Outrageous Tips About Prepaid Salary In Balance Sheet

![[Solved] Answer the following question ASSIGNMENT MATERIAL DIRECTION](http://exceltemplate.net/wp-content/uploads/2017/06/Salary-Slip-Template.jpg)

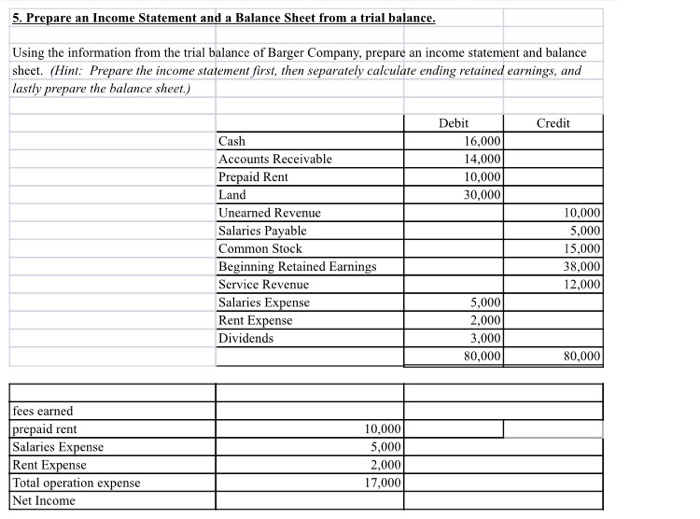

The balance sheet lists prepaid expenses under current assets, which are expected to be consumed or utilized within a year.

