Fabulous Tips About Modified Cash Basis Irs

In some cases it can be adjusted upward if you also spend money increasing that asset’s value.

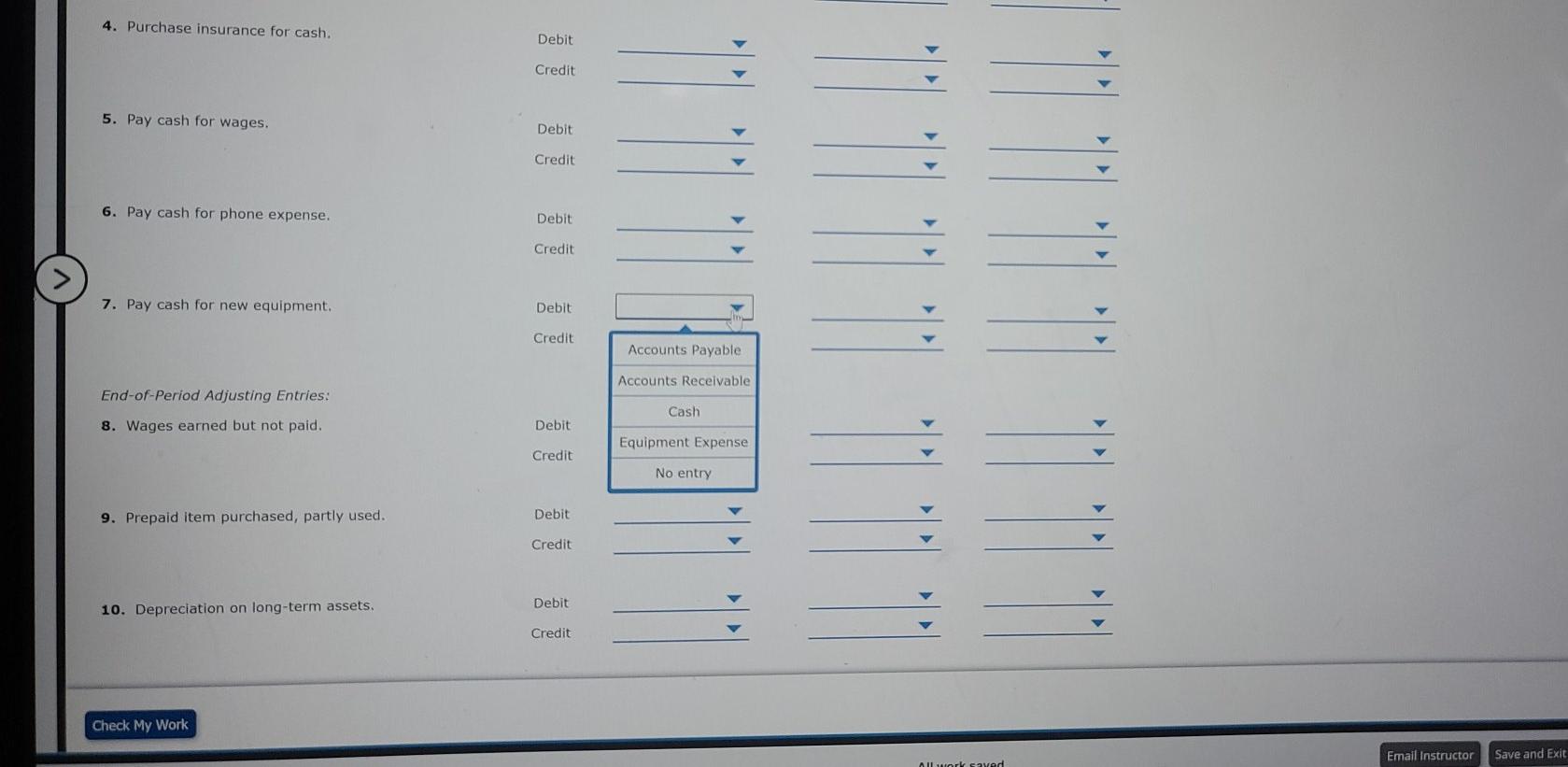

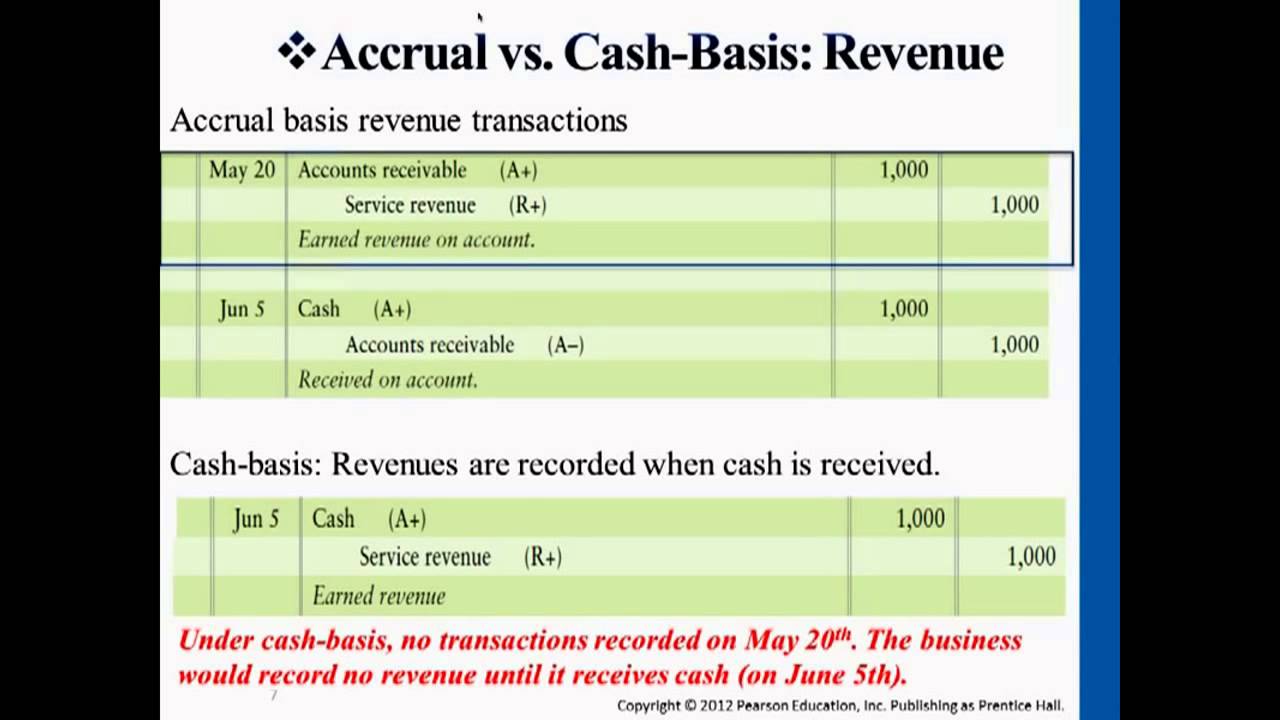

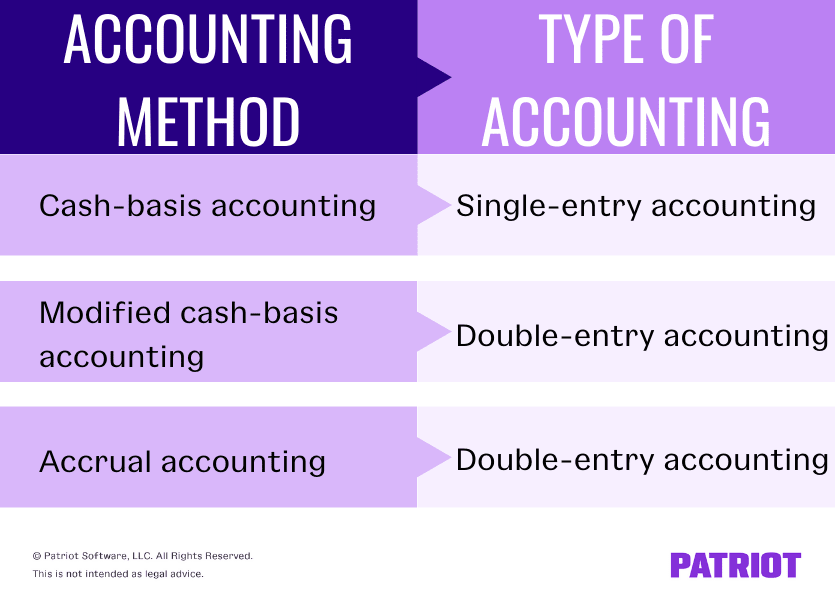

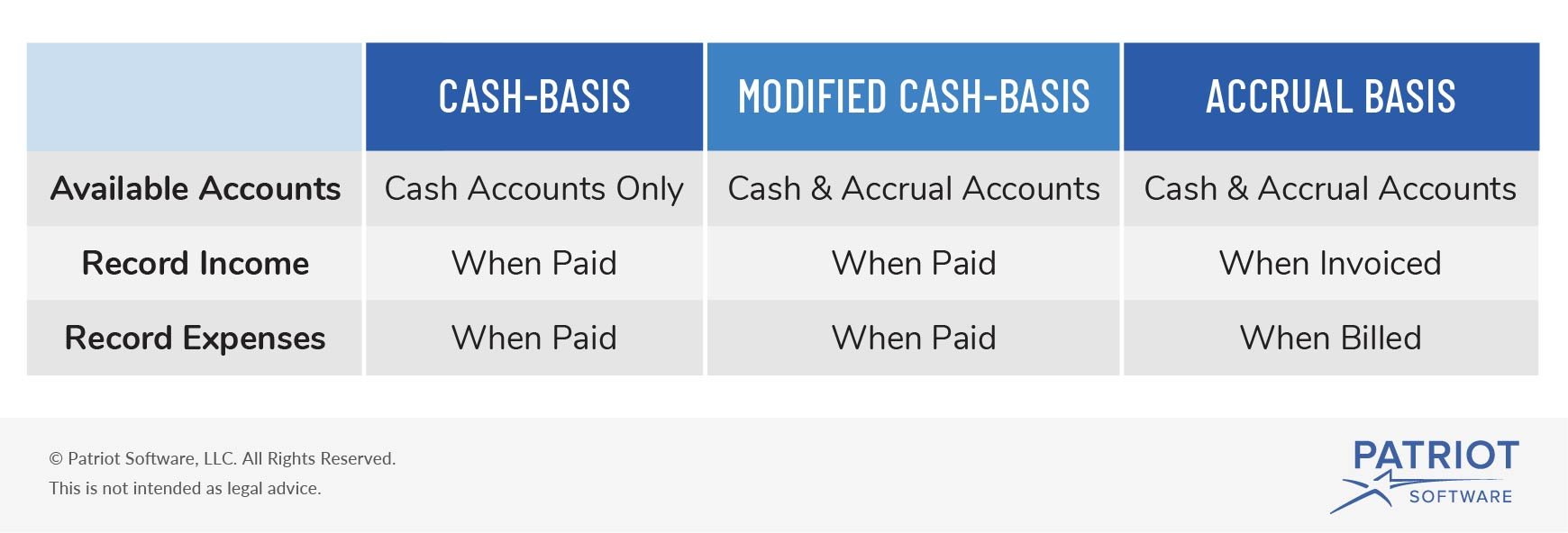

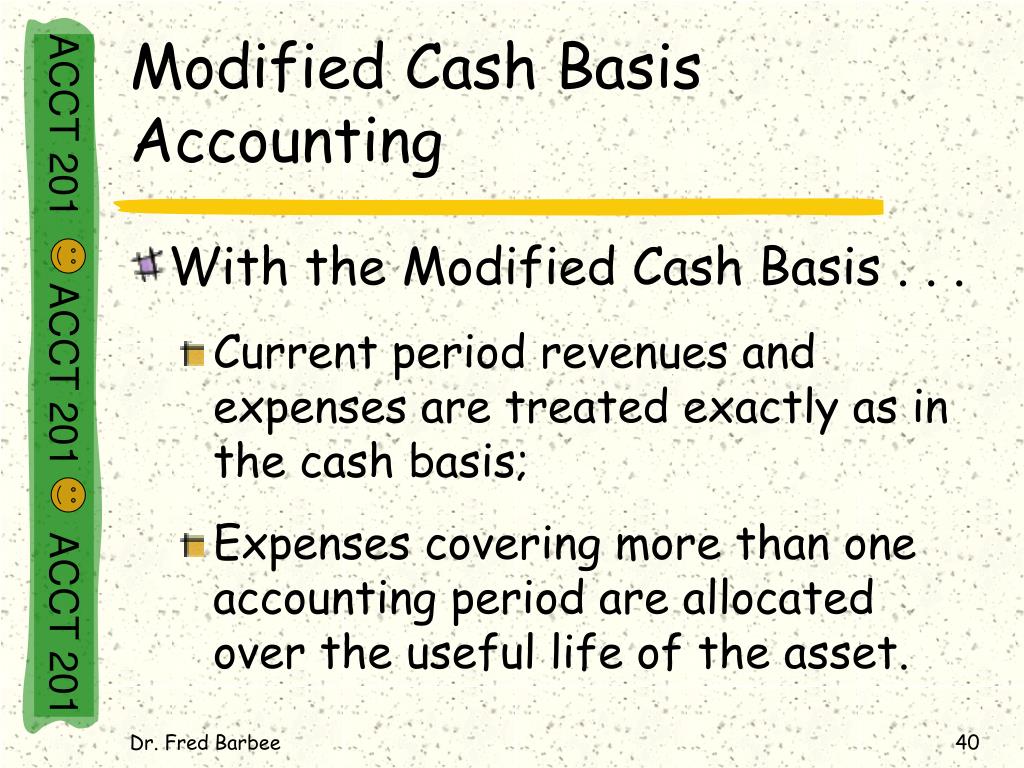

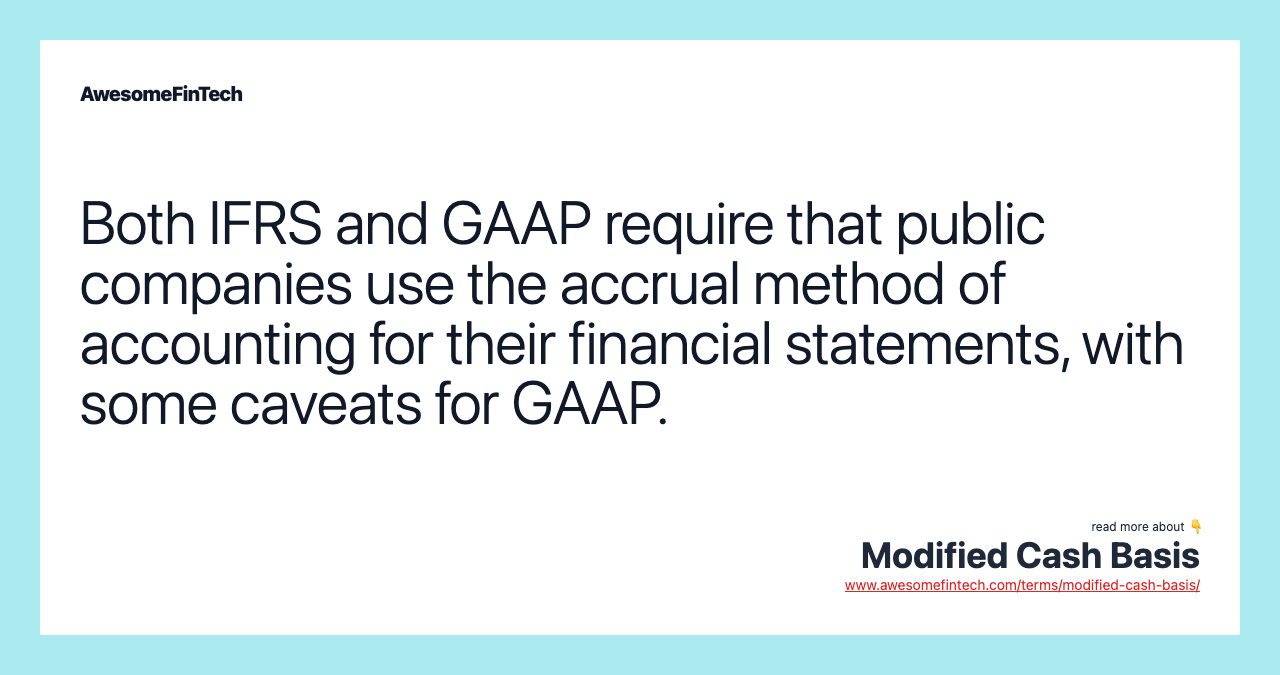

Modified cash basis irs. If he chooses to file a bond, he will likely. Modified cash basis is a hybrid accounting method that combines aspects of both cash and accrual accounting. To modded cash basis combines elements of the two major accounting methods:

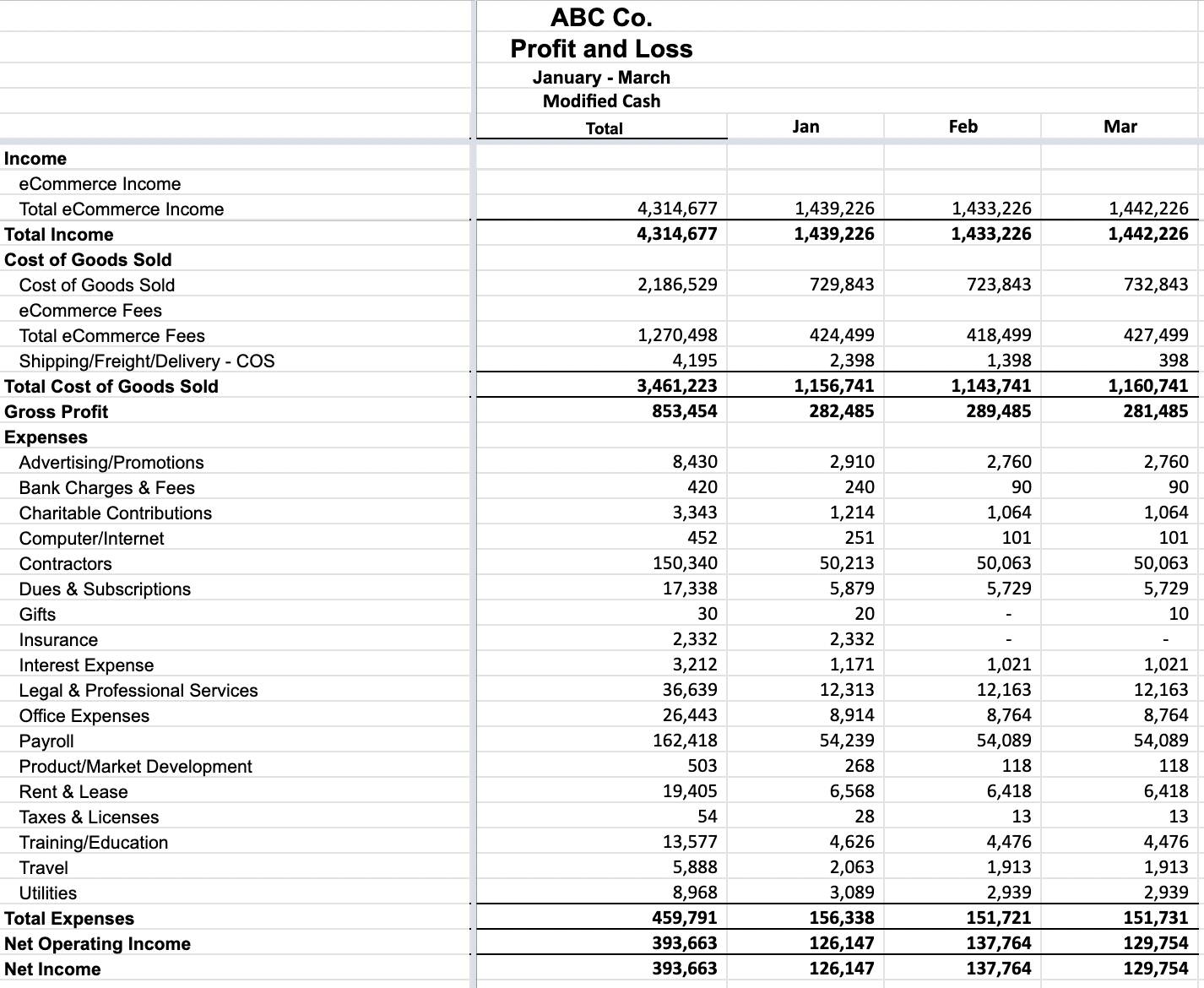

Subtract the amount in (2) from the amount in (1). It is also called hybrid accounting, where the cash. It provides businesses with a more comprehensive view of.

Modified cash basis accounting is an accounting method that combines aspects of both cash and accrual accounting, in which companies record revenues when. The modified consent procedures for an overall cash to accrual method change under section 15.01 of rev. Trump claimed under oath last year that he was sitting on more than $400 million in cash, but between justice engoron’s $355 million punishment, the interest mr.

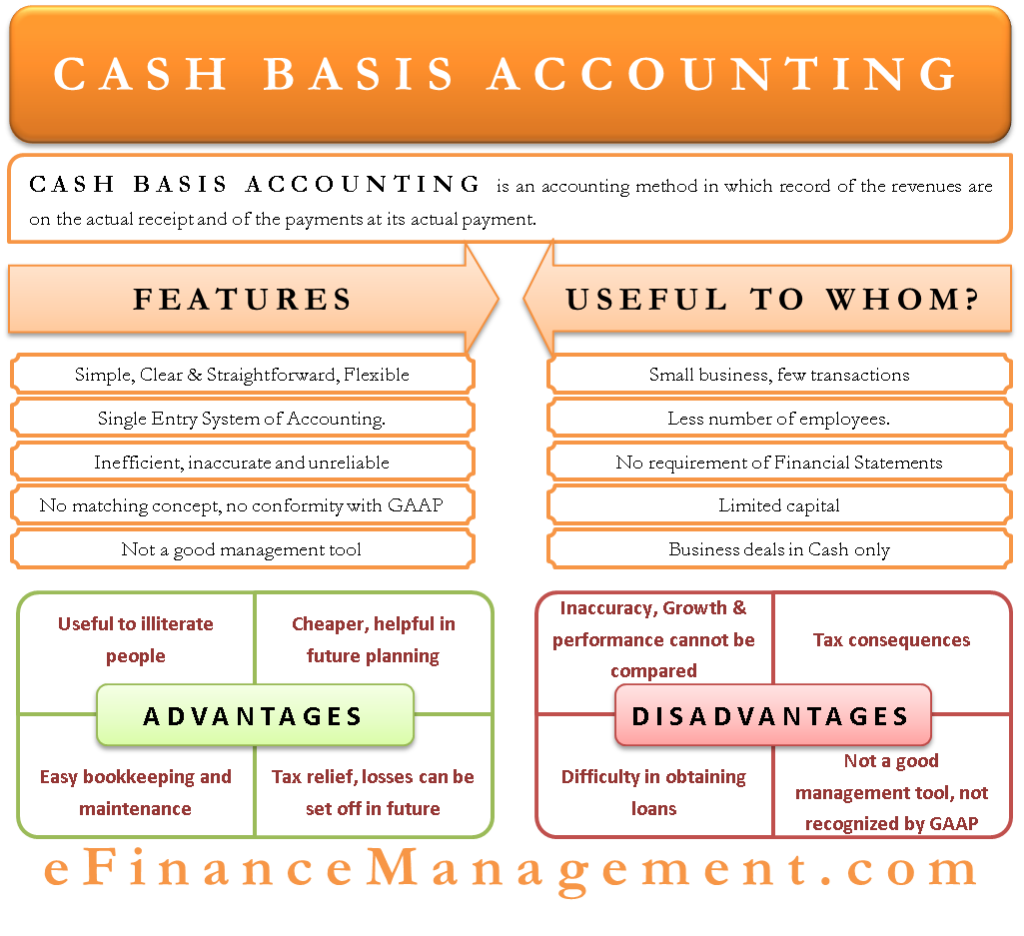

Certified vita tax preparer, irs. A cash basis taxpayer is a taxpayer who reports income and deductions in the year that they are actually paid or received. The modified dough basis combines elements of.

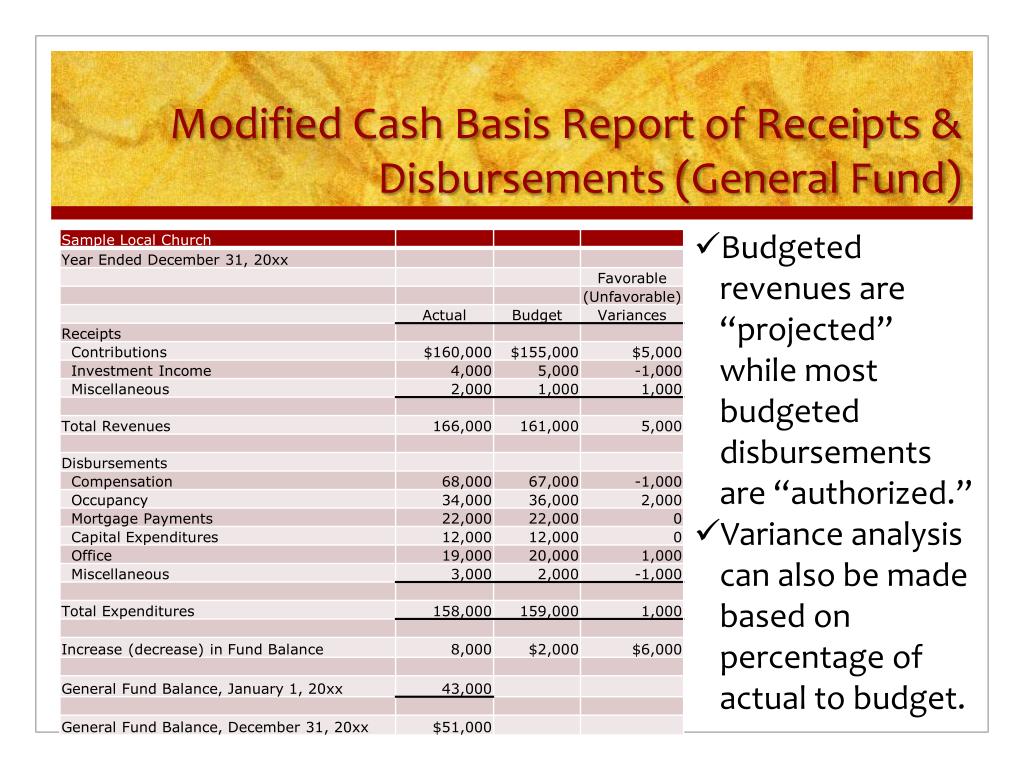

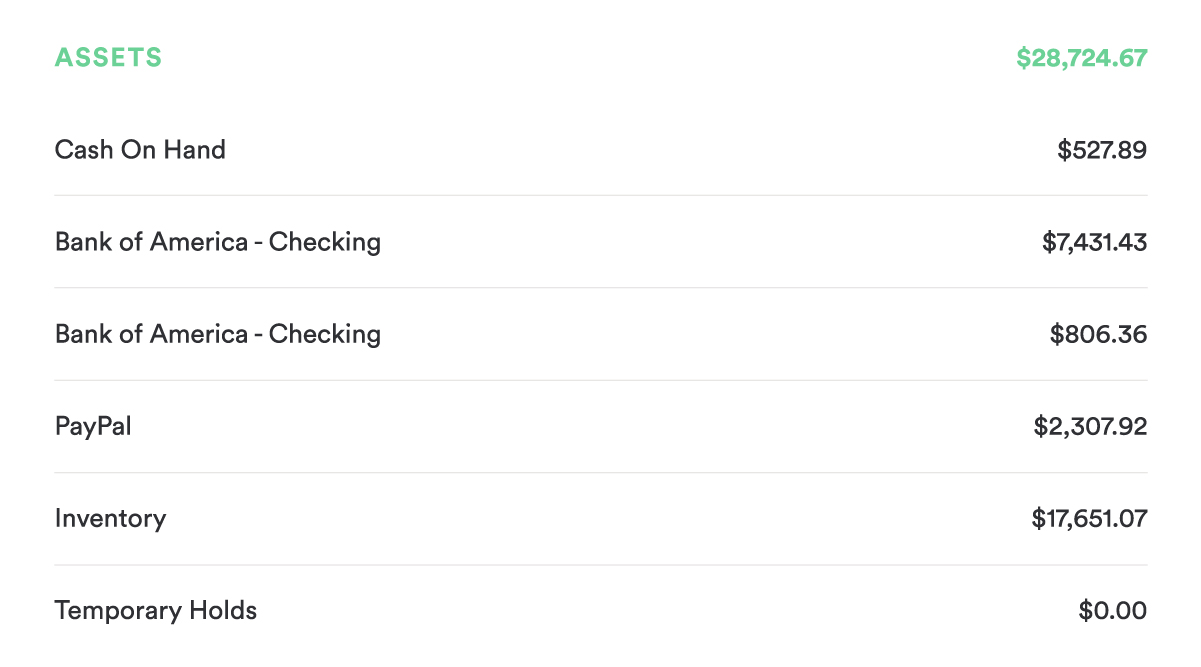

Cash basis refers to a major accounting method that recognizes revenues and expenses at the time physical cash is actually received or paid out. The modified cash basis provides financial information that is more relevant than can be found with cash basis record keeping, and generally does so. Learn how to prepare spf financial statements using the cash, modified cash, and tax basis of accounting;

The result is your annualized income. Modified cash basis refers to an accounting method that utilizes the features of both the accrual and cash basis methods. The result is your modified taxable income.

Some nonprofits use a hybrid accounting system called modified cash basis accounting. It uses the cash method when needed except when making accrual entries. 26 verdict to either pay cash into the court’s escrow or get a bond while he appeals.

Multiply the modified taxable income in (3) by 12, then divide the result by the number of months in the short tax year. 703 basis of assets basis is generally the amount of your capital investment in property for tax purposes. In this system, you generally recognize revenues and expenses as you.

Modified cash basis accounting is the sweet spot between cash and accrual. Modified cash basis is an accounting method often used by smaller businesses that are not required to provide audited financial statements. Use your basis to figure depreciation,.

:max_bytes(150000):strip_icc()/final5468-d59a89b4ff49437d99fe74b841514308.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1190763079-c4852538ec704b9c8305ffc2d4465939.jpg)

:max_bytes(150000):strip_icc()/Modified-cash-basis-4192797-primary-final-230f2cc9c4f947cba79fa4d83fdb10cf.png)