Glory Info About Accrued Liabilities Balance Sheet Sample Profit And Loss

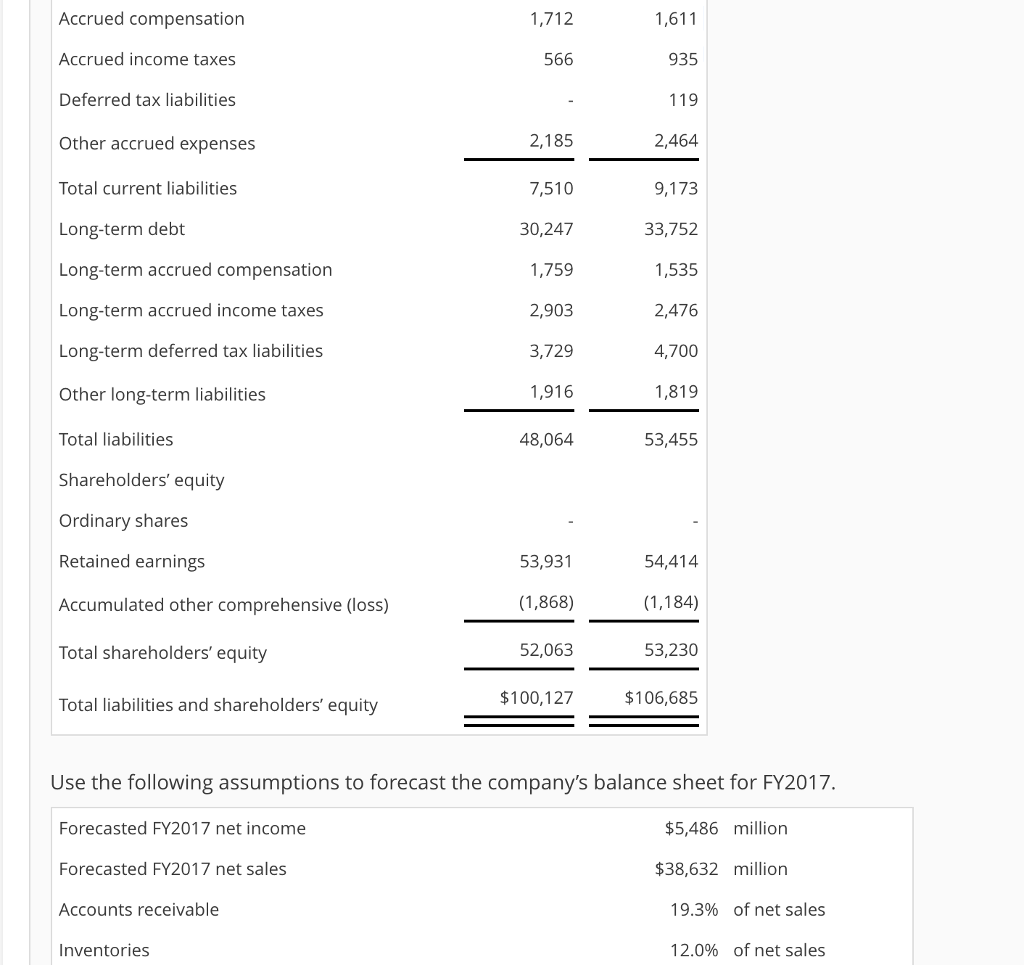

