Formidable Info About Investment Disclosure In Financial Statements

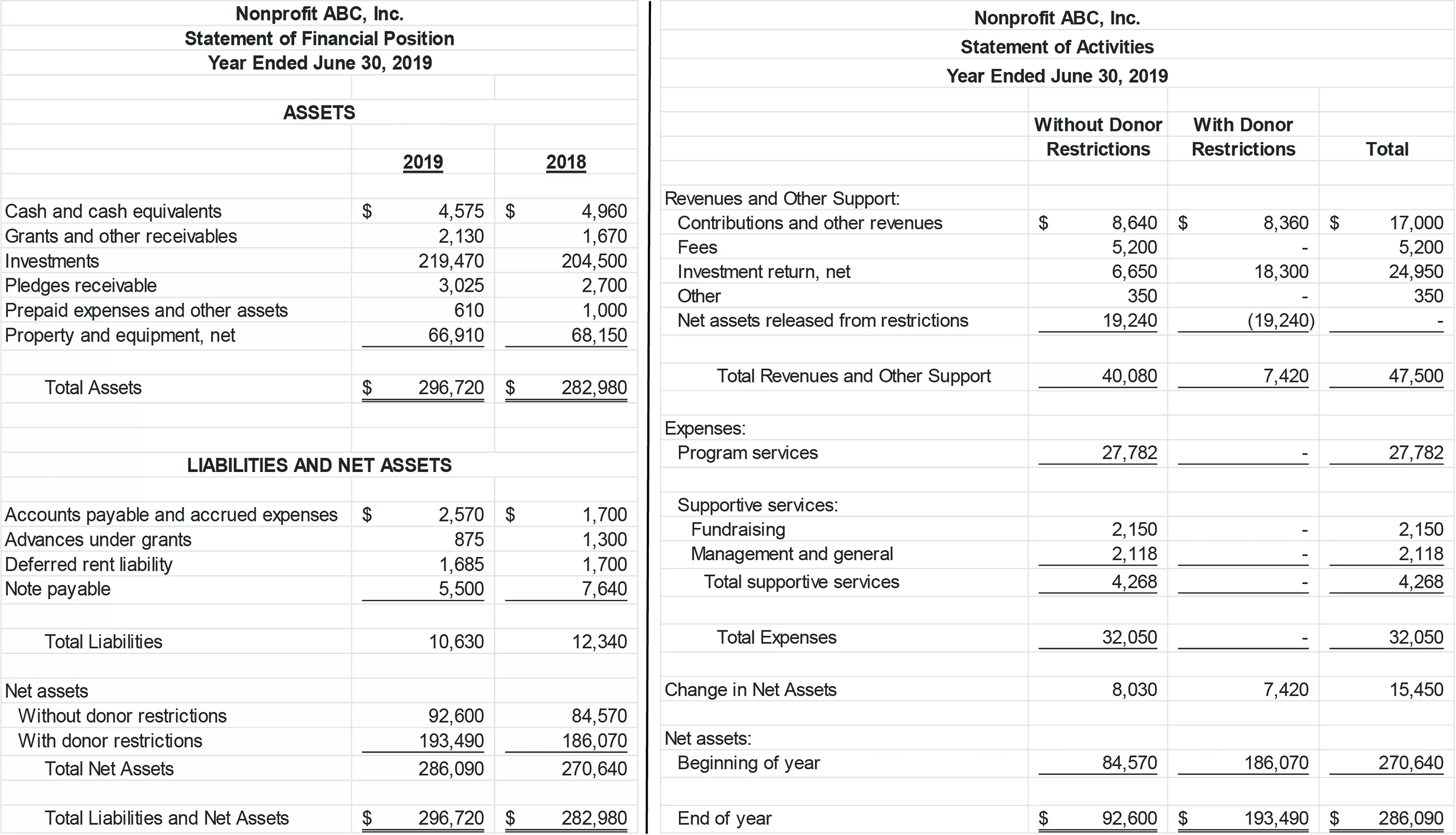

We have audited the consolidated financial statements of [name of the company] and its subsidiaries (the group), which comprise the consolidated statement of financial position as at 31 december 2020, and the consolidated statements of profit or.

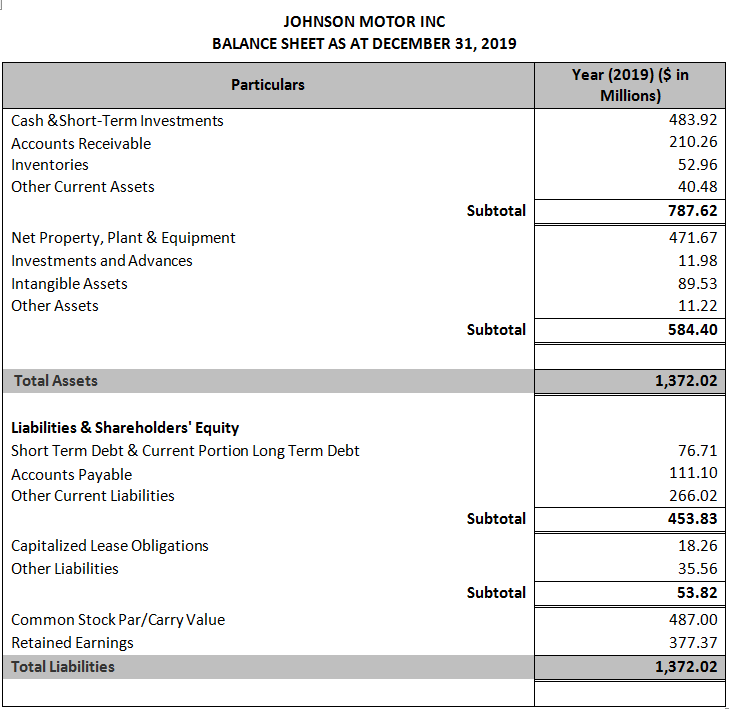

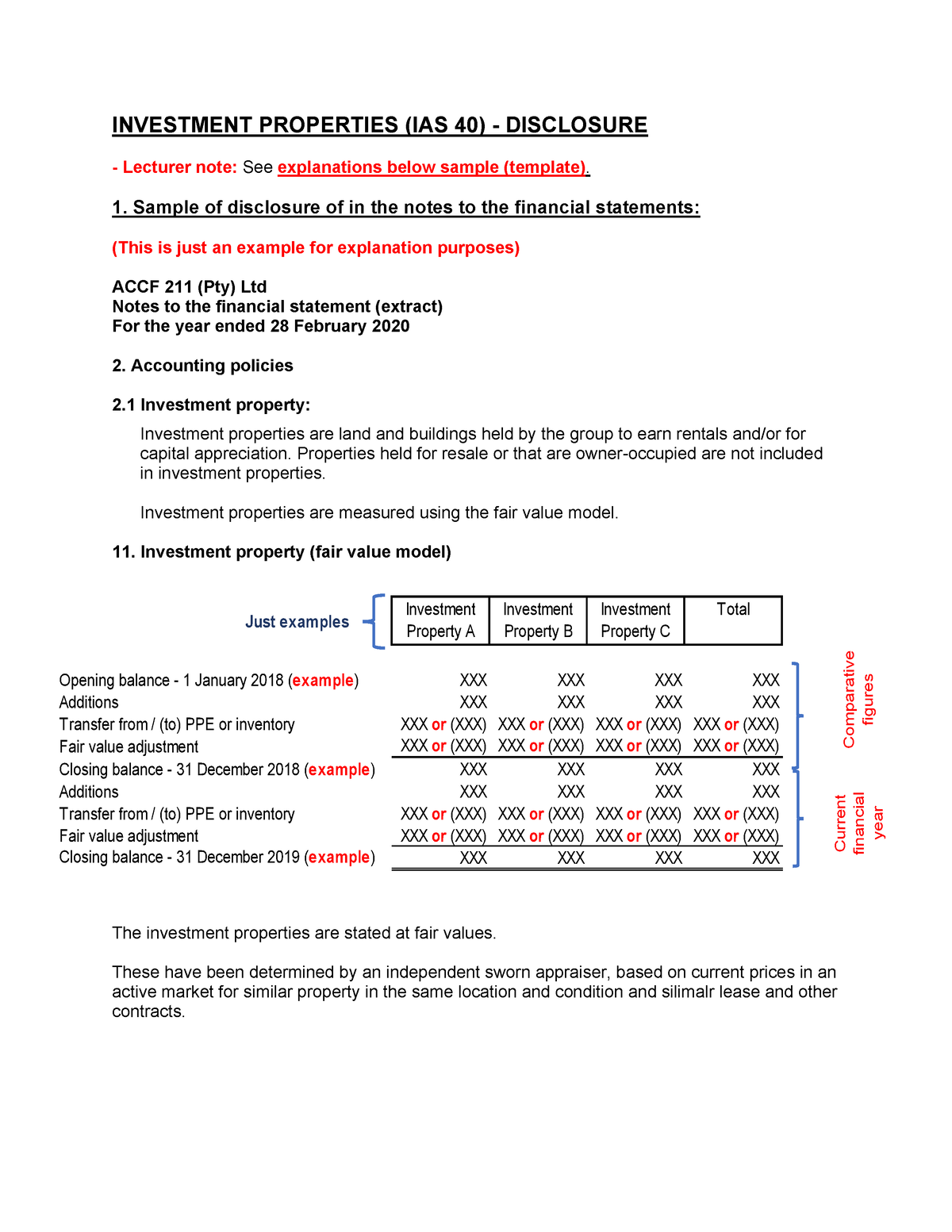

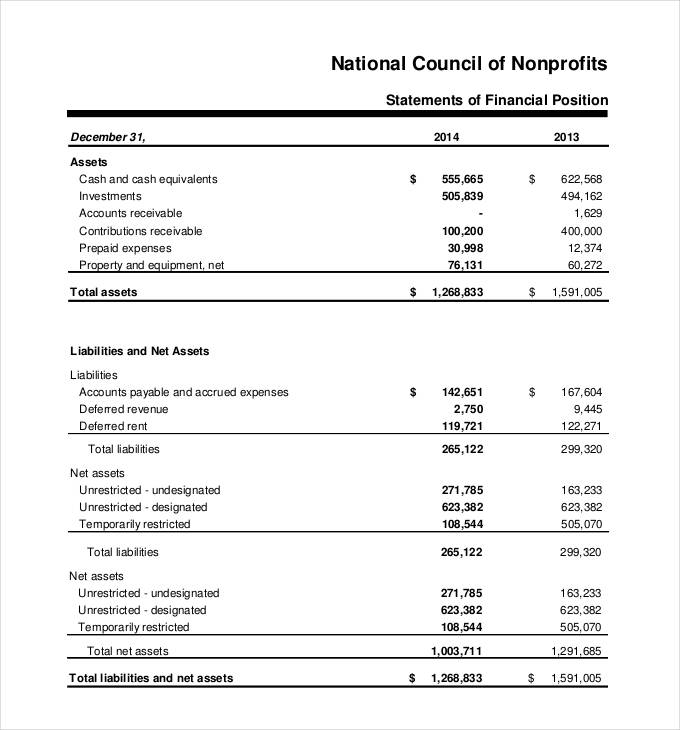

Investment disclosure in financial statements. Cpe webinars & seminars. Ifrs 16 contains both quantitative and qualitative disclosure requirements. These example accounts will assist you in preparing financial statements by illustrating the required disclosure and presentation for uk groups and uk companies reporting under frs 102, 'the financial reporting standard applicable in the uk and republic of ireland'.

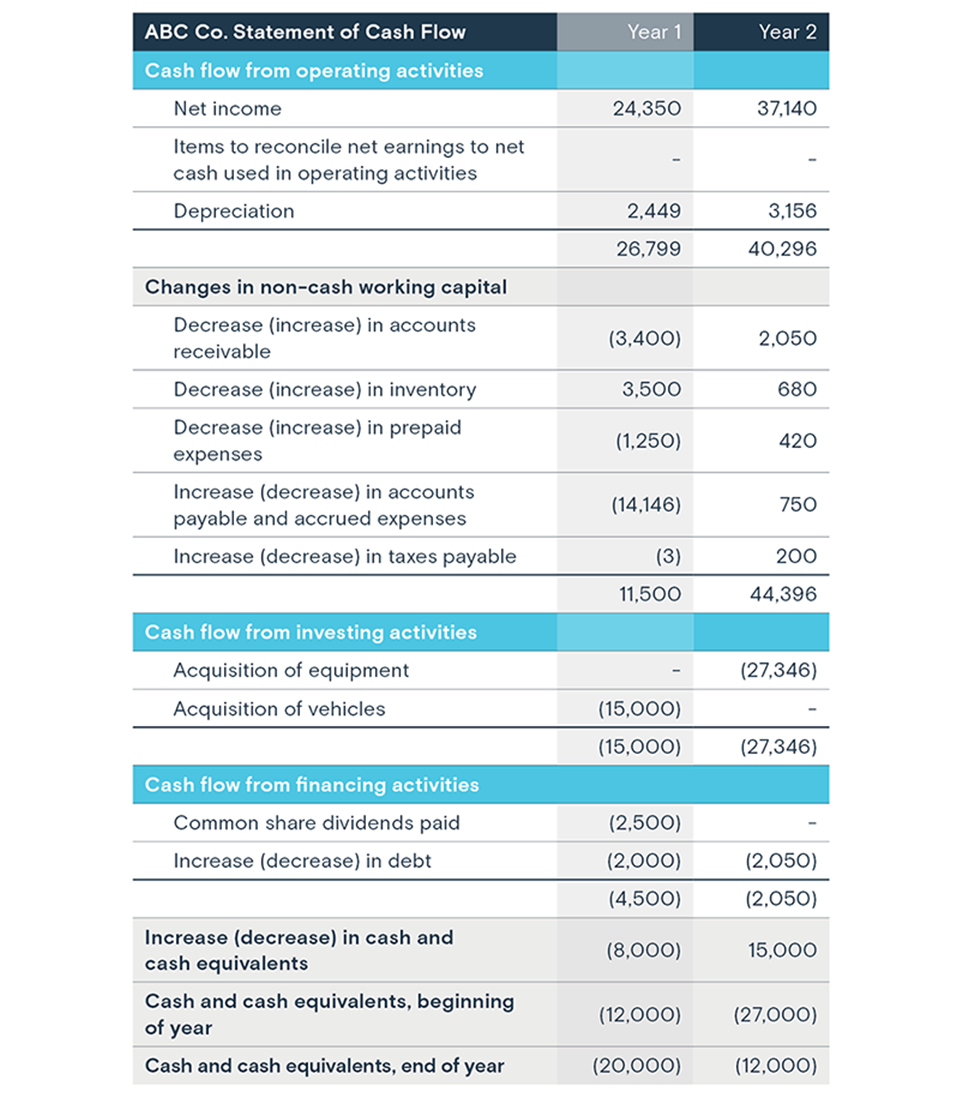

Statements for investment funds or similar financial institutions in accordance with ifrs. Asc 321 provides an example of the formula for calculating the unrealized gains and losses to be disclosed. New disclosures (such as changes in response to the commission’s adoption of new rules) disclosures that influence investment decisions, such as disclosures regarding strategies, risks, fees, and performance.

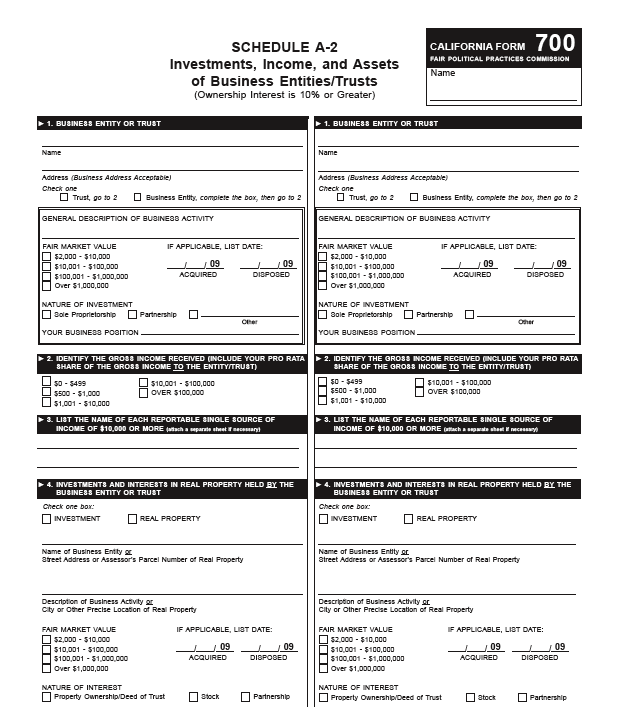

Disclosure checklist, which identifies the disclosures that may be required based on currently effective standards; Ifrs 7 requires disclosure of information about the significance of financial instruments to an entity, and the nature and extent of risks arising from those financial instruments, both in qualitative and quantitative terms. Voluntary) indicates the relevant ias or ifrs encourages, but does notrequire, the disclosure.

These consolidated financial statements also. This disclosure includes equity investments accounted for under the measurement alternative and equity investments that are reported on a fair value basis. Materiality is relevant to the presentation and disclosure of the items in the financial statements.

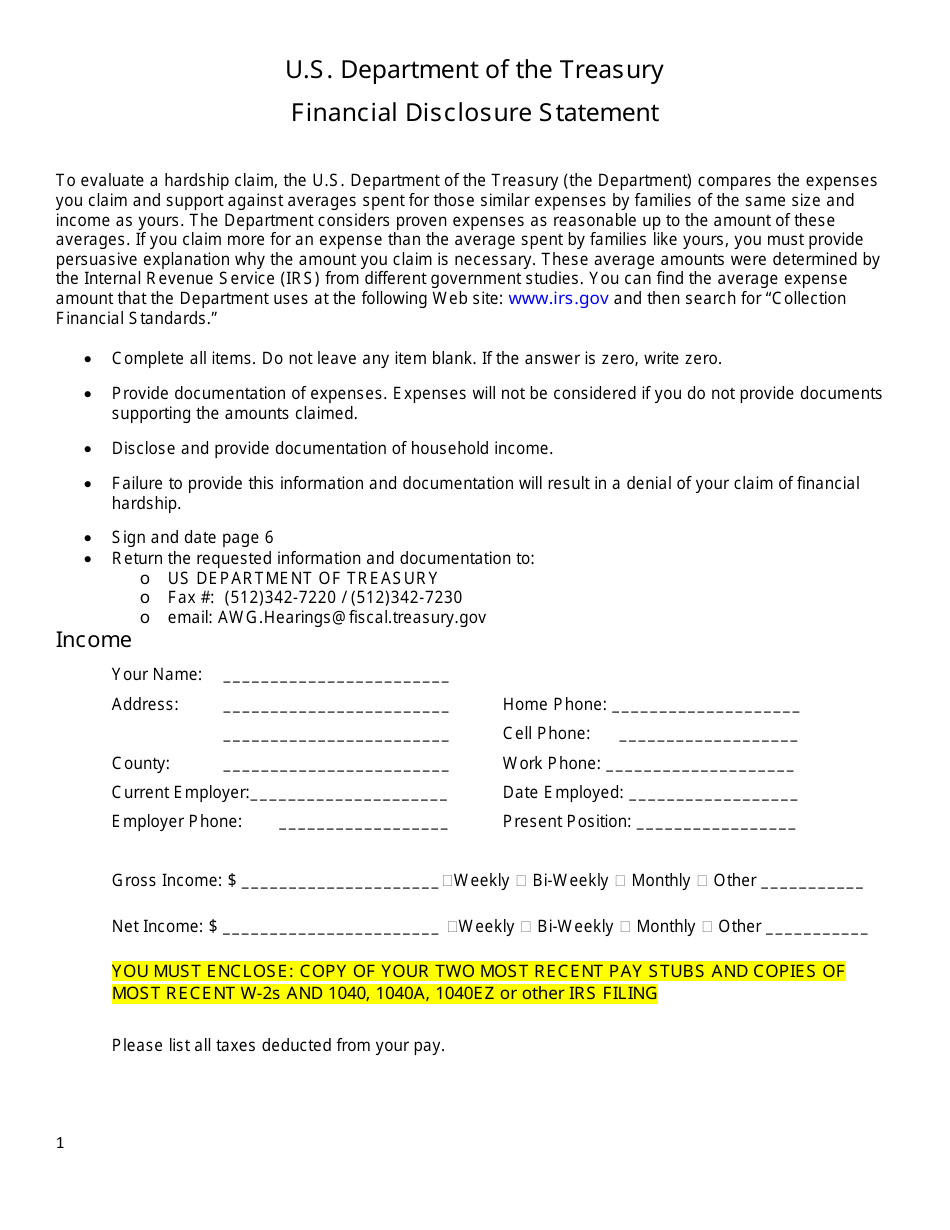

It is intended to help preparers in the preparation and presentation of financial. Financial statements of the fund. Disclosure of accounting policies shall identify and describe the accounting principles followed by the entity and the methods of applying those principles that materially affect the determination of financial position, cash flows, or results of operations.

These illustrative financial statements will assist y ou in preparing financial statements by illustrating the required disclosure and presentation for uk groups and uk companies reporting under frs 102 ‘the financial reporting standard, applicable in In addition, the standards and their interpretation change over time. Investors have been calling for better disclosures in financial statements, but delivering more useful disclosures to them proves to be a consistent challenge for companies.

This publication provides illustrative financial statements for the year ended 31 december 2021. Entities should focus on the disclosure objective, not on a fixed checklist. Ias 27 (as amended in 2011) outlines the accounting and disclosure requirements for 'separate financial statements', which are financial statements prepared by a parent, or an investor in a joint venture or associate, where those investments are accounted for either at cost or in accordance with ias 39/ifrs 9.

Delivering insights to financial reporting professionals. This guide has been prepared to support practitioners in the preparation of their financial statements. In addition, accounting standards and their interpretation change over time.

[insert 6k link] please note the following points: The ordering of notes to the financial statements, how the disclosures should be tailored to reflect the reporting entity’s specific circumstances, and the relevance of disclosures considering the needs of the users. Filings by novel and complex funds.

The objective of the disclosure requirements is to give a basis for users of financial statements to assess the effect that leases have on the financial statements. Hopkins’ personal conduct did not impact exscientia's consolidated financial statements or our internal controls over financial. Our guides to financial statements help you to prepare financial statements in accordance with ifrs accounting standards.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)