Breathtaking Info About Statement Of Comprehensive Income Problems And Solutions

Disadvantages of statement of comprehensive income.

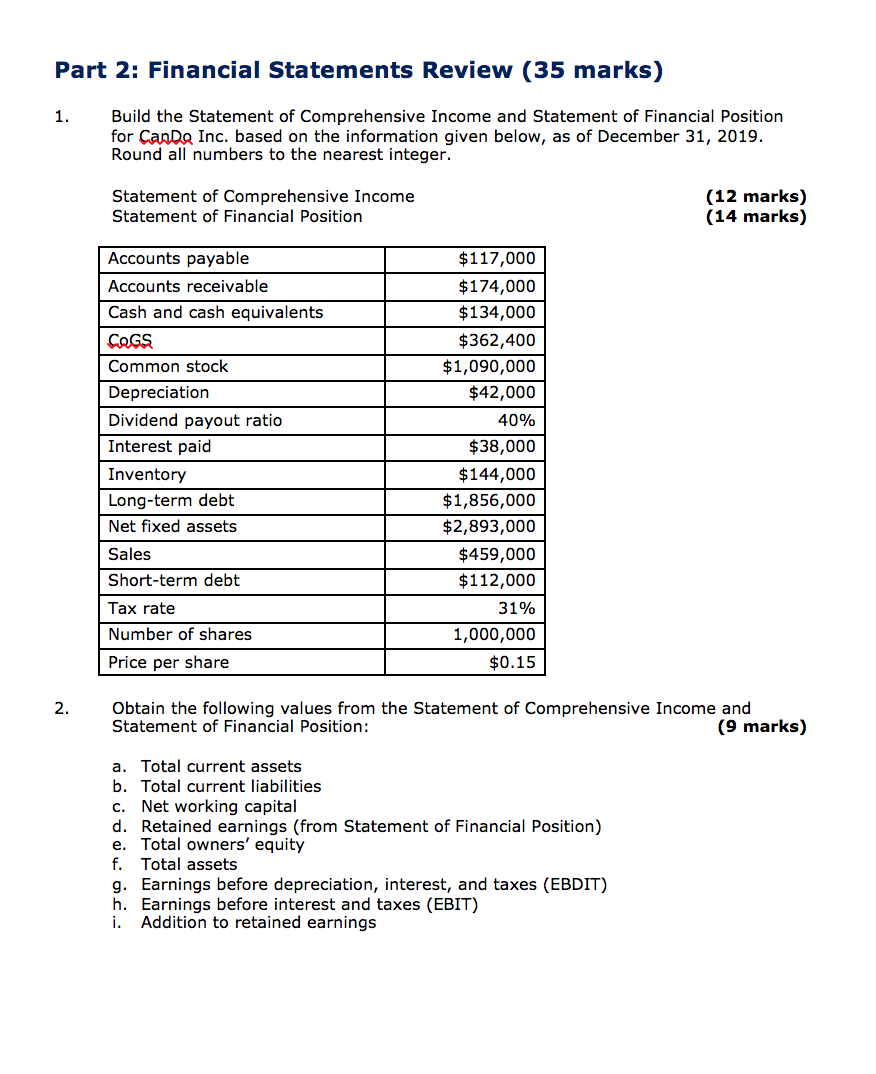

Statement of comprehensive income problems and solutions. It says that ai systems that can be used in different applications. (c) comprehensive income is defined as the change in equity (net assets) of a business during a period from transactions and other events and circumstances from nonowner. Difficulties in predicting the future.

