Sensational Tips About Financial Statement Ifrs

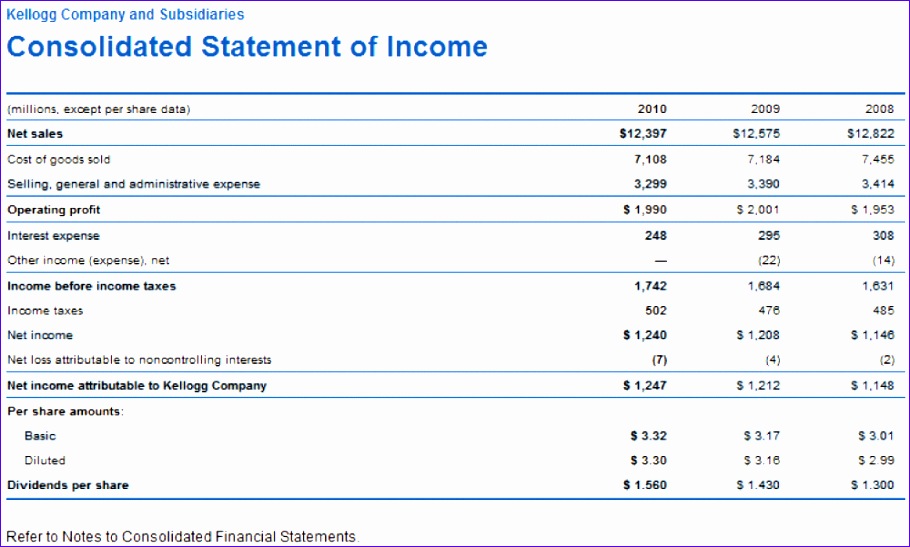

Ifrs 10 establishes principles for presenting and preparing consolidated financial statements when an entity controls one or more other entities.

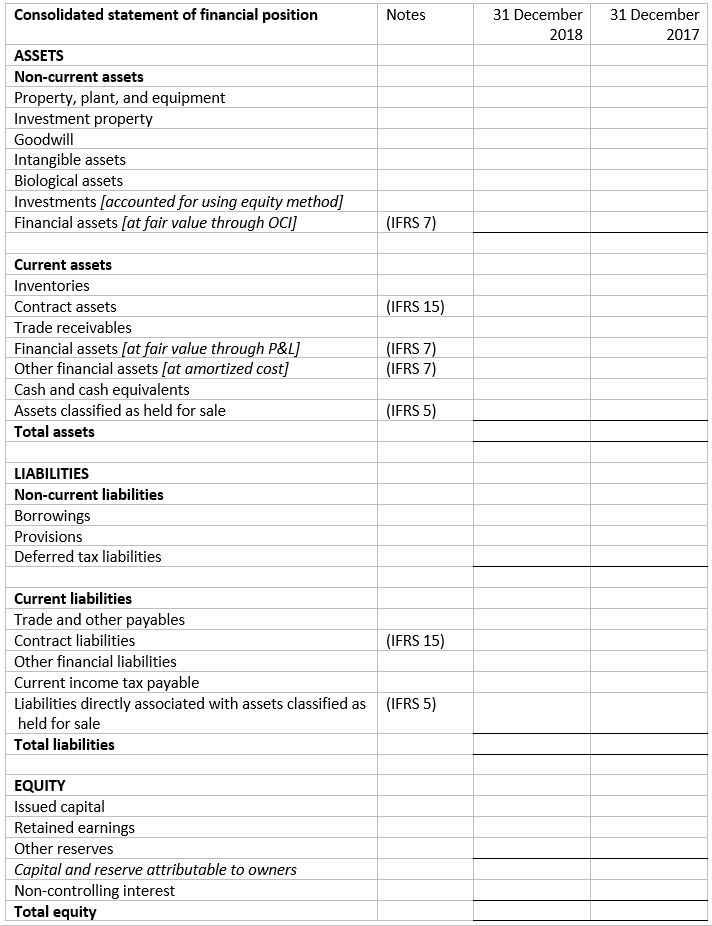

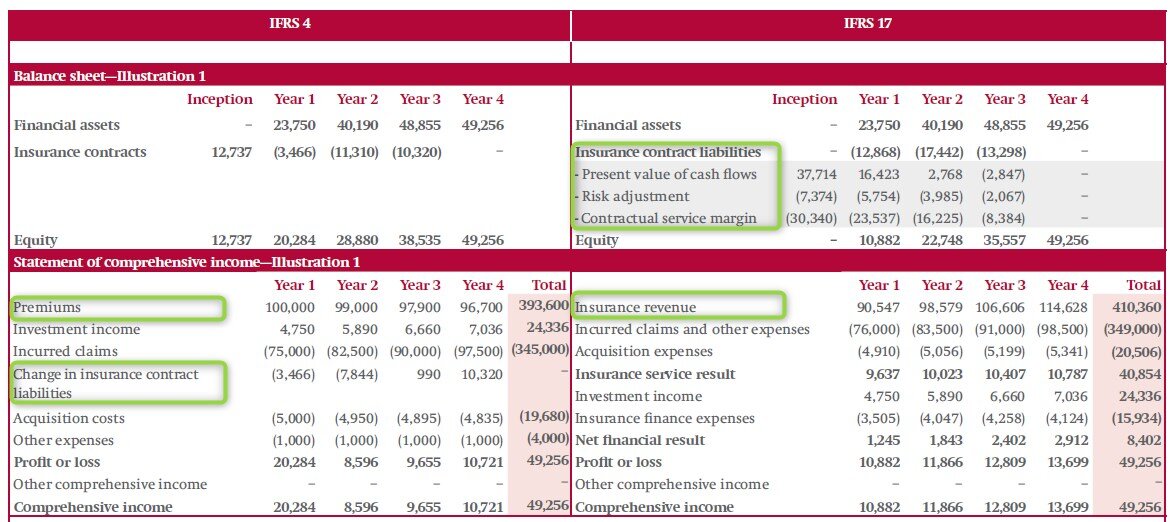

Financial statement ifrs. Consolidated financial statements in april 2001 the international accounting standards board (board) adopted ias 27 consolidated financial statements and accounting for investments in subsidiaries, which had originally been issued by the international accounting standards committee in april 1989. This standard prescribes the basis for presentation of general purpose financial statements to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities. Such disposals include the outright sale for cash, the distribution of marketable equity securities to investors following the successful public offering of the investees’ securities and the disposal of investments to the public or other.

Limited partnership has plans to dispose of its interests in each of its investees during the 10‑year stated life of the partnership. Control requires exposure or rights to variable returns and the ability to affect those returns through power over an investee. The model financial statements of international gaap holdings limited for the year ended 31 december 2021 are intended to illustrate the presentation and disclosure requirements of ifrs standards without the use of any actual numbers.

Ias 27 prescribes the accounting and disclosure requirements for investments in subsidiaries, joint ventures and associates when an entity elects, or is required by local regulations, to present separate financial statements. Ifrs 10 outlines the requirements for the preparation and presentation of consolidated financial statements, requiring entities to consolidate entities it controls. Superseded by ifrs 11 and ifrs 12 effective 1 january 2013.

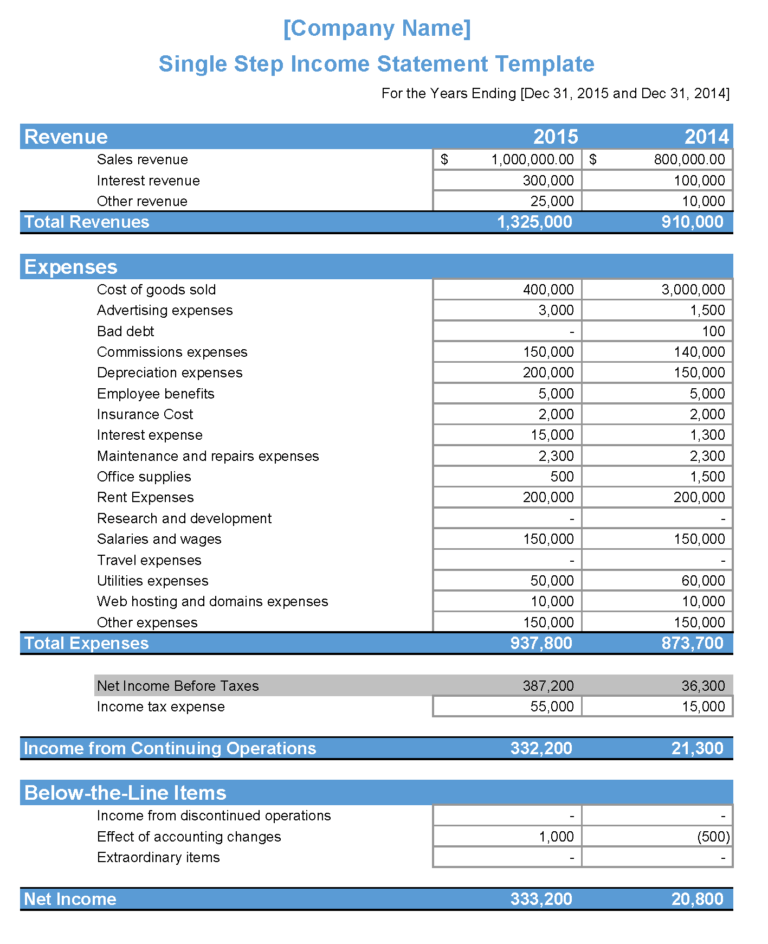

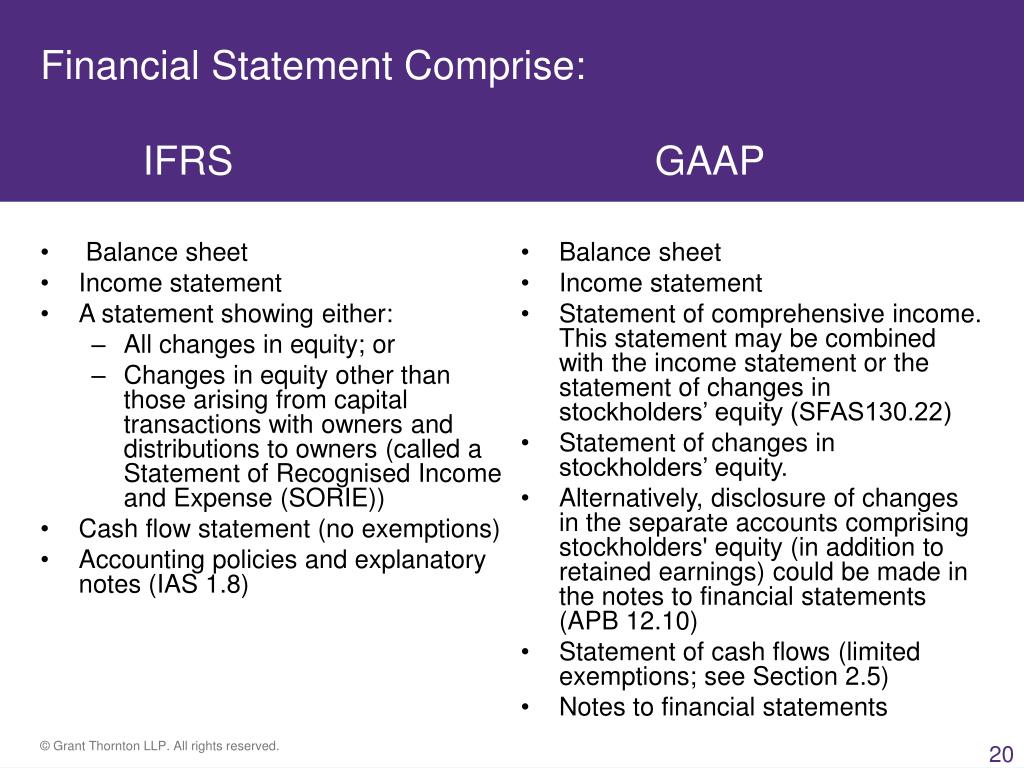

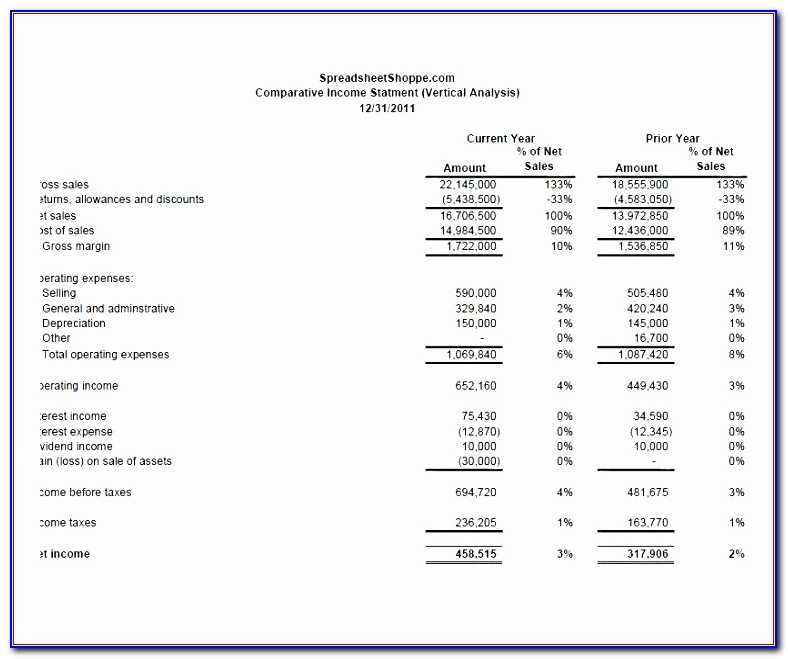

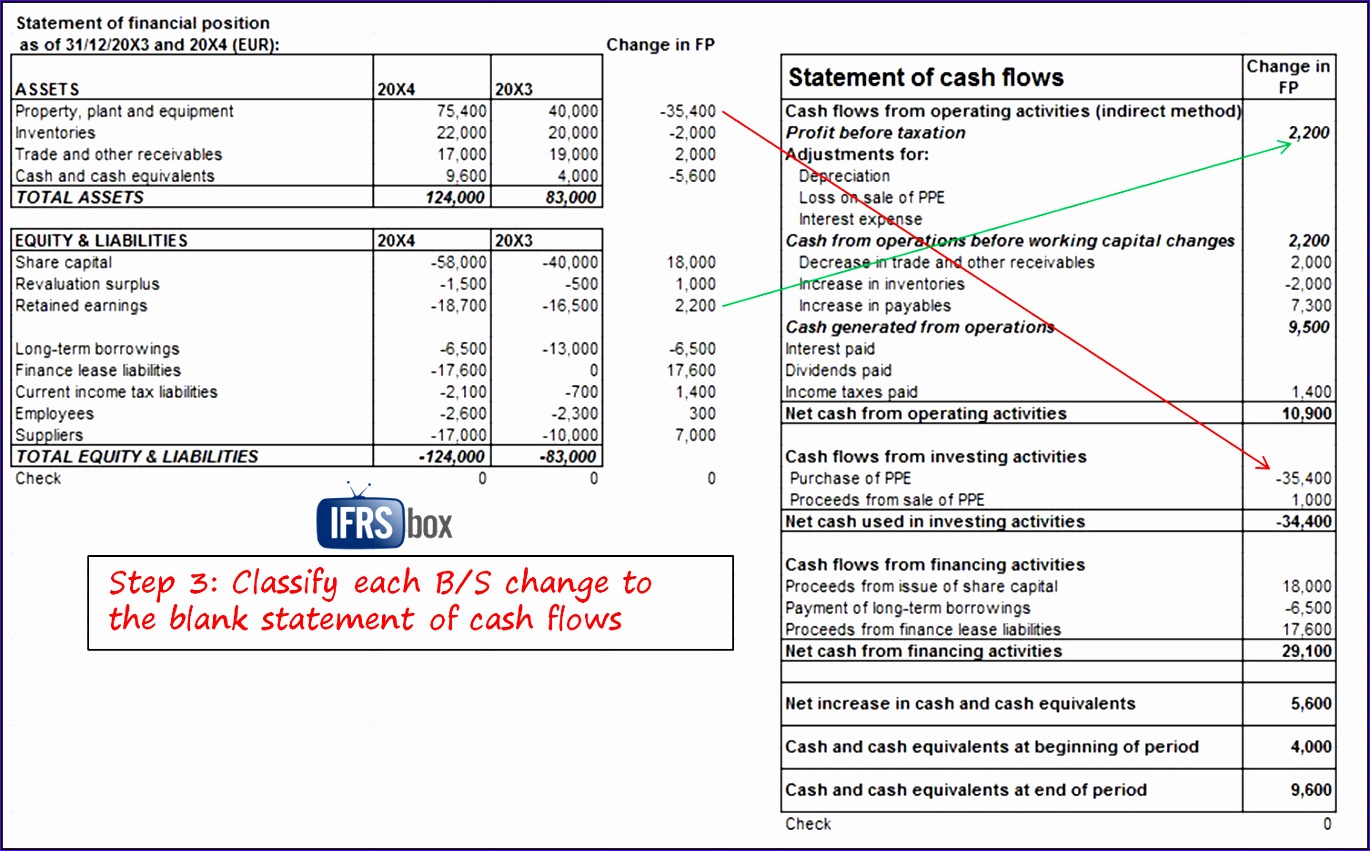

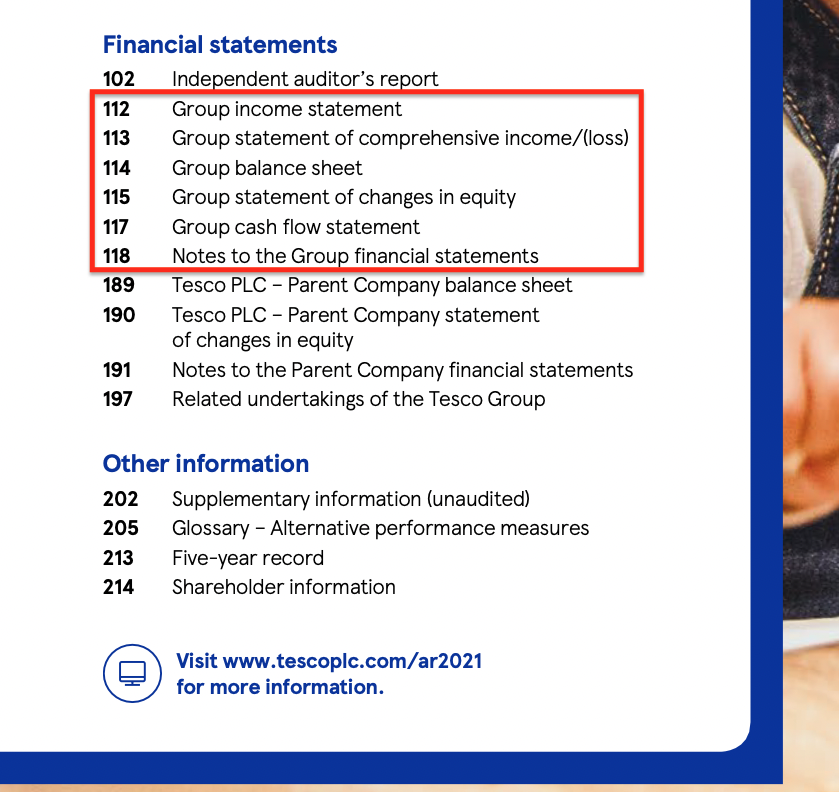

Disclosures in the financial statements of banks and similar financial institutions. Ifrs financial statements consist of: The illustrative financial statements of international gaap holdings limited for the year ended 31 december 2023 are intended to illustrate the presentation and disclosure requirements of ifrs accounting standards without the use of any actual numbers.

This guide is part of our suite of guides to financial statements and specifically focuses on compliance with ifrs standards. The ifrs grants limited exemptions from the general requirement to comply with each ifrs effective at the end of its first ifrs reporting period. Requires an entity (the parent) that controls one or more other entities (subsidiaries) to present consolidated financial statements;

Our guides to financial statements help you to prepare financial statements in accordance with ifrs accounting standards. International accounting standard 1 presentation of financial statements. Entities identify the potential financial statement impacts for their business.

Presentation of financial statements. They also contain additional disclosures that are considered to be best. Except for the oecd pillar two amendments, there were no changes to the financial reporting requirements this year that affected the disclosures in our illustrative financial statements.

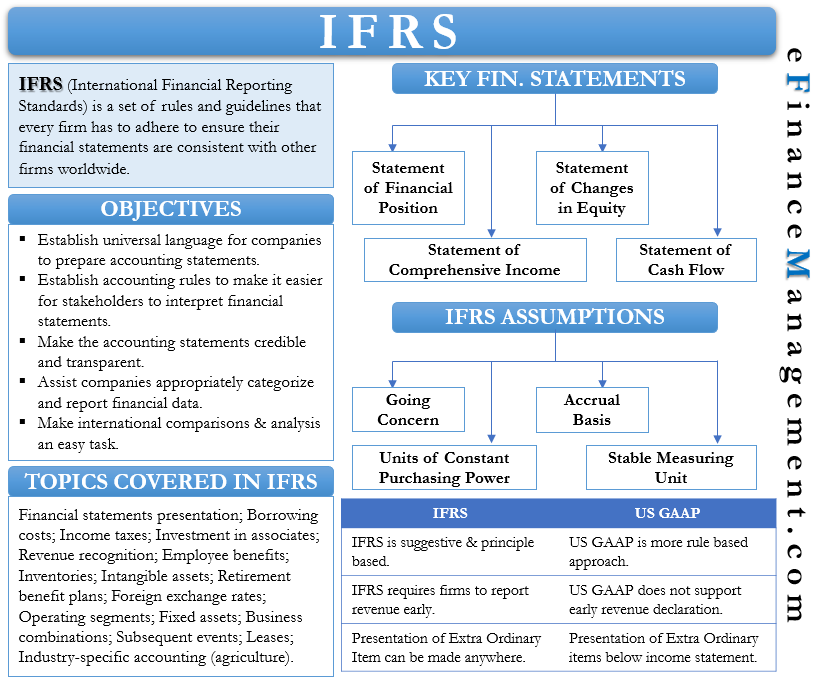

I am ifrs, a globally accepted accounting standard for public company financial statements, aiming to ensure consistency, transparency, and comparability worldwide. International financial reporting standards (ifrs) are a set of accounting rules for the financial statements of public companies that are intended to make them consistent, transparent, and. A statement of financial position (balance sheet) a statement of comprehensive income.

Ifrs accounting standards are, in effect, a global accounting language—companies in more than 140 jurisdictions are required to use them when reporting on their financial health. With this second survey, efrag invites users of financial statements to provide their views on the usefulness of information as a result of the. Ebit excluding certain items which do not reflect the corporations core performance or where their separate presentation will assist users of the consolidated financial statements in understanding the corporation’s results for the period.

Links to summaries, analysis, history and resources for international financial reporting standards (ifrs) issued by the international accounting standards board (iasb). This may be presented as a single statement or with a separate statement of profit and loss and a statement of other comprehensive income; Disclosure of immaterial items can obscure material information.