Ace Info About Cash Flow Items

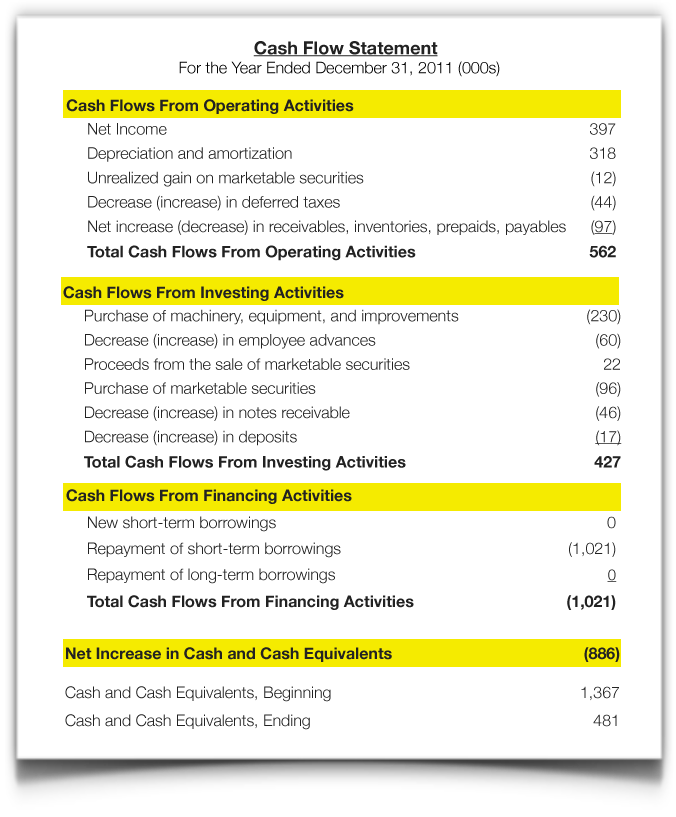

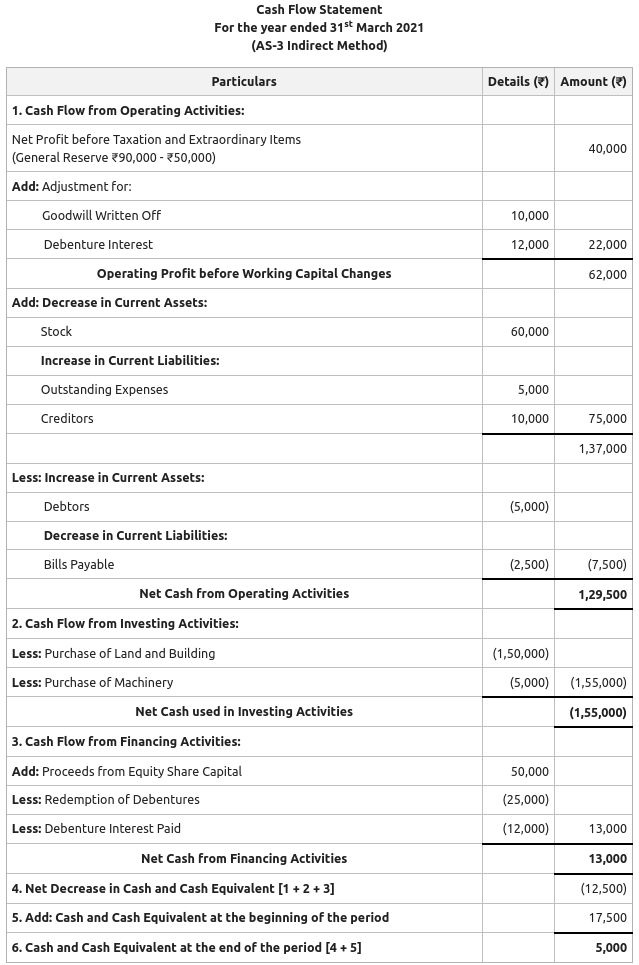

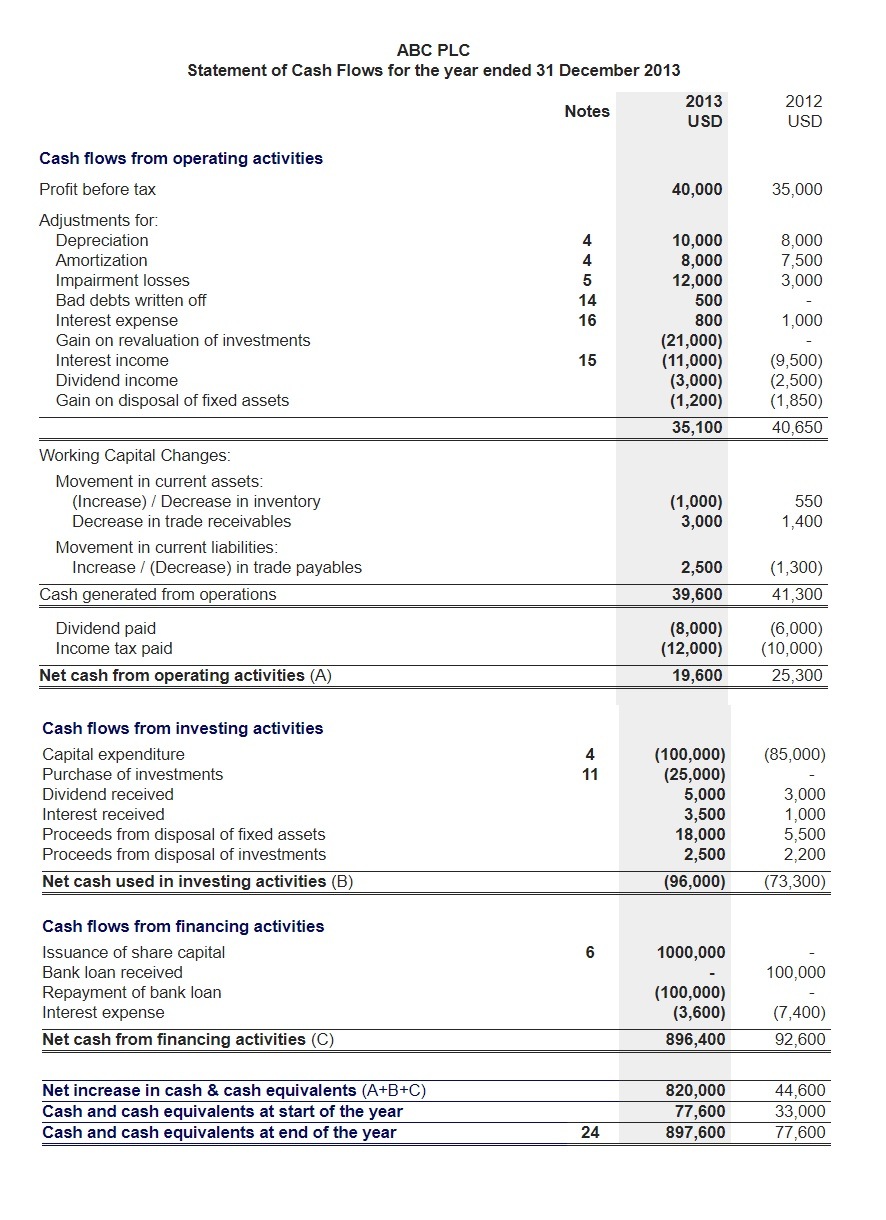

