Amazing Tips About Adjustment In Financial Statements

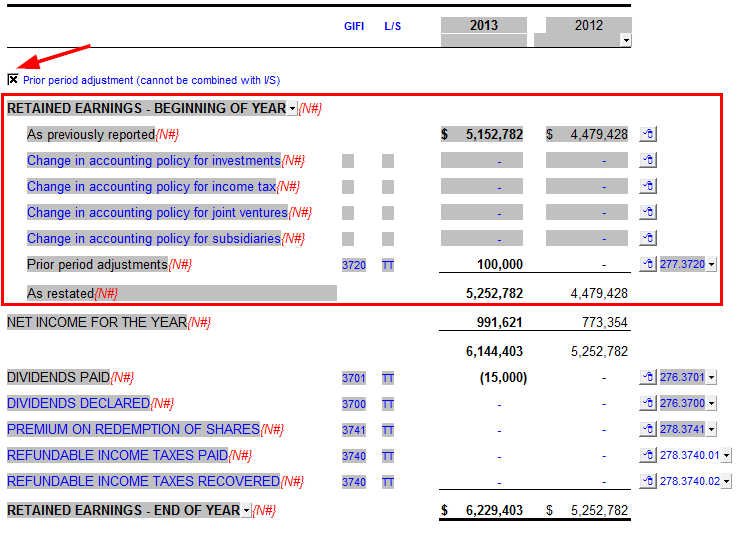

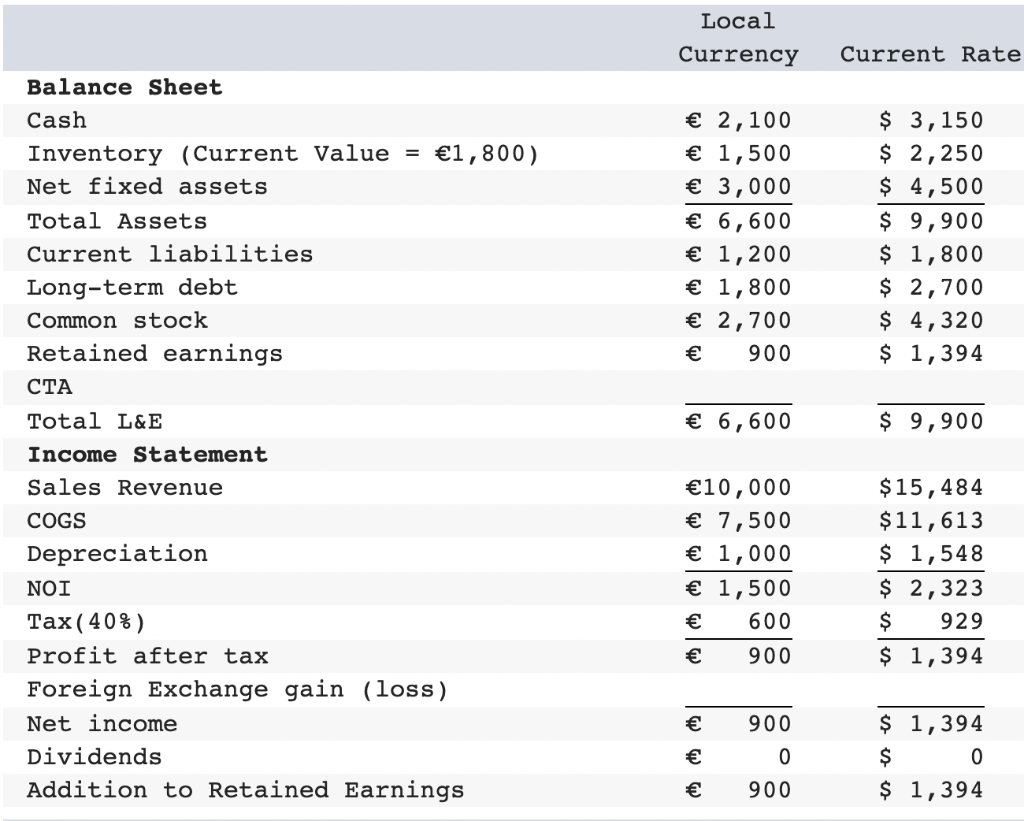

The adjustments total of $2,415 balances in the debit and credit columns.

Adjustment in financial statements. One important accounting principle to remember is that just. To get the numbers in these. Adjustments to financial statements inventory.

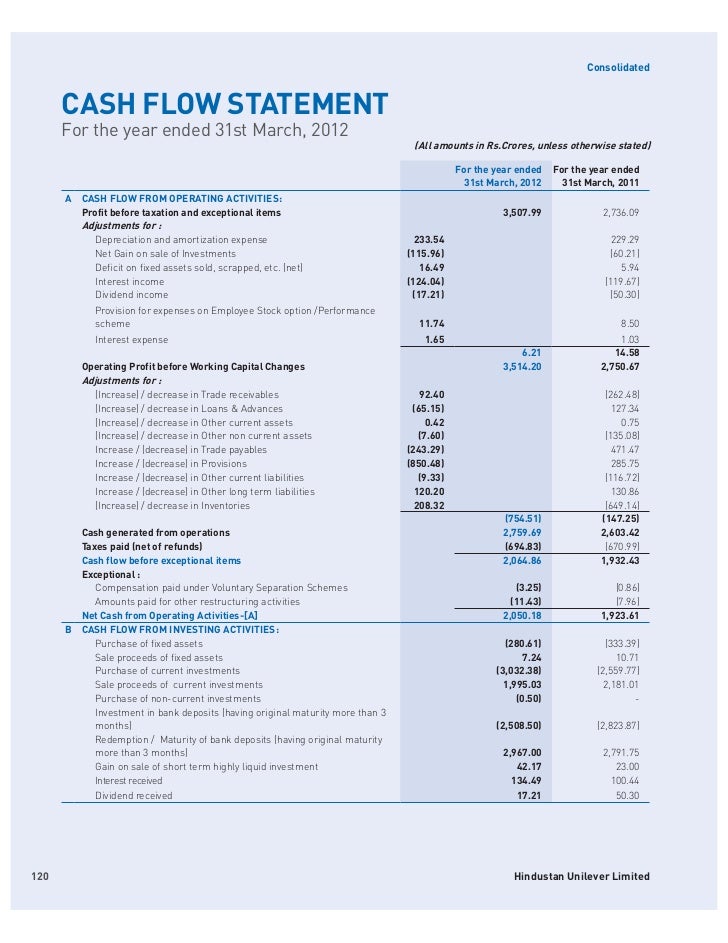

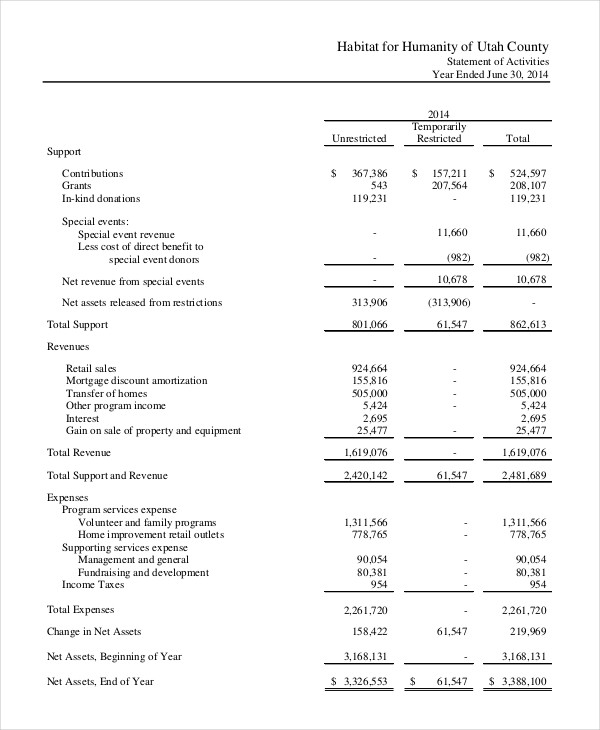

Types of adjusting journal entries 1. Analysts frequently make adjustments to a company’s reported financial statements when comparing those statements to those of another company that uses. Record and post the common types of adjusting entries;

