Spectacular Tips About Retained Earnings In The Balance Sheet

The statement can be prepared to cover a specified cycle, either monthly, quarterly or.

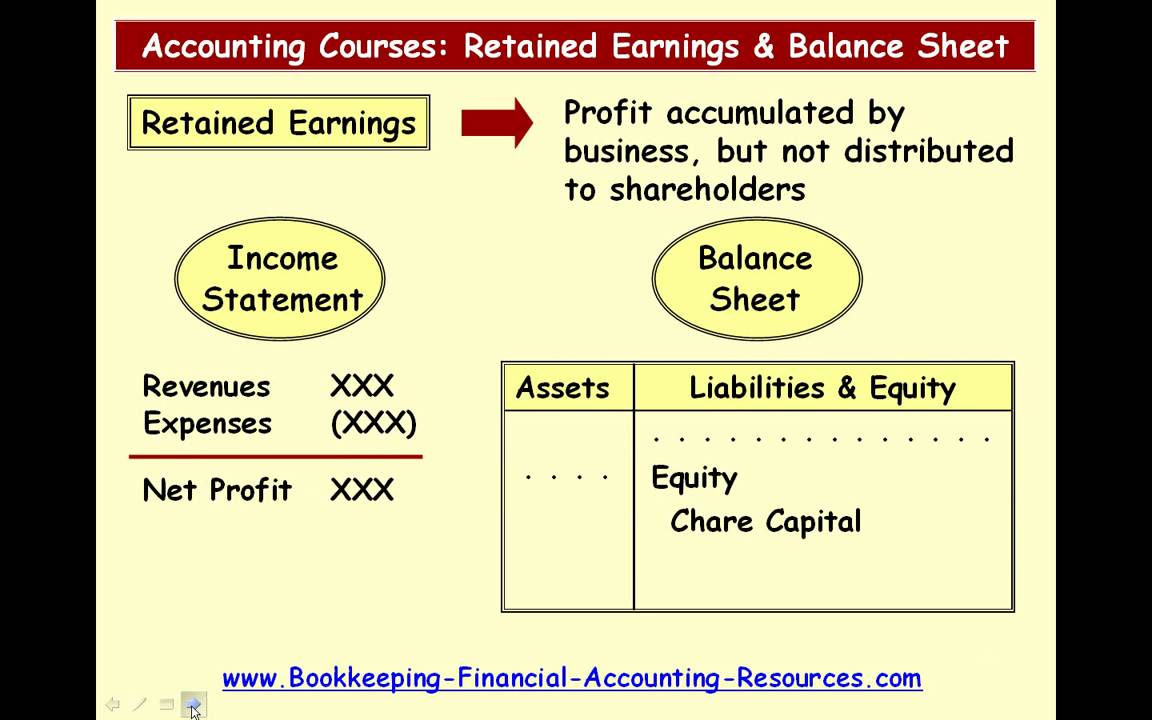

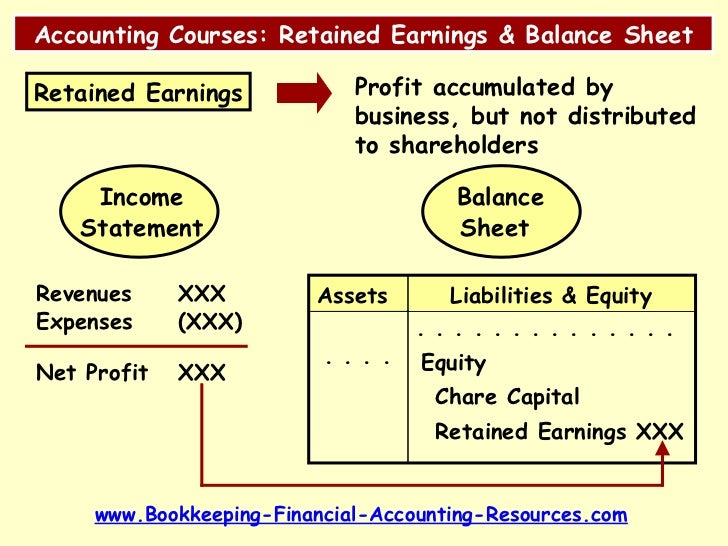

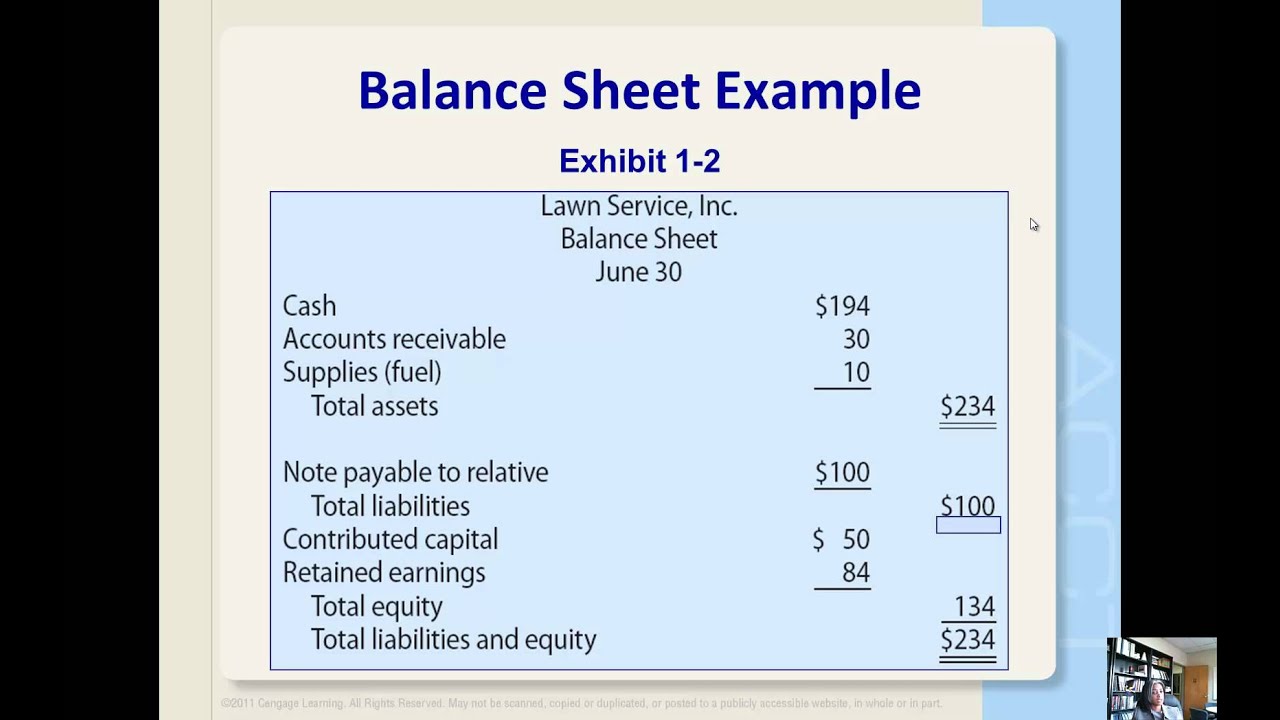

Retained earnings in the balance sheet. Revenue is the income earned from selling goods or services produced. Retained earnings can typically be found on a company’s balance sheet in the shareholders’ equity section. They reflect the residual net income after accounting for any dividends distributed to shareholders.

Retained earnings, also known as accumulated earnings, is a company’s total earnings or profit that have been retained since the business first began operations. The balance sheet provides a snapshot of a company’s financial position, highlighting its assets, liabilities, and shareholders’ equity at a specific point in time. Retained earnings is a term used to describe the historical profits of a business that have not been paid out in dividends.

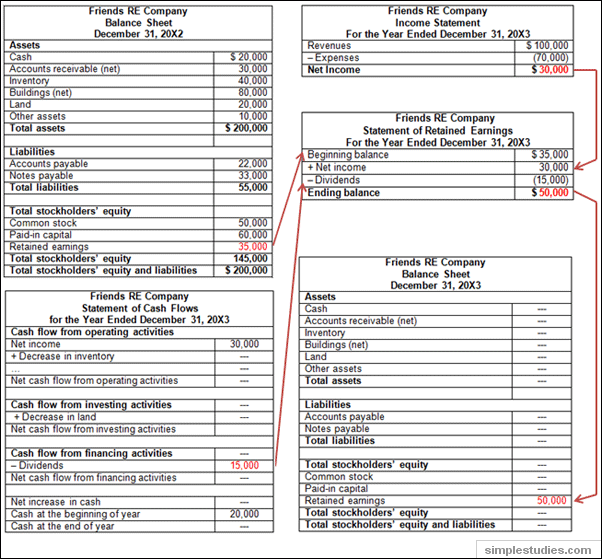

Retained earnings make up part of the stockholder's equity on the balance sheet. Retained earnings=beginning retained earnings+net income−dividends. To calculate re, the beginning re balance is added to the net income or reduced by a net loss and then dividend payouts are subtracted.

Sometimes a separate statement for the. Determine beginning retained earnings balance; The statement of retained earnings can be created as a standalone document or be appended to another financial statement, such as the balance sheet or income statement.

