Fine Beautiful Tips About Difference Between Direct Method And Indirect

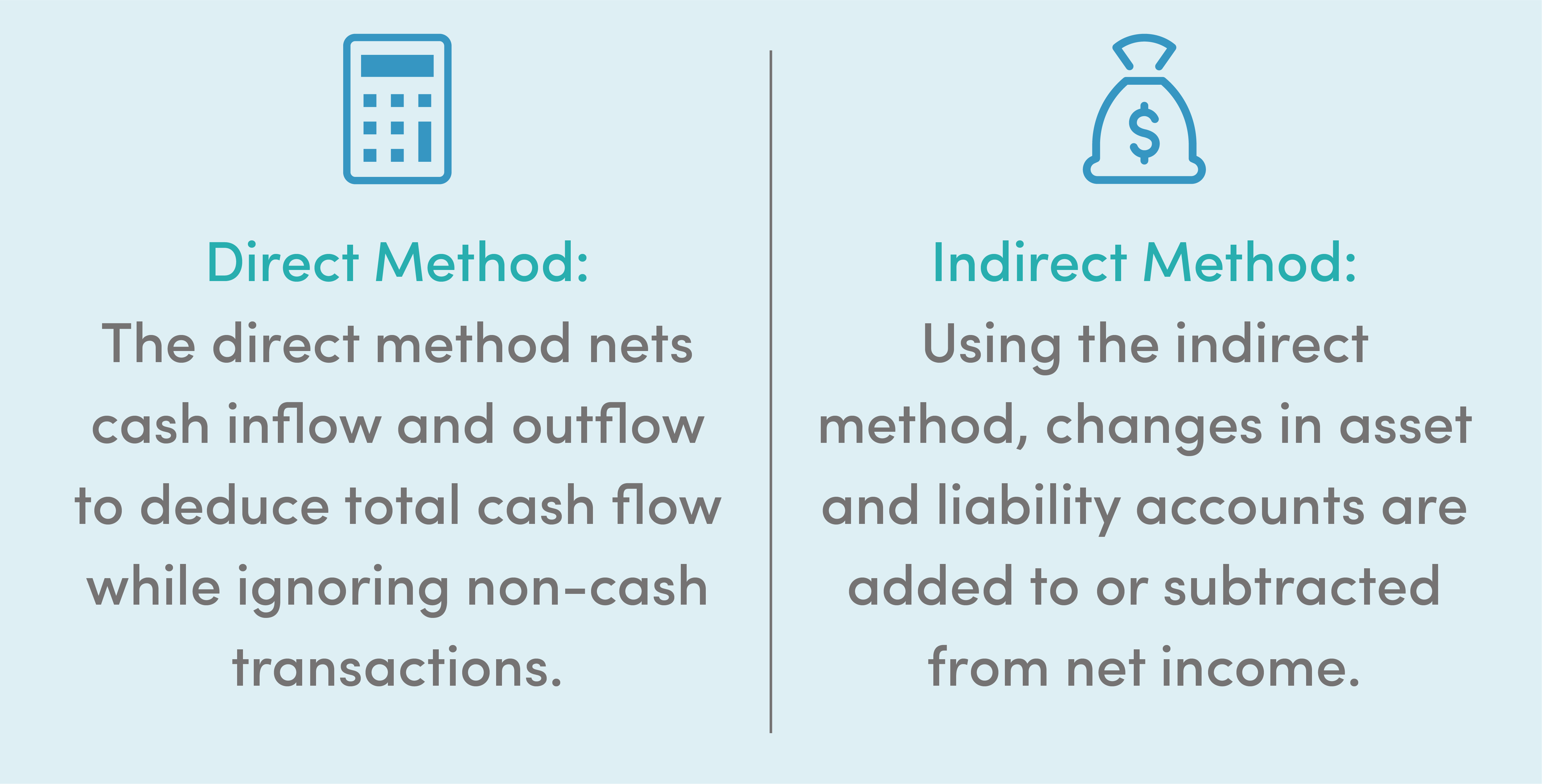

The direct method individually itemizes the cash received from your customers and paid out for supplies, staff, income tax, etc.

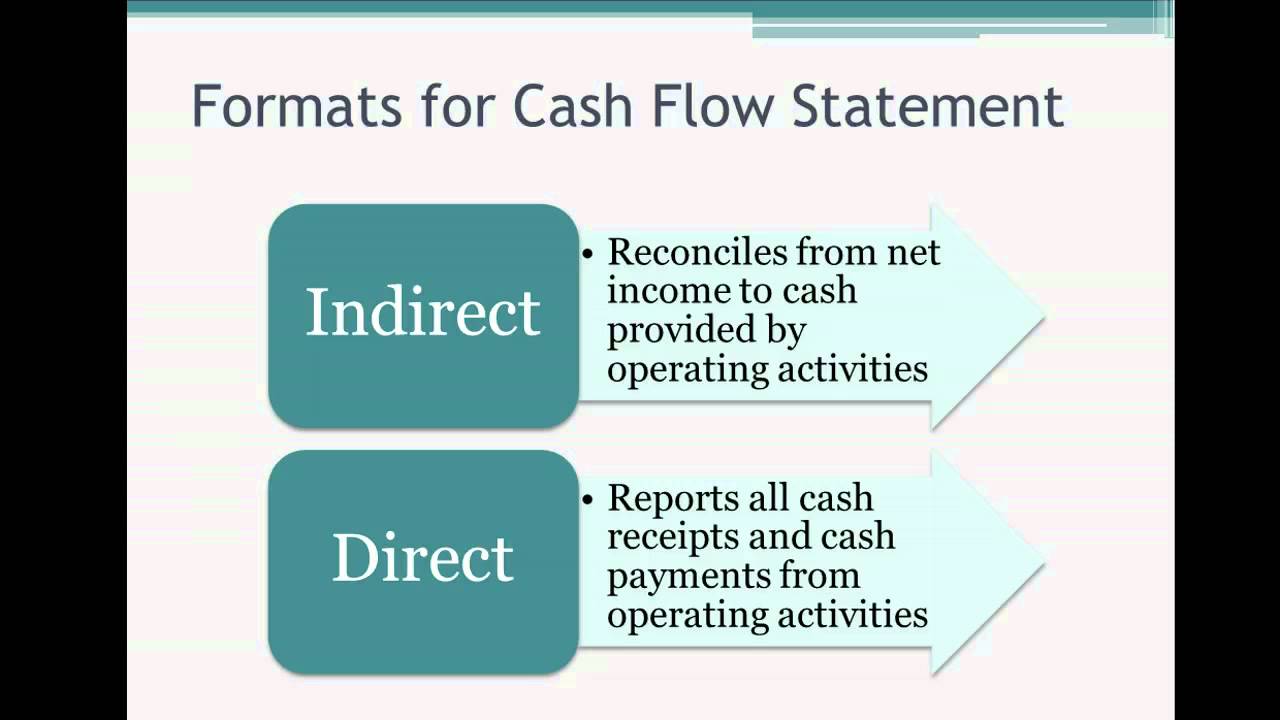

Difference between direct method and indirect method. The difference between these methods lies in the presentation of information within the cash flows from operating. The direct method, the income statement is reformulated on a cash basis, rather than an accrual basis from the top of the statement (the income part) to the bottom (the expense. The two main methods for preparing a cash flow statement are the direct method and indirect method.

The indirect method takes the net income generated in a period and adds or subtracts changes in the asset and liability accounts to determine the implied cash. The direct method and the indirect method are alternative ways to present information in an organization’s statement of cash flows. The indirect method always starts with the net income.

The indirect method is relatively complex method as compared to the. The direct method, the income statement is reformulated on a cash basis, rather than an accrual basis from the top of the statement (the income part) to the bottom (the. Estimating the gravity disturbance vector from airborne.

Example let’s work out the cash flow statement using the indirect method given the following balance sheet: The direct method of cash flow shows the actual cash transactions, like money received from customers and paid to suppliers. (a) the direct method and (b) the indirect method.

In the direct method, we find out. Formula we can work out the cash flow from operations using two methods: The main way you can spot the difference between the direct method and indirect method is as follows:

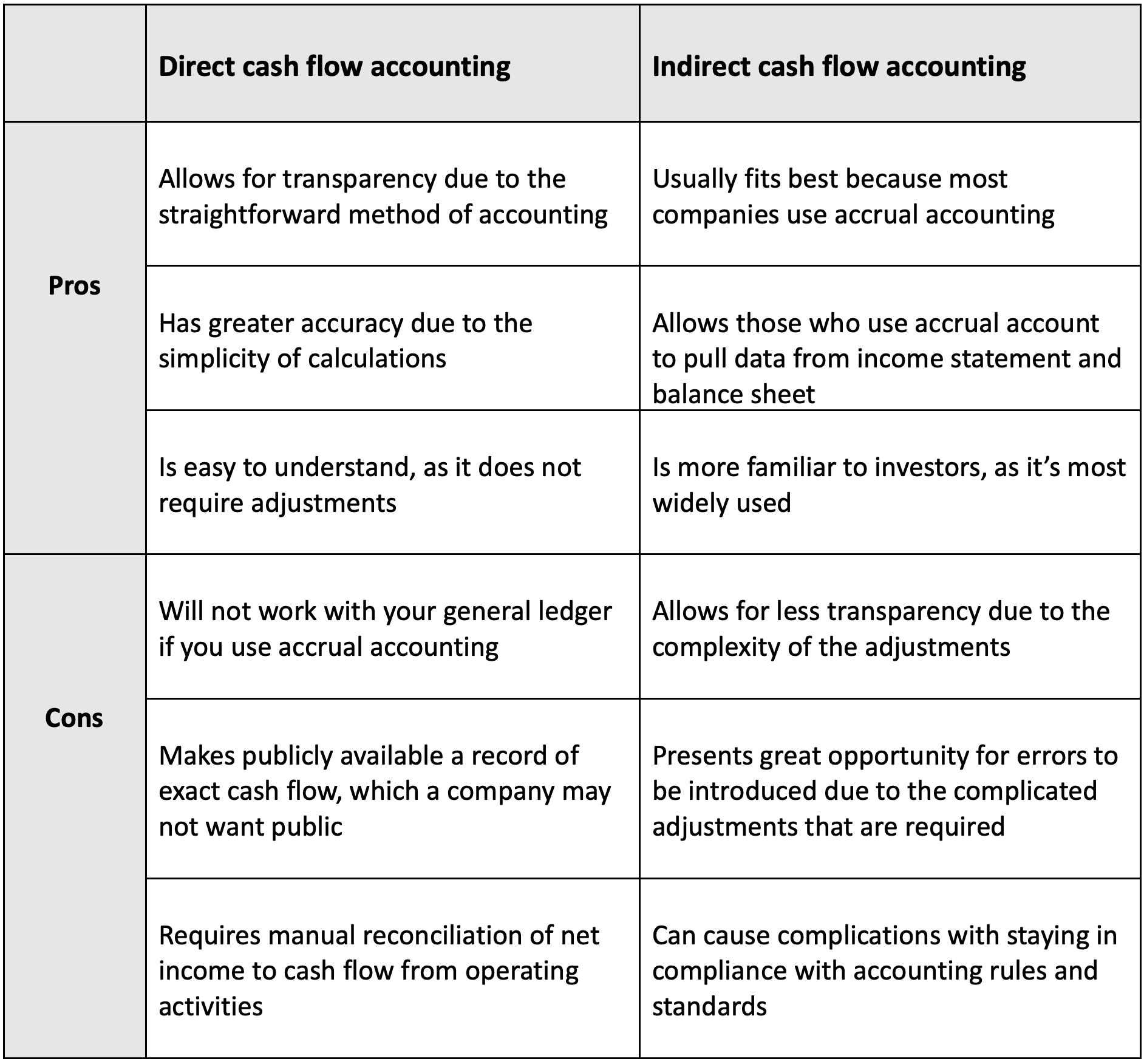

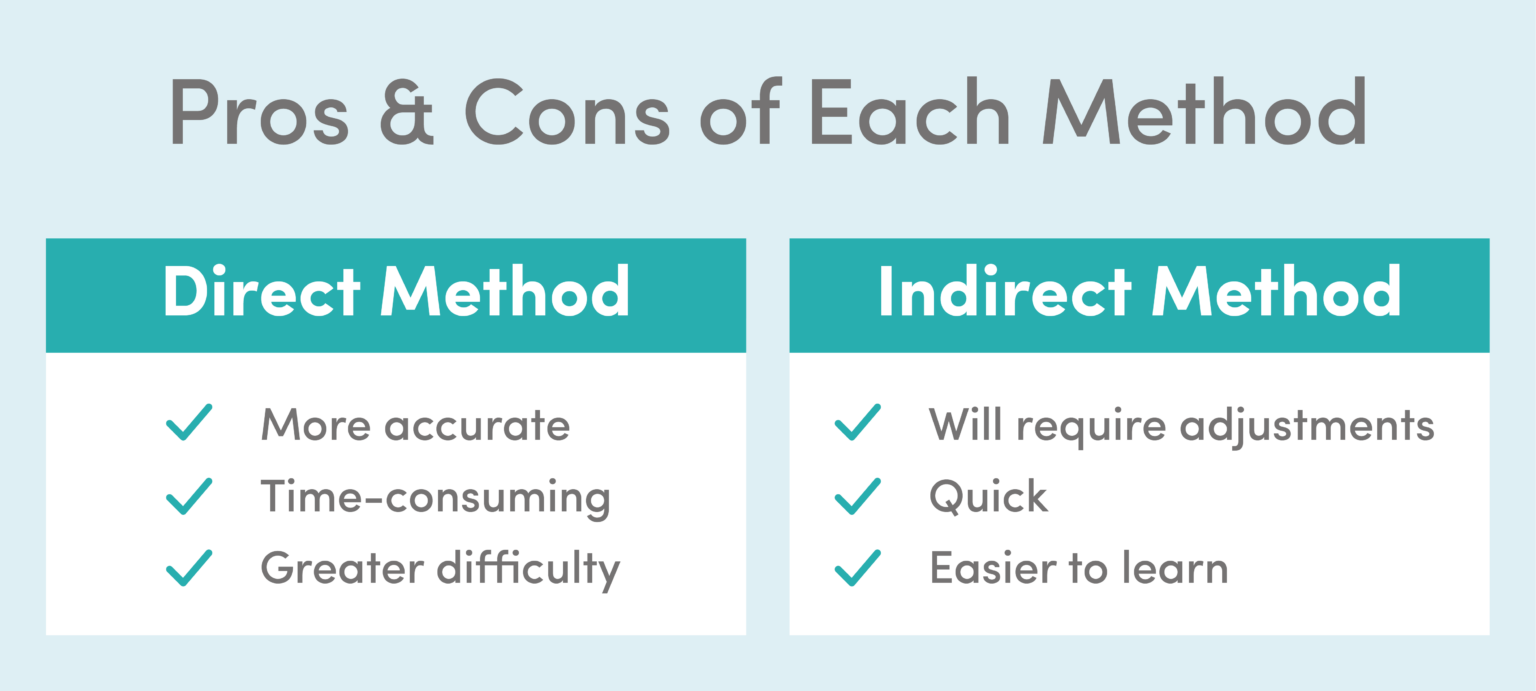

The key differences between the direct vs indirect cash flow methods are as follows: The choice between the direct and indirect cash flow methods depends on several factors, including reporting requirements, available resources, and the desired level of. The direct method.

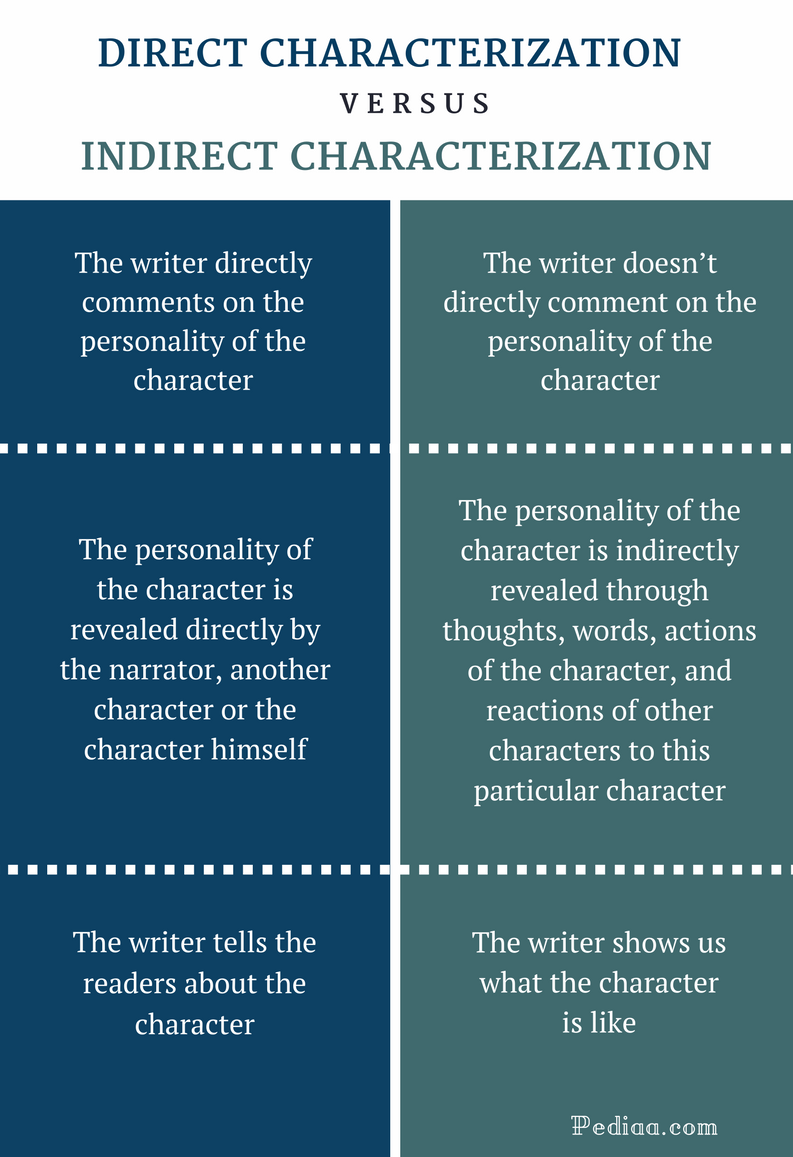

The direct method, the income statement is reformulated on a cash basis, rather than an accrual basis from the top of the statement (the income part) to the bottom (the expense. In short, the direct method is helpful when you need to make it easy for other people—like investors and stakeholders—to understand your cash flow. Download scientific diagram | differences between the direct method and the indirect method from publication: