Underrated Ideas Of Tips About Benefits Of Pro Forma Statements

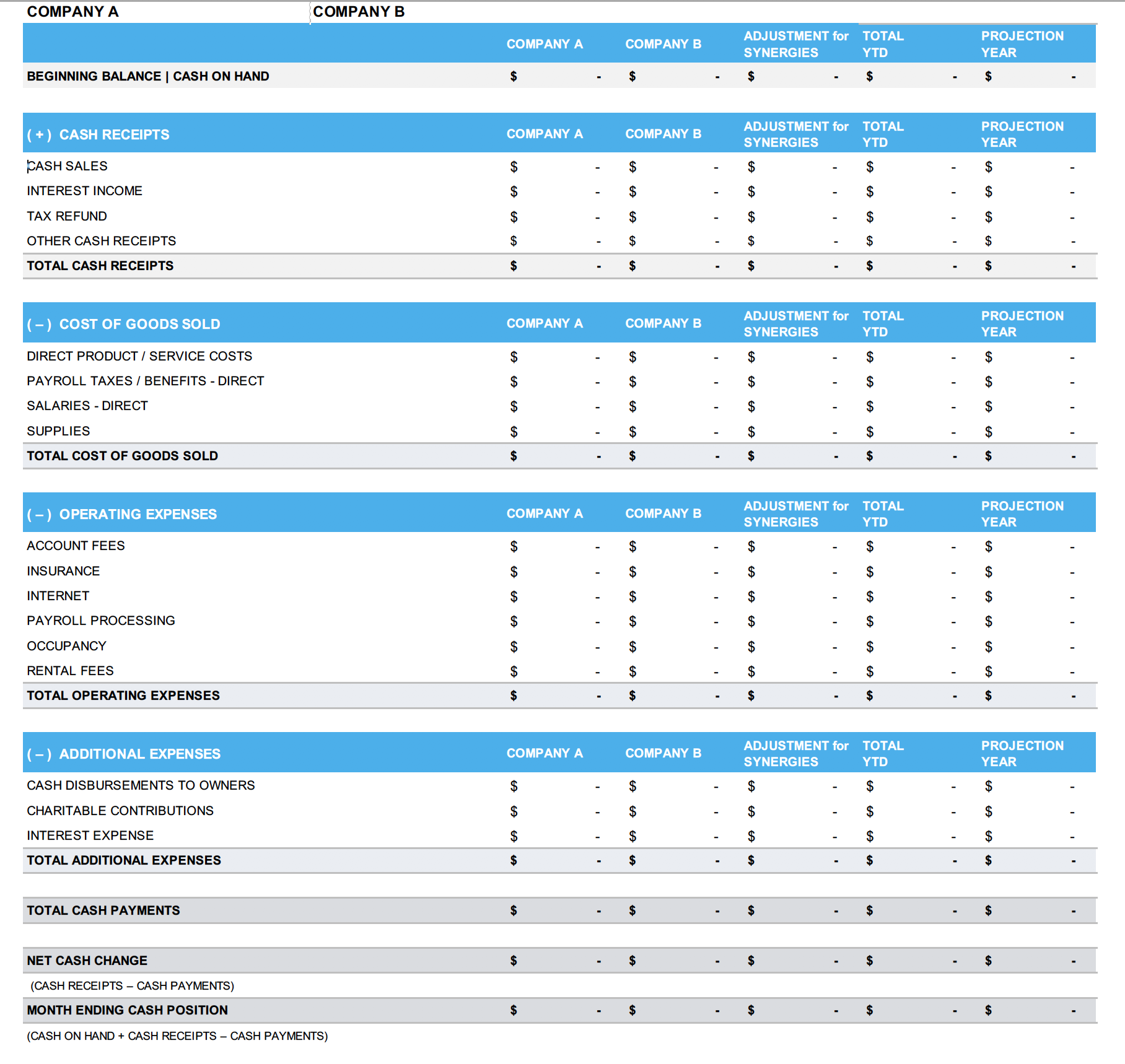