The ideal ratio between retained earnings and total assets is 1:1 (or 100 percent). They can be reported on the balance sheet and earnings statement. Retained earnings are cumulative on the balance sheet.

Beginning re (2015) = $18,861 million. Imagine a company that started the year with an impressive retained earnings balance of $50,000. Your accounting software will handle this calculation for you when it generates your company’s balance sheet, statement of retained earnings and other financial statements.

Retained earnings are the cumulative net earnings (profit) of a company after paying dividends; It is represented in the equity section of the balance sheet. Retained earnings on a balance sheet are the amount of net income remaining after a company pays out dividends to its shareholders.

Add current period net income to beginning retained earnings balance; Retained earnings can be found in the shareholders’ equity section of a company’s balance sheet. The net income of colgate in 2016 was $2,441 million.

Financial reporting includes collecting and documenting your finances to monitor your business’. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. Businesses generate earnings that they reflect on their balance sheet as negative earnings, or losses, and positive earnings, or profits.

Retained earnings are calculated by adding the current year’s net profit (if it’s a net loss, then subtracting the current period net loss) to (or from) the previous year’s retained earnings (which is the current year’s retained earnings at the beginning) and then subtracting. Retained earnings are reported on the balance sheet under the shareholder’s equity section at the end of each accounting period. How are the retained earnings calculated on the balance sheet?