Best Of The Best Tips About Form No 26as Pdf

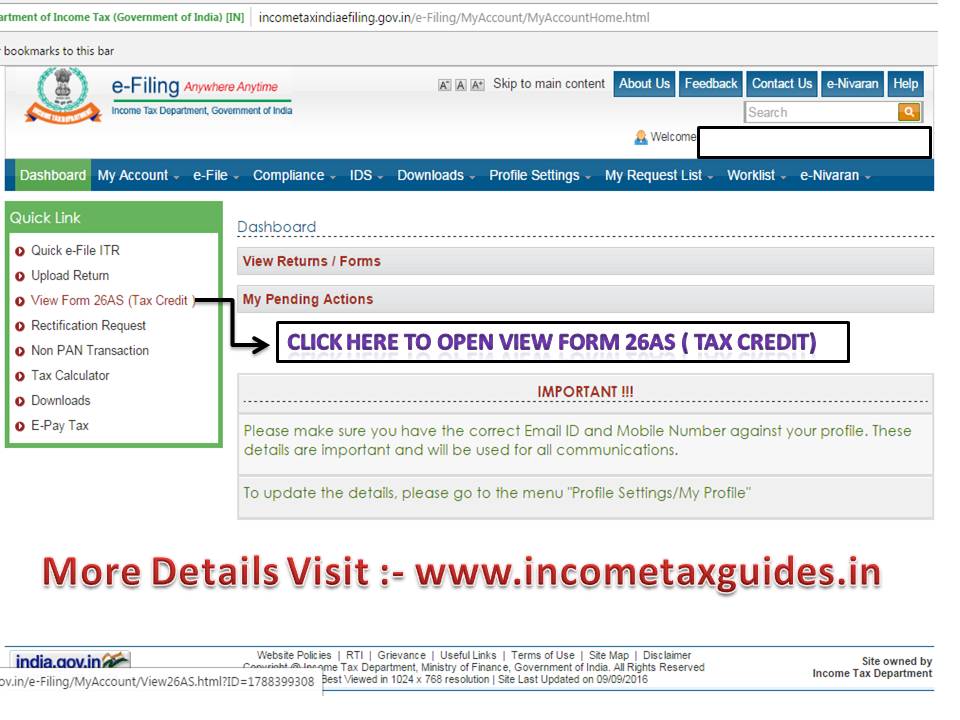

Click on the link view tax credit (form 26as) at the bottom of the.

Form no 26as pdf. Here are some steps to easily download form 26as on the new income tax portal. Form 26as is now available at the new income tax portal and can now be downloaded. You can now view and download form 26as.

Select the assessment year and the format (html/text) i n which you want to. Click ‘view tax credit (form 26as)’ select the ‘assessment year’ and ‘view type’ (html, text or pdf) click ‘view / download’ note to export the tax credit. If you are not registered with traces, please refer to our e.

