Best Tips About Warranty Liabilities On Balance Sheet

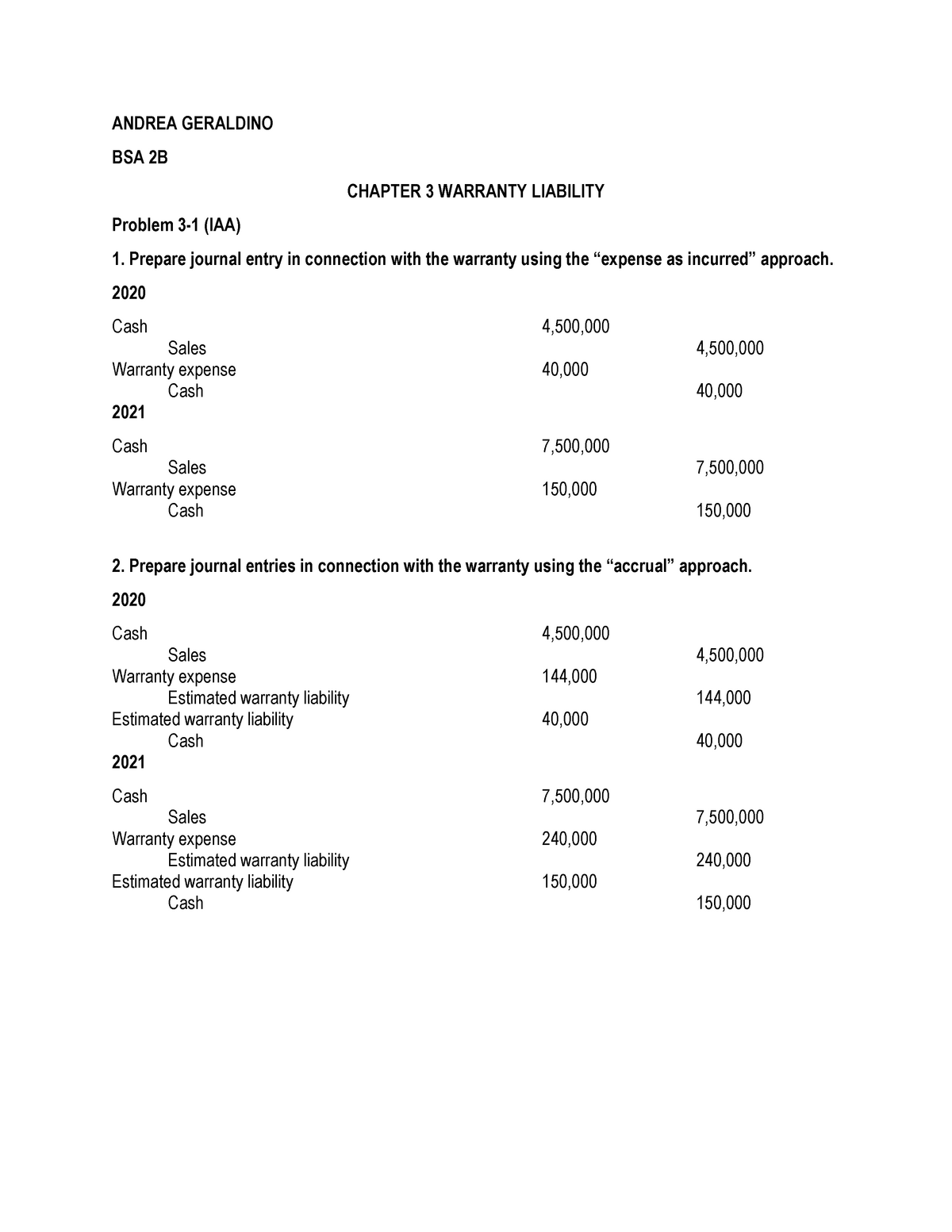

A warranty liability is a liability account in which a company records the amount of the repair or replacement cost that it expects to incur for products already shipped or services already provided.

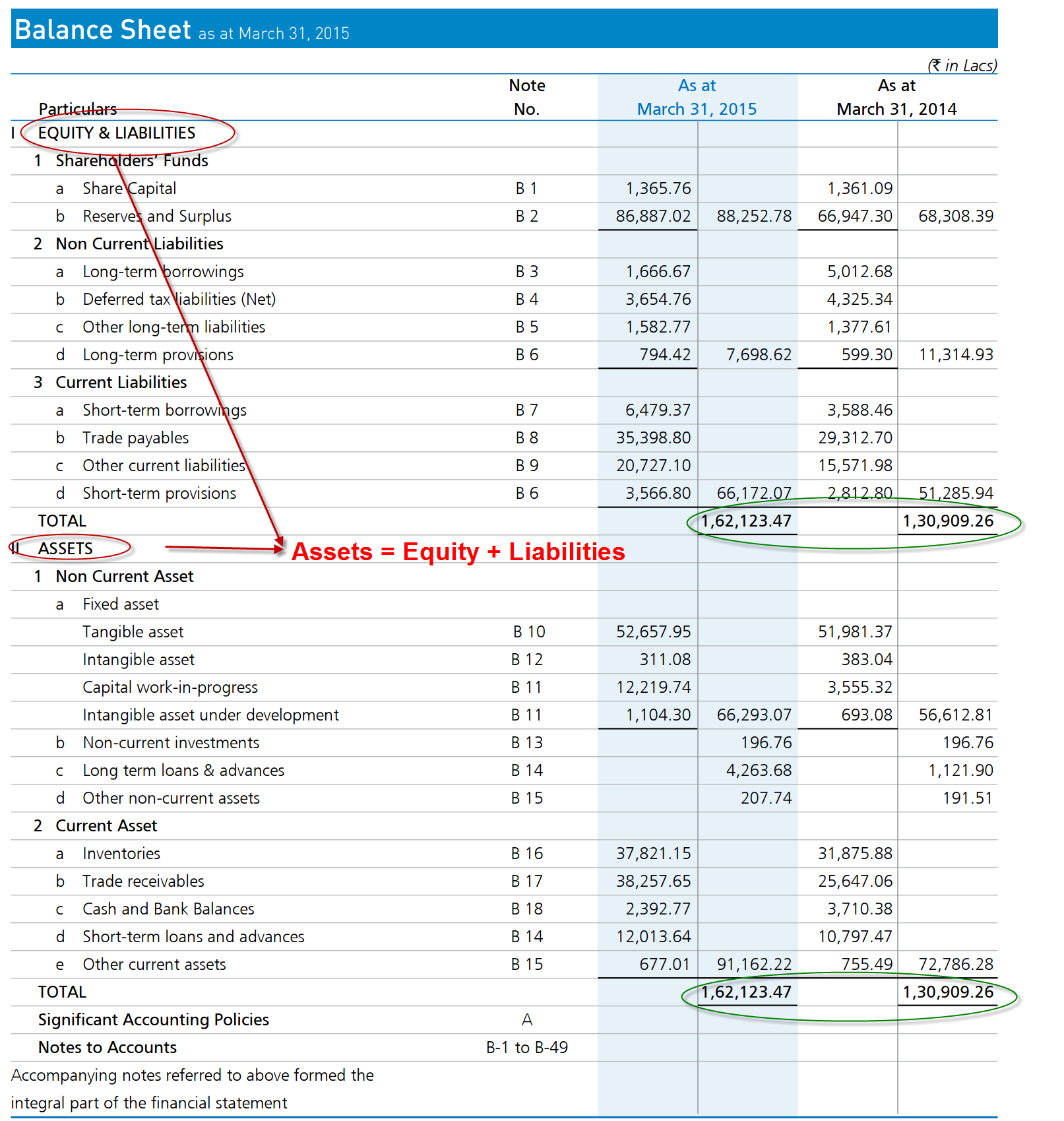

Warranty liabilities on balance sheet. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Current liabilities are a company's obligations that will come due within one year of the balance sheet's date and will require the use of a current asset or create. They are also known as current.