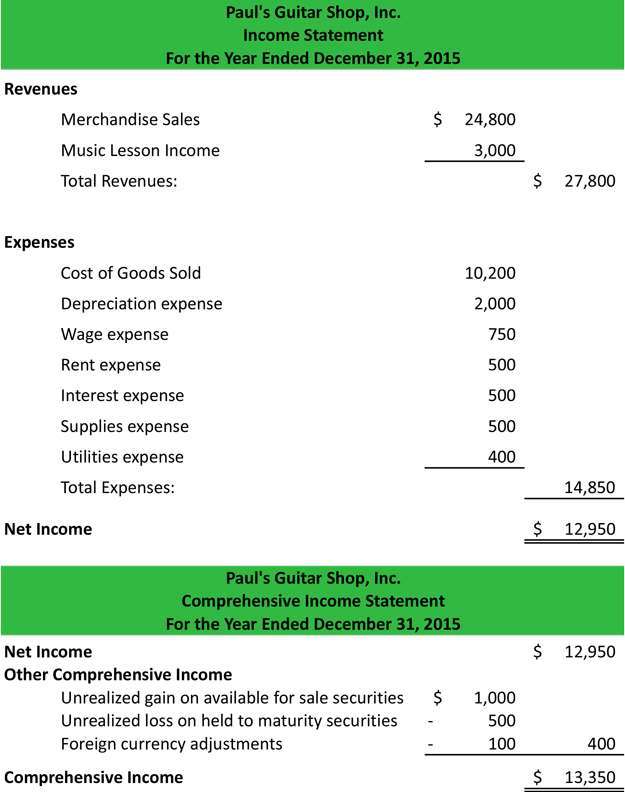

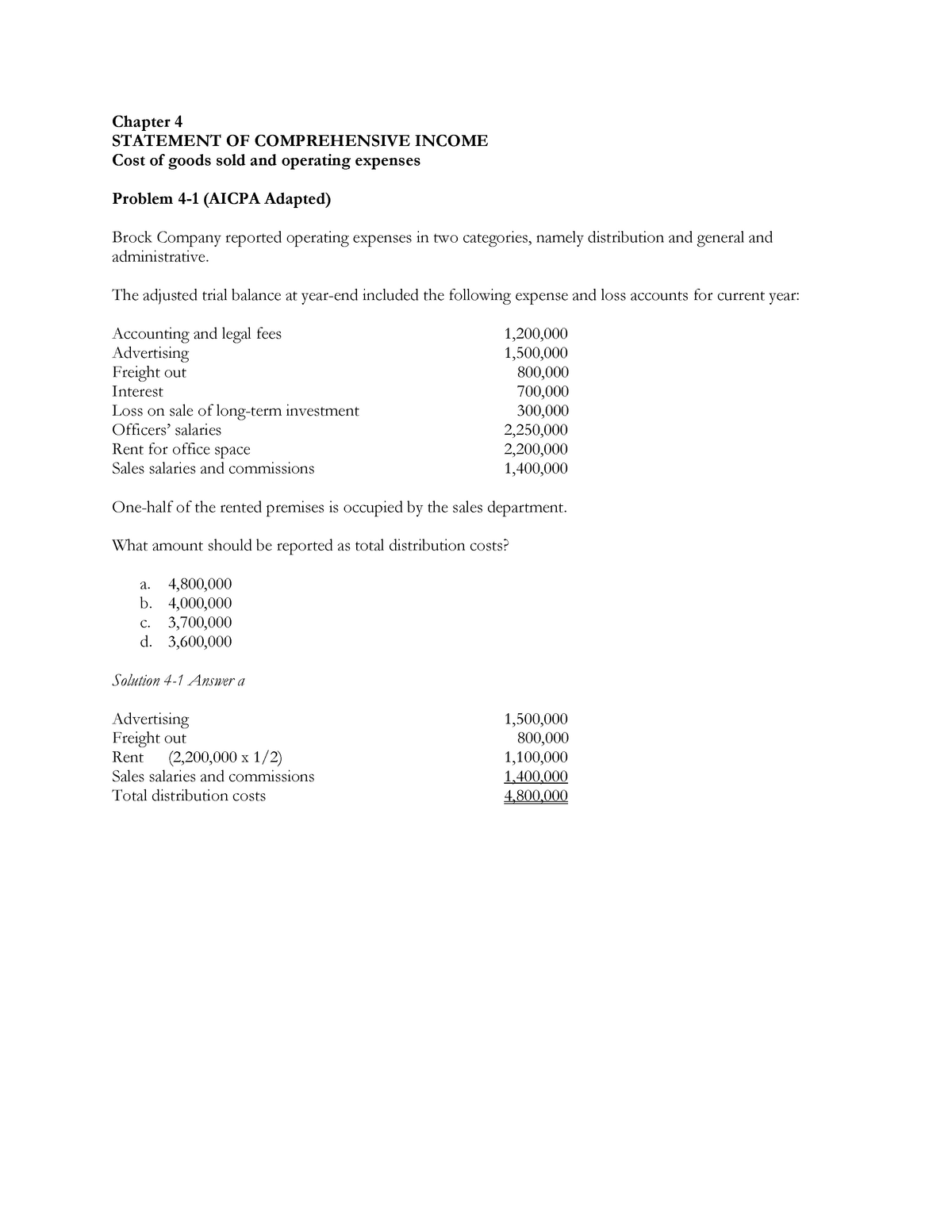

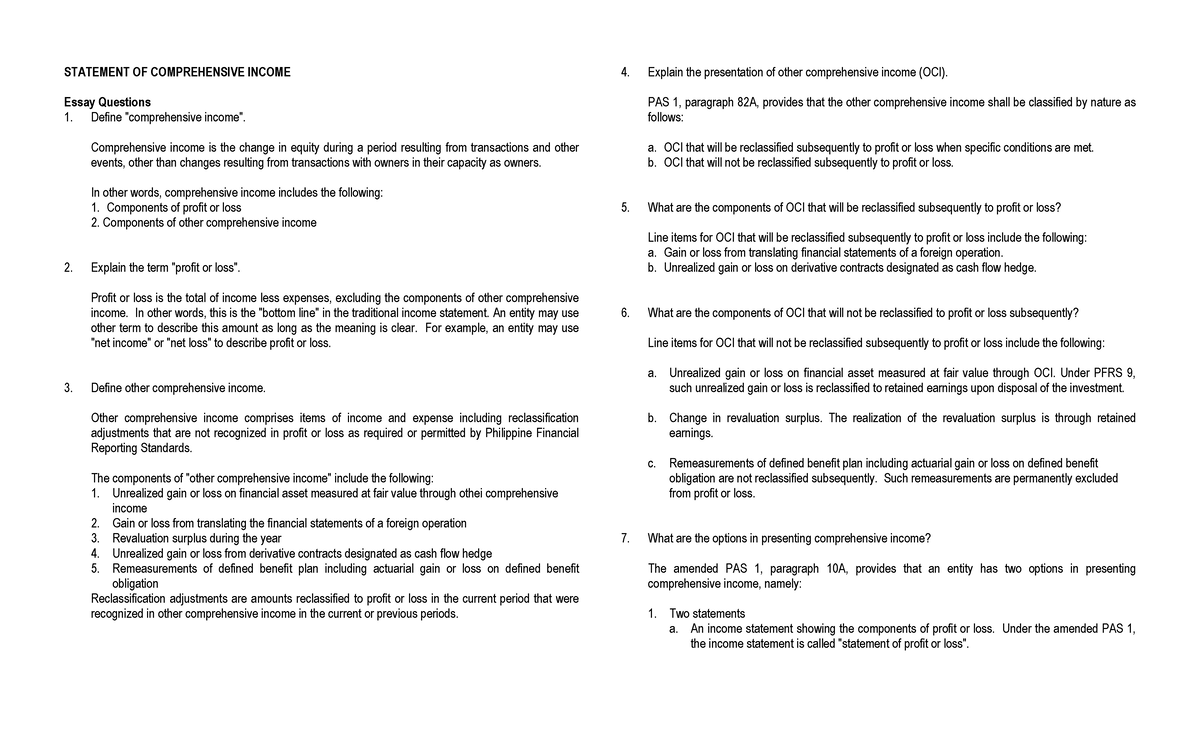

Identify the three main components of the. The income statement summarizes the financial performance of the business for a given period of time. What is other comprehensive income?

The income statement reports how the business performed financially. Let us look at the disadvantages of comprehensive income: Prepare a statement of owner’s equity.

(f) this means the share of. Note that the statement for toulon ltd. The third session of the meeting of the parties to the protocol to eliminate illicit trade in tobacco products concluded today after taking decisive action to combat.

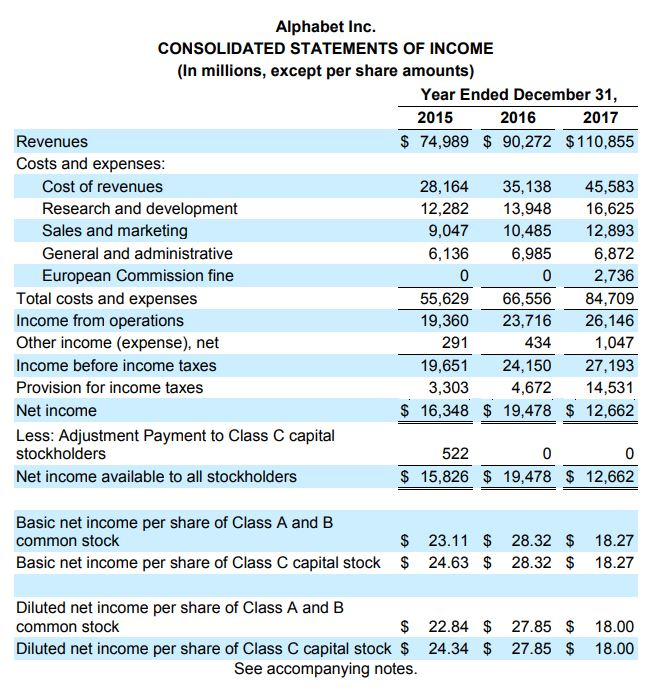

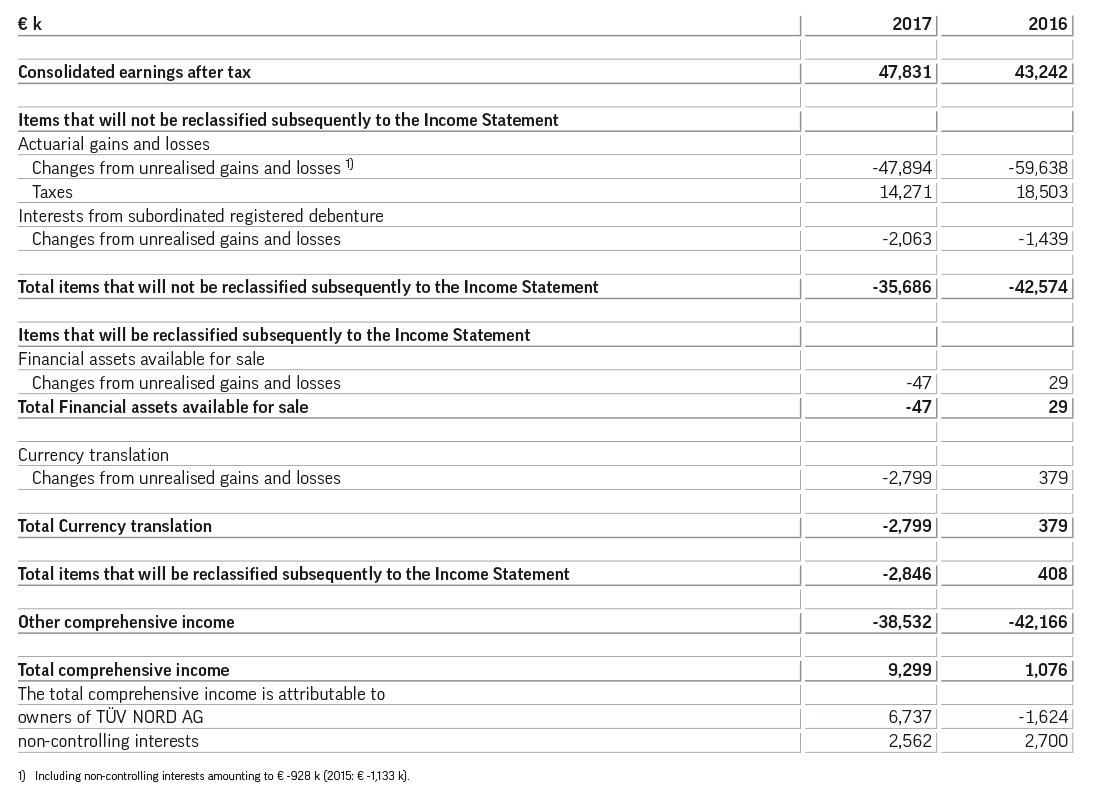

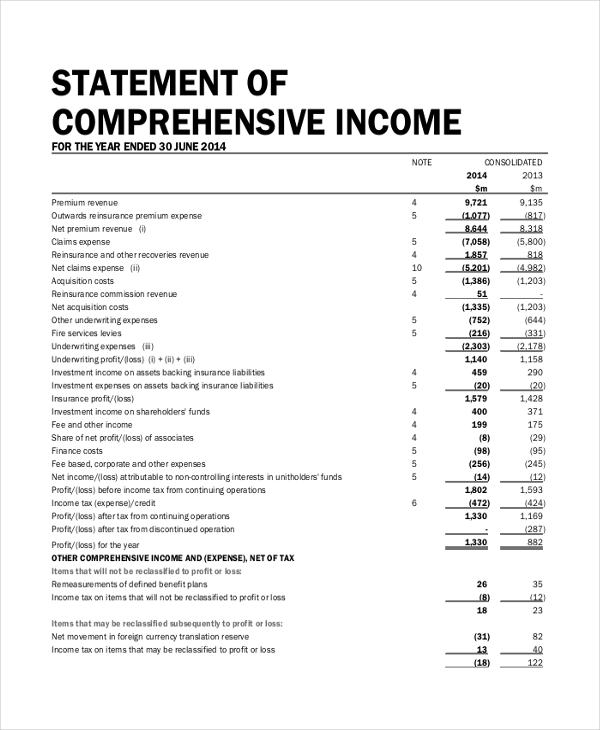

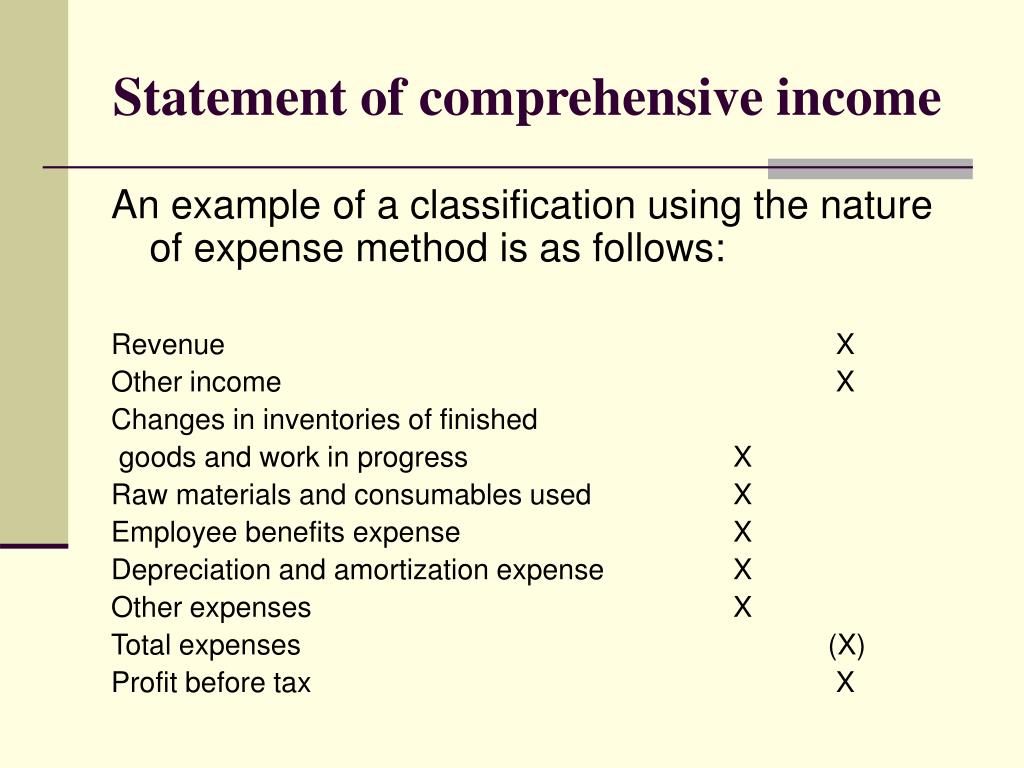

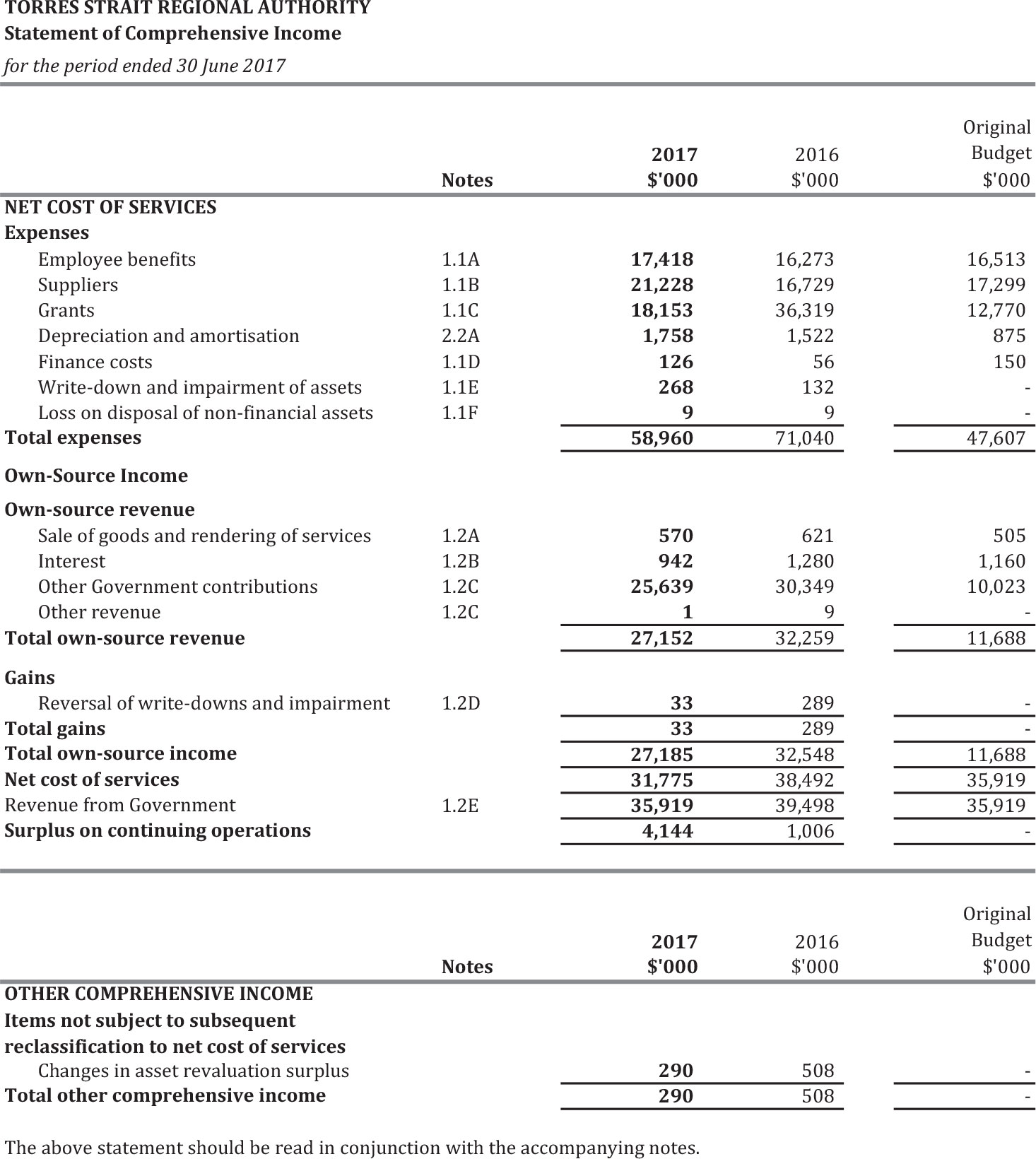

This module focuses on the general requirements for the presentation of the statement of comprehensive income and the income statement in accordance with section 5. (shown earlier in the chapter) combines net income and total comprehensive income. Net income and comprehensive income.

For instance, the quarterly income statement. No solutions/answer key so you can practice. Comprehensive income is often listed on the financial statements to include all other revenues, expenses, gains, and losses that.

The income statement captures all activity related to revenues and expenses over a particular time period. The statement of comprehensive income illustrates the financial performance and results of operations of a particular company or entity for a period of. The statement of comprehensive income is a financial statement that highlights your business's net income and other comprehensive income (oci).

Adjustments inventory on 31 st,. In april 2021, the european commission proposed the first eu regulatory framework for ai. Refer to the statement of comprehensive income illustrating the presentation of income and expenses in one statement.

The eyring company income statement for 20x1 shows net income of $170,300. Sales of $140,000 made on credit.