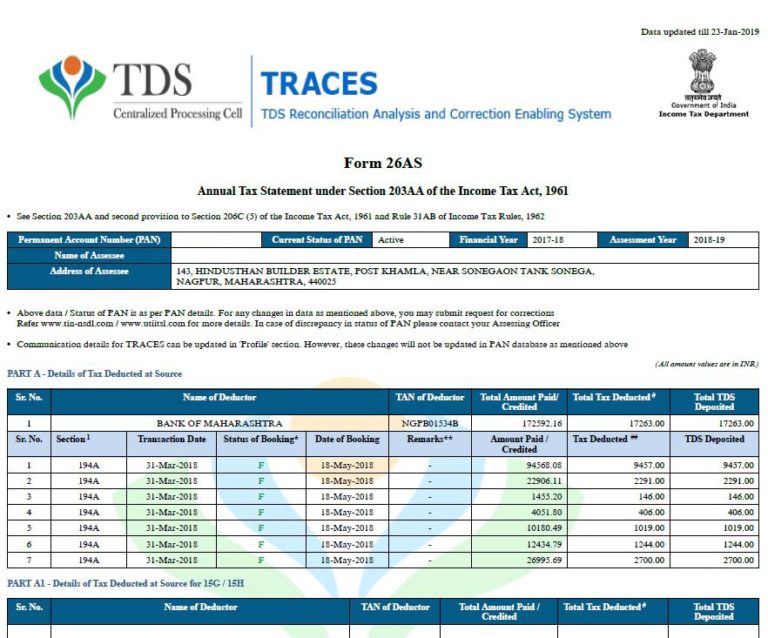

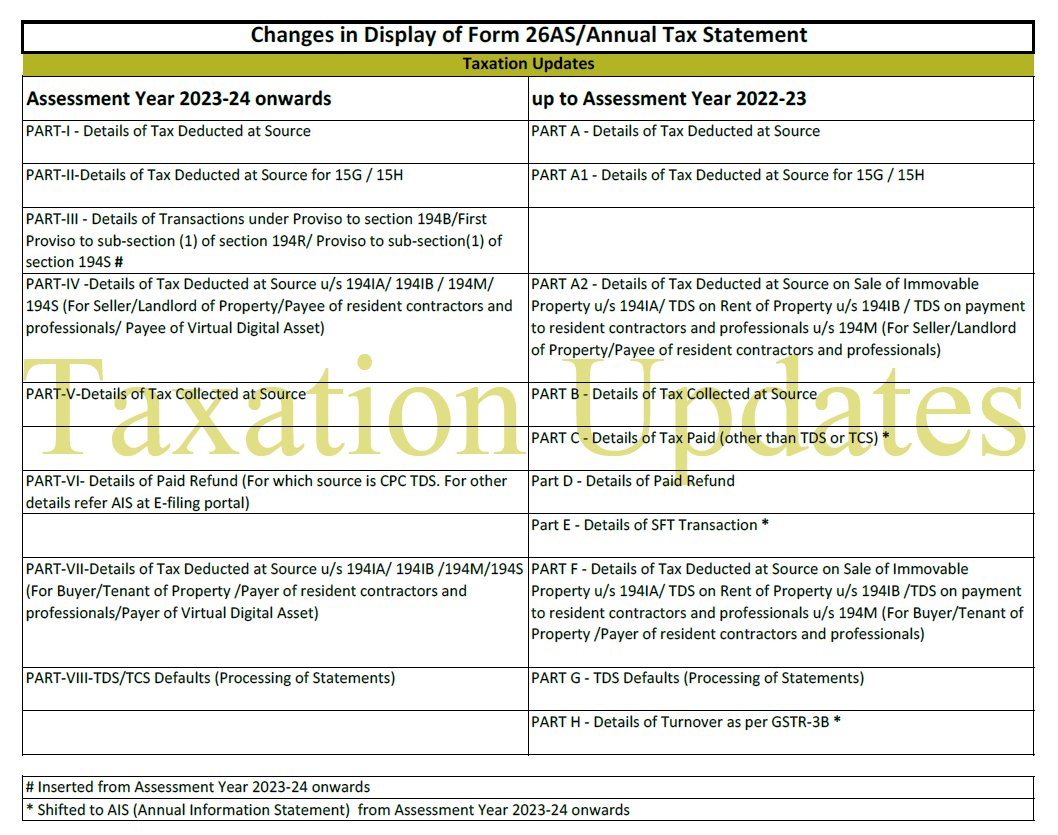

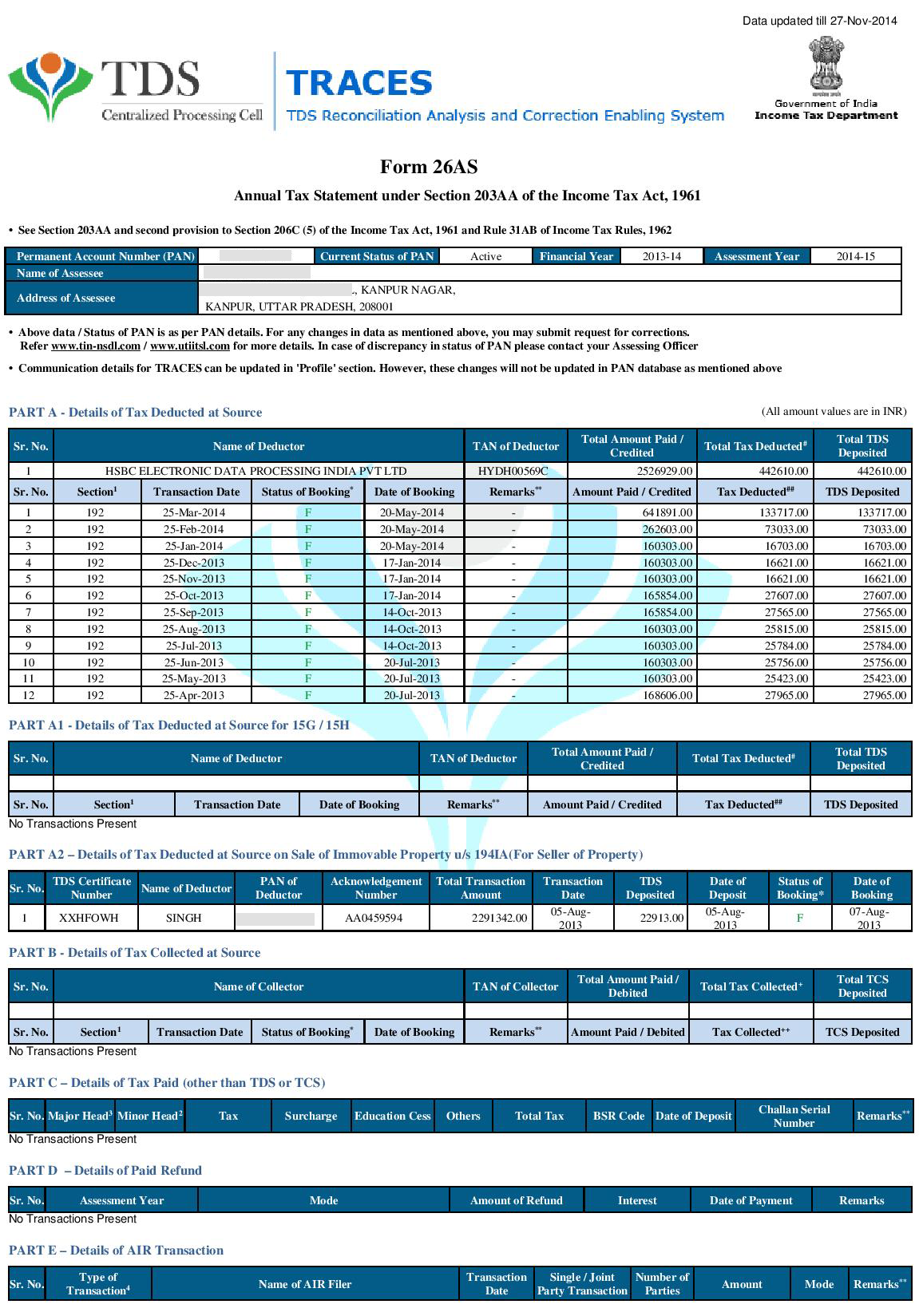

It will download the form 26as as a pdf file. Form 26as, or tax credit statement, is one of the most important documents when filing taxes. With the deletion of rule 31ab.

What is form 26as used for? A screen displaying form 26as will appear. Form 26as is an annual consolidated credit statement that provides the details of the taxes deposited with the government by a taxpayer.

Click on ‘view tax credit (form 26as)’ to view your form 26as step 6: The process is easy and simple like it was in the earlier portal. Form 26as is an official form that contains details of the tax deducted by the deductor.

Once logged in, select the 'form 26as' option to access the form and download it in pdf format. From new income tax portal thus, it becomes important to download and carefully check the necessary details. Form 26as is an annual.

Form 26as, often known as the tax credit statement, is a crucial record for filing taxes. The website provides access to the pan holders to view the details of tax credits in form 26as. The form 26as holds the ‘tax credit’ details of a taxpayer as per the records of the income income tax department.

The days of manually filing it returns by downloading form 26as are long. There are two ways to download this tax passbook: 26as (see section 203aa and second proviso to section 206c(5) and rule 31ab) annual tax statement under section 203aa permanent account number :

How do i view form 26as using. Here is a step wise guide to.

![[PDF] Revised 26AS Form PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/revised-26as-form-3463.jpg)