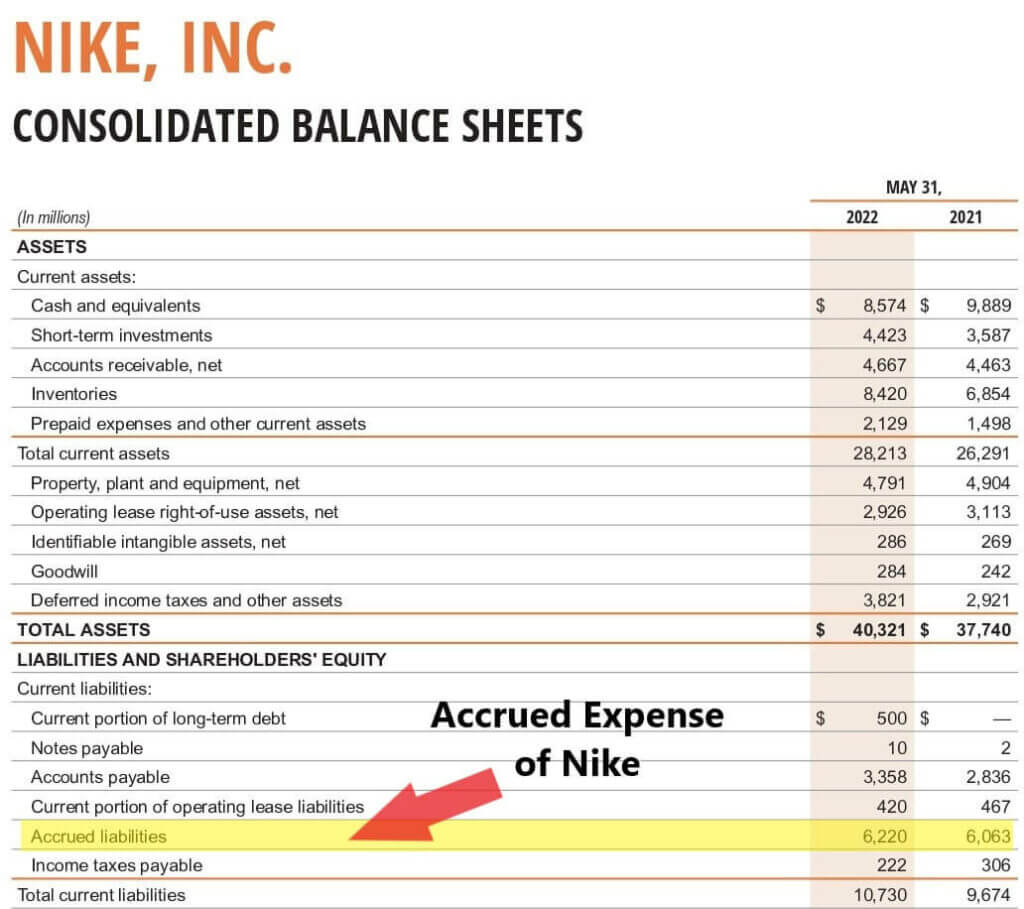

Liabilities is one of the five main types of accounts in accounting and bookkeeping. That expected cost is recorded as a liability on its balance sheet and as an expense on its income statement. Warranty liability definition a liability account that reports the estimated amount that a company will have to spend to repair or replace a product during its warranty period.

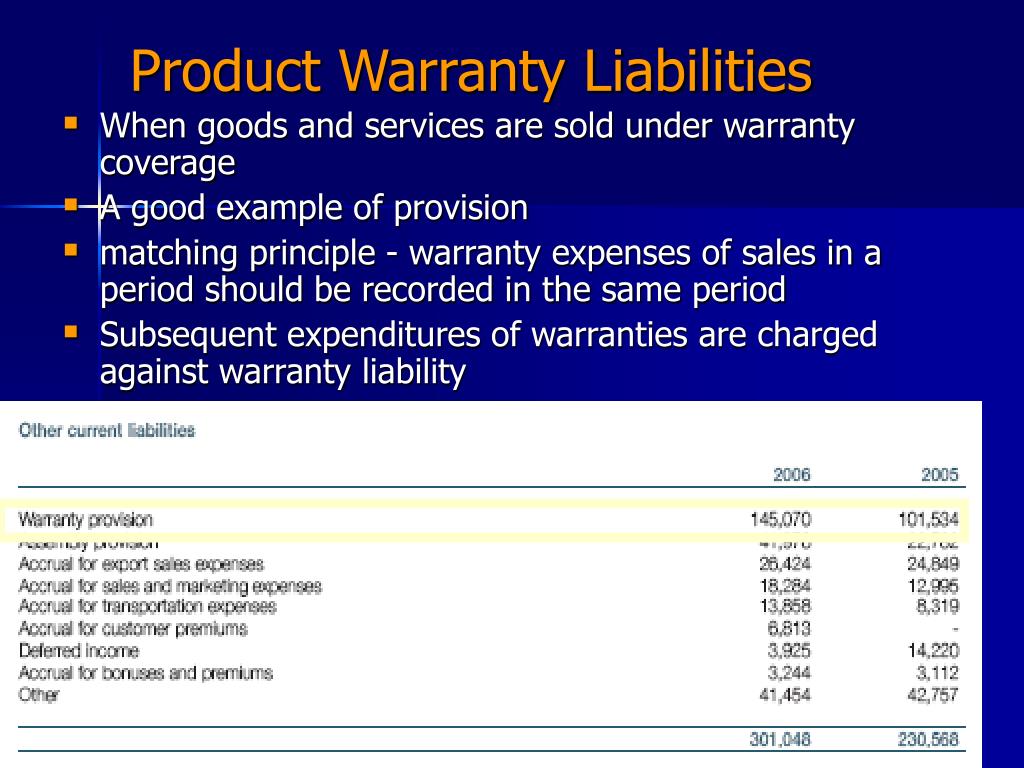

As an example, general electric reported on its december 31, 2008, balance sheet a liability for product. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. The likelihood that claims will result from the warranty;

Warranties will create a liability account when the costs are probable and if the cost of. Here we look at its definition, classification, and the liabilities recorded on the balance sheet, along with practical. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, bonds, warranties, and accrued.

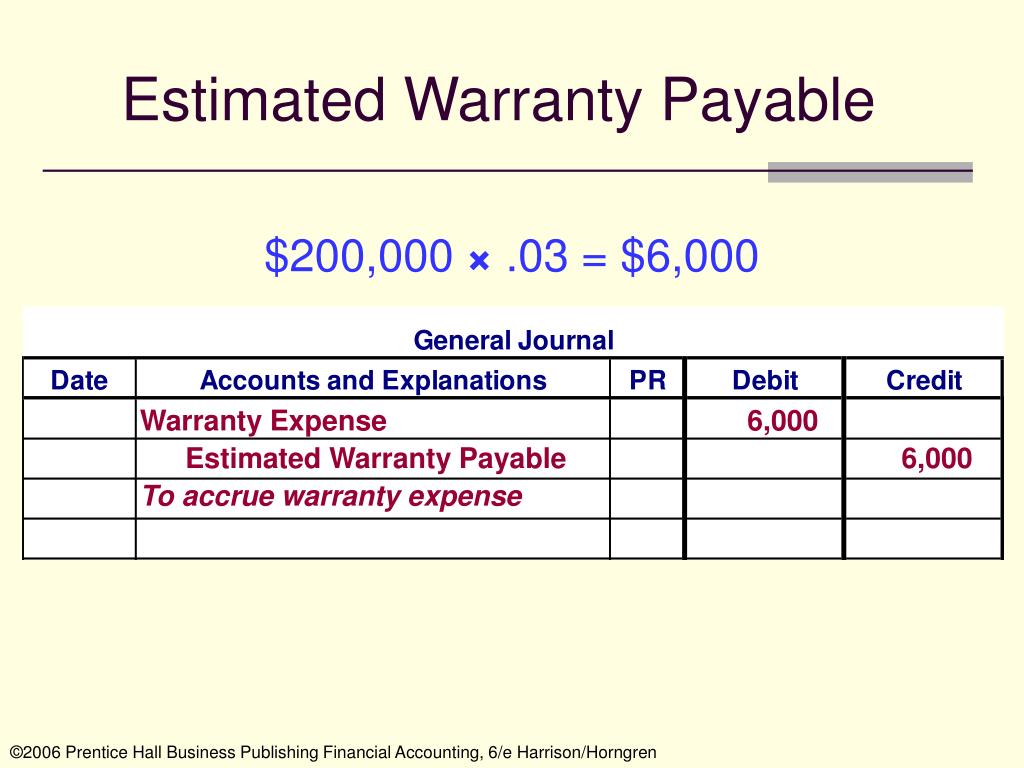

As you’ve learned, not only are warranty expense and warranty liability journalized, but they are also recognized on the income statement and balance sheet. This can be a significant liability for more. Units sold, the percentage that will be replaced within the warranty period, and the cost of replacement.

What are liabilities? It can also be referred to as a statement of net worth. Warranty liability is the type of contingent liability that the company usually needs to record and disclose as this liability is usually probable and can be reasonably estimated.

In this journal entry, warranty expense is recorded as an expense item on the income statement while warranty liability is an obligation that the company owes to the. The likelihood that claims will result from the warranty; Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

The main use of warranty liability is in a company's accounts, specifically its balance sheet. As fixed assets age, they begin to lose their value. What is a warranty liability and when should it be recorded in the financial statements?

It is an attempt to take account of the fact that a company may incur. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity. As an example, stanley black and decker reported on its december 31, 2022, balance sheet a liability.

This has been a guide to types of balance sheet liabilities. As an example, general electric reported on its december 31, 2008, balance sheet a liability for product. To record the warranty expense, we need to know three things:

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)

/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)