Unique Info About Investment Is Debit Or Credit In Trial Balance

Exclusive list of items 1.

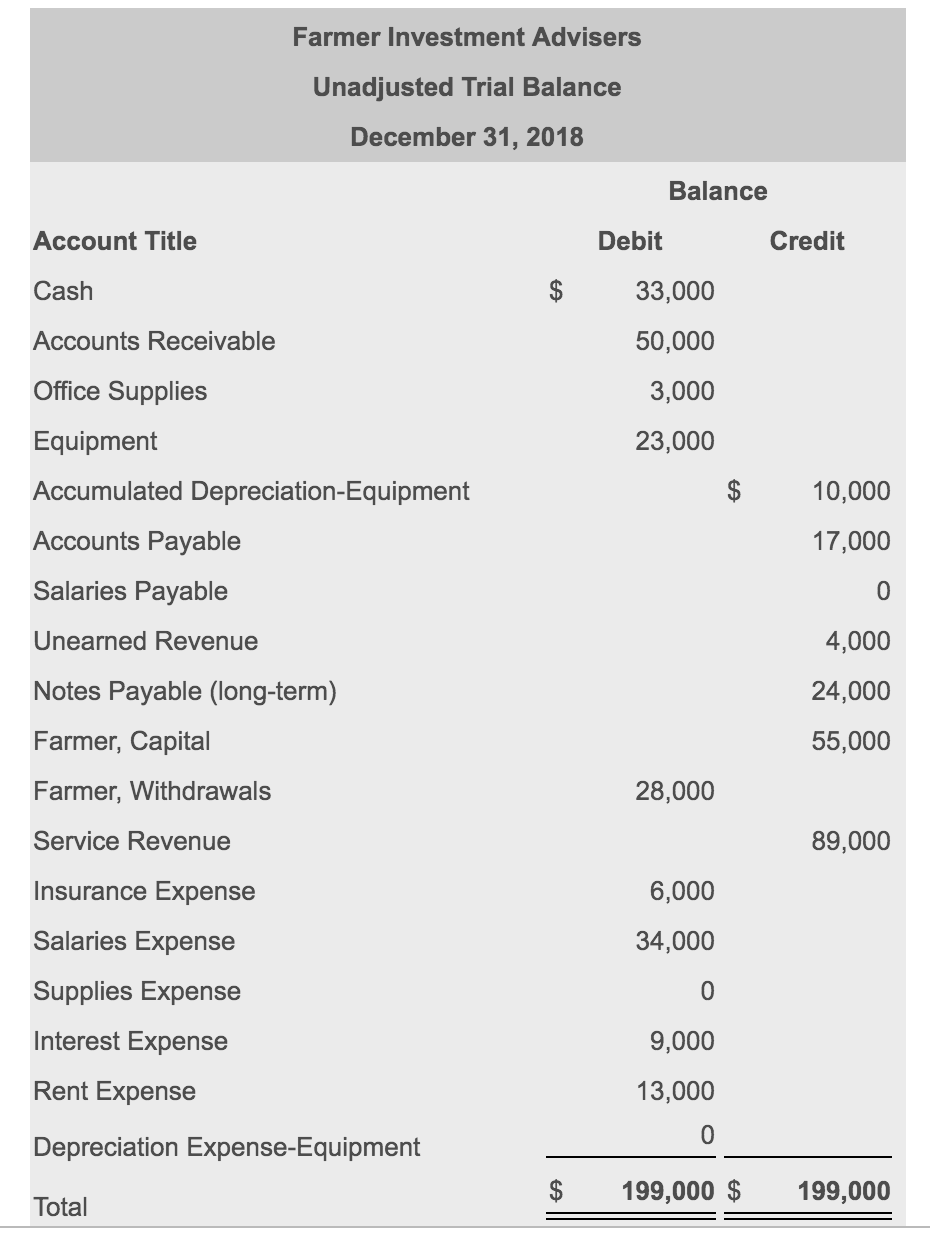

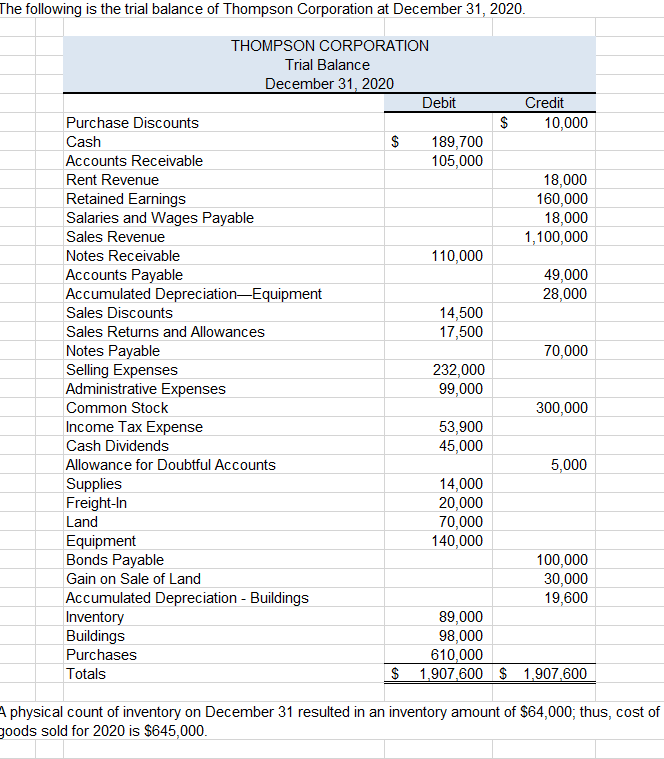

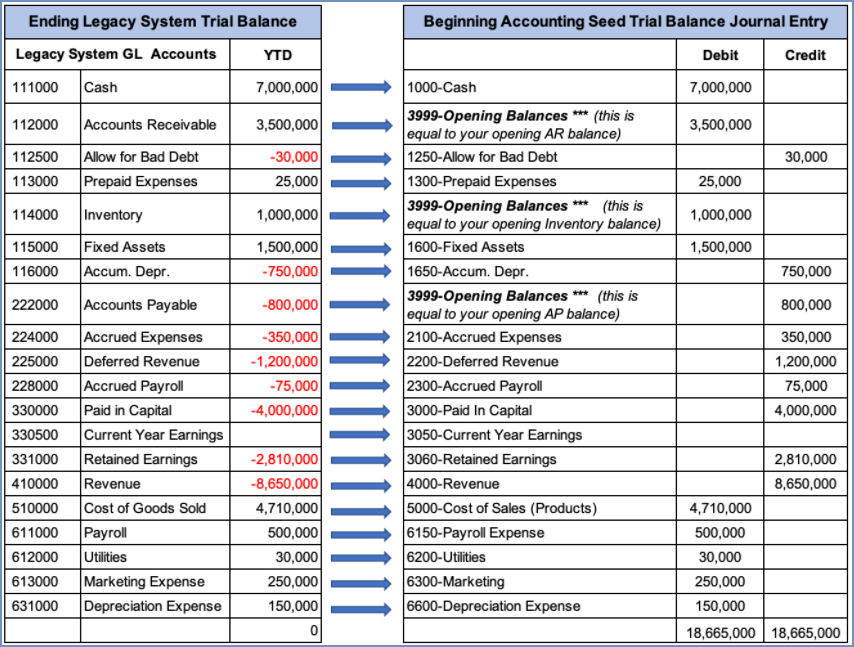

