Great Info About Law Firm Income Statement

In general, it is intended to provide.

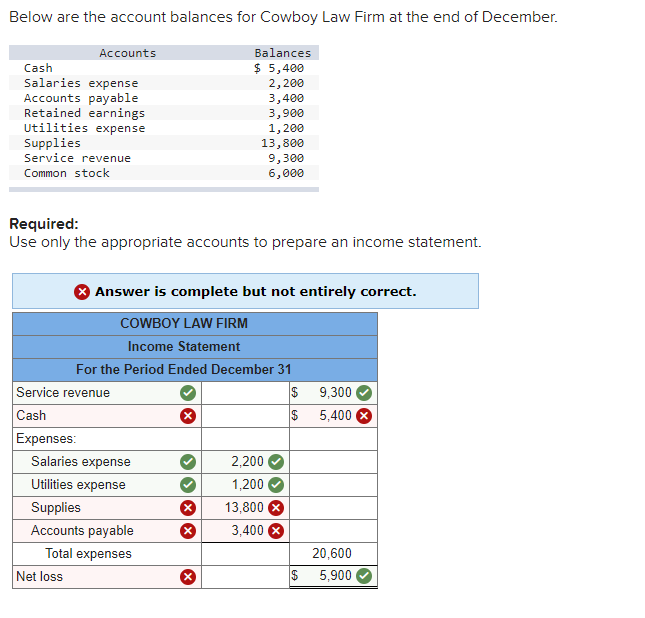

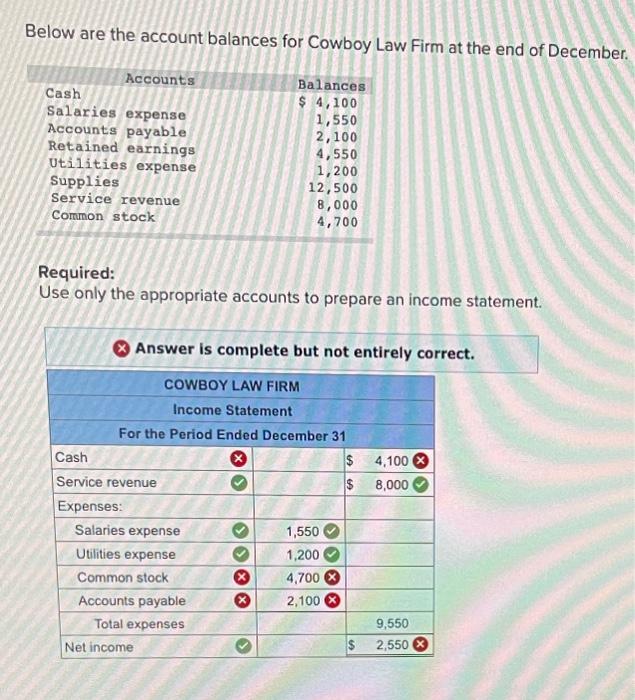

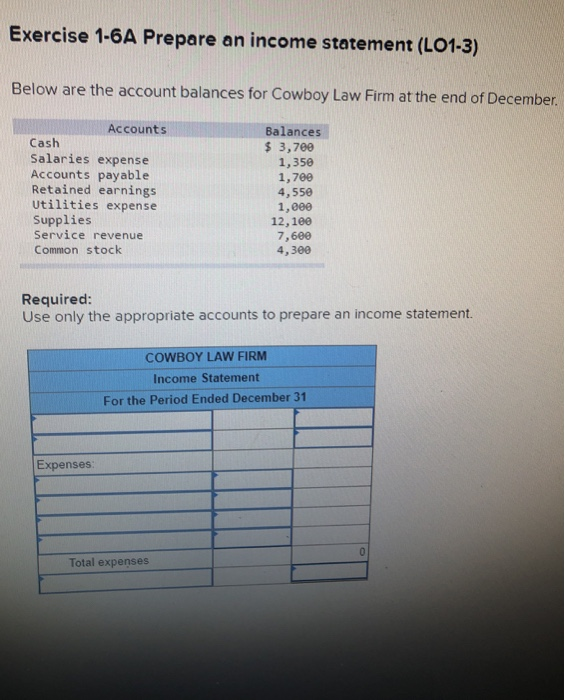

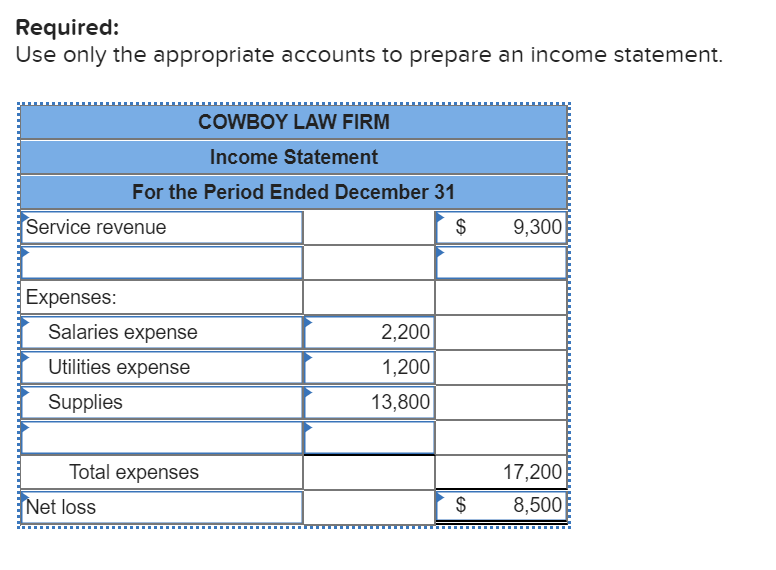

Law firm income statement. This document serves as an income statement or cash flow statement, painting a clear picture of the law firm’s financial position at a specific time. His decision to allow a vote on a labour. The main purpose of these financial reports is to convey details of profitability and financial results of business activities.

Intuit provides a method for benchmarking these metrics against other firms that do the same work you. Here is a summary of what that can look like. Cost of goods sold (cogs) = gross profit less:

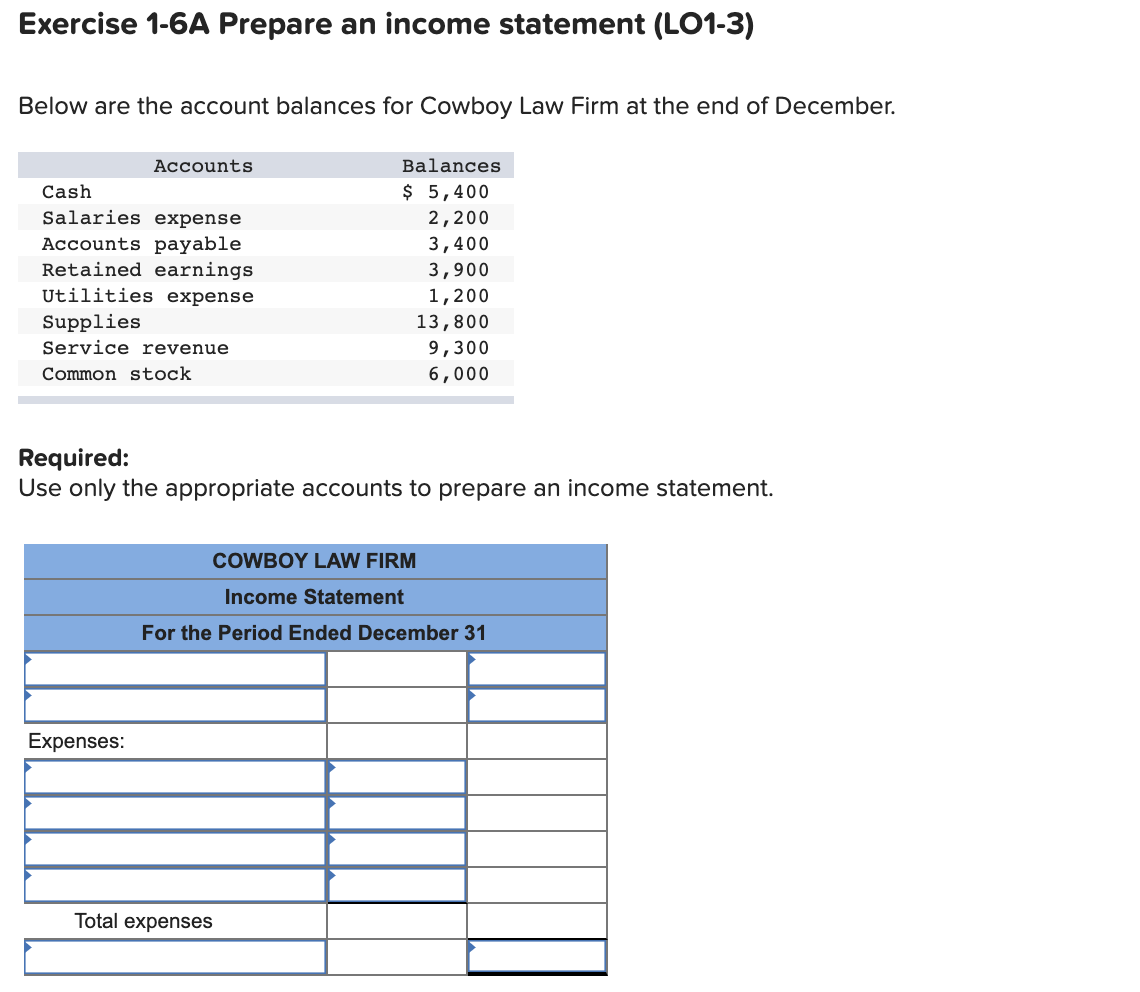

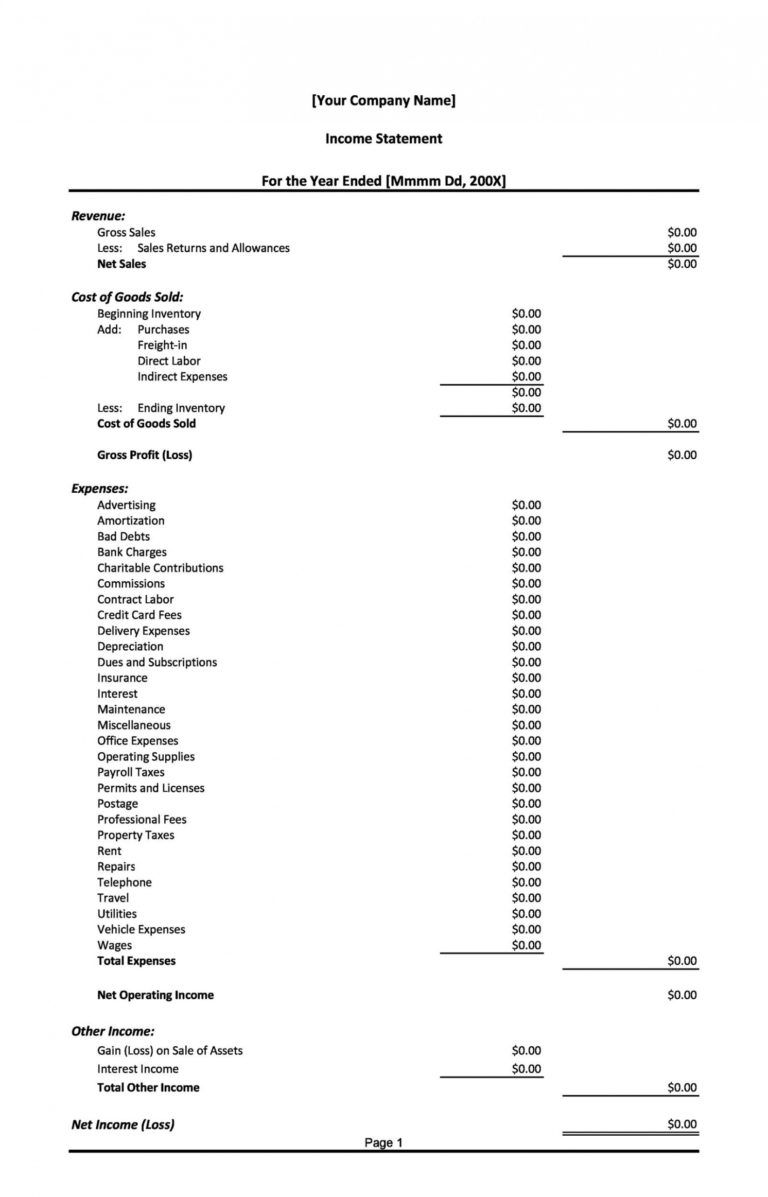

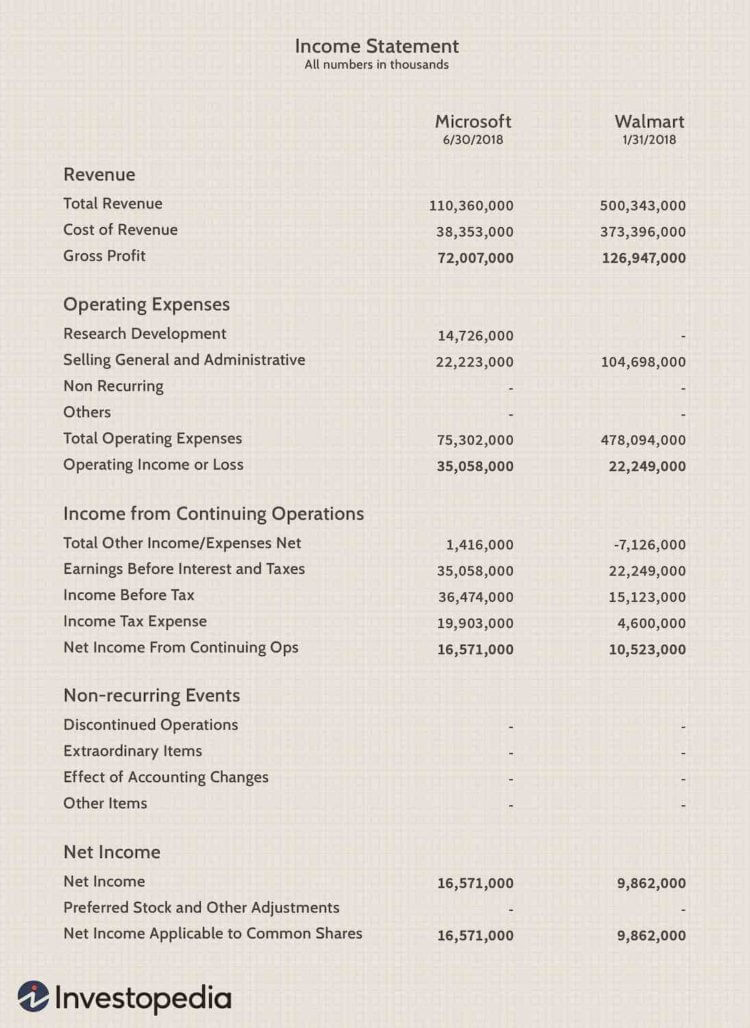

A profit and loss statement (p&l), also known as an income statement, sets out the revenues earned and the expenses paid by a law firm during a specific. The income statement the income statement is important because it shows how profitable your law firm has been during the time period shown in the statement’s. Law firm accounting guidelines to help you do this for your own firm.

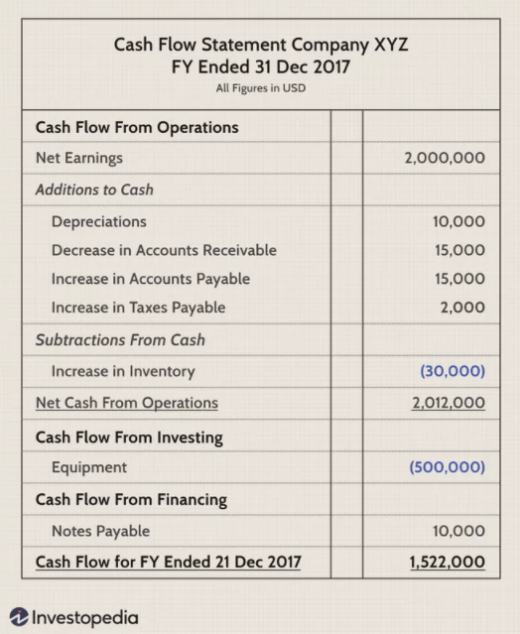

The bottom line, or net. In a nutshell you need to make sure that the cash you have on hand and what is coming in are going to exceed what is going out. The income statement shows your firm's aggregate revenues and expenses over a specified timeframe.

Together, these statements show how your law. No matter how much money you have, what practice area you’re in, or how long you’ve spent practicing, you’ll need a budget to help your law firm succeed. The income statement includes revenues and expenses, including the money you’ve earned and most anything you’ve spent, from office supplies to payroll.

As the name implies, a. The legal industry saw profitability resume its growth in 2023, with law firms increasing average revenues by 6.1% in the last year, outpacing expense growth of. And for law firms, there's a specific percentage you want to guide your firm.

A p&l statement, also called an income statement, is a record of income and expenses that reports the law firm's net profit or loss for a specific reporting period. The income statement measures a law firm’s performance over a specific period and presents information about revenues, expenses. Insist on clarity in financial statements.

The income statement report offers a detailed analysis of your law firm’s financial activities, allowing you to pinpoint specific areas. The statement of cash flows, sometimes alternatively referred to as the cash flow statement, shows law firms where the cash is coming in and where it’s going. Without further ado, here’s a brief explanation of the most common financial statements your firm should use.

Precise financial analysis: Most law firms report on a cash basis, and therefore, the revenue shows what has. A basic income statement typically contains the following line items:

Commons speaker sir lindsay hoyle is under pressure this morning over his handling of the snp's motion for a ceasefire in gaza. A profit and loss statement displays a company's income and expenses for a specific time period, typically a month, quarter, or fiscal year. Your income statement displays revenue, expenses and a profit or loss.