Build A Info About Bad Debts Profit And Loss Account

Learn how to calculate and record the bad debt expense in this guide.

Bad debts profit and loss account. It is considered as the business loss of the company and reduced the accounts receivable amount from the books of accounts. We debit this amount to profit and loss a/c. The average reserves at jpmorgan chase, bank of america, wells fargo, citigroup, goldman sachs and morgan stanley have fallen from $1.60 to 90 cents for every dollar of commercial real estate debt.

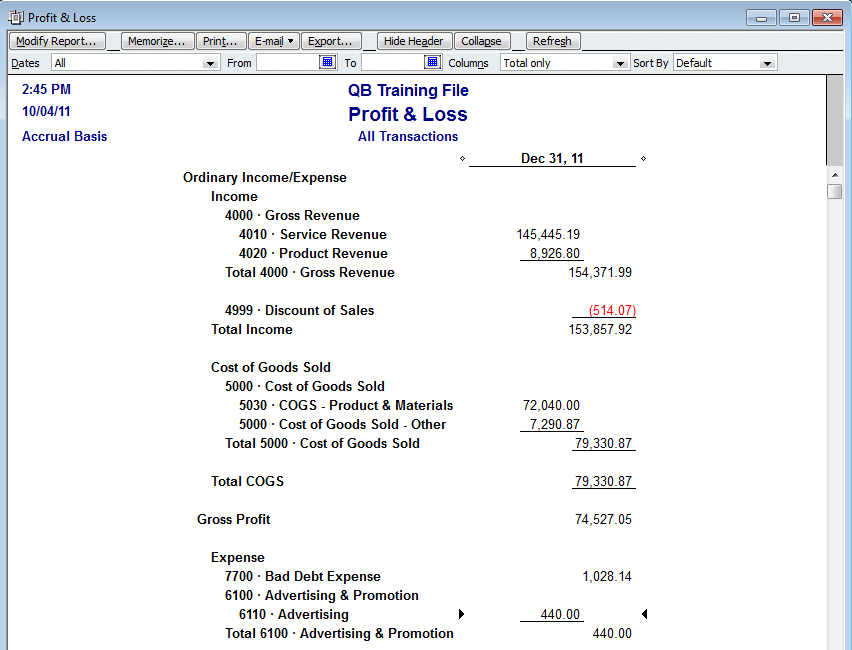

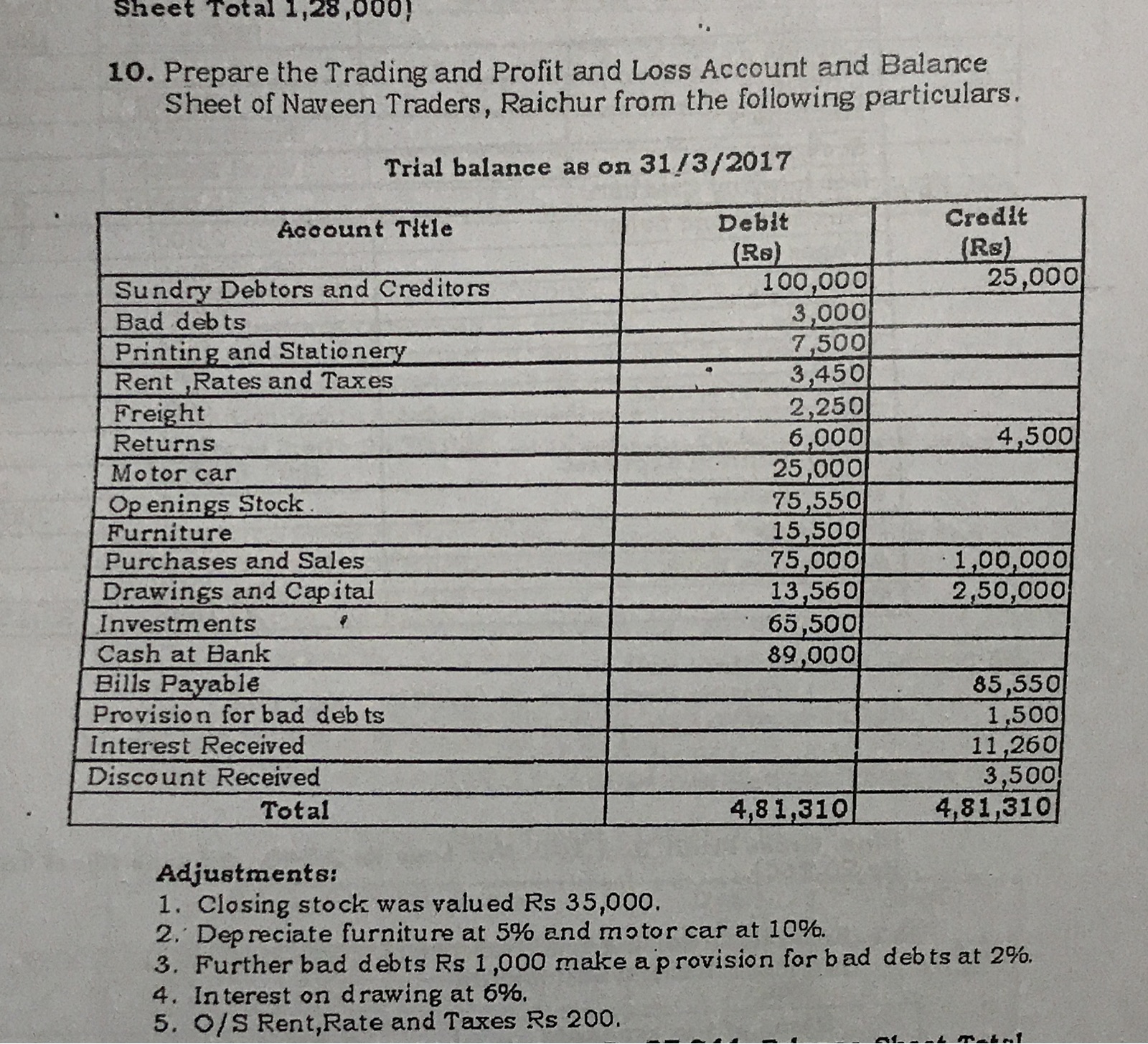

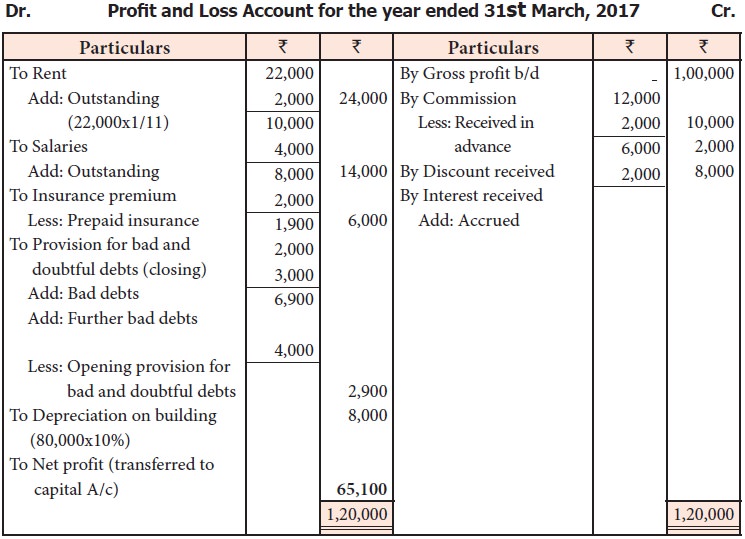

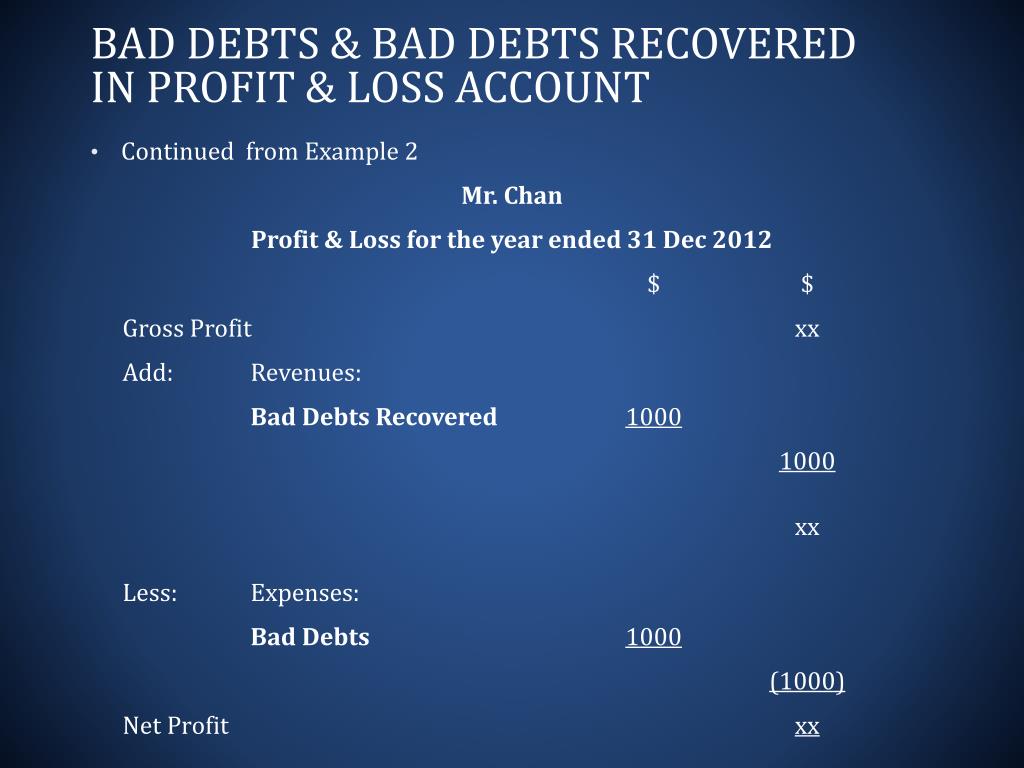

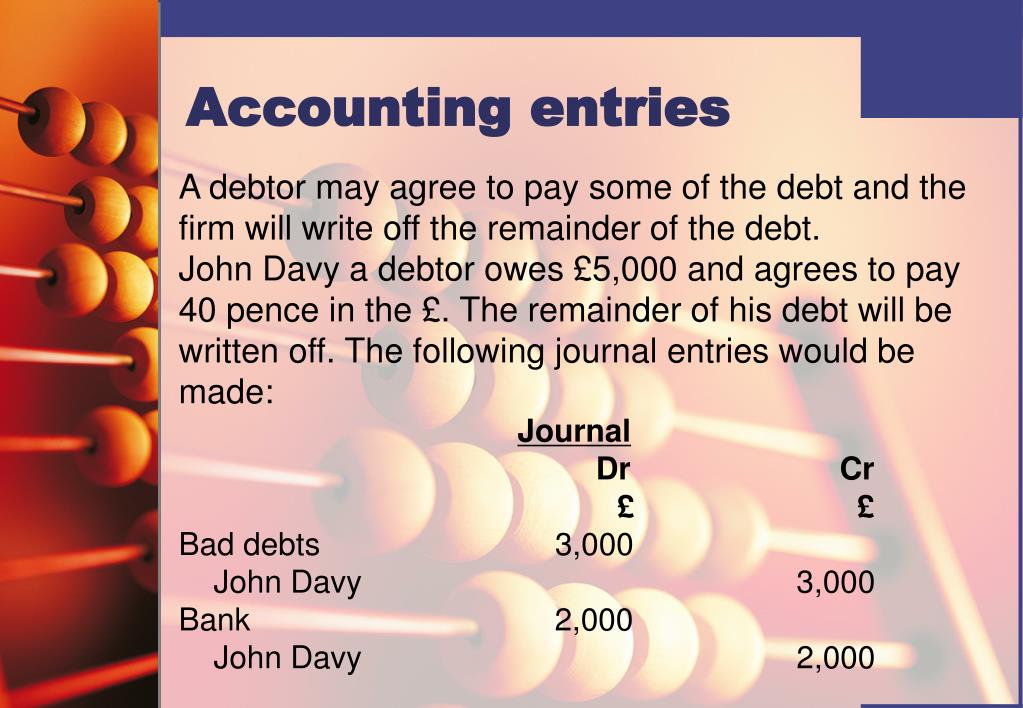

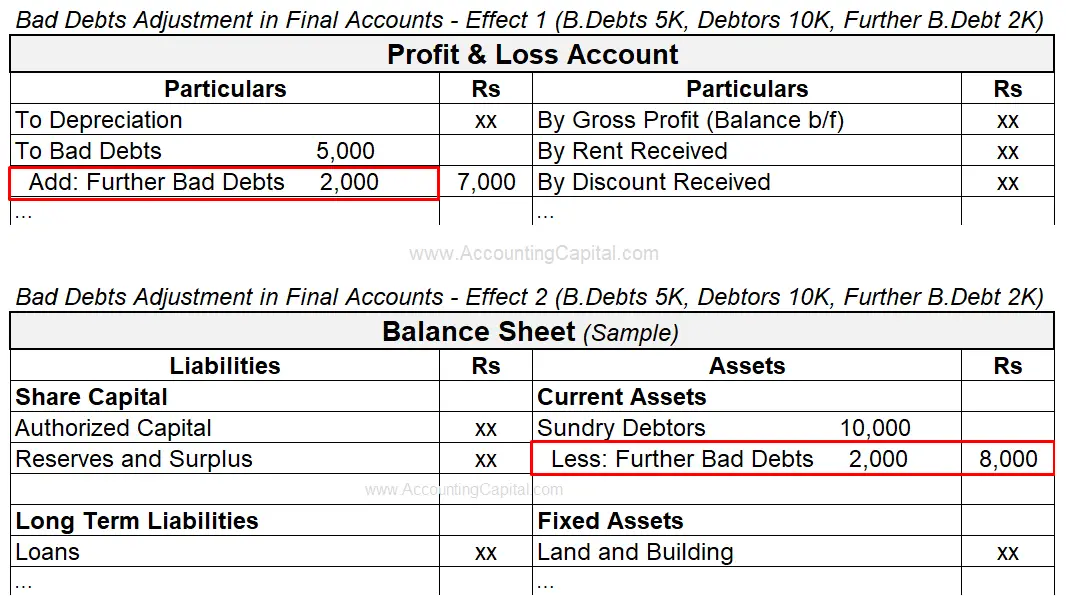

For example same as above which i have explained but before transferring to balance sheet bad debt will be debited to profit and loss account as expense. Profit and loss account bad debts is treated as an expense and debited to profit and loss account. 500 , provision on debtors @ 3 %.