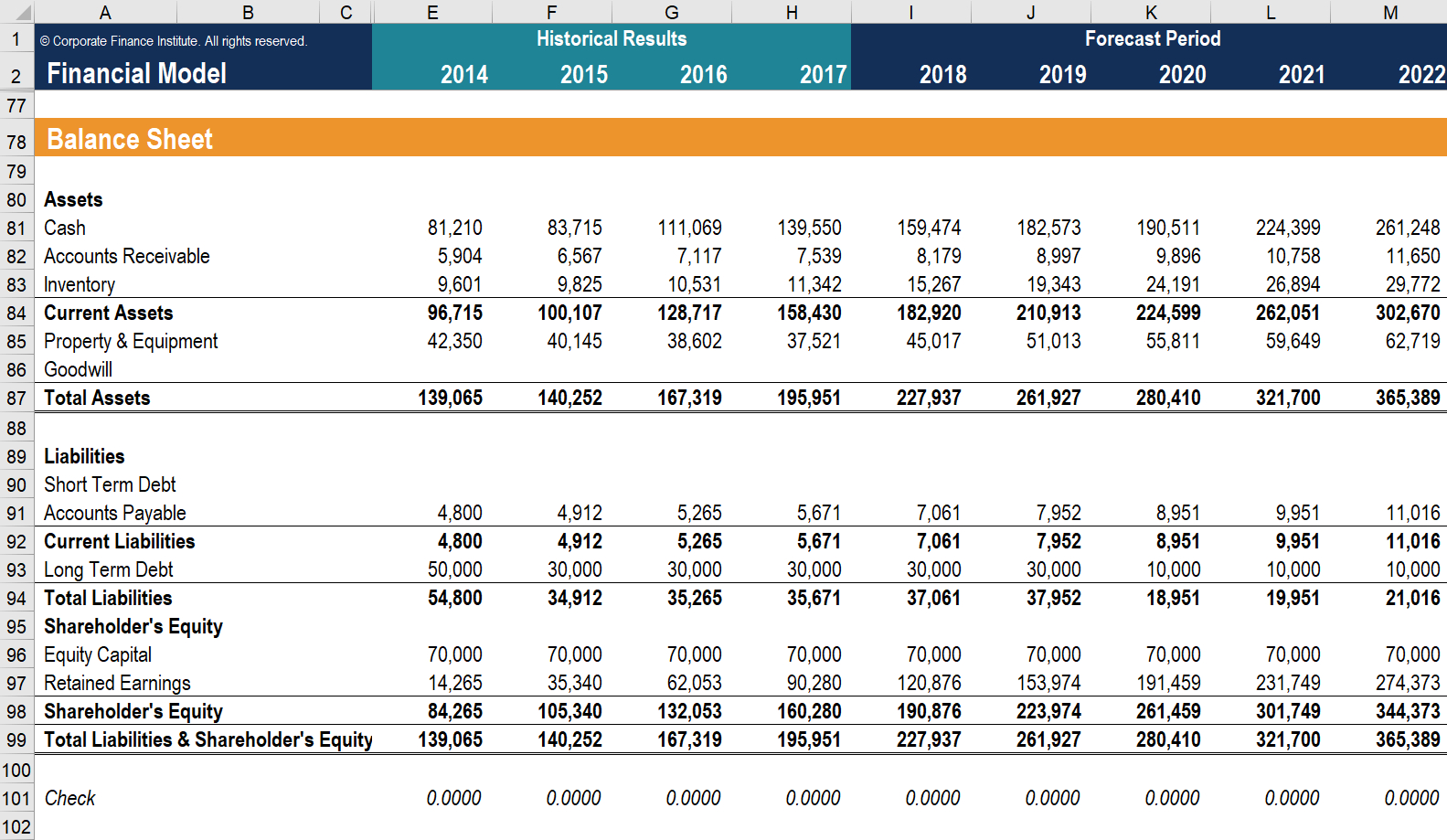

How to forecast balance sheet in excel?

