Outrageous Tips About Unearned Revenue Income Statement

Unearned revenue is the money that a customer pays in advance for a service you'll provide them.

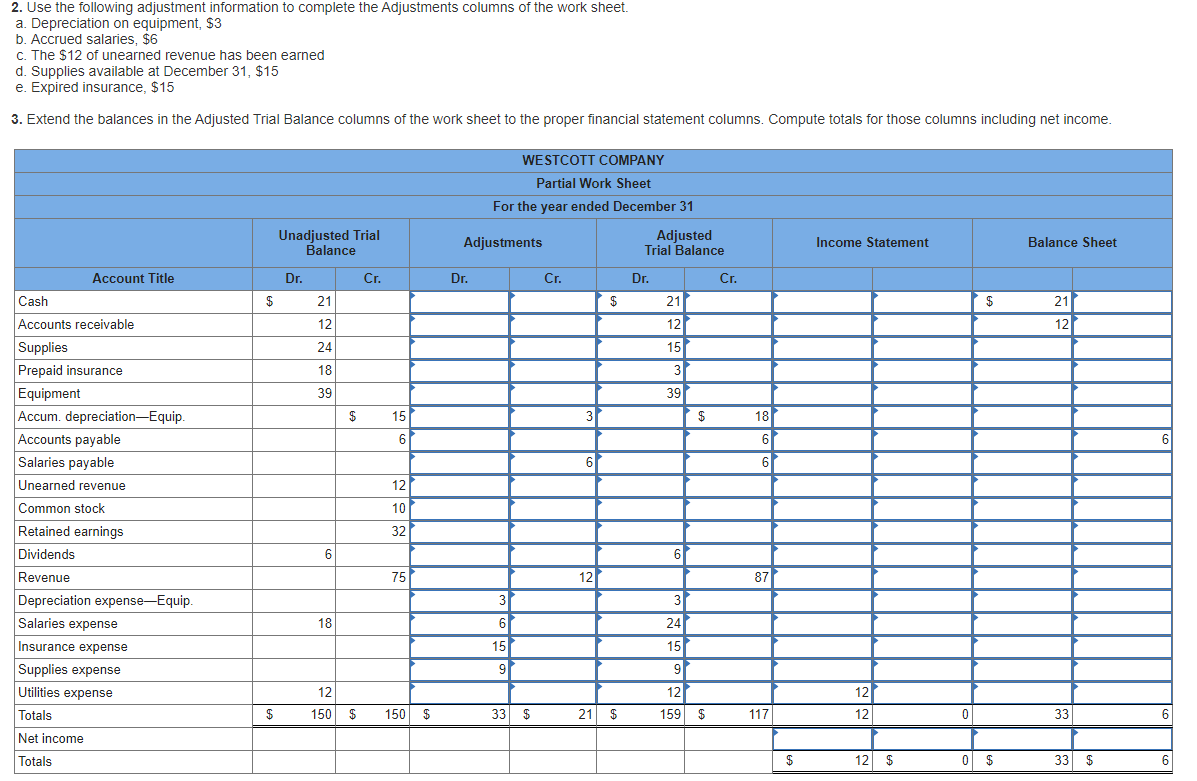

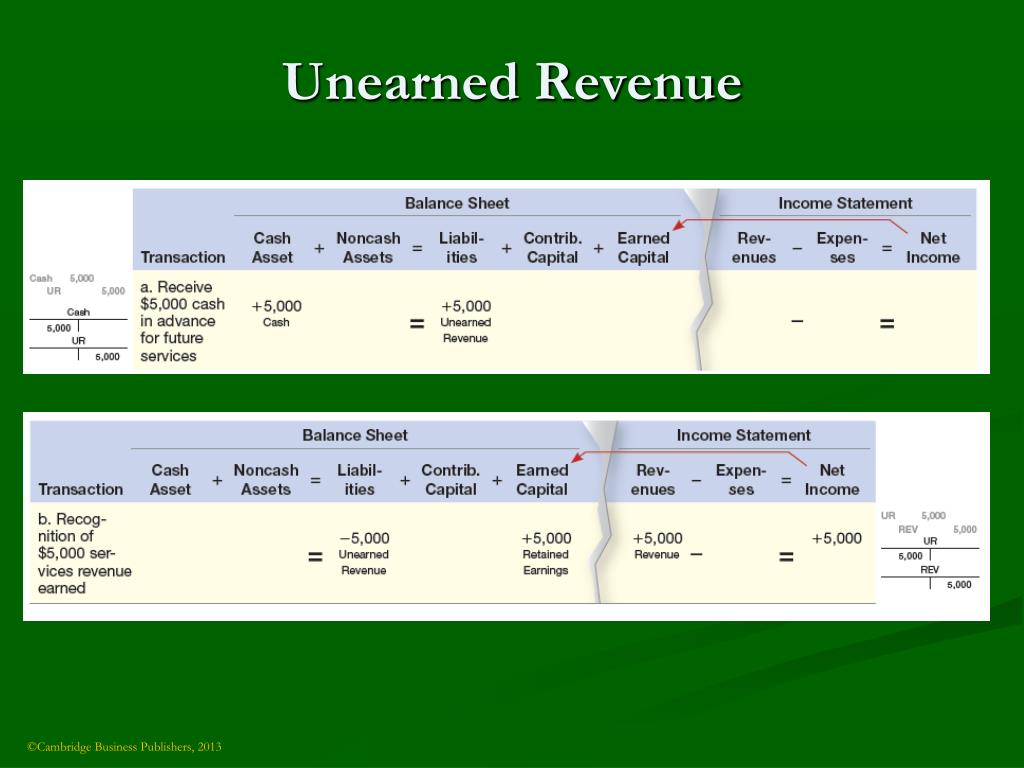

Unearned revenue income statement. Following the accrual concept of accounting, unearned revenues are considered as liabilities. No, unearned revenue does not go on the income statement. Unearned revenue on financial statements.

