Who Else Wants Tips About 26as For Tds

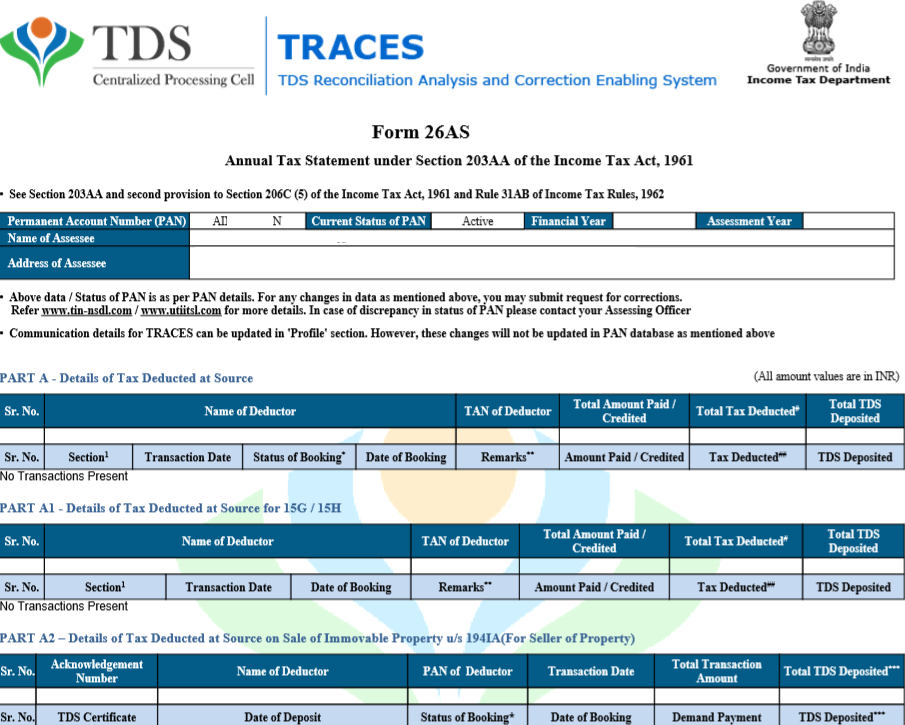

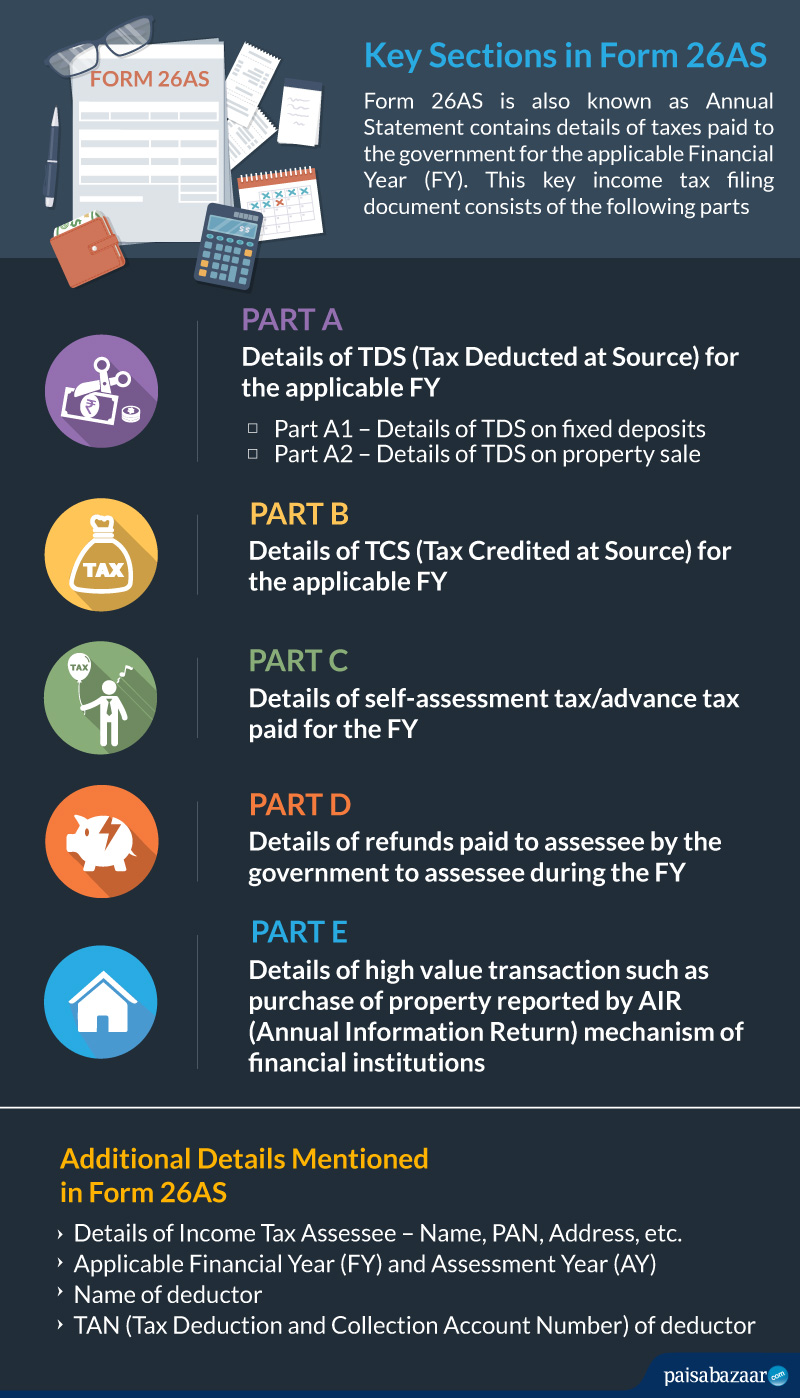

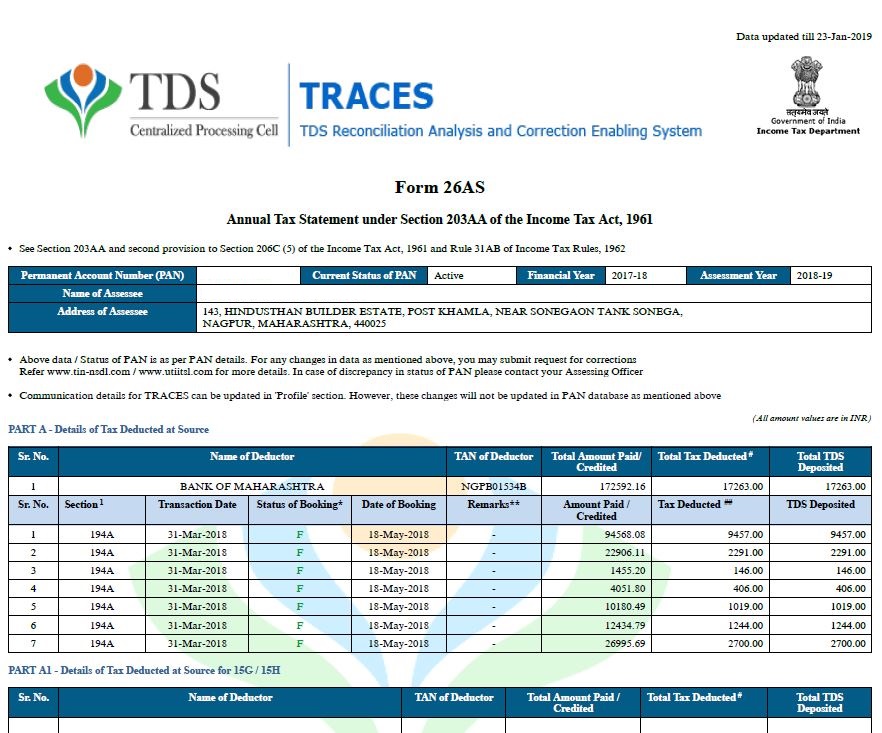

