Outstanding Tips About Cash Flow Statement Positive And Negative

Cash flow statement positive and negative. To turn a negative cash flow into positive cash flow requires careful planning and management of finances. Fails to present net profit: Interpreting positive and negative cash flow.

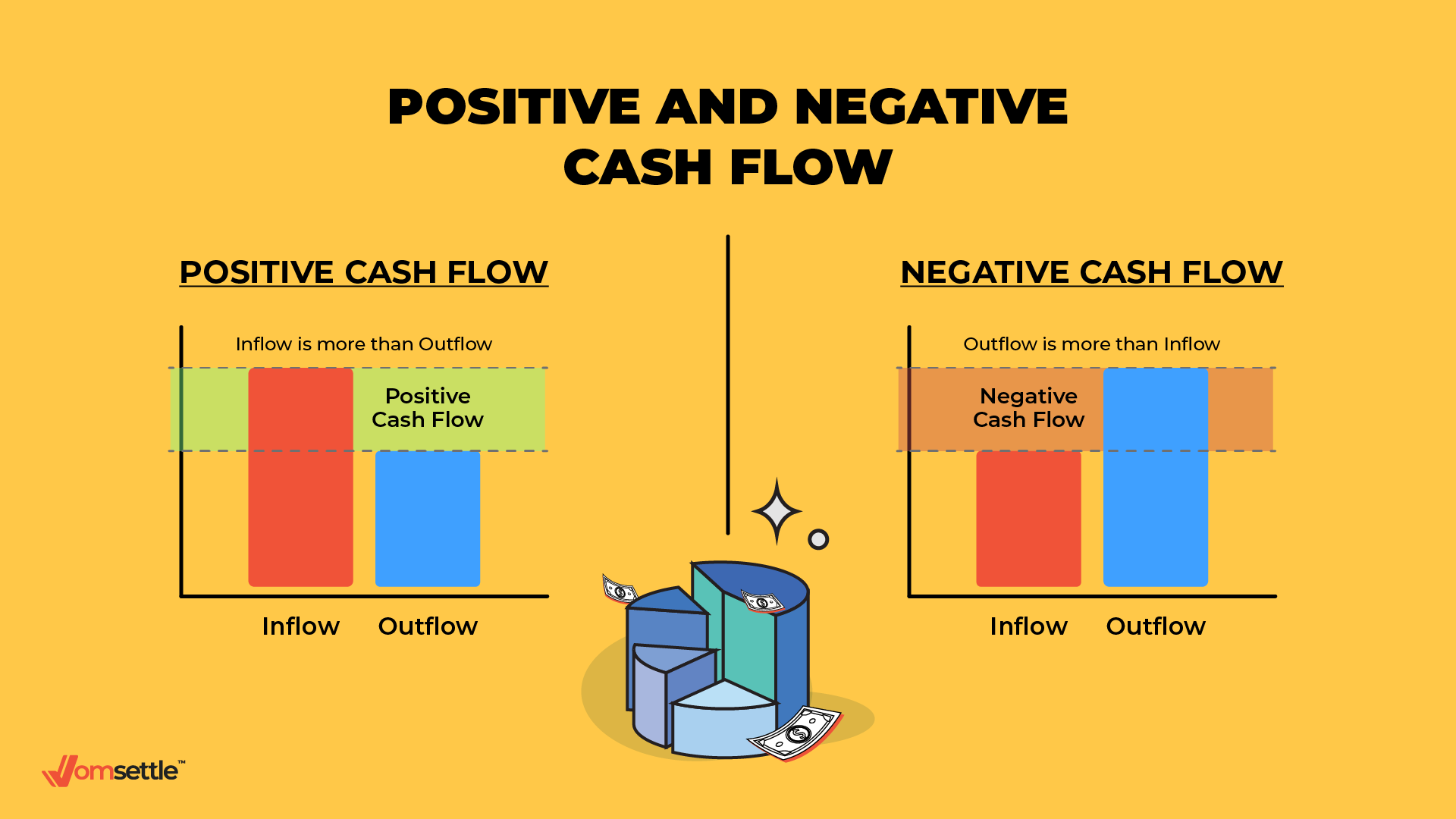

If you are cash flow positive for several months in a row, your business is accumulating cash. Cash flow is measured over fixed periods of time, typically a month. Positive cash flow occurs when the inflow of cash is greater than the outflow, whereas negative cash flow happens when the outflow of cash exceeds the inflow.

If a company has positive cash flow, the company's liquid assets are increasing. Taking steps such as identifying revenue streams and learning. Positive cash flow occurs when more cash flows into your business than flows out of it.

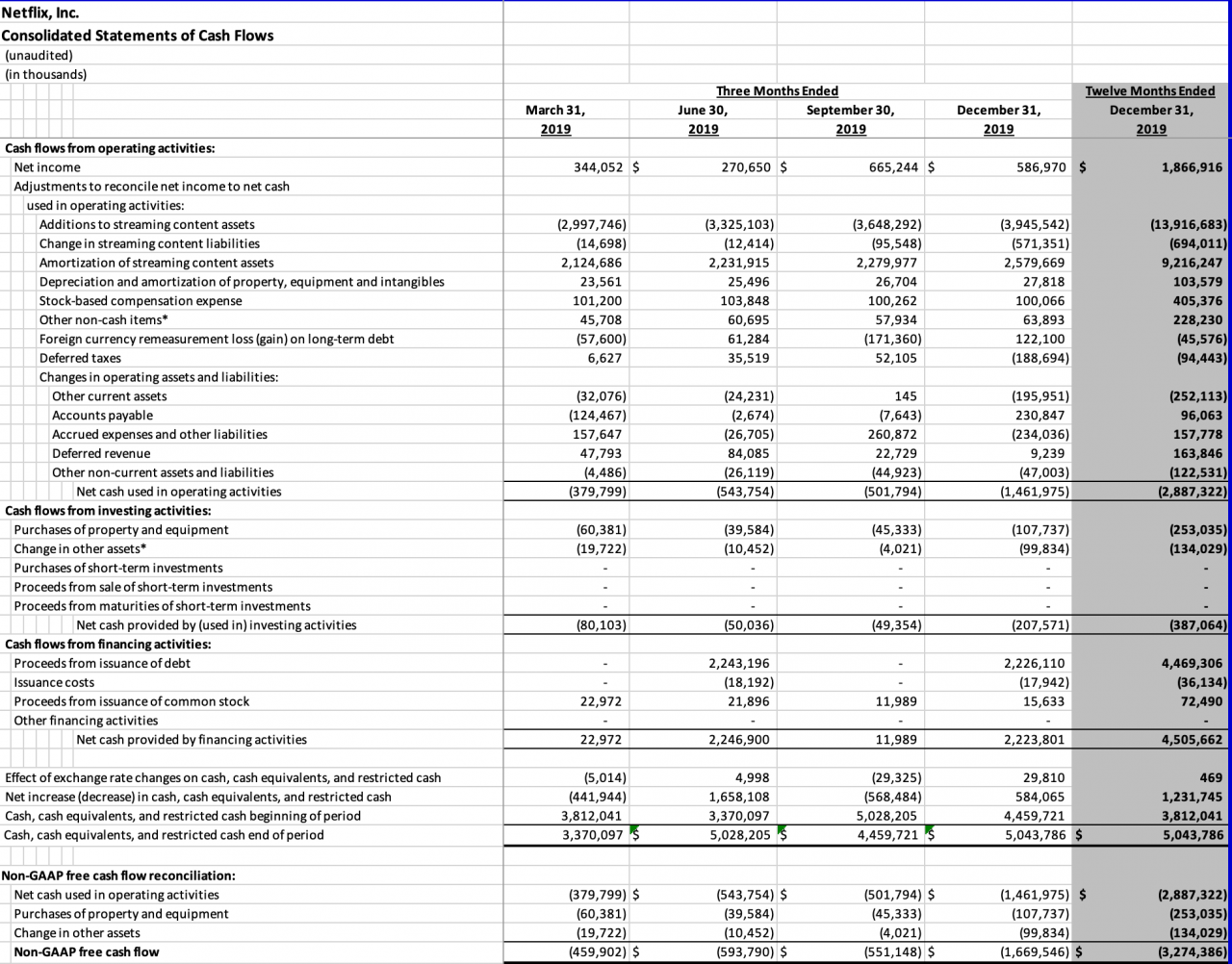

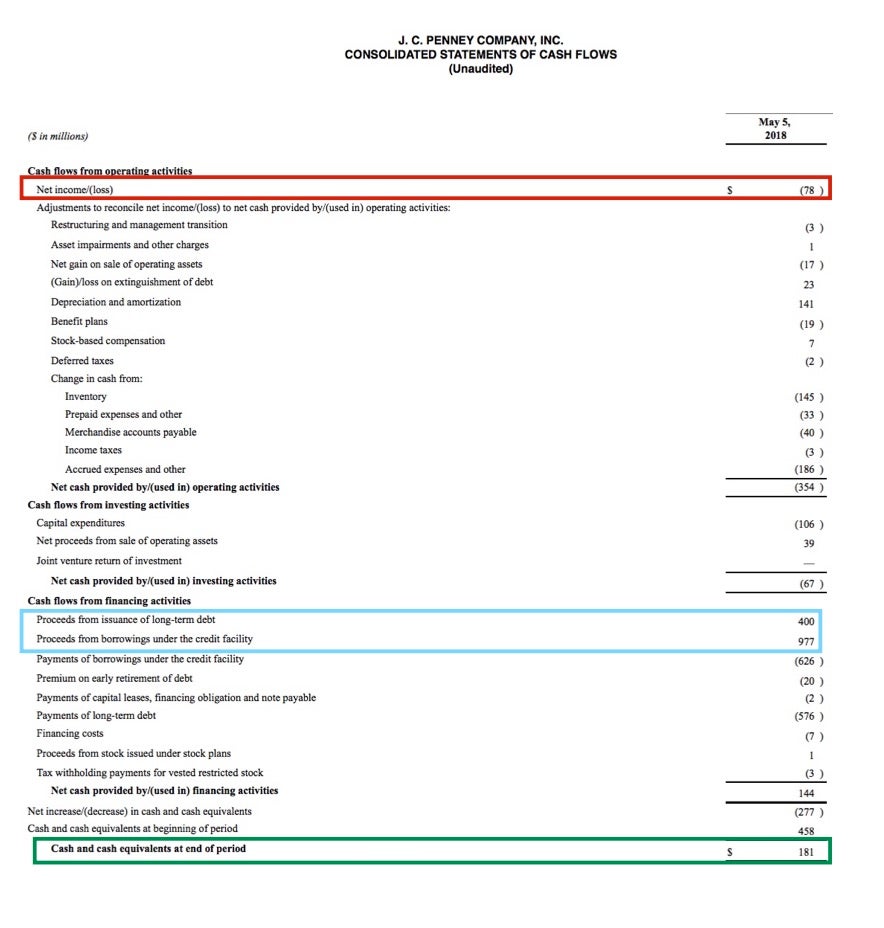

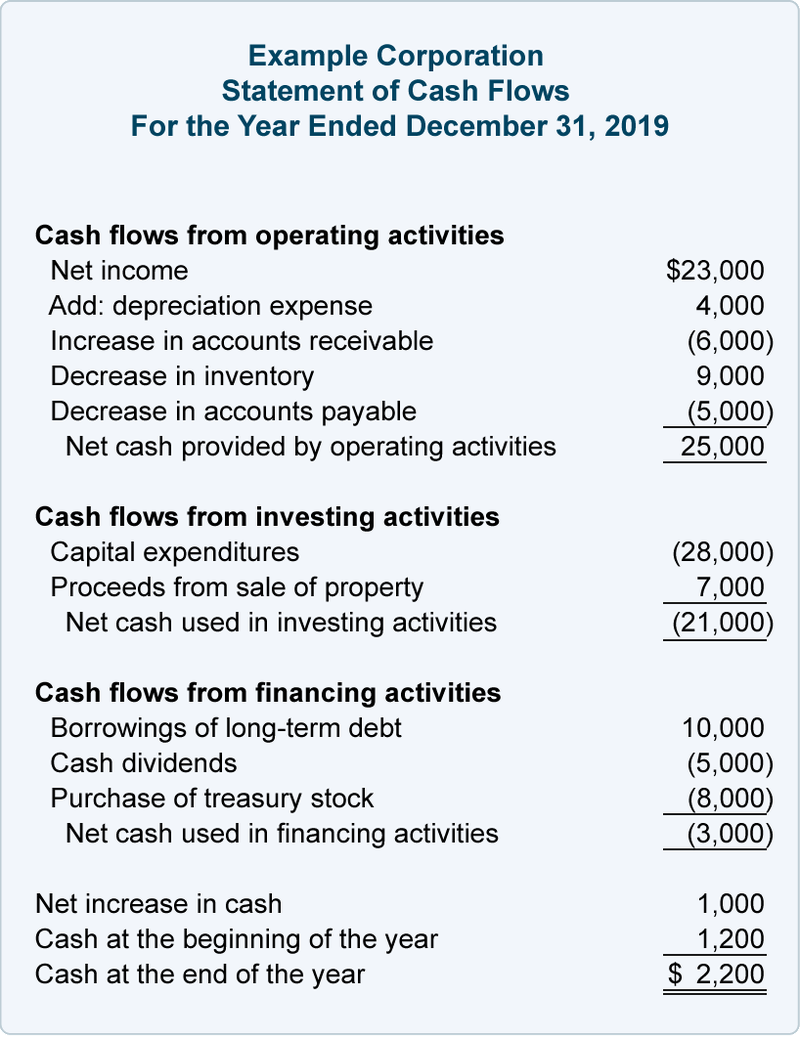

To get a complete picture of the business we need to look at its cash flow statement. Net incomeis the profit a company has earned, or the income that's remaining after all. The limitations of cash flow statement are as follows:

Cash flowis the net amount of cash and cash equivalents being transacted in and out of a company in a given period. A cash flow statement (cfs) is a financial statement that shows the inflow and outflow of cash in a company over a specified period. Think of the cash flow statement as a report that show you how cash.

Cash flow statement shows negative from operating activities but shows positive on cash at the end of the period. A positive cash flow indicates that the company has generated more cash inflows than. To decide if a company's negative cash flow from investing activities is a positive or negative sign, investors should review the entire cash flow statement.

Cash inflows are entered as positive numbers, and cash outflows are entered as negative numbers. The cash flow statement fails to present the net income of a firm for the period as it ignores non.

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)