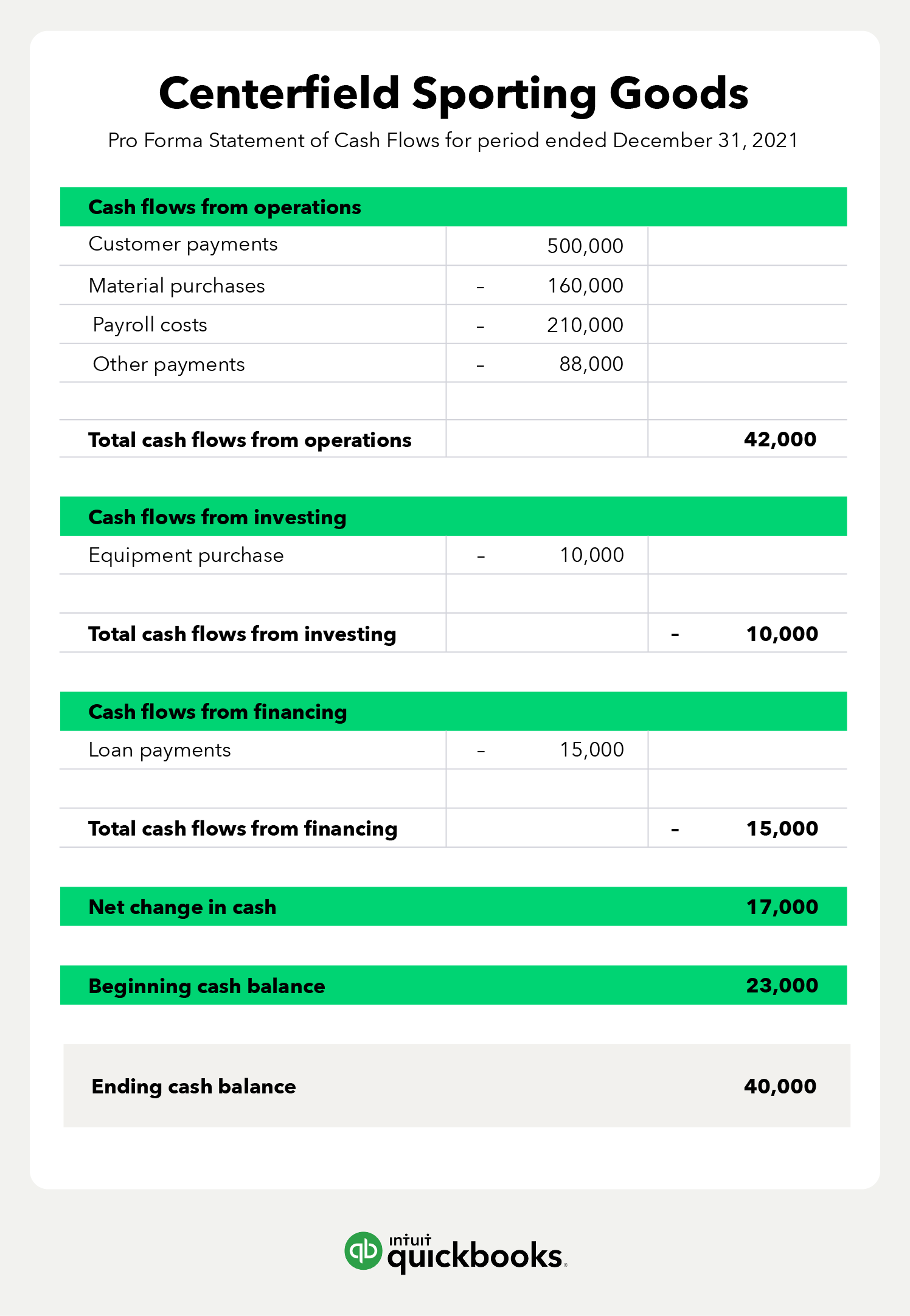

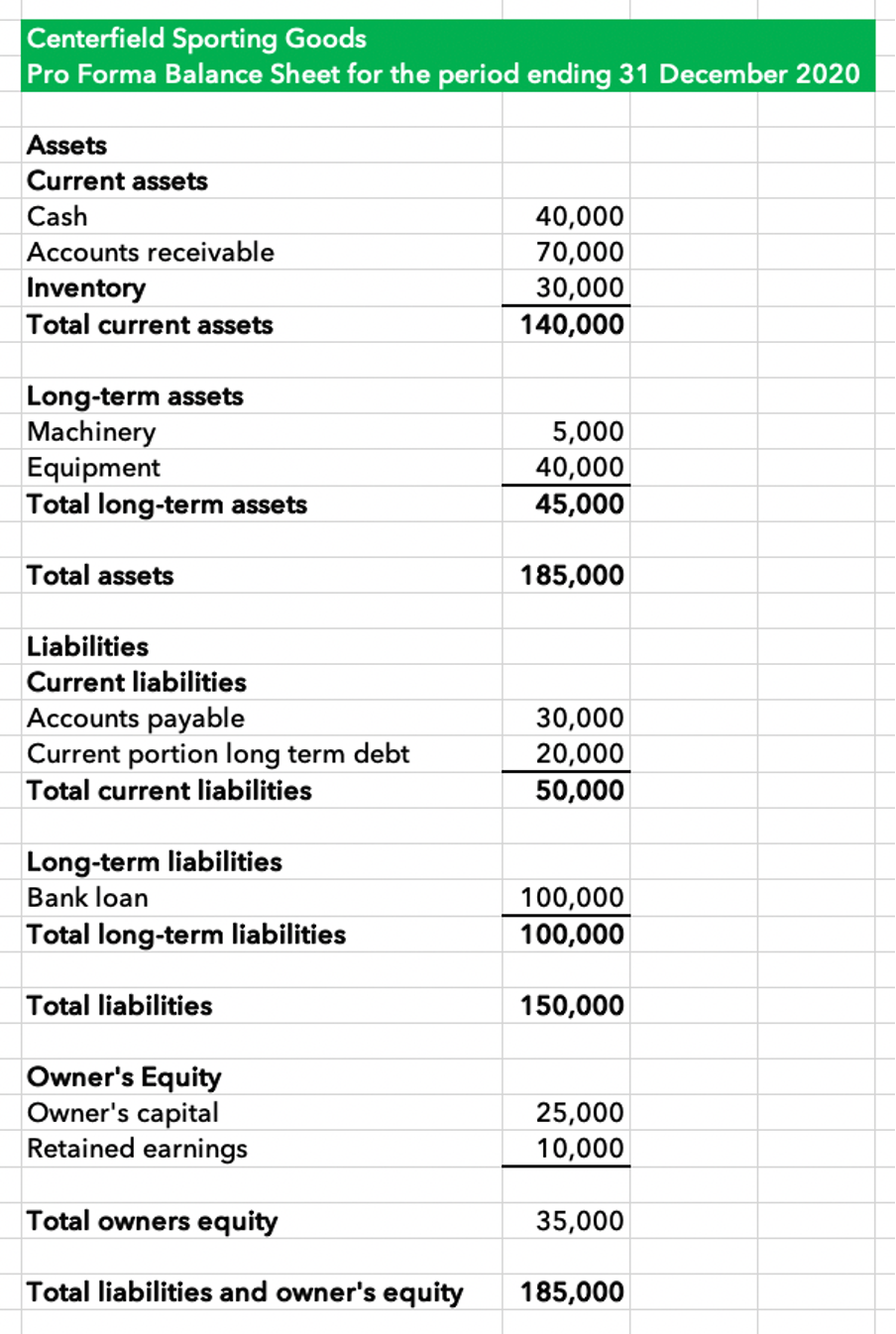

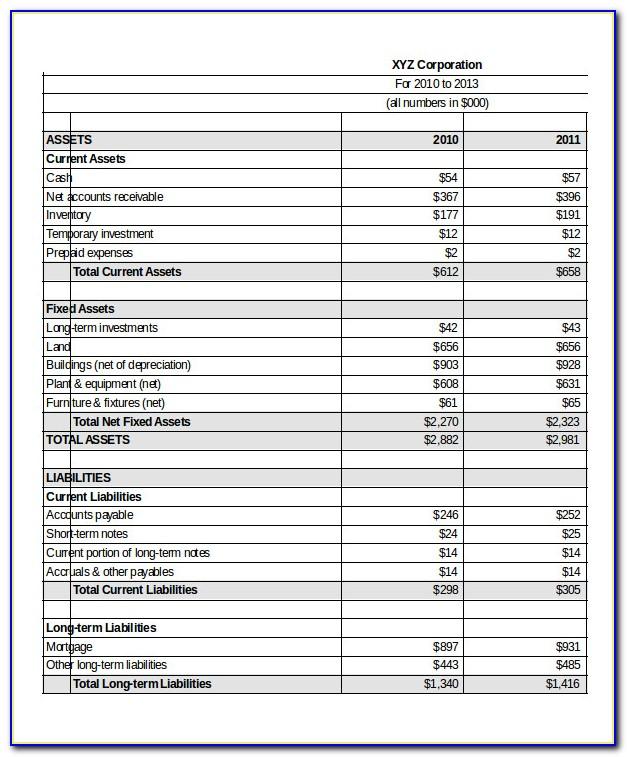

Pro forma statements typically take the form of an income statement, balance sheet, and/or cash flow statement.