So we need a bad debt provision of £600, £100,000 x 0.6%. Where is bad debt expense reported? Discount allowed to debtors @ 2%.

Companies do business by selling products whose purpose is to make a profit. The ban on applying for loans from banks registered or chartered in new york could severely restrict trump's ability to raise cash. It may be included in the company's selling, general and administrative expenses.

(b) show in profit and loss account; A bad debt reserve is the amount that companies set aside to cover uncollectible receivables, notes or loans. The bad debt expense records a company’s outstanding accounts receivable that will not be paid by customers.

In the future if an account becomes uncollectible, write it off to the allowance account by recording an entry to reduce accounts receivable with the offset against allowance for doubtful accounts. If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an operating expense on the company's income statement. For example, in one accounting period, a company can experience large increases in their receivables account.

A provision for bad and doubtful debts is created so that the debtors who are not able to make the payment of their liability on the due date has no major effect on the profits of the current year and the. Planning for this possibility by estimating the amount of uncollectible loans is called bad debt provision and can enable companies to measure, communicate, and prepare for financial losses. Provisions for bad debts account, with the amount of anticipated bad debts at the end of each subsequent financial year, the balance of the provision for bad debts account is adjusted to the correct level of expected bad debts for the next year.

This year the debtors are now £100,000, and we expect 0.6% of these to go bad, based on previous experience. In case if the provision is already made for bad bets than it is first written off from it. In this way, the bad debt will not impact your profit & loss report.

Understanding bad debt and how it works is essential for all businesses to prevent or minimise losses from uncollectible accounts receivable or sales ledger. The amount goes into the statement of profit or loss as an expense and is deducted from the receivables figure in the statement of financial position. In case if bad debts are recovered, so it is again.

Clearly, one should credit the provision for bad debts account with rs. In this article, we will look at types of bad debt, how to reduce bad debt and how to record bad debt expenses in the accounts. However, there is already a provision of £500,.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)