Awesome Info About Adverse Opinion Audit Report

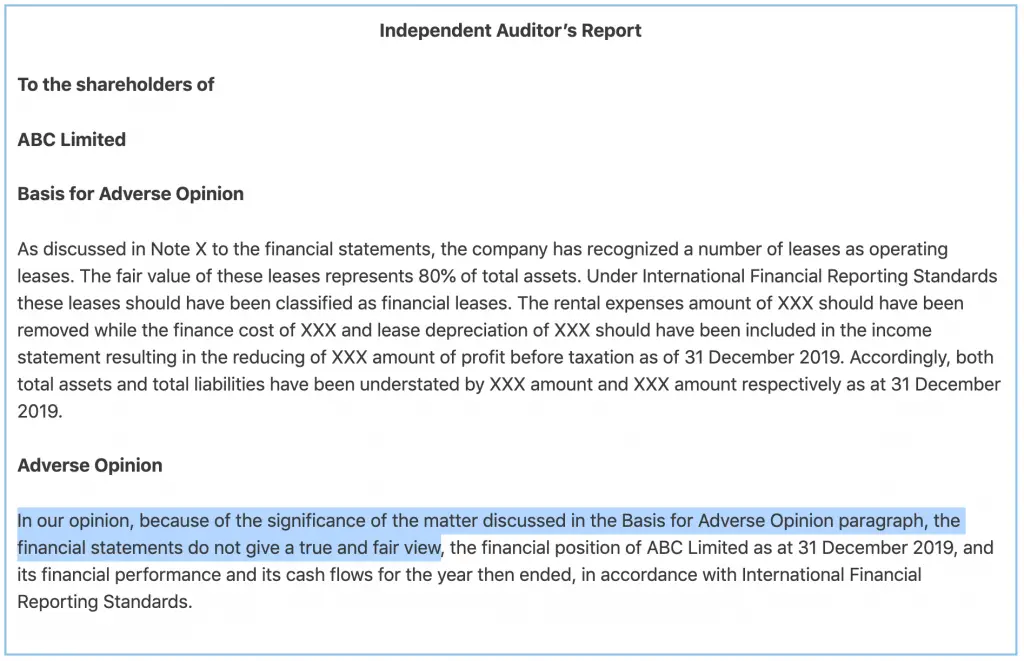

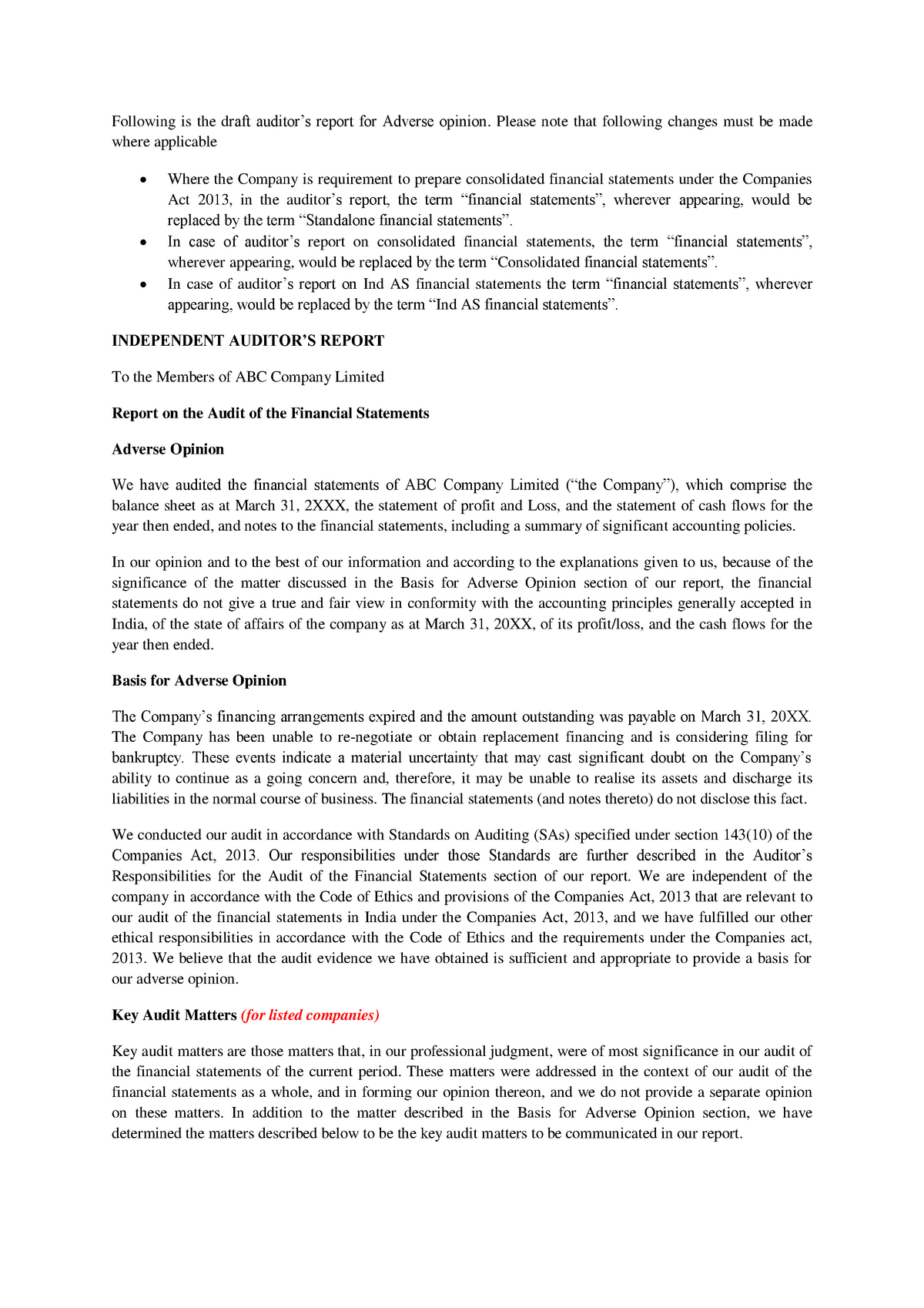

This guide is designed to explain the main changes that are needed to the audit report when an auditor considers it necessary to issue an adverse opinion on the financial.

Adverse opinion audit report. Adverse audit report or adverse opinion. An adverse opinion report is the most critical and unfavorable type. Adverse opinion provided by the statutory auditor in his audit report denotes that the company’s financial statements do not show a ‘true & fair’ view.

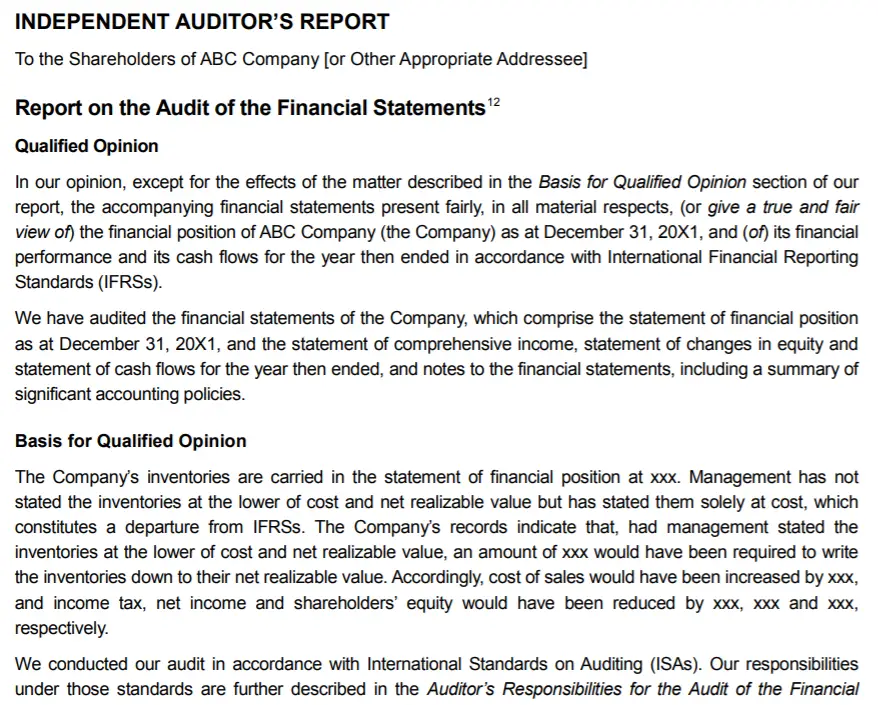

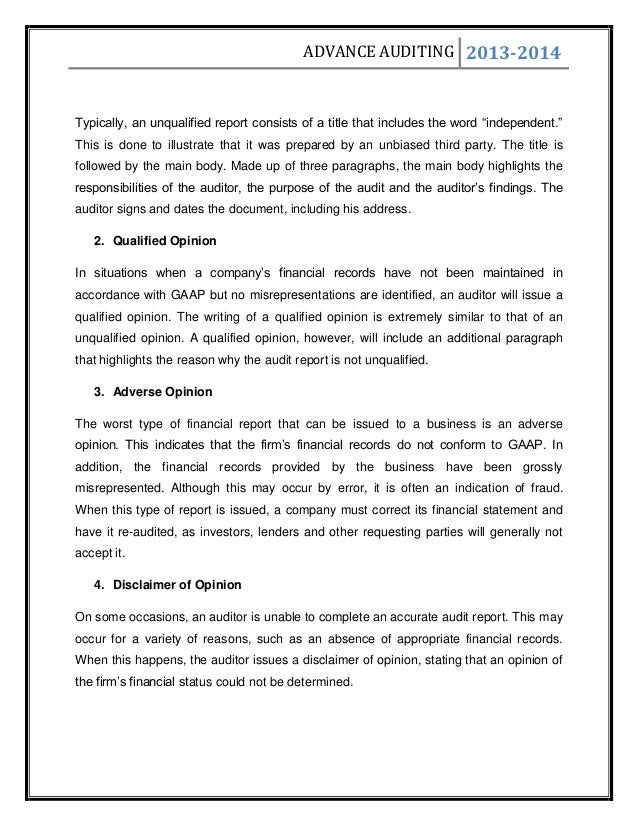

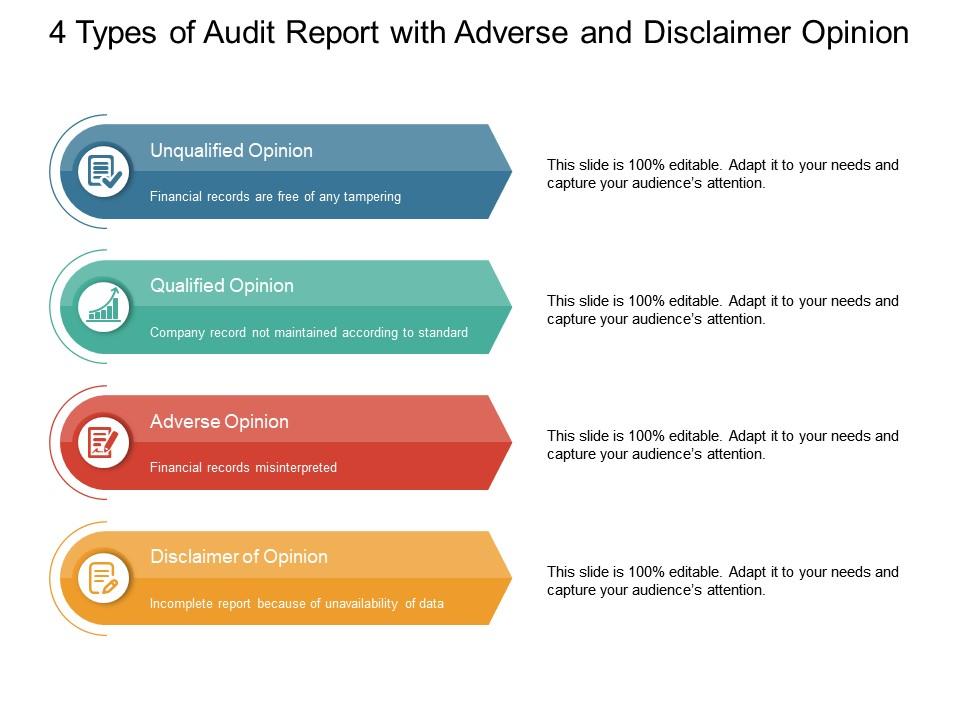

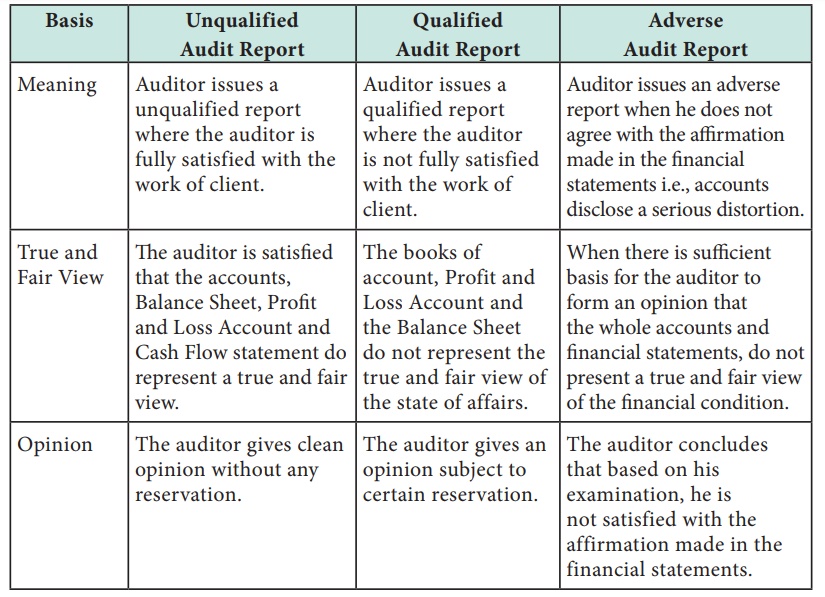

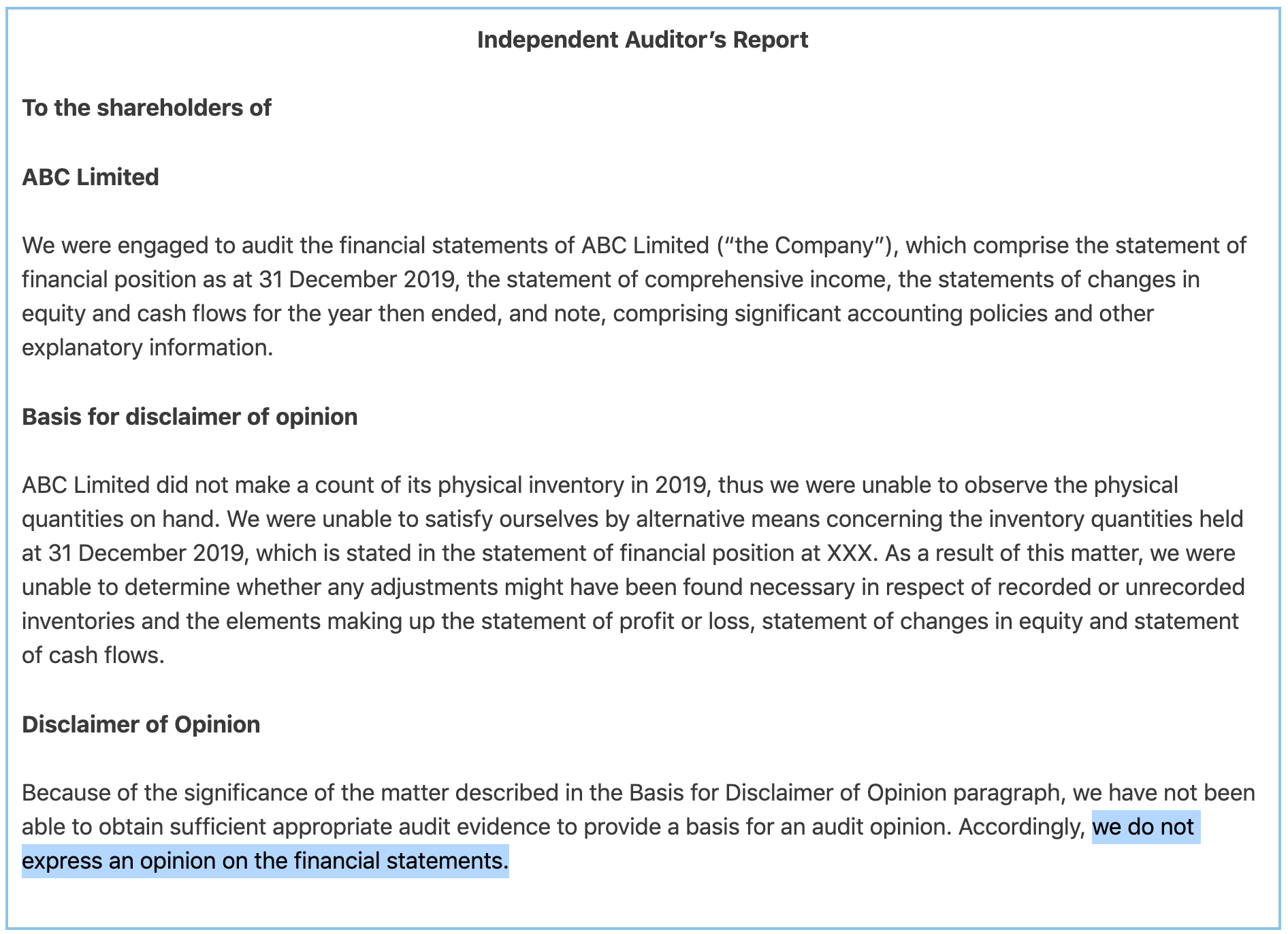

Basis for qualified/adverse opinionsection of the auditor’s report, the auditor states that a murgc exists and that the financial statements do not adequately disclose this matter. What is adverse opinion? Unmodified(unqualified), qualified, adverse, and disclaimer opinion.

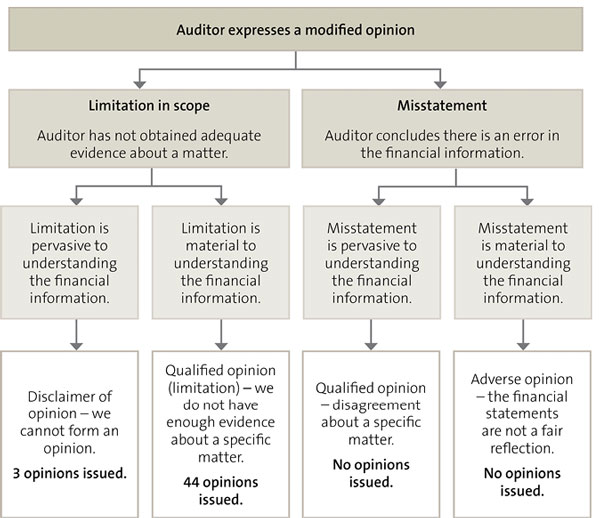

Isa 705 (revised) requires that the auditor includes a basis for qualified/adverse opinion section in the auditor’s report. Let’s see the audit opinion flow chart below to gain. So, in total, there are four types of audit opinion right?

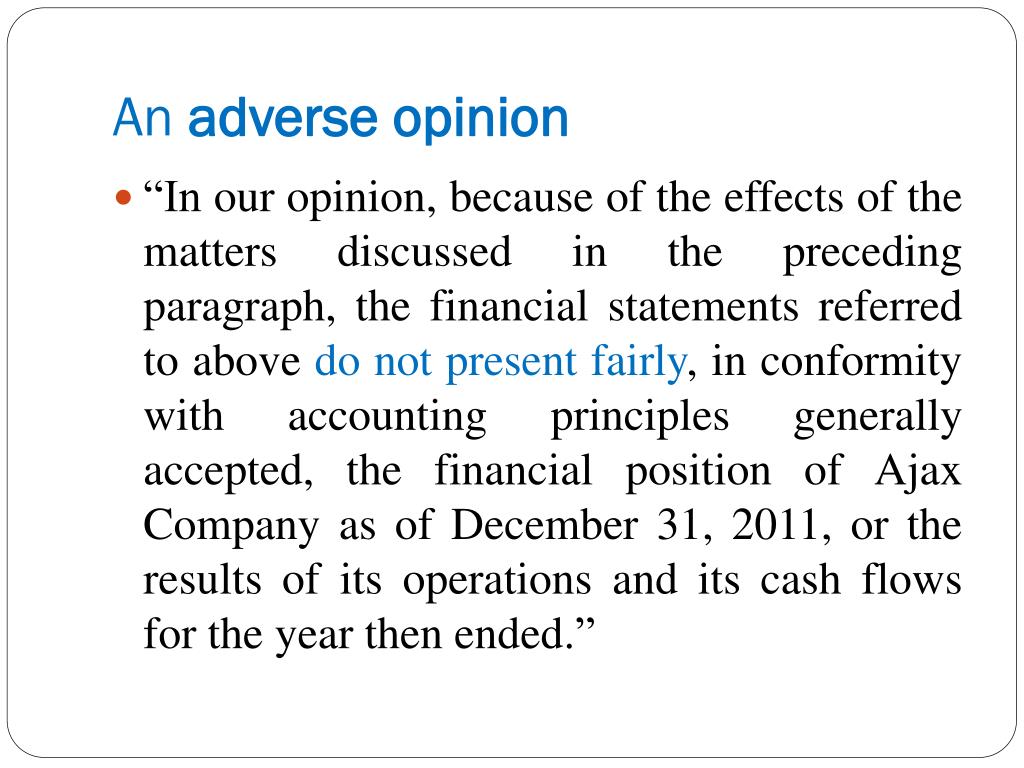

It is issued when the auditor uncovers. An adverse opinion states that the financial statements do not present fairly the financial position, results of operations, or cash flows of the entity in conformity with. When the auditor expresses a qualified or adverse.

These four types of audit reports include: An auditor’s adverse opinion is a big red flag. The audit opinion is crucial for.

The auditor shall express an adverse opinion when the auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements,. The auditor may express an unqualified opinion on one of the financial statements and express a qualified or adverse opinion or disclaim an opinion on another if the. Guidance as to the usage of the three forms of modification is provided by isa 705, modifications to the.

As appropriate, a qualified or adverse opinion a statement in the basis for qualified (adverse) opinion section of the auditor’s report that a material uncertainty exists that. An adverse opinion indicates financial records are not in accordance with gaap and contain grossly material and pervasive misstatements. The audit opinion refers to the statement issued by an auditor expressing the examination results on their clients’ financial statements.

An adverse opinion is a professional opinion made by an auditor indicating that a company's financial statements are misrepresented,. The final type of audit opinion is an adverse opinion. The auditor shall express an adverse opinion when the auditor, having obtained sufficient appropriate audit evidence, concludes that misstatements, individually or in the.

:max_bytes(150000):strip_icc()/Adverse_Opinion_Final-1920273493f848f2bcae18c385f72904.png)