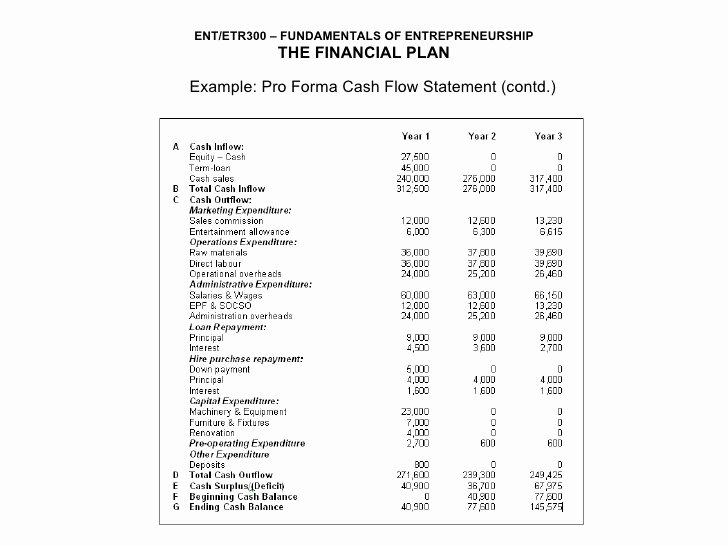

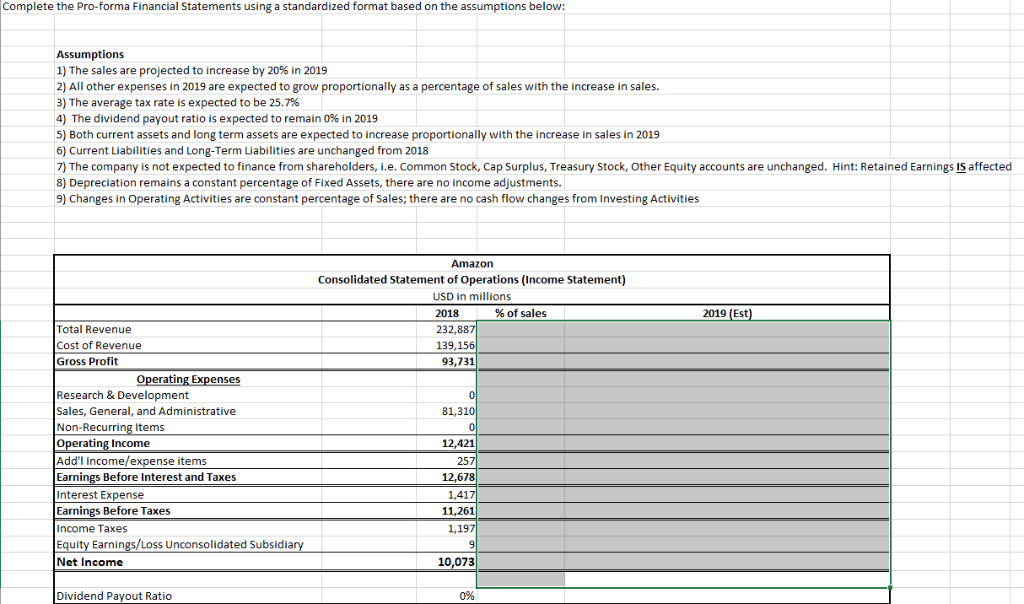

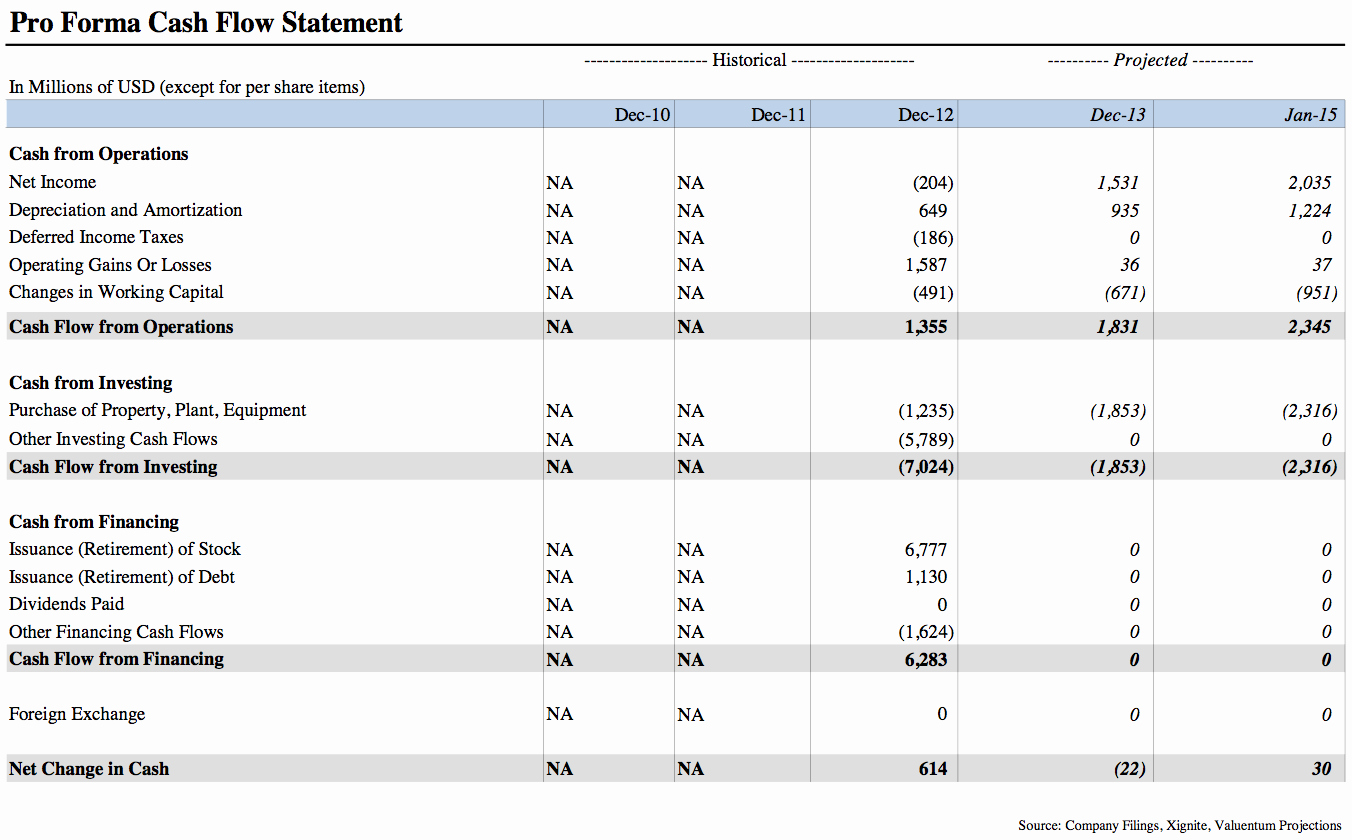

Benefits of pro forma statements. Using these financial statements, you can plan for the future and lower your risk, as well as attract investors or get approved for financing. By trying to predict future needs and operational income and expenses, a company develops a cash budget. Essentially, a pro forma financial statement can exclude anything a company believes obscures the accuracy of its financial outlook and can be a useful piece of information to help assess a.

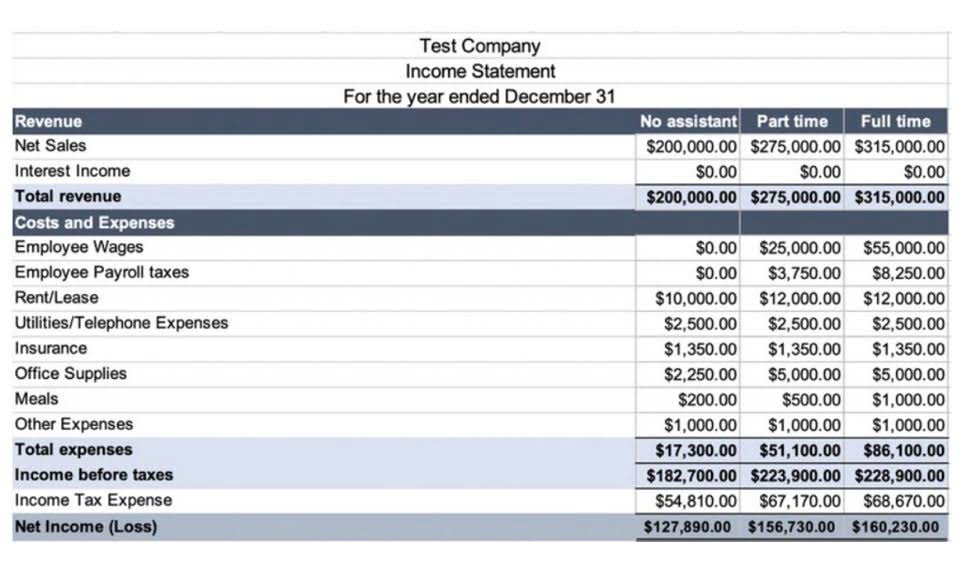

That is, as if the state of the world were different from that which is in fact the case.1 pro forma data adds to or subtracts from. If proper investigation and predictions are made, a cash budget can be very accurate. There are three main types of pro forma statements:

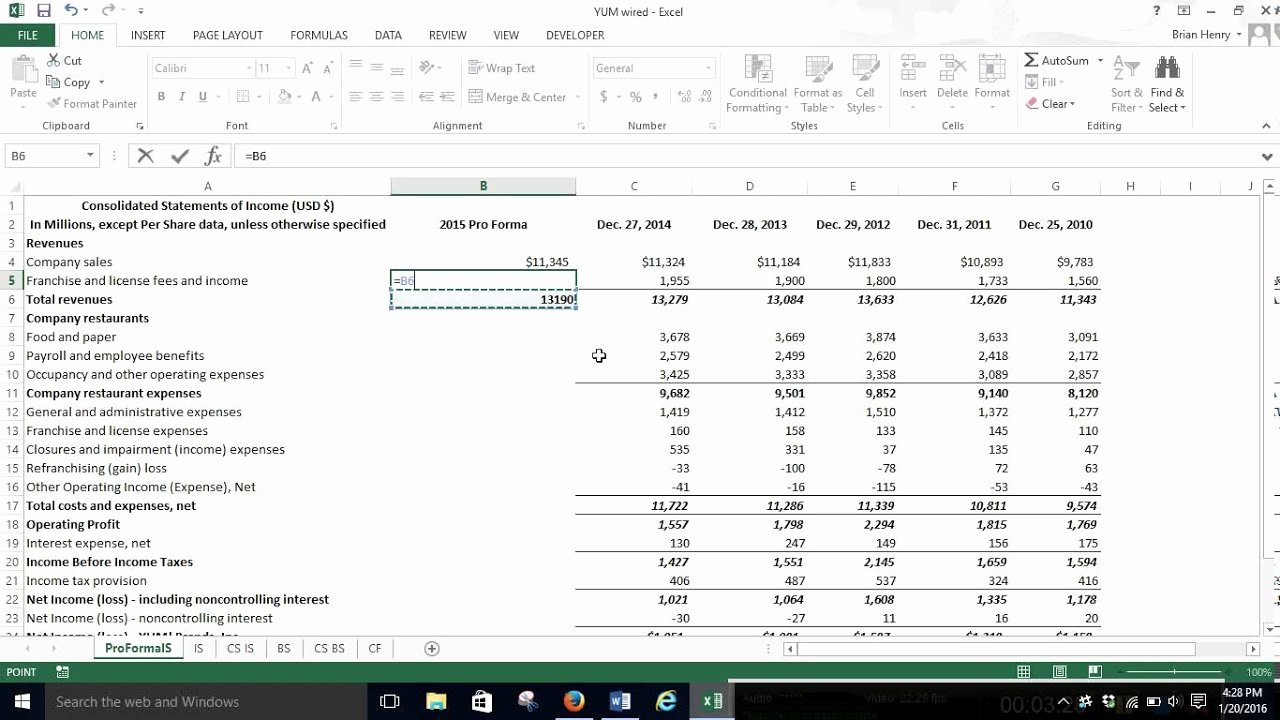

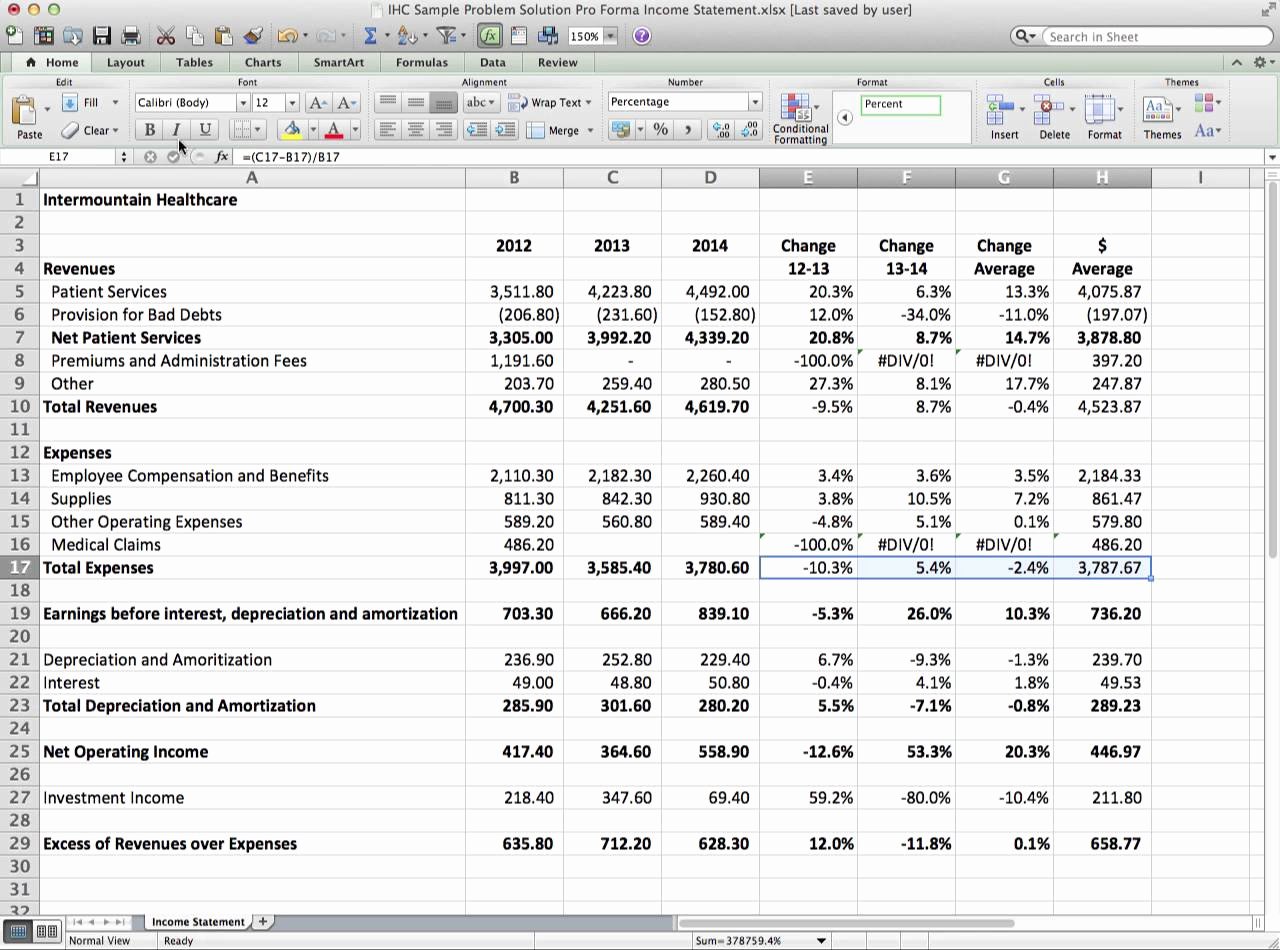

With the historical knowledge of past performance in mind and a careful eye on current trends in the industry, revenues and expenses can be accurately. Benefits of pro forma financial statements pro forma financial statements provide a wealth of information that is useful to businesses, investors, and potential buyers, particularly during the process of mergers and acquisitions. Budget based on the projections for the future, a company develops a cash budget which correlates with the pro forma statement.

4 main types of pro forma statements. The following are some of the key advantages of using pro forma financial statements: Pro forma statements are an integral part of business planning and control.

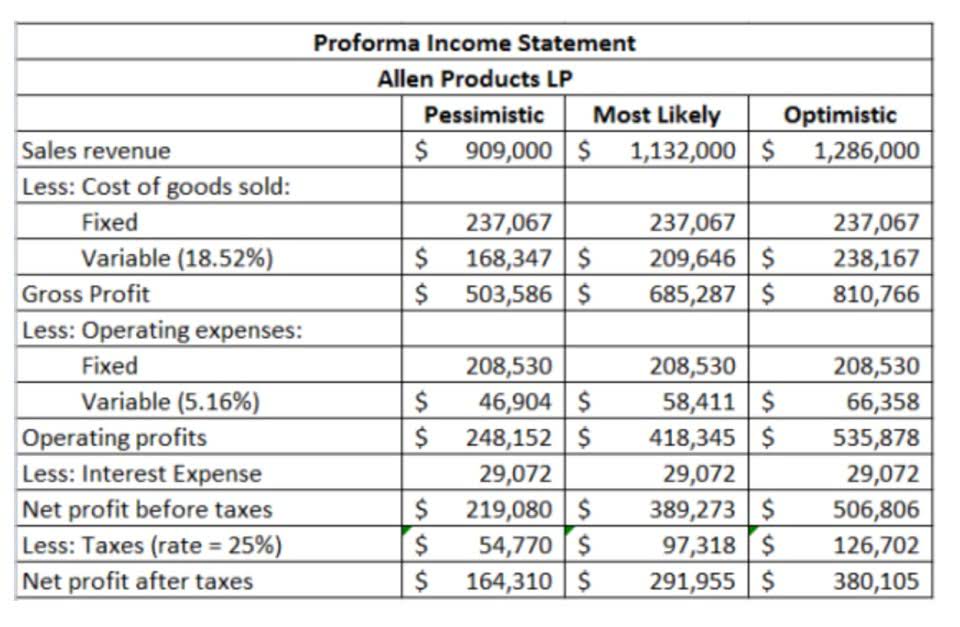

You can send clients pro forma invoices to let them know how much their order would be if they placed it today. Short of having a crystal ball, pro forma financial statements can help you predict things like net income and gross profit in the future. Benefits of pro forma statement.

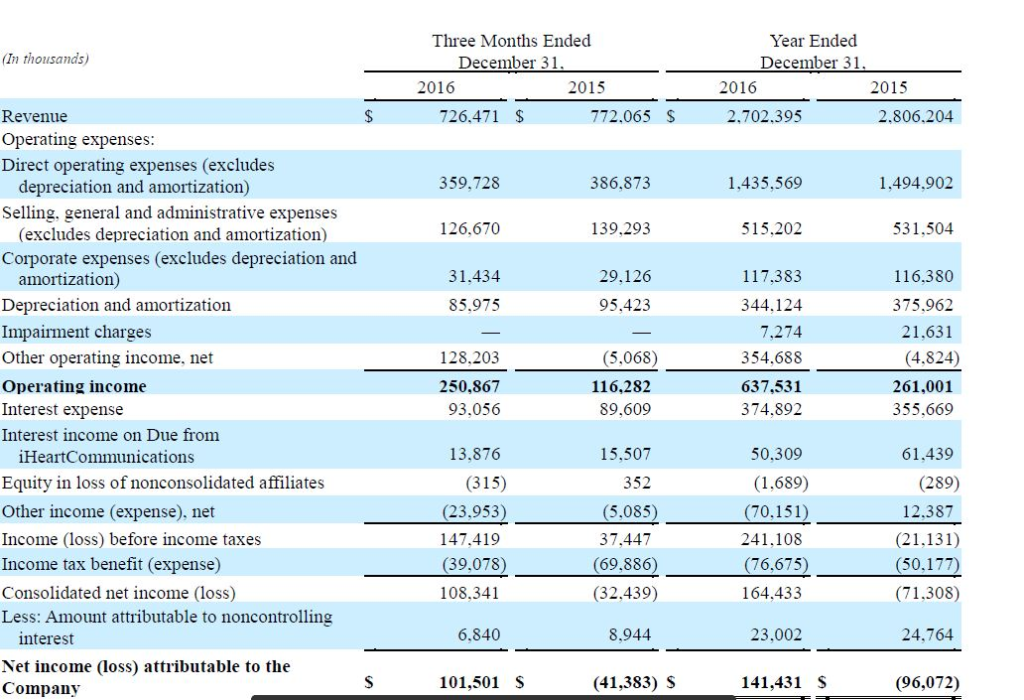

Pro forma statements are also valuable in external reporting. Benefits of pro forma financial statements some common reasons organizations calculate pro forma financial statements are: Income sheet, balance sheet, and cash flow statement.

This gives management realistic numbers of cash needs. A presentation of data, typically financial statements, where the data reflects the world on an “as if ” basis; Pro forma statements can help predict cash flow, analyze risks, and secure funding.

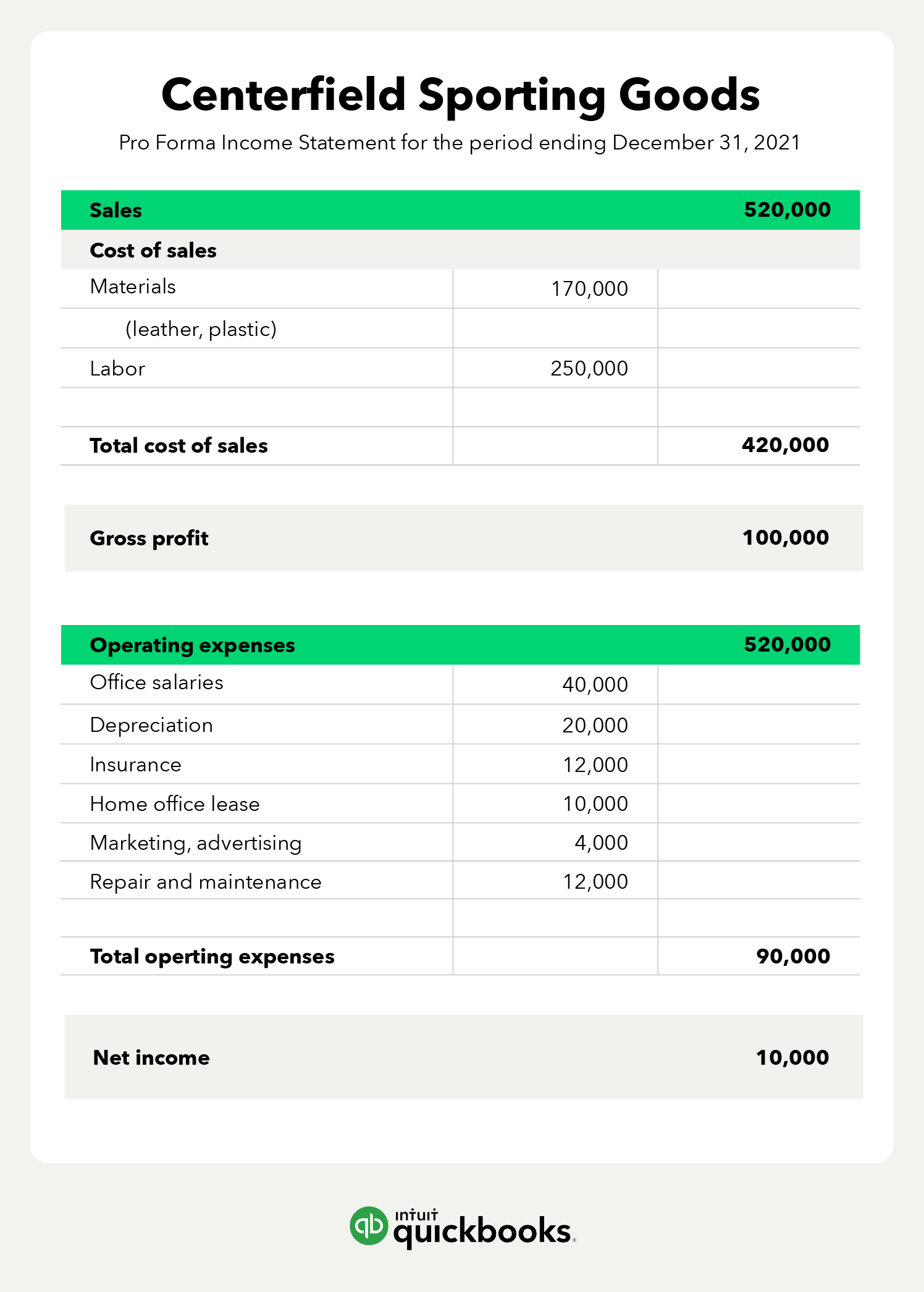

Pro forma income statements. To deliver financial projections, to forecast the impact of a proposed merger or expansion, and to secure. If you’re considering a major decision, such as a business merger or a new product launch, creating pro forma statements is important.

They can help you make a business plan, create a financial forecast, and even get funding from potential investors or lenders. There are four main types of pro forma statements that you can use to manage your cash flows and the financial health of your business. The companies can identify growth opportunities by adjusting the numbers that significantly affect the bottom lines of financial statements.

Pro forma statements are used to create a budget and determine the need of the company for capital. Accelerate your path to better funding Benefits of creating pro forma financial statements pro forma financial statements vs.