Sensational Info About Provision For Bad Debts Meaning

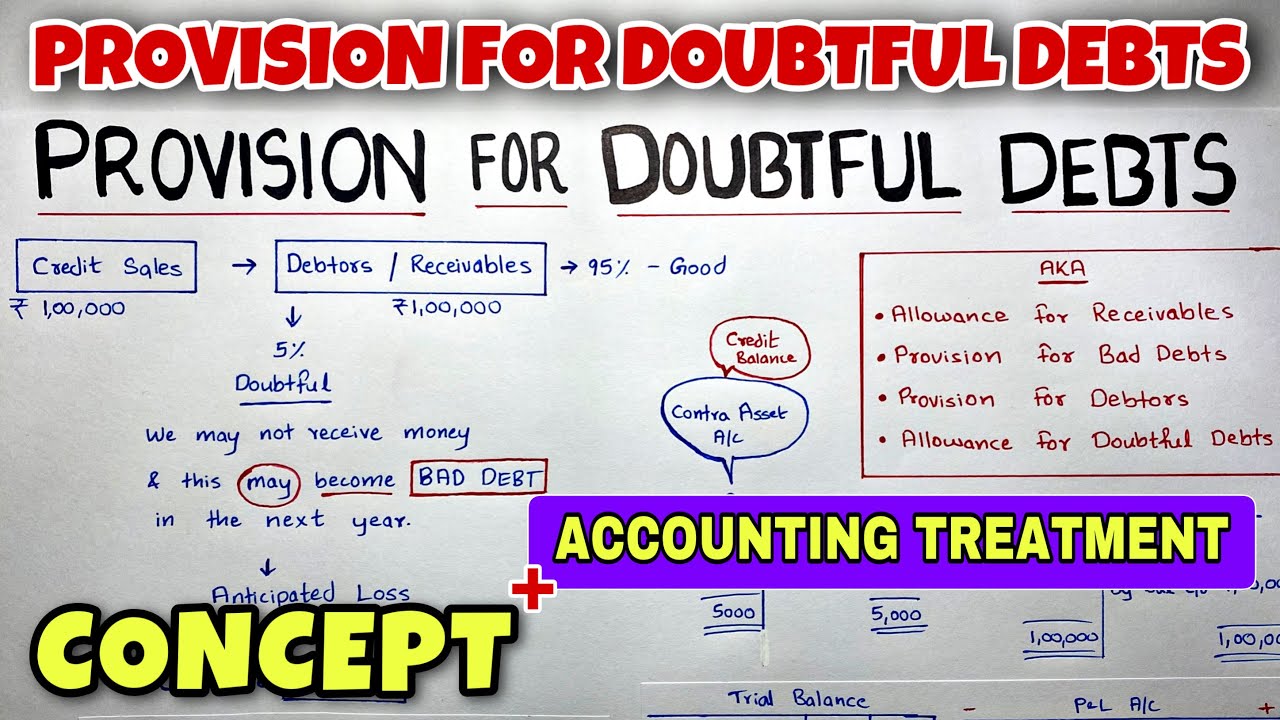

The provision for doubtful debts, which is also referred to as the provision for bad debts or the provision for losses on accounts receivable, is an estimation of the amount of.

Provision for bad debts meaning. The process of strategically estimating bad debt that needs to be written off in the future is called bad debt provision. Any company that has a policy of selling goods on credit has to deal with the problem of bad debts. It adversely affects any business organization being.

Let us take the example of a company that recognized credit sales worth $20 million during the year. It represents the outstanding balances of a company that are. A bad debt provision is a reserve made to show the estimated percentage of the total bad and doubtful debts that need to be written off in the next year.

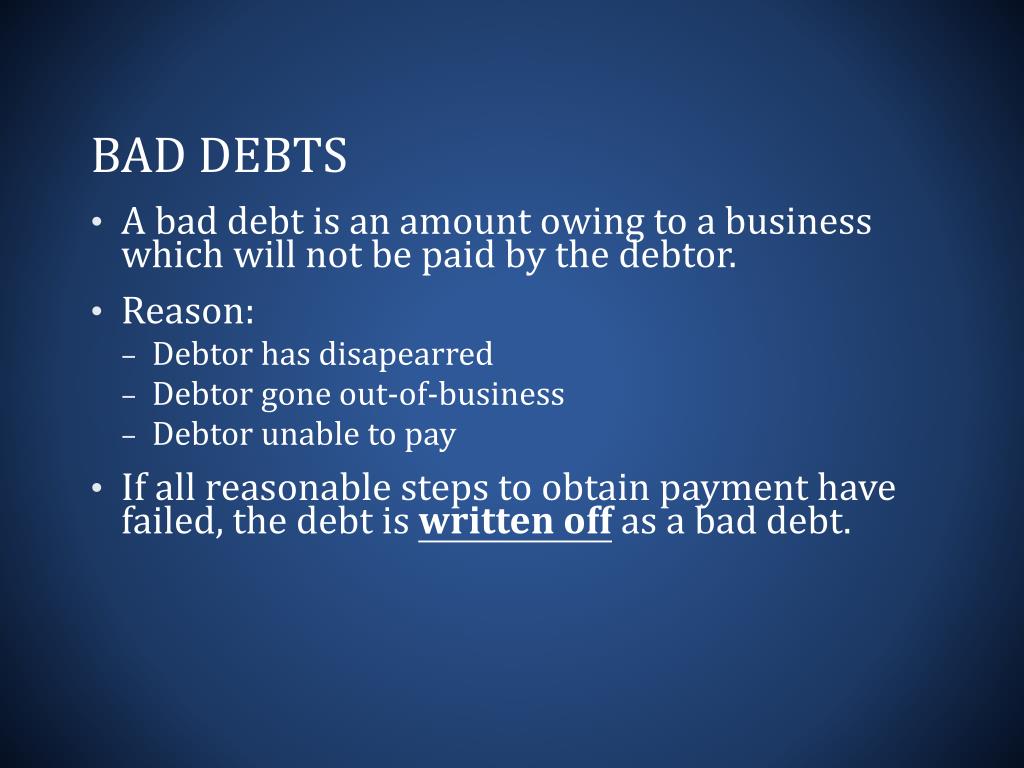

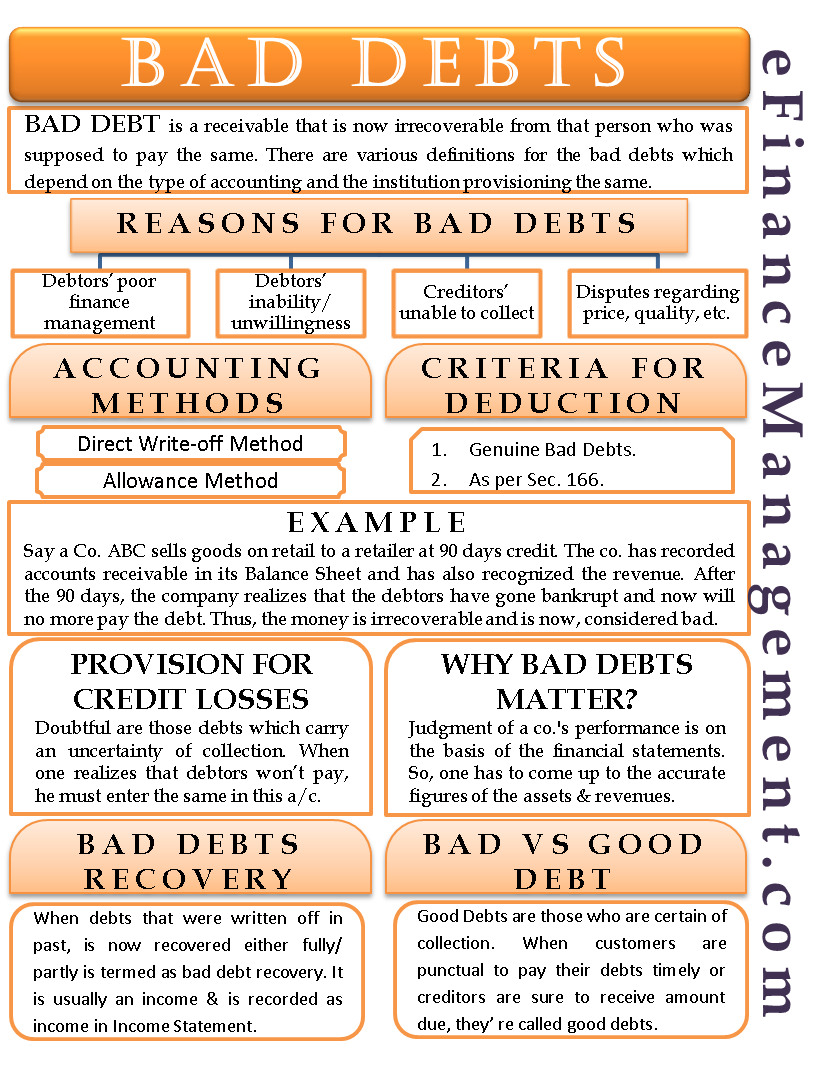

Bad debt refers to the extended credit that businesses offer customers, which they fail to repay within the promised tenure. Bad debts meaning and examples bad debt is that debt that was previously receivable but now is irrecoverable from that person who was supposed to pay that. Provision for bad debts the provision for bad debts is not the same as bad debts.

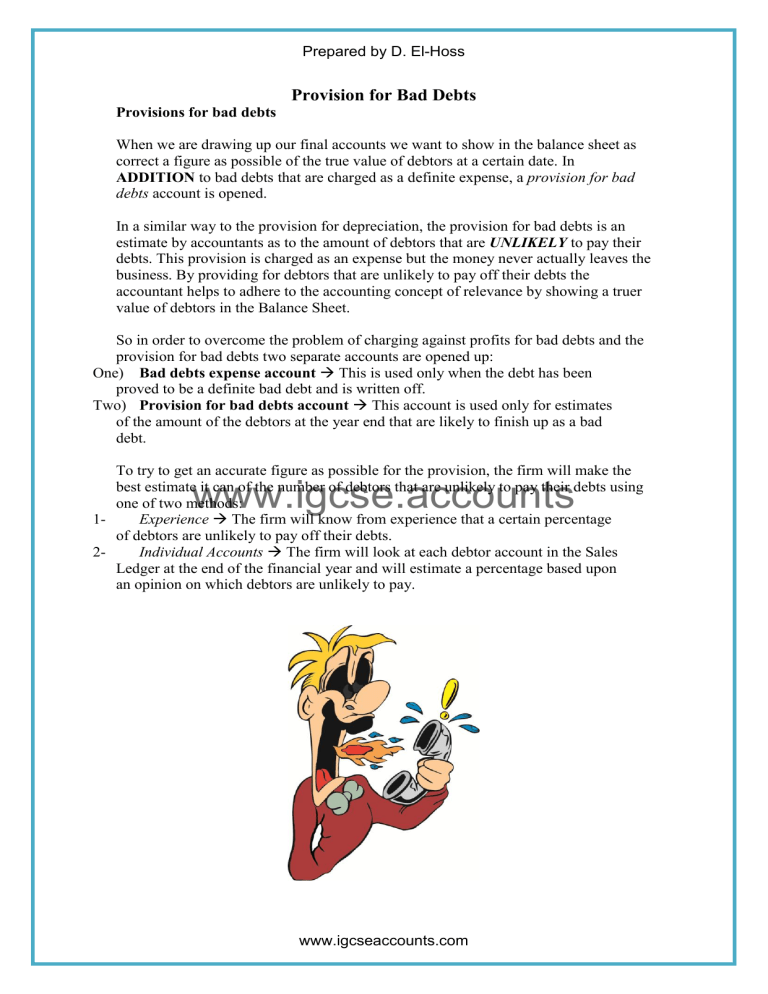

When certain bad debts are to be written off and a provision for doubtful. Oppositely, doubtful debts are a part of sundry debtors for the purpose of. Bad debts for the current year are to be set off, and an additional amount of provision is to be added.

A bad debt provision is also known as the allowance for doubtful accounts, the allowance for uncollectible accounts, or the allowance for bad debts. The provision for bad debts is a contra asset account that records the net realizable value of the company's accounts receivable. The provision for doubtful debts is also known as the provision for bad debts and the allowance for doubtful accounts.

Bad debt is money that is owed to the company but is unlikely to be paid. Bad debt provision is used for doubtful debts. Table of contents bad debts.

A provision for bad debts is the amount of receivable where the accounts manager feels that certain receivable amount could not be recovered. It is simply a loss because it is charged to the profit & loss account of the company in the name of provision. Historical trends suggest that approximately 5% of the.

A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in. The provision for doubtful debts is the. There are several ways to make the.

It is important to understand that debts are. The provision for bad debts is an estimate of the debts owed to us that will go bad in the. A provision for the same is created, namely, “provision for credit losses.” this forms a part of selling and administration expenses.

This method involves recording an estimate of the amount likely to be uncollectible and creating a provision. The provision for the bad debt is an expense for the business and a charge is made to the income statements through the bad debt expense account. It is used along with the accounts receivable.

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)

:max_bytes(150000):strip_icc()/baddebtreserve.asp_final-2e6562d79b874ef39946ab765138946a.png)