Casual Info About Understanding Balance Sheet India

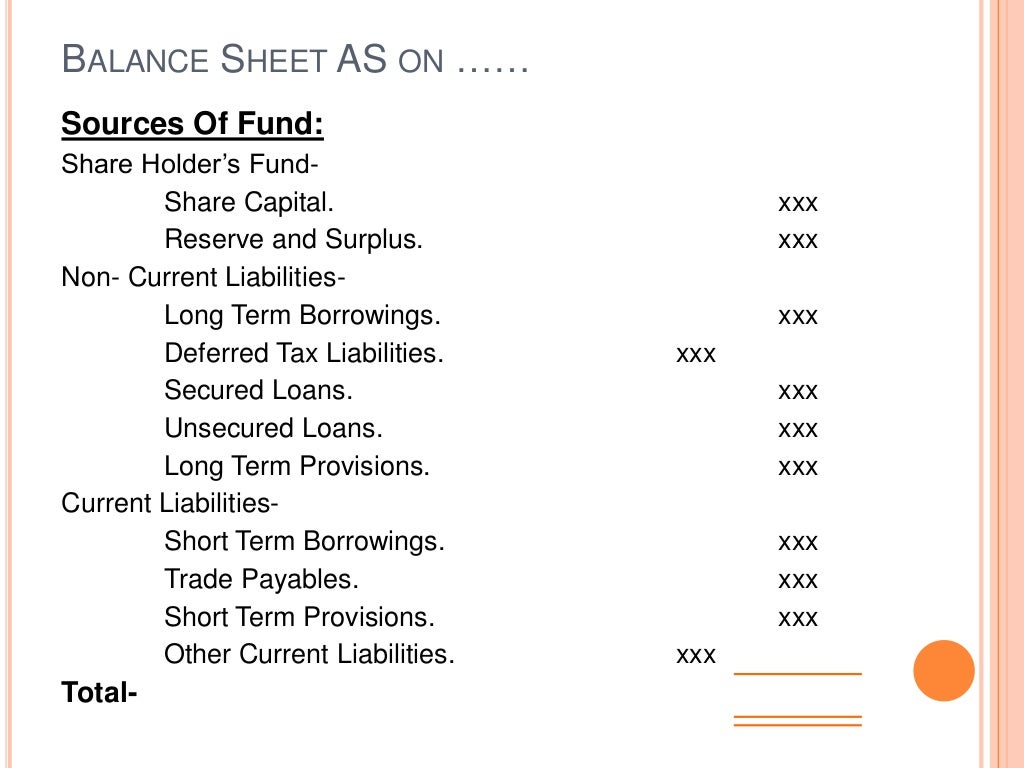

As the balance sheet conveys the financial position of a firm, it should mention the name of firm and date to which it applies.

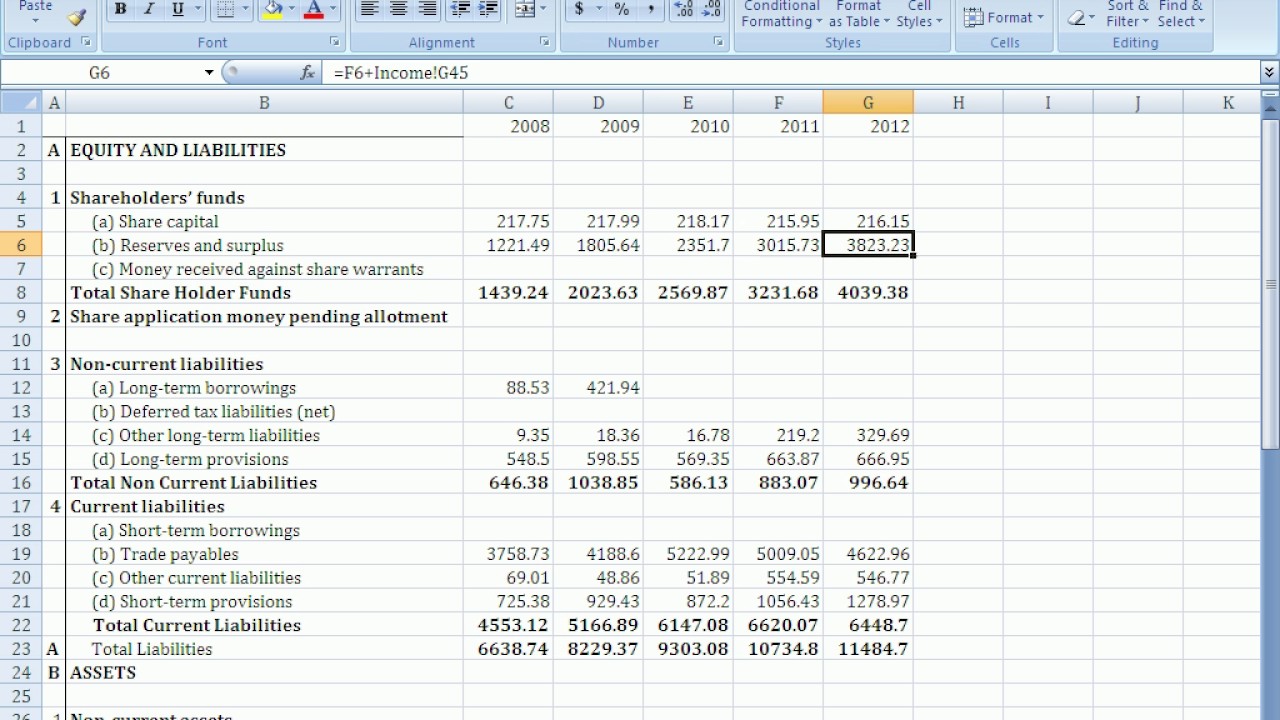

Understanding balance sheet india. You can assess a company's financial health better if you know what a balance sheet includes and its significance. Learn how to analyze balance sheets and use key ratios for financial insights at icici direct. A balance sheet is among the key monetary statements used for accounting and it’s divided into two sides.

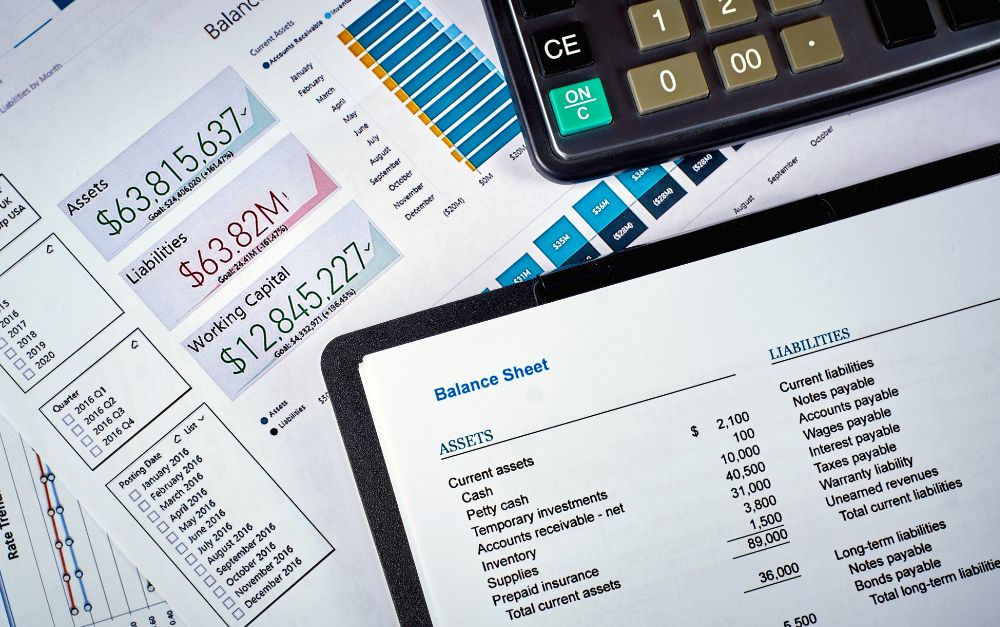

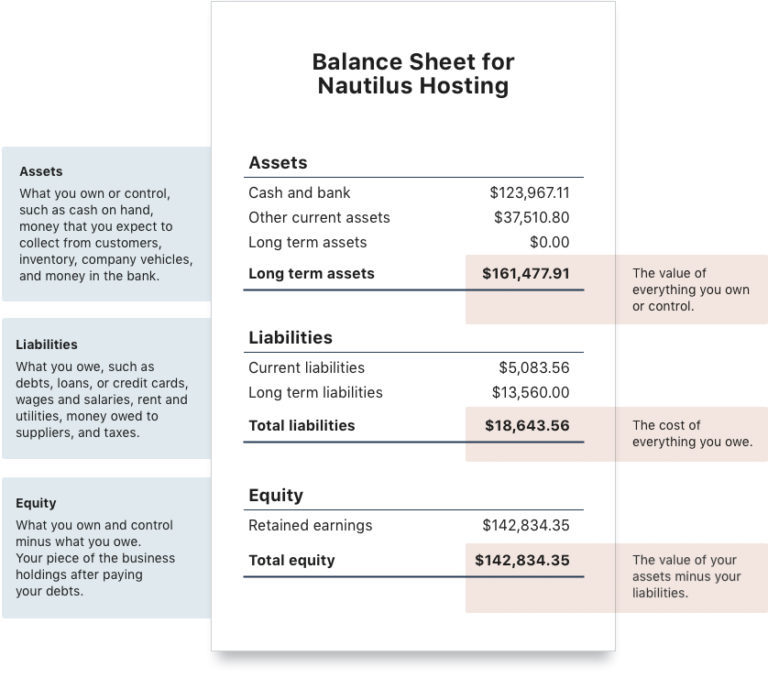

Assets are expected to give an economic benefit during their useful life. A balance sheet aims to allow internal and external stakeholders and potential stakeholders such as investors and lenders to analyse a company’s overall financial health. A company's balance sheet, also known as a statement of financial position, reveals the firm's assets, liabilities, and owners' equity (net worth).

The assets side of the balance sheet displays all the company’s assets. From arbl’s balance sheet, the total asset for fy14 is rs.2139crs. A manager's guide to finance & accounting

Key takeaways from this chapter. We will now understand the 2 nd half of the balance sheet, i.e. This implies that at the start of the financial year 2014 (1 st april 2013), the company must have commenced its operation with assets carried forward from.

The profit & loss account is a financial statement prepared for the entire financial year. Balance sheets, income statements, cash flow statements, and annual reports. It helps evaluate a business’s capital structure and also calculates the rate of returns for its investors.

Also describes the connection between the balance sheet, profit and loss statement and cash flow. The business’ efficiency, which is determined by how well it manages its assets, and its liquidity, which is determined by how readily you can convert its assets. In financial statements, the balance sheet indicates an entity's current financial situation.

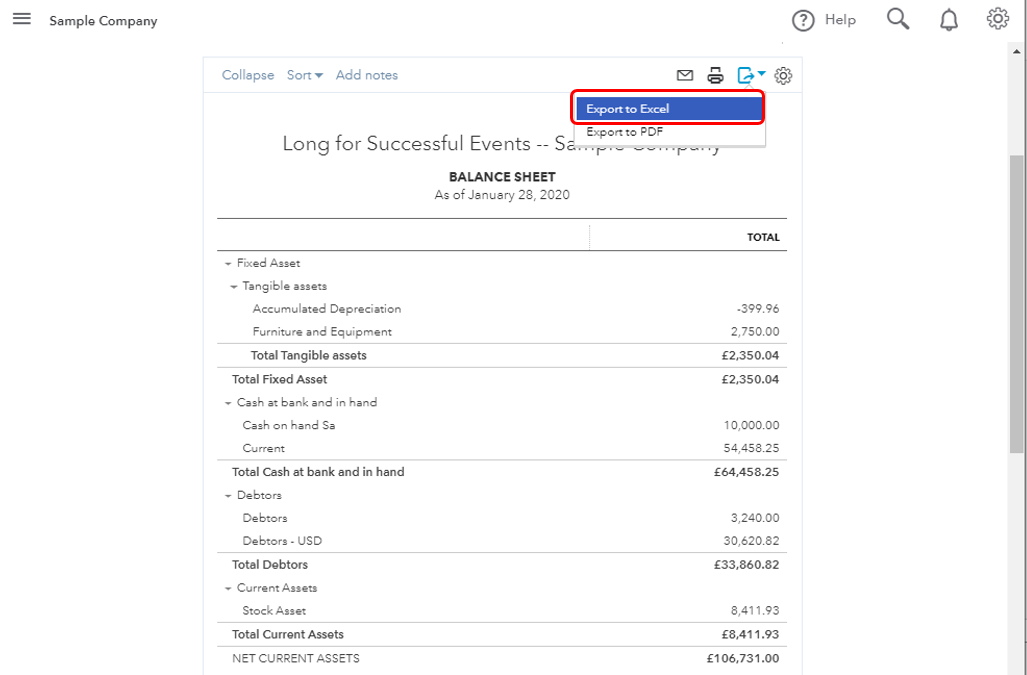

The balance sheet is a statement that gives an account of the assets, liabilities and equity of a company. An understanding of the balance sheet enables an analyst to evaluate the liquidity, solvency, and overall financial position of a company. Learn how to analyse the balance sheet (with example case study of dabur india limited).

The chapter discusses an outline on the key components of the cash flow statement, and their analysis. Let’s find out a bit more about it. The right facet reveals the enterprise’ liabilities and shareholders’ fairness.

1) profit and loss account 2) balance sheet 3) cash flow statement a listed company releases these financial statements for the general public to read and comprehend. Discover how balance sheets work, including their components such as assets, liabilities, and shareholders' equity. The balance sheet, together with the income.

Assets, liabilities and ownership equity are listed as of a particular date, such as the end of its financial 12 months. The value of these documents lies in the story they tell when reviewed together. A balance sheet gives us an overview of assets and liabilities.

![Making Sense of Your Balance Sheet [Infographic] Learn accounting](https://i.pinimg.com/originals/f7/0d/ec/f70dec3a63cbcc1511efabd76241ea3c.jpg)

:max_bytes(150000):strip_icc()/balancesheet.asp-V1-5c897eae46e0fb0001336607.jpg)