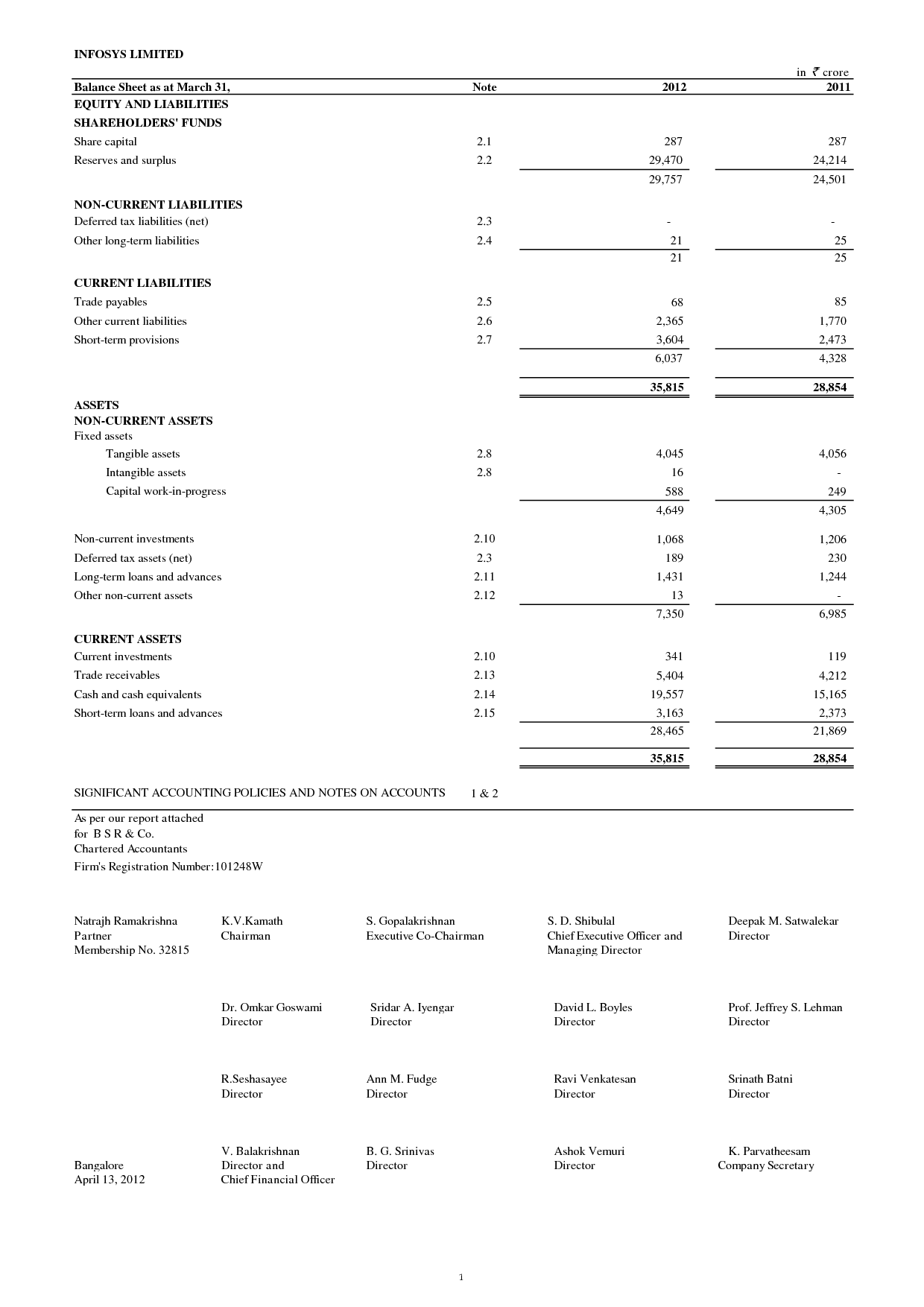

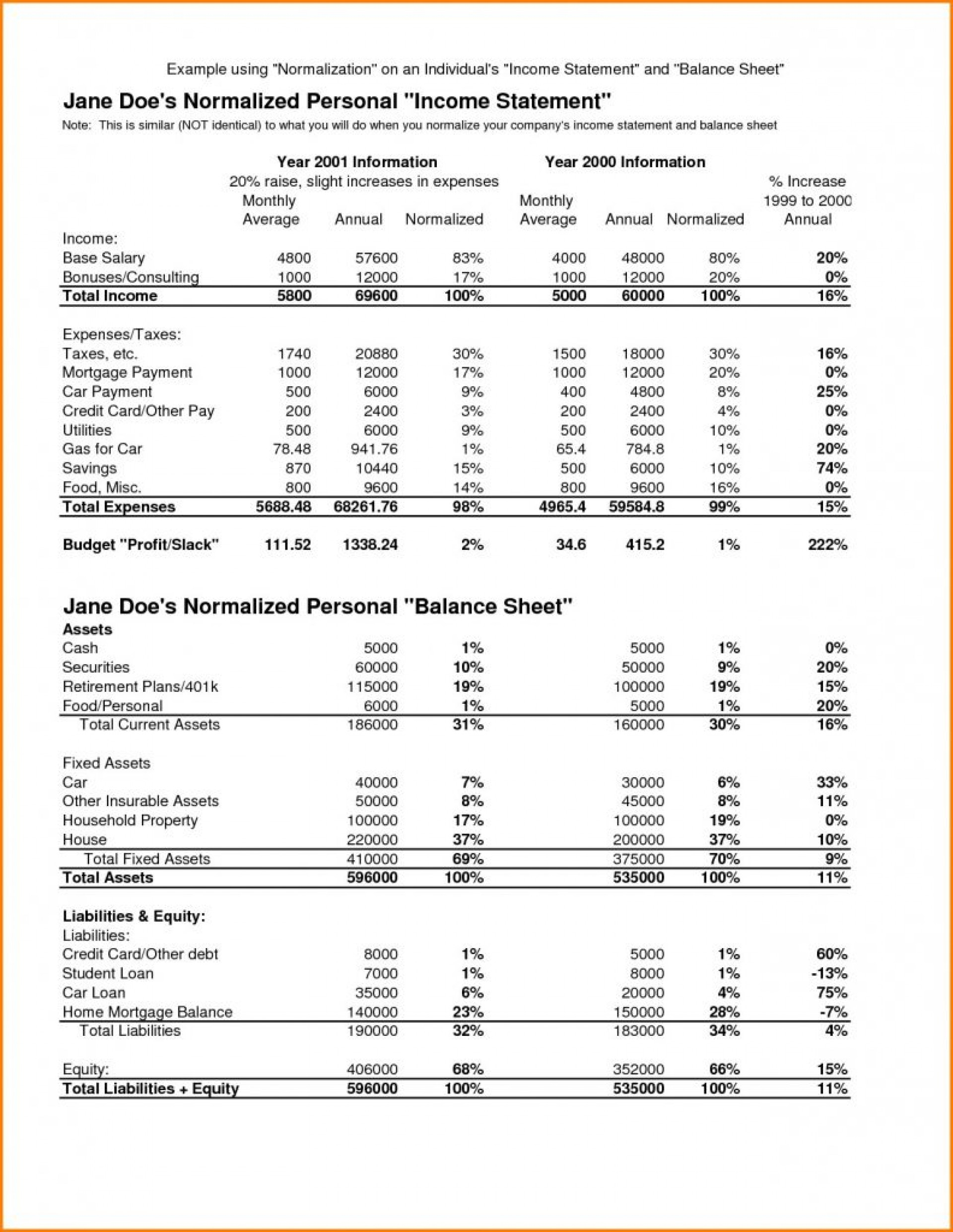

Accrued liabilities balance sheet sample profit and loss sheet. As fixed assets age, they begin to lose their value. Accruals recorded as current liabilities. Profit & loss account (income statement) purpose.