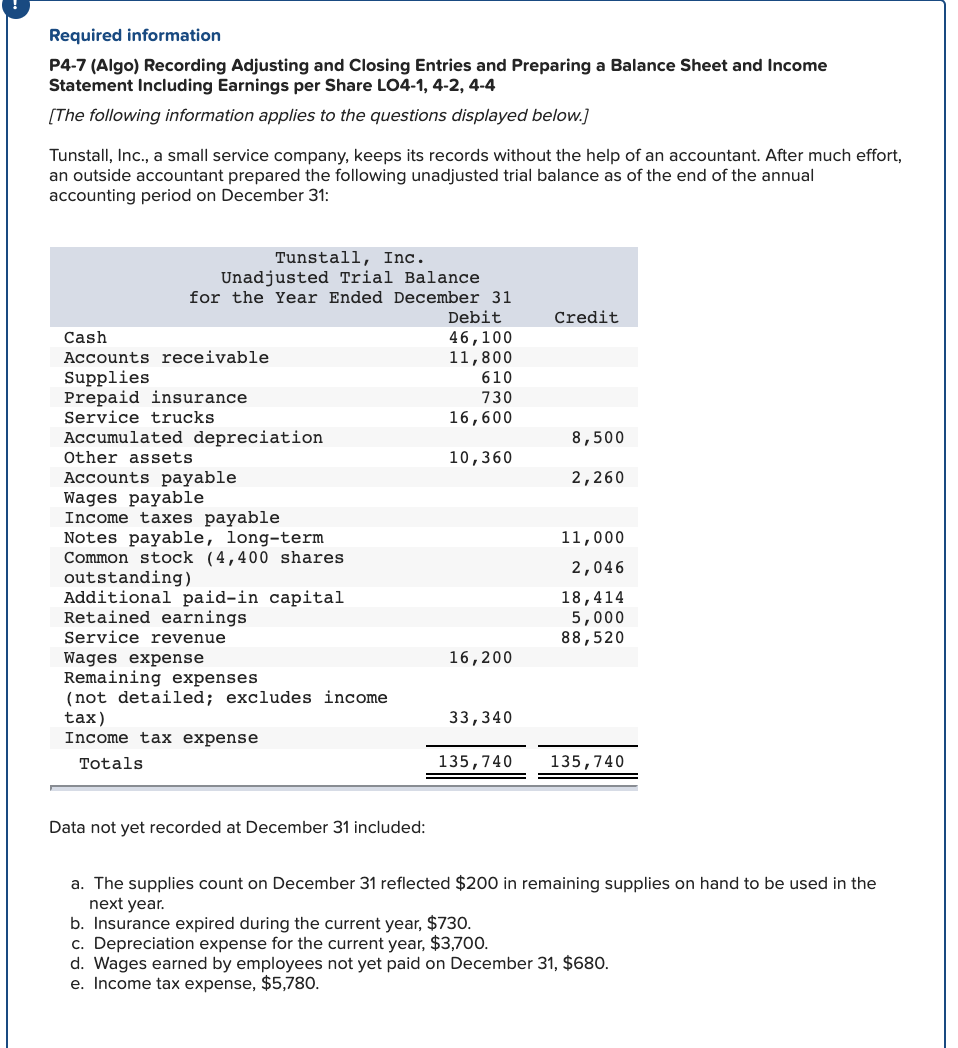

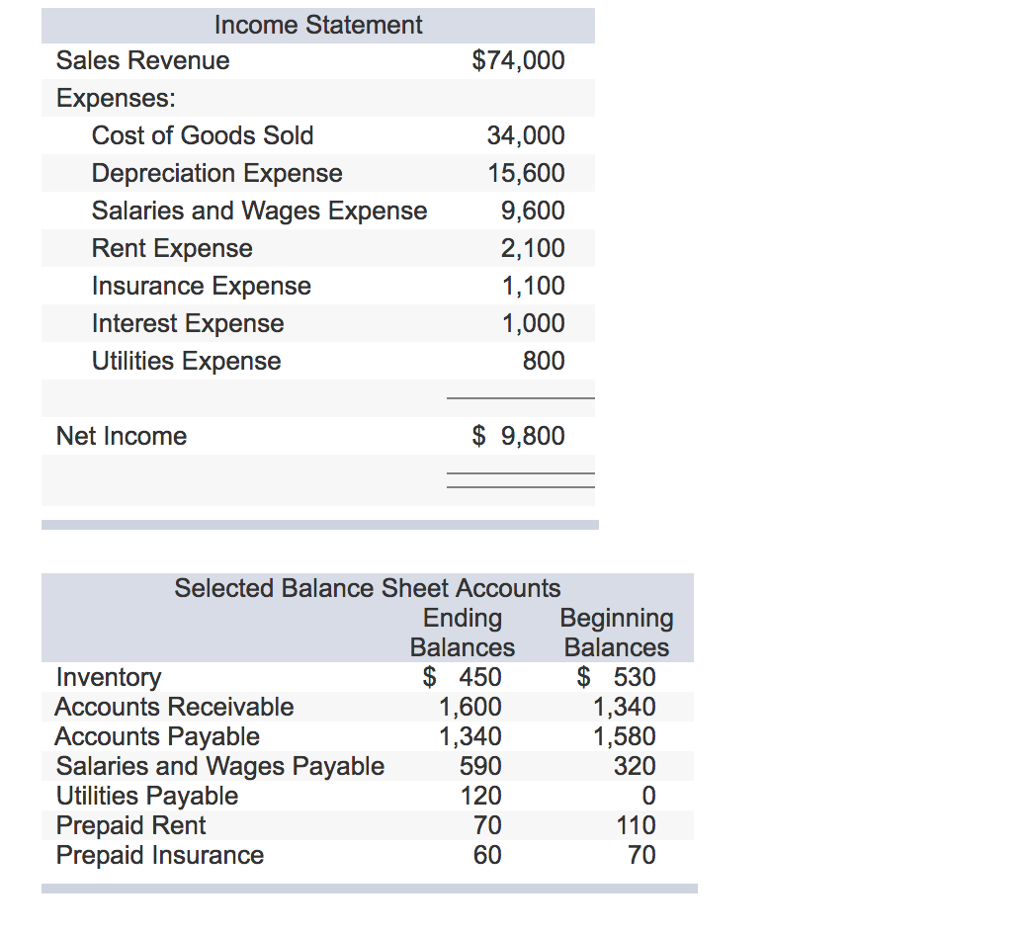

Prepaid salary in balance sheet. Each month, as the company consumes a portion of the prepaid rent, it recognizes a $1,000 rent expense on the income statement. The adjusting entry on january 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent). Salaries, wages and expenses are vital components of your income statement, which lists everything you earned and everything you spent during a given period.