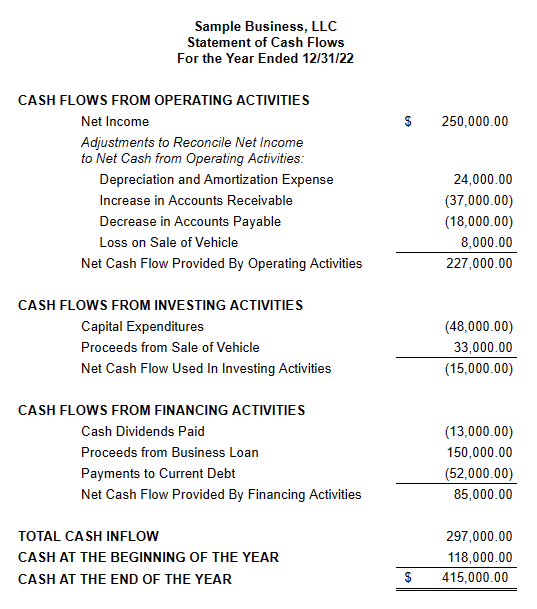

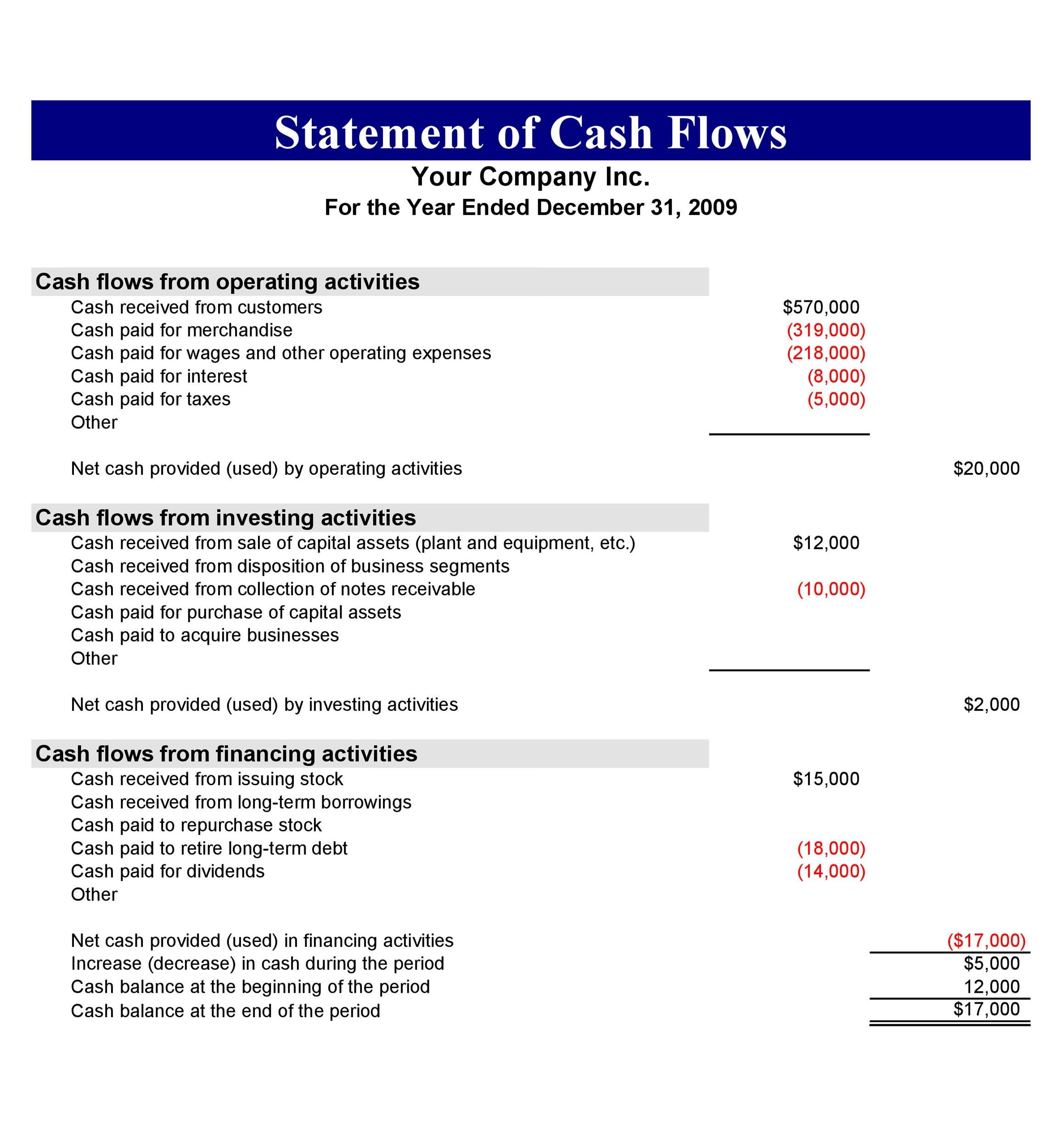

The cash flow statement is typically broken into three sections:

Cash flow items. The cfs measures how well a. Example and template (2024) learn the basics of a cash flow statement, including the common elements and how to prepare one. A typical cash flow statement comprises three sections:

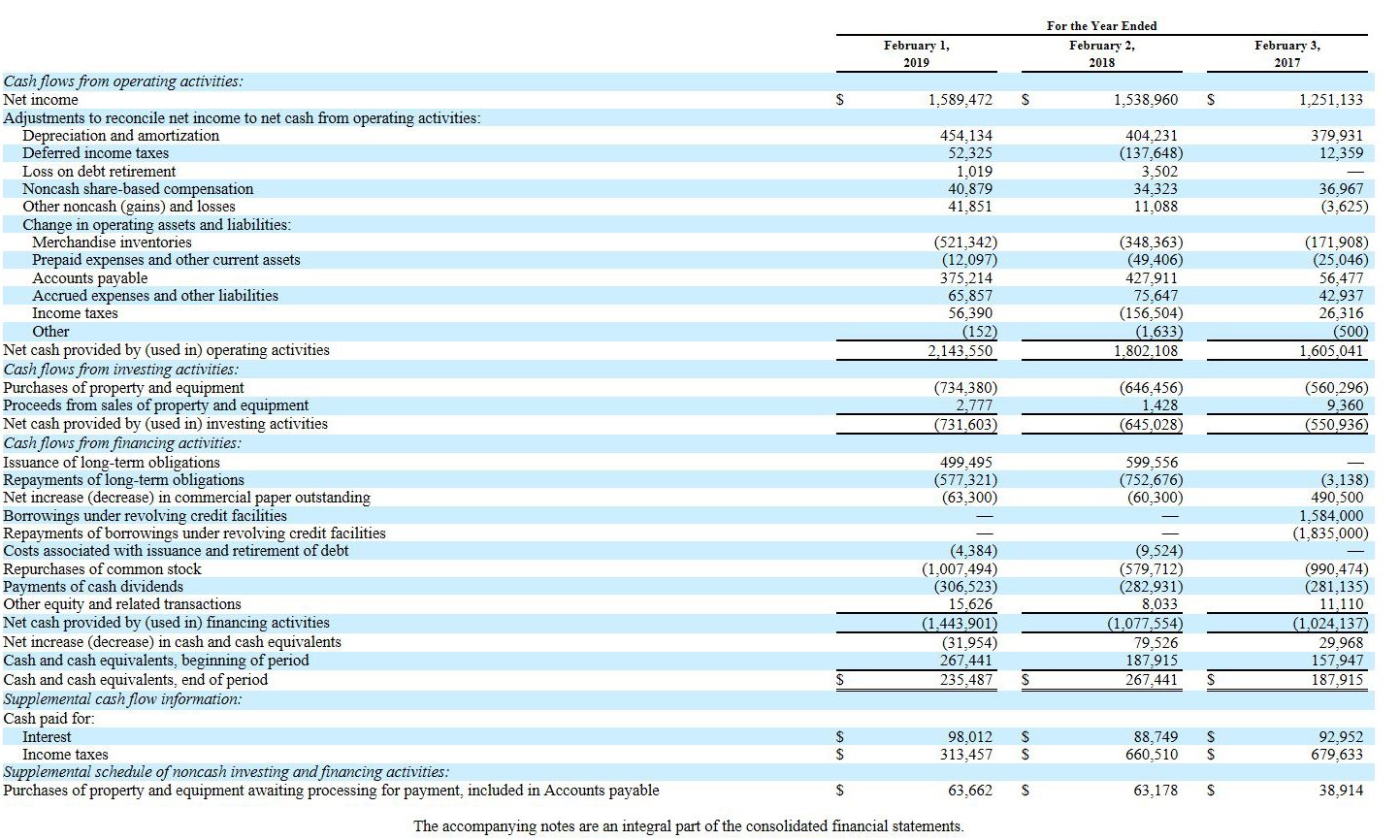

Cash flow from financing activities (cff) is a section of a company’s cash flow statement, which shows the net flows of cash that are used to fund the company. The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). The statement of cash flows acts as a bridge between the income statement and balance sheet by showing.

Definitions cash and cash equivalents presentation of a statement of cash flows operating activities investing activities financing activities reporting cash flows from operating activities from paragraph 1 4 6 7 10 13 16 reporting cash flows from investing and financing activities reporting cash. Ias 7 requires an entity to present a statement of cash flows as an integral part of its primary financial statements. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period.

Think of it as the vital fluid that keeps your business’s heart pumping, allowing you to cover expenses, pay employees, and invest in growth. How to create a cash flow statement This includes all money your company makes and spends.

Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories generally presented on a gross basis. Cash flow is the net cash and cash equivalents transferred in and out of a company. Cash flow is the heartbeat of your small business, reflecting the movement of money in and out.

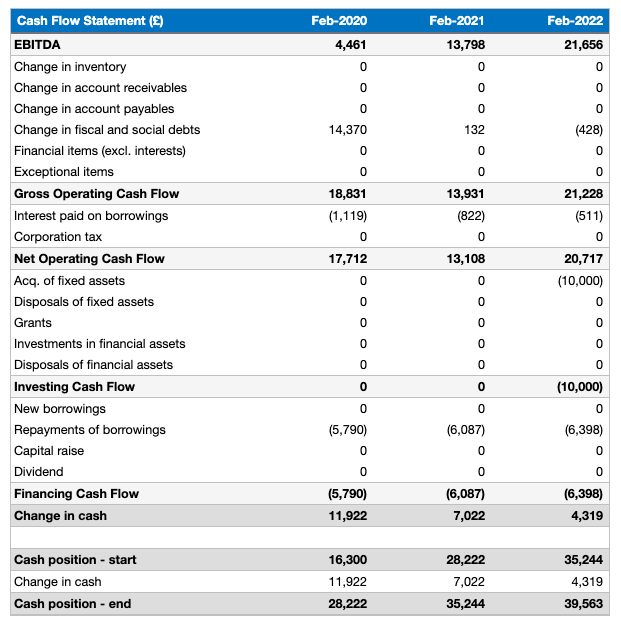

Cash flow analysis example. In finance, the term is used to describe the amount of cash (currency) that is generated or consumed in. Your company’s cash flow statement provides a detailed look at how your business’s cash has moved during this period, which could be monthly, quarterly, or annually.

Cash flow (cf) is the increase or decrease in the amount of money a business, institution, or individual has. $0 read review learn more what is cash flow used for? The ocf calculation will always include the following three components:

Cash from investing activities formula Begin with net income from the income statement. Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period.

Key takeaways cash flow from investing activities is a section of the cash flow statement that shows the cash generated or spent relating to investment activities. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Get a cash flow statement template and more in this guide.

June 7, 2022 cash flow is the amount of cash and cash equivalents, such as securities, that a business generates or spends over a set time period. While the exact formula will be different for every company (depending on the items they have on their income statement and balance sheet), there is a generic cash flow from operations formula that can be used: Add back noncash expenses, such as depreciation, amortization, and depletion.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)