Matchless Info About Cash Flow From Operating Activities Direct Method

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-02-c2254626b9bb4e8eacbfaf47e4e83784.jpg)

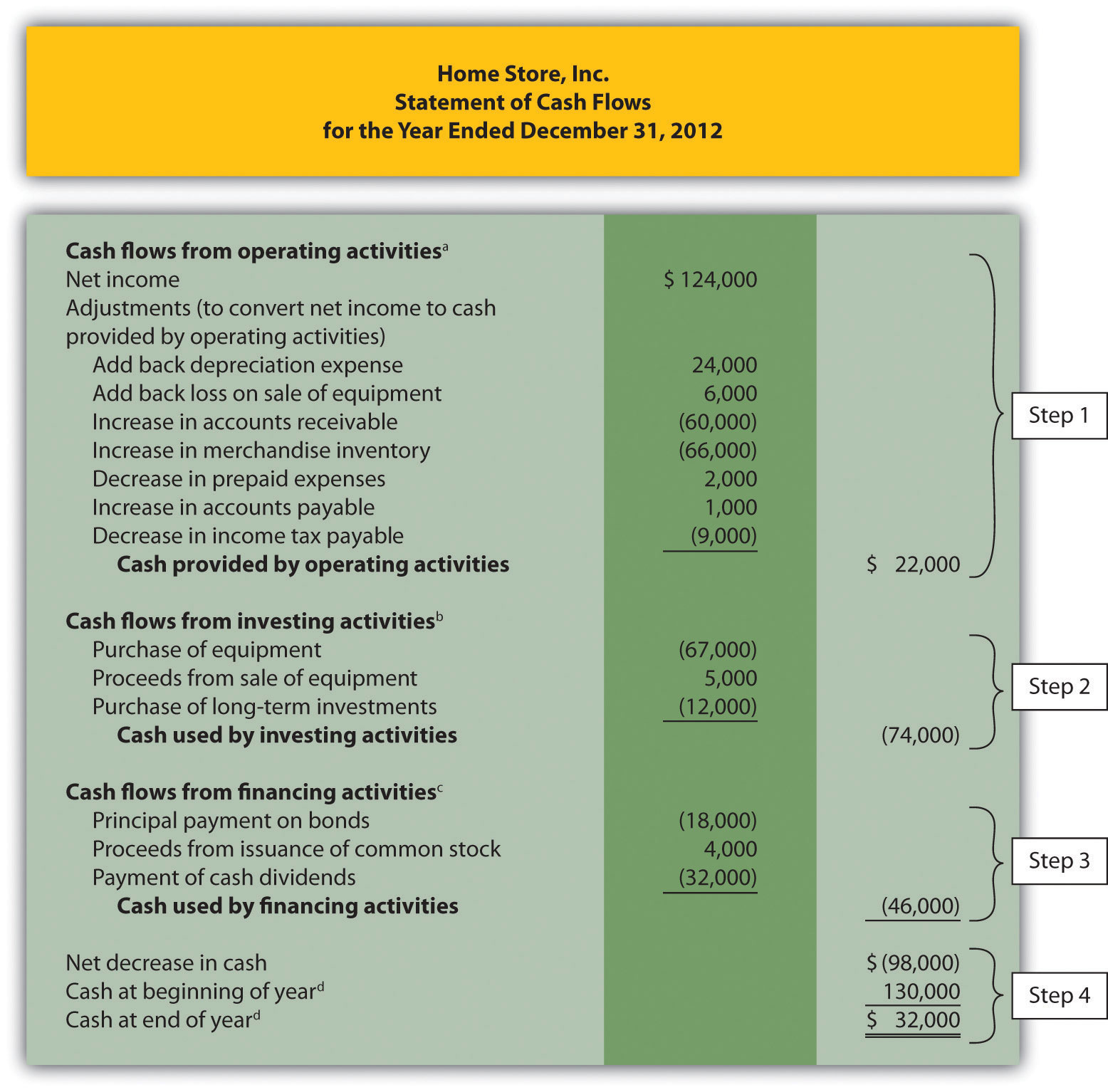

Calculating cash flow from operations using indirect method

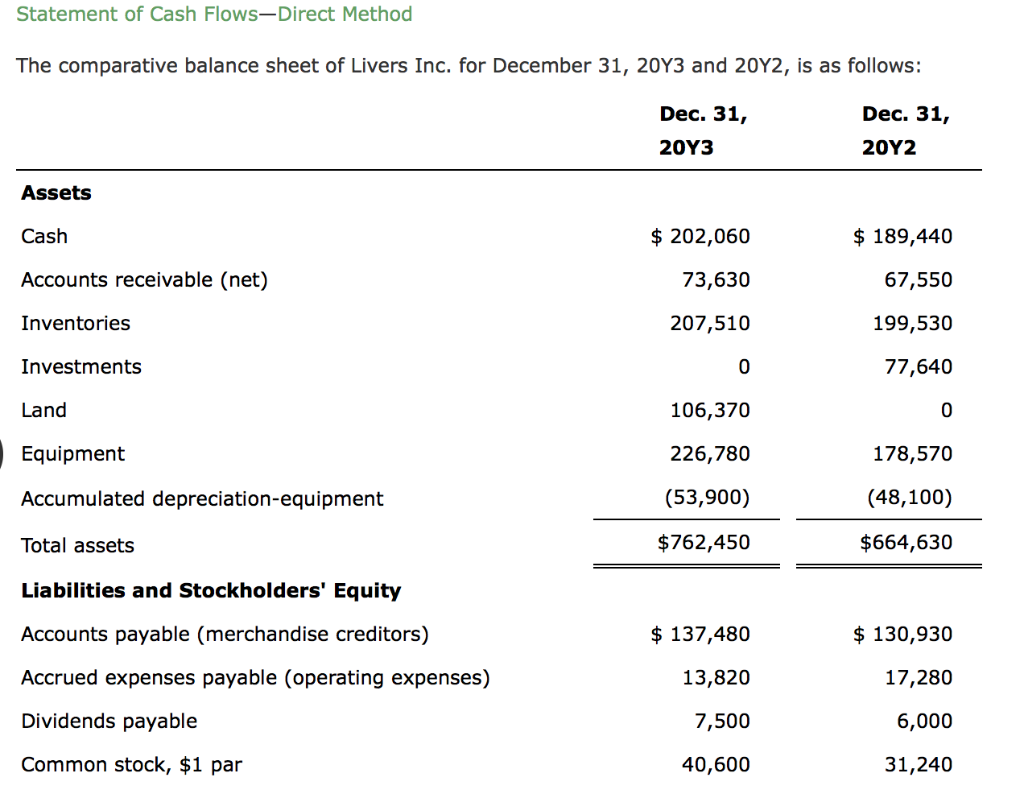

Cash flow from operating activities direct method. $405,200.00 adjustments to reconcile net income to net cash flows from (used for) operating activities: Cash flow from operating activities (cfo) indicates the amount of money a company brings in from its ongoing, regular business activities, such as manufacturing and selling goods or providing a. Operating activities are any activities necessary to operate a business.

Direct method of operating activities cash flows is one of the two main techniques that may be used to calculate the net cash flow from operating activities in a cash. List the income statement accounts that are removed entirely in computing cash flows from operating activities and explain that procedure when the direct method is applied. Calculate cash flows from operating activities by the direct method the direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow.

The two methods of calculating cash flow are the direct method and. What is the cash flow statement direct method? Financing activities display a company’s financing structure.

Cash flow from operating activities group 1: Interest received interest paid group 3:. A direct method cash flow statement includes the company’s operating, financing, and investing cash flow.

Below is an example of the cash flow from the operations segment of a cash flow statement prepared under ifrs using the indirect method: Items that typically do so include: Identify the two methods available for reporting cash flows from operating activities.

It can be calculated using either the direct method which finds out actual receipts from customer and payments to suppliers and others, or the indirect method which adjusts net income to arrive at net cash flow from. Then, each of the separate figures is converted into the amount of cash received or spent in carrying on operating activities. $81,750.00 loss on disposal of equipment:

The main components of the cfs are cash from three areas: Items that typically do so include: As you can see, all of the operating activities are clearly listed by their sources.

This categorization does make it useful to read, but the costs of producing it. $22,300.00 changes in current operating assets and liabilities: Cash flows from operating activities:

Under the direct cash flow method, you subtract cash payments, such as payments to suppliers, employees, cash receipts operations and customer receipts, during the period. Dec 31,2016 dec 31,2015 $ $ cash flow from operating activities net profit 3,457 4,256 taxation 1,200 1,189 net finance costs 536 245 operating profit (continued and discontinued operations) 5,193. Cash flows from operating activities:

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Cash paid for goods and services (2,473,420) depreciation expense: The direct method of accounting for cash flows from operating activities.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)

/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)