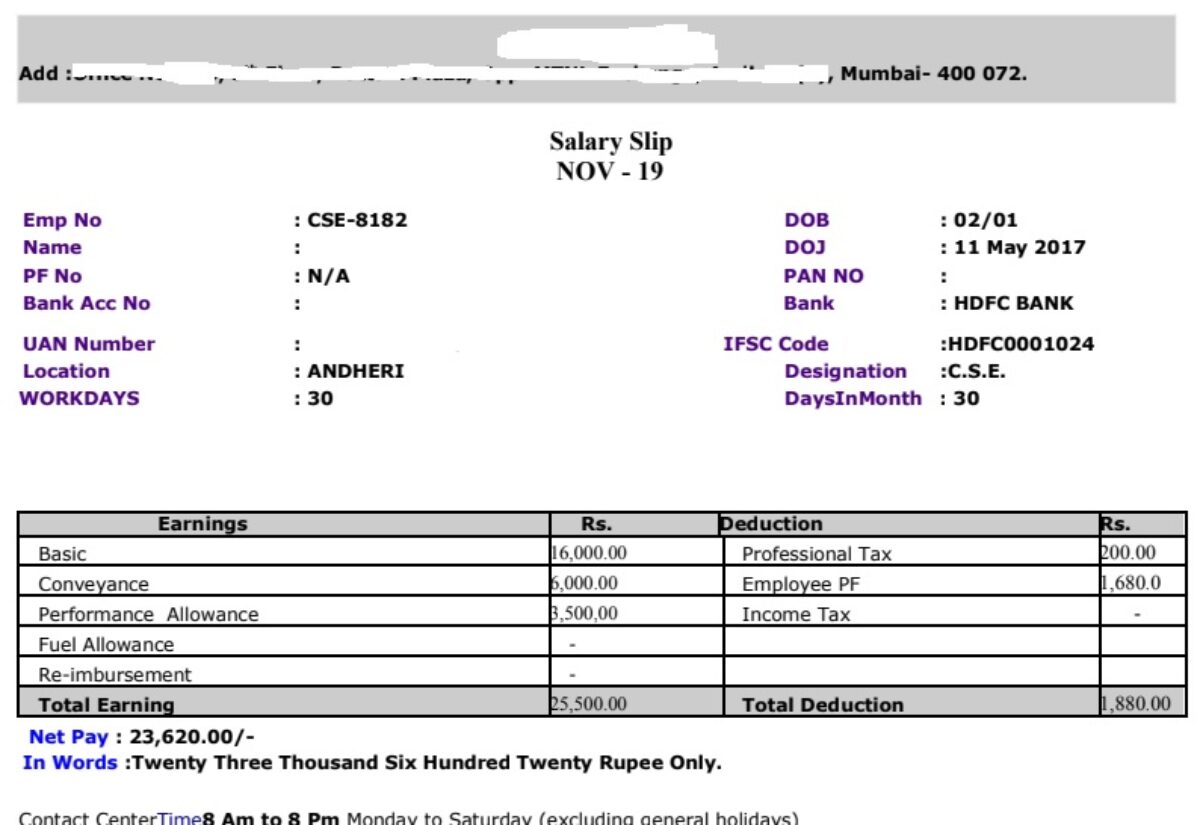

These are things that are owed to other individuals or companies, such as unpaid bills or. An accrued expense account is a liability, which means that the company ought to pay them in the future. However, the benefits are yet to be realized.

On the balance sheet, the prepaid expense account would initially show a $12,000 asset. The prepaid expenses definition is the amount paid for a good or service before receiving the good or service. The expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000.

Prepaid expenses are first recorded in the prepaid asset account on the balance sheet. Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset. In the year, a company paid rs 10,000 in rent and estimated the prepaid rent to be rs 3,000.

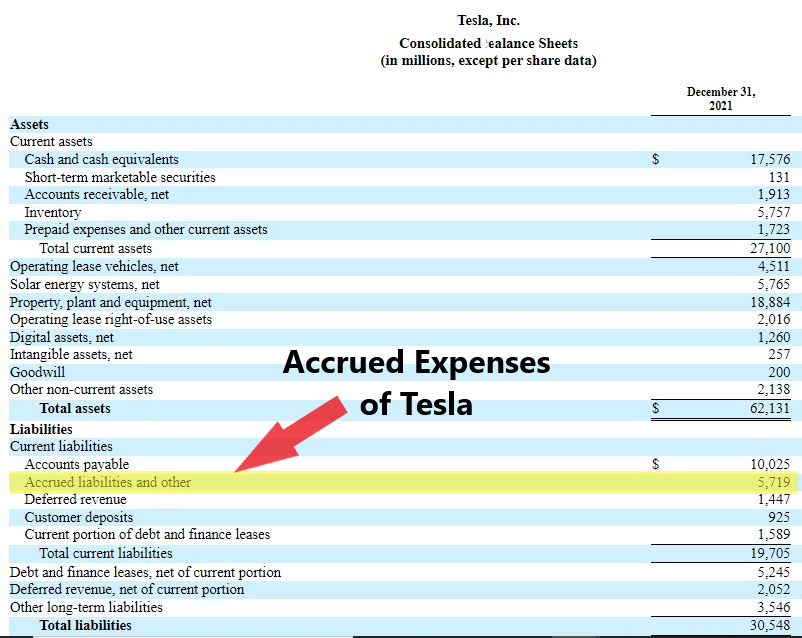

How to find prepaid expenses on the balance sheet? Expense transferred to profit and loss account / income statement. For example, the following screenshot from the balance sheet of tesla (tsla) for fiscal year 2022 illustrates where to find prepaid expenses.

Utility bill paid in advance for coming months that are still unaccounted for. The amount of prepaid salary is deducted from salary and shown on the debit side of the profit and loss account. In short, these expenses are considered assets because they represent future economic benefits for a business.

Rent for future months that are paid in advance) prepaid utility bill: A “prepaid asset” is the result of a prepaid expense being recorded on the balance sheet. Prepaid expenses are recorded on the balance sheet as an asset, most often as a current asset.

The main prepaid expenses include: Income statement vs. Treatment of prepaid expenses in final accounts (or) financial statements.

The gaap matching principle prevents expenses from being recorded on the income statement before they. A balance sheet is made up of three main parts:

Prepaid salary, rent, taxes, electricity bills, and telephone bills are examples of. Assets are all the things that are owned by the business and that hold financial value, such as cash, accounts receivable, and of course, prepaid expenses. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet.