Formidable Info About Fast Food Industry Financial Ratios

Description search inside report related reports the 2024 u.s.

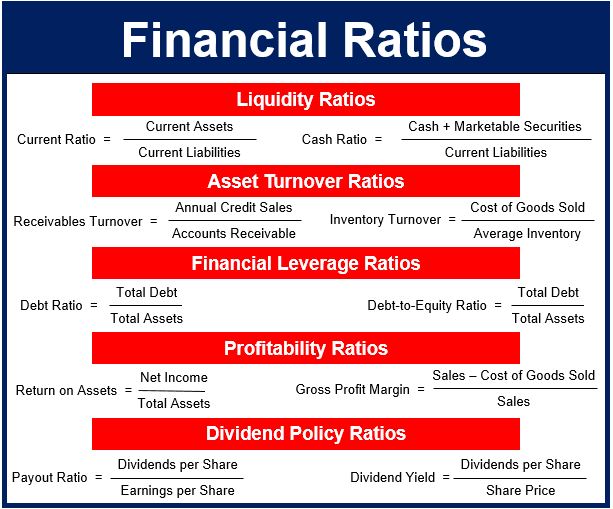

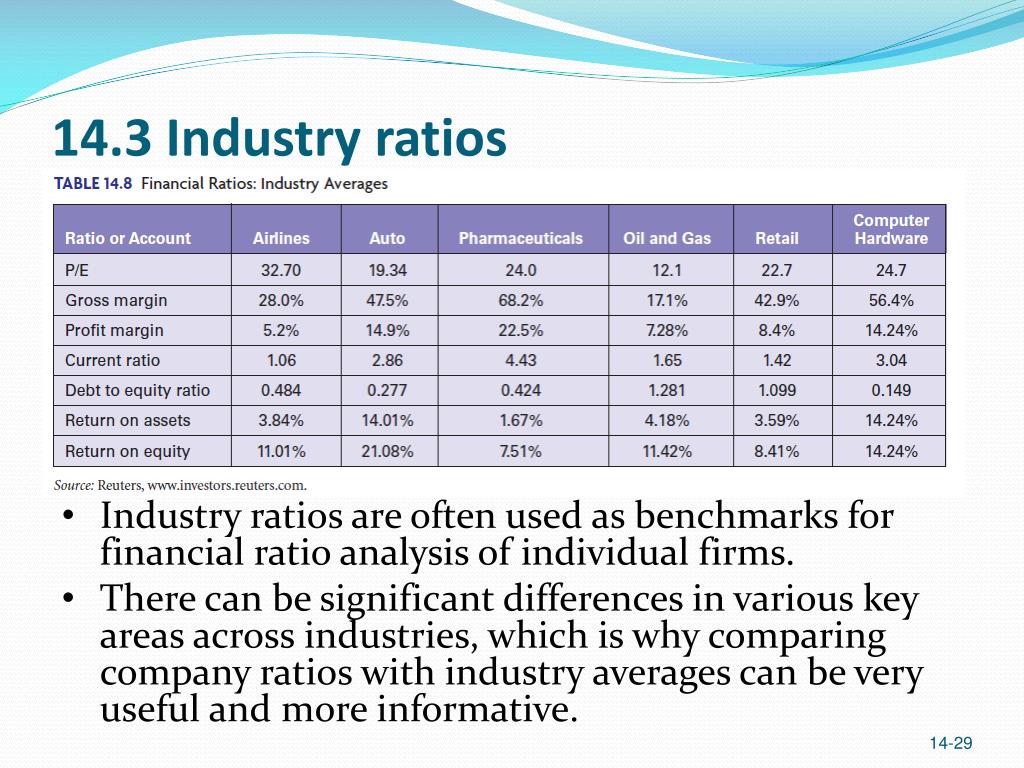

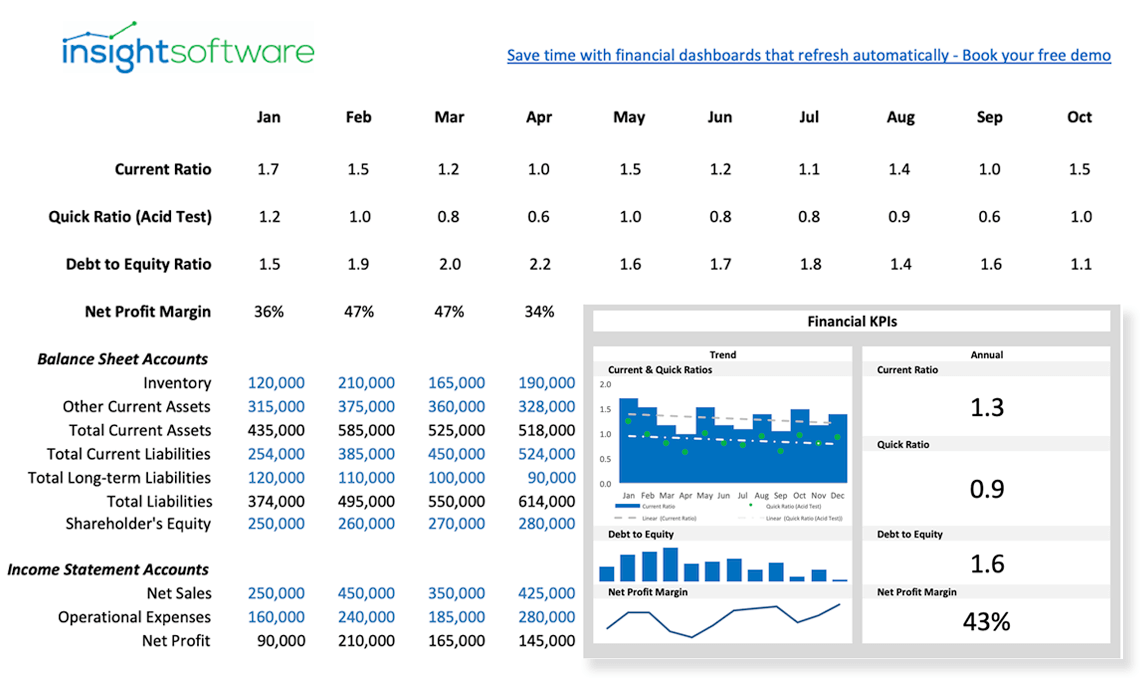

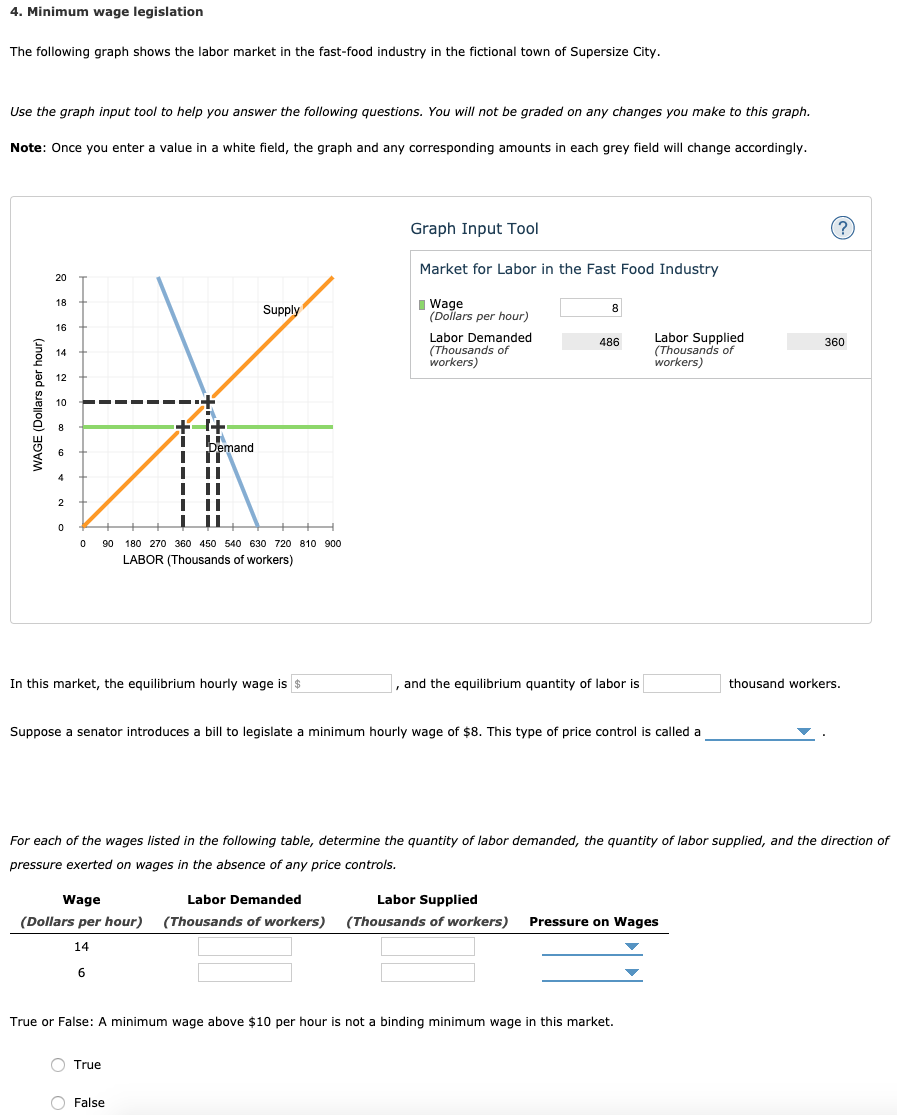

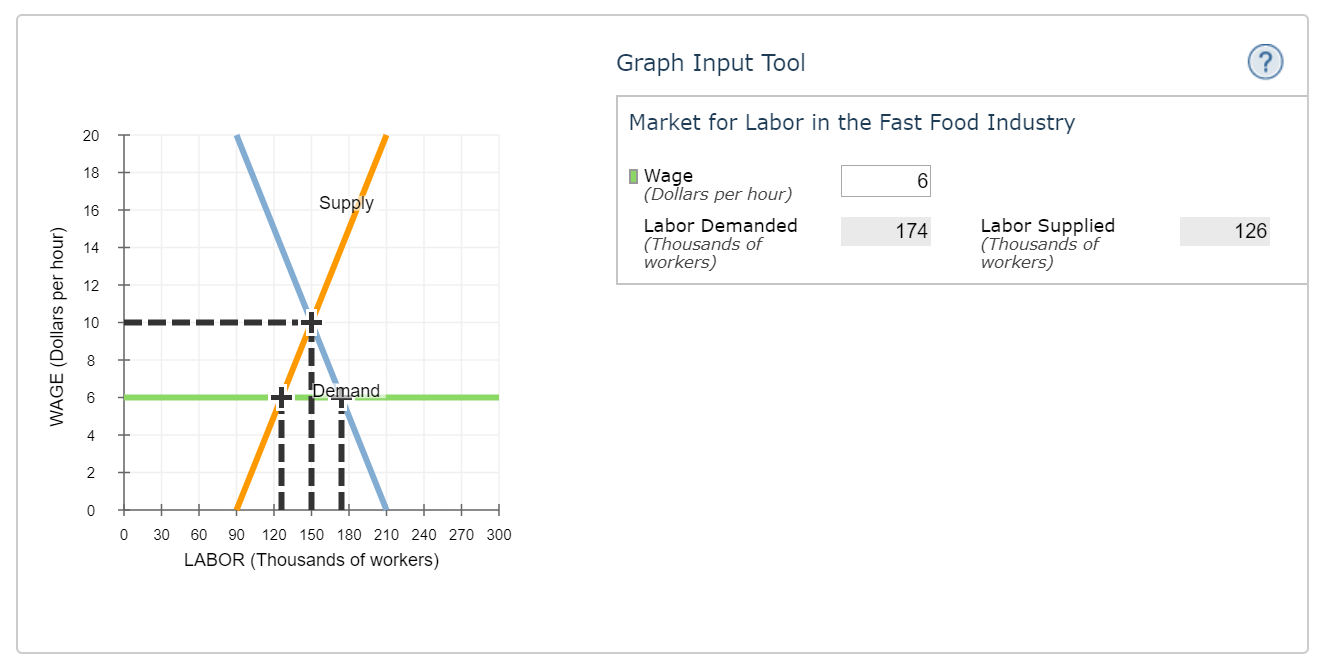

Fast food industry financial ratios. Analytics, extensive financial benchmarks, metrics and revenue forecasts to 2022, naic 722000 That’s reflected in this year’s. Make better business decisions, faster with ibisworld's industry market research.

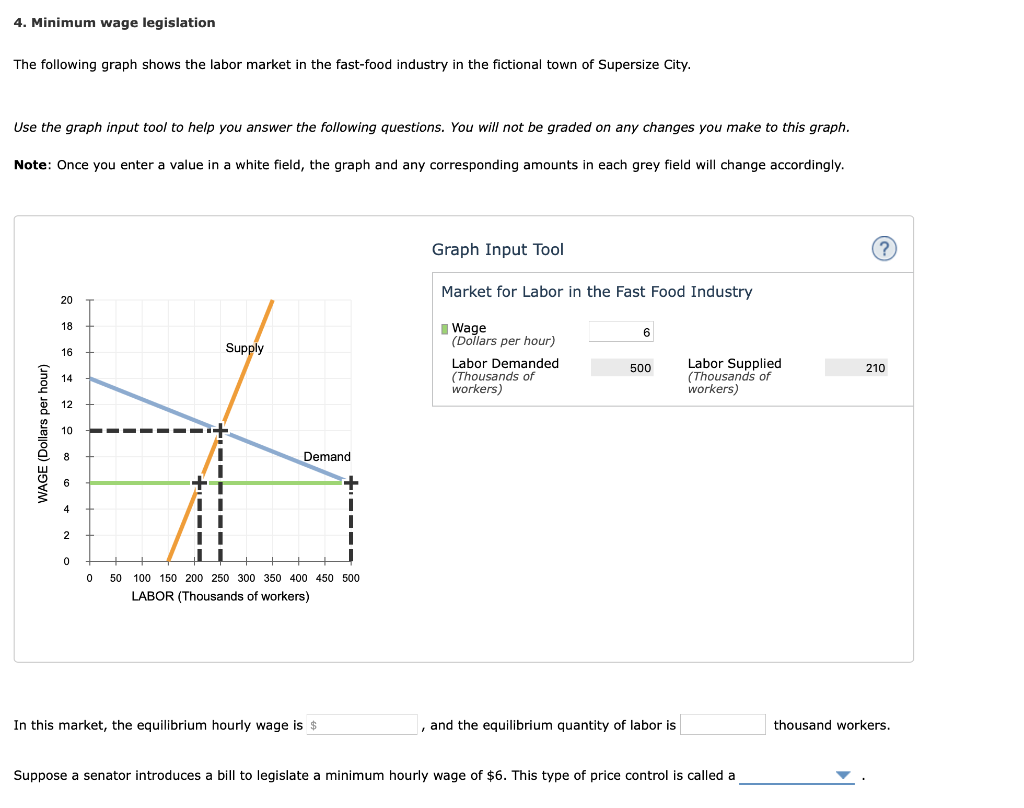

Chipotle mexican grill (cmg) united states: Restaurant benchmarking is the process of evaluating a chain’s or single restaurant’s practices, products and services against. On the trailing twelve months basis restaurants industry's ebitda grew by.

What is restaurant benchmarking? Food processing industry financial strength, from the q4 2023 to 4 q 2022, leverage, interest, debt coverage and quick ratios growth rates profitability valuation financial. According to these financial ratios food & drinks.

Back in february, executives said the product helped push $400,000 in added sales, per restaurant, across popeyes’ entire mature base. Net worth current and historical p/e ratio for restaurant brands (qsr) from 2013 to 2023. Ten years of annual and quarterly financial ratios and margins for analysis of restaurant brands (qsr).

52 rows current and historical current ratio for restaurant brands (qsr) from 2013 to 2023. Make better business decisions, faster with ibisworld's industry market research. The price to earnings ratio is calculated by taking the latest closing price and dividing it.