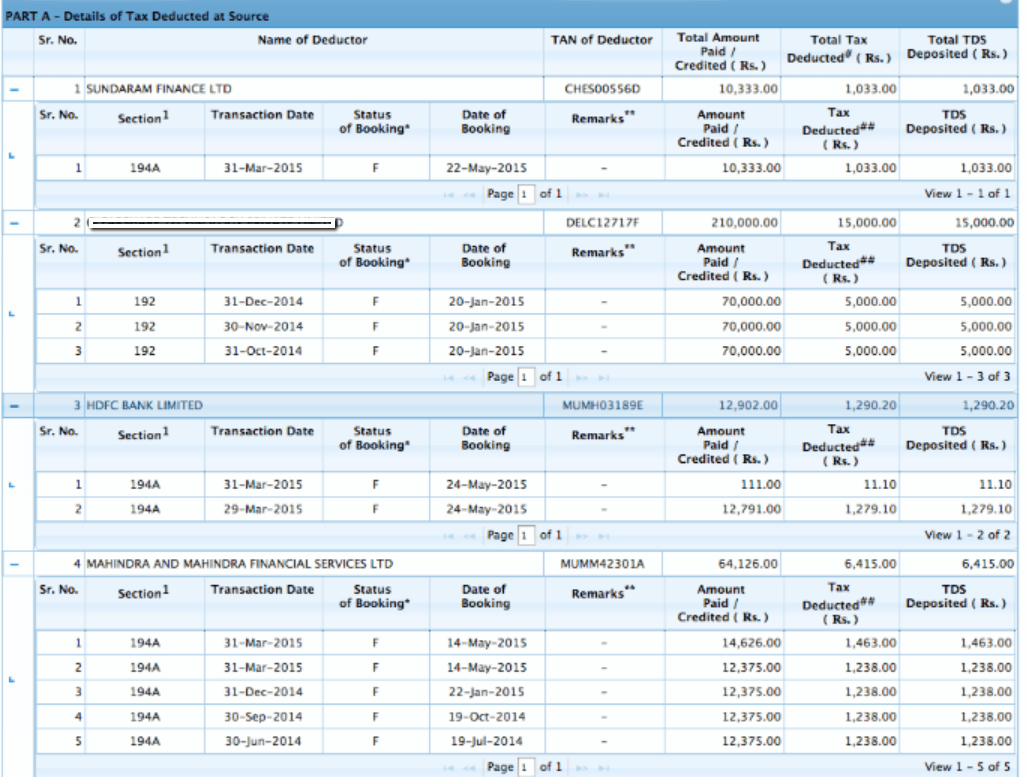

Form 26as is a consolidated tax statement that provides tax related information (tds, tcs, refund etc).

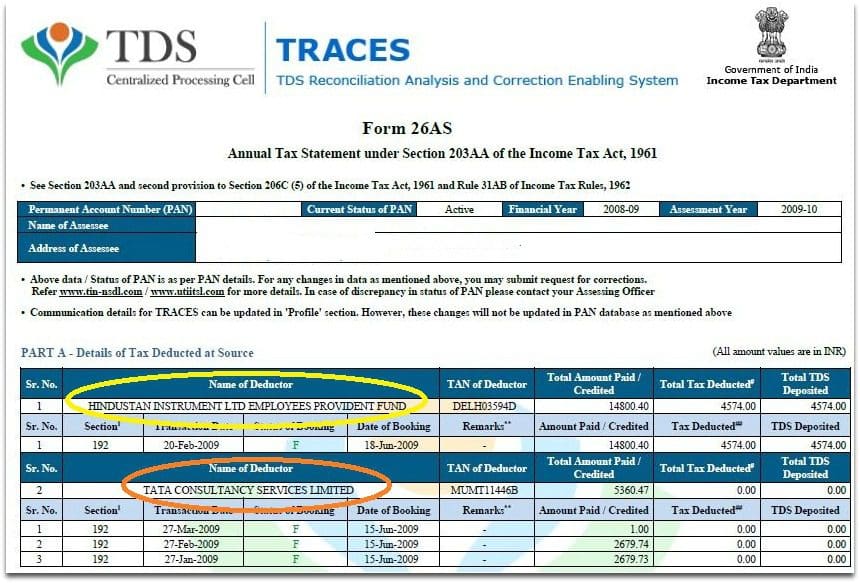

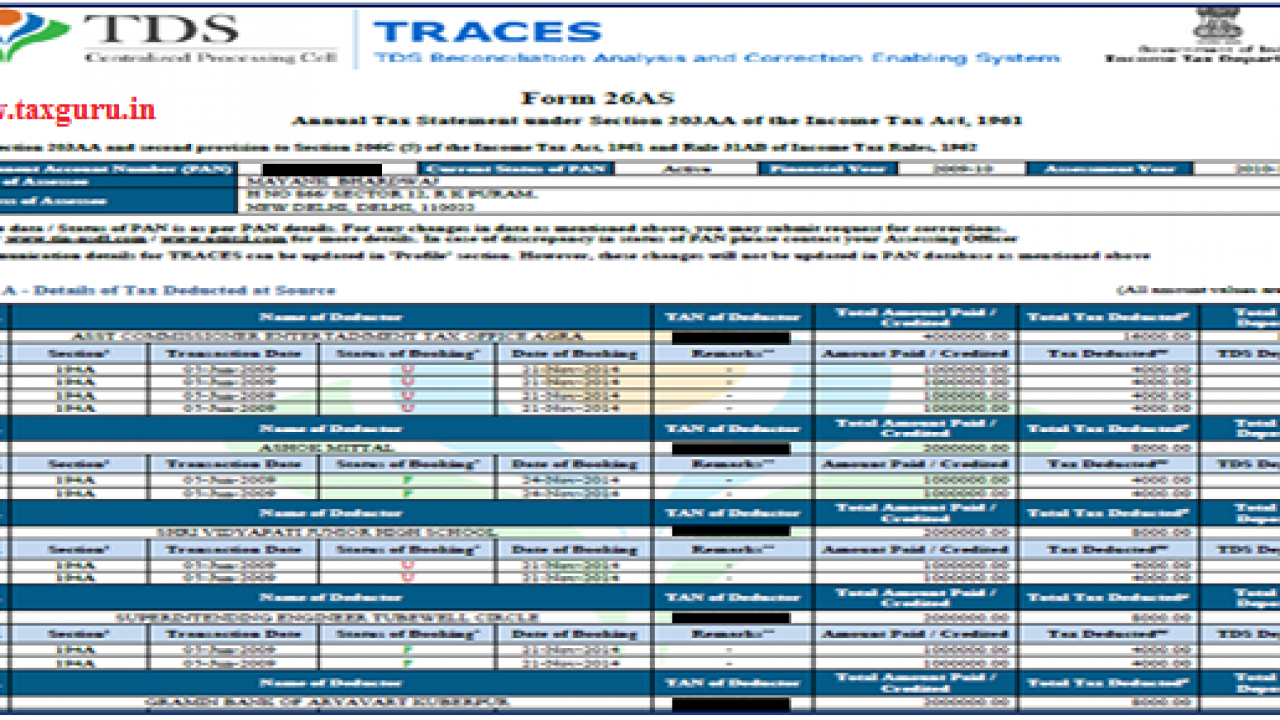

26as for tds. It is important to understand how tds is linked to your pan. The assessee’s submissions were that the services were rendered in a.y. Instructions could be issued to the field officers to accept form 26as based tds credit claims during assessment proceedings (or even after completion of.

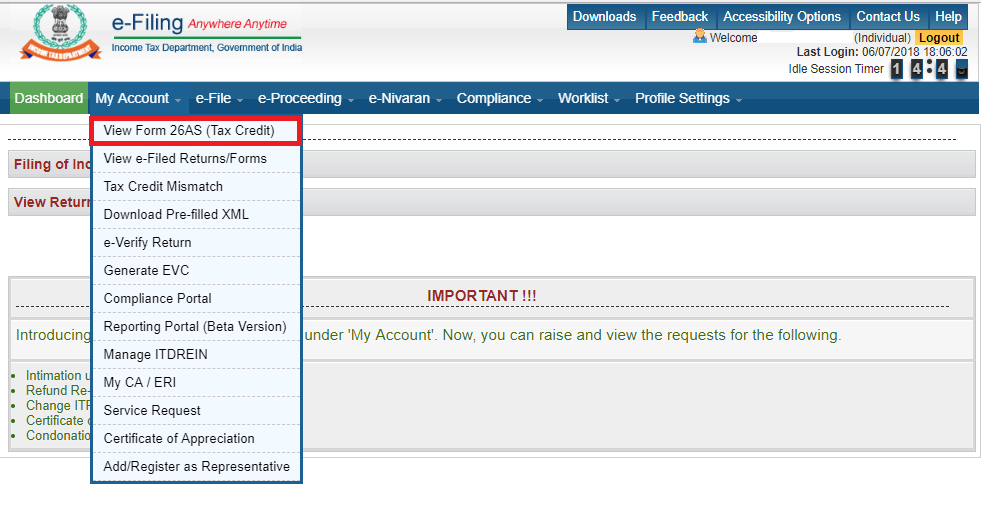

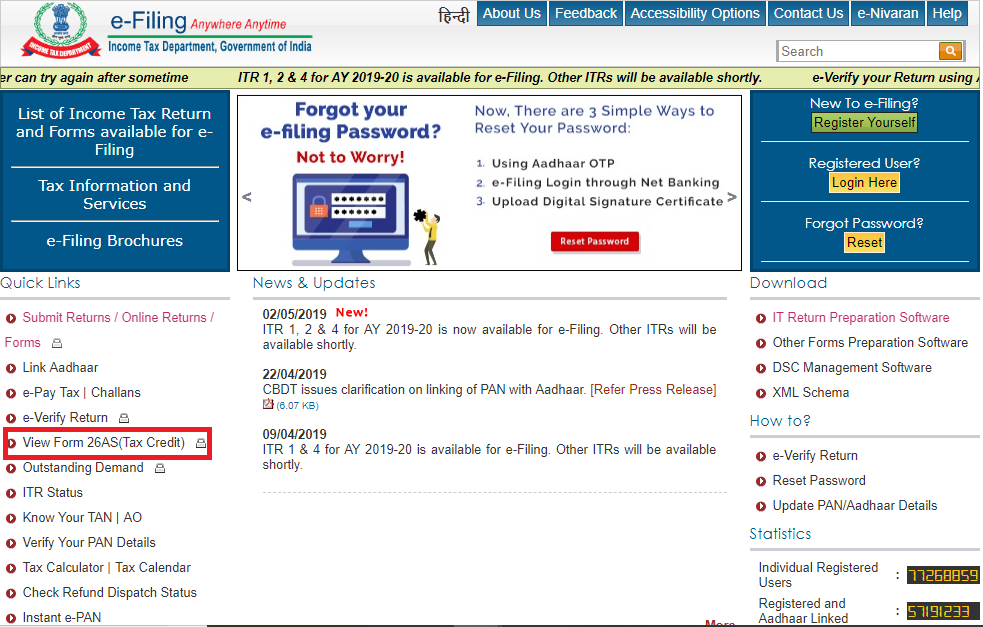

The days of manually filing it returns by downloading. Place the cursor over the. Form 26as is a consolidated annual tax statement that shows the details of tax deducted at source, tax collected at source, advance tax paid by the assessee along.

Form 26as, often known as the tax credit statement, is a crucial record for filing taxes. The website provides access to the pan holders to view the details of tax credits in form 26as. If you are not registered with traces, please refer to our e.

Taxilla provides the most efficient and effective 26as reconciliation along with the ability to. Tds credits in form 26as. Spillover to next tax.

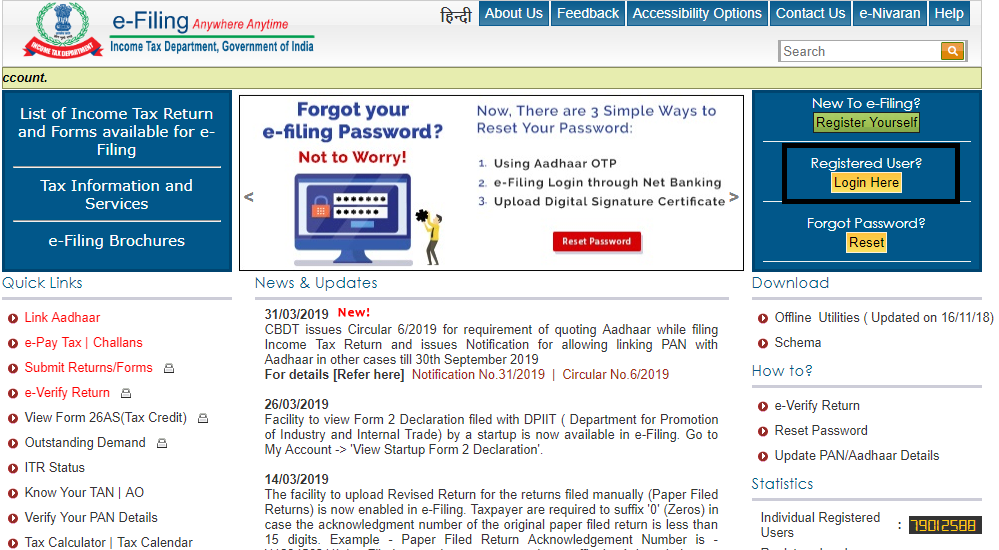

The tax credit statement, also known as form 26as, is an annual statement that consolidates information about tax deducted at source (tds), advance tax paid by. Discrepancy in tax deducted and tds credit. Open incometaxindiaefiling.gov.in/home and log in using pan number (user name) and the password.

Read the disclaimer, click 'confirm' and the user. Form 26as means. Verification of tds amounts can be accomplished through two avenues:

Form 26as is a statement providing information on any amount deducted as tds or tcs from different income sources of a taxpayer. Tds deductions are linked to pan numbers for both the deductor and. Form 26as provides the taxpayer with the relevant tax related information such as details of tds and tcs, details of taxes paid in the form of advance tax and self.

In the matter of 26as, the traces portal collaborates all the 16as from different deductors at the backend and issues the combined tax credit statements, i.e.,. In this blog kinow how to access form 26as. Algoriq reads the 26as statements and matches the entries against the.

Log in to the traces website and select the taxpayer/pao option, then enter “user id”, “password”, and “verification code” to proceed further. Algoriq tracks the provisioned tds entries against 26as entries for reconciliation.