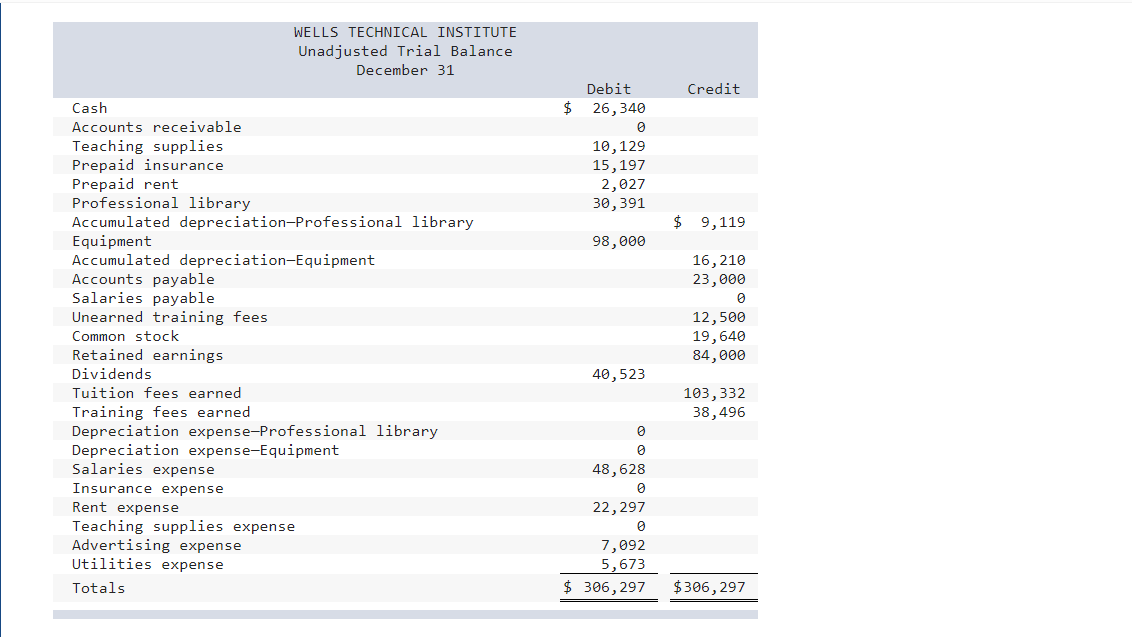

Unearned revenue, sometimes referred to as deferred revenue, is payment received by a company from a customer for products or services that will be delivered at some point in the future. In that sense, it's income that your company has collected but hasn't rendered services for. Instead, unearned revenue can be found on a business’s balance sheet or financial statement.

It is also referred to as deferred revenue or even advance payment. Perhaps indicative of its importance in business, revenue is the first item on a company’s income statement, which is why it is called the ‘top line’. The term is used in accrual accounting, in which revenue is recognized only when the payment has been received by a company and the products or services have.

Unearned revenue is recorded as a current liability when the products or services are to be delivered in the next 12 months or lower than 12 months. Unearned revenue, also known as unearned income, deferred revenue, or deferred income, represents proceeds already collected but not yet earned. This is why deferred revenue is also called unearned revenue.