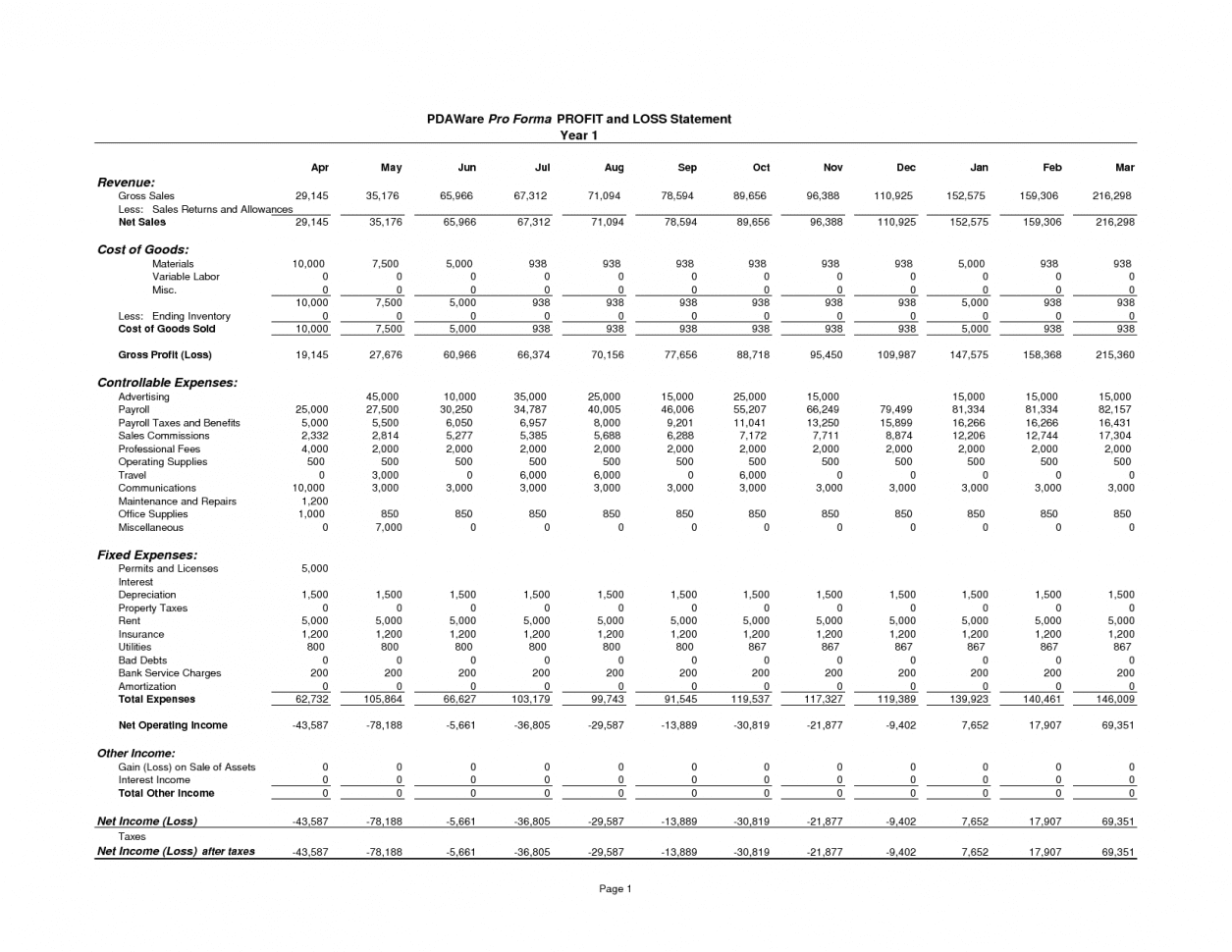

Evaluates a company's financial performance over a specific period, such as a month, quarter, or year. Cash accounting and accrual accounting. The balance sheet contents under the various accounting methodologies are:

The profit and loss statement sample template (basic). A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies. Assets = liabilities + equity.

While the balance sheet is a sheet mentioning the assets and liabilities, profit and loss evaluation is concerned with an account. It focuses on analysing the income and expenses. This will include daily running costs or overheads, such as renting a workshop or office space, and direct costs, such as buying materials.

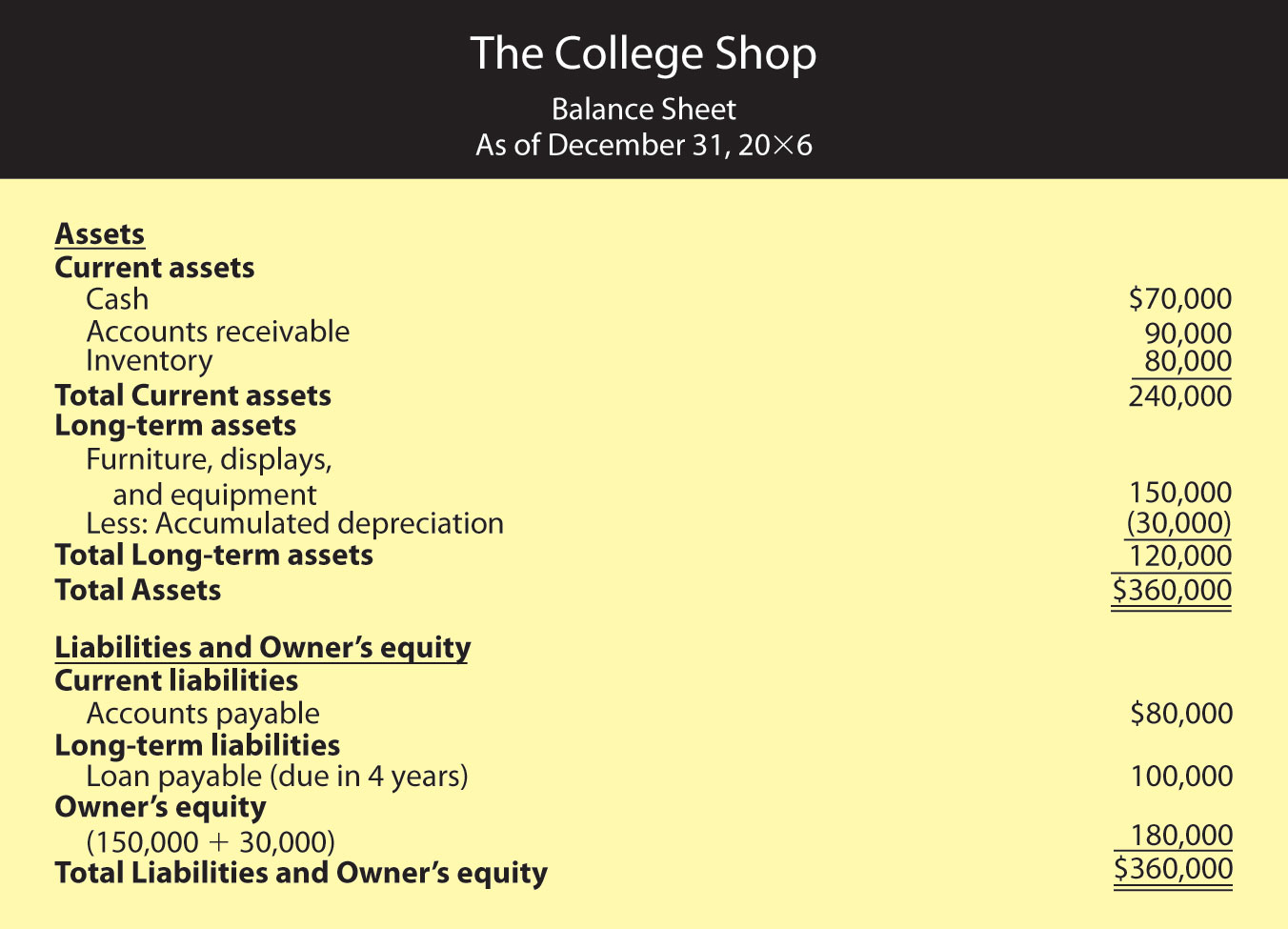

So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset. Two of the most important financial statements for a business are the profit and loss account, and the balance sheet. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

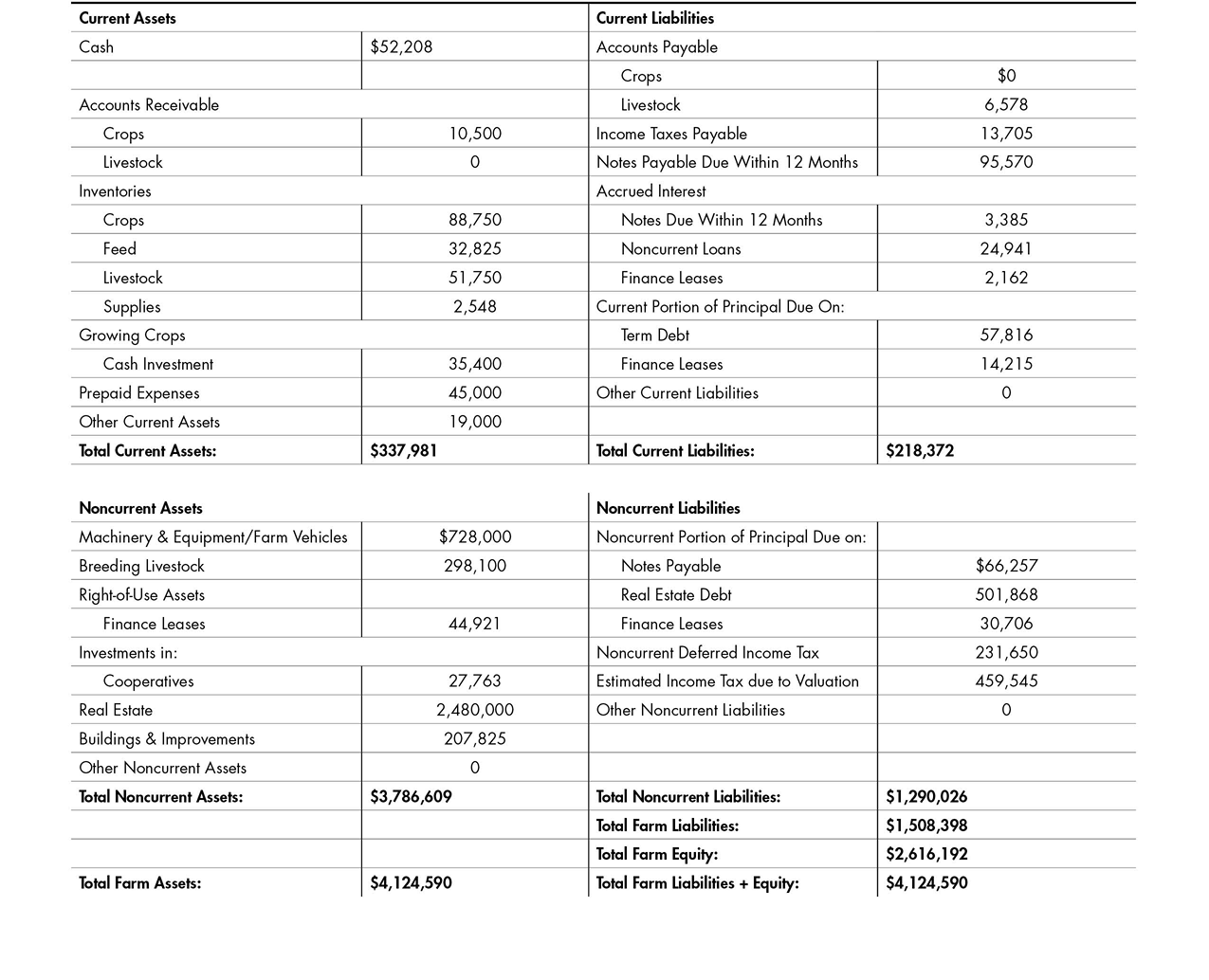

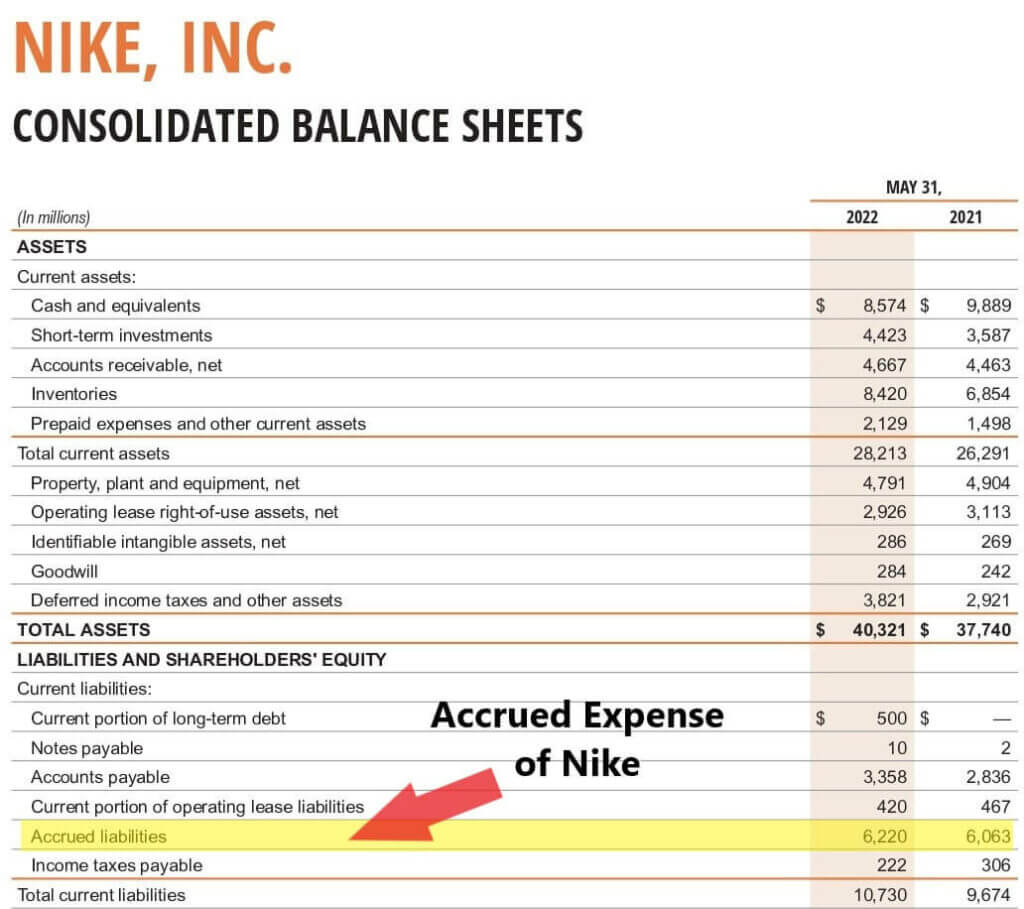

An increased accrued liabilities would indicate an increased cash inflow. Categorize and record each liability accurately to provide an accurate representation of the company's financial position. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

Provides a snapshot of the company's financial position at a specific point in time. Enter all liability information into the balance sheet template. The offset to accrued revenue is an accrued asset account, which.

Post accrued liabilities in the balance sheet when preparing balance sheets, you can record accrued liabilities in the current liabilities category. It is made for use within the company. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year.

It is recorded as a current liability on the balance sheet. A typical profit and loss account would look as shown in fig. The balance sheet is based on the fundamental equation:

Summarizes revenues, expenses, and profits or losses over a specific period (e.g., a month, quarter, or year). Such statements provide an ongoing record of a company's. 7.1 the profit and loss account the profit and loss account is a very useful statement.