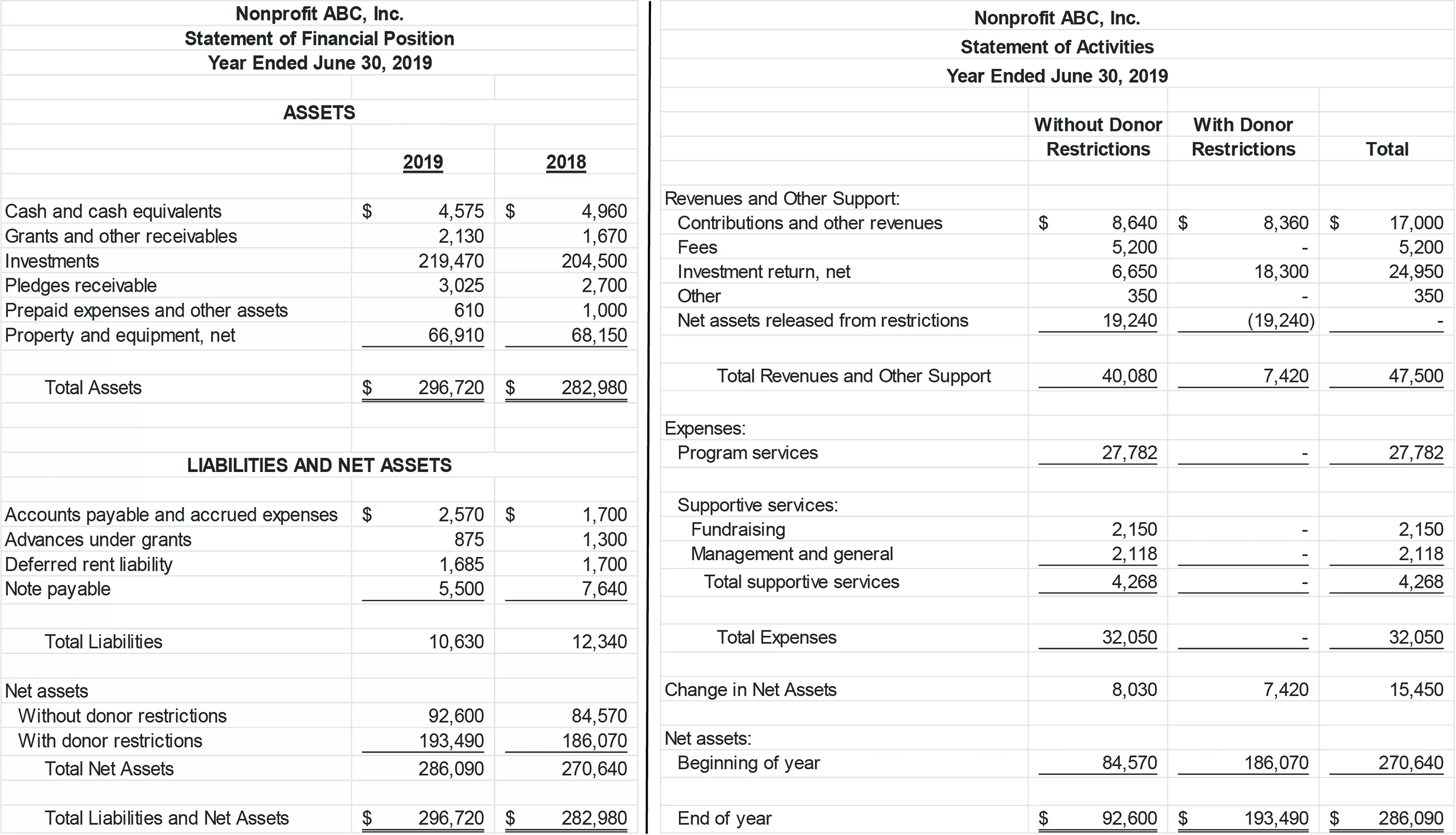

In this publication, we provide an. Adjusting entries update accounting records at the end of a period for any transactions that have not yet been recorded. Adjustments in financial statement:

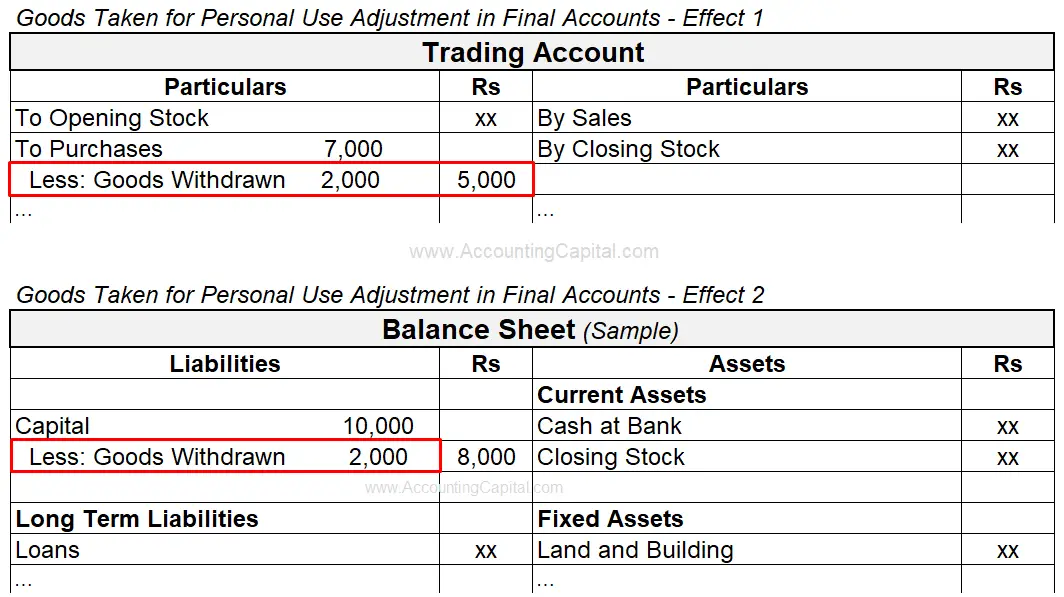

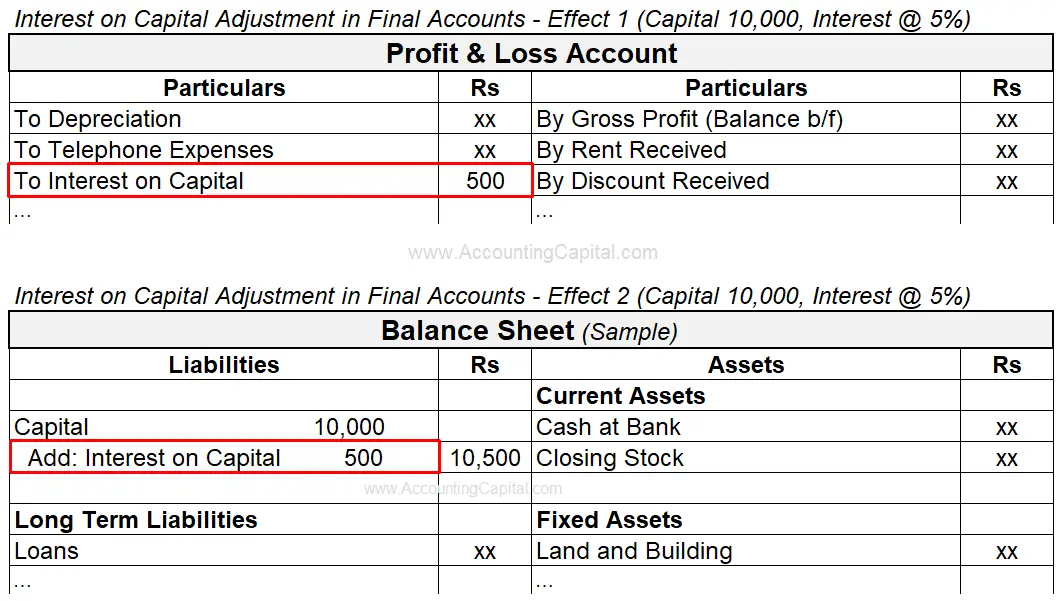

An adjustment to two figures are now needed. A prior period adjustment is used to adjust financial statements from a previous accounting period to reflect changes or corrections that were not recorded in. To know the correct net profit or net loss of the business for an accounting year.

Accounting adjustments are required because of the following purposes: Adjustments for accounting changes and error correction for financial statements to be useful, they must apply accounting policies consistently and must be comparable. The main objective of preparing a financial statement is to know about the financial position of a company and find out the.

Accounting changes and errors in previously filed financial statements can affect the comparability of financial statements. Discuss the adjustment process and illustrate common types of adjusting entries; The process to ensure that all accounts are reported accurately at the end of the period is called the adjusting process.

Adjustments in final accounts refer to changes made to certain financial entries at the end of an accounting period. These adjustments are crucial for presenting a true and fair view. Every adjusting entry will have at least one income statement account and one balance sheet account.

Bad debts appear as an adjustment outside the trial balance. The cost of sales consists of opening inventory plus purchases, minus. Get nature and significance of.

This is a very common adjustment. The statement of profit or loss must include the expenses relating to the period, whether. At the end of an.

The next step is to record information in the adjusted trial balance columns. The amount goes into the statement of profit or loss as an expense (it. Financial statement with adjustment with.