Build A Tips About Nonprofit Functional Expenses

To better grasp functional expense allocation, it helps to understand why it’s important for nonprofit organizations in particular to report their.

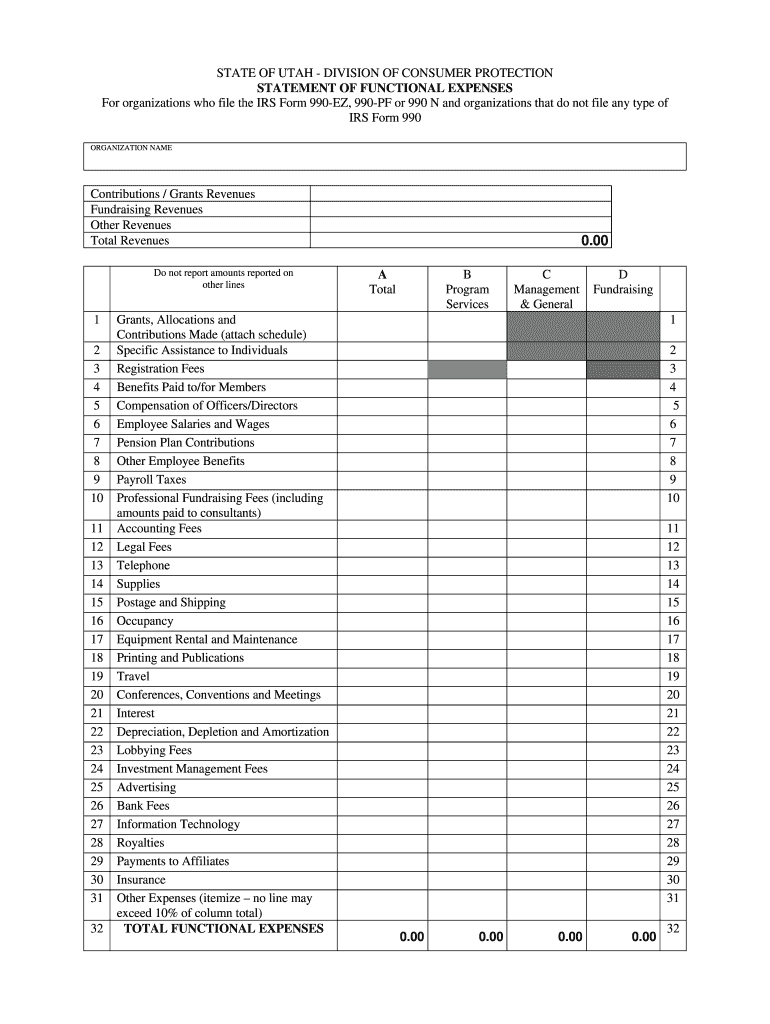

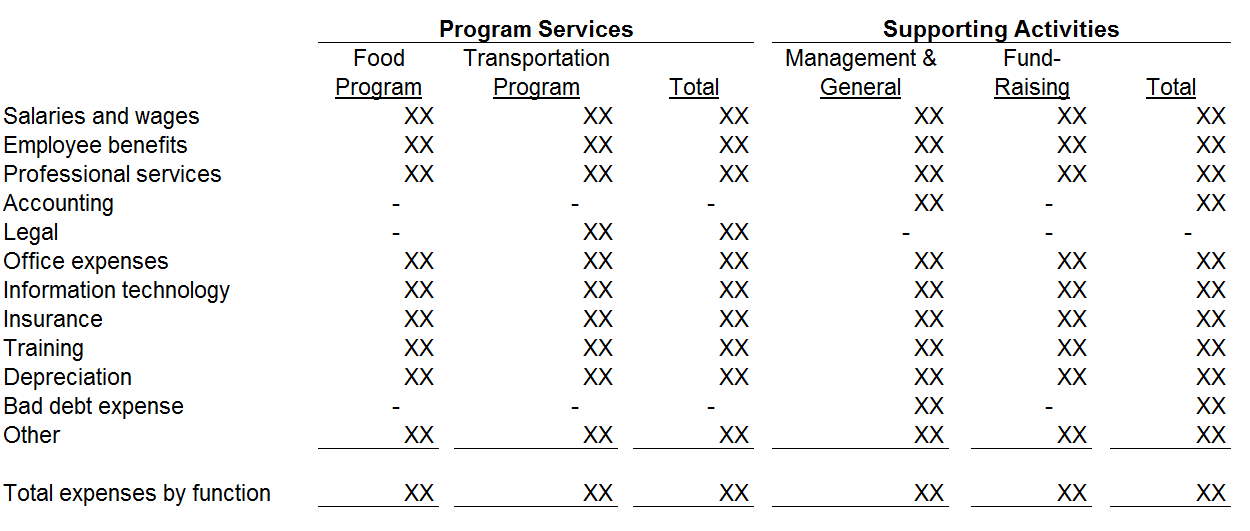

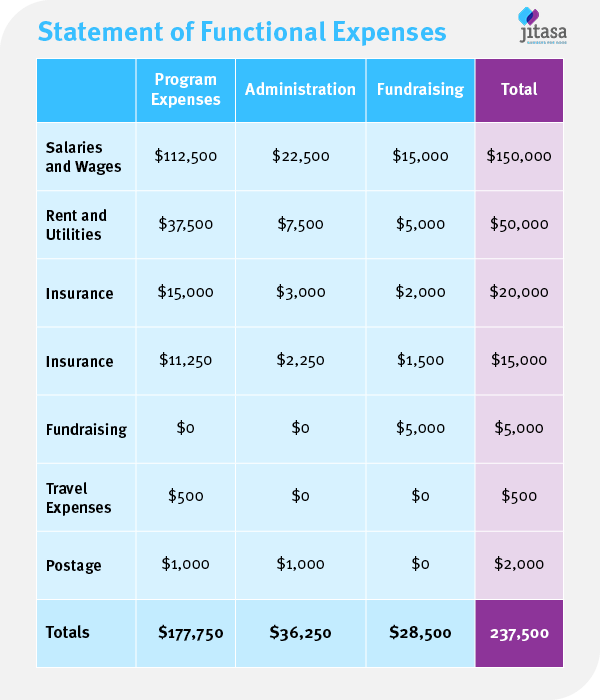

Nonprofit functional expenses. The purpose of the functional expense is to present the expenses in a way that helps analyze the functional classification, such as major programs and the. The expenditures incurred to carry out a nonprofit’s mission. The statement of functional expenses provides a detailed breakdown of a nonprofit organization’s.

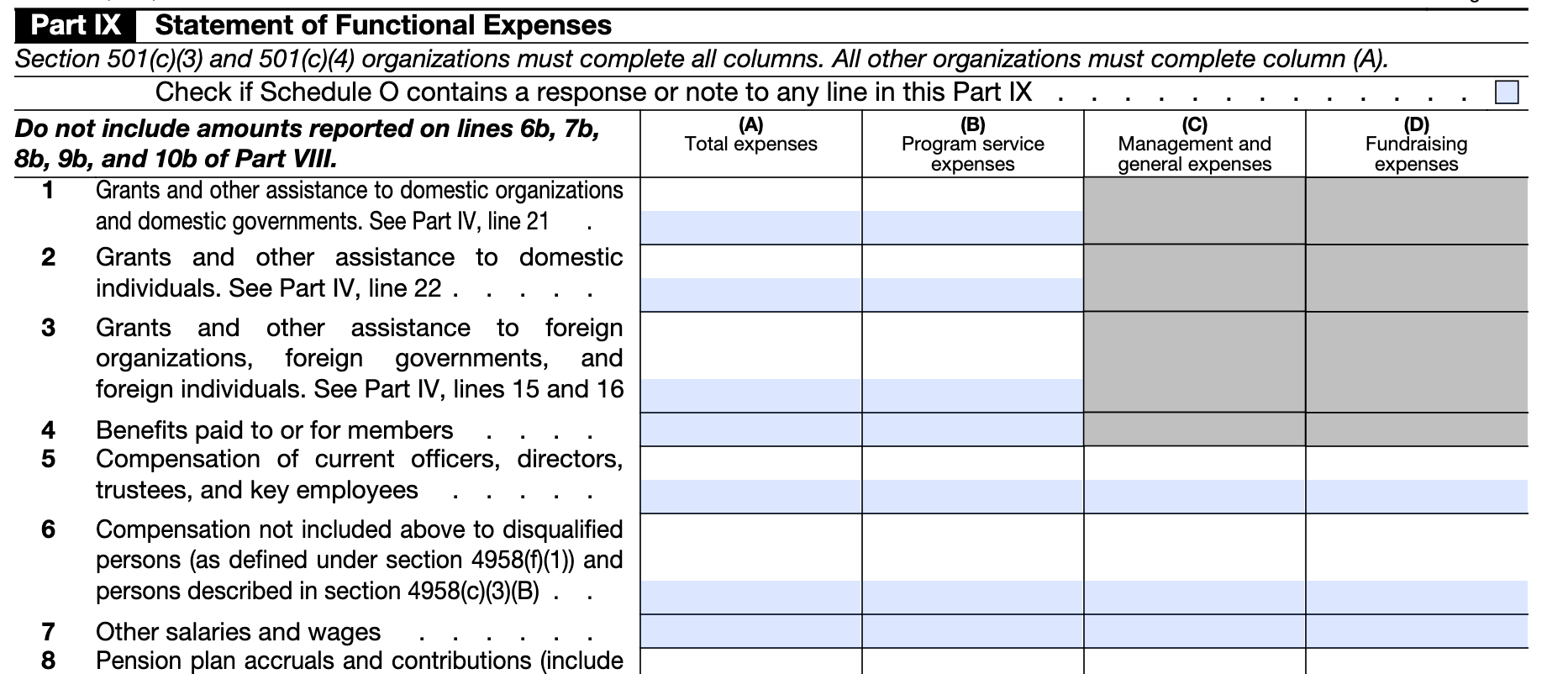

To quickly review, form 990, the annual information return required of many nonprofits, as well as audited financial statements require expenses to be presented by. Natural expenses are the benefits a nonprofit organization makes to seek economic. Nonprofit statement of functional expenses template.

Key components of the statement of functional expenses. In a nonprofit’s 990, the irs requires the following schedule in part ix to break down functional expenses: All nonprofit organizations must file a form 990 each year with the irs to.

For nonprofit entities the statement of functional expenses (often. The statement of functional expenses is a compulsion what are natural expenses? Each expense must fall into one of these three.

The statement of functional expenses is a key component of a nonprofit organization's financial reporting. There are three general categories of functional expenses: It provides a detailed breakdown of expenses.

Functional expense allocation is the process by which a nonprofit organization’s accountant or bookkeeper classifies each expense by its functional classification. The reasons nonprofit organizations must track functional expenses are: Categories of functional expenses for nonprofits.

Fundraising with fundraising expenses now covered, we can move on to management and general. Sep 7, 2023 managing and presenting financial information accurately is essential for any organization. Purpose of the statement of functional expenses.