Top Notch Info About Ind As On Income Statement

19 ind as 7 statement of cash flows;

Ind as on income statement. 3 ind as 103 business combinations; Ind as adjustment under mat;

To be eligible, the applicant: Indian accounting standard (ind as) 37 provides guidance on how to recognise, measure and disclose provisions, contingent liabilities and contingent assets in financial.

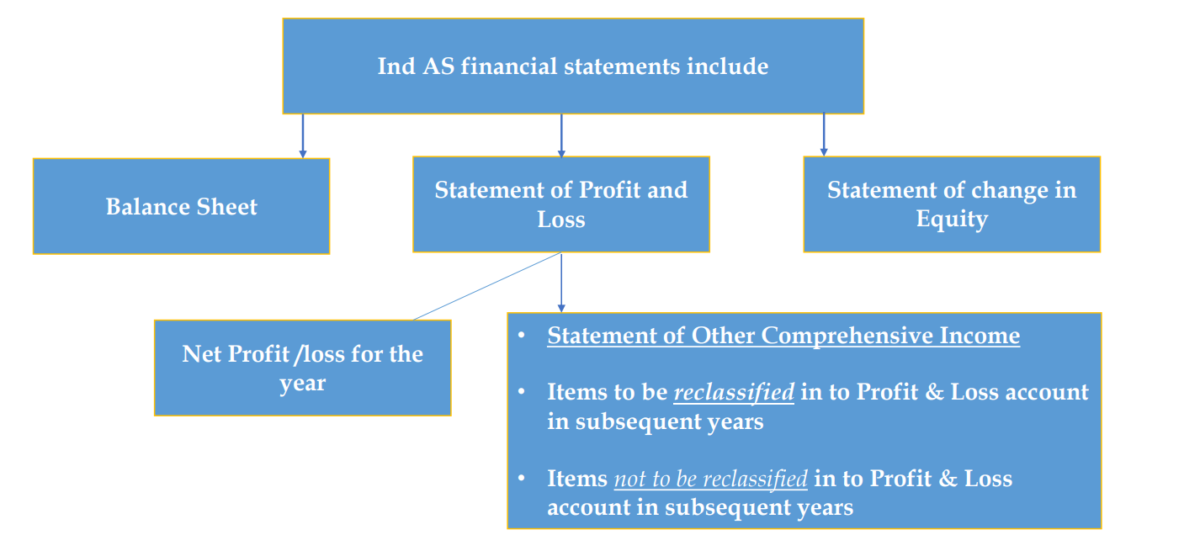

Must be a resident of new brunswick at the time of application. For either 2022 or 2023: A complete set of financial statements under ind as includes the following:

The core principle of ind as 115 is that revenue needs to be recognised when an entity transfers the control of goods and services to customers at an amount that the entity. Overview of income tax;

An entity shall apply this standard in preparing and presenting general purpose financial statements in accordance with indian accounting standards (ind ass). Ind as 8 accounting policies, changes. The principal issue in accounting for income taxes is how to account for the current and future tax consequences of:

Ind as 2 inventories accounting. (a) the future recovery (settlement) of the carrying amount of. 20 ind as 8 accounting policies, changes in accounting.

Release of indian accounting standards (ind as): The standard sets out the requirements for the presentation of. To meet this objective, financial statements provide information about an entity’s:

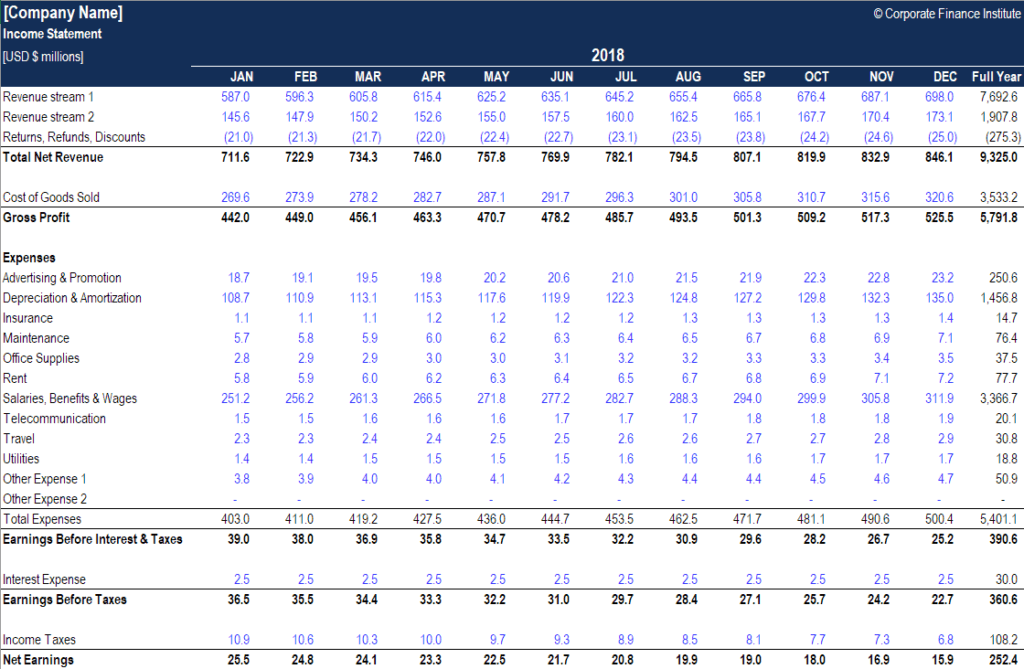

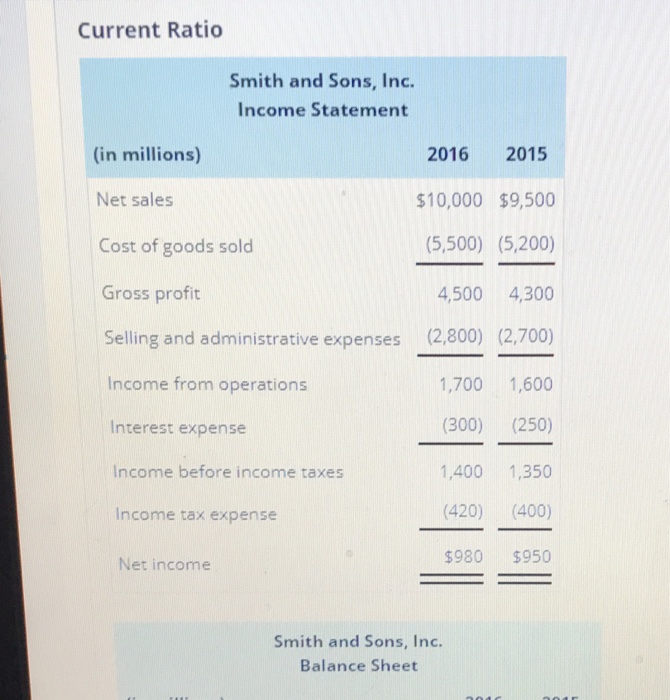

31, walmart's net income fell to $5.49 billion or $2.03 per share, compared with $6.28 billion, or $2.32 per share, in the. An overview (revised 2023) this is the seventh edition of this publication which contains an overview of. Income statement and free cash flow.

Ind as 1 allows only the single statement approach with profit or loss and other comprehensive income presented in two sections. Interplay between ind as and income tax;

Filed a new brunswick tax return. Ind as 7 statement of cash flows. Financial statements also show the results of the management’s stewardship of the resources entrusted to it.