Smart Info About Profit And Loss Statement Sole Proprietorship

However, this is incorrect if you’re a sole proprietor—these.

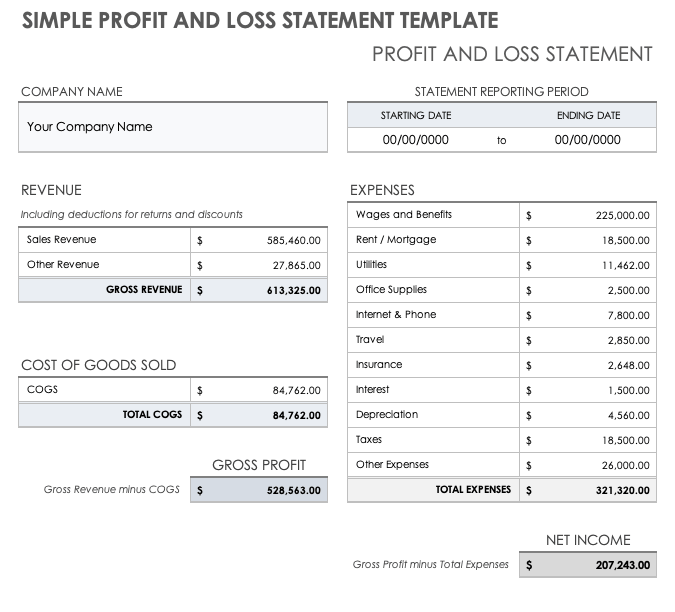

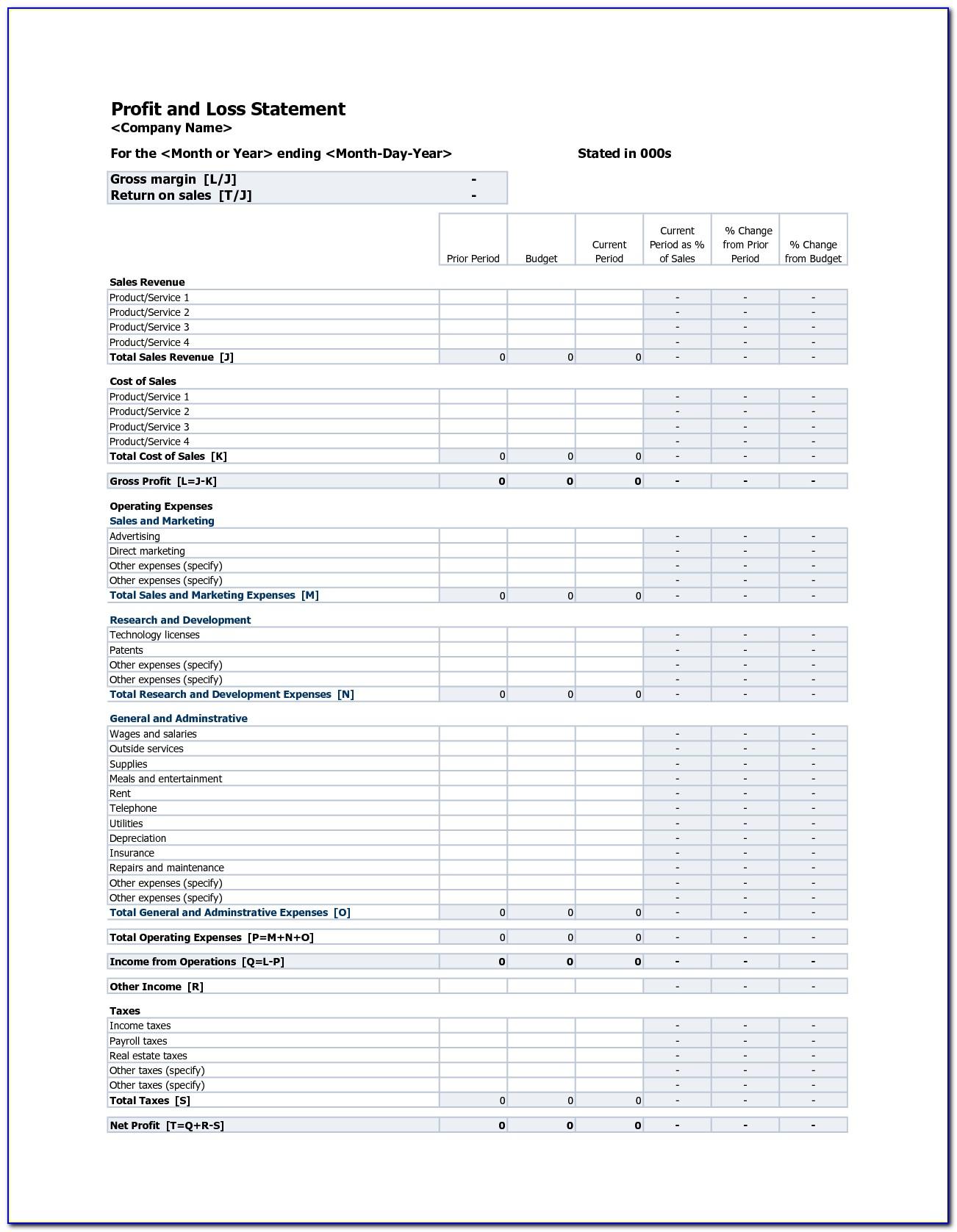

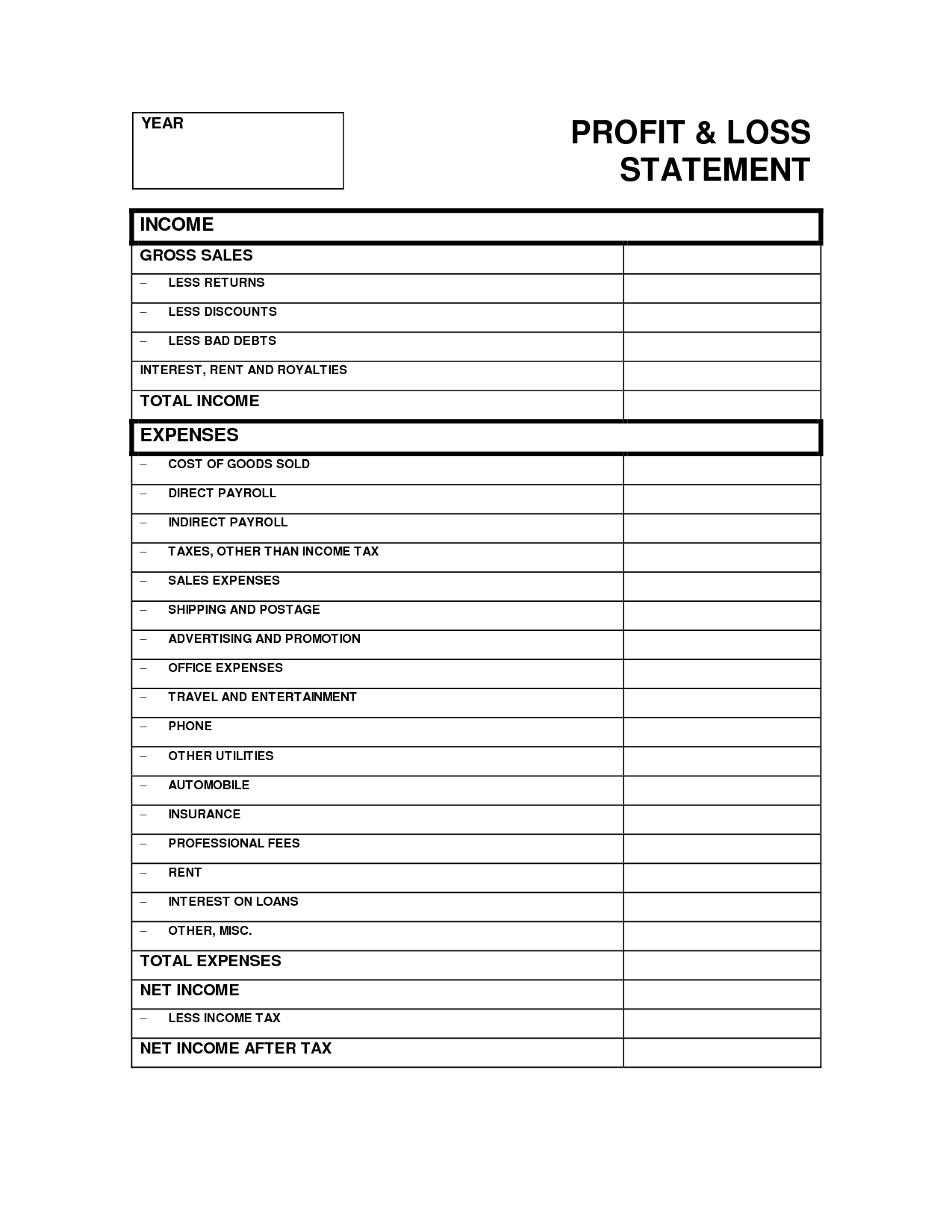

Profit and loss statement sole proprietorship. How do you know if the activity in which you're engaged qualifies as a business? The single step profit and loss statement formula is: Because a profit and loss statement is a financial document, there are simple math formulas that you can use to determine your gross margin, net operating.

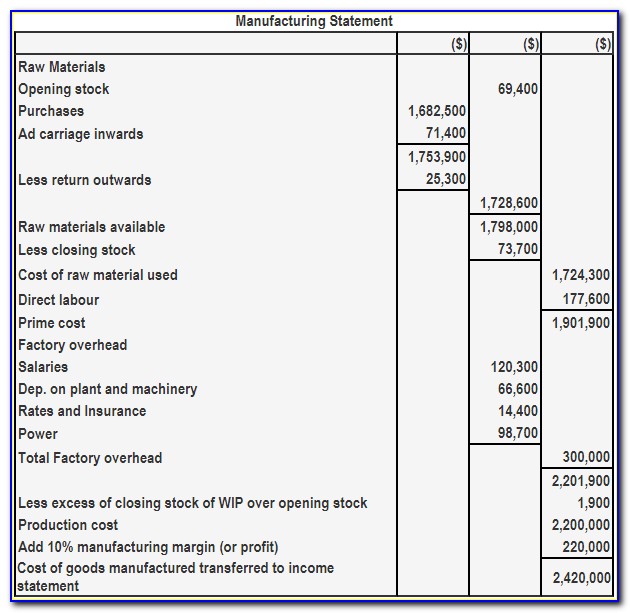

The profit and loss statement for a sole proprietorship reflects all the income that a company has earned after subtracting revenue from expenses. Partnerships must generally file form 1065. The profit and loss statement (p&l) is one of the most important financial documents that any small business owner or sole trader should maintain regularly.

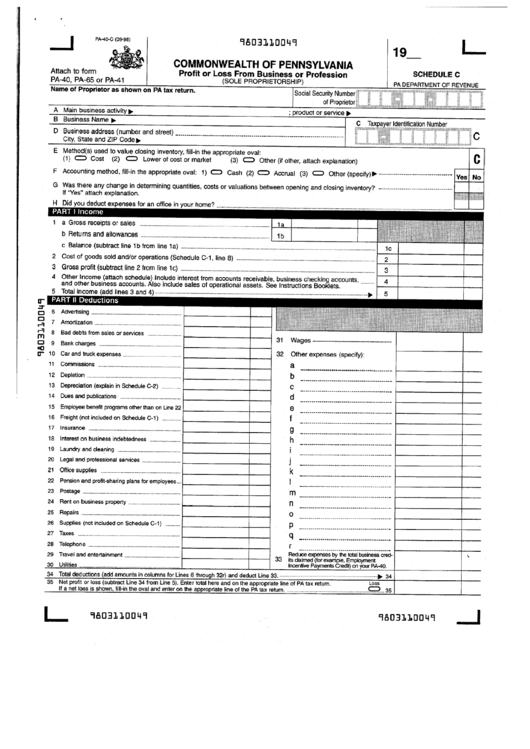

According to the irs, it's a business if: Sole proprietorships are easy to. The irs requires sole proprietors to use profit or loss from business (sole proprietorship) (schedule c (form 1040)), to report either income or loss from their businesses.

The first step in creating a profit and loss statement is to calculate all the revenue your business has received. Revenue and adjusted profit/loss, is increased from $100,000 to $200,000 from ya 2021 for sole. Information about schedule c (form 1040), profit or loss from business, used to report income or loss from a business operated or profession practiced as a sole proprietor;.

A profit and loss statement is also called an income statement, a statement of profit, or a profit and. Report income or loss from a business you operated or a profession you practiced as a sole. For the purposes of a sole proprietorship's profit and loss statement, the amount the business owner actually withdraws from the business is irrelevant.

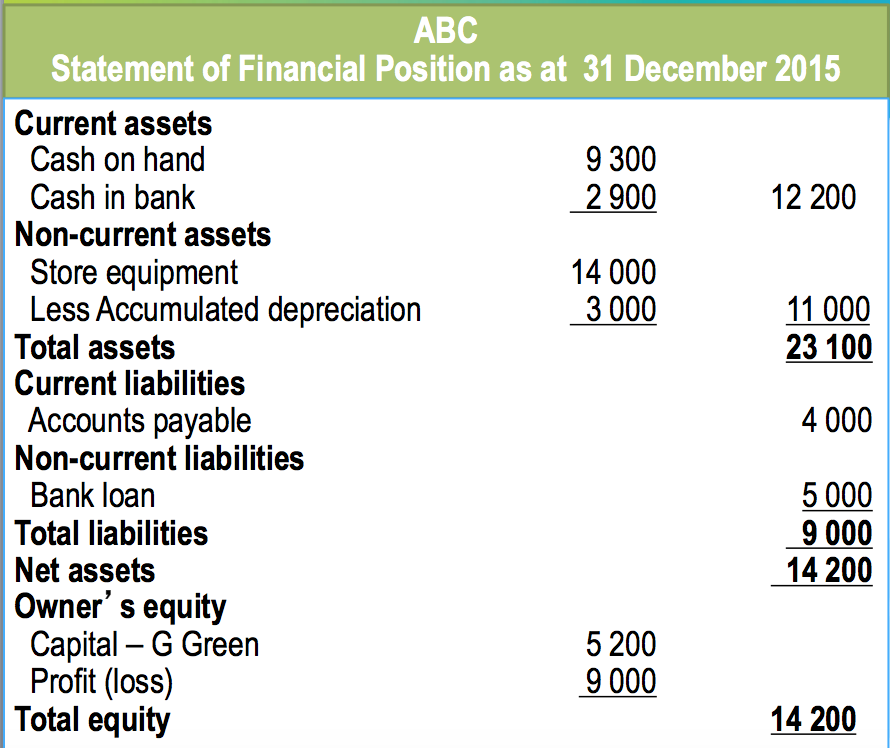

A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies. The income earned during the period of the. The other two are the balance sheet and the cash.

A profit and loss statement is a concise way to show how much the business has earned, and how much discretionary cash it is likely to have available. If you have a c. It captures how money flows in and out of your business.

Some business owners post income tax payments on their profit and loss statement as expenses; A sole proprietorship is an unincorporated business with only one owner who pays personal income tax on profits earned. Key components of a profit and loss statement for small businesses the p&l is comprised of two main parts: