Recommendation Info About Tax Expense In Income Statement

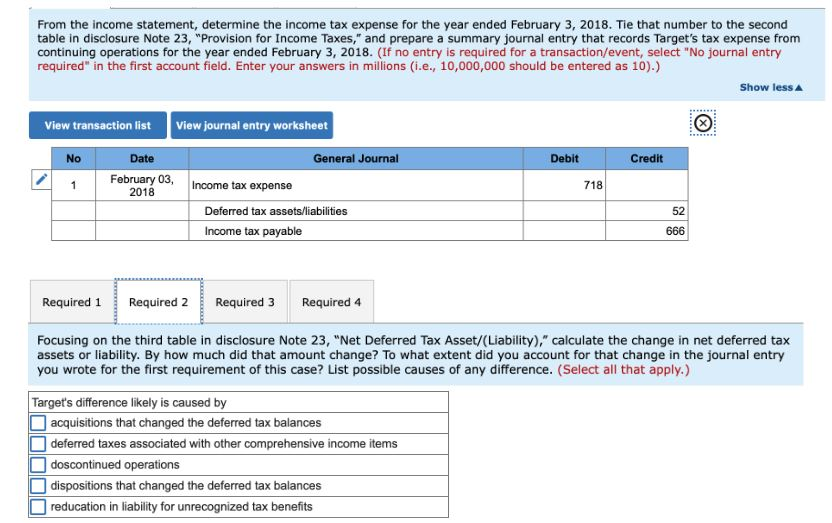

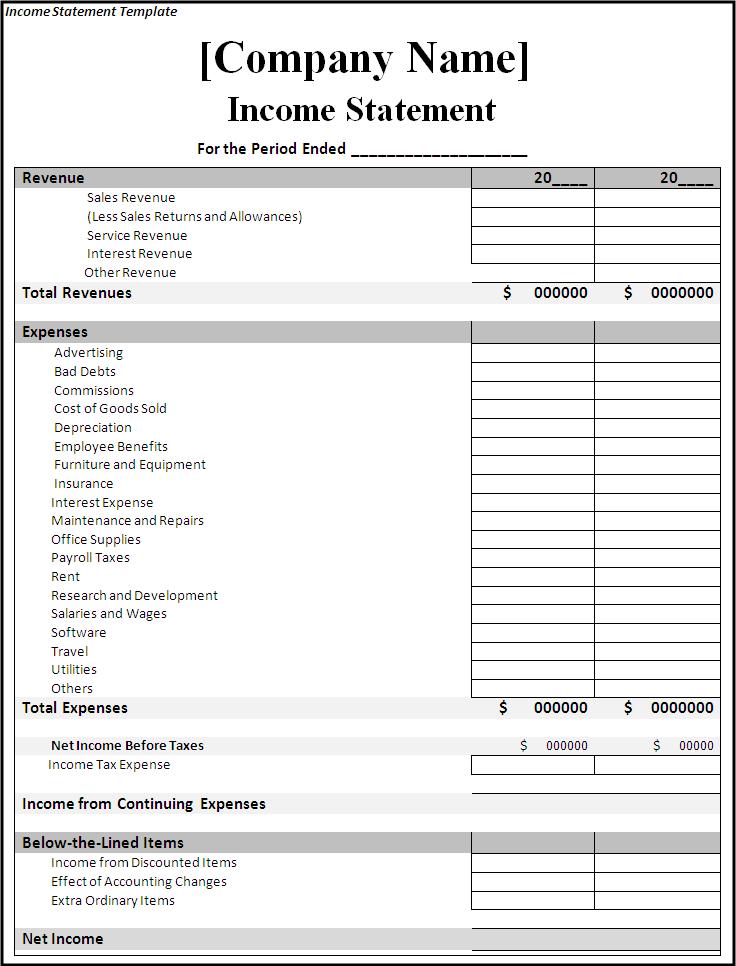

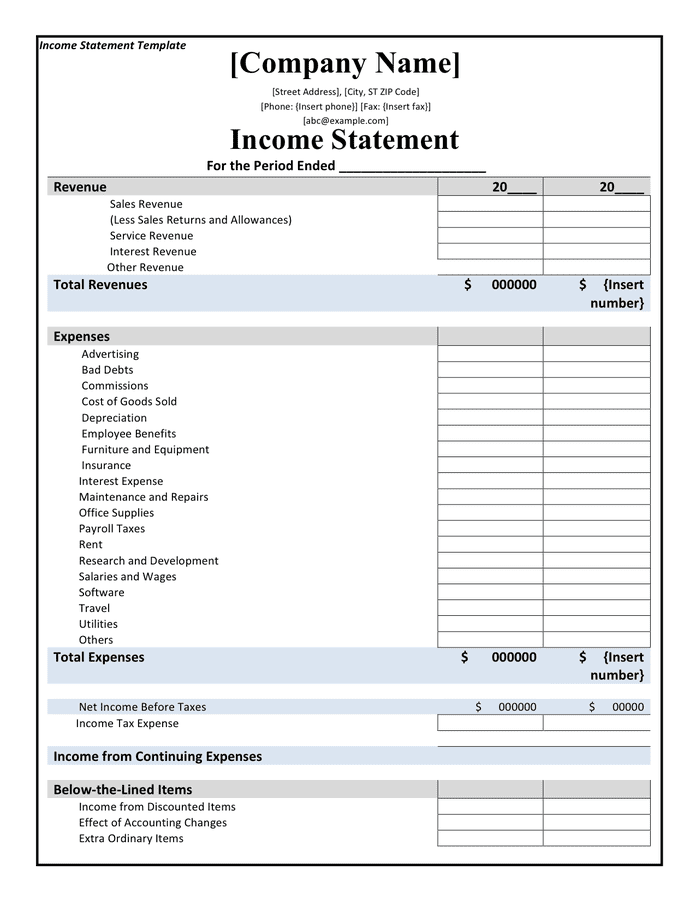

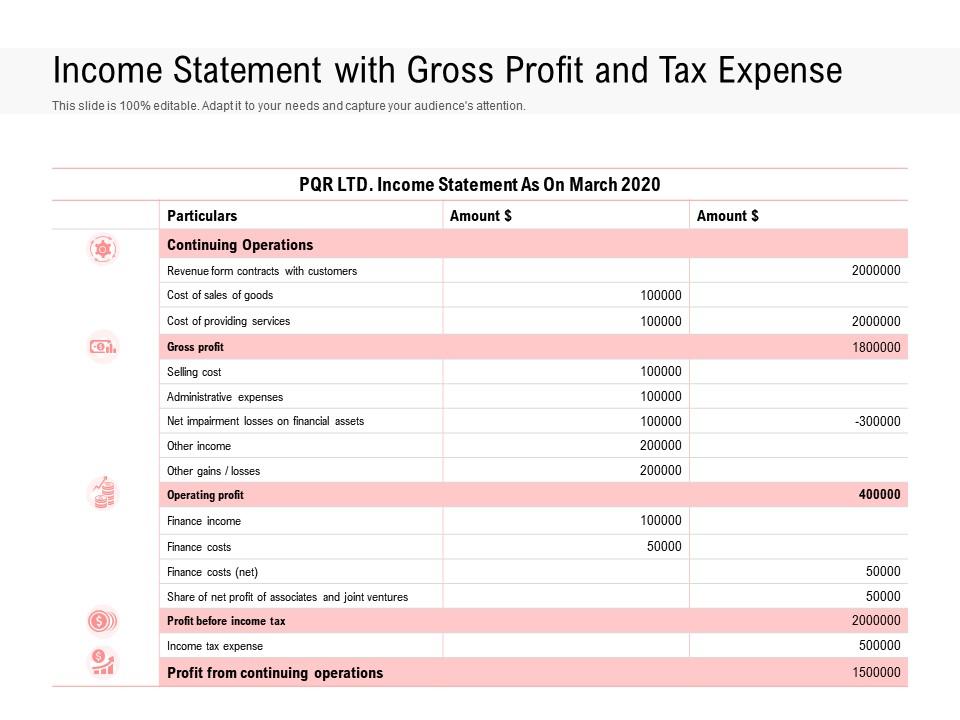

Income tax expense can include the current tax expense and a deferred tax expense or benefit.

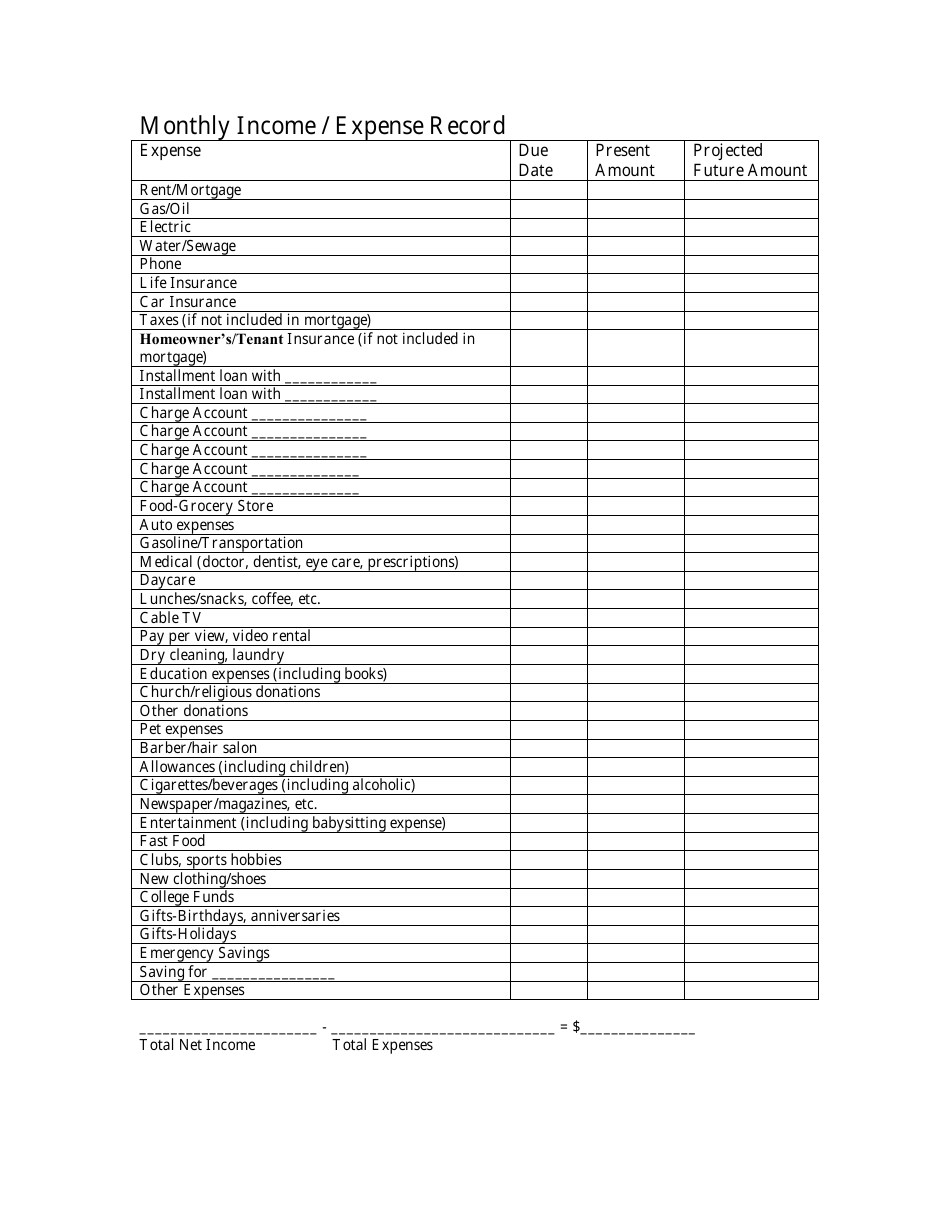

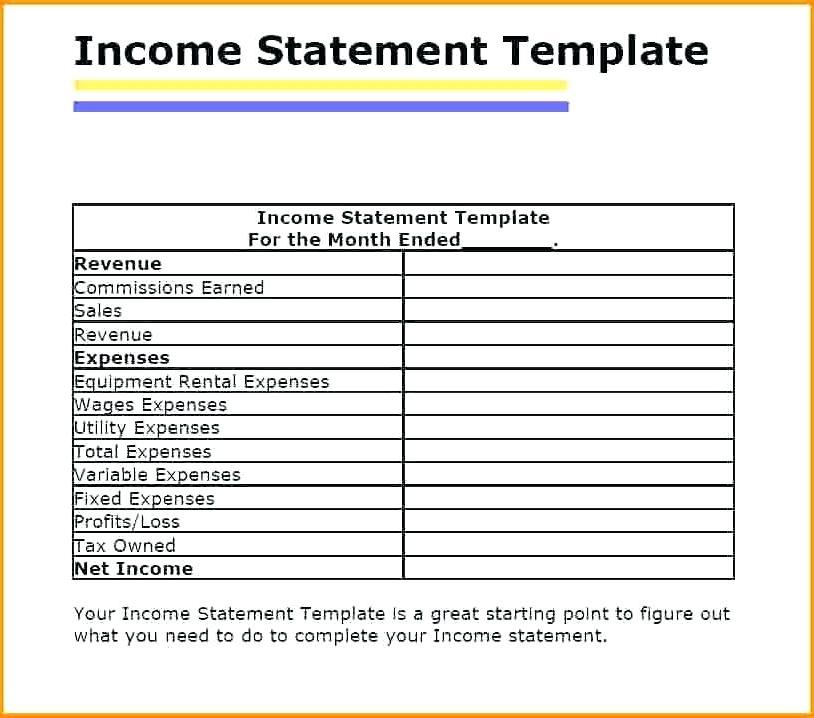

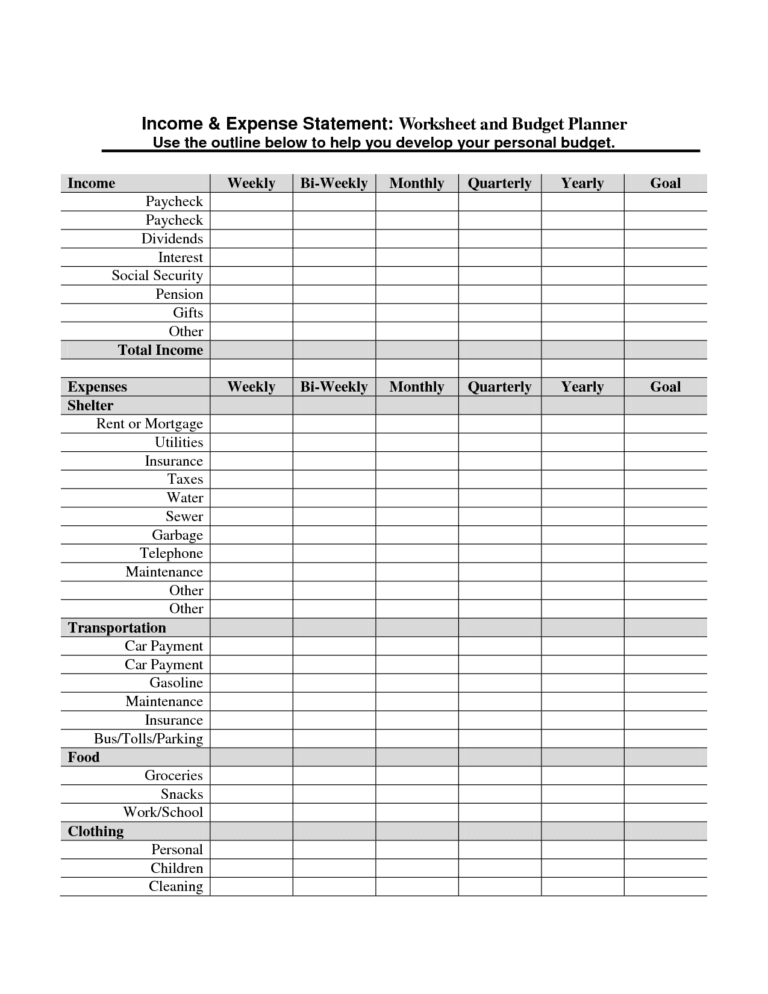

Tax expense in income statement. If you file on paper, you should receive your income tax package in the mail by this date. Income tax is the amount of tax a company is liable to pay to its local government. Income tax expense is a company’s liability arising from the income earned yearly by doing business.

Income tax is an expense on profits earned for a specific accounting. The accountant has calculated the annual income tax expense which is equal to $ 23,000. For example, if you itemize, your agi is $100,000.

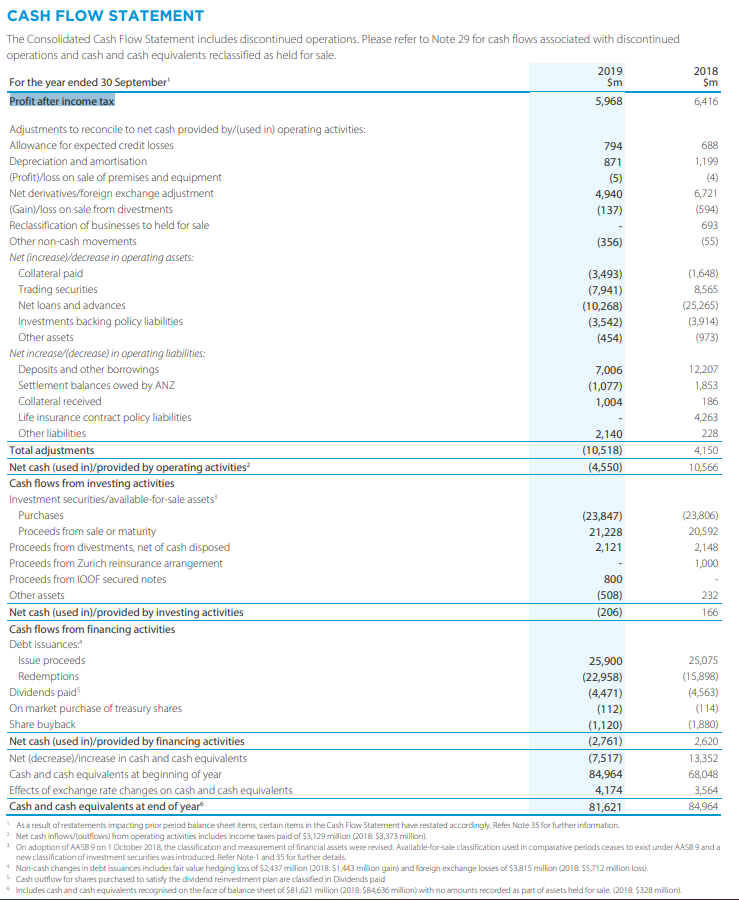

The income tax amount will be paid to the government within 2 months after the. Current income tax refers to the income taxes that are either payable to or recoverable from tax authorities, relating to the taxable profit or tax loss for a period (ias. Total income tax expense or benefit for the year generally equals the sum of total income tax currently payable or refundable (i.e., the amount calculated in the.

This can be taxes at the federal, state, or local levels. Medical expenses are deductible only to the extent the total exceeds 7.5% of your adjusted gross income (agi). Income tax is considered an.

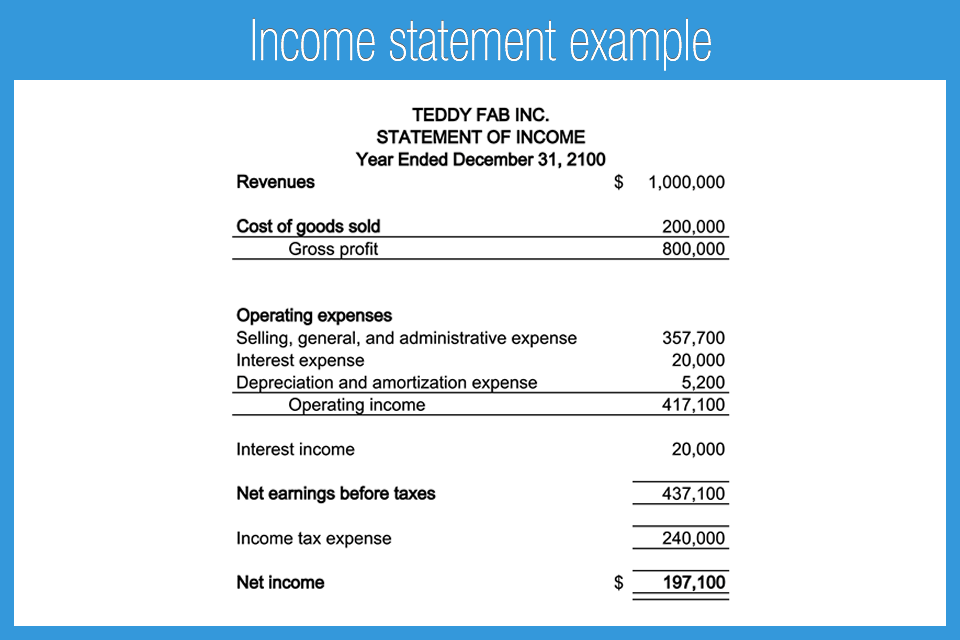

The corporate income tax expense is a component that features on the income statement under the heading of ‘other expenses.’ it is a type of liability on the business or an individual. Taxable income x tax rate = income tax expense for example, if your company had a total taxable income of $1. Federal governments, central governments, or both levy.

It is a tax levied by the government on a business’s earningsand an individual’s income. January 13, 2023 it’s no secret that most individuals pay a standard income tax percentage back. Input the appropriate numbers in this formula:

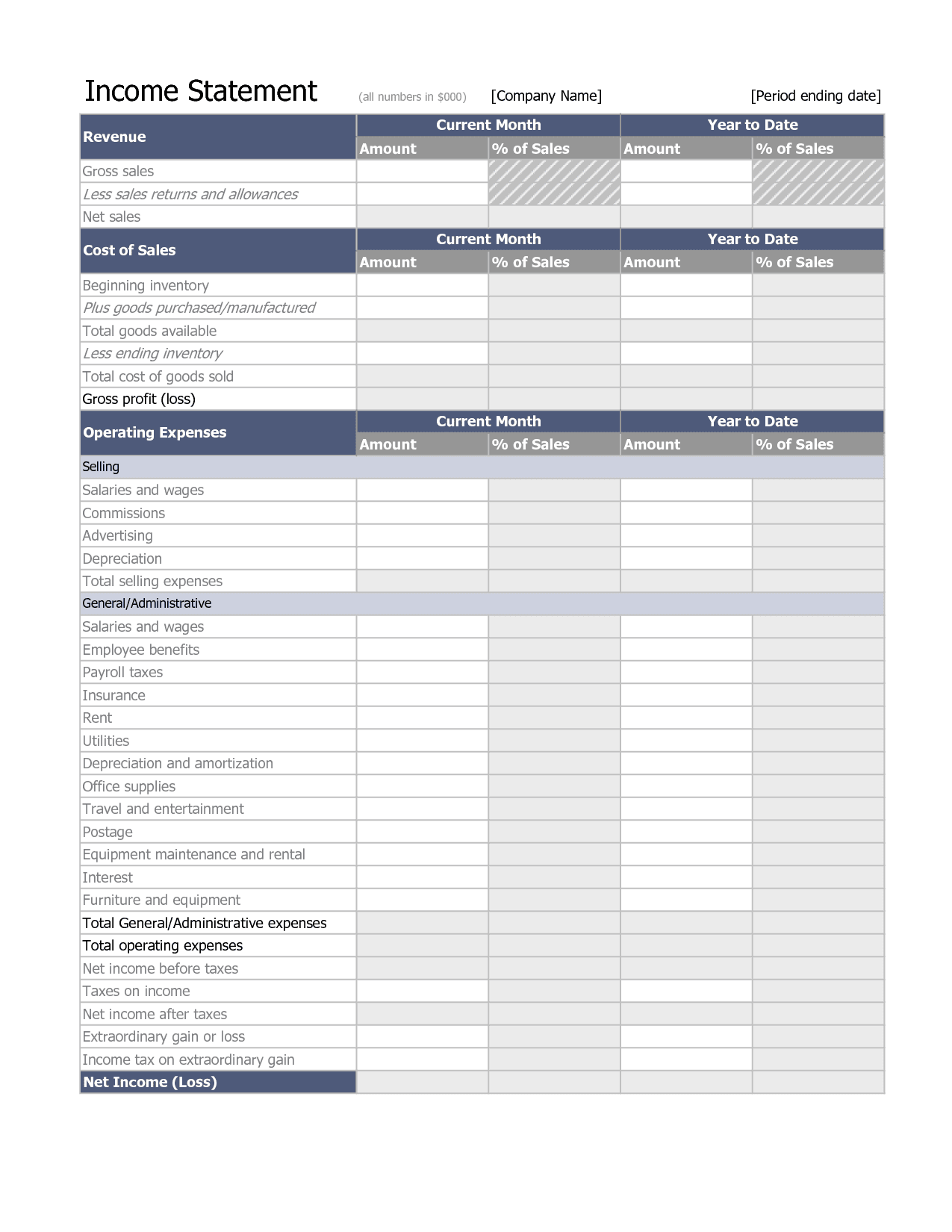

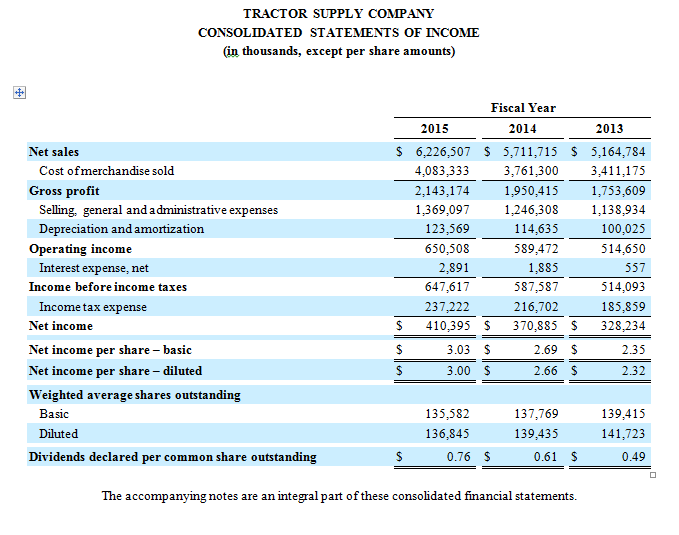

The last expense reported on the income statement is income taxes. Also known as profit and loss (p&l) statements, income statements summarize all income and expenses over a given period, including the cumulative. The current tax expense is the amount that a business expects.

It shows all revenues and expenses of the company over a specific period of time. Income tax expenses on the income statement the income tax expense is the total amount the company paid in taxes. Beginning with t tax expense tax expense:

Interest expense (18,177) income before taxes: This figure is frequently broken out by. Income tax expense on its income statement for the revenues and expenses appearing on the accounting period's income statement, and income taxes payable (a current.

Income (loss) before income taxes and income from equity method investments 474 1,828 (9,426 ) 2,321 provision for (benefit. How effective tax rate is calculated from income statements by troy segal updated december 26, 2022 reviewed by thomas brock fact checked by.