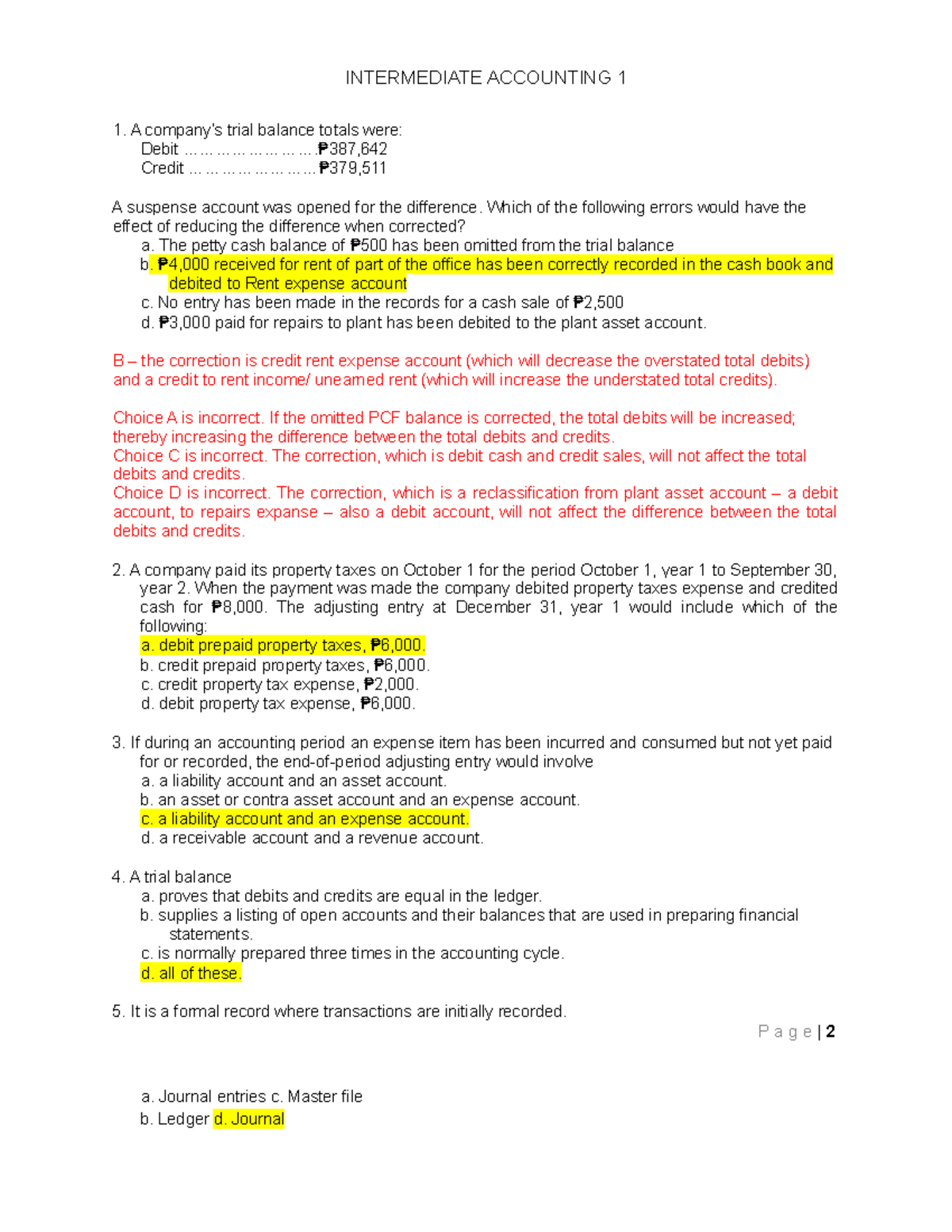

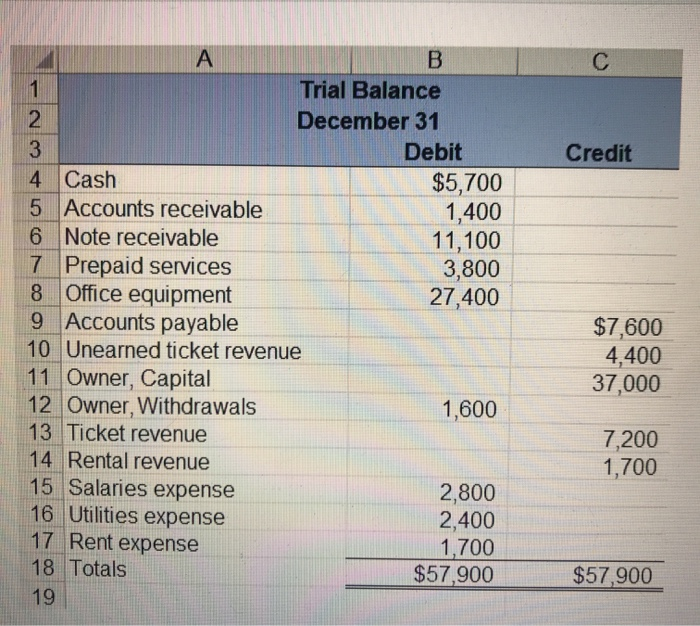

Investment is debit or credit in trial balance. A trial balance is a listing of the ledger accounts and their debit or credit balances to determine that debits equal credits in the recording process. Amanda jackson there are a few theories on the origin of the abbreviations used for debit (dr) and credit (cr) in accounting. Investment is an asset to business.