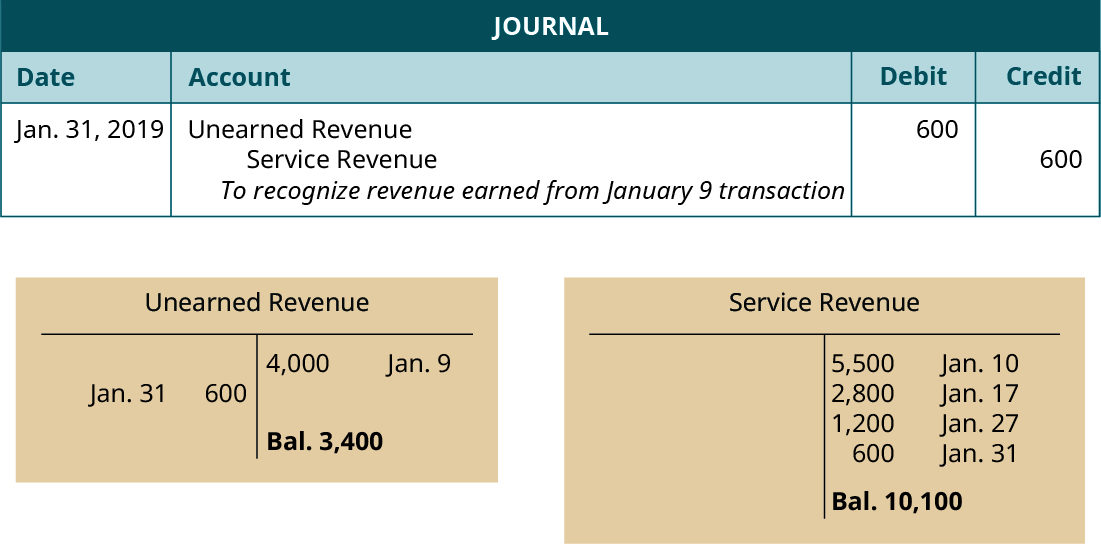

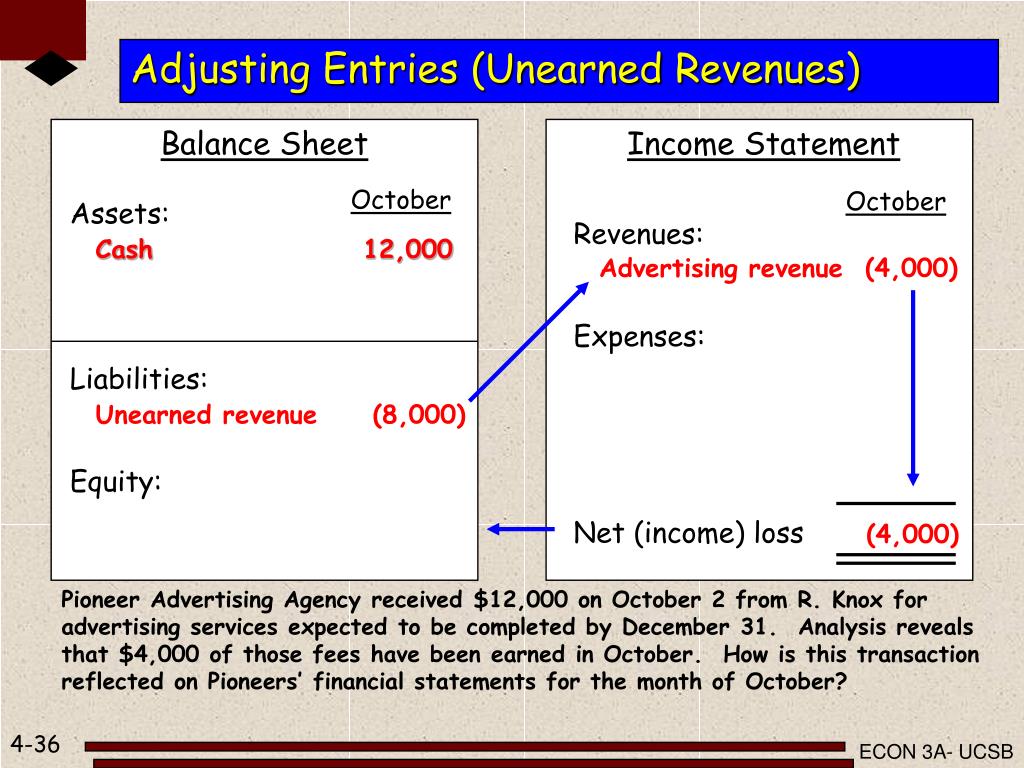

If a company didn’t classify the unearned revenue as a liability and instead recognized it as profit or revenue, it would overstate the profit in the income statement and when the service or good is actually provided, the profits would be understated for that time period. Unearned revenue is not recorded on the income statement as revenue until “earned” and is instead found on the balance sheet as a liability. This means you’ll debit the unearned revenue account by $2,000 and credit the revenue account by $2,000.

Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the delivery and includes transactions like amount received for the goods delivery of which is to be made on the future date etc. So, it's not included in an income statement. These are both balance sheet items and hence do not affect the income statement items.

As the owner of a small business, it is up to you to determine how best to manage and report unearned revenue within your accounting journals. First, since you have received cash from your clients, it appears as part of the cash and cash. When a company accepts cash for unearned revenue, it increases the cash as well as the current liability account.

This process is referred to as deferred revenue recognition. Unearned revenue affects your financial statements, assets and liabilities. Once the services or products are provided to the customers, these unearned revenues will be reclassified into revenues in the company’s income statement.

Unearned revenue is a liability, or money a company owes. What is unearned revenue? It is documented as a liability on the balance sheet as it represents a debt or outstanding balance that is owed to the customer.

When services or products are provided to customers, the deferred revenue is reduced and the corresponding amount of earned revenue is recognized. December 10, 2020 4 min read every business will have to deal with unearned revenue at some point or another. Hence, they are also called advances from customers.

.webp)

:max_bytes(150000):strip_icc()/ScreenShot2021-07-31at3.56.40PM-f53c6447715749d79f242c0a0759fbb5.png)

![What Is Unearned Revenue [Definition Examples Calculation]](https://www.realcheckstubs.com/media/Is Unearned Revenue a Liability.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)