Breathtaking Tips About Advance From Customers In Balance Sheet

An invoice is sent to the customer, consequently, the customer advance shown as a liability on the balance sheet is.

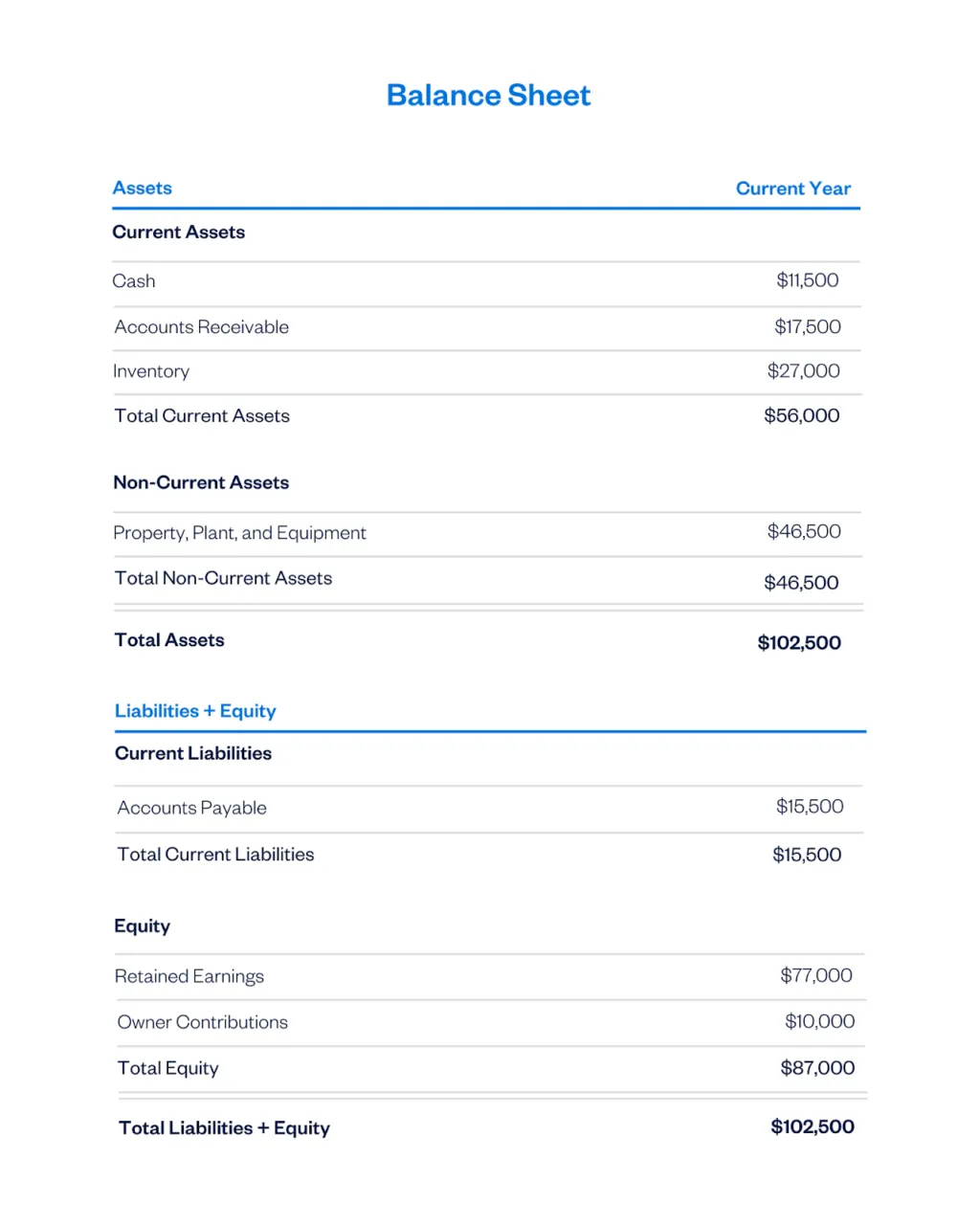

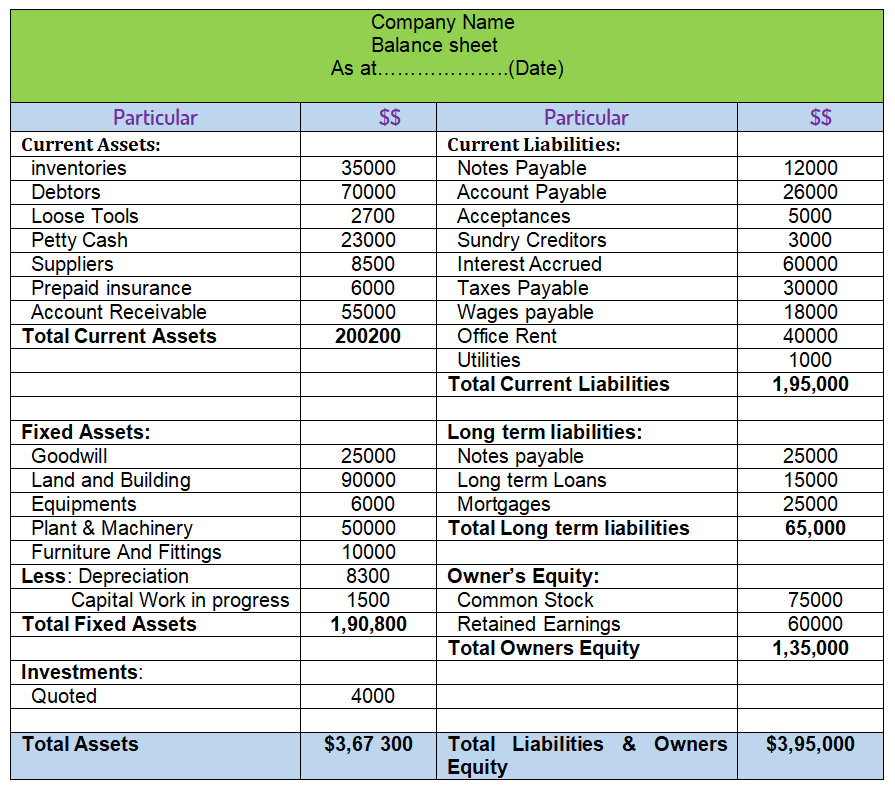

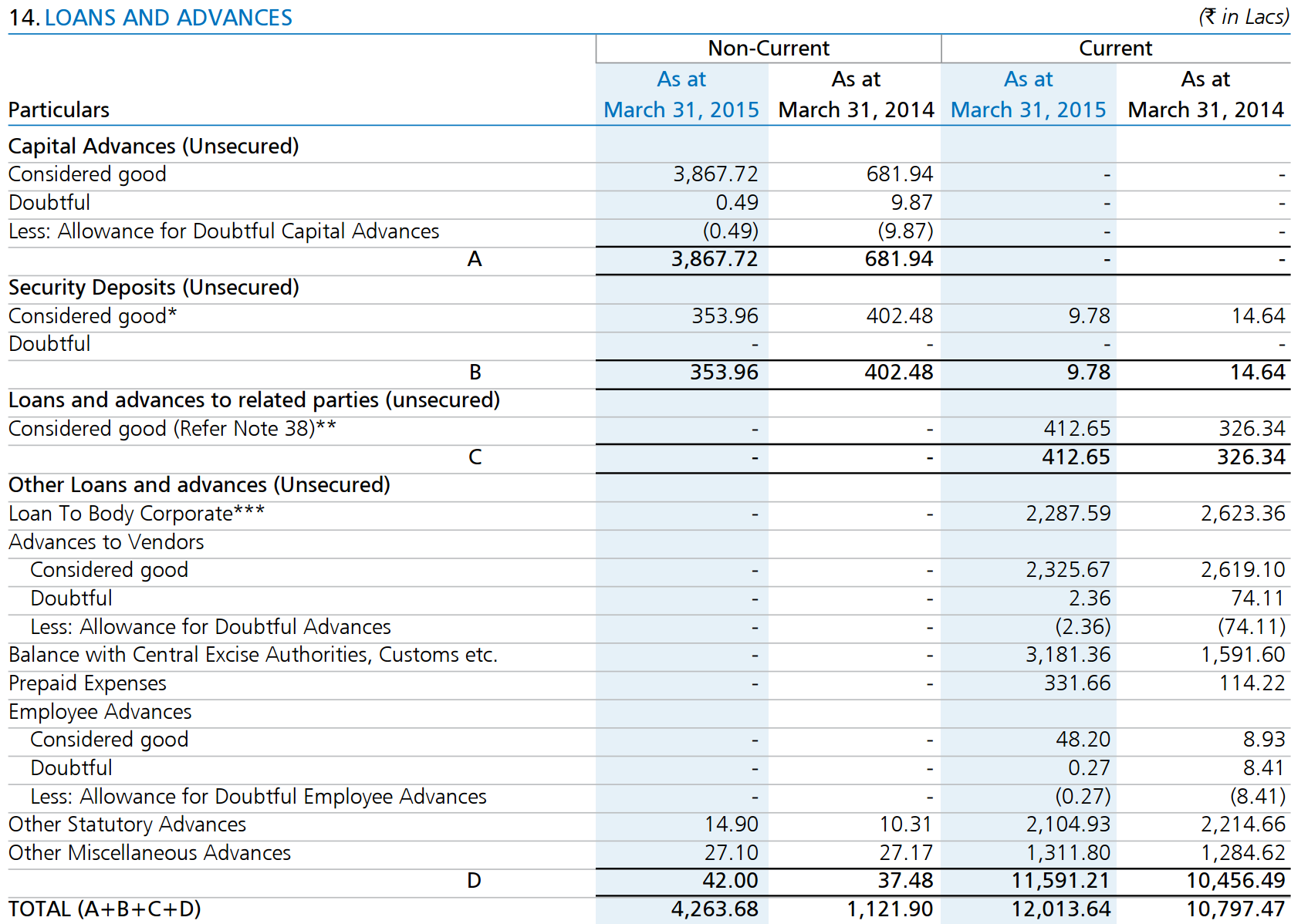

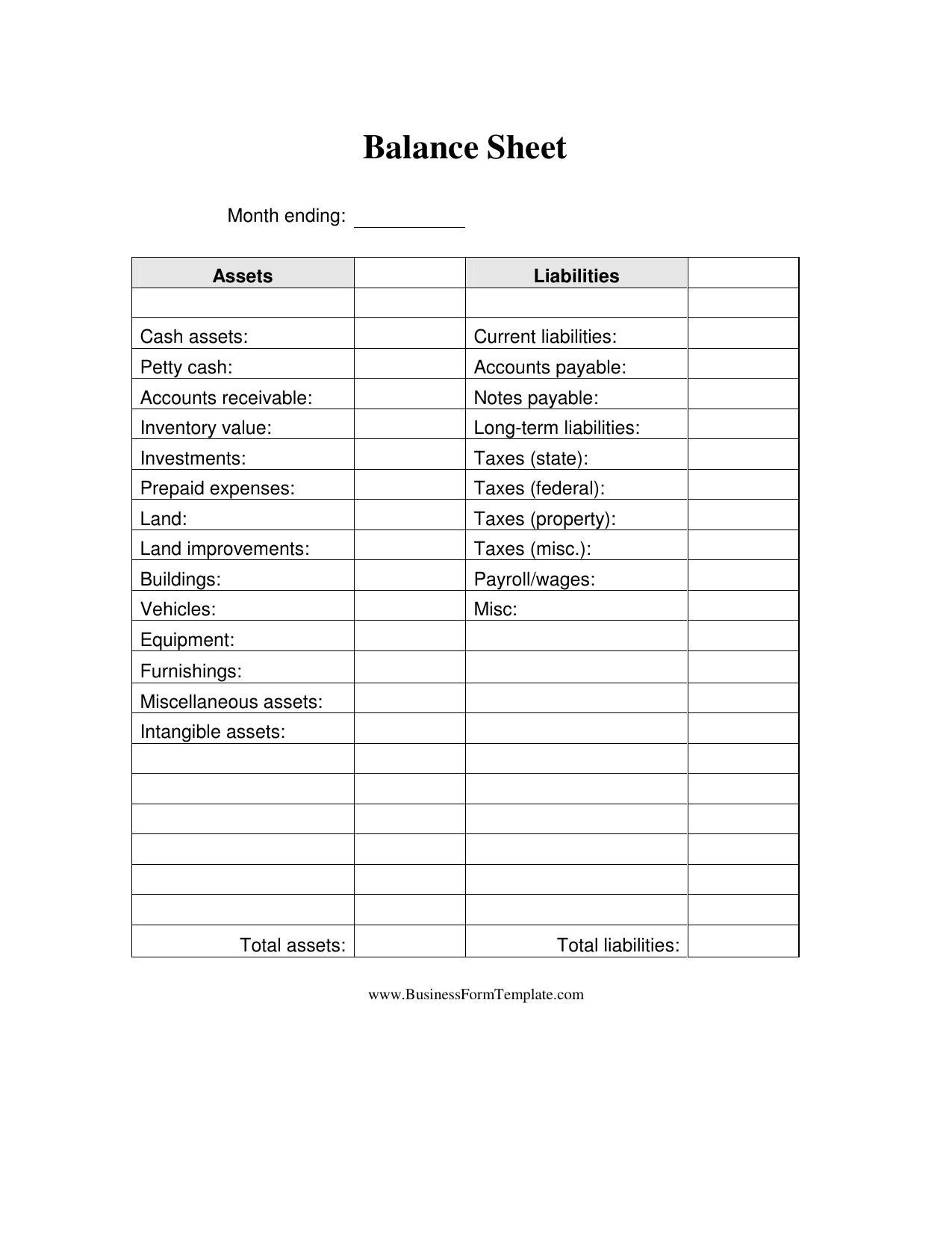

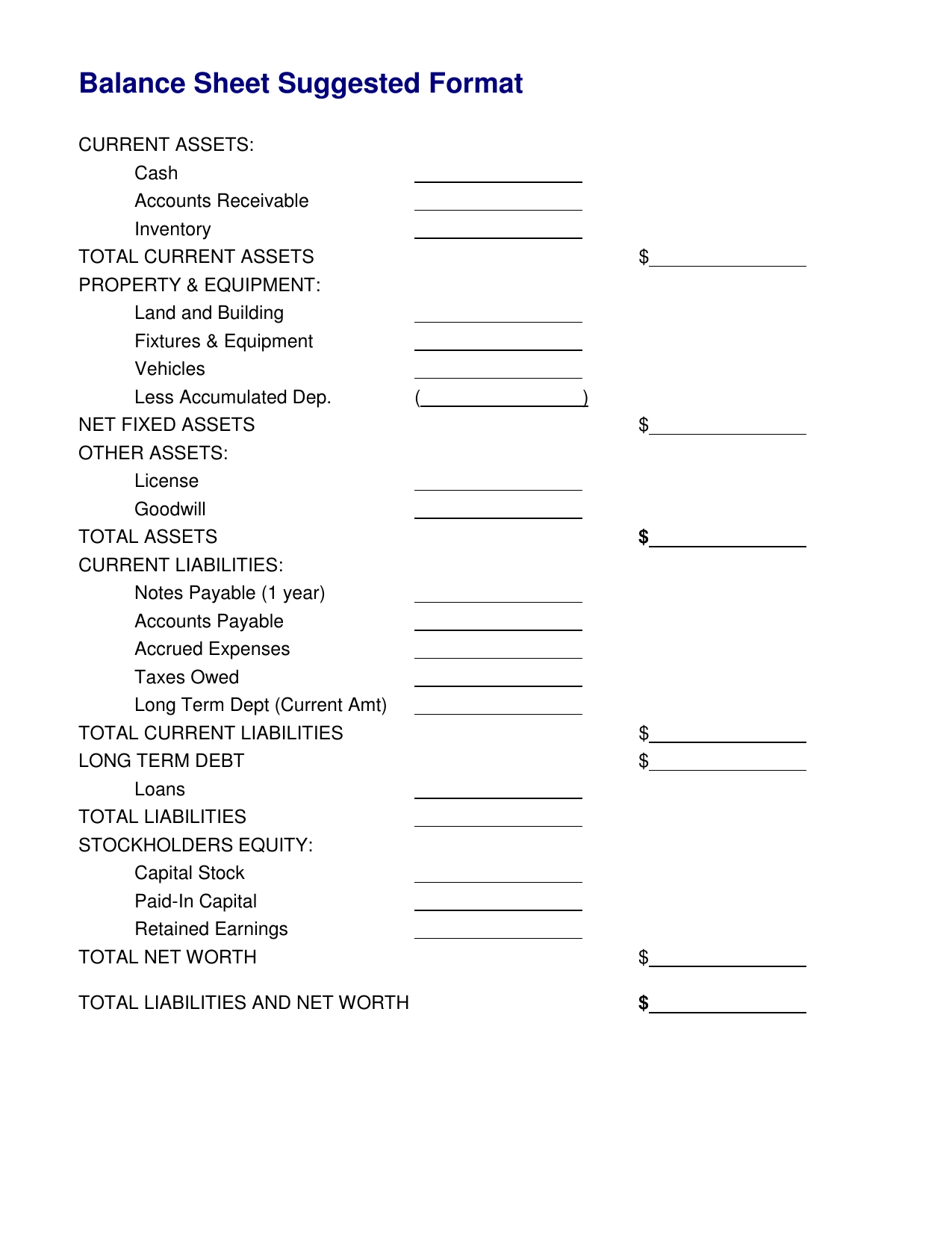

Advance from customers in balance sheet. Once the related goods or services have been delivered, the amount in this account is shifted to a revenue account. Showing the customer advances in the balance sheet is the most important thing which states the financial position of the firm. Loans and advances are general descriptions of debt obligations companies owe and must show on their balance sheet as part of total liabilities.

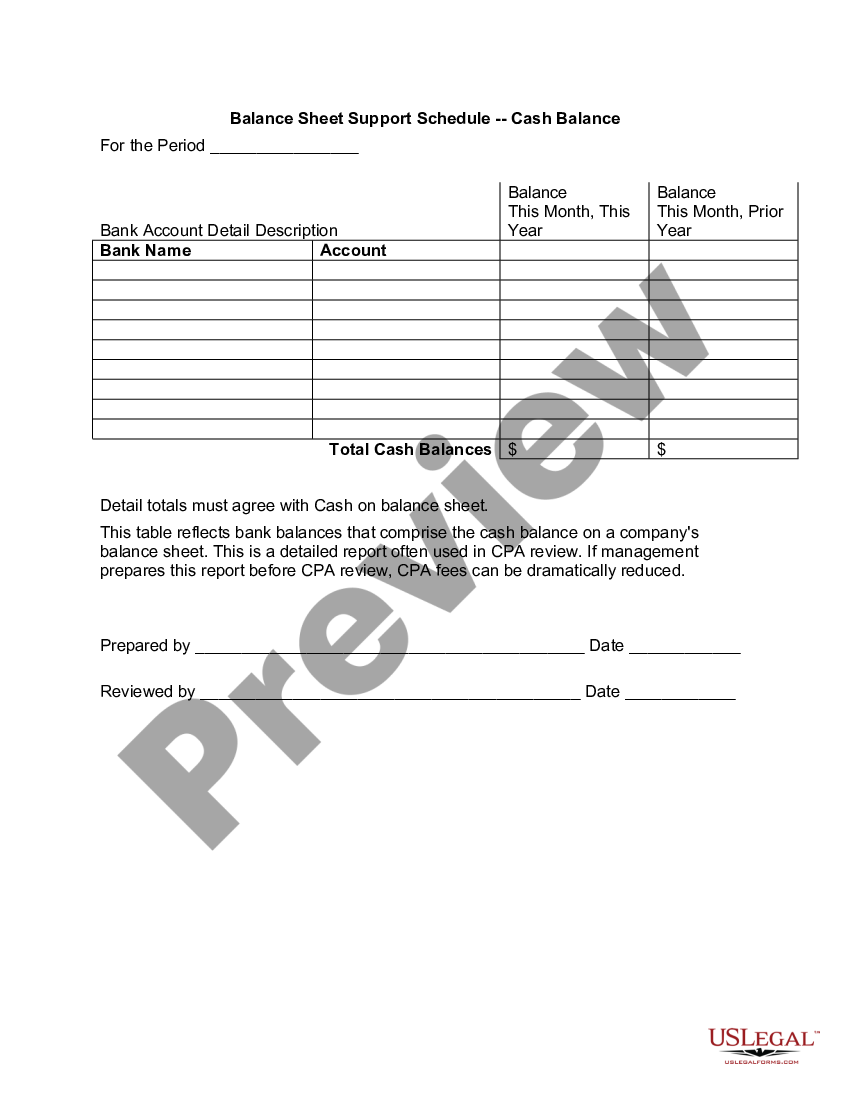

To request advance payments, businesses should communicate payment terms and policies. Formal contracted loans are typically designed as notes payable on a balance sheet, whereas advances or purchases on credit are recorded as accounts payable. If they will be earned within one year, they should be listed as a current liability.

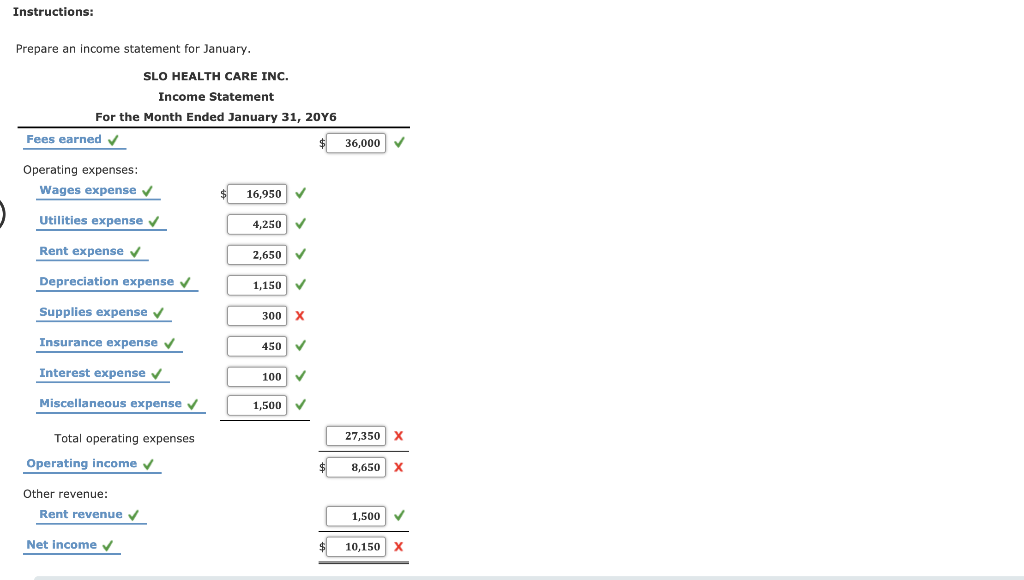

When the final product is ready for delivery. As these assets are used, they are expended and recorded on the income statement for the period in which they are. Advance payments are recorded as a prepaid expense in accrual accounting for the entity issuing the advance.

Advance from customer is not shown in income statement, but in balance sheet as liability. The reason behind customer advances being classified as a current liability is that this amount is owed by the organization, and they need to carry out performance obligation tasks in order to fulfill that particular sale. To tackle this problem, there’s a solution called “advance billing.”

Advance payments are recorded as assets on a company's balance sheet. Where does revenue received in advance go on a balance sheet? As per accrual based accounting the revenue is earned at this step i.e.

We know that the company collected cash, which is an asset. It can make the already tough job of running a business even tougher. Do not venture to combine the customer advances with the sundry creditors under current liabilities on liabilities side of.

Definition of revenue received in advance. Sending this invoice in advance helps increase cash flow for your company and makes it easy for your customers to set up recurring payments. As per accrual based accounting the revenue is earned at this step i.e.

If revenue is earned, it is treated as income. Advance from customer is a liability account , in which is stored all payments from customers for goods or services that have not yet been delivered. Introduction running a business in today’s world can be quite challenging.

How can i request advance payments from customers or clients? This change to assets will increase assets on the balance sheet. Advance payment is the type of transaction where the payment for the goods or services is paid even before they are delivered.

The change to liabilities will increase liabilities on the balance sheet. Customer advance account is shown on the liability side of the balance sheet as the related revenue is still unearned. 1 qualify the type of advance payment.