Nice Info About Operating Section Of The Cash Flow Statement

Common cash flow calculations include the tax paid, which is an operating activity cash out flow, the payment to buy property plant and equipment (ppe) which is an investing activity cash out flow and dividends paid, which is a financing activity cash out flow.

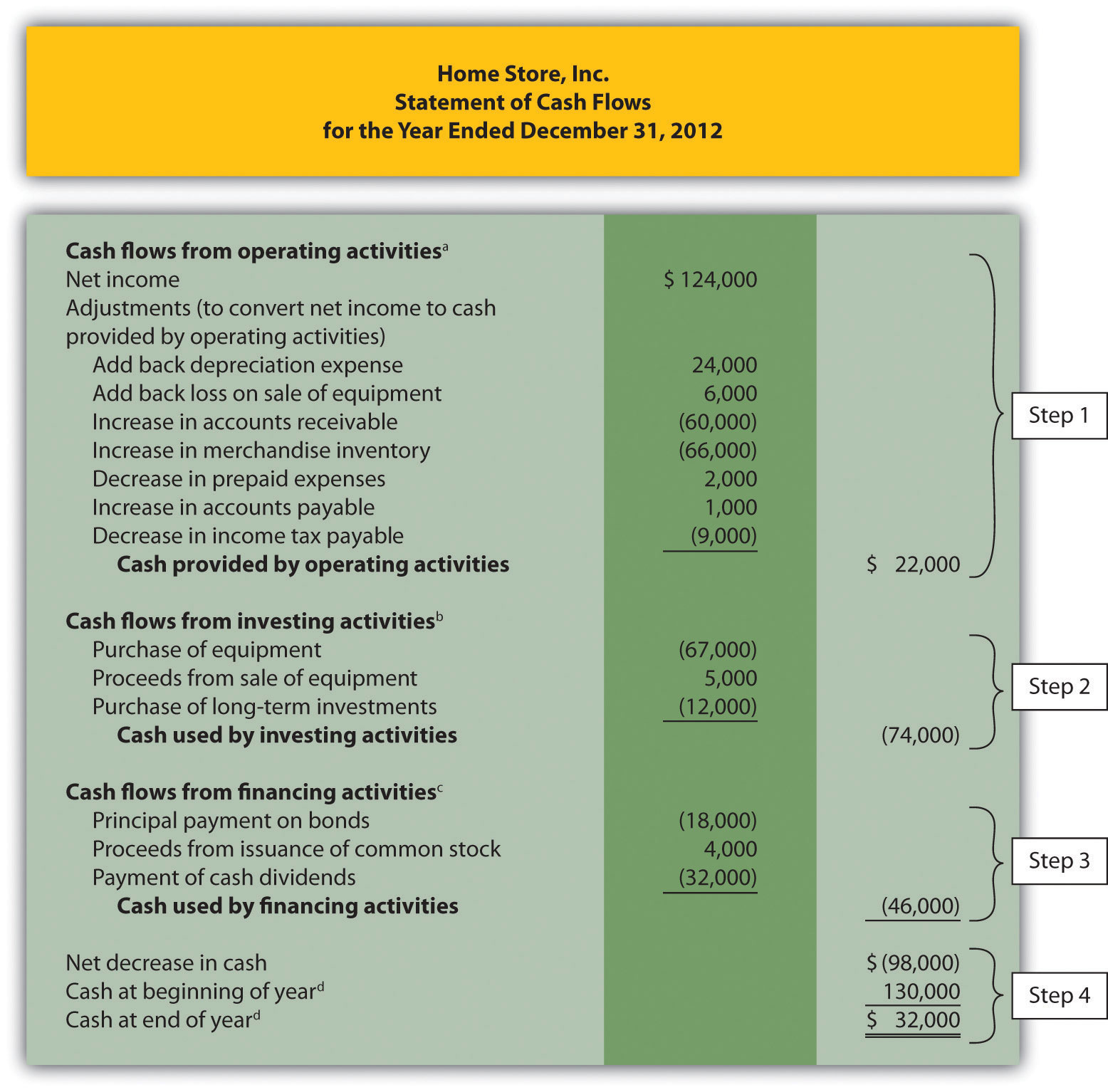

Operating section of the cash flow statement. Let’s look at what each section of the cash flow statement does. The first section of the cash flow statement covers cash flows from operating activities (cfo) and includes transactions from all operational business activities. Net income, adjustments to net income, and.

For operating cash flows, the direct method of presentation is encouraged, but the indirect method is acceptable [ias 7.18] the direct method shows each major class of gross cash receipts and gross cash payments. Operating section of the cash flow statement. You’ll also notice that the statement of cash flows is broken down into three sections—cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

The operating cash flows section of the statement of cash flows under the direct method would appear something like this: Operating activities include generating revenue, paying expenses, and funding working capital. The “cash flow from operations” is the first section of the cash flow statement, with net income from the income statement flowing in as the first line item.

A typical cash flow statement comprises three sections: Most israelis, both jewish and arab, do not believe absolute victory is possible in the war against hamas, a survey has found. Operating cash flow is the first section depicted on a cash flow statement, which also includes cash from investing and financing activities.

Your operating cash flow offers a clear picture of the current state of your business. When a statement of cash flows is prepared, these three types of cash flows are reported under separate sections, which are the operating activities section, the investing activities section, and the financing activities section. Key takeaways a cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company.

Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities. How to create a cash flow statement 1. The three sections of a cash flow statement

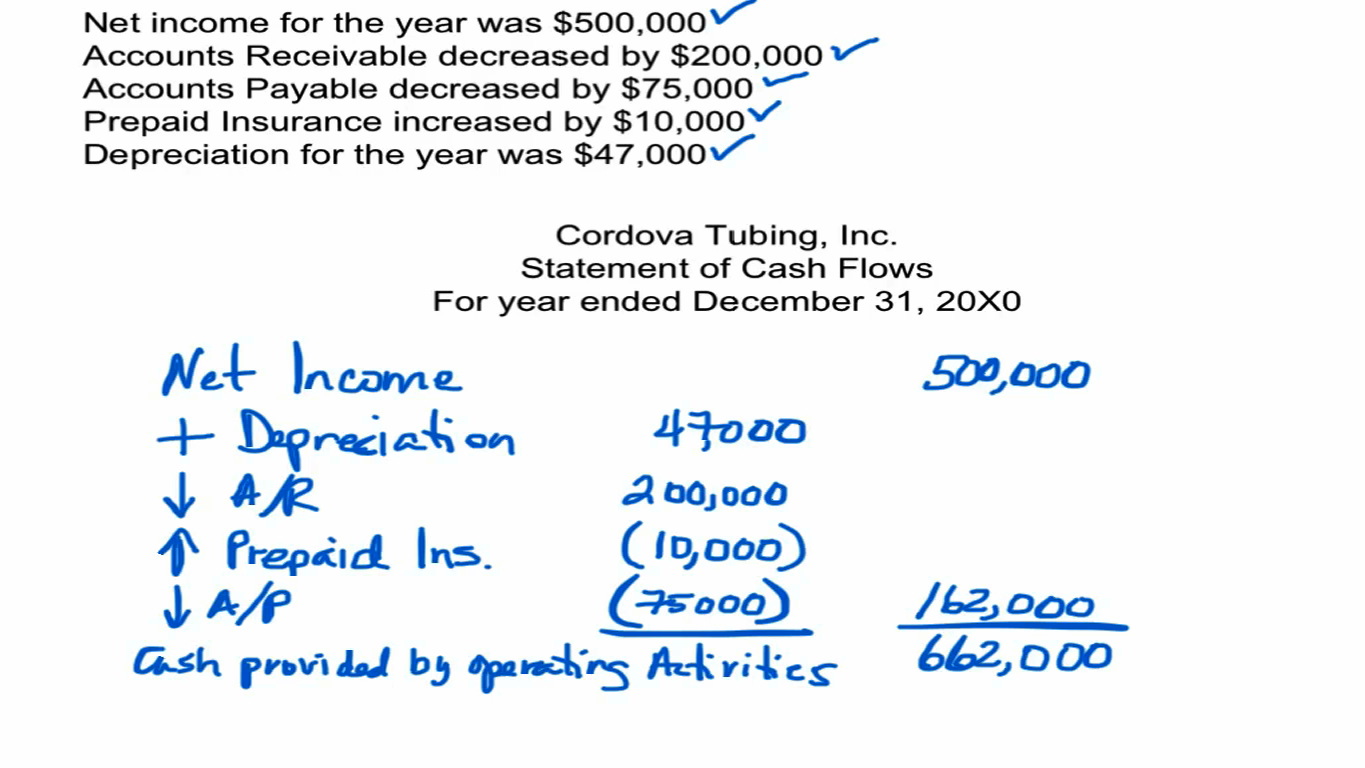

Companies can choose two different ways of presenting the cash flow statement: Add back noncash expenses, such as depreciation, amortization, and depletion. Operating cash flow is cash generated from the normal operating processes of a business.

There are two methods for. The cash flow from operations is the first section of the cash flow statement and includes money that goes into and out of a company. The first section of the statement of cash flows is described as cash flows from operating activities or shortened to operating activities.

Dec 31,2016 dec 31,2015 $ $ cash flow from operating activities net profit 3,457 4,256 taxation 1,200 1,189 net finance costs 536 245 operating profit (continued and discontinued. The operating cash flow serves as the first section of your company’s cash flow statement. The cash flow statement is typically broken into three sections:

A company's ability to generate positive cash flows consistently from its daily business. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Using the indirect method, operating net cash flow is calculated as follows:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)