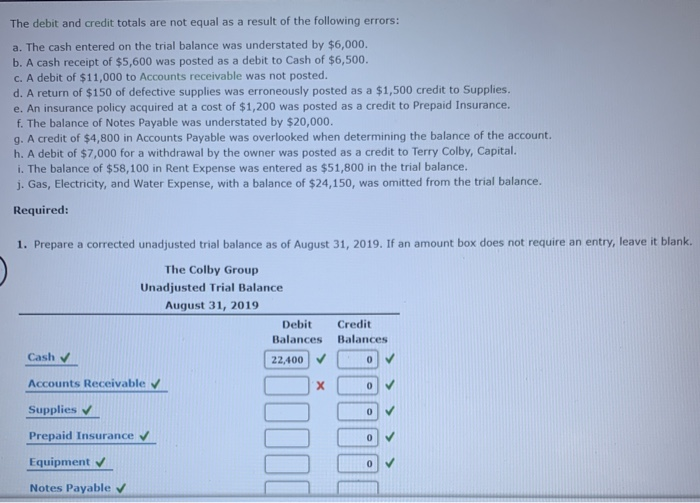

If the final balance in the ledger account (t. And companies, accountants and auditors alike. The rule to prepare the trial balance is an equation which is as follows:

At the end of the month, creative designs decides to create a trial balance to ensure the books are balanced: This statement comprises two columns:. Because every credit entry to a company’s account must have an offsetting debit entry.

The trial balance is a handy accounting tool. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. Trial balance definition a trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that.

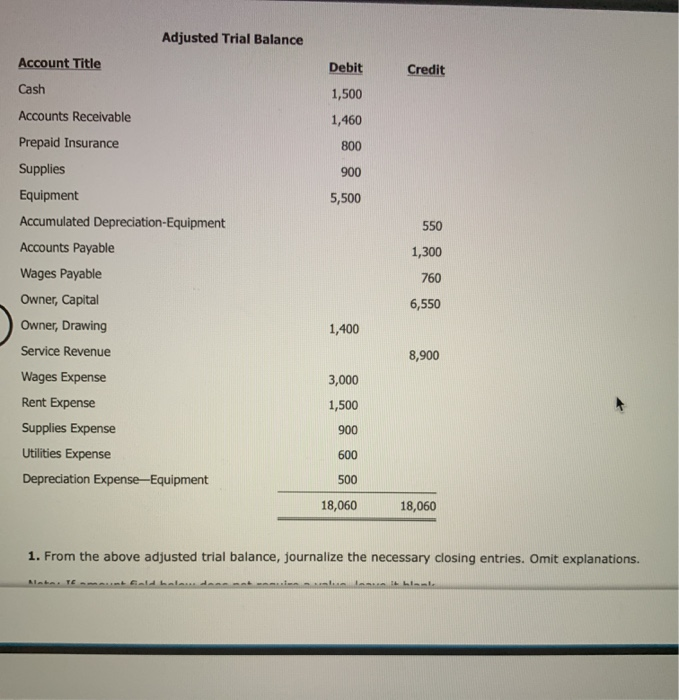

Trial balance entails the accuracy of the financial record and comparing the debit and credit balances in the general ledger accounts to find any possible errors or. Since interest on investment is an income, it is shown on the credit side of the trial balance. Generally capital, revenue and liabilities have credit balanceso they are placed on the credit side of the trial balance.

Since interest on investment is an income, it is shown on the credit side of the trial balance. Rules to prepare the trial balance. For the trial balance to be correct, debit and credits must be equal.

Is investment credit or debit in trial balance? As assets, expenses, drawings, provisions are shown in the debit. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into equal debit and credit account column totals.

$10,000 (initial assets) + $3,000. Total debit entries = total credit entries. The capital, revenue and liability increase when it is credited and vice versa.

This entry reflects the reduction in cash (or bank balance) and the increase in the insurance. Is investment debit or credit in trial balance? This is based on the accounting rule that all increase in incomes are credited.

To explain these theories, here is a.