Roi return on tangible equity current and historical asset turnover for restaurant brands (qsr) from 2013 to 2023. Restaurants industry debt coverage statistics as of 4 q 2023. The ev/ebitda ntm ratio of food & drinks pcl is significantly lower than the average of its sector (food products):

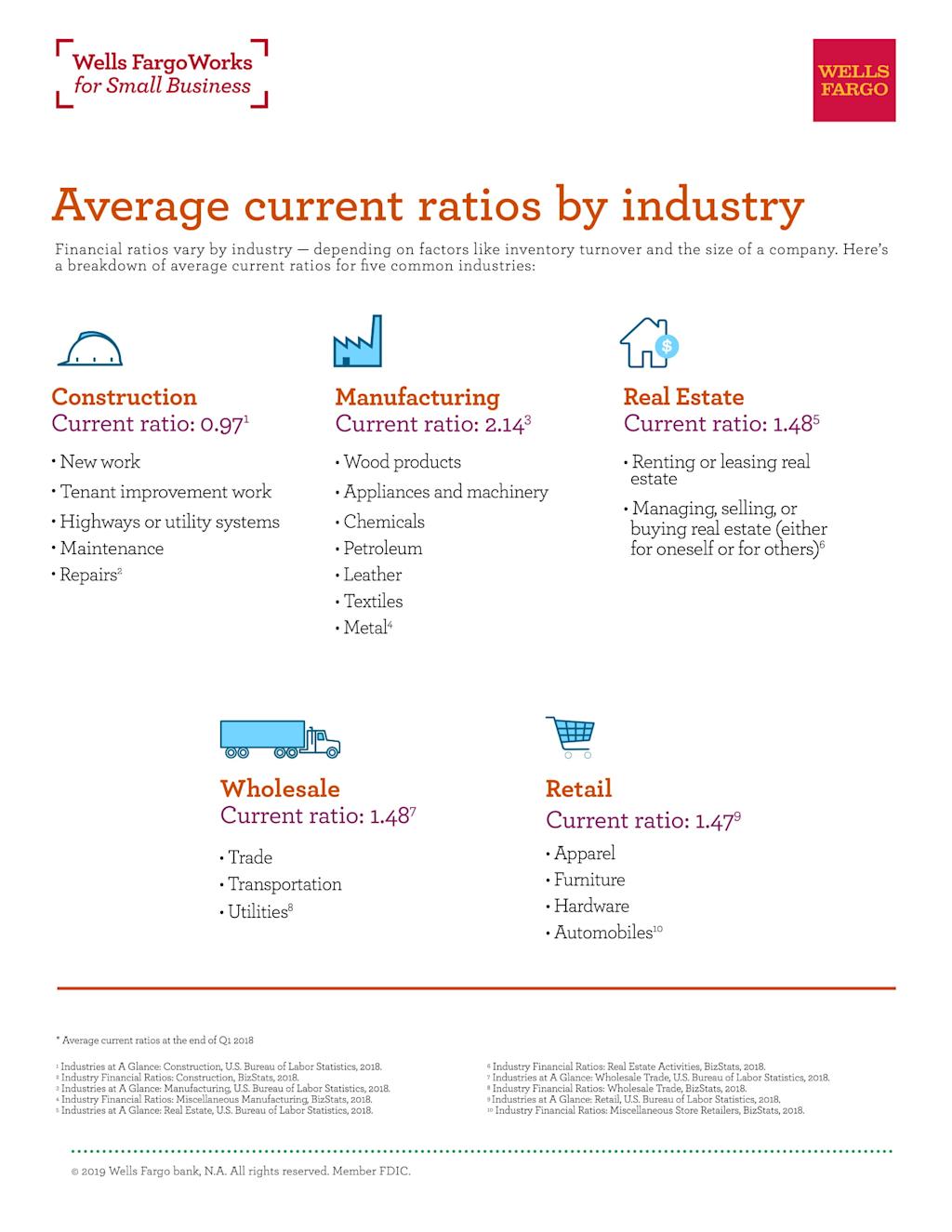

Current ratio can be defined as a liquidity ratio that measures a company's ability.