Glory Tips About Negative Net Income On Statement

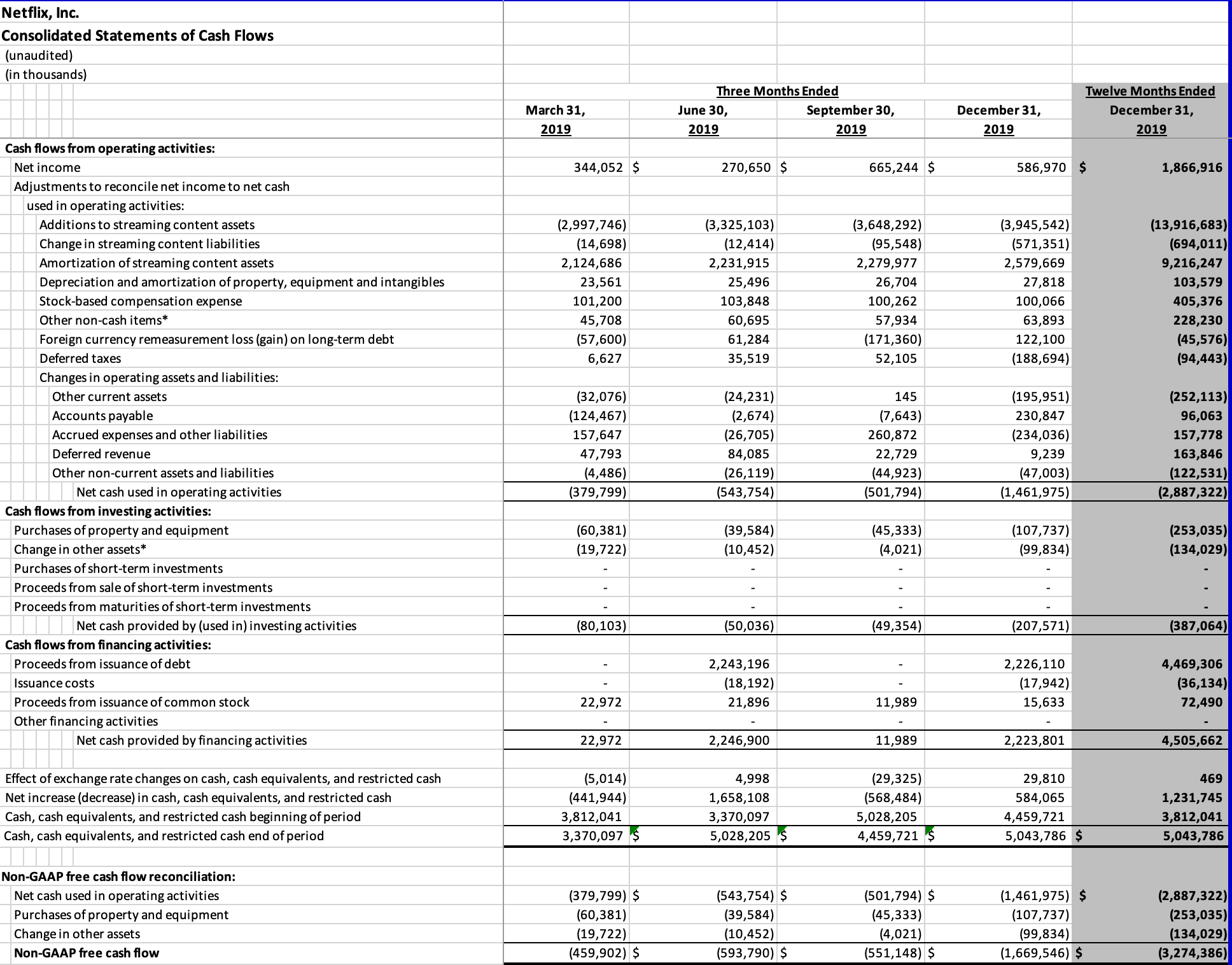

Consistent positive or negative net income shows effective management or financial instability.

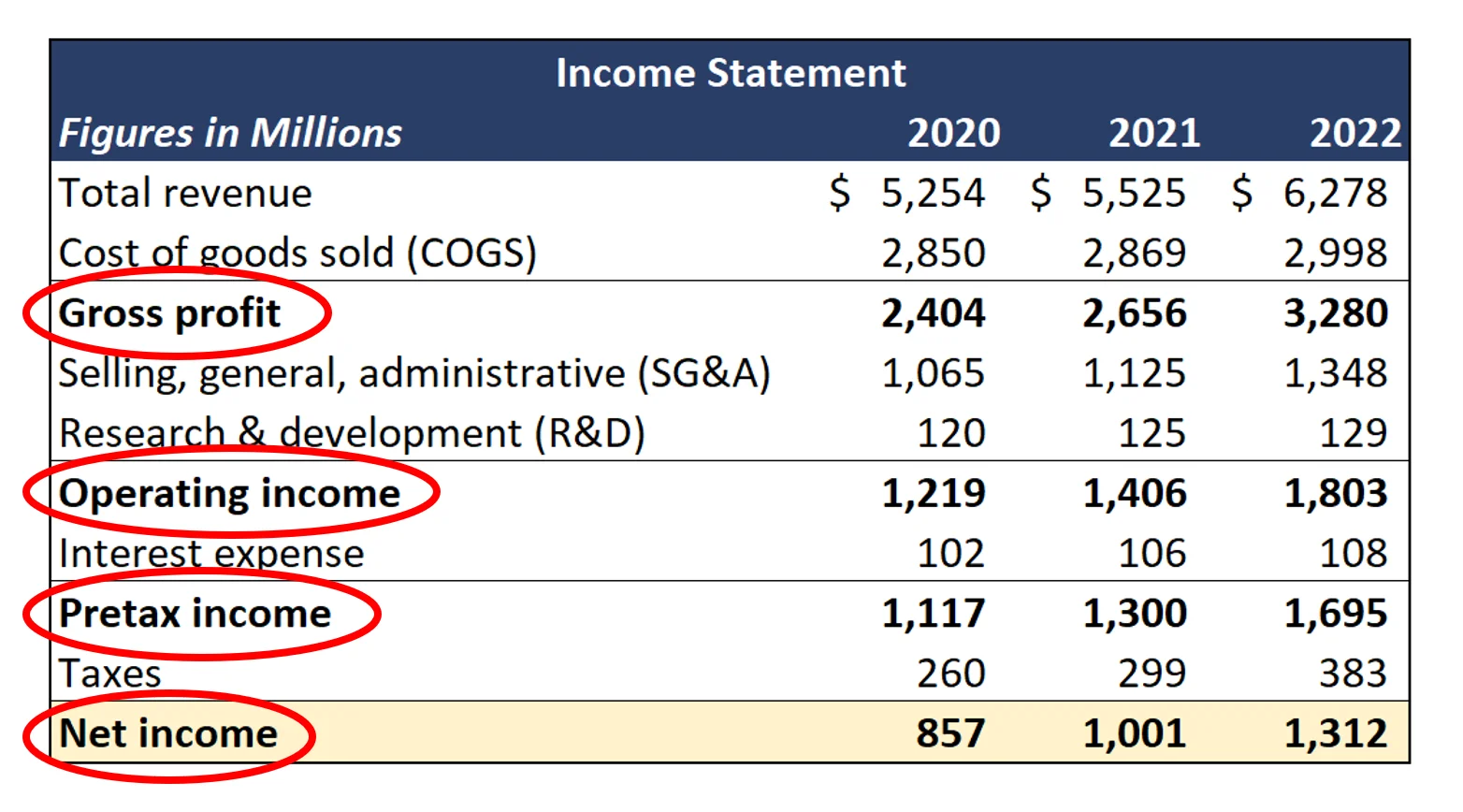

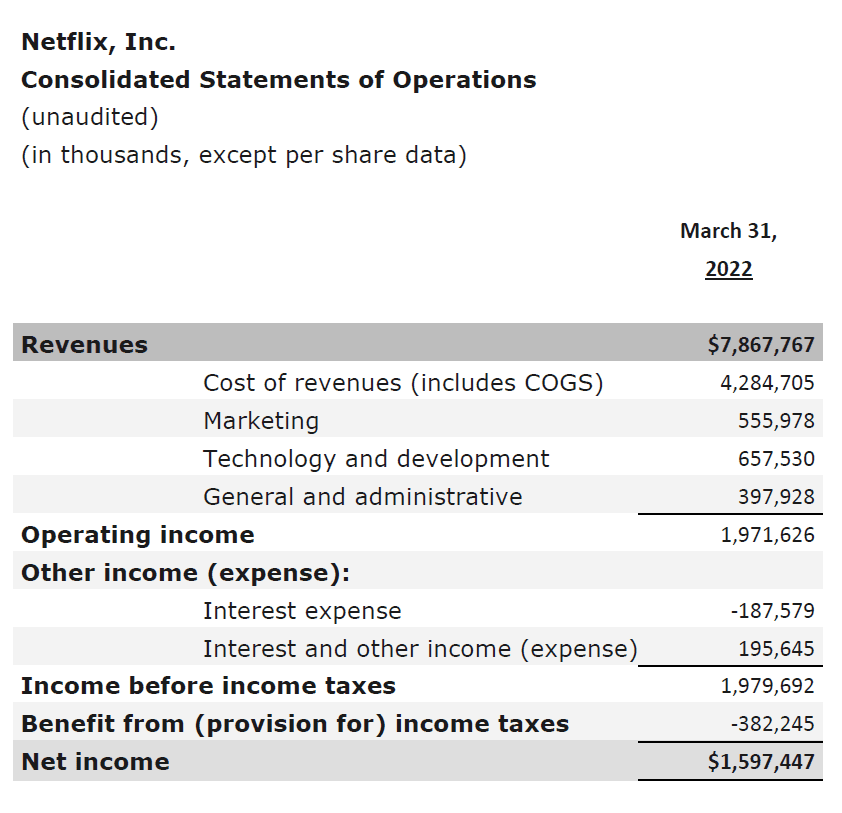

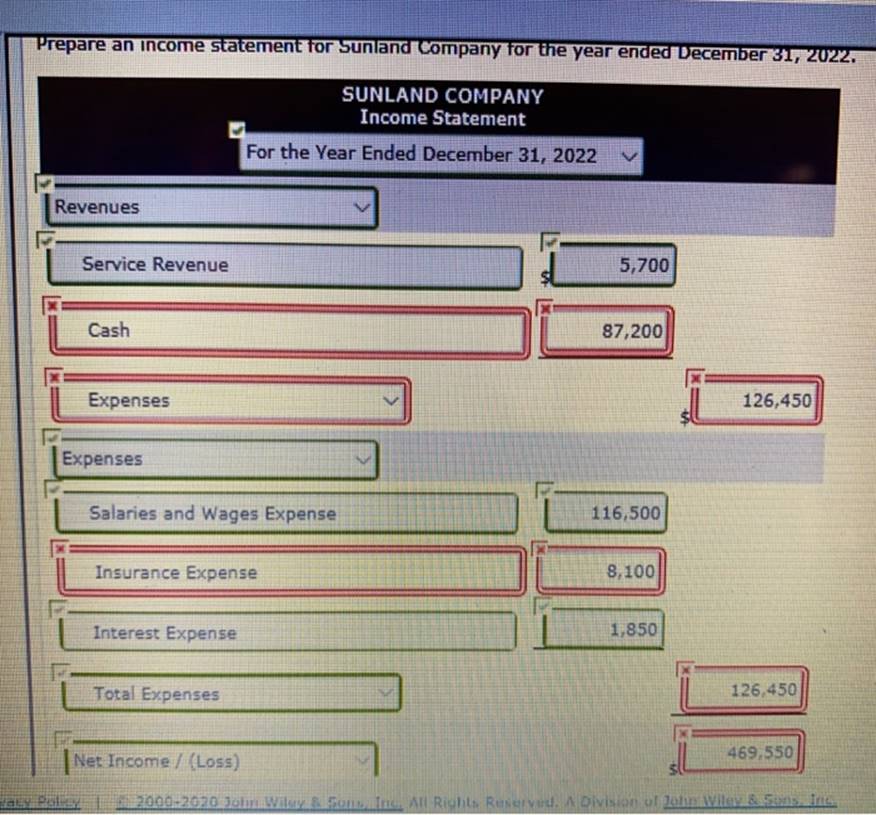

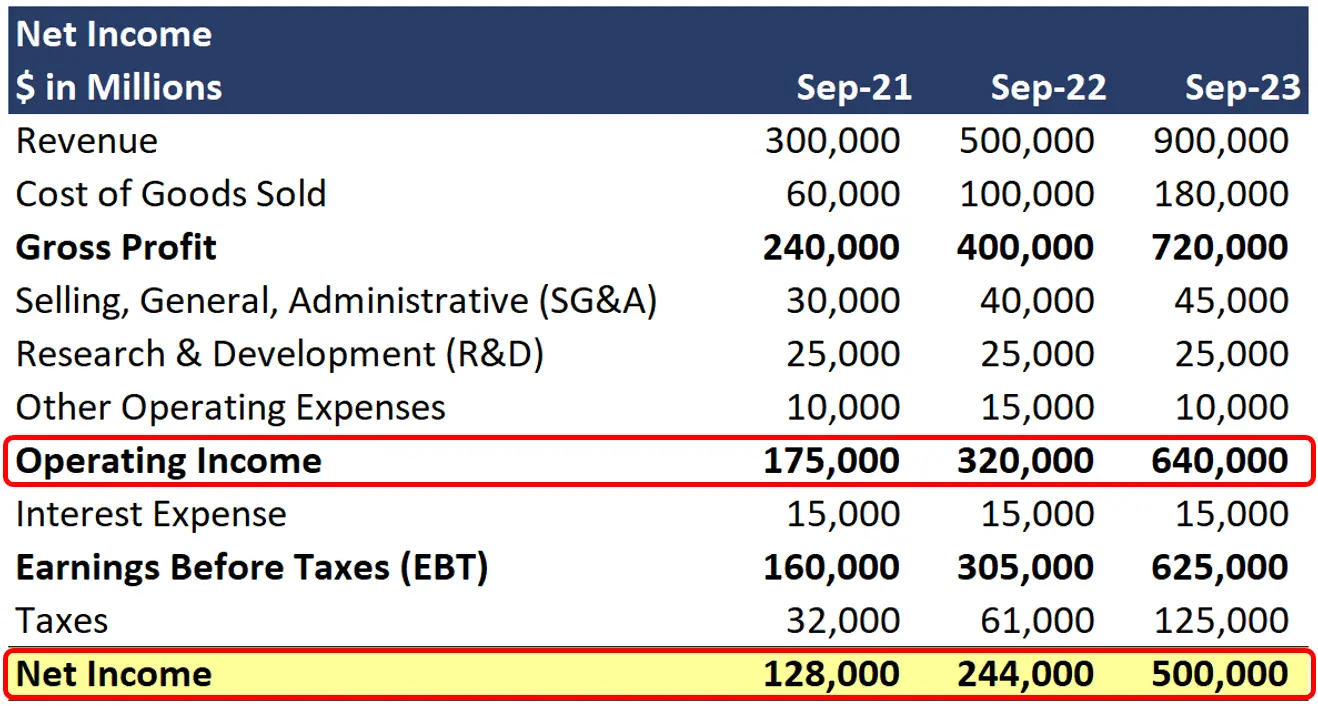

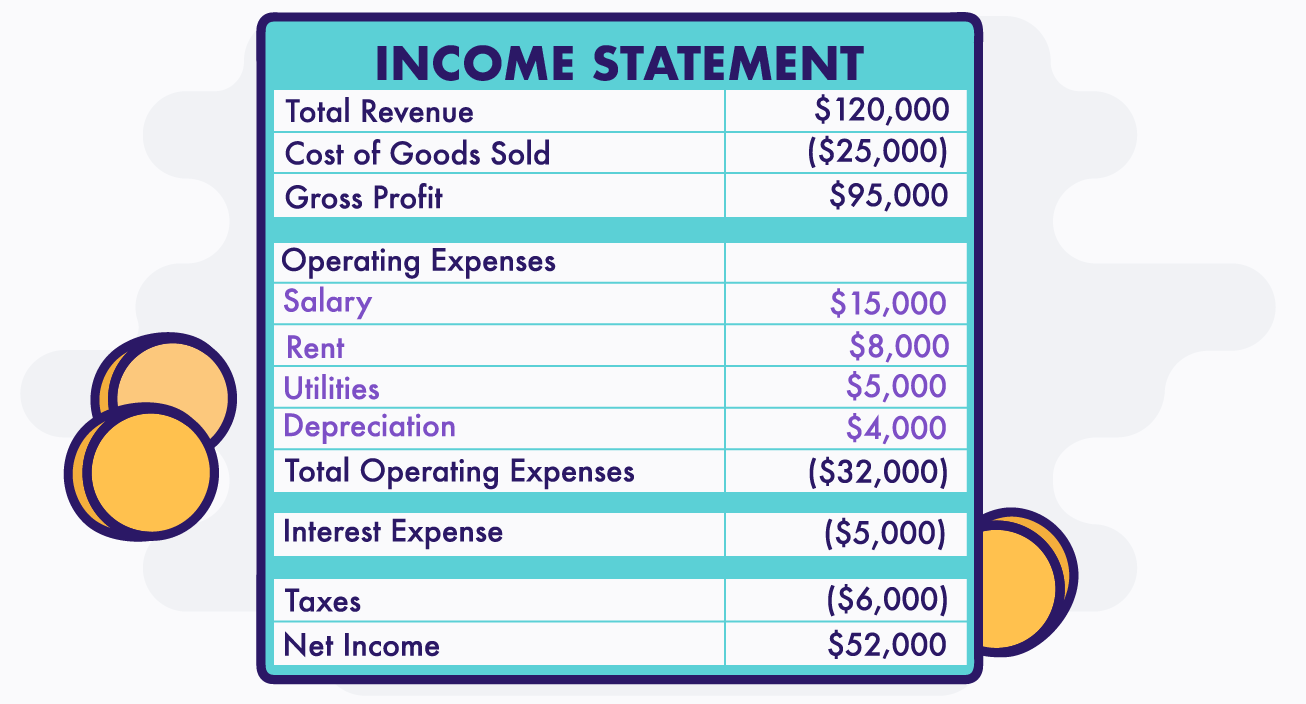

Negative net income on income statement. Net income from operations summarizes revenue and expenses from operational transactions. It is found by taking sales revenue and subtracting cogs, sg&a,. Here are the advantages and disadvantages of income statements to review.

The final calculation is the net income. Typically, a bottom line profit is referred to as net income. A negative income figure appears on a company's income statement, also known as a profit and loss statement.

Net income after taxes (niat) is an accounting term, most often found in a company's annual report , that is meant to show. Regular (ideally quarterly) reviews of the income statement are necessary to. The role of net income in financial statements.

Assets (increase) = liabilities (decrease) + owner’s equity (increase) the assets of the company are increased when net profit is calculated. The income statement shows the company's. Net income is your company’s total profits after deducting all business expenses.

List of the advantages of an income statement 1. Net income is the amount of accounting profit a company has left over after paying off all its expenses. What is the income statement?

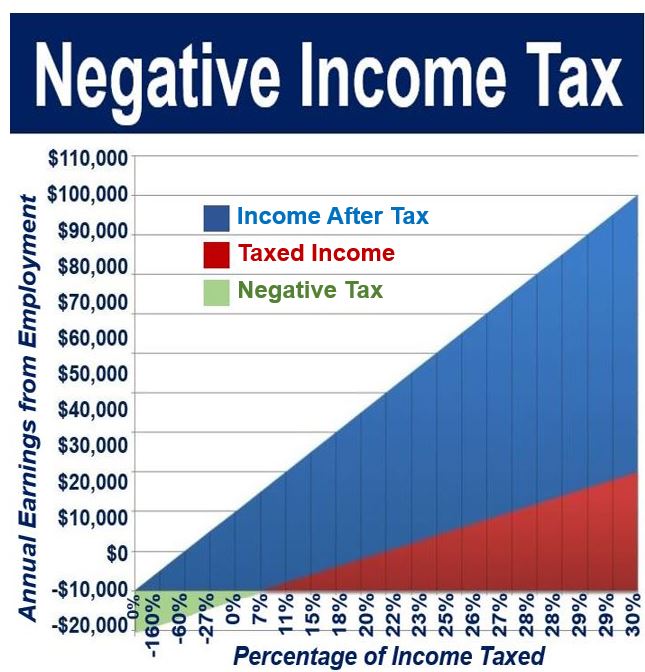

Depending on the values for revenues and expenses, net income can be a positive or a negative number. Total cash flow is the sum of operating,. Net loss (also called negative profit) is a financial metric that assesses a company's overall profitability.

It offers a glimpse at revenue. Net income video definition watch on net income is the amount of money that’s left after taxes and certain deductions are made. The net income becomes negative, meaning it is a loss, when expenses exceed sales, according to investing answers.

A negative result when costs are subtracted from revenue is labeled a net loss. Updated may 17, 2021 what is net income? Also, i've noticed that if you take.

Even with a positive net income, a small business may have a. Gains are added to that amount and losses are deducted to. When total costs (including taxes, fees, interest, and.

The liability might be decreased as. If you record a negative net income but a positive ebitda, you can start exploring refinancing options to reduce your interest rates and as a result, your interest payments. Meaning it doesn’t necessarily represent operating expenses which are higher than operating revenues but does represent losses “on the books”.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Operating_Income_Aug_2020-01-e3ccd90db6224fc8b0bea6dac86e478f.jpg)

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)