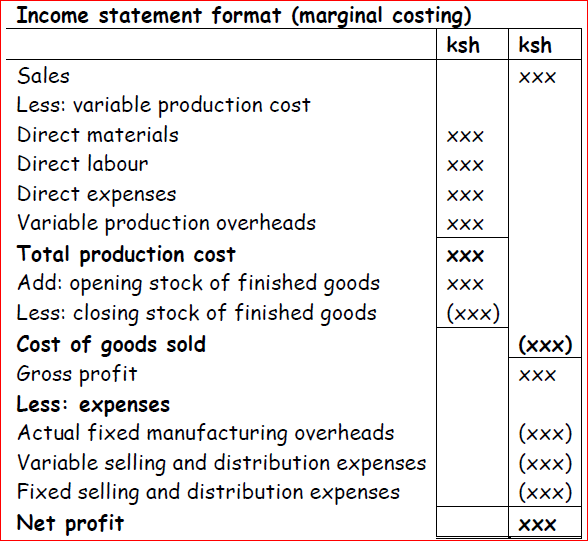

Variable costing uses the contribution margin format and separates cost based on their behaviour (fixed and variable). The traditional income statement absorption costing income statement format & examples by saka | mar 27, 2020 | bookkeeping | absorption costing means that ending inventory on the balance sheet is higher, while expenses. Income statement (absorption) for month ended may:

These traditional income statements use absorption costing to form an income statement. However, the absorption assessment net statement first subtracts the cost of goods sold from sales to calculate gross margin. Selling expenses (15,000 fixed + variable 0.20 x 9,000 units sold) 16,800 + general and admin.

The absorption costing and marginal costing income statements differ significantly in format. In contrast, fixed costs are apportioned over different products manufactured over time. Expenses are separated into two accounts:

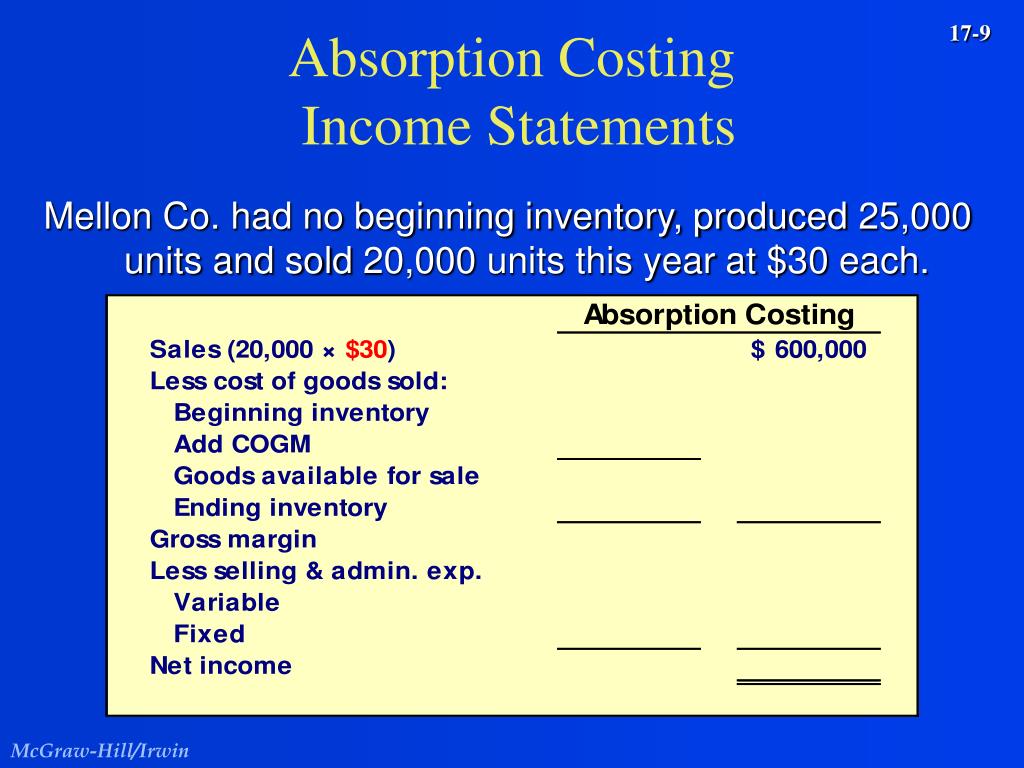

The traditional income order, also called absorption estimate income statement, uses immersion valuation to build the income statement. To calculate cogs, add the cost of products produced for the time to the dollar worth of initial inventory. Cost of goods sold , which are product costs of the manufactured goods themselves, and selling and administrative expenses , which are general operating costs.

This format is referred to as an absorption costing income statement. This income statement looks at costs by dividing costs into product and period costs. Its use applies to identifying expenses that relate to the production of products.

Every other part of the income statement becomes easy to calculate once you have gotten your cost per unit. This is important because data related to absorption costs will usually be required when you present an external report on your company. In order to complete this statement correctly, make safer you understand product and period costs.

The absorption costing income statement follows a more traditional format of computing gross profit first and then subtracting operating expenses. What is absorption costing? Both begin with gross marketing and end with low operating income for the period.

:max_bytes(150000):strip_icc()/Absorptioncosting-1a583ac14f1e40dda214632af50ec4fd.jpg)