Breathtaking Tips About Balance Sheet From Adjusted Trial

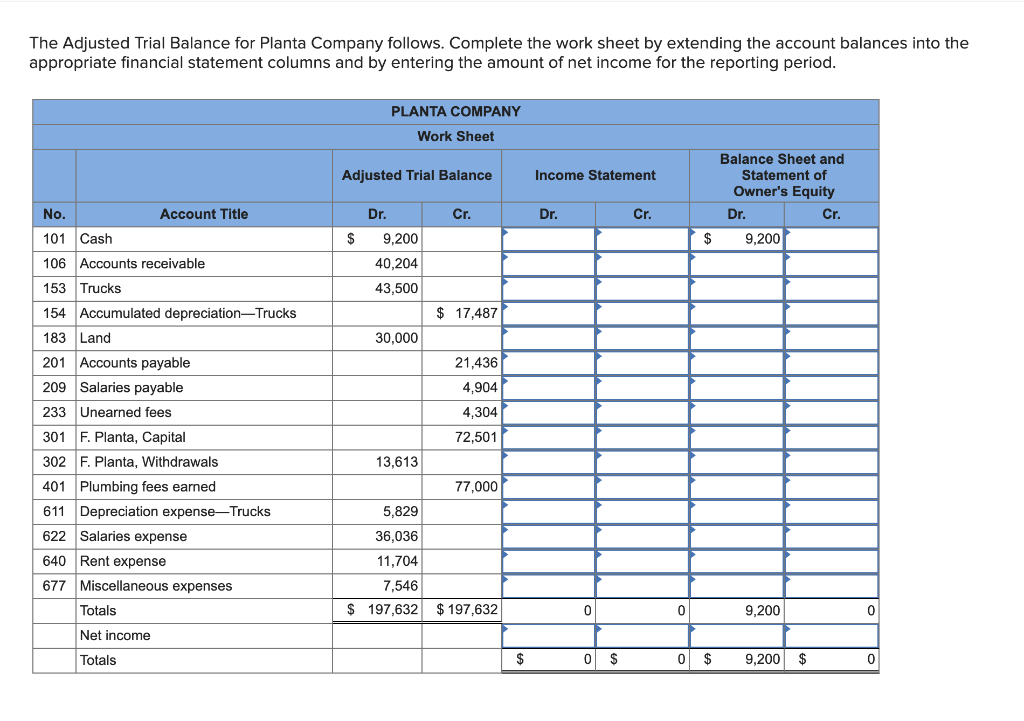

The accumulated depreciation ($75) is taken away from the original cost of the equipment ($3,500) to show the book value of equipment ($3,425).

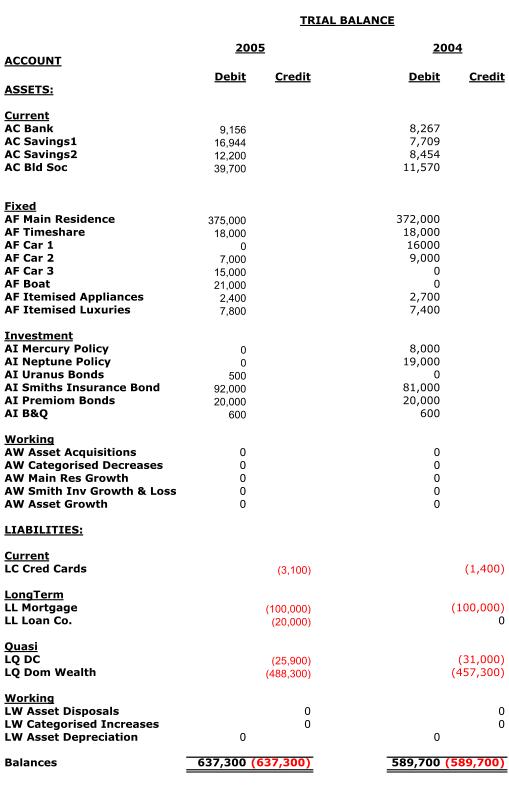

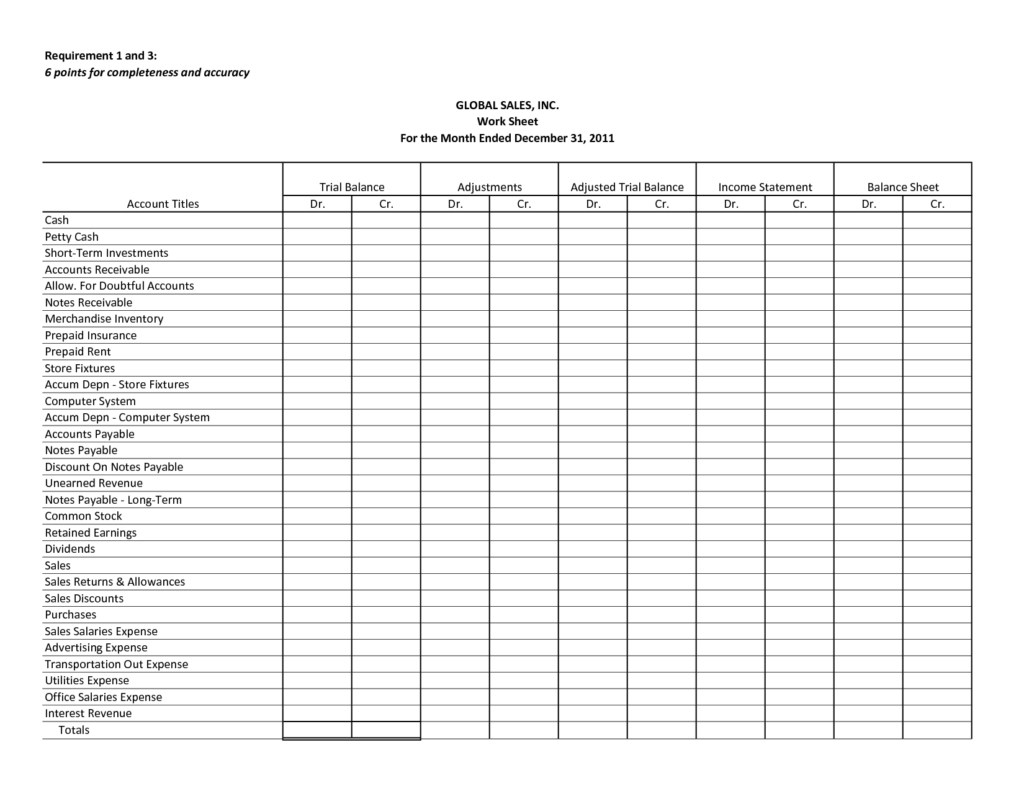

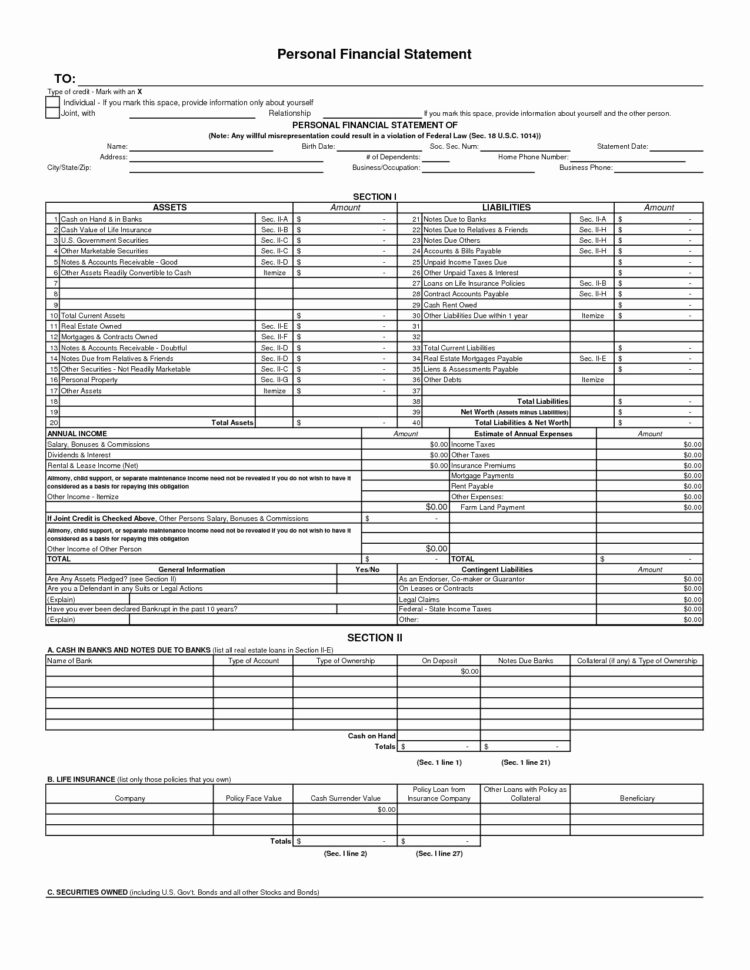

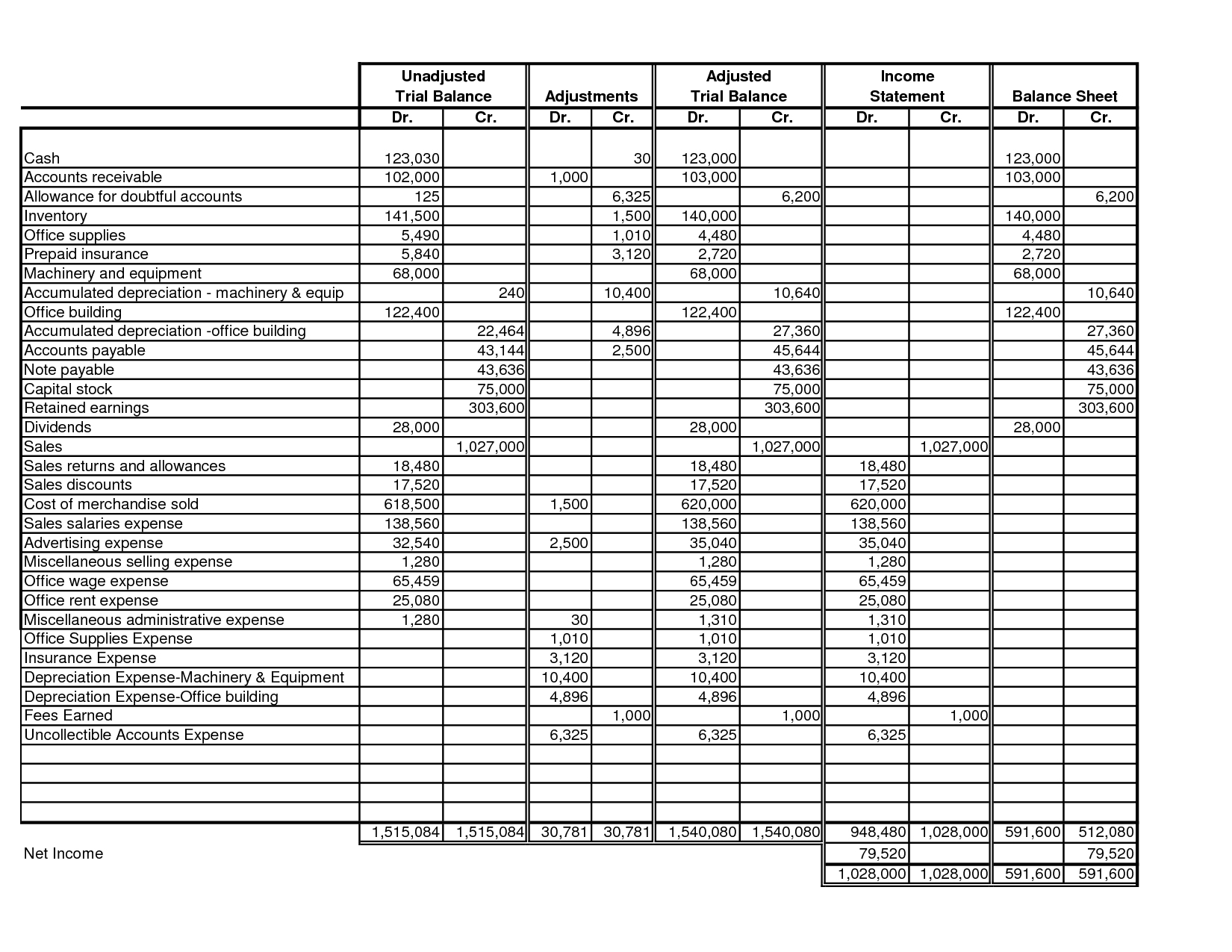

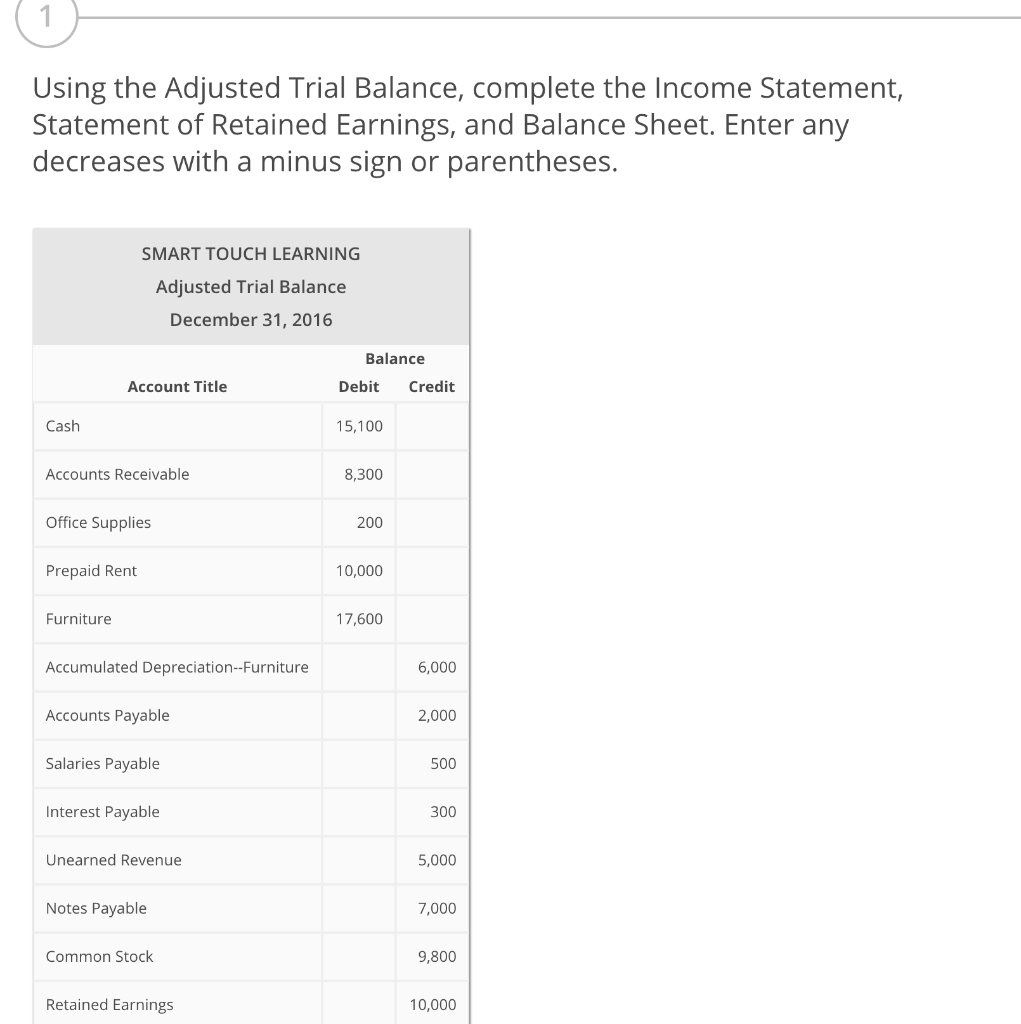

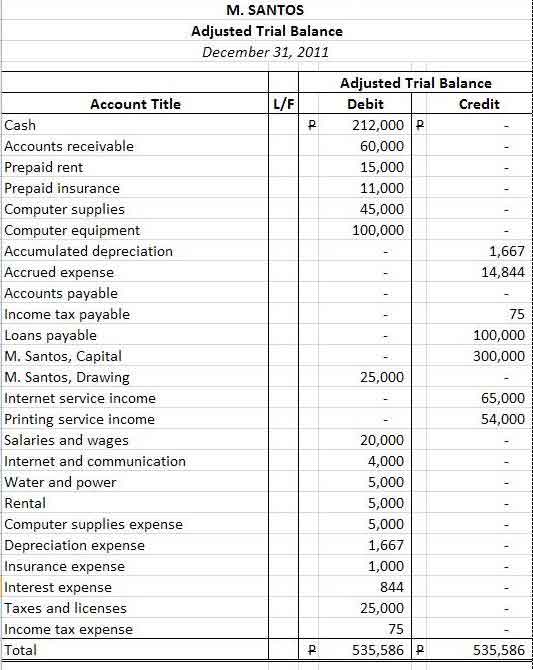

Balance sheet from adjusted trial balance. An adjusted trial balance represents a listing of all the account balances after posting of all the necessary adjusting entries in ledger accounts.¹ the purpose of. It acts as one of the pillars based on which the financial statements are prepared. An adjusted trial balance is prepared after adjusting entries are.

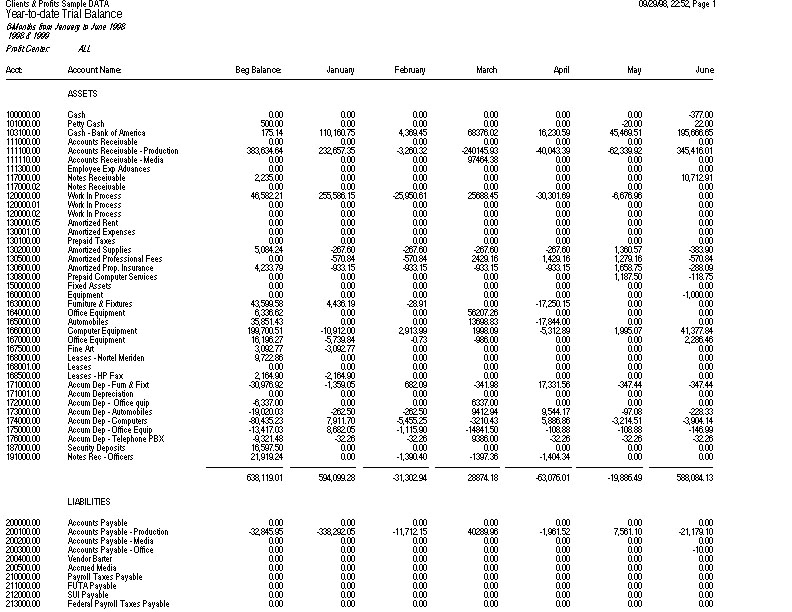

In the profit and loss statement, income and expenses are recorded. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Adjusted trial balance.

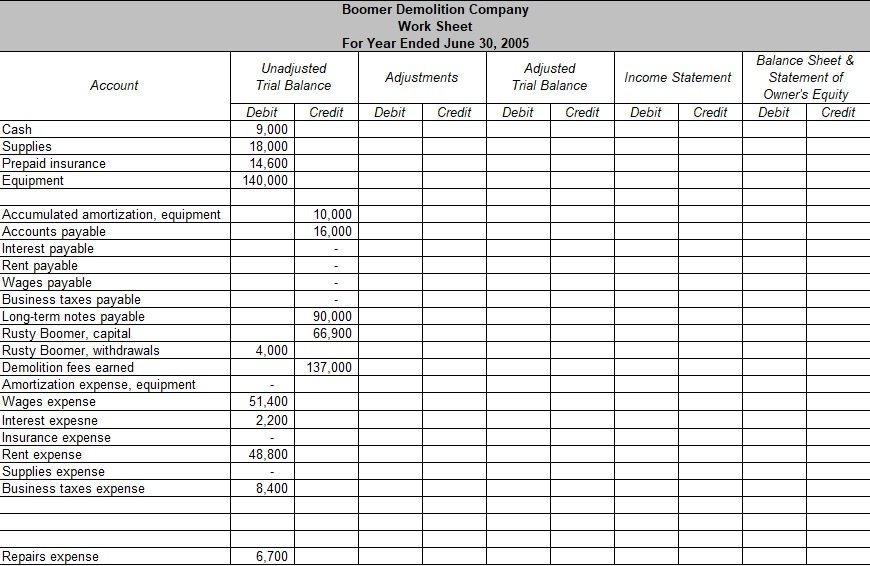

A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit account column totals that are equal. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. Adjusted trial balance contains both the elements of balance sheet and income statement.

The income and expenses balances will be recorded in the. Review this example of an adjusted trial balance: Checked for updates, april 2022.

The trial balance includes the closing balances of assets, liabilities, equity, incomes and expenses. The preparation of final accounts is. On an unadjusted trial balance for a business, the company's accountant enters each transaction twice so.

This is actually can be viewed as the combination of trial balance. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet. The trial balance information for.

Run an unadjusted trial balance the above trial balance is a current summary of all of your general ledger accounts before any adjusting entries are. A trial balance is an accounting report used by business accountants during the accounting close process to ensure that all general ledger accounts have equal debit and credit. A balance sheet is that trial balance is the report of accounting in which ending balances of different general ledger of the.

Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount,. The key difference between trial balance vs. The accumulated depreciation ($75) is taken away from the original cost of the equipment ($3,500) to show the book value of equipment ($3,425).