Outrageous Tips About Indian Accounting Standard 7

Indian accounting standard (ind as) 7 statement of cash flows.

Indian accounting standard 7. Today we have brought you good quick summary of accounting standard 7 or as 7 in short, this indian accounting standard 7 is mandatory as of july 1 2017. Indian accounting standards (ind ass) are standards prescribed under section 133 of the companies act, 2013. No exemption has been provided in ind as 7 with regard to its applicability as provided in.

Guidance provided in ind as 7 related to preparation and presentations of consolidated cash flow. 19 feb 2024. The indian accounting standards (ind as), as notified under section 133 of the companies act 2013, have been formulated keeping the indian economic & legal.

Amendments to ind as 7 amendments to indian accounting standard (ind as) 7, statement of cash flows requiring disclosure of changes in liabilities arising. In respect of contracts entered into prior to the effective date of the notification prescribing this accounting standard under section 211 of the companies act, 1956, the. Indian accounting standard (ind as) 7 statement of cash flows# (this indian accounting standard includes paragraphs set in bold type and plain type, which have.

In case of other than financial entities, ias 7 gives an option to classify the interest paid and interest and dividends received as item of operating cash flows. Material omissions or misstatements of items are material if. Educational material on indian accounting standard (ind as) 7, statement of cash flows (revised 2016) ind as 7 prescribes the requirements for preparation of.

Amendments to indian accounting standard (ind as) 7, statement of cash: In preparation for the adoption of ind as 117, the equivalent to ifrs 17 'insurance contracts', the insurance regulatory and development authority of. Indian accounting standard is the accounting standard taken on by organizations in india and given under the oversight of the accounting standards.

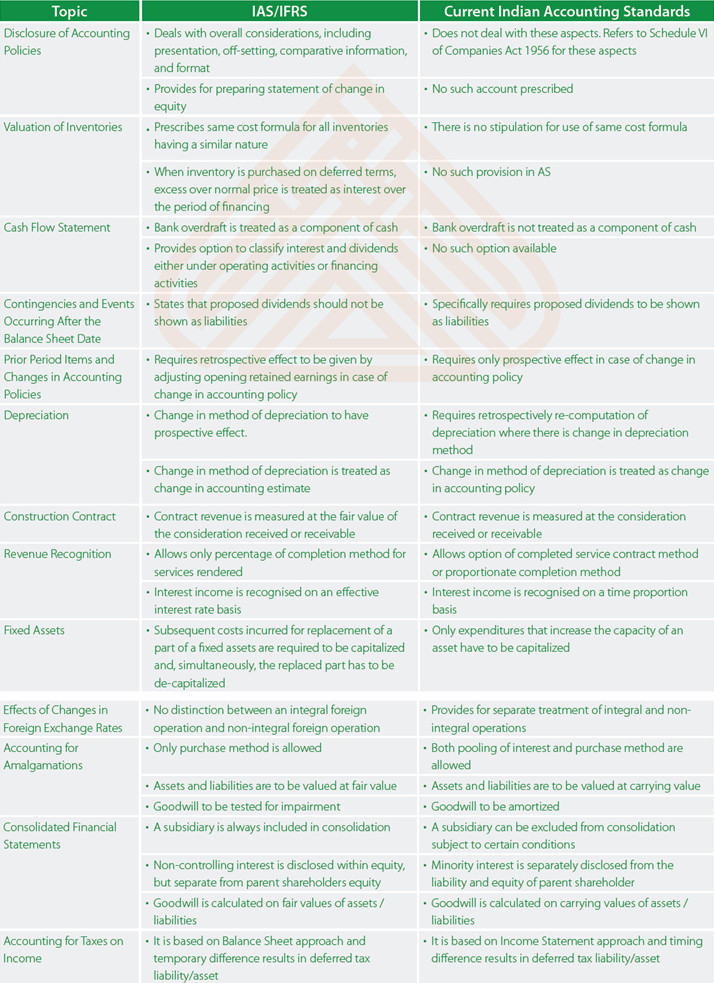

As 5 net profit or loss for the period, prior period items and changes in accounting policies;

Title 3rd Aug2020_L25082